In This Article

“Because of the Fed’s interventions, market prices and credit spreads don’t have the information content that we think they have. The Fed is mucking up what prices mean.”

Peter Fisher, former Fed Executive VP, Bank for Int’l Settlements, US Treasury, etc.

“There is a bear market out there – it’s in true price discovery.”

David Rosenberg, former chief economist Merrill Lynch

Something is going on out there – the repo panic of Sept/19, followed by the equities panic of March/20 … suggest systemic risks, which the Fed has been scrambling to cover. The Fed’s current largesse is an order of magnitude beyond anything previously seen. Depending on whose data you use, it’s well in excess of $6 TRILLION.

Does anyone else remember when Bernanke and Paulson nearly wet themselves asking Congress for $700 billion in 2008? You may recall, the TARP (Troubled Asset Relief Program), while initially rejected by Congress at the very least brought scrutiny; triggering public hearings with high profile bank CEOs being hauled before Congress to be grilled. This time around, the money has hemorrhaged with no questions asked.

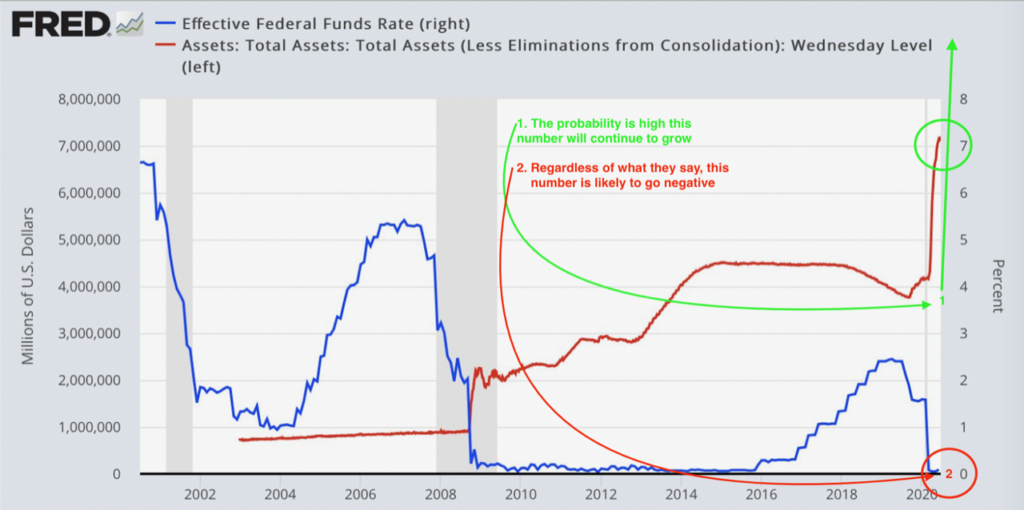

The below chart summarizes the increased Fed balance sheet and the flooring of interest rates. Such volumes of liquidity and artificial suppression of rates inevitably destroy normal price discovery.

Sustainability, that is, whether the Fed can indefinitely save the day, well that’s a different story… this is the primary reason that we’re not in a rush to chase US equity markets at this moment. Note that the Fed must issue record levels of liquidity and push rates to record lows each time it is called upon. Yet they have utterly failed in attaining their stated goal of 2% inflation.

Probabilities suggest that not only is the Fed’s response MUCH less likely to work as it has in the past, but given the Fed’s inability to rein in volatility, RISK continues to be exponential. The volatility of the equities markets as measured by the VIX, is currently in the mid 30s; a level which, historically, is unsafe for investing your nest egg. It is fine for casino bets with the money that you can afford to lose, but your retirement plan deserves better.

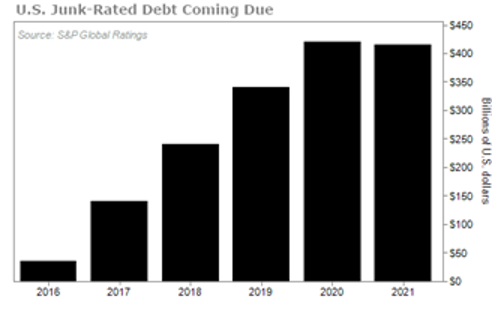

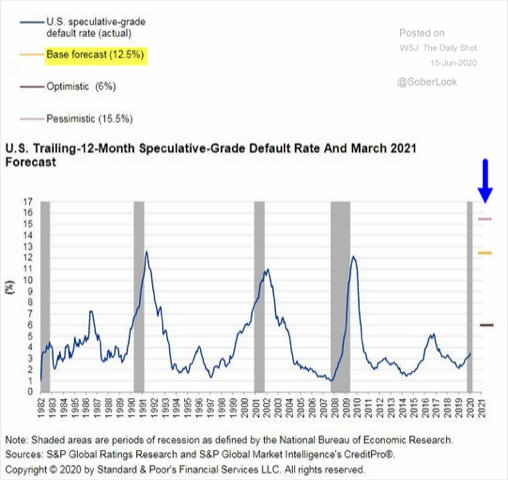

In the minute market timing is a challenge. Having said that, larger secular trends are often easier to spot. We’ve been writing about the next credit cycle dating as far back as 2016/2017, placing the most probable timing between 2019-2021. Why then? Simple, an insurmountable debt maturity wall coupled colliding with decelerating revenues in the face of THE WORST CREDIT QUALITY EVER.

