If you knew the odds of any specific outcome was 85% in one direction or another, what would you do?

In previous notes we’ve broached the subject of discounting outcomes; today we’re going to discuss placing the odds in our favor, displaying it in real time…

We titled a section, “Cloudy with a chance of Meatballs” in our 4Q2017 note (an homage to the children’s film after having watched it with my daughters). In that section we said:

“If the weather report suggests a 20% chance of rain tomorrow, how many people would carry their umbrella? Be truthful – the answer is virtually no one. Human behavior suggests most people either round large probabilities up to 100% likewise, they round small probabilities down to 0%; but if it actually rained, most people would more than likely be upset with the weatherman…”

For decades studies have shown we discount the minority percentage of most outcomes to zero and while inflating sizable favorable outcomes to 100%. Since our writing in 2017, World series poker champion Annie Duke has written and released “Thinking in Bets; Making Smarter Decisions When You Don’t Have All the Facts”. It’s the largest compilation on the subject (written in plain English) I’ve seen as she cites more sources than this note has room to tackle. I highly recommend the read, you’re likely to learn quite a bit about your own decision making.

Annie Duke isn’t simply a World Series of Poker champion, among her English and psychology degrees from Columbia, she’s also got her masters and doctorate in cognitive psychology from the University of Pennsylvania. She has made a career off of reading people and how they think, making her a highly sought-after public speaker, while also working with c-level executives in an effort to help them understand the difference between quality of decision vs. merely linking quality to outcome (more on this later).

While it’s important to remember that there is always a chance of the minority percentage of any specific outcome occurring, it’s called the minority outcome for a reason; they occur less frequently; how much less frequently depends on the percentages – our odds… If the weatherman’s computer models called for rain with an 85% probability, we are much more likely to grab our umbrellas then if s/he called for a 15% chance of rain; 85% is a much higher probability then 15%; our risk of getting wet is MUCH greater with an 85% chance of rain then the 15% chance of it not raining.

So, I’m going to ask again: If you knew the odds of any specific outcome was 85% in one direction or another, what would you do? Would you use it for convenience like grabbing an umbrella, so you don’t get wet? Would you use it for gain like playing more blackjack, placing larger bets or playing the lottery more frequently? What about protection like installing a home security system in your home reducing the chances of a home invasions by a substantial percentage? What if it’s an 85% chance of a destructive hurricane, would you react?

The simple answer is, in most cases – the vast majority, you would use the odds to your favor!

Over the last few years we’ve attempted to detail numerous warning signs emerging in the financial markets, deciphering that which is market moving from simple headline noise; as currently we’re being fed a healthy dose of both. From copious amounts of debt and poor credit quality to inverted yield curves, leveraged loans and trillions of dollars in negative yielding corporate and sovereign debt, we’ve written about it and have invested accordingly, placing the odds in our favor.

We’ve tried to be crystal clear; no single indicator is reason to believe we’re headed for an imminent market crash, it’s more the collection of warnings that have been growing in both size and scope, that’s given us reason for pause and caution leaning us to our slightly defensive positioning (i.e. raise cash, own gold and experience some short exposure as a hedge).

In this note, we’re going to add two more indicators to the list, though, this time, we’re going to provide you with some firm numbers – odds if you will. Again, we understand the minority outcome can play out – though, we’d ask anyone who consistently plays the minority odds how it worked out for them over the long-term. We believe a moderate hedge is warranted at this point.

The first is something we believe most are overlooking – this being the market action last Monday, August 5th. US markets fell big – a 3% drop as measured by the S&P 500. The S&P 500 is comprised of 500 of the largest companies from many different sectors – it’s revered as a strong, diversified index – a benchmark. A 3% sell off is not a frequent occurrence, it’s actually quite rare.

Over the last decade the S&P has fallen by 3% or more in a single day only 19 times; 16 of which have been part of a much larger correction ranging between 10-20% (16 out of 19 equates to 84.12%). Even when looking at the 3 out of 19 that weren’t part of a 10-20% correction, they were still part of a larger sell off (just sub 10%).

The second indicator every talking head on Wall Street has mentioned ad nauseum the last 3 days. The 2-year yield curve finally inverted with the 10-year yield curve, as has the 3-month curve inverted with the 10-year (some time ago). Many say it’s a predictor, I would argue it’s the cause of… but our focus will be on the former thought vs. the latter as the former is more immediate while the latter tends to have a lag time associated with it. Still important to remember, 100% accuracy rate over decades is nothing to scoff at; I digress….

So, how do we place the odds to our favor? Protection! We’re currently positioned slightly defensively and have been over the course of the last few quarters. We’ve increased our gold stock positions, our cash holdings and recently added short exposure through an ETF designed to capitalize on markets moving down. Additionally, we continue to follow our sell disciplines should they be triggered. All of these protections are in place to soften the blow of a larger, broad market sell-off as they have for us all year (the odds of which that is likely to occur being 85%).

