In This Article

Introduction

“Psychology plays a large part in business movements, and overoptimism can only land us on the shores of overdepression.” President Herbert Hoover, 31st President of the United States of America 1/1/1926

We do our best to remind investors that financial markets only become emotional if you allow them to be… In the end, the majority of investors allow them to be…

Investor sentiment measures emotions, which showed investors to be extremely pessimistic as December 2018 came to a close. At the time, equity markets were down nearly 20% and the Fed had just hiked rates for the 4th time in nearly as many months (bringing the Fed funds rate to a range of 2.25-2.5%) with another 2 hikes projected for 2019.

As the sun set on 2019, sentiment became even more extreme, though, optimism replaced fear as the emotion du jour. As reported by Sentimenttrader.com, “managers’ positions in index futures have never been higher.” The Fed cut rates 3 times beginning July 2019; more importantly, and as discussed last month; the Fed also began to flood markets with “liquidity” in September.

With a new decade upon us, we’ve done quite a bit of reflecting; and with that, came an onerous amount of reading…

We started with a comprehensive review of 2019; our holdings, positioning and thesis; what we believe we got right and where we may have gone wrong; it snowballed from there.

Currently, we are redesigning our online archive library. When completed, it will allow for easy navigation and simple searches of all previously published notes. The timing couldn’t have been better for us to scour our previous 4 years of writing in its entirety (2016 being the year we began managing discretionary models for our clients).

Then came the task of reviewing what we consider to be the most pertinent essays and books written on finance and investing by arguably the greatest investors of all time; Howard Marks, Warren Buffett, Paul Tudor Jones, Martin Zweig, Porter Stansberry and Steve Sjuggerud to mention a few. We turned to audio books, interviews and conversations with the best and brightest investors while driving in an effort to be more efficient and cover more ground.

We also spent quite a bit of time on our “why”, why we felt compelled to open our doors, why we do what we do and for whom…

Every passing day brings us an opportunity to learn from masters of the game (both past and present) while constantly evolving our process. We will continue to stand on the shoulders of giants while focusing on capital preservation and true risk management bringing you what we would want to hear and know if our roles were reversed.

Admittedly, this note has subtle nuances than past quarterlies. We do take a look at our 2019 “year in review” touching on both our successes and challenges, while providing forward thoughts based upon current data. Though, most importantly (in our opinion) these pages provide quite a bit of historical context and references (all work cited); pertinent quotes and excerpts directly from the author. Words written nearly a century ago to more recent, though you’ll likely swear they were written for current day.

Historical Perspective – Looking back to move forward!

At the onset of World War I, Germany invaded a “neutral” Belgium on August 3rd, 1914. Their goal was to gain positioning on France whom they had just declared war on. Upon hearing the news of Germany’s occupation of Belgium, Britain immediately sent Germany an ultimatum to withdraw their troops from Belgium; which the Germans rejected.

Great Britain immediately declared war on Germany…

In an effort to starve the German Army from receiving war supplies, the British Navy erected a strong blockade denying Germany imports. This, however, created a problem for Great Britain’s ally, Belgium. The ban on imports included Belgium as their territory was occupied by the German Army. This prevented necessities like FOOD from reaching everyday citizens of Belgium. It’s been estimated that nearly 78% of Belgians dietary needs came from abroad.

With Germany also occupying Northern France at the time, the blockade led to more than 7 million Belgian and 2 million plus French civilians on the verge of starvation as the Germans claimed they had no responsibility to feed civilians…

Before he was president, Stanford graduate, businessman and mining engineer, Herbert Hoover became the unstoppable director of a newly created “CRB” (Commission for Relief in Belgium). Through tactical “neutral party” negotiations, Hoover was able to engineer, build the infrastructure, raise necessary funding and lead the CRB in delivering nearly 5 million tons of wheat, rice, beans and peas using over 2,500 ships over a 4 year period; feeding the innocent civilians of Belgium and Northern France, while more importantly, keeping food out of the hands of the German Army. Hoover earned the nickname “The Great Engineer”.

Herbert C. Hoover became the United States first “Food Czar” when he accepted the directorship of the U.S Food Administration. He later served as the 3rd U.S Secretary of Commerce prior to becoming the 31st President of the United States. Hoover’s pedigree earned him a decisive Presidential victory collecting 444 of the 531 electoral votes in 1928; Hoover took office March 4th, 1929…

Hoovers very first year in office, a quick 8 months post his taking office, came “Black Tuesday” (October 29, 1929).

“The Great Engineer” credited with literally saving the lives of nearly 10 million people nearly a decade prior, and highly successful businessman, Hoover was largely blamed for the epic stock market crash as well as the recession which led to the prolonged Great Depression.

