In This Article

The first quarter of 2017 came to a close a few weeks ago. “Interesting” could be a word I might use to describe it? In this note I’ll provide a brief synopsis of our Solution Equity Model’s performance, followed by a more in depth overview of my views given the current investing environment.

So – how’d we fare vs. broader market indices 1Q2017?

S&P performance for 1Q2017

6.07% Total Return

5.53% Performance Return

The DJIA performance for 1Q2017

5.19% Total Return

4.56% Performance Return

Our Equity Solutions Model performance for 1Q2017

~7.89%* Total Return

~7.47%* Performance Return

Throughout the first quarter, we maintained our hedge in gold stocks, as well as a cash position of roughly 17-19%, creating a volatility lower than that of the both the S&P & DJIA. Given the positive movement over the quarter, we have recently “volatility adjusting” our position sizes, while concurrently adding a few new names to the model in an effort to further reduce the overall risk of the portfolio.

Observation:

It been virtually impossible, to avoid the continuous stream of negative news that’s been circulating out of Washington these days. Regardless of what news channel is on your TV or web browser, the first quarter of 2017 has been filled with mudslinging coming from all angles. Accusation after accusation of “alleged” scandal after scandal coming from both sides of the aisle; we’ve even witnessed internal strife within the Republican Party, while the POTUS and the media have quite the dynamic relationship.

At the end of the day, much of this is simply “noise”. In this age of “instant information” turning off your television and stepping away from the computer and “smart devices” could behoove us all at times. Instant doesn’t always prove to be “right”; “knee jerk” reactions often proves to be the incorrect action. Through all the protests, the “unexpected” Trump victory, fighting over the inauguration attendance (Obama v. Trump), Russian hacking accusations, Trump’s alleged “ties” to Russia, WikiLeaks and Vault 7, CIA and intelligence agencies being able to hack, well – just about anyone… Trump’s failed 1st attempt at a new healthcare bill (repeal and replace), The Federal Reserve raising interest rates; heck, the US just launched an aggressive airstrikes against a sovereign nation (Syria) last week, tensions are tremendously high with North Korea; YET, the markets moved through the first quarter of 2017 with solid strength, and no significant sell off to speak of. This has caught many managers off guard, ad they now are chasing returns based upon their underperformance vs. their respective benchmarks. Many managers were “under invested” heading into the election and now they are attempting to play catch up in a market that doesn’t seem like it wants to go down? Stepping away from the “noise” for a few moments and taking a view from 30,000 feet looking down may provide a different picture of the current scenario? This is what I will attempt to provide below.

When Bigger forces play “Tug of War”:

“Optimism”…

$70 Trillion dollars…

In 2014, Fortune magazine described BlackRock as “The 4.3 trillion dollar force”. At the time, BlackRock was the largest asset-management company in the world. In September of 2016, BlackRock President, Rob Kapito, estimated there to be some $70 Trillion dollars in cash on the sidelines, globally; with nearly $10 Trillion of which, earning negative yields. Per Reuters

Additionally, central banks around the world have now resorted to outright equity purchases, and while it’s happened in previous years, we’re looking at some extreme levels.

- The Swiss National Bank owned more shares of Facebook then its founder, Mark Zuckerberg… Reuters

- The Bank of Japan owned 60% of their nations ETF market and is on pace to be the #1 buyer of Japanese stocks. Bloomberg

- China’s Central bank, through subsidiaries is a Top 10 shareholder in many of the well-known stocks in Shanghai. Wall Street Journal

- Fed chair Yellen, has even suggested “There could be benefits to allowing the central bank to buy stocks.” Wall Street Journal

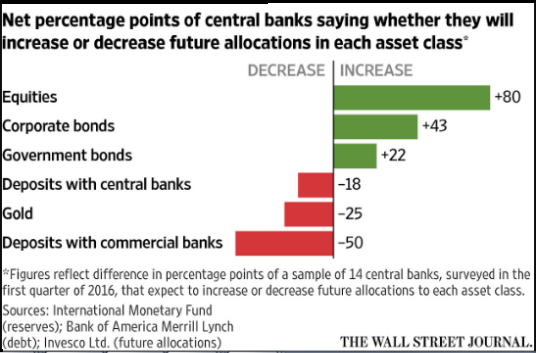

Having said all that, a recent survey by investment firm Invesco suggests; 80% of Central Banks plan to buy even more stocks in 2017.