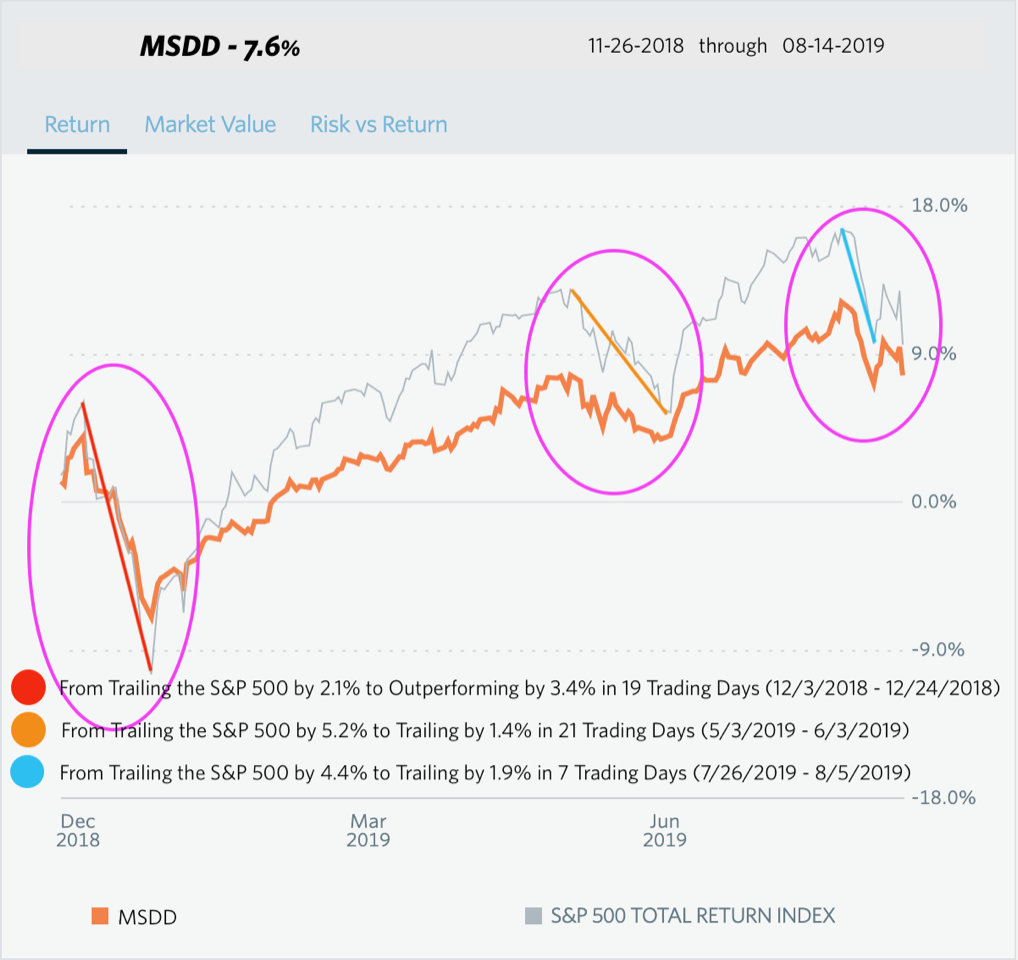

As you can see from the image below, each of the most recent corrections, while we have sold off, it has been much less than the major benchmarks. December of 2019, we went from trailing the S&P to outperforming, while both May and currently August, we’ve pulled within a few percentage points rather quickly. Markets typically correct much faster than they advance. As the saying goes, escalator up, elevator down.

It’s important to note the date range on the graph is 11/26/2018 – 08/14/2019, it is not a YTD chart.

Some have suggested, we’re fine buying and holding; a 10-20% correction is more of an opportunity; and it’s true, we haven’t sold everything and headed for the hills just yet either as we don’t believe it’s time to get too bearish just yet. Though, we wouldn’t consider committing more capital on a 5/6% dip from all-time market highs buying at a discount either.

We’ve gone on the record numerous times: our belief is Central banks will exhaust all resources to protect themselves, which will likely result in a blow-off top of epic proportions. Though, in understanding the characteristics of blow-off tops we know their conclusions have been disastrous. History suggests investors will fail to prepare as their concern for keeping up with benchmarks will overshadow the necessary preparation. For those wondering, markets have yet to announce the date of its next major liquidity and credit default crises – it’s still TBD.

The question is and will always be, when? As discussed for years, no one – not the brightest of the bunch knows the exact timing… Though understanding the markets structural deficiencies and hedging yourself places the odds in your favor. Just because I don’t believe this will be “the big one” doesn’t mean it won’t be… It doesn’t mean we shouldn’t be prepared. No one has any idea how UBS’s decision to charge 0.75% on larger deposits will affect the bank? Who wants to be charged to park money not earmarked for investment? This could easily create a run on their bank as well as the entire European banking system; taking the entire sector down. Just because no one knows what will light the wick doesn’t mean you can ignore the enormous bomb in the room.

