In This Article

“Interesting” was the word used to describe the first quarter of 2017, though, “return of volatility” might be the phrase best suited to describe Q2, although at this moment, volatility still remains near historic lows. In this note I’ll again provide a brief synopsis of our Solution Equity Model’s performance, followed by a more in depth overview of my views given the current investing environment.

So – how has our Equity model fared vs. broader market through – 2Q2017?

2017 performance through Q2 for the S&P

9.34% Total Return

8.24% Performance Return

2017 performance for Q2 for the DJIA

9.35% Total Return

8.03% Performance Return

2017 performance through Q2 for our Equity Solutions Model

10.52%** Total Return

9.74%** Performance Return

We continue to maintain our gold hedge. As interest rates rise, many feel as if the allure for gold dissipates. The higher rates go, some migrate themselves from one “safe haven” to another. However, in times of stress to the credit markets and the financial system, the interest rate “play” takes more of a backseat to safety and stability. While we remain cautiously optimistic we’ll see some significant moves higher in equity markets over the next 6-12 months, there are eerily familiar stresses and parallels forming in our financial markets to that of 2006/07. Regardless of what type of market we are in, what we “would like” to happen or “believe” will happen; we are not so arrogant as to believe everything will always work out as planned; which is why we make sure to wear our seatbelts every time we get into our cars to drive… Hence, our discipline with the capital preservation strategy on each core holding.

In mid-April, we VAPS (volatility adjusted our position sizes) and added a few new names for different reasons. Some added to our thesis on MSCI’s addition of China local A shares to their indices (which was announced late June) this has worked out very nicely for us and should continue to do so as the initial inclusion happens next year. Hundreds of billions of dollars should flow to these names over the next handful of years. We added arguably the premier distressed debt managers in the business (OAK), as I anticipate some rough roads ahead for the high yield credit markets. We exited two positions based upon our disciplines as well. All in all, given our gold hedge, our VAPS, additions and subtractions, our liquidation arbitrage play on NYRT (which won’t contribute much alpha until the liquidation is complete) and our cash position of roughly 15.3% we continue to outperform the primary bench marks with less volatility.

Observation:

Cracks in the dam are getting bigger… We’ve got it covered… I asked 100 friends and colleagues a question… Will you have a chair when the music stops? Have you been paying attention? The Experts…

Cracks in the dam are getting bigger…

Per Reuters: Monday, June 26th, 2017:GM lowers outlook for U.S. 2017 new vehicle sales

“The market is definitely slowing … it’s something we are going to monitor month to month,” Chief Financial Officer Chuck Stevens told analysts on a conference call. “Pricing is more challenging.”

GM’s latest sales revisions take the company’s production levels back to those not seen since… 2015; yet, the company still remains positive…

GM had previously announced it expected 2017 new vehicle sales in the “mid-17 million” unit range. Stevens told analysts that sales could fall by 200,000 to 300,000 units this year but that the automaker had “somewhat insulated” itself from a downturn by reducing fleet sales, which lower vehicles’ residual values.

However, GM’s CFO, Chuck Stevens, admits the company has a supply of 110 days sitting on dealer lots right now compared with the historical averages of all major U.S Automakers of a typical 65 day supply dating back to 1960. If you happen to be curious, for comparison purposes, 17 million new vehicle sales happens to be where new vehicle sales peaked out in 2005, just prior to falling off a cliff, settling in the 10 million range during the “great recession” of 2008/09.

I’ve talked ad nauseam on the explosion of sub-prime debt, including that of sub-prime auto loans which fueled new vehicle auto sales over that time, pushing those markets to a record high 17.55 million units in 2016, with a little help from abnormally high dealer incentives.

Per my Q1 note:

The first being Auto loans, which we’ve discussed in the past, however, recent data shows delinquencies within this space to be deteriorating at a significant rate.

Per rating agency Fitch:

“Subprime asset performance remains considerably weak and continues to be affected by collateral originated and securitized from 2013 to 2015. The 2015 subprime transactions are the weakest from a credit and loan attribute perspective, even when compared to most recessionary transactions.”

Delinquencies of 60 days or more on relatively new loans are well above the 5% mark, and quickly closing in on 6%. These loans are going bad faster than they were back during the 2008 – 2009 crises. Adding insult to injury, car manufacturers are working on razor thin margins in what many would consider to be booming times for these companies.

