In This Article

Introduction

“They owe the bank more than $34-million dollars and haven’t turned a profit in over 6, maybe 7 years… They lost another million in Q1, but the bank keeps giving them more money…”

This above comes from a recent conversation that I had with a very good friend of mine. His perspective is unique as is his clientele ranges from multi-billion dollar corporations down to small (Mom & Pop) type family businesses.

The company’s assets are nowhere close to the $34-million owed; in fact, their assets are worth very little to a bank. Even the ‘land’ of an Ag company in the middle of no-where, yields little value to a financial lender, and yet, the bank continues to provide this company with large sums of capital.

Prevailing consensus agrees the primary catalyst of the Great Depression was the stock market crash of 1929. However, students of the Depression, including former Federal Reserve Chairman Ben Bernanke, would argue the prolonged damage was caused by something different. In July of 2017 we wrote:

The Credit/Debt dynamic is without question, THE PRIMARY driving force behind our economy; without credit, the vast majority of American consumers wouldn’t be able to spend a majority of what they spend…

We stressed:

Understanding this dynamic is so, tremendously important; for as the credit/debt

dynamic goes, so goes our ability to spend, which fuels our consumption, and in turn, growth.

In the early 1930’s, with nearly 1/3 of financial institutions shuddering their windows and doors, the general economy was hit with a disruption of credit. Virtually overnight, the majority of Americans lost their ability to borrow money; to buy a home, start a business or stock shelves. The economy came to a grinding halt for a prolonged period of time.

We know that credit has the ability to fuel a modern economy, where lack of credit can and will destroy one swiftly and with no remorse, but what impact does excessive credit have? No one has been more accurate on the subject of excessive credit than Lacy Hunt of Hoisington Investment Management whose work has detailed this ‘contrarian’ view for more than 30-years; too much credit can stifle growth and productivity. You can read Lacy’s most recent work here. (Can it be considered “contrarian” if you’re right for 30-years?) I digress…

We began this note discussing a relatively small “Zombie” company. “Zombies” are companies who don’t earn enough money to cover the interest expense on their debt, let alone their principal. We argue, ‘zombies’ are a product of absurdly low interest rates, hidden like land mines; out of sight, yet scattered throughout the economy waiting to be stepped on. These companies suck good capital out of the system, which could be used in more productive ways. So long as credit is cheap credit can be extended, things appear to be fine (on the surface). However, as credit tightens, BOOM!

The concept of “Extend and pretend” is indicative of a much larger, more pervasive issue permeating the smallest of consumers to the largest corporations and governments. While we began this note with a small Agricultural company who owes the bank $34-million dollars, we can just as easily be discussing a multi-billion dollar company like Tesla (TSLA) or the US government!

Full disclosure, we have NO position in Tesla; however, as a public company we have the ability to take a ‘good look under the hood’. As a highly recognizable brand we can also examine “public perception” vs. “reality”. We believe Tesla is a perfect example of what happens when too much money floods an economy. Given its size, one can begin to image how much productivity and growth has been wasted on all too many failed promises. Additionally, we’ll touch upon the ubiquitous nature of this issue allowing readers to make up their mind as to how efficient or inefficient, the highly touted ‘Efficient Market Hypothesis’ truly is.

It’s important to acknowledge we can obviously be wrong about this and everything we write for that matter. We never want you to simply take our word for anything– which is why we provide so many supporting documents – we want you to become invested in your future. To date, we have accumulated a fairly accurate track record. Our current opinion is that Tesla is an extremely visible, teachable moment with too many lessons to ignore.

While we are detailing Tesla as our example over the next few pages, it is but one of countless companies we could highlight; billions of dollars in debt with no earnings or future earnings visibility. Tesla’s recent capital raise immediately following their Q1 earnings release allows us to utilize examples directly from the deal’s prospectus and most recent filings (documents that often go overlooked).