Nothing Hoover did as sitting president stopped the proverbial bleeding, though, what’s striking to me is so much of what Hoover said PRIOR to his taking office went unnoticed and ignored…

We began this note with a quote from former President Hoover: To be specific, from his memoirs written shortly after he lost his bid for reelection The Memoirs of Herbert Hoover – The Great Depression 1929-1941. This isn’t the medium to detail the Great Depression, though perspective and context is tremendously important to understand given current economic conditions.

Hoovers warnings came well before 1929… Prior to 1926 he noted the importance of credit, though also warned of speculation and more importantly “credit machinery” (i.e. Federal Reserve intervention) … The below excerpts are directly from Hoover’s Memoirs, specifically pages 5&6, which are pages 17&18 in the hyperlinked PDF. Hoover states:

“Psychology plays a large part in business movements, and overoptimism can only land us on the shores of overdepression.” 31st POTUS Herbert Hoover, January 1, 1926, Memoirs page 6 (page 17 of PDF)….

THE FEDERAL RESERVE INFLATION OF CREDIT

My Annual Report as Secretary of Commerce, published in midyear of 1926, said:

No one doubts the extreme importance of credit and currency movement in the “business cycle.” Disturbances from this quarter may at once interfere with the fundamental business of producing goods and distributing them. Many previous crises have arisen through the credit machinery and through no fault of either the producer or consumer. . . .

That the Federal Reserve System should be so managed as to result in stimulation of speculation and overexpansion has received universal disapproval.

Behind these alarms was my knowledge that the Federal Reserve Board had deliberately created credit inflation. The Reserve System had been established early in the Wilson administration on December 23, 1913. The act was largely fathered by Senator Carter Glass and was hailed by him, President Wilson, and Secretary of the Treasury William G. McAdoo as the remedy to the whole problem of booms, slumps, and panics. They asserted that, by the control of discount rates, open market operations, and currency issues, business crises could be eliminated. They contended that raising rediscount rates and restriction of credit through the sale of government securities by the Reserve Banks (“open market operations”) would curb all speculation, and that the opposite actions by the Reserve Banks would stimulate business activity. A few of their expressions were:

We shall have no more financial panics. . . . Panics are impossible. . . . Business men can now proceed in perfect confidence that they will no longer put their property in peril. . . . Now the business man may work out his destiny without living in terror of panic and hard times. . . . Panics in the future are unthinkable. . . . Never again can panic come to the American people. A contribution to optimism and the belief in the “New Era” was the illusion that the economic system was thus completely immune from financial crises.

A contribution to optimism and the belief in the “New Era” was the illusion that the economic system was thus completely immune from financial crises. Bankers, accepting this illusion, neglected many of their own responsibilities.

Does any of the above sound familiar?

Hoover’s efforts to educate the masses years before he took office fell on deaf ears, no one listened. When the market crashed and economy sunk from recession to depression, it was too late to listen and still no one cared why, they just wanted an immediate fix. Economies, like massive ocean liners, don’t just turn on a dime; bubbles don’t just appear overnight … they build over time.

Prosperity, post bubbles, comes large in part, at the hands of the debt restructuring and bankruptcies that occur during the crises. If this part of the process never takes place, it leaves significantly less room for credit expansion to fuel future growth. Which is what’s happened since 2008. Companies which should have failed, weren’t allowed to, losses which should have been taken, have not been. Copious amounts of debt have piled higher on top of already bad debt leaving many bloated, over-leveraged companies unable to fuel additional growth with rates near all-time lows.

Ahh the Hubris… both then, and now…

October 16, 1929, as the equity markets had begun to sell off from their August highs, famed economist of his time, Yale professor Irving Fisher is quoted as saying:

“stocks have reached a permanently high plateau“

As in, they won’t fall… 5 days later – October 21, 1929 Fisher then said:

(The market was) “only shaking out of the lunatic Fringe”

Damn speculators… At a bankers meeting on October 23 Fisher reiterated:

“Security values in most instances are not inflated”

Keep buying the dip, stocks are cheap… Finally, October 30th, 1929, after equity markets had fallen by 40% over roughly two weeks, Fisher made an appearance on TV, you can watch his original statement by clicking here:

“Stocks have fallen in a week 30%, and a week ago they had fallen some 10% from the previous high of this year… The real reason, as I understand it, for this drop is that people have been speculating on small margins. It was not that the stock market was very much too high… but that people were so enthusiastic about making the money that they properly expected to make in the investment of stocks, tried to do business on a shoe string, they went into debt and the real lesson of this market is if you buy stocks, buy them with your own money and not with borrowed money any more that can be helped. If that lesson is learned, possibly in the end this experience to some people may be a blessing in disguise?! This country is fundamentally sound, and the technical situation in the stock market is not going to prevent the great improvement, progressive improvement in our wonderful prosperity.”