Auto loan defaults continue to steadily increase, as have repossessions and unexpected early lease returns, flooding the used car markets with a glut of inventory. With increased defaults nearing 6% lending standards are beginning to tighten; it’s beginning to show up and down the auto supply chain. As money becomes more difficult to borrow, both sales and revenues have been rolling over starting with the lenders, followed by the rental car companies (largest U.S Auto fleet buyers who rely on both used car sales and a constant stream of credit to fund their CAPEX (capital expenditures, new car purchase, etc.) – all with tremendously thin margins), hitting Auto manufacturers as Q1 earnings releases have begun to reveal; eventually leading to weakness in the part suppliers, and quite possibly, US manufacturing as a whole later in the year (As the Auto sector is a large percentage of the US manufacturing sector).

This trickle-down effect began back in mid-2105 for those paying attention here, with one of the largest sub-prime auto lenders, Santander Consumer finance (SC), needed to delay earnings as their book of business reported significant deterioration year over year. This was foreshadowing for the rental car companies, with both Hertz and Avis having a very difficult last 6 months. The next domino to fall will most likely be the larger manufacturers, and while both GM and Ford have remained relatively strong, GM’s CFO Chuck Stevens has admitted markets have begun to rollover while dealer inventories have blossomed to startling levels.

As mentioned, these issues are not isolated solely to General Motors as Ford’s first quarter, while beating “industry experts” expectations, were 36% lower than 2016Q1 numbers. As Reuters reported here:

The company reported a first-quarter net profit of $1.6 billion, or 40 cents a share, down 36 percent from $2.5 billion, or 61 cents per share, a year earlier.

“(CFO Bob) Shanks said Ford’s own used-car values at its finance arm were down 7 percent compared to the same quarter in 2016, but said customers’ credit scores remained high and we “feel really good about where credit is.””

“Clearly we’re moving to a different stage of the cycle, but we think based on what we know that we’ve got it covered,” he said.

We’ve got it covered!

Hmm… Where have we heard that before???

For those who have ever been white water rafting, a relatively calm stream can turn into class 5 rapids fairly quickly; you know all too well, if you’re not paying attention, tremendously strong currents can capsize you in a split second (and turn your pants into a parachute rapped around your ankles making it nearly impossible to swim to safety as you get smacked around in between rocks like a pinball machine! but that’s a story for a different time).

While it feels like a century ago, in 2005, Federal Reserve Chairman, Ben Bernanke said…

“We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit…

House prices have risen by nearly 25% over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.”

Fast forward to 2007, it was Ben Bernanke who constantly assured the public that the problems in subprime mortgages were “contained”…

“Despite the ongoing adjustments in the housing sector, overall economic prospects for households remain good. Household finances appear generally solid, and delinquency rates on most types of consumer loans and residential mortgages remain low…

The effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.”

Again, in 2008, mere days before the collapse in subprime debt demolished Wall Street icons like Lehman Brothers and Bear Sterns, while forcing J.P. Morgan to throw Merrill Lynch a lifeline as we watched “unbreakable” mortgage giants Fannie Mae (FNMA) and Freddie Mac (FMCC) collapse; Bernanke swore the following before Congress:

“Fannie and Freddie are adequately capitalized. They are in NO danger of failing.” (Emphasis mine)

While I am in no way, shape or form advocating for any specific politician or political party – Senator Sanders (VT-D) has an entire page documenting countless Bernanke’s “We’ve got it covered” – here; Adding a single hyperlink is simply more efficient than adding 15 different hyperlinks from countless .gov sites or news sources.

So…I asked 100 friends and colleagues a question.

People of all walks of life read these thoughts; Bankers, entrepreneurs, business owners, c-level execs, professional athletes, doctors, dentists, CPAs, attorneys, the list go on. I decided to take an informal poll and asked roughly 100 friends and colleagues, the same question:

What is the primary fuel, which makes our economy function – the single, key item or “driving force” necessary for the U.S. economy to function?

The answers were as diverse as those who read this; Consumer spending topped the list with jobs, i.e. “employment” closely behind. Other suggestions were small business, free enterprise, self-preservation, heck – I even got the answers “freedom” and “faith”. While many great answers, my personal belief is none of the aforementioned would be the primary force, which drives our economy. I believe it’s much more obvious, yet hidden in plain sight. It’s something that is so etched into our cultural fabric that we don’t think twice about it and often take it for granted…