Kicking The Can

Often correlated with our government’s propensity to borrow and spend, most of us have heard the euphemism, “kicking the can” (down the road). This attitude continues to push our current economic challenges square into the hands of future generations. Absurdly low interest rates for an extended period has pulled future consumption forward (spending now vs. later) fostering an “Extend and Pretend” mentality. In many cases it simply means “prolonging the inevitable”.

In our original example, the financial institution continues to provide their “client”, (the Agricultural Company) with cheap credit necessary to keep the company operational (“extend”). The “client” spends this money, on among other things, interest payments on their debt, yet in all likelihood, there is not a prayers chance in hell they ever repay the principal on their loans (“pretend”). This charade can continue only as long as the bank a. has access to and b. is willing and “able” to extend cheap credit.

Tesla is a much larger beast similar in nature, though in my opinion, exponentially worse. They take extend and pretend to a much higher level. Without labeling it as such, we described the extend and pretend mentality of Wall Street last April in our 1Q2018 note:

“TSLA’s survival is (predicated upon) the “typical” Wall Street mindset; I’ve already poured billions of other people’s money into this (worthless) company, if we don’t give them more now, we’re sure to lose it all.

Our statement was partially incorrect; and while no one likes to be wrong, it’s important we show you how we were off (more on this below). In that note we also talked about Tesla’s cash position, cash burn, debt levels and their NEED to raise capital, while Tesla CEO Elon Musk took a differing opinion via twitter as we highlighted:

“Elon Musk “tweeted” they (TSLA) would NOT need to raise additional capital this year. SMH.”

We wrote:

“In late 2016, the company (Tesla) said they wouldn’t need to raise additional capital before the end of they year as well – and admittedly, they didn’t. They waited till mid 2017 to raise an additional $1.8 billion via a debt offering. You can play with what amounts to be semantics all you want, eventually, investors will need to hold the company accountable.”

We also warned, and this is an important point:

“NEVER underestimate a desperate CEO, greedy Wall Street Investment banks, corporate financiers, and brokers who get paid significantly more to SELL a “new issue or secondary offering” – recognize where the money is made and understand whom the “real” clients of an investment bank are…”

The Current Debacle

Tesla recently reported a $702 million dollar loss for 1Q2019. Cash flow from operations was a NEGATIVE $640 million coupled with an additional $280 million spent on capital expenditures (this is a cash burn of nearly $1 billion dollars for the quarter while guiding lower for 2Q2019).

More disturbing is Tesla CEO, Elon Musk freely admitting, almost bragging to investors on their earnings conference call:

“Over seas volume strained our logistics operation and resulted in over half of our global deliveries occurring in the final 10 days of Q1.”

Delivering these cars in the final 10 days of the quarter represents nearly $2 billion in cash flows!

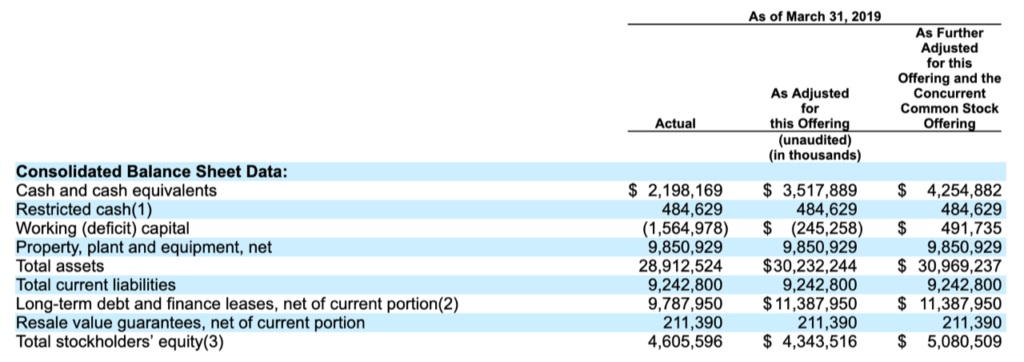

Why is this so important to understand? Per the most recent prospectus, Tesla ended the first quarter with just under $2.2 billion in cash?! See below…

To simplify, $2 billion dollars coming through the doors in the last 10 days of a quarter is akin to someone who is living paycheck-to-paycheck, finally getting paid and “hoping” their check clears so they don’t bounce the check they just wrote to their dry cleaner”; only Tesla’s “drycleaners” are their parts suppliers (without parts, cars can’t be built). These admissions coupled with the numbers from the prospectus put this company as dangerously close to “cash strapped” (pre capital raise) as it gets.