It had nothing to do with stocks being too high, it was margin buying – all of it… But, hey, there’s a lesson to be learned in all of this… Don’t buy on margin! Does any of this sound familiar to anyone? Seriously?!?!

Anyone remember July of 2007? Citigroup CEO Chuck Prince infamously said… “As long as the music is playing, you’ve got to get up and dance. We’re still dancing.” He even attempted to defend this quote to the Financial Crises Inquiry Commission in 2010… Citigroup is still down over 80% from 2007 highs on a split adjusted basis.

Fast forward to current times…

January 22nd, 2020: Bridgewater Capital CIO, Chuck Prince stated: “We’ve probably seen the end of the Boom-Bust cycle” he later qualified statement with “as we know it”; admitting the “Fed is in a box, they can’t tighten and they can’t ease.”

The list of individuals joining this chorus that markets will forever move higher is growing at an alarming rate, making statements nearly identical to those President Hoover both warned and wrote about years preceding “Black Tuesday” and the Great Depression. (Former Federal Reserve President Janet Yellen comes to mind immediately – which we’ll discuss later in the note)

We’ve cited countless blunderous quotes from Federal Reserve officials that have not aged well; writing an entire section entitled “Fed Speak” in our 2Q2018 quarterly and yet it seems as if very few learn from history? Howard Marks, however learns from history…

Howard Marks

There is so much to be learned from history. Understanding it gives us the ability to stand on the shoulders of giants, utilizing the lessons from vetted experts who have lived under similar conditions and circumstances (especially when emotionally driven). In sticking with historical references which parallel today’s environment, we bring you some fairly recent thoughts from Howard Marks.

We’ve referenced Marks many times in the past, our belief is that he’s one of the finest, if not THE best distressed debt manager Wall Street has ever seen. We owned OAK prior to BAN (Brookfield Asset Management) acquiring a majority stake in Oaktree. On June 12, 2019 Marks penned a note to his investors; we encourage you to read it by clicking here… For those who want the cliffs notes, we’ve pulled some of the more pertinent thoughts for you below.

Marks titles his note “This Time It’s Different” (inspired by Anise C. Wallace’s New York Times article dated October 11, 1987 titled “Why This Market Cycle Isn’t Different” (you can read the original NYT article by clicking here). Marks begins…

I first came across the title of this memo in an article titled “Why This Market Cycle Isn’t Different” by Anise C. Wallace in the New York Times of October 11, 1987. It went as follows:

The four most dangerous worlds in investing are “this time it’s different,” according to John Templeton, the highly regarded 74-year-old mutual fund manager. At stock market tops and bottoms, investors invariably use this rationale to justify their emotion-driven decisions.

Over the next year, many investors are likely to repeat these four words as they defend higher stock prices. But they should treat them with the same consideration they give “the check is in the mail….”

Nevertheless, in the bull market’s sixth year, the “this time it’s different” chorus is beginning to be heard. Wall Street professionals predict that, before the bull market ends, individual investors, who have mostly stayed on the sidelines, will be swept along in the mania characterizing a market peak.

They will invest in stocks despite the fact that the Dow Jones Industrial average has more than tripled in the last five years. They will be hearing overwhelmingly compelling reasons why stock prices should go higher, why the bull market should las considerably longer than any other in history, why this boom will not be followed by a 1929-like crash and why “this time it’s different.”

Many of these arguments will be tempting because they will have some element of truth to them. Even Mr. Templeton conceded that when people say things are different, 20 percent of the time they are right. But the danger lied in thinking that different factor – like the recent investment in United States stock by the Japanese will be uninterrupted.

Wallace’s essential message is that investors must take heed when the four words are win widespread use. Why? Look back at the paragraph introducing the above quote: when you first read it, did you happen to notice the date of the publication? It was just eight days before Black Monday (October 19, 1987) the worst day in stock market history. We know how bad it feels when the market falls 20% in a year. Try 22% in a day!! Wallace’s warning was particularly important at the time the article was published, but for me it’s always important.

Marks continues…

Think of a rocket launched from Cape Canaveral. Gravity has to be overcome in order for it to escape the earth’s atmosphere. Likewise, the limitations imposed by past norms have to be overcome in order for asset prices to slip their historic moorings and blast off int outer space.