Yes, a stable workforce is imperative for economy to function, so clearly we need people working; without small business, we lose many of these jobs and wages, which is arguably the “Bedrock” of our economy. While small business is clearlya driving force of the economy, it’s not the primary “fuel”. Free enterprise, in theory, allows companies to compete against one another with limited governmental control (cough), and then there’s consumer spending… Wages made are typically wages spent; depending on where we fall on the wages scale. We purchase everything from airplanes and fancy cars, to furniture, food, clothing, books, toys and well, junk… Our culture consumes, we buy computers, buy iPhones, buy, buy, buy and spend, spend, spend; in the end, we save very little…

We could argue that a slowdown in consumer spending creates a compounding downward snowball effect for our economy; less spending generates a glut of inventory, which creates a slowdown in manufacturing, generating an inventory glut down the supply chain, forcing layoffs as the snowball continues downhill getting bigger the whole way. Without spending we don’t function, period! BUT WAIT…

Didn’t you say people gave consumer spending as an answer to your question and you said, “my personal belief is none of the aforementioned would be the primary force, which drives our economy” and I stick to these words… While I completely agree that Consumer spending is pivotal, there is something that’s much more important which allows us to spend and consume as much as we do.

I’m speaking about the dynamic between CREDIT and DEBT! The Credit/Debt dynamic is without question, THE PRIMARY driving force behind our economy; without credit, the vast majority of American consumers wouldn’t be able to spend a fraction of what they do. The instant an item is purchased on credit, an immediate debt is created. We could argue the semantics as to whether or not we’re discussing two separate items, but it’s nothing more than a chicken or the egg scenario; without being approved to assume the debt, the credit isn’t extended, once an item is purchased with credit, the debt is immediately created. This dynamic is the lighter fluid on the U.S economy’s campfire.

Banks/lenders offer consumers “credit” to buy their home; the consumer assumes “debt” in the form of a mortgage. Without this dynamic, the housing markets freeze, as we witnessed in 2008/09. While outstanding mortgages dwarf other segments of “consumer credit” markets, i.e. Auto loans, Student loans and Credit Cards, these markets are what allows the vast majority of our country to spend any discretionary money at all. Most individuals in the United States do not have the ability to outright purchase any large ticket items without first, being approved to assume a significant DEBT before the “credit” is extended to them.

Without this dynamic, small businesses can’t get their feet off the ground, while larger businesses don’t have the ability to grow as quickly. For example, Amazon just purchased Whole foods for $13.7 billion dollars. And while I am not advocating for or against them, Amazon’s lifetime “earnings” are roughly $5 billion dollars. Sure they have some staggering revenues, though, when you spend more than you make, investors extending credit and the assumption of debt is necessary to bridge the gap or fuel leveraged expansion, regardless of how much “infrastructure” or cloud service is in the process of being built out; regardless of how great that platform is or will be – extension of credit and acceptance of debt fueled it.

Without the credit/debt dynamic, discretionary spending grinds to a halt as individuals focus more of their attention to buying necessities; food, heat, electricity and a roof over their heads and less on more expensive cars, vacations, casual dining, clothing, etc. We witnessed the entire housing market seize as mortgages dried up in 2008/2009. Congress shouted at bankers under testimony, “get the money we gave you into the hands of “Main Street”! Before you say, I’m wrong… Ask yourself what happens if everyone needed to purchase their home or their cars for cash? A. most couldn’t and B. for the majority of those left who could, they have very little to spend on everything else, including junk?

Understanding this dynamic is so, tremendously important; for as the credit/debt dynamic goes, so goes our ability to spend, which fuels our consumption, and in turn, the growth of our economy.

Will you have a chair when the music stops???

Debt, in and of itself, isn’t necessarily a bad thing, we just talked about how it allows people to consume as well as provides leverage for companies to grow. However, too much debt extended to too many people who have an inability to repay it, backed by little to virtually no collateral, has the ability to create a disaster. For example, too much sub-prime auto debt extended to those without an ability to repay given the specified terms of a loan that can’t be met (absurdly high interest rates with too lengthy a term) leads to, a glut of upside down, repossessed cars and early lease returns – adversely affecting new sales, leading to idle production, and what once was a class 1 rapid, which US manufacturing markets could handle, now becomes a nasty class 5 that few have the ability to navigate.