CAPITAL RAISE = CREDIT/DEBT DYNAMIC

When you hear “Capital Raise”, I want you to think about the “Credit/Debt Dynamic” we’ve previously written about. When I hear capital raise, for better or worse, I think possible conflicts of interest?

As mentioned above, no one likes admitting when they’re wrong, though, earlier I shared a quote from our 1Q2018 note describing the typical “Wall Street mindset” of pouring “other people’s money” into a “(worthless)” company. “Other peoples money” isn’t the only money possibly “at risk” based upon the completion of a deal– let’s refer back to Tesla’s prospectus to understand who else might be at risk of losing money should a deal not get done.

We’ll first point you to section S-22 of Tesla’s convertible note offering:

“Elon Musk has pledged shares of our common stock to secure certain bank borrowings…”

Certain banking institutions have made extensions of credit to Elon Musk, our Chief Executive Officer….. these loans, which are partially secured by pledges of a portion of the Tesla common stock currently owned by Mr. Musk.

So what, Elon Musk took out a loan! That’s a fair thought, but the loan is secured by TSLA stock, so who is “at risk” if there is no TSLA stock and for how much? Again, from the prospectus:

- Morgan Stanley Smith Barney LLC, an affiliate of Morgan Stanley & Co. LLC, has made various extensions of credit to Elon Musk… As of April 30, 2019, the outstanding balance under these loans is approximately $208.9 million.

- Goldman Sachs Bank USA, an affiliate of Goldman Sachs & Co. LLC, has made various extensions of credit to Mr. Musk and the Trust. As of April 30, 2019, the outstanding balance under these loans is approximately $213.0 million.

- Bank of America, N.A., an affiliate of Merrill Lynch, Pierce, Fenner & Smith Incorporated, has made extensions of credit to the Trust and guaranteed by Mr. Musk, which are secured by shares of Tesla. As of April 30, 2019, the outstanding loan balance was approximately $85.5 million.

Affiliates of Morgan Stanley, Goldman Sachs and Bank of America have collectively lent Elon Musk (the individual) over $507-million dollars “partially secured” by Musk’s personal TSLA stock holdings he has pledged as collateral. Half a billion dollars in loans is secured by Elon Musk’s personal Tesla stock.

One can find additional disclosures in the “Underwriting” section S-32 of Tesla’s most recent equity raise prospectus or S-82 of the convertible note prospectus, … such as:

In 2015, we entered into our senior secured asset-backed revolving credit agreement, with certain lenders, including Deutsche Bank AG…, Goldman Sachs Bank USA…, Morgan Stanley Senior Funding Inc., and Bank of America, N.A., an affiliate of Merrill Lynch, Pierce, Fenner & Smith Incorporated. The credit facility allows us to borrow up to $2.4 billion and provides for a $400 million letter of credit subfacility and a $50 million swingline loan subfacility, the proceeds of all of which may be used to fund working capital and for general corporate purposes. Affiliates of the underwriters that are lenders and/or agents under the credit facility have received, and may receive, customary fees. As ofMarch 31, 2019, $1.9 billion was outstanding under this agreement.

So in addition to the $507-million in personal loans “certain banking institutions” have personally extended to Tesla CEO Elon Musk, subsidiaries of Deutsche Bank, Goldman Sachs, Morgan Stanley and Bank of America have agreed to provide Tesla (the company) up to $2.4-billion dollars in the form of an “Asset Backed Revolving Credit Agreement”; “Asset Backed” meaning Tesla needs to have ‘backed’ what they borrow with collateral (possibly with some cash requirements). Having already borrowed $1.9-billion of the $2.4-billion facility (as of March 31, 2019); Tesla has exhausted over 80% of their revolving credit line for those keeping track.

