In This Article

Complexity

When was the last time you went to the bank? I mean physically walked up to a teller in a brick and mortar location? Some may answer this question easily as small businesses owners may still deposit their daily “cash” in-take, while it might take others quite a bit of time to think about it. Banking has transformed over the years from face to face (interactional) to a more “virtual” (transactional).

April 2018, NACHA (The National Automated Clearing House Association) estimated that over 82% of US workers “are paid Direct Deposit via ACH, up from 74% in 2011”. More than 4 out of every 5 people don’t see an actual “paycheck” anymore.

With access to countless global ATM machines, credit cards offering “points”, online bill-pay, new technologies and applications like, PayPal, Zell and Venmo giving individuals the ability to move money to friends or creditors within seconds, walking into a physical bank location has gone the way of the dinosaur.

Having access to our money 24/7 is typically where our interest in banking/finance stops for most. I have X dollars in my checking, savings or brokerage accounts, press a few buttons and viola, my money is now where I need it to be.

If it were only that simple…

As close as we think we are to our finances, we’ve never been further away from understanding how the system works. While many of you may not want to know how the sausage is made, it’s never been more important for you to have a better understanding, if even slightly. In mentioning “REPO” (repurchase markets) in both our most recent quarterly and monthly, we have yet to elaborate on how it correlates to everything from simple banking at your local ATM to systemic risk in financial markets; specifically, “why” or “how” it can impact your life.

For better or worse, OSAM has committed to telling you what we would want to know if our roles were reversed. No one is going to leave this note as an expert on the Global Shadow Banking system given its complexity, but there are a few key things we sincerely believe you should be aware of (preferably have an understanding of) as it has a direct correlation with true risk management, not just what the S&P is doing.

We’re going to try to keep this simple and tackle 3 key thoughts:

- The complexity of the banking system – how money flows – it’s not as simple as most believe

- Fragility of the banking/financial system is very real

- Contagion from Repo markets – how easily it can roll into financial markets and the Fed’s involvement