Per the Wall Street Journal:

One can only invest in low to negative interest rates for so long before they begin to search for higher yielding returns. “Don’t Fight the Fed” has been an industry adage for many years now. At this point, it’s not just “The Fed” the bears are fighting, but countless central banks from The Swiss National Bank to the Bank of Japan, People’s Bank of China, et al.

vs. “Caution”

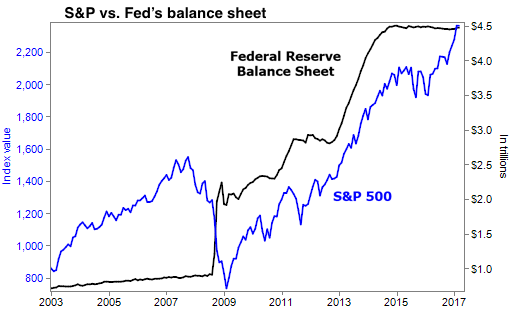

It’s difficult to overlook the correlation between equity markets growth in the recent past mirroring that of the Fed’s balance sheet.

Minutes released from the Fed on April 5th reflected their intent to shrink their $4.5 Trillion dollar balance sheet; no longer reinvesting their maturing U.S Treasury bonds and mortgage backed debt back into these markets. While this has been spoken about for sometime, these are the first “Fed minutes” which directly speak to it.

The roll-off and reinvestment of the Fed’s $4.5 Trillion dollar balance sheet has created significant demand in the treasury markets, keeping interest rates at or near record lows for a prolonged period of time. With the Fed stepping away from buying bonds, questions remain as to whether or not other buyers will step up to the plate to absorb this liquidity at these low interest rate levels or will they demand higher yields?

Dark clouds still loom in the distance… Debt.

Debt, in and of itself, doesn’t create an end of the world scenario… However, when those who have borrowed can no longer pay back what they’ve borrowed, and the underlying asset held as collateral has little to no value… “Houston, we have a problem”

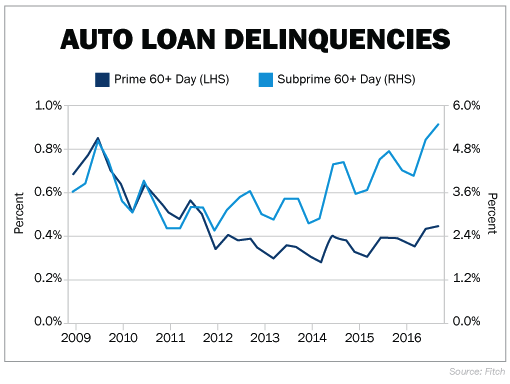

Per rating agency Fitch:

“Subprime asset performance remains considerably weak and continues to be affected by collateral originated and securitized from 2013 to 2015. The 2015 subprime transactions are the weakest from a credit and loan attribute perspective, even when compared to most recessionary transactions.”

Delinquencies of 60 days or more on relatively new loans are well above the 5% mark, and quickly closing in on 6%. These loans are going bad faster then they were back during the 2008 – 2009 crisis. Adding insult to injury, car manufacturers are working on razor thin margins in what many would consider to be booming times for these companies.

When borrowers fail to repay their debts, banks, in turn, begin tightening their lending standards bringing the economy to a grinding halt as witnessed during the recession of 2008 – 2009.

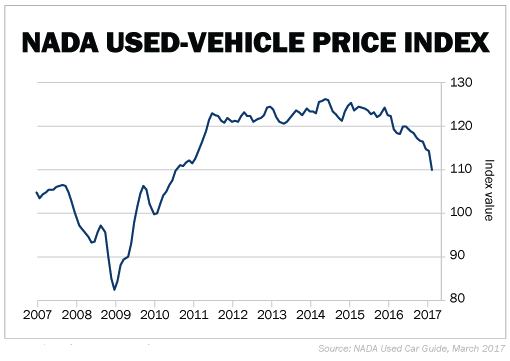

Used car prices are plummeting as well.

While sub-prime mortgages were the culprit of the 08/09 disaster, sub-prime Auto Lending coupled with the sheer volume of debt in the student loan markets could be a determining factor in terms of how long these markets can run and for how long? I recently read this sentence the other day, how would you answer this question? Would you lend $1 trillion dollars to a bunch of 18-year-olds?

Per Bloomberg: over $1.3 trillion in debt to nearly 41.5 million American with more than 1 in 4 either delinquent or in default.

Did the chicken cross the road blindfolded?

Powerful deep pockets involved in equity markets don’t mean we throw caution to the wind. The sheer volume of cash in the global system alone doesn’t mean a straight shot to the moon for equities. Neither does investors growing tired of negative rates, however, they are significantly more influential driving forces to the financial markets and reasons to be “cautiously optimistic” then the typical negative headlining story on most news networks these days.