In our 2Q2017 note, we provided the below chart, noting:

“More than 9.5 Trillion dollars’ worth of Global Corporate Debt will be coming due over the next 5 years. Roughly 2.3 Trillion of this is considered “High yield” – “Junk Bonds”

Roughly 1.5 Trillion of this debt is that of United States corporates”

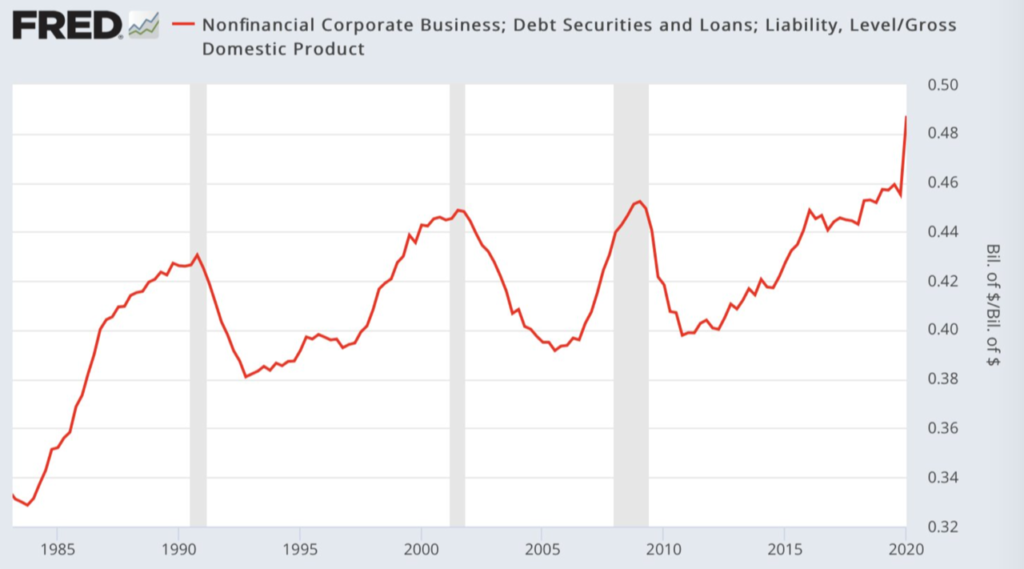

So, with a record bounce off March 23rd lows, one which most are calling a “reflationary” move, everything’s fixed right?! Wrong… Near insolvent firms are taking on more debt than ever before… note the “little” COVID spike in corporate loans below:

Typically, when times are good, when cash flows are strong, and when earnings are growing the multi-trillion-dollar debt scheduled to mature would roll over with a “refunding issue”. These are not the circumstances today.

That Damn Cycle Again – What Goes Up Must Come Down

Business cycles happen, have always happened, and always will happen. The up-cycle – the growth part of the cycle requires:

- Access to credit in order to expand and grow; and

- A robust consumer to support the expansion and growth.

The inevitable down-cycle is necessary to bring on Schumpeter’s “gales of creative destruction”, to cull the unproductive and unprofitable firms that have been able to limp along during the good times – the corporate zombies.

We argued the down-cycle is as natural and necessary to an economy as fire is to the growth, expansion and health of a forest in our 4Q2018 note:

Credit default cycles are normal; they are as natural for the investing ecosystem as is a forest fire’s ashes returning nutrients to the soil rather than being trapped remaining in old, dead vegetation.

About 70% of the US economy is based on consumer spending. That is where the corporate revenue comes from, a portion of which is used to service debt. When times are good, poorly managed companies are allowed to increase their debt to levels where, when the downturn inevitably happens, they can no longer make their interest payments. Hyman Minsky called this the Ponzi level of financing; we’ve described it as “Extend and Pretend”. The longer the period of growth, the more debt companies incur. You might think of airlines and car rental companies at this point.

Debt servicing was becoming an issue pre-COVID19. Our 1Q2019 quarterly cited Jim Bianco’s work:

