When was the last time you went to the bank? I mean physically walked up to a teller in a brick and mortar location? Some may answer this question easily as small businesses owners may still deposit their daily “cash” in-take, while it might take others quite a bit of time to think about it. Banking has transformed over the years from face to face (interactional) to a more “virtual” (transactional).

April 2018, NACHA (The National Automated Clearing House Association) estimated that over 82% of US workers “are paid Direct Deposit via ACH, up from 74% in 2011”. More than 4 out of every 5 people don’t see an actual “paycheck” anymore.

With access to countless global ATM machines, credit cards offering “points”, online bill-pay, new technologies and applications like, PayPal, Zell and Venmo giving individuals the ability to move money to friends or creditors within seconds, walking into a physical bank location has gone the way of the dinosaur.

Having access to our money 24/7 is typically where our interest in banking/finance stops for most. I have X dollars in my checking, savings or brokerage accounts, press a few buttons and viola, my money is now where I need it to be.

If it were only that simple…

As close as we think we are to our finances, we’ve never been further away from understanding how the system works. While many of you may not want to know how the sausage is made, it’s never been more important for you to have a better understanding, if even slightly. In mentioning “REPO” (repurchase markets) in both our most recent quarterly and monthly, we have yet to elaborate on how it correlates to everything from simple banking at your local ATM to systemic risk in financial markets; specifically, “why” or “how” it can impact your life.

For better or worse, OSAM has committed to telling you what we would want to know if our roles were reversed. No one is going to leave this note as an expert on the Global Shadow Banking system given its complexity, but there are a few key things we sincerely believe you should be aware of (preferably have an understanding of) as it has a direct correlation with true risk management, not just what the S&P is doing.

We’re going to try to keep this simple and tackle 3 key thoughts:

- The complexity of the banking system – how money flows – it’s not as simple as most believe

- Fragility of the banking/financial system is very real

- Contagion from Repo markets – how easily it can roll into financial markets and the Fed’s involvement