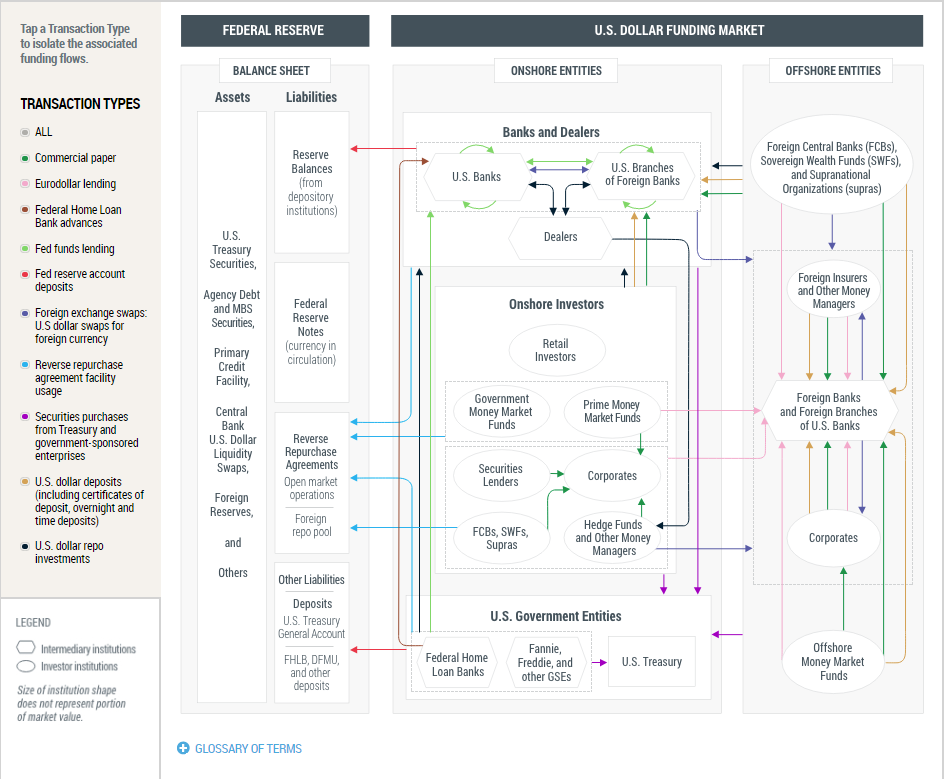

Let’s start with the complexity of the banking system: Below please find a visual from the Federal Reserve Bank of New York. CLICKING this link will take you to an interactive version of the below map showing how various institutions generally engage with one another, and the Federal Reserve’s balance sheet, in the course of borrowing and lending U.S. dollar instruments in the money.

There is NOTHING simple about the below illustration, which is specifically designed to simplify the flow of money. Colored arrows depict the transaction type (the flow of money for collateral of sorts). Money is constantly flowing from banks to dealers to the Federal Reserve; both on and offshore financial institutions constantly transact and, in an effort, to settle transactions/obligations from day to day, an enormous amount of both liquidity and trust is required. The liquidity primarily comes from overnight borrowing via repurchase markets (Repo) – the trust is required for counterparties to trade amongst themselves. Financial transactions take place and settle based upon a belief a security will be delivered in exchange for cash.

Collateral, typically in the form of short-term T-bills (Treasuries), is provided in exchange for dollars. The vast majority of these transactions occur on an o/n (overnight) basis (rinse/repeat), while “short-term” can span up to 3 months. Consider these transactions “carry trades”; which can be likened to a “Bridge loan” (short-term loans that satisfy immediate obligations while permanent financing is arranged).

This concept is foreign to most of us and truthfully taken for granted, yet it is in these flows, which again, typically take place on an o/n (overnight) basis, that allow all financial markets to function properly. Relative Value funds can roll their books, dealers can settle with their clearing firms, banks can fund their everyday obligations making dollars available to all of us on demand. When the system works properly, it does so all because of this relatively obscure, complicated, misunderstood yet enormous marketplace.

While the above visual gives you a glimpse at the complexity of the banking system, you may still be thinking “so what”, so long as my money is where I want it to be when I need it, I don’t care!

This is why point number 2 is so important.

Fragility

If carry makes the world go ‘round, and reserves make carry possible…the day we run out of reserves would be the day when the world would stop spinning... No, this is not an overstatement. Zoltan Pozsar Credit Suisse Global Money Notes #26

You may have seen his name in the news recently, but Zoltan Pozsar is by no means a household name. In fact, many within the financial industry don’t even know who he is (as most financial professionals take the inner workings of our system for granted, too). Outside of my mentions or unless you follow a select minority in the financial space you’ve likely never heard of him (until very recently)?!

And yet… There is a reason we keep writing about his work! Those at the Federal Reserve continue to tell us financial institutions are bigger, stronger and have more reserves then prior to the GFC (Great Financial Crises). While “bigger” is a factual statement, “stronger” and “having more reserves” is misleading at best, negligent at its core.

We’ll also point out that on March 28, 2007 former Federal Reserve Chairman Ben Bernanke also said:

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.”

We could (and have) filled pages of notes with quotes, from those who’ve occupied the most powerful seats at the Federal Reserve, that have proven to be obnoxiously inaccurate. If “stronger” and “more reserves” was in-deed factual, the Federal Reserve’s response to the recent Repo Market turmoil which began on September 16, 2019 wouldn’t be necessary, rather, their insanely unprecedented ACTIONS paint a VERY different, much more concerning picture as we discuss throughout.

Assume you were building a house. After the initial framing inspection your primary architect informs you that there is a very high probability the structure will collapse as currently built. During the build, the general contractor altered the architects design placing more weight on the load bearing structural beams, in turn they would not be able to support the weight overhead in many probable scenarios.