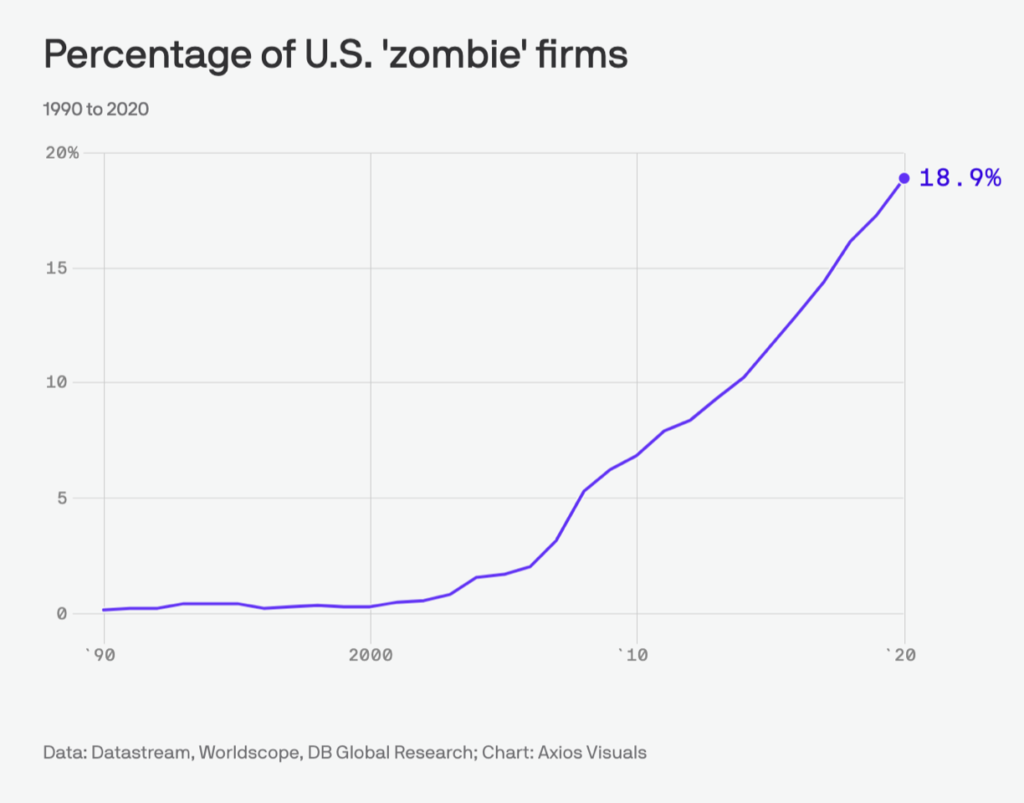

Bianco research detailed the rise of more zombie companies (defined as those who can’t service their interest expense through operating income) suggesting a number greater than 15%, more than twice the level seen pre 2008 mortgage crisis.

Recent research out of Axios suggest this number to be near 20%

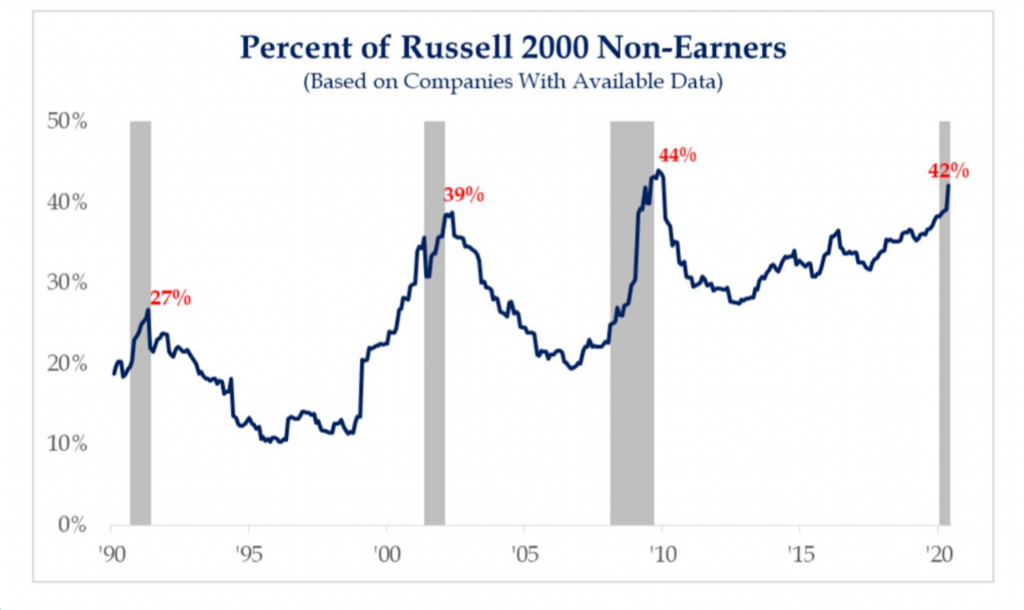

While work out of Strategas suggests over 40% of all small cap companies are now Zombies.

