In This Article

Change of Plans…

It typically takes weeks to properly prepare our notes (I’m not a writer, our business is investing… we muddle through the writing best we can) … As I sit down to type, the evening of Thursday, February 27, 2020, I’m faced with two options; the first, finish the note I’ve worked on for multiple weeks – option two, address recent market activity…

Option 1 would definitely be more polished, though we believe option 2 to be a much more significant topic in the moment. We’ve opted for latter and will release what we had been working on in a few weeks. Please allow a little leeway should we bounce around a bit, this is important…

Unless you’ve been living under a rock, you’re well aware of the recent turmoil in financial markets that’s transpired over the week.

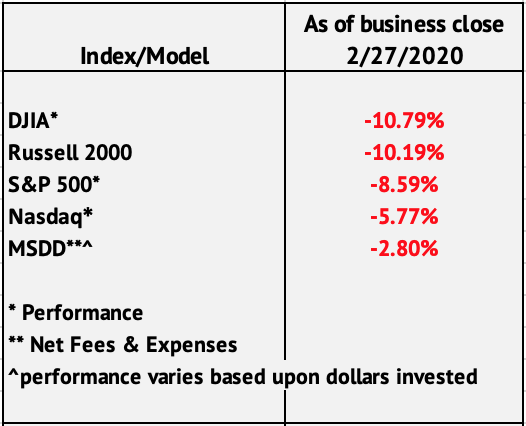

After hitting a new all-time high on February 19th; the Nasdaq has collapsed -12.97% in 7 trading days, closing down -4.61% today alone. A similar story for the DJIA, as it reached new heights on February 12th, losing -12.9% since, -4.42%today as well. Like the Nasdaq, the S&P 500 hit new highs on February 19th, it too has shed -12.26% since and closed down -4.42% today. Finishing with the Russell 2000, it saw new highs dating back to January 17th, and while it had remained relatively flat over the last month, it’s experienced a downdraft of -12.78% over the last 5 days as well; closing down -3.54% today.

With many individual names faring far, far worse.

We titled our 3Q2019 note, “Cycles Matter & Risk Happens Quickly”, (If this week’s proven anything, it’s that “they” surely do and “it” absolutely does…) Market volatility has blown out to unprecedented levels. More concerning, traditional refuge asset classes such as REITs, Utilities, Consumer staples even Gold have broken down experiencing significant drawdowns. These asset classes tend to be more stable in a low growth, slowing inflation environment (like the one we are currently in).

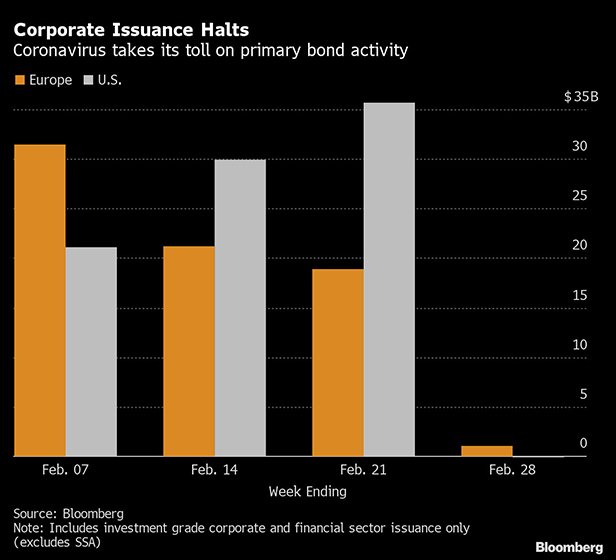

As active investment managers see redemptions, they NEED to sell in order to meet investor requests. With credit markets grinding to a halt this week, managers will sell where liquidity exists, this is often referred to as the liquidity trade.… We believe that in our current environment, where passive investing has become pervasive, air pockets which provide no liquidity exists, exaggerating & perpetuating panic selling.

Make no mistake – we have entered an extremely challenging investing environment. It is true that Rip-your-face-off-ralliesdo typically occur during extreme sell offs. Though, as the majority of traditional Wall Street advisors and financial news network pundits (including the POTUS) have parroted, “COVID-19 is no big deal”, “the Fed will save us”, “the consumer is resilient”; let us remind you of a few things…

- ~480 companies have reported 4th Quarter 2019 earnings to date… “growth” lies at 0.69%. Without a positive 20.33% coming from Utilities – these anemic “earnings” would have been NEGATIVE (PRE-COVID-19).