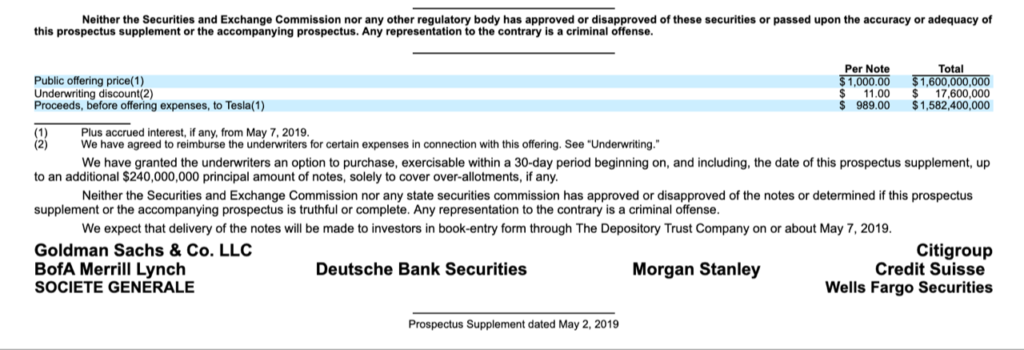

Below is a snap shot of the prospectus cover from Tesla’s most recent capital raise; does anyone want to play a game of “I spy”? We’re looking for how many underwriters of this deal have affiliates, which fall into the “certain banking institutions” that have lent Elon Musk or Tesla money, category. (Company’s possibly “at risk” if Tesla fails)

It’s important to note the prospectus clearly states these affiliates make independent decisions from the parent companies.

As regulated entities, Morgan Stanley Smith Barney LLC, and Goldman Sachs Bank USA and Bank of America, N.A. make decisions regarding making and managing their loans independent of Morgan Stanley & Co., LLC, and Goldman Sachs & Co. LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated, respectively. Mr. Musk and these banks have longstanding relationships of over a decade. We are not a party to these loans, which are full recourse against Mr. Musk and the Trust and are secured by pledges of a portion of our common stock currently owned by Mr. Musk and the Trust. The terms of these loans were negotiated directly between Mr. Musk and Morgan Stanley Smith Barney LLC and Goldman Sachs Bank USA, and Merrill Lynch, Pierce, Fenner & Smith Incorporated, respectively.

Cheap Capital My A$$

I’ve recently read multiple reports that “hypothesized” with over $2-billion of cash reportedly on their books; Tesla didn’t need to do this capital raise. One report stated that if “investors” did not see the deal as a “safe-bet”, Tesla would never have been able to borrow money at such a cheap rate (referring to the 2% interest rate on the convertible note vs. the 10-year treasury rate of 2.5%) Face meet Palm.

We’ve already shown you Tesla finished the quarter with roughly $2.2-billion in cash on their books, while bringing in nearly $2-billion in the last 10-days of the quarter, over 80% of their asset backed loan exhausted and burning though nearly $1 billion in the quarter. They were virtually tapped out.

But again, in going directly to the prospectus we can see an even more ugly scenario: from the “Convertible Note Hedge and Warrant Transaction” section S-19 or S-59 Tesla notified investors that they would use:

“approximately $262.1 million of these proceeds (after such cost is partially offset by the proceeds from warrant transactions described in “Description of Convertible Note Hedge and Warrant Transactions”) to pay the net cost of the convertible note hedge transactions entered into in connection with this convertible notes offering.”

When comparing the prospectus with the final 8-k; the document which announces the FINAL details of the combined deals, one might have missed this mind-numbing nugget under Note Hedge Transactions (page 2)

“On May 2, 2019, in connection with the offering of the Notes, the Company entered into note hedge transactions (the “Note Hedge Transactions”) with each of Société Générale, Wells Fargo Bank, National Association, Goldman Sachs & Co. LLC, and Credit Suisse Capital LLC, with Credit Suisse Securities (USA) LLC as agent, or their respective affiliates…

…The Company expects to use approximately $413.8 million from the net proceeds from the issuance and sale of the Notes to pay for the Note Hedge Transactions.”