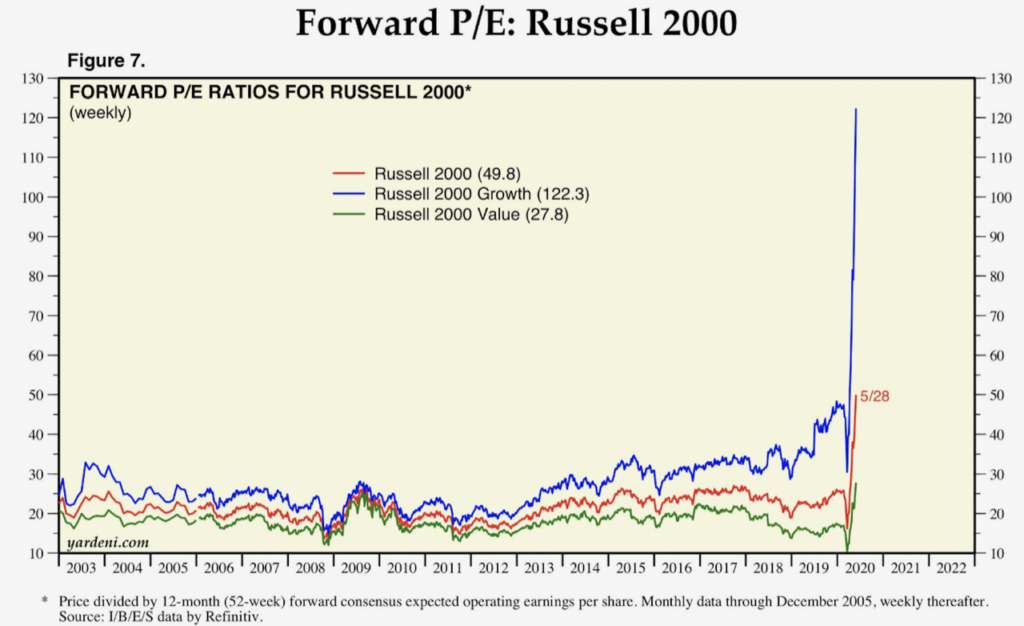

Which seems to be supportive of work out of Yardeni research on Forward Price to Earnings metrics of small caps … with no earnings, small cap stocks have NEVER been more expensively valued.

Earnings have been declining for years as the resilient (over leveraged) consumers we’ve heard so much about have been tapped out. Following the COVID shock, the destruction of cash flows has been traumatic. Yes, it is blissful to temporarily watch an ever-increasing S&P or Dow Index, allowing you to think that all is well, but …. EARNINGS driven by consumption MATTER!

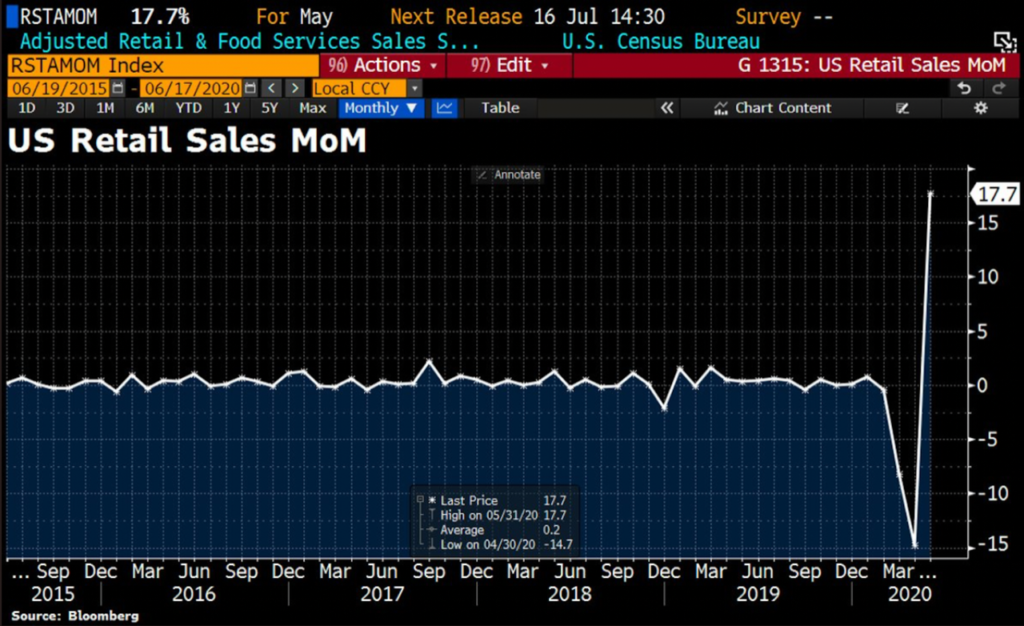

You may have heard that retail sales crushed expectations in May, up 17.7% vs. the expected 8%… Let’s put some perspective on this with two charts … the first is the May Retail Sales, MoM (Month over Month). Looks pretty impressive, doesn’t it?

Not so much when reality smacks us while looking at YoY (year over year) data:

The first chart is an illusion built off pent up demand, suggesting that individuals who had been locked in their homes for nearly 2 months were finally returning to their normal spending levels. The second shows the true recessionary pattern. It’s a simple mathematical progression: Lower sales lower revenue lower earnings lower debt servicing.

The Wall Street Journal reported on June 18 that millions of mortgages, rent payments, student loans, credit cards, and auto loans are in forbearance or outright default:

“Americans have skipped payments on more than 100 million student loans, auto loans and other forms of debt since the coronavirus hit the U.S.”