Our November Monthly was titled “Economic Gravity: The more things change, the more they stay the same! Have we learned Nothing?!” Horse, meet water…

More from Marks:

Today we’re not hearing much about historic valuations being irrelevant, as they’re not terribly high. Instead, what we’re told is different this time is the relevance of restrictions on future economic and market performance:

- There doesn’t have to be a recession.

- Continuous quantitative easing can lead to permanent prosperity.

- Federal deficits can grow substantially larger without becoming a problematic.

- National debt isn’t worrisome.

- We can have economic strength without inflation.

- Interest rates can remain “lower for longer.”

- The inverted yield curve needn’t have negative implications.

- Companies and stocks can thrive even in the absence of profits.

- Growth investing can continue to outperform value investing in perpetuity.

I rarely participate in a meeting these days without someone asking about one or more of these propositions. The bottom line is that for any of the nine to be true, things really have to be different this time.

After discussing the outlook for each of the above Marks states:

What do all the theories propounded above have in common? That’s easy: they’re optimistic. Each one provides an explanation of why things should go well in the future, in ways that didn’t always go well in the past.

In recent years, the U.S. has simultaneously experienced economic growth, low inflation, expanding deficits and debt, low interest rates and rising financial markets. It’s important to recognize that these things are essentially incompatible. They generally haven’t co-existed historically, and it’s not prudent to assume they will do so in the future.

I’ve seen times in the past when people believed such an ideal state would continue in perpetuity, but it has never worked out that way. Maybe it will this time – no one can prove it won’t until it doesn’t – but certainly broad acceptance of such a proposition indicates that optimism prevails in the current investment environment.

The nine propositions reviewed above all represent variations on “things can only get better forever.” If they’re the ideas guiding investors today, that should be considered worrisome.

The best investments often are made in times of fear and desperation. That’s rarely possible when investors are willing to blithely dismiss the limitations of the past with the words “this time it’s different.” I would remind those investors of a quote usually attributed to Mark Twain: “History doesn’t repeat itself, but it does rhyme.” Of course it’s important that investors keep up with current developments and those that will shape the future. But it’s also essential that they not completely unlearn the lessons of the past.

Over the years our notes have had similar themes, lessons and near identical thoughts… Do you see any parallels from the past to today? For those who invested during the Tech bubble or the mortgage meltdown – does anything look familiar to you?

The Vultures are swarming… Again!

Howard Marks is a giant whose shoulders we attempt to stand on, his lessons are to be heeded, as are “The GOATs” (The Greatest Of All Time) Warren Buffett! You’d think after decades of outperformance and numerous annual letters to investors, more would attempt to suck in as much knowledge from this individual as possible; yet investors, Wall Street and the media alike, time and time again, prove to be tremendously fickle.

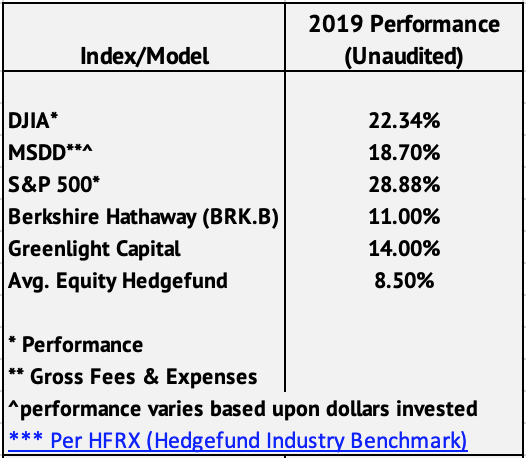

A recent Google search for “Warren Buffett” brought up a myriad of headline that all read similarly: “Warren Buffet Clocks Worst Year in a Decade as Cash Pile Swells to $128 Billion.” CNN wrote, “Warren Buffett has $130 billion in cash. He’s looking for a deal”. From Markets Insider’s, 2019 was Warrant Buffett’s worst year in a decade. Each pointing to the same thing, Berkshire Hathaway’s 1-year stock performance; it’s worst underperformance (vs. the S&P 500) in a decade; gaining a meager 11%, with the S&P 500 gaining 29%. Additionally, investors seem to be confused as to why Buffett isn’t spending his record $128 billion cash pile?!

This is where historical perspective and context comes into the picture.