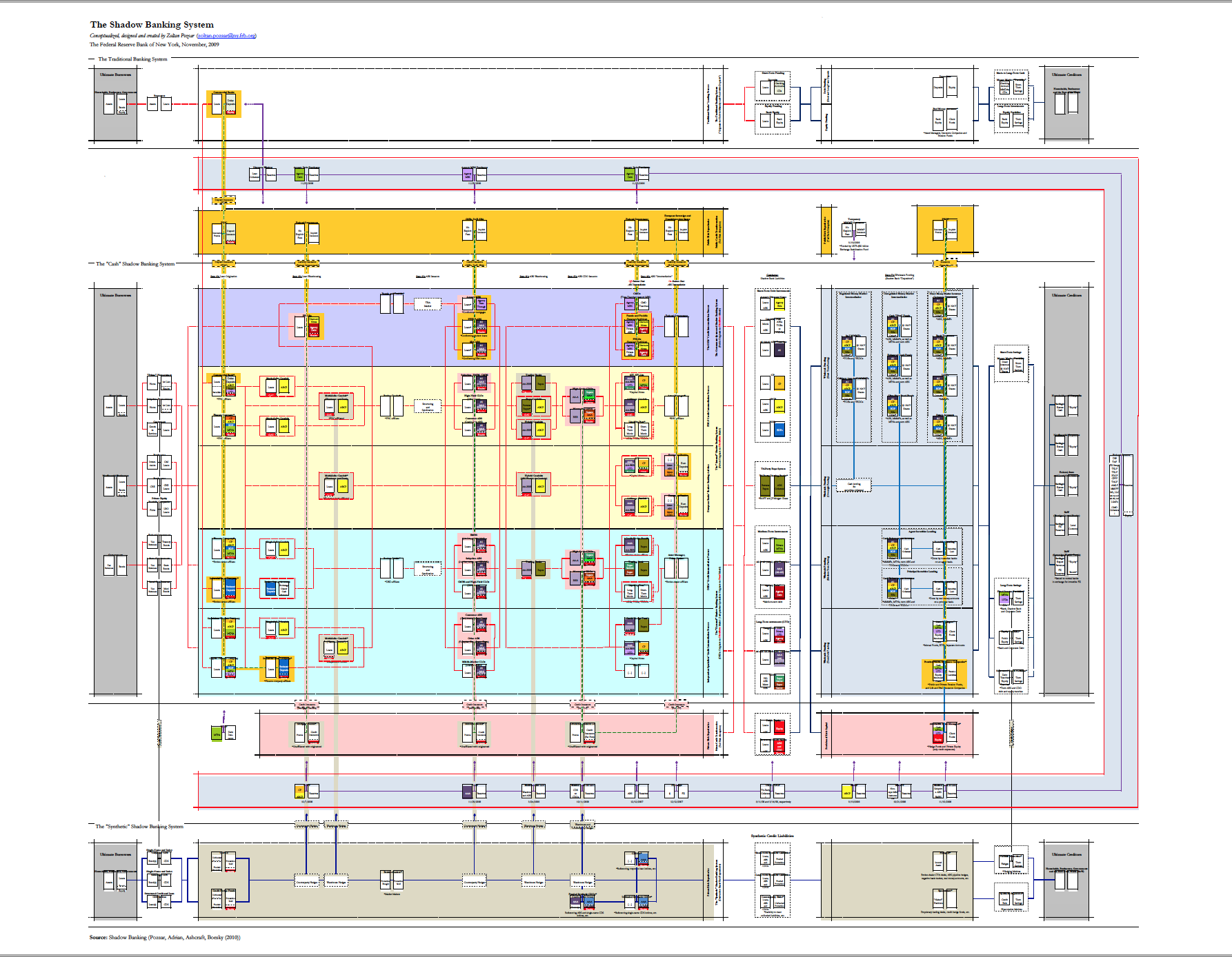

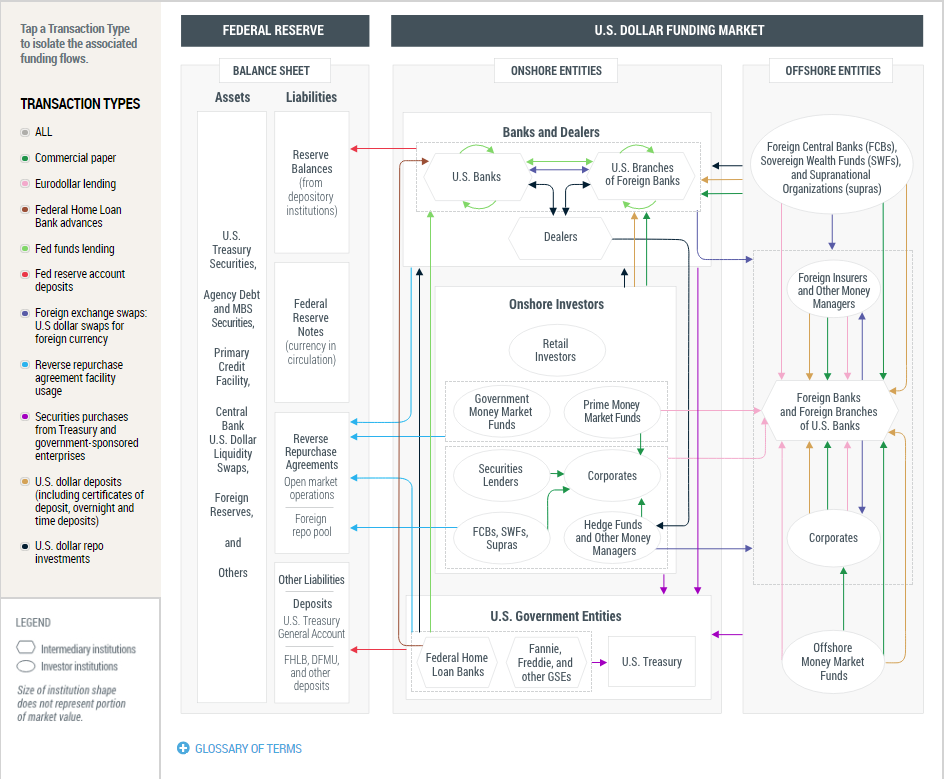

Let’s start with the complexity of the banking system: Below please find a visual from the Federal Reserve Bank of New York. CLICKING this link will take you to an interactive version of the below map showing how various institutions generally engage with one another, and the Federal Reserve’s balance sheet, in the course of borrowing and lending U.S. dollar instruments in the money.

There is NOTHING simple about the below illustration, which is specifically designed to simplify the flow of money. Colored arrows depict the transaction type (the flow of money for collateral of sorts). Money is constantly flowing from banks to dealers to the Federal Reserve; both on and offshore financial institutions constantly transact and, in an effort, to settle transactions/obligations from day to day, an enormous amount of both liquidity and trust is required. The liquidity primarily comes from overnight borrowing via repurchase markets (Repo) – the trust is required for counterparties to trade amongst themselves. Financial transactions take place and settle based upon a belief a security will be delivered in exchange for cash.

Collateral, typically in the form of short-term T-bills (Treasuries), is provided in exchange for dollars. The vast majority of these transactions occur on an o/n (overnight) basis (rinse/repeat), while “short-term” can span up to 3 months. Consider these transactions “carry trades”; which can be likened to a “Bridge loan” (short-term loans that satisfy immediate obligations while permanent financing is arranged).

This concept is foreign to most of us and truthfully taken for granted, yet it is in these flows, which again, typically take place on an o/n (overnight) basis, that allow all financial markets to function properly. Relative Value funds can roll their books, dealers can settle with their clearing firms, banks can fund their everyday obligations making dollars available to all of us on demand. When the system works properly, it does so all because of this relatively obscure, complicated, misunderstood yet enormous marketplace.

While the above visual gives you a glimpse at the complexity of the banking system, you may still be thinking “so what”, so long as my money is where I want it to be when I need it, I don’t care!