It’s bad enough most don’t even understand what a note hedge transaction is, and while the capital raise did grow in size from initial announcement to final pricing; it was originally anticipated the company would use $262.1-million for this note hedge transaction, the final outcome was nearly 58% greater – 58%!

Telsa and their bankers used a complex deal structure with nearly half of the $800-million of capital raised in their equity transaction ($413.8-million dollars) going back to a collective of their bankers to hedge the notes they just issued.

Forget the jargon for a second – just ask yourself, does this sound kosher to you? Is it easy to understand? Does it sound cheap? Does it scream transparency?

In our opinion, this wasn’t cheap capital raised at all, we believe this was yet another bailout for a failing company which hasn’t produced a positive year of earnings in their existence. We believe this packaged deal in its most simple form is “Extend and Pretend” to the extreme.

Compounding the Problem

I want to point you to a quote from Wedbush’s technology analyst Daniel Ives following Tesla’s most recent earnings report. I believe this quote is telling for more reasons than the obvious…

“In our 20 years of covering tech stocks on the Street we view this quarter as one of top debacles we have ever seen while Musk & Co. in an episode out of the Twilight Zone act as if demand and profitability will magically return to the Tesla story.”

Did you catch it? Tesla is NOT a “technology” company and yet that’s what they’ve sold themselves to the investing community as. Why are “Technology analysts”, covering an automobile manufacturer? Because that’s what Tesla has sold themselves to the investing community as. EV is not a “new” concept; it’s just more acceptable and accessible to the mainstream today then ever before.

Tesla is a car company. They manufacture automobiles. That’s it! As an EV Car Company goes, the competitive moat Tesla once had vs. their peers has disappeared after 16 unprofitable years. Market heavyweights like Audi (eTron), Jaguar (i-Pace), Porsche (Taycan) and Mercedes (EQC) are all entering the high-end EV markets in a big way while over 30 more companies including Volkswagen and Ford are a few quarters away from attacking the lower to middle-end markets.

“Self-driving autonomy” is a “feature” being developed by Tesla, as well as 46 other car and technology companies. If you want to make a bet on autonomous cars or robo-taxis by all means, feel free to do so – yet Tesla’s autonomous technology arguably ranks amongst the worst while at the same time they are saddled with the overhead and Cap-ex of manufacturing cars.

Autonomous cars will likely enter our lives, quite possibly in the near future (given the pace at which AI/machine learning is moving at), though, history has proven time and time again, the winner isn’t always the one who got there first – it’s often the one who does it best (is Steve Jobs that far removed from our lives for us to forget his legacy?). Is IBM or Xerox a cult or “Apple”? Now tell me who was first and who borrowed certain thoughts and ideas?

Car companies manufacture cars – technology companies develop technology, in the end, the best technology will more than likely be licensed to multiple manufacturers. Musk can claim 1-million robo taxis on the road by 2020 all he wants – but I’ve read this children’s story before – no one was there to save the “little boy cried wolf” one too many times…

At the end of the day, Tesla or any company for that matter, needs to make enough money to a. make a profit and b. pay back lenders… Without those with money “at risk” fostering an “Extend and Pretend” culture and government “credits” (subsidies), Tesla would have been bankrupt years ago. Again, Tesla has never had a profitable year in their 16-year existence, what in the world makes anyone think they will do so when competing against just about every established car company in the world (including over 400 EV manufacturers in China)?

Easy monetary policy continues to extend the lives of companies who have never achieved profitability in countless sectors; it’s not just Tesla. Though, so long as near zero interest rate policy exists, bankers can continue to “extend and pretend”. This mentality has robbed future productivity and economic growth, not only from future generations, but from those who may have been able to do something with the countless billions of dollars Tesla and other profitless companies have burned through over the past decade of ZIRP (in the name of giving the wealthy tax credits to by an over-priced luxury car in Tesla’s case).