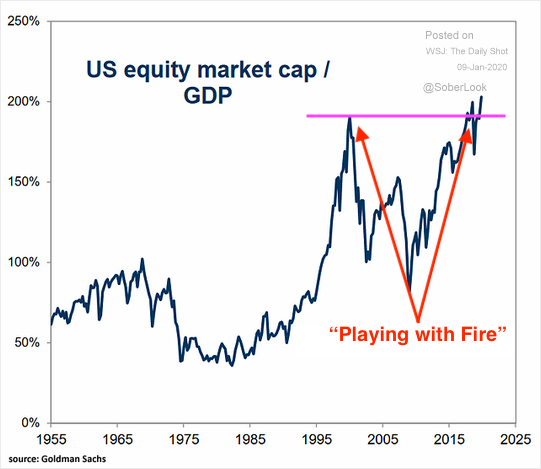

First thought, find an 11% return in a relatively safe bond… Good luck. Having written extensively on Buffett, specifically in our 3Q2018 quarterly we noted Buffett’s underperformance vs. both the S&P and Nasdaq typically comes as market valuations scream out of control. Total Market Cap of US Stocks to GDP being Buffetts favorite market valuation metric having described this indicator as “the best single measure of where valuations stand at any given moment” and that when the metric exceeds certain levels, like it did back in 2000, “you are playing with fire.”

While we discuss market valuation in our final section, let’s take a look at what Buffet’s favorite market valuation metric suggesting today? US equity market cap to GDP: From the WSJ’s “The Daily Shot” published 1/9/2020, OSAM denoting “playing with fire” levels.

Buffett and Munger are highly disciplined, extremely skilled value investors. In that 3Q2018 note we also wrote:

“Buffet has had his fair share of significant drawdowns and underperformance (33% of the time he has lagged the S&P (17 out of 53 years) with 11 negative years). Did you know there was a time in the last 20 years Berkshire underperformed both the Nasdaq and S&P 500 by over 133% and 44% respectively…”

AND STILL, HE HAS CRUSHED THE S&P OVER DECADES!

At the time, Buffet didn’t flinch, he understands reversion to the mean and the power of free cash

flow…”

Berkshire’s cash pile has been growing for years. An entire section of our 1Q2019 note dissects Berkshire’s annual letter to shareholders, we opined:

Warren Buffet released his annual letter (scorecard) to Berkshire Hathaway shareholders on February 23, 2019. Within hours it’s read front to back, back to front and analyzed. Every investor will pull from this report what he or she feels most poignant; below we share ours.

“Berkshire will forever remain a financial fortress. In managing, I will make expensive mistakes of commission and will also miss many opportunities, some of which should have been obvious to me. At times, our stock will tumble as investors flee from equities. But I will never risk getting caught short of cash.” ~ Warren Buffett; February 23, 2019 – Annual letter to Shareholders.

And continued:

“In the years ahead, we hope to move much of our excess liquidity into businesses that Berkshire will permanently own. The immediate prospects for that, however, are not good: Prices are sky-high for businesses possessing decent long-term prospects.

That disappointing reality means that 2019 will likely see us again expanding our holdings of marketable equities. We continue, nevertheless, to hope for an elephant-sized acquisition.”

If Buffett and Monger believed prices were sky high in 2018 and valuations today are exponentially higher, the logical thing to do for those who understand value and price discovery would be, to buy nothing…

We can be slightly more nimble than a Berkshire, which gives us the opportunity to buy smaller positions in companies which we believe to have high internal growth prospects, solid free cash flow, low debt while maintaining our capital preservation strategies wrapped around each position (i.e. our exit strategy).

Having said this, finding companies in today’s ever bloated market that meets these criteria is much like searching for a unicorn (not a Silicon Valley one). Additionally, like Buffett and Munger, we view a strong cash position to be an asset in times like these. Side stepping large downdrafts while holding proverbial dry powder in hand, as assets go on sale can easily make up for a few missed percentage points as markets rip uncontrollably higher on liquidity injection and multiple expansion with no underlying economic support (discussed below).

Above is the performance of our MSDD model for 2019 vs. traditional metrics as well as vs Berkshire, the average equity hedge fund returns as tracked by HFR Indices touted as the industry standard benchmark for hedge funds, as well as David Einhorn’s Greenlight capital. (*performance differs based upon dollars invested which can hinder our ability to get position sizes to where we want them)

We believe there is always room for improvement – always. Though, given the current RISK embedded in financial markets at this moment, we are comfortable to mildly pleased with where we landed in 2019. Our goal is to manage risk and preserve capital, which is what dictates our hedged portfolio’s positioning, i.e. Equity positioning, crises hedges, precious metal holdings and cash.