What amplifies the debt problem we are currently dealing with isn’t necessarily its size, but the amount of sub-prime loans that are packaged up and sold off as AAA rated “safe debt” and subsequently sold to a bank, insurance company or pension fund near you drives its magnitude…

Per the Federal Reserve, there is over $10 Trillion dollars of 1-4 family mortgage debt outstanding, as of June 1, 2017. Auto loans have eclipsed $1.004 Trillion dollars; credit card debt is over $1 trillion as are Student loans ($1.4 Trillion). During the housing crisis of 2008/09 there were roughly $8.4 Trillion, 1-4 family mortgages outstanding – with roughly $1 Trillion dollars’ worth of mortgage related products defaulting. As with subprime mortgages being packed up and sold off as AAA debt obligations (never having defaulted pre-2008), Sub-prime Auto debts have been packaged and sold in the very same way, in the form of CDO’s (Collateralized Debt Obligations). The collateral on a mortgage is typically the land and home that mortgage is written on. As mentioned above, the collateral on an Auto loan is a vehicle, which depreciates with ever mile put on the car and every day that passes; every accident, bump or blemish. What do you think the recovery on these sub-prime auto loans will be as the used car markets are flooded with these vehicles?

While “experts” like to point out that the entire Auto loan market adds up to a fraction of what the mortgage market looked like back in 2008/09 (which is “technically” true; in 2008/09 nearly $1 trillion worth of mortgage related product failed vs. $8.4 trillion dollars of outstanding mortgages in the US) what they neglect to mention is what really matters in terms of the stability of the banking industry is how many of these loan were securitized, along with the specified “type” of credit (prime, sub-prime or deep sub-prime); as was the case with securitized mortgages, the securitization model creates complexity – which consists of bundling these loans together and selling them to investors worldwide.. Nearly 80% of all sub-prime auto loans were securitized and sold off as a high quality security, there is over $500 billion securitized auto loans circulating around the markets; when these loans are securitized, no one knows how deep these problems are or will be.

“Along with innovation came complexity – and complexity is the enemy of transparency… and complexity is NOT a good thing in finance!” Treasury Secretary Henry “Hank” Paulson 2013 Documentary HANK: Five Years from the Brink

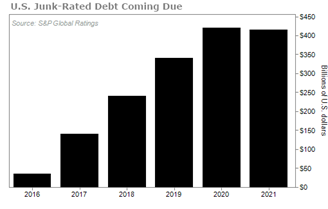

Some estimate nearly $250 billion or more of these loans could default. That’s one quarter of “what went bad” during the mortgage meltdown may soon be coming to a bank, bond fund or pension fund near you! (Again, these products were sold as AA and AAA, safe investments) Couple this with a significant amount of delinquencies and defaults piling up in the $1.4 trillion dollar student loan market added to the spike in delinquencies in the trillion dollar consumer “credit card” markets, and roughly $1.5 trillion dollars of junk bonds which will need to roll over in the next 4 ½ years, we could be staring down that class 5 rapid very quickly?! When functioning properly, our markets could very well weather a storm of defaults, however, when credit begins to freeze, it can adversely affect all credit markets creating an environment for the “perfect storm” which hits from multiple directions.

I mentioned the “consumer credit card” market.

Capital One is the 3rd largest Credit Card issuer in the United States, with the fastest growth in outstanding card balances since 2010. Buried in their Q1 numbers Page 13 Table 8 management felt the need to increase their loan loss reserves by $1.7 billion or 30%. For those unfamiliar with balance sheets, you don’t increase loan loss reserves by 30% unless you anticipate or there is a high likelihood of something relatively bad looming…

Every segment of the “consumer credit” markets have begun to show stress and as I refer to it above, the cracks in the dam are now visible and leaking. So that begs the question, where will you be when the music stops? What is your protection strategy? What are you doing differently today then you were in 2006/07; the years leading up to 2008/09? For those of you who are following my equity solutions model, we have our capital preservation strategies in place – while there are no guarantees – we have our plan and will stay disciplined to it. We have installed the hurricane shutters before any hurricane hits… and if it doesn’t hit, we’re still in excellent position to take advantage of the flood of money that central banks have been putting to work in equity markets around the globe. (See Q1 note)

Question; How long did it take for markets (as measured by the DJIA to break even after the Crash of 1929?

Answer: 26 years…

Next question: How long has it taken Japan’s Nikkei to break even following its crash which began in 1989?

Answer: It still hasn’t – 28 years later, the Nikkei is still nearly 100% lower than its peak of over 39,000 in 1989.

If you have been doing the same things since 2008/09, you should consider some alternative solutions. I’ve said it before – if you sold your BMW to buy a Mercedes, on the surface it looks like you’ve done something different, when in reality, you’ve merely traded for a highly priced German luxury sports car – you’ve done nothing different. If you switched funds, or brokers – have you really done anything different? Have you considered an “In-service” 401k rollover? Do you know or understand what that is and or the benefits of doing so? If you don’t know what it is, get a copy of your plan summary from your human resources department and call me!