It’s not merely millions – IT’S OVER 100 MILLION. LET THAT SINK IN…

Previously we’ve noted that over 68% of the unemployed are making MORE money remaining unemployed based upon the federal government’s additional UE benefit programs (incentives) under the CARES ACT. The additional $600 per week of benefits provided under the CARES ACT expires on July 31st while forbearance on auto loans, mortgage payments, and rent will expire shortly thereafter.

Anyone want to take a stab at what might happen to all of the “pent up demand” and retail sales discretionary spending when the 106+ MILLION LOANS (and growing) need to be brought “CURRENT” as the PPP unemployment benefits come to a screeching halt?! Um, Income CLIFF anyone?

People stop making payments on their loans because they have no money (or incentives suggest ignoring them).

These programs may or may not be extended, but the fact that our economy (and stock market) is currently relying on such loan deferrals raises two issues that are beyond the scope of this paper:

Issue #1: The Fed can’t print money forever – they can’t monetize all US debt and support all of the holes in corporate cash flows as they have over the past 3 months. Such a huge generation of money supply has unavoidable consequences, starting with foreign selling of US Treasuries (which saw record levels of such sales in both April & May) leading to questions of uncontrolled inflation and cracks in the USD as the world’s reserve currency.

Issue #2: Continued forbearance might be fine for the unemployed consumer, but it has an immediate impact on revenue and cash flows for the banks, credit card/loan companies and mortgage holders who own the debt. It is an open question what percentage of these 100+ million loans will go into delinquency and default, but the number will be large. Every defaulted loan impacts a bank’s balance sheet.

Again, the above two issues are beyond the scope of this paper, but they should be a warning flag to you that all is not well in the US economy and financial system … something is going on out there.

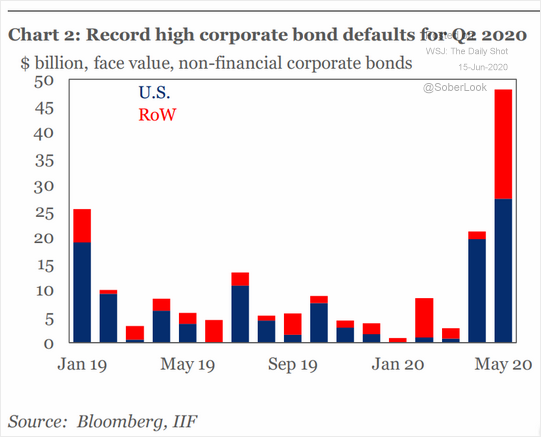

Defaults are already showing up in enormous size in the corporate bond market. There have been more defaults in the past 2 months than in the entire previous year. Again, every bond default deteriorates a balance sheet:

With more lined up, not yet showing in the data.

One prominent example is the Mall of Americas in Bloomington, Minnesota. It is two months delinquent on a $1.4 billion-dollar loan. “The loan is currently due for the April and May payments”, according to a report filed by the trustee of the debt, Wells Fargo as reported by Bloomberg.

It’s tough to make payments when your tenants are all standing in line together waiting to file for bankruptcy protection.

Is there systemic risk here? It’s important to note consensus opinion tells us that the banks are well capitalized and that our current “crisis” is not a banking crisis as in 2008/09. Indeed, the crisis lies in the debt loads of the banks’ clients, however, a wave of rolling bankruptcies will cause severe loan losses for the banking sector, and many GSIBs (Global Systemically Important Banks) are levered far more than Lehman was.