The late Martin Zweig is one of the giants we’ve read, studied and written about in the past… and the answer to improvement, likely lies in his words and lessons. While he was a “risk management guy” he was also a “liquidity guy”; it’s all about the liquidity… Don’t fight the Fed! We get that…

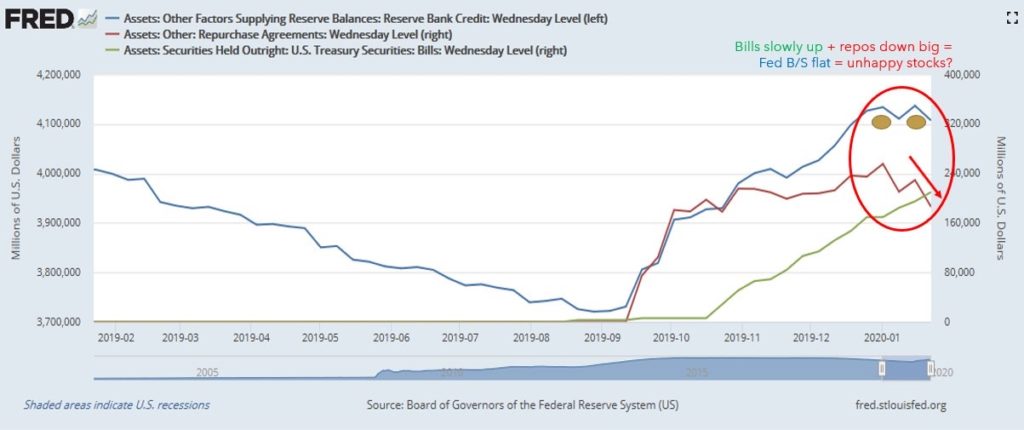

Our apprehension to recklessly go “all in” lies in the fact that equity markets have become a benefactor of near disaster. The correlation between Fed liquidity injections and S&P performance is undeniable as the ratio appears to be 1-1; for every 1% the fed increases its balance sheet the S&P gained 1%. Still, the liquidity the Fed is providing is literally maintaining the integrity of the global banking system via Repo markets.

The Fed has no known permanent solution to the Repo market issues discussed in our December monthly; other than to throw tens of billions of dollars at the problem nightly. While the real economy continues to decelerate. Most think the economy is in great shape because equity markets are near all-time highs – which is directly tied to a temporary and unsustainable fix. In 2020 we will continue to be prudent while aggressively following Fed liquidity operations, attempting to be more tactical when opportunities present themselves. Speaking of Federal Reserve liquidity operations…

One of the smartest Senior market/macro strategists we’ve recently read is George Goncalves (twitter handle @bondstrategist). An early confidant of Fed insider Danielle DiMartino Booth during her tenure at the Dallas Fed, George’s pedigree is second to none; including but not limited to: Head of Rates Strategy and Fixed Income Strategy at Nomura, Head of Fixed Income and Rates at Cantor Fitzgerald, Senior Rate Strategist at Morgan Stanley. Among other things George currently contributes to Macro Hive.

George recently stated:

“Repo is down, and stocks have stalled along with the Fed’s balance sheet (stuck around $4.1 Trillion). In fact, the latest data shows a contraction of the balance sheet, close to $30 billion, mostly from lower repo usage, as T-bill purchases continue at a slower pace. Will stocks end up with a sad face?”

With Georges permission I share with you the below graphic he generated:

We’ve discussed the Fed painting itself into a box. Liquidity has become the driving force of markets as balance sheets have been flat to shrinking for 4 consecutive quarters and with just over 10% of the companies in the S&P having reported for 4Q2019, earnings have come in negative 3-4% vs. and expected + 4-6%. Just recently, it appears as if the Fed has taken the gas off asset purchases and markets have sold off. With the Fed taking themselves out of the guidance game (more on this later), where will equities land? Or as George put it, “will stocks end up with a sad face?”

Very little of current equity market growth is organic.

A brief example of this would be Apple (AAPL). Apple didn’t double its revenue or sales in 2019, in fact revenue and profits were flat to negative. The iPhone, which represents nearly 2/3rds of revenue is losing market share around the globe, yet it’s multiple doubled from 13 to 26 times earnings… Apple is the benefactor of two primary driving forces. 1. Fed liquidity finding its way into markets and 2. The ETF revolution… Momentum investing… For every $1.00 invested in an ETF which holds the name, a buy ticket is generated. Largest market gets the largest buy order. Momentum up/momentum down…

The question ultimately becomes, will Fed liquidity trump an outright economic contraction which will lead to compounding layoffs and unemployment?

More of… You just can’t make this sh*t up!

“That’s a little bit of a trial and error kind of thing.”