Would you pay attention, would you ask questions lots of questions and have the problems fixed (assuming they could be)? or would you ignore your architect and continue with the build “as-is”?

The same analogy holds true If you were buying a new home that’s already been built. During your home inspection, the inspector warns you that there was significant risk of collapse due to structural walls or beams being damaged over the years. Again, would you buy the home “as-is” because it “looks beautiful” risking your family’s lives or, get the issues fixed prior to doing so?

We all know the answers to these questions… In both cases, fragility and safety play a role in the decisions you make moving forward. Odds are you take a slightly more conservative approach when it comes to the safety of your family.

Circling back to Zoltan Pozsar, it’s important you understand his pedigree; the “REASON WHY” we keep coming back to his work. The below is an excerpt as described by his current employer, Credit Suisse:

Zoltan Pozsar is a Managing Director in the Investment Strategy and Research department and is based in New York.

Prior to joining Credit Suisse in February 2015, Zoltan was a senior adviser to the US Department of the Treasury, where he advised the Office of Debt Management and the Office of Financial Research and served as the Treasury’s liaison to the FSB on matters of financial innovation. Zoltan was deeply involved in the response to the global financial crisis and the ensuing policy debate. He joined the Federal Reserve Bank of New York in August 2008 in charge of market intelligence for securitized credit markets and served as point person on market developments for senior Federal Reserve, US Treasury and White House officials throughout the crisis; played an instrumental role in building the TALF to backstop the ABS market; and pioneered the mapping of the shadow banking system which inspired the FSB’s effort to monitor and regulate shadow banking globally. Later at the IMF he was involved in framing the Fund’s official position on shadow banking and consulted G-20 working groups. He consulted G-7 policymakers, central banks and finance ministries on global macro-financial developments.

Before joining the official sector, Zoltan was a US macroeconomist and Fed watcher for six years. He is a founding member of the Shadow Banking Colloquium of the Institute for New Economic Thinking, and a former adviser on European affairs to Oriens Investment Management, a CEE-focused merchant bank in his native Budapest, Hungary.

This is important: Pozsar JOINED the Federal Reserve Bank of New York in the midst of the worst financial crises since the Great Depression. He was immediately “IN CHARGE OF market intelligence for securitized credit markets”, serving “asPOINT PERSON on market developments for senior Federal Reserve, US Treasury and White House officials throughout the crisis.”

Please digest this point: you don’t just “join” the Federal Reserve Bank of NY in the middle of the worst financial crises since the Great Depression as point person to the Federal Reserve, US Treasury and WHITE HOUSE officials unless you know something the “smartest people in the room” don’t know. Try walking on to the field come the next Super Bowl and tell them you’re going to play quarterback…

While notable public figures like Neil Kashkari, Tim Geithner, Ben Bernanke and Hank Paulson take credit for saving (cough) the global banking system during the crises of 2008/2009, it was Pozsar who literally mapped out (page 3) and brought the opaque shadow banking system to light.

Think of it this way, in its most simplistic form; “primary architect” = “in charge of market intelligence for securitized credit markets” = “point person on market developments for senior Federal Reserve, US Treasury and White House officials” = ZOLTAN POZSAR, while the “general contractor” can be likened to financial regulators.

While we can be sure he wasn’t the only guy in the room making decisions, it has been reported by many well-respected individuals who were also directly involved at the time that NO ONE understands the underlying “guts”/plumbing/architecture of our financial system better than Zoltan Pozsar.

Only it wasn’t a house being re-designed or overhauled; it was the overnight lending markets (Repo) that drives/fuels ALL THINGS financial. With an estimated size between $5-7 TRILLION DOLLARS (depending on whether or not you include the FX swap markets) these markets functioning properly is the difference between some of the largest financial firms in the world opening their doors the next day or not; sending tremors through the global financial system. This is the very essence of the word, FRAGILE…

So, when the soft-spoken Hungarian speaks or writes on financial stability and systemic risk, every single one of us should pay attention!