It also doesn’t mean you can attempt to cross the I-5 at rush hour while wearing a blindfold, buying yesterday’s winners expecting them to be an automatic winners. The current administration has voiced 3 primary “focuses” they are looking to tackle relatively early in their tenure in office; Healthcare reform, Infrastructure improvements and Tax Reform. Each one of these may have significant implications (good or bad) for many publically traded companies?! Think about the impact a Trump/Republican BAT (Border Adjustment Tax) could have on a company which manufactures and imports the vast majority of their products overseas. Given the uncertainty in Washington right now, it’s a coin flip as to what bill, (watered down or not) “may” or “may not” get passed, though we are attempting to be extremely mindful of the fluidity of each independent situation.

What can Investors learn from… Rock Climbers?

There is reason to remain skeptical with markets, as it remains unclear as to what happens as the “taper” continues? Will the abundance of money on the sidelines absorb this demand keeping rates low allowing equity markets to expand further? My personal belief, and reason for being cautiously optimistic is there is more money in the Global financial system struggling to find growth or yield in the short term ($70 Trillion is a big #), which can propel markets to levels unfathomable by most, yet, there is a tremendously large black cloud looming in the distance and it’s fueled, once again, by bad debt.

Those familiar with my writing have heard a few of these thoughts before, yet they’ve never been more poignant then they are right now.

My markets thesis has remained fairly consistent over the past few years, if anything has changed; it’s merely been “timing”. While I believe markets should move higher over the next few years… This doesn’t mean it comes without volatility or correction; the overall trend should be up, yet the elephant still remains in the room…

There are few things that appeal to me less then that of scaling a vertical wall placing myself hundreds of feet in the air with a mere sliver of rock under my toes, those of us in the investing world can learn a lot from many of these brave souls. Many skilled climbers have more under their toes then just the sliver of rock.

In climbing, a “Piton” (also called a pin or peg), is a metal spike (usually steel). The climber places the “Piton” in strategic locations as they scale the face of a given mountain; these pitons are hammered into cracks and crevasses along the climber’s journey to act as an “anchor” to protect the climber against the consequences of a fall, OR to assist progress in “aid climbing”. In the below image, the Pitons have been secured in a vertical manner, though different terrain calls for Piton with different characteristics that allow for better safety and performance based upon conditions. There are knifeblades, lost arrows, angles, baby angles, bongs and RURPs, each serving its own purpose based upon the condition of what lies in front of the climber.

Those familiar with my narrative understand that I preach protecting downside first with capital preservation strategies. While it’s my belief we can’t absolve ourselves of all downside, as some form of risk exists in everything we do (including hoarding cash). Given our investment approach, we do look to provide ourselves with enough “rope” to allow our winners to “run”, yet, securing “pitons” along the way up as we don’t want to hit the ground at terminal velocity should we slip off the face of the mountain (should those names within out portfolio turn and look to become problematic.) see what I did there?…

Understanding our downside and volatility the day we make an investment and cutting losers before they become a drag on the portfolio is a key building block of our model. We administer a capital preservation strategy on each core investment we own. Coupling this with our VAPS (Volatility Adjustment Position Sizing) approach given each name’s historic volatility, we build a portfolio that should temper volatility, while providing solid returns with downside protection.

We continue to take a cautiously optimistic approach to broader markets at this point in time, while attempting to be mindful of the new administration’s policies and how it may affect certain sectors. As mentioned earlier, we have begun to volatility adjust our position sizes, which has freed up some capital to move to some additional names, diversifying the portfolio into some special situation names with less market correlation, in an effort to further reduce volatility and risk.

Please call with any questions or concerns, I will be happy to walk anyone through our current positons and elaborate on my thoughts and concerns.

Many thanks,

Mitchel

*Fee schedule differs slightly based upon total dollars invested. Also, each account is its own entity; and fractional shares are not purchased, minor performance differences will exist. Performance also varies upon your specific “date of entry” into the model if after January 1, 2017. Performance numbers are unaudited.

Legal Information and Disclosures

This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. Other Side Asset Management, LLC. has no duty or obligation to update the information contained herein. Further, Other Side Asset Management, LLC. makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Other Side Asset Management, LLC.. (“OSAM”) believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Other Side Asset Management, LLC..

Some headlines have been slightly modified, shortened, broken into multiple levels in order to fit our Web-based table of contents – early PDFs have no hyperlinked Table of Contents…

**To reiterate: Past performance is NO guarantee of future results. You can lose all of your money investing in the equity markets. Performance varies slightly based upon; differing fee schedules, total dollars invested, fractional shares are not purchased, “date of entry” the portfolios most recent “volatility adjustment of position size”, along with many other unforeseen variables, et al. If “date of entry” into the model is after January 1, 2017, your performance numbers are based upon date of money being in good form to invest. Call with specific questions or concerns. Additionally, these are my views, thoughts and opinions which may differ from that of the firm. These are the views I use to gauge how I run my discretionary Equity Solutions Model.