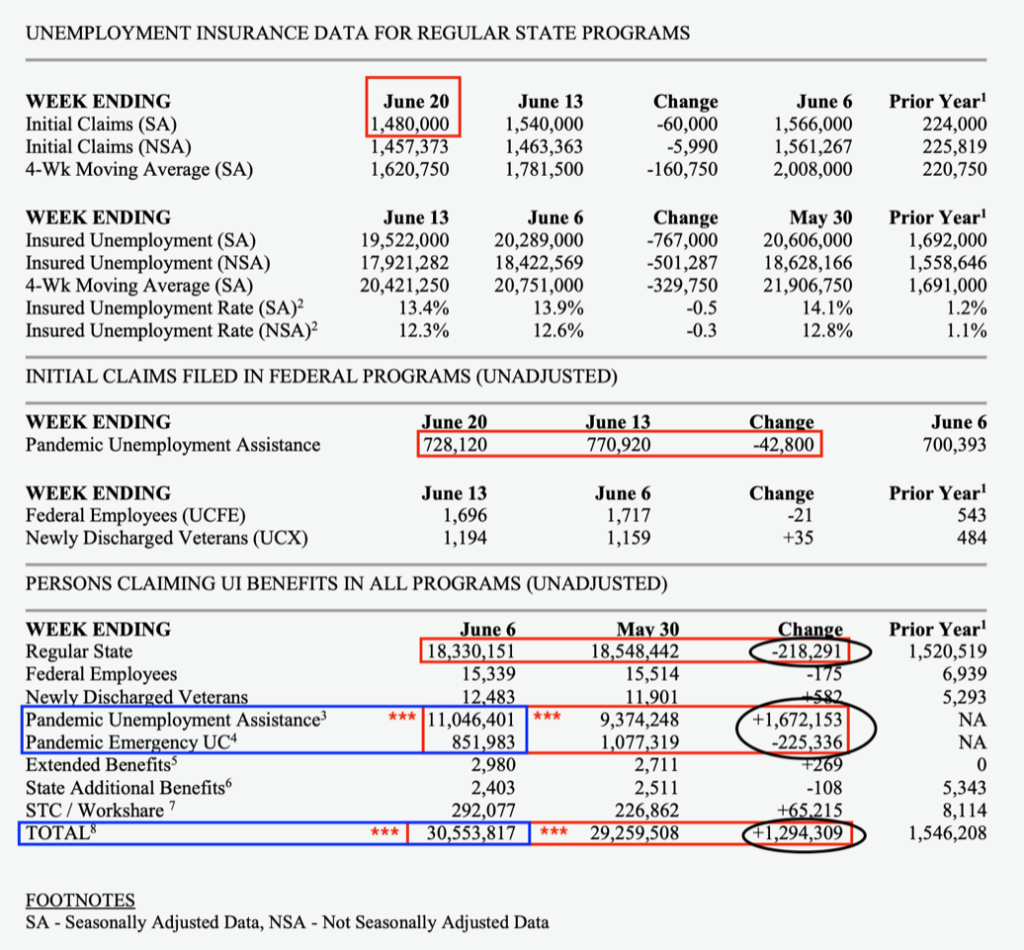

Given, the US economy rests on the consumer’s shoulders, and with 31,000,000 US workers currently unemployed, recovery will not be quick or smooth.

This month, with a h/t to @HedgeyeFIG we bring to you PEUC (Pandemic Emergency Unemployment Compensation), which provides up to 13 weeks of ADDITIONAL unemployment benefits to those who have already EXHAUSTED previous state and federal compensation. This number grew to over 1 million individuals WoW; increasing by 107% into May 30th data. While this week’s data shows a slight decline, PUA jumped by nearly 1.7 million claims as TOTAL CLAIMS grew from 29.3mm to 30.55 MILLION. Unemployment is STILL GROWING, not shrinking.

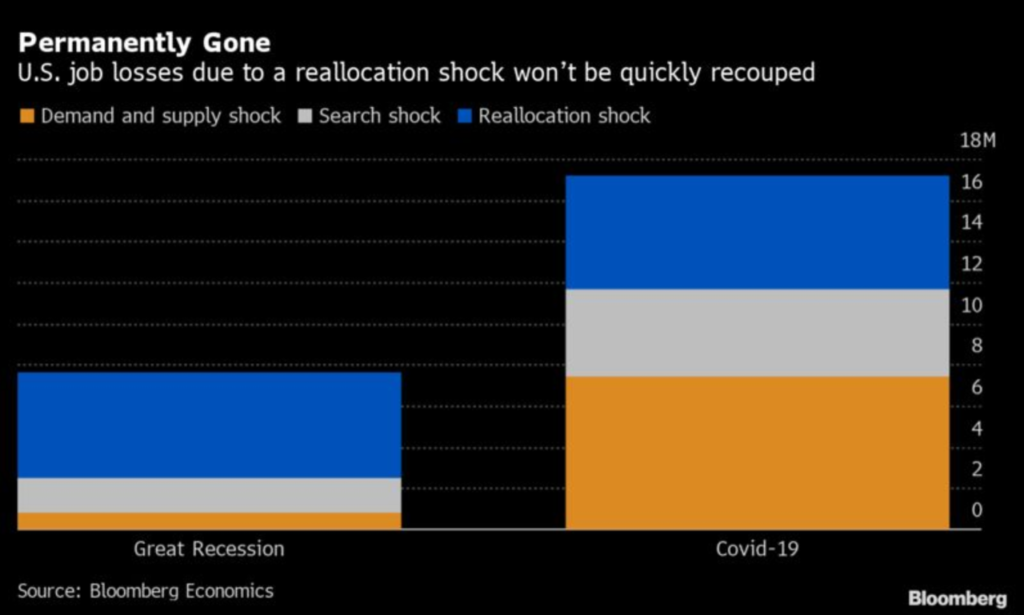

With more of these job losses looking to be more permanent by the day.

Distress is literally everywhere …

At the end of the day, if this were a story about the COVID virus only, then we might be singing another tune, but it’s not; it’s an end of the business cycle story with the cover of a virus. The Fed cannot endlessly print income for 30,000,000+ unemployed, and it cannot print free cash flow for millions of companies adversely affected. It can’t print jobs, and it can’t print away the rolling bankruptcies that we are seeing.