On December 27, 2019, Former Atlanta Federal Reserve President Dennis Lockhart appeared on CNBC and uttered the above words to describe the Fed’s response to the September 16th, 2019 actions in Repo markets. As a reminder, borrowing rates in repo markets spiked from roughly 2% to 10% in what amounts to be in the blink of the eye and the Fed has been injecting liquidity into the financial system ever since.

A cavalier Lockhart believes our current scenario to be nothing more than a “miscalculation” for the proper amount of reserves needed in the system to be distributed among banks. Mind you, the top 5 banks hold over 90% of the reserves in the system per the WSJ 9/26/2019. Distribution of reserves among banks uneven? You think? Lockhart continued:

“And they (the FED) have been injecting more bank reserves into the system to try to make sure the repo market first got through year-end, which we’ll see in the next couple of days, and secondly continues without undo volatility.”

As the clock turned from 2019 to 2020, clearly, the global financial banking system didn’t implode due to “the turn” and a shortage of bank reserves (which is clearly a good thing). Nor did we call for such a thing (as some have suggested after reading our last note).

However, while talking heads around old Wall Street trumpet victory as repo markets made “the turn” into the new year without issue, this “miscalculation” has only needed roughly $413,680,000,000 (that’s billion AND COUNTING) of Federal Reserve’s balance sheet expansion via nightly liquidity operations, over a 4-month period of time to calm THE primary market which allows our entire global financial system to function…

Just… $413 billion dollars, uh, hold please… make that another $51.15 billion of overnight Repo operations January 3rd, 2020; ahh, and another $76.895 billion on January 6th, 2020, and another $98.919 billion on January 7th, 2020… and another… I hope you get the picture; Repo operations have been nightly and large…

Mr. Goncalves’s chart above, without question shows the Fed’s balance sheet to be leveling off (even shrinking by roughly $30 billion), as not all Repo flows through to the Fed balance sheet, though what will happen should the Repo markets need for liquidity grow as April approaches; or credit markets crack and freeze as they did with a simple GE downgrade in 2018 (no high yield bonds priced for over 40 days) or equity markets sell off?

Federal Reserve officials haven’t “fixed” anything. Unfortunately, they have created an enormous quagmire which continues to get bigger by the day. But, but, but the S&P’s up so who cares?! In August we wrote about consistently making the highest quality decision based upon the most mathematically probabilistic outcome. (if you haven’t read it, now would be a good time)

Current members of the FOMC continue to hide behind the statement, “the economy is strong”. Please, ask yourself what that means relative to investing? Economies accelerate or decelerate; earnings grow or slow; credit is extended or tightened; companies have the ability to pay roll their debt or they don’t; this is what creates business CYCLES.

Now ask yourself what is currently happening around the Globe (including the US)? The data suggests deceleration – companies have generated flat to negative earnings for the previous 4 quarters. The hiring currently taking place is among temporary employees and low paying positions, while hiring among the higher paid “top tier” jobs has become anemic. As real inflation is accelerating… (Core wage, core services, energy (crude oil) to name a few).

As former Fed officials like Lockhart make statements like it’s “a little bit of a trial and error kind of thing.” You can’t make it up – you just can’t…

Consider this… In what reality is a half-trillion-dollar (and counting) “miscalculation” grounds for those who created and have perpetuated this calamity to 1. maintain their jobs and/or 2. continue to have a platform/voice on our country’s financial policy?!

From Ben Bernanke June 2018 interview with AEI (American Enterprise Institute):

”while we certainly have not existed yet, the exit process has begun, asset purchases ended in October of 2014; now we’re at a process of where the balance sheet is actually beginning to run off and of course, it hasn’t finished, but that also has not shown itself to be a big problem so far”

In our 4Q2018 note we asked:

“what happens when “not shown itself to be a big problem so far” becomes “is now showing itself to be an enormous problem?””

We then proceeded to outline why it would become an enormous problem, which it has, September 16, 2019.

Making matters worse, Bernanke just won’t shut up, and people continue to listen to him. In a recent address to the American Economic Association from Jan 3rd-5th, Bernanke has again pleaded his case for negative interest rates stating:

“The Fed should also consider maintaining constructive ambiguity about the future use of negative short-term rates, both because situations could arise in which negative short-term rates would provide useful policy space; and because entirely ruling out negative short rates, by creating an effective floor for long-term rates as well, could limit the Fed’s future ability to reduce longer-term rates by QE or other means.”

We couldn’t disagree more. Positivity in rates needs to exist somewhere in the world for economic models to work; they’re needed for a fractional reserve banking system to function. Adults in the room – we are literally staring at the pied piper playing his flute, watching our children’s futures dance off into the sunset never to be seen again, but hey… The S&P.