- Wall Street consensus calls for “accelerating growth” through 2020?! Seriously?

- With the 2nd, 3rd, 7th & 8th largest economic contributors to global GDP in the world virtually grinded to a halt due to COVID-19 with no defined end in sight, global GDP is likely to print negative for 2020. (China, Japan, France & Italy respectively) – #4 Germany is on the brink of recession as well… What could possibly go wrong?!

- The largest of publicly traded companies have withdrawn forward earnings guidance for 2020

- Credit Markets have temporarily seized up given this week’s turmoil. As reported by Bloomberg, there will likely be NO Investment Grade Bond offerings this week. How long do you think this can last?

Did I mention the 10-year treasury yield is 1.18 as I type?

Investors are awaiting guidance from the Federal Reserve; treasury yields are screaming for them to cut rates. Most are shocked they haven’t cut yet; and as you could imagine, our take is slightly different.

The Federal Reserve has stood at their pulpit preaching these most recent 3 rate cuts to be “mid-cycle insurance adjustments”. The moment they cut rates further; they will have admitted this is much more than a poorly supported ‘sold narrative’. Remember this is a confidence game.

Few people are willing to use the R-word (recession), but with corporate earnings having been flat to negative for 6/7 quarters and balance sheets being as levered as they are (which we’ve discussed ad nauseam), even the slightest hit to cash flow can adversely impact a balance sheet; large scale layoffs should be anticipated and surprise no one.

Layoffs tied with prolonged investment account weakness will force individuals to tighten their budgets; further curtailing spending.

Supply chain disruptions have the ability to bring about inflation (and not the kind the Federal Reserve seeks). We’ve written at length about inflation, we’ll point to our 2Q2018 note, specifically the , “Fed Speak” section. However, for the purposes of this thought we ask that you consider the farming industry, which has not deleveraged in decades, while at the same time commodities have seen depressed pricing.

Farmers have taken on copious amounts of debt and should we fall on recessionary times, there is a very real chance many of these farmers go out of business. From those we speak to who are close to the industry, we believe financial institutions have begun to tighten the noose on small/mid-sized farmers already, and should we see bankruptcies from this industry, food prices have the ability to move significantly higher, quickly. (We noted The Memoirs of Herbert Hoover, The Great Depression in our last note, Hoover specifically discusses how farmers were hit hard and fast)… How do bankrupt farmer’s pay for their John Deere tractor leases?! Think about it…

Additionally, China’s biggest factories are offering bonuses to entice employees back to work, per the Financial Times.

“Foxconn recently raised its bonus for returning workings to Rmb 5,250 ($747). Rival contract manufacturer Pegatron, also an Apple supplier, has offered Rmb 10,000 bonuses to attract temporary workers to its Shanghai campus.”

Who do you think will ultimately offset these bonuses? The already highly leveraged American consumer who is not nearly as strong as most would have you believe.

What does it all mean?

It means excessive leverage and debt matters, cycles matter, liquidity traps created by a passive investment world matters, Federal Reserve policy perpetuating an extend and pretend mentality matters… While COVID-19 is an unknown uncertainty, it didn’t create these problems, but it surely is exposing them.

In plain English we’ve detailed the Fed’s inability to increase interest rates as they attempted to, we outlined why Quantitative Tightening (QT) as the Fed likened it to watching paint dry. We lambasted a cavalier Bernanke for his smug, “it hasn’t finished, but that also has not shown itself to be a big problem so far”.

It means just about everything we’ve written for the last 3-5 years matters, as we’ve always said, it’s just a matter of time and no one knows exactly when?! The first paragraph of our conclusion from 1Q2018:

Our thesis still remains higher highs this year, we maintain the belief that at some point, this won’t end well for many. Our “years to come” thesis revolves around the volume of debt that needs to re-price 2019-2021, met with rising interest rates, QT (Quantitative Tightening) from the federal reserve taken too far; coupled with a tapped out, over leveraged corporate and consumer borrower. Until proven otherwise, this volatility remains a correction in what appears to be a continuing “late stage” bull market. I’m not convinced we’ve seen the worst of what’s to come before the market resumes its march higher fueled by continued global central bank buying (remember, I said fireworks).