Desperation

On Thursday, June 11th, a day which followed Fed Chair Powell’s most recent statements on the path of the Fed’s policy, equity markets sold off -6.9%, -5.89%, -5.27% & -7.58% for the DJIA, S&P, Nasdaq & Russell 2000, respectively. The selloff continued through Friday the 12th, with markets opening significantly lower on the Monday the 15th as well, until … The Federal Reserve announced an “update” to their Secondary Market Corporate Credit Facility (SMCCF) which was formed on March 23rd. (note the 4th arrow labeled on the image below)

It’s bad enough investors are willing to watch their portfolios fall by 5-8% in a single day, yet with every perceived crack in confidence, the Fed becomes more desperate crossing red line after red line. This announcement is no different. As re-announced on June 15th, the Fed will NOW be buying individual corporate bonds on top of the corporate and Junk ETFs they had already been buying… You can read the update by clicking here.

After nearly $2.9 trillion of fiscal stimulus, a Federal Reserve balance sheet expansion of over $3 trillion, 10+ purchasing/direct lending facilities creating a record “bounce” off the fastest decline in history of equity markets, the Fed chooses this day to re-announce their purchases of individual bonds? WHY?

Because this was not just a re-announcement of the already known; this announcement created an entirely NEW class of “eligible assets” the Fed could purchase called “Eligible Broad Market Index Bonds”. The Fed’s original announcement required issuers to comply with the Coronavirus Aid, Relief and Economic Security Act.

This provision excluded many company’s corporate bonds from being purchased based on restrictive hurdles, such as: a large portion of corporate operations and a majority of employees must be US based (imaging that)?! Additionally, Section 4003(c)((3)(c) states the purchases need to be “security based on an index or that are based on a diversified pool of securities.” i.e. an index or ETF. So, what did the fed do? They crossed yet another RED-LINE by creating THEIR OWN Index. (ZERO shame…)

For further consideration:

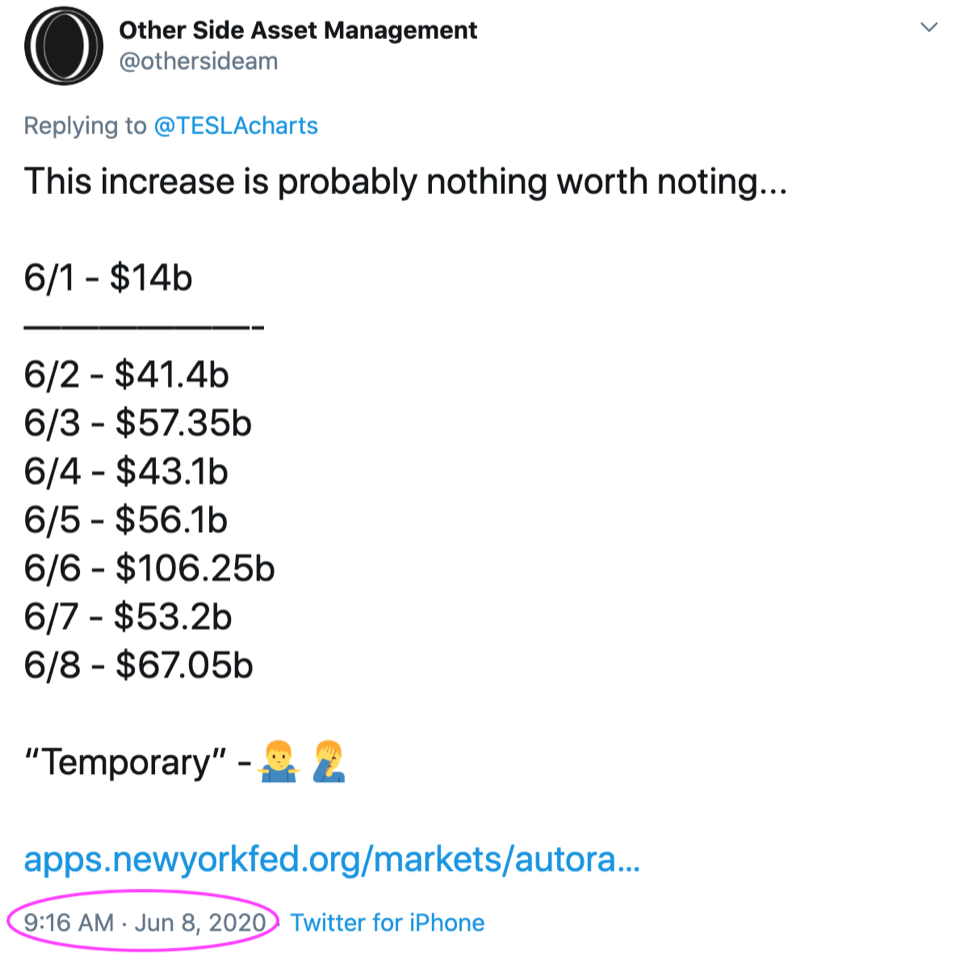

On June 8th we noted on twitter that the Repo markets (which saw significant turbulence last September and largely contributed to the 2020 market collapse) began to show signs of stress, again:

We followed up a few days later on 6/11, as the stress continued:

And to complete the data series up through the Fed’s June 15 announcement:

6/12 – $49.2b

6/15 – $53.35b

6/16 – $21.9b

6/17 – $4.5b

6/18 – $1.0b

6/19 – 6/23 saw $0.00 … You read that correctly from $50/$100 billion to ZERO immediately following the Fed’s new tweak.