Former Federal Reserve President Janet Yellen is no better stating the below on June of 2017:

“Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be.”

WHAT DID HOOVER WARN OF? Re-read the beginning on this note… “We shall have no more financial panics. . . . Panics are impossible. . . .” Yellen, translated: I don’t believe we’ll see another crises in our lifetimes… “I don’t believe it will be”

Yet on January 5th, 2020, she began lobbying for new tools for the FOMC to combat potential asset bubbles! Yellen said, I’m quoting here – you really can’t make this sh*t up… she said:

(these low rates) “could engender risks to financial stability as investors reach for yield and take on leverage.”

These are the words from the FORMER FED CHAIR PRESIDENT WHO NEVER SAW A FED FUNDS RATE HIGHER THAN 1.42% and refused to take NIRP (Negative Interest Rate Policy) off the table in February of 2016…

We are no more than a few years past her statement stating we won’t see a financial crisis in our lifetimes as she NOW lobbies for new tools so the Fed can combat against risks she fostered while she was head of the FOMC?!

We’re going to temporarily refrain from lambasting Fed Chair Powell in this note for a few reasons. First, we’re tired of doing so and if we’re tired, we know you need a break from reading about him. Though, more importantly, after reading the Fed minutes from December, we’re simply disgusted.

The FOMC has decided to not comment “on Longer-Run Goals and Monetary Policy Strategy at the January 2020 meeting.” At a time when communication couldn’t be more important, the Fed is going dark. As reported by Forbes footnoting the Fed’s December meeting minutes:

“Participants agreed that their review of monetary policy strategy, tools, and communication practices would continue at future meetings and, as a result, that the committee would not reaffirm its existing Statement on Longer-Run Goals and Monetary Policy Strategy at the January 2020 meeting,” the Fed said in minutes of its December meeting released Friday.

“The Committee plans to revisit this statement closer to the conclusion of the review, likely around the middle of 2020.”

If these individuals haven’t completely destroyed free market capitalism and price discovery, they are doing their absolute best to do so. Stansberry editor Dan Ferris recently hit the nail on the head when he said, “it’s Shakespearean, the lie reveals more truth than honesty.”

Through all of this, it’s still our job to manage your risk. So, is there risk in the real economy? Keep reading.

FROTH

Over the last decade, the US economy and “stock market” have become one in the same. Currently, investors to average Joe’s correlate “Market highs” to a great economy. Market sell offs now equate to weakness in the economy. This thinking has become pervasive and outright dangerous as it couldn’t be further from the truth.

Equity markets continue to diverge from the real economy for numerous reasons, but none greater and more obvious than the already discussed, copious amounts of Federal Reserve intervention; yet linking the two one is akin to staring at a beautiful home (Equity markets) with a termite infestation that has gone untreated for years (Real economy); as the house rots from the inside out. The damage isn’t so visible unless you’re willing to do something other than surface work (and not just take someone else’s word for it).

The obvious question would then be, why should we take your word for it rather than the majority? I would say, you shouldn’t take our word for it, we challenge you to research in an effort to foster a discussion – our answer lies in the data. We didn’t make up the data, it’s just real, unemotional data that very few are reporting on (it’s not sexy) … We continue to hear from both Federal Reserve official and financial news networks alike that the consumer is strong…

We’ve argued otherwise… so who’s right?

Holiday headlines screamed strong retail sales supporting the mainstream “consumer is strong” narrative… We’ve talked about retailers before, how’d did Macy’s to Kohls fair during the holiday season? Data = substantial losses. Apparently, selling a whole lot of crap for a fraction of their value equals, whoopsies…

Kohls…

JC Penny…

Bed, Bath and Beyond…

The bloodbath reached far beyond these 3 names as Macy’s announced the closing of 28 locations and 1 Bloomingdale’s over the next few weeks while pier 1 Imports announced the closure of 450 of their 942 stores amidst rumors of an imminent chapter 11 bankruptcy filing. Papyrus, who once had over 450 stores around the nation has recently announced the closing all 260 remain stores while Express is closing 100 stores over the next few years in an effort to cut costs…

This does NOT represent a robust consumer or “the best economy ever” … Even Amazon’s stock price has remained weak relative to other technology companies as equity markets await their earnings (1/30/2020).

While we’re on the subject, how do retail stores stock their shelves? Transportation… Shipping, Trucking, Rail. Recently, Colorado based H.H. Williams who’d been in business for 39 years, and “had a dedicated account with Walmart for over 34 years” just shut down. Indianapolis based, Celadon group, who employed 2