Tell me what part of this hasn’t happened over the last 2 plus years? We then said this, which still holds true today:

I wish I could tell you exactly how this will play out… We’ve had a fairly good run so far; we’ve been pretty accurate in speaking to things prior to them happening, but as I have said numerous times, no one has a crystal ball. We will continue to tirelessly study, read, research and seek out larger macro trends that have an ability to alter our thesis and how? If necessary, we will adjust our strategy based on any new information we come across. When facts change, we’ll be as fluid as we can and adjust as quickly as possible. I’ll leave you with a relevant quote.

I said empty your mind, be formless, shapeless, like water. Now you put water into a cup, it becomes the cup; you put water into a bottle, it becomes the bottle; you put it in a teapot, it becomes the teapot. Now water can flow or it can crash. Be water my friend. ~Bruce Lee

Typically, we don’t release performance numbers till quarter end, though as of close of business Thursday, February 27th, our primary model did go negative today, though, we’ve held up fairly well all things considered. Prior to the sell off, we were up slightly more than all indices (except against the Nasdaq), however, our current drawdown is significantly less than all major indices.

We’ve done our best to provide you the information we would want to hear if our roles were reversed. We will remain disciplined in our process while dialing in additional risk management tools; favoring odds over outcomes when taking advantage of opportunities as they present themselves.

We’ll continue to seek ways to best protect retirement assets that have challenges taking advantage of market sell offs. We do not and will not accept the narrative that is constantly sold by the industry… As “risk mitigation” through diversification via ETF/Mutual Fund investing has again failed to protect the majority of investors from this most recent sell off (Risk Happens Quickly).

No one has any idea how damaging COVID-19 will be? With advanced medicine, proper hygiene will it be nothing more than a flu or pneumonia? Truthfully, we have no idea. There are reports out of Thailand that their incidence rate is falling, suggesting weather may have an effect on reducing transmission. We just don’t know… We typically lean to the “be prepared” mentality.

COVID-19 will play itself out over the course of time. It does seem a bit extreme to us that a country like China would literally weld people into their homes and build 600,000 bed hospitals in 8 days – or Japan would close ALL schools till spring and consider cancelling an event like the Olympics if this were so benign, but again, we humbly submit, we just don’t know.

What we do know is that much of the lost consumption is just that – lost. We will not see people double the number of coffees they drink from Starbucks as things normalize. People won’t eat double the number of burgers from McDonalds. Will the number of iPhones increase in kind, who knows? That’s not the issue…

The issue has been a slowing economy with flat to negative earnings for a prolonged period of time (pre-COVID-19). It continues to be excessive leverage and debt paired with a slowdown in global growth. The “fix” of “more of the same” is a noose around all of our necks.

Obnoxious amounts of Global Central Bank intervention have failed to achieve the growth Central Bankers have strived for while savers and pension funds are forced to take excessive risk in an effort to keep up with obligations (spoiler alert: it’s failing).

I’ve noted this before, but for all of those reading this who believe they “investing for the long haul” … that’s fine, I get it – just do yourself a favor and please 1. Read Hoovers Memoirs and 2. Remind me how many years it took for the DJIA to reach its August 1929 high following the Great Depression? ~25 years. Then ask yourself what the average life expectancy is for a healthy US citizen? What type of lifestyle would you like to experience in those years?

The premise of averaging down only works if you have the capital to do so… It doesn’t work so well when your capital is wrapped up in investments that are under-water and you’re drawing on principal for income. When your principal is required to live because your interest income is virtually nil – then you have a sequencing of returns problem.

When debt is your problem – and “more debt” has been the solution for decades – come the time when something ultimately breaks, the old solution will be no solution at all…

Investing as we once knew it broke decades ago, we’ll discuss this in more detail in a few weeks. If we want to thrive moving forward, it’s time to evolve.

Can asset prices move significantly higher from here, sure…? No one knows to what length Central Bankers will go to perpetuate “our current expansion”. And if they do, we’ll adjust accordingly.

Though as we mentioned in December, whether you know it or not, times like NOW are the reason you have hired us or consider doing so…

As always, we’re happy to discuss our market thoughts along with strategies and more, never hesitate to reach out with any questions or concerns.

Thank you for your continued trust and support!

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

www.othersideam