Have you been paying attention?

Warning signs have been flashing in certain sectors of the markets for some time; the flashing yellows are getting a touch brighter, however, my belief is they are suggesting we continue to proceed, albeit, with caution. They aren’t saying stay out or pack your bags and run for the hills… Not just yet anyway. It’s time to be much more selective with what we are investing in though.

History suggests the late stages of most bull markets are where the greatest of gains are typically made. Euphoric buying pushes stocks up to unrealistic valuations. Given our current environment with direct central bank intervention and equity purchases, central banks will more than likely attempt to “defend” their positions should markets move lower. It’s either “defend” your equity position and the markets themselves or deal with a severe currency issue based upon the value of your respective equity positions?!

The Swiss National bank owns nearly $500 billion worth of equities in markets around the globe, growing by 41% in 2016. With a population of roughly 8 million people – it’s nearly the 10th largest investor in the world. What happens to the Swiss Franc should global equity markets sell off?

Anyone who’s taken a moment to read just one of my notes over the past year and a half has more than likely read about this looming debt crisis in sub-prime auto loans, student loans and the high yield debt market (which I’ve written on for nearly 2 years now, June 17th, 2015).

January, 2017, I wrote:

More than 9.5 Trillion dollars’ worth of Global Corporate Debt will be coming due over the next 5 years. Let’s let that sink in for just a minute…

- Roughly 2.3 Trillion of this is considered “High Yield” – “Junk Bonds”

- Roughly 1.5 Trillion of this debt is that of the United States

In that January note, I also spoke of the dangers of Bank Investment grade bonds, i.e. the bonds we’re led to believe are the safest! (For those with a short memory – the AAA rated Collateralized Mortgage Obligations was the 800-pound gorilla that nearly collapsed the economy – not junk bonds).

I continued…

Corporate bond analysts at Morgan Stanley anticipate the default rate among junk companies to reach 25% within 5 years. The lowest “rung” of high quality bonds or BBB Rated bonds used to comprise roughly 17% of the market now represents nearly 30% of all bond issuance. When adjusted for the amount of corporate debt issued, US equity markets are trading at record highs with outlandish valuations – though corporate earnings have fallen for five straight quarters.

What does this mean? It means BBB credits may not be investment grade credits anymore?! In a recent report from Bloomberg found here – both Moody’s and S&P have been “cutting companies slack on mergers and acquisitions, an analysis of credit-ratings by Bloomberg News found.”

“Over the past year and a half, both have bumped up their ratings by two, three or even six levels on a majority of the biggest deals, the analysis found.” (Emphasis mine)

It also means that if you own the Equity or Stock of a company whose debt goes into default – the equity value will more than likely be wiped out as bond or debt holders take precedence over that of Equity holders.

I’ve also attached the Q1 note above should you like to revisit the “optimism vs. caution” piece as it still holds true.

The Experts…

Above, I referenced and provided quotes from Former Federal Reserve Chairman Ben Bernanke. I don’t know him personally, I’m sure he’s a brilliant academic; though, clearly not always right, in fact, very often wrong, and publically at that. I’m not picking solely on Bernanke here. I could cite examples of Paulson and Geithner – you could name most any CEO at any major financial firm back during that time who said they were “fine”; Merrill CEO John Thain repeatedly said the firm has enough capital, only to rush out and raise more, to then agree to be bought for a fraction of what it was once worth by Bank of America in a move of desperation. Dick Fuld of Lehman Brothers still blames others for the demise of Lehman, not poor risk management, lack of oversight, and plenty of greed. I could go on and on…

Tuesday, June 27th, 2017, during a Q&A discussion in London, Fed Chair Janet Yellen was asked about the likelihood of another financial crisis. Do you want to take a guess at what she said?

“Speaking during an exchange in London with British Academy President Lord Nicholas Stern, the central bank chief said the Fed has learned lessons from the financial crisis and has brought stability to the banking system…”

Yellen also made a prediction:

“That another financial crisis the likes of the one that exploded in 2008 was not likely “in our lifetime”.

She added: “I think the system is much safer and much sounder.”

“The crisis, which erupted in September 2008 with the implosion of Lehman Brothers but had been stewing for years, would have been “worse than the Great Depression” without the Fed’s intervention, Yellen said.

I often wonder how, at times, there can be such a disconnect between what is being said by so many of the most powerful, in the “know” people in this business, publically vs. reality can be so large? How so many, so close to a situation can be blindsided?