Regardless of what Fed officials and media outlets have been reporting, Repo markets are NOT functioning normally right now. Don’t just take our word for it, it The Federal Reserve Bank of New York has been providing tens of billions of dollars of liquidity to these markets on an overnight basis since September. The embedded link takes you directly to the FRB of NY web page showing date and dollar amount in BILLIONS. Again, don’t focus on their words, focus on their actions.

In a November 11th interview, Pozsar was asked if and why those of us not involved in “Repo” should care about what happened in these markets back in September, Pozsar’s did not mince his words, minute 17:00:

“No, no, no – I think it’s something far bigger – So why does this matter? Again, it’s an overnight trade.

Repo is how you get to live to fight another day… It’s very important!”

Pozsar credits Harvard educated, former Columbia University professor of economics of 30 years, currently with Boston University, Perry G. Mehrling with the “Meme”. I, personally found Mehrling’s exact words to be, “If you need to live to fight another day, that’s (repo/overnight borrowing markets) where all the liquidity is…” (5:00 minute mark of the embedded hyperlink, I would recommend watching all 9:42).

“What that means is… You go to the overnight repo market because you run out of money. You can’t make payments today; payments that are due today. So, on the margin you go and try to get some money so that you can make a payment today and you pay that money back tomorrow… If you can’t borrow in the repo markets, and you can’t get the cash to make your payments today, you’re not going to open up tomorrow, ok? So if you are an RV (Relative Value) fund that needs to roll funding on its position, if you are a primary dealer and you can’t fund to roll your positions and top up your clearing account at your clearing bank, if you’re a small dealer that can’t fund, YOU’RE OUT OF BUSINESS TOMORROW, so that is why you basically care about this stuff…”

“…you know it’s like when you look at an electrocardiogram and the heart ticks; you know it ticks, ticks, ticks, and then it doesn’t tick and it starts to beep – so it’s something like that it either ticks or it doesn’t tick, so it’s existential – you know when you see these rates at 10% it means that people are having a hard time getting the money to make payments. The US Treasury is having a hard time pumping treasuries into the system on settlement days. The money is not moving to the treasury’s general account because people are not willing to part with their money. In this case, the large banks run out of reserves so the money ain’t going to the US Treasury, so quite frankly, you know if you need to pay unemployment, insurance benefits, and food stamps and all that stuff – the funding of that stuff the process gets gummed up so this is serious stuff.

When the money doesn’t flow people can’t pay – people can’t pay and they go out of business. Headlines can happen.”

Merry Christmas & Happy Chanukah, right?! Pozsar used the term existential; existential as in relating to existence; the heart ticks or it doesn’t, the company is in business today or “out of business tomorrow”.

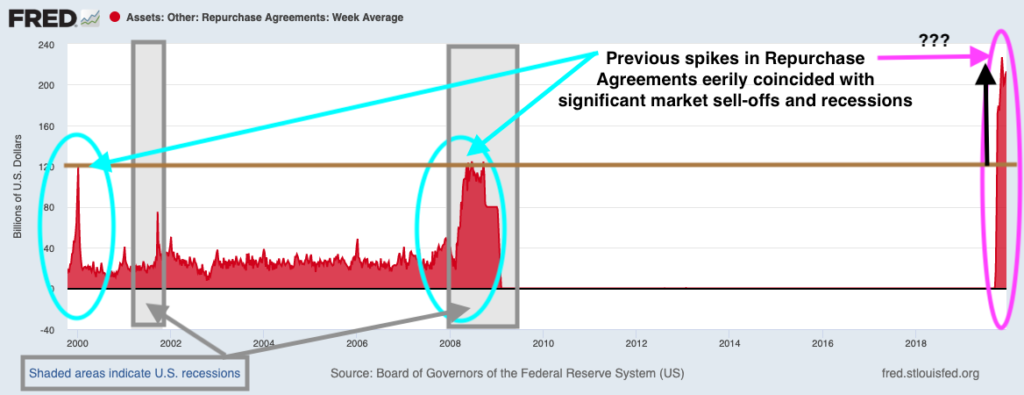

The message he has presented over the course of this past year could be described as a steady crescendo (as discussed last month) getting louder and more intense with each passing interview and note. While repo did have a hiccup back on December 31, 2018, the last onset of persistent instability in Repo markets was back in 2008, roughly 10 days before Lehman Brothers failed. In fact, the last two occurrences in which the Federal Reserve stepped in to “calm” the Repo markets eerily coincided with some very difficult times for financial markets (as you can see from the below illustration):