With roughly 5 Quarters of cash on hand post-capital raise, Tesla investors need to take a long hard look in the mirror, we all do…

Efficient Market Theory (EMT) would have you believe asset prices fully reflect all available information. That information is the sole driver of price in “financial markets”. Those who preach it would have you think that all investors have poured through hundreds of pages of legalese and multiple prospectuses leveling the playing field before investors bought, sold or shorted the name. They would tell you most institutional brokers; asset managers and individual investors alike understand Tesla’s packaged deal and hedged convertible notes structure…

Information can only drive market prices “efficiently” so long as those who invest on either side of the trade read and comprehend all available information.

It’s not easy to make it through a prospectus… Most people never will – unfortunately, neither do most financial professionals. Though, in having read just a few sections of Telsa’s, do you really think a profitless company over a 16-year time frame with over $10 billion in debt deserves a $45-50 billion market cap? Do you really think it makes sense for anyone to lend a company who has never had a profitable year another $2.2-billion dollars?

Then just ask yourself a simple question. Would a bank give you a loan if you’ve never recorded a profit in 16 years? And if you think they would, what interest rate do you think they would charge you?

What does it all Mean

It means we’ve got a problem – starting at the very top. The Federal Reserve has been attempting to solve a spending problem by promoting more spending. In turn, they’ve created a growth, productivity and debt problem. Zero Percent Interest Rate Policy has created a culture addicted to credit; they’ve created unproductive Zombie corporations. While larger investment banks with access to copious amounts of capital have perpetuated the issue and retarded growth in the name of facilitating it by lending to profitless institutions.

There are ultimately two ways for a company to go bankrupt. The first is by breaking a covenant; a rule within the company’s bylaws, operating agreements or loan documents. The second way is simply running out of money.

So long as debts can be financed, they can be added to and extended at the discretion of their lenders… It’s in this discretion when combined with “cheap money” that has created a problem of epic proportions not solvable with normal economics.

Those lenders (who would argue they have no vested interest as they and their subsidiaries act independently from each other) can ultimately prolong what should be inevitable. So long as this credit window remains open this paradigm exists, though, when that credit spigot closes and the extending is over, there will be no more pretending; the pain will become very real to many.

Excessive credit has created asset bubbles everywhere we look, from stock and bond prices to the price of rare paintings and sculptures. Markets have been artificially manipulated for decades now, creating a conundrum virtually impossible to unwind in an orderly fashion.

This will continue until those who have been extended the credit can no longer make payments regardless of how low interest expense is. We can see the signs of Zombies dying today as credit defaults begin to creep higher, as sub-prime auto loans unexpectedly move up, as credit card default rates exceed 5% and continue higher as more and more student loans go into default and an already levered system can’t bail them all out.

Companies like Tesla are a symptom of a much larger, deeper-rooted systematic problem few care to acknowledge.

I don’t believe a collapse will happen today, tomorrow or next week, but the signs of it are everywhere for those with their eyes open; though, will likely prove catastrophic for those who ignore them (the majority). To understand these signs gives us an ability at the very least, to protect and in many cases, profit when things really do start to turn down.

Our goal in discussing “Extend and Pretend” is NOT to scare you; it’s to make you aware. It’s to provide you with tools and place the odds in our favor for when things do begin to break down and fall apart.

“Extend and Pretend” will be alive and well until it’s not… By then, we hope you will have taken the warning signs seriously. Until then, we’ll stick to our plan. We will capture our share of upside; cut losers before becoming problematic; we will remain opportunistic while being a bit conservative, hedging ourselves with cash. We do not subscribe to the “sell everything today” strategy, but do believe you cannot protect yourself against anything if you are unaware of what it looks like or fail to acknowledge it even exists.

No sooner had we finished our final edits, CNBC reports, Elon Musk has written an email to employees revealing: Tesla has 10 months of cash @ Q1 burn rate. You really can’t make this sh*t up…

“Those who do not learn history are doomed to repeat it” ~ George Santayana (1905)