I can only imagine how it feels to have every single word you say, scrutinized down to tone and inflection. How confidence alone, can shift the way hundreds of billions to trillions of dollars are traded every single day? Though, what happens when the weight of the world is no longer on your shoulders? Does your viewpoint change as you distance yourself from the internal strife of running a public company or the Federal Reserve – or the Treasury? Do your thoughts change a bit as possible conflicts of interest disappear?

If you happen to have NETFLIX, assuming you haven’t already watched it, I suggest you watch the documentary:

“HANK: Five Years from the Brink”

Released in 2013, it highlights the 2008/09 crises from the eyes and perspective of former U.S. Treasury Secretary Henry “HANK” Paulson, straight from the horse’s mouth. There is slight perspective from Hank’s wife, Wendy Paulson as well. It’s directed by Joe Berlinger.

While Hank Paulson has said some things that weren’t exactly accurate as he attempted to navigate what was nearly a global disaster. Fast forward 5 years to a time with no spotlight shining down on him; Having had time to reflect and think about things, with no hidden agenda or boss to please; he has, what I believe, to be some very poignant and timely thoughts…

“I get asked all the time, what’s the likelihood of another financial crisis? And I begin by saying it’s a certainty; as long as we have markets, as long as we have banks, no matter what the regulatory system is, there will be flawed government policies – those policies will create bubbles. They will manifest themselves in the financial system no matter how it’s structured and how it’s regulated.”

“When I came to Washington, the largest 10 banks held over 50% of the assets held in the banking system, 10 years early that would have been 10%. Today the problem is worse because obviously to get through the night, we needed to encourage consolidation. Too big to fail is a phenomenon that is definitely NOT acceptable.”

While Paulson does go on to say that he believes the banks are stronger, better capitalized and more prepared for a crises due to more regulation. He concludes with this message:

“More still needs to be done with the shadow banking markets, the money market funds, the wholesale lending markets – the so called repo market. When I came to Washington Fannie or Freddie guaranteed or insured roughly ½ the new mortgages in America, today, well over 90% are insured by the government. So today it’s worse.”

“I tend to look forward. The whole reason I am doing this is not because I want to look back, but because I have increasingly come to the view that it’s important that there be a historical record for those that come after me. So we don’t replay this movie all over again….”

Given Paulson’s words were in 2013, and exploding bad loans have only gotten larger while credits have deteriorated further… My hope would be current Federal Reserve Chairwoman Yellen, give Hank a call.

Writing a note speaking to deteriorating credit and loan defaults brings me no joy. I don’t write these notes to be negative, nor to scare people; I write them from the perspective of what I would want to know if roles were reversed. I write them to empower people. I sincerely believe markets can move significantly higher from here based upon numerous factors, I wouldn’t be invested if I didn’t, but having a greater understanding of how our economy functions, what stress fractures may break and how it more than likely effects markets, helps us all be more prepared to navigate our boat as we head down these rocky waters. Having a capital preservation strategy and other small hedges allows you to take advantage of markets moving higher and seek for shelter when things become too volatile to stomach. Lying to yourself isn’t going to help anyone of our bottom lines. I have saved speaking about the oil and agriculture businesses for a later date, though, definitely something I’ve spoken about in the past and closely watching as rig counts move higher, prices will more than likely continue to fall.

Please call with any questions or concerns, I am always happy to talk and elaborate on my thoughts, views and concerns.

Best,

Mitchel C. Krause

Legal Information and Disclosures

This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. Other Side Asset Management, LLC. has no duty or obligation to update the information contained herein. Further, Other Side Asset Management, LLC. makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Other Side Asset Management, LLC.. (“OSAM”) believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Other Side Asset Management, LLC..

Some headlines have been slightly modified, shortened, broken into multiple levels in order to fit our Web-based table of content – early PDFs are all in original form as they have no hyperlinked Table of Contents…

**To reiterate: Past performance is NO guarantee of future results. You can lose all of your money investing in the equity markets. Performance varies slightly based upon; differing fee schedules, total dollars invested, fractional shares are not purchased, “date of entry” the portfolios most recent “volatility adjustment of position size”, along with many other unforeseen variables, et al. If “date of entry” into the model is after January 1, 2017, your performance numbers are based upon date of money being in good form to invest. Call with specific questions or concerns. Additionally, these are my views, thoughts and opinions which may differ from that of the firm. These are the views I use to gauge how I run my discretionary Equity Solutions Model.