Full disclosure: I have seen a similar graphic published by Sven Henrich @NorthmanTrader prior to my note being released, the visual is too important not to include, so I will hat-tip Sven. He has a brilliant financial mind, his work to the financial community is invaluable – if you don’t follow his work, you should.

While the Federal Reserve continues to tell us the economy is strong, the consumer is “resilient” and labor markets are in good shape, the above visual is fairly straight forward and clear. In my humble opinion, the Fed’s actions look more like an outright panic suggesting they are very afraid of something… Fragility!

Bringing us to point number 3…

Contagion

We’ve written and referred to the BIS (Bank of International Settlements) in the past. Often regarded as the Central bank of Central banks, the BIS publishes a quarterly report that is widely unread by most. We’ve joked before, but if you think our “notes” are long, try the BIS quarterly at over 150 pages. Ironically, as Zoltan Pozsar published his December 9, 2019 piece “Countdown to QE4”, the BIS released their most recent quarterly, highlighting September’s Repo spike as well. Below is an excerpt which we believe to be tremendously poignant:

“Shifts in repo borrowing and lending by non-bank participants may have also played a role in the repo rate spike. Market commentary suggests that, in preceding quarters, leveraged players (eg hedge funds) were increasing their demand for Treasury repos to fund arbitrage trades between cash bonds and derivatives. Since 2017, MMFs have been lending to a broader range of repo counterparties, including hedge funds, potentially obtaining higher returns.” December BIS quarterly report page 23

Additionally, on December 8, 2019, the FT (Financial Times) interviewed head of the monetary and economic department at the BIS, Claudio Borio, who had this to say:

““High demand for secured (repo) funding from non-financial institutions, such as hedge funds heavily engaged inleveraging up relative value trades,” was a key factor behind the chaos”

In both quotes you may notice the term, leverage? In 2012, Powell himself admitted that low interest rates entice excessive risk taking and here we are, nearly 11 years into the current “expansion” and 7 years post his own comments, finding ourselves with turmoil in the overnight lending markets (Repo), being met with a secretive defacto bailout by the Federal Reserve which Powell is Chairman of … being attributed to excessive leverage.

So how could this leverage adversely affect you? How does it become contagious to financial markets?

Zoltan Pozsar has already been about as blunt as it gets when he says, “Repo is how you get to live to fight another day” and without it or with disruptions, “if you can’t fund…you’re out of business tomorrow”. We don’t think we need to educate readers on what happened post Lehman Brother/Bear Sterns, et. al. It’s not a stretch to draw comparisons, especially with financial institutions larger today than there were back then. While the Fed uses bigger as a positive, it’s not…

If you couple this with the BIS report and a little bit of history, things get a bit dicier.

Many of you may not recall the late 1990’s, though leading up to the proverbial tech bubble was the epic fall of Long-Term Capital Management (LTCM) in 1998, which sent tremors through financial markets. LTCM was a HIGHLY LEVERAGED absolute-return hedge fund which attempted to capitalize on pricing discrepancies in sovereign bonds; considered “relatively safe” at the time.

Following the 1997 Asian financial crises and Russian financial crises of 1998, LTCM lost $4.6-billion dollars in a very short period of time requiring 14 financial institutions to recapitalize (bailout) the Greenwich CT based fund. Again, “RELATIVELY SAFE”… Do you see a common theme or pattern here?