For those making decisions based upon favorable odds… Central banks around the globe as well as the US Federal Reserve are now emulating the monetary policy handbook of the ECB and Japan. Those paying attention have watched the ECB destroy its financial sector in real time, as multiple bank CEOs have recently come public (August 2nd 2019) speaking to the damage of negative yielding rates, do we even need to discuss the Japanese financial sector?

The Fed has painted itself into a corner as we detailed this in our 1Q2019 note summing up with:

“If it’s not yet clear to anyone with their eyes open, the Fed is hostage to its own bad policy, and we don’t believe it’s a good position for them or any of us to be in.“

Rates didn’t jump off the building – they’ve been pushed – In May we wrote:

“The Federal Reserve has been attempting to solve a spending problem by promoting more spending. In turn, they’ve created a growth, productivity and debt problem. Zero Percent Interest Rate Policy has created a culture addicted to credit; they’ve created unproductive Zombie corporations. While larger investment banks with access to copious amounts of capital have perpetuated the issue and retarded growth in the name of facilitating it by lending to profitless institutions.“

We read extensively and are constantly trying to understand our surroundings; to be mindful of the “Paradigm Shifts” Ray Dalio recently wrote about which we shared in our most recent quarterly. Inflection points don’t happen in an instant, they tend to occur over time leaving a trail of breadcrumbs to follow for those looking.

At times, there will be discrepancies between our performance and that of “Markets” (as you can see from the chart above), both to the upside and downside, we’ve never been shy in saying this. We manage as we do for a reason… We allow our winners to “run” while cutting losers before becoming problematic. When our discipline delivers cash to us, we don’t always rush to put it to work. At times, when the tea leaves suggest prudence, we exhaust all efforts to listen.

**We outperformed the S&P in 2016, we were just about dead on S&P returns in 2017(both years risking substantially less), we admittedly underperformed in 2018 while still committing less capital (without question, a miscalculation on how a political leader would bury us into a trade war, with our largest trading partner and #2 world power) it was a nominal trail, yet, we own it) and currently, we sit 2.4% off the S&P while being up roughly 12.5% net fees and expenses YTD as hedged as we are. We are proud of our efforts yet will constantly strive to be better.

Quality of Decision vs. Outcome

Circling back to Annie Duke, “Thinking in Bets” discusses in great detail how we not only measure the quality of our own decisions based upon the outcome of that decision; but also how we are judged by the outcome rather than the quality of the decision. Even with the knowledge there is a minority percentage that can always occur based upon the unknown or unforeseen (which we’ve likely discounted this to zero) At times, there is a degree of luck involved in all of life.

Among her many detailed examples on this behavior, Duke uses an excellent example which I’ll borrow and paraphrase. Being a fan of football – and regardless of how many times I’ve had this discussion with people, I’ve never documented my thoughts so credit to Annie Duke on this one.

Having transpired on a global stage most have weighed in with their opinions, though Duke takes the time to detail the play call, which ended Super Bowl XLIX in 2015 – Seattle Seahawks vs. the New England Patriots.

With 00:26 second remaining in the game and Seahawks down by 4 on the Patriots 1-yard line having only one remaining timeout, a touchdown was needed to win the game. Seahawks coach Pete Carroll called a pass; one that was infamously intercepted by Patriots cornerback Malcolm Butler leaving every “expert”, Monday morning quarterback and Seahawks fan branding the call as one of the dumbest in football history. Clearly the outcome of the call was bad, but was the call itself?

A touchdown gives the Seahawks a win (barring a miraculous kick-off return or Hail Mary). An incomplete pass affords the Seahawks to run 2 more plays (again, having only one time out remaining). In playing the odds, this call would have ordinarily given Pete Carroll and his Seahawks the favorable odds at having 3 chances at the endzone, placing his team in the best position to win. History shows that a pass on the goal line (like the one Carroll called) has resulted in a touchdown or incompletion over 98% of the time – and yet – the roughly 1-2% outcome occurred.

Carroll’s decision has been measured by the masses based upon the outcome of the play, not the quality of his decision. The call was a brilliant call, the outcome, no bueno. That’s football, this is your retirement and financial future. Currently, there is a 15% chance we “lose the game”, as positioned, the likely result is a slightly lower return than a benchmark index over the next month or two.

We’ve positioning ourselves to use the odds in our favor – an 85% chance of “winning the game” with the likely result of preserving capital and mitigating a more probable and larger loss.

I will defend positioning ourselves to an 85% probable outcome any day of the week and twice on Sunday. Should the 15% happen; I’m comfortable knowing I’ll likely be judged on outcome, though I will continue to place our investors in the best position to win based upon the most probable outcomes – not based upon what the Monday morning quarterbacks say.

We will continue to be our own largest critic, constantly monitoring the quality of our decisions as objectively as possible – we’re confident this discipline will stand up over time.