The innocent will say this is merely a coincidence; that overnight repo operations just happened to fall off a cliff the day after the Fed made this announcement; heading into quarter end when liquidity is needed the most. A skeptic might think that something is going on out there.

What should terrify the sh*t out of every long beta market participant is that the Fed can’t seem to plug the holes fast enough.

Immediately following yet another significant equity market drumming on 6/24 and significant follow through the morning of 6/25; the FDIC with the OCC by its side, announced they would be loosening restrictions of the “Volker Rule”, allowing financial institutions to make large investments into the VC (Venture Capital) markets. You remember, that rule inserted into the 2010 Dodd-Frank Act, which was passed in an effort to PREVENT another financial crisis due to the irresponsible risk-taking behavior of financial firms which led us into the GFC (Great Financial Crises).

Passage of this proposal would also allow these institutions to avoid setting aside CASH for derivatives trades between affiliates of the same firm. Relaxing these margin requirements for swap trades between affiliates could free up an estimated 40 billion dollars earmarked for arguably the riskiest of asset classes as we continue along into the largest bubble inside of a depression ever seen. Why not, it’s not like this past year hasn’t been a banner one for VC firms like SoftBank who have been decimated by tens of billions of losses, why not allow banks to just let it fly?!

Sheila Bair, chairwoman of the FDIC throughout the financial crisis called the two changes, “ILL ADVISED!” “As a former chair of the FDIC, it won’t surprise you that $40 billion dollars that will no longer be in banks to protect them against derivatives exposures” will likely increase risk to government, said Sheila Bair on CNBC’s Squawk in the Street 6/25/2020.

The LONE dissenting vote on the Fed was that of Lael Brainard, you can read her dissent in its entirety here, though here are a few of her thoughts,“I am concerned key changes in the final rule weaken core protections in the Volcker rule and will permit banking entities to return to risky activities seen in the 2008 financial crisis … The final rule does not provide evidence of changes to the statute or the associated risks that would justify permitting banks to make such investments … I do not support the final rule.”

Ah, who needs evidence?! The recklessness is mind numbing at this point; it SCREAMS DESPERATION!!!

This will not bring back jobs. This will not fill the consumer spending blackhole. This will NOT remove debt from overly leveraged companies with limited to no cash flow. This does zero to solve the real problem, making it yet another feeble and yet, transparent effort to artificially inflate asset prices, which is losing efficacy with every new attempt. (See May 2020, Law of Diminishing Returns)

The reflation camp on Wall Street is a big one. It is vocal, influential, and has every interest in keeping the bull market going. By definition, it’s the 440,000 brokers whose primary advice is “buy and hold!” and “buy the dips!”

The problem is even with millions going back to work, there continue to be MILLIONS left lingering with no jobs for some time… Will that number be 5-10 million? Will it be 15-20 million? Whichever it is, that consumption will be missing for some time from a consumption driven economy.

Final Thoughts

Which brings us to a quick lesson on Risk Management. Last month we felt very strongly about the US Dollar, and long-term, we still believe in this thesis. The reality is, if stagflation sets in, the dollar is likely to be weak with commodities rising. As much as I believe in the strong dollar thesis, capital preservation and risk management aren’t always about being right. Our capital preservation strategy has triggered, so we’ll take a breather, placing the strong dollar thesis on the bench for a while just as a good coach would.

We’ll leave you with a few words from the highly respected Jeremy Grantham. Those with me for some time may recall I wrote about being lucky enough to witness a debate between Jim Grant and Jeremy Grantham back in 4Q2017, a great exchange from two brilliant minds. Grantham is one of few men who have successfully called the last 3 stock market bubbles. In a recent CNBC interview Grantham was asked about the current investing environment, to which he stated:

“This is crazy stuff! And I’m talking about not the last 3 or 4 months, but the last few weeks. We’ve now reached a level where you buy bankrupt companies; you issue stock in bankrupt companies that will probably be used to pay off the bondholders and ah, you bid up your favorite companies to ludicrous levels … this is really, the Real McCoy.” Jeremy Grantham CNBC 6/17/2020

Maybe this euphoric new bull market will continue. But ask yourself, can it continue its unrealistic valuations indefinitely? And, if not, how do you protect yourself?

As mentioned at the opening of this paper, “we’re not in a rush to chase US equity markets at the moment”. If you do buy equities, be very selective of the names that you buy. Do not rely on broad indices. Remember these indices by definition cause you to be invested in zombie companies, being nearly 20% of the S&P 1500 and 40% of the Russell 2000. Buy defensive names, commodities, gold, treasuries and consider hedging your positions with trailing stops or selected short sales.

Be careful out there.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.