We find it important to remind readers of the Long-Term Capital scenario based upon the words of the BIS quarterly, those of Claudio Borio and more specifically, Zoltan Pozsar’s in depth analysis on a market within the Repo markets called “sponsored repo”. Stated simply, sponsored repo is a way for hedge funds to gain access to Repo markets via a sponsor bank bringing them to the door allowing them access to additional short-term LEVERAGE. What could possibly go wrong?!

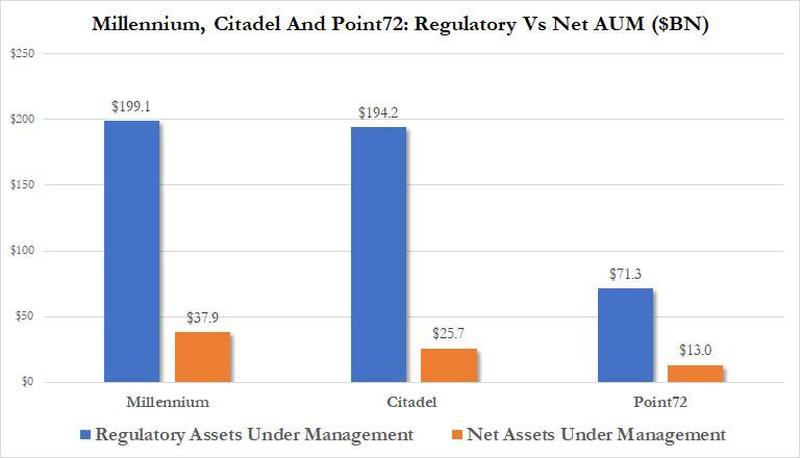

This market has grown significantly throughout the year. The FT article noted that hedge funds Millennium Partners and Capula are among the larger hedge funds in the market, while Zero Hedge has reported that between Millennium, Citadel and Point72 that as a collective, their $76.6 billion of Assets Under Management has been leveraged up to roughly $465 billion. Per ZeroHedge:

“Not only was Fed Chair Powell facing an LTCM like situation, but because the repo-funded arb was (ab)used by most multi-strat funds, the Federal Reserve was suddenly facing a constellation of multiple LTCM blow-ups that could have started an avalanche that would have resulted in trillions of assets being forcefully liquidated as a tsunami of margin calls hit the hedge funds world.”

The safest of assets can become extremely toxic given enough stress and leverage. LTCM lost $4.6 billion… The Fed is staring at multiple scenarios which dwarf that of LTCM.

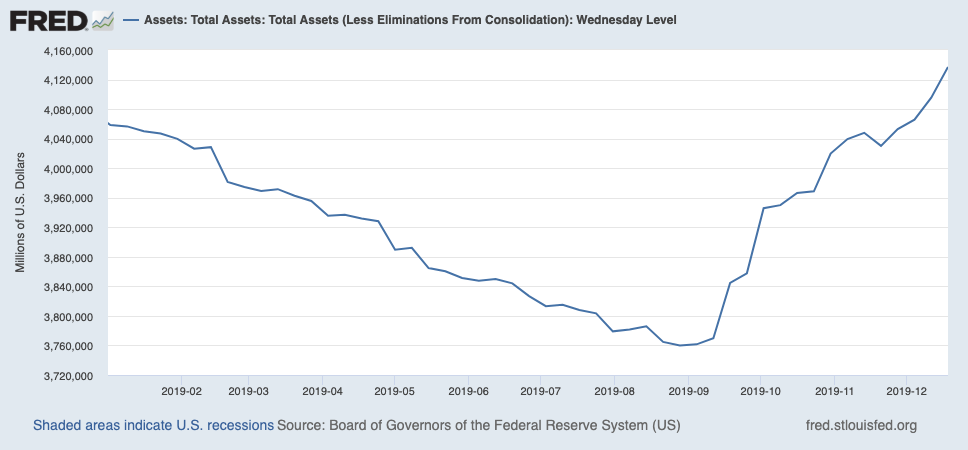

For something which the Fed has claimed from the start to be “temporary” and “NotQE”, they have been intervening in the repo markets every day since September 16th. Per a recent press release issued by the Federal Reserve Bank of New York (December 12, 2019) – ironically a few days after Zoltan Pozsar’s December 9, 2019 report, the Fed has committed over $500 billion to the repo markets in the next few weeks, per the Federal Reserve Bank of New York’s Press Release:

“The Desk will continue to offer two-week term repo operations twice per week, four of which span year end. In addition, the Desk will also offer another longer-maturity term repo operation that spans year end. The amount offered in this operation will be at least $50 billion.

Overnight repo operations will continue to be held each day. On December 31, 2019 and January 2, 2020, the overnight repo offering will increase to at least $150 billion. In addition, on December 30, 2019, the Desk will offer a $75 billion repo that settles on December 31, 2019 and matures on January 2, 2020.”

THIS IS NOT NORMAL BEHAVIOR, but let’s just say it was… Powell and the Federal Reserve have the market’s proverbial “back” with this cannon of liquidity, what could possibly go wrong?!

The devil is always in the details. We have been very deliberate to discuss the repo markets as a short-term lending tool (predominantly overnight – short term T-bills as collateral). Yet, financial institutions have shifted the composition of their balance sheet to “coupons” or longer dated maturity bonds.

JP Morgan, once considered the lender of last resort into repo markets prior to the Fed’s recent liquidity intervention, has quietly shifted their balance sheet from short-term bills to now loading up on long bonds, over $130 billion of them! (as the largest bank they had the most “excess” reserves)

However, this shift has drained JP Morgan of its “excess” reserves, leaving them with just enough reserves for themselves (hopefully). While financial institutions are doing anything, they can in an effort to grow their earnings; which is nearly impossible to do given our currently contracting global economy… Though I don’t believe the CIO (Chief Investment Officer) of the largest financial firm in the US would make this shift for some incremental yield.

I may not be the smartest guy in the room, but I’m not the dumbest either… This is a big bet for anyone to have on their books, including JPM. There aren’t that many reasons a firm of this size would position themselves this way. Yes, a recession would likely trigger what’s known as a “flight to safety”; investors flee “risk assets” (stocks) and flock to “risk off” assets (Treasuries) pushing yields lower, inflating prices of the longer-term bonds JP Morgan has migrated to. It’s a monstrous bet with countless variables for anyone.

If inflation (as measured by the Fed) rises, as it appears to already be doing (as seen in the recent rise of commodity prices), the long bond may spike, and in turn, crush JP Morgan’s balance sheet?! What do you think this would do to the aforementioned hedge funds? Some fairly risky bets to make unless you believe it to be a short term one with little risk.

While the following thought is purely speculation, I don’t believe it to be a stretch to think with the current liquidity crunch/balance sheet set up we are facing into year end, JPM may be trying to force the Federal Reserve’s hand into buying their longer dated inventory in an effort to prevent a liquidity crisis and market disaster, though with equity markets near all-time highs, it will be a pretty tough sell for the Fed to the people; ala another bank bailout (nothing like front running the Fed and being compensated for doing so). If so, it’s quite an interesting game of chicken being played right now with a $5 plus trillion-dollar market on the line? Who blinks first?

Bringing us to our final thoughts…

Final Thoughts

Currently, NotQE has the Fed buying very short-term treasuries. The moment the Federal Reserve begins to buy “coupon”, they will have official entered QE4 and the bailout of banks has resumed. Hence, the title of Pozsar’s December 9th note (Countdown to QE4). As just mentioned, this is a difficult sell to the people with enormous political risk involved … and yet financial markets hang by a string.

Our goal of this note was to shed some light on the complexity of our banking system, discuss how fixes for fixes have created fragility in the very market (repo) that makes the “world go ‘round”; elevating contagion risk to dangerous levels. The Federal Reserve’s disparate actions are attempting to ward off this contagion from repo markets, but very real risks still have the ability to send shock waves through equity markets as most investors are enamored with unsustainable asset price inflation.

We highlight and introduce the words of Zoltan Pozsar as he is literally the smartest guy in the room when it comes to the architecture of our banking system. As for the BIS (Bank of International Settlements), at the very least they’re being honest in discussing the issue of hedge funds and leverage. Two tremendously credible sources that arguably know more about this subject than those who large in part created the problem they are once again attempting to now fix.

Without the Federal Reserve’s near decade long policy which begged institutions to leverage balance sheets, we could argue we don’t have this mess to begin with (discussed in many notes over the years). Though, make no mistake, banking supervisory committees should shoulder a significant portion of the responsibility as well with the post crises introduction of new regulations: LCR (Liquidity Coverage Ratio rules), HQLA (High Quality Liquid Asset Rules), Basel III and GSIB (Global Systemically Important Bank) rules. In revisiting our home builder analogy from earlier, regulators have acted as the General contractor who decided to alter the architects plans making the house unstable to begin with.

There is absolutely no question that the very recent run up in equity prices has a direct correlation between the Fed’s enormous liquidity injections which began in September, in conjunction with countless central banks around the globe; and it has people euphoric. At some point, something will break, and another “fix” will be necessary. Sr. Market Strategist George Goncalves recently said, “this liquidity spaceship is being held together via bubble gum, shoe-strings and a ton of Fed Repo” – duct tape came to my mind, but that might be too strong?!

For those who make the case for the China Trade deal being the difference maker, let’s put this into perspective: the agreed upon, yet not signed Chinese purchases of Agricultural products from the US amounts to $32 billion over 2 years(with a possible, but not promised additional $5-10 billion purchased per year if possible)… We remind you the Chinese were purchasing roughly $25 billion in US Ag products in 2017 before the Trade war even got started.

Compared this with the $380 billion dollars the Fed has grown its balance sheet by in an effort to stabilize Repo markets (with an additional $500 billion slated for the next week and a half).

While this note is less about the enormous disconnect between economic reality and current equity prices/valuations, as we sum up it’s impossible to ignore. We’ll leave you with a recent quote from Federal Express CEO, Fred Smith on his very recent earnings call after noting truckload carrier Celadon “just went bankrupt”:

“So, it’s really a tale of two economies and the stock market, of course, is very bullish, but the industrial economy does not reflect any growth at all, worldwide, to speak of.”

We will continue to preach our goal to be that of proper risk management. In order to do this, AT TIMES OF GREAT STRESS, one may need to give up a little return in the short term, in order to prevent catastrophic loss as the cycle turns… We’re proud of our return vs. risk profile given where we are in the current cycle any day of the week and twice on Sunday. Unless you are retiring tomorrow, your closer to the start line than finish line.

We have seen this movie before and yet we fail to learn. It’s like watching the predictability of the “very attractive female lead” in a horror film as she runs back into the house where 8 people have just been killed (and ultimately the murderer is waiting to kill her, too) … You don’t have to run into the house!

If you think it prudent to be focused on the return of the S&P, God Speed. The ripple effects of what would amount to be much LARGER multiple “Long-Term Capital Management” blowups caused by/coupled with Repo market turmoil has the potential to become existential (to borrow a word from Mr. Pozsar).

Equity prices are moving higher in a parabolic manner – and admittedly, have the ability to move much higher given the absurd amounts of liquidity being pumped into the system.

Or, you could believe Chris Rupkey, chief financial economist at MUFG Union Bank as he recently wrote to clients::

“Take risk off the table as a concern to be hedged… There is no risk… Bet on it… Back up the truck and buy, buy, buy.”

You can’t make this sh*t up folks, “NO RISK” – no need to be hedged… and they likely pay this guy millions?!!! As I said earlier, “most financial professionals take the inner workings of our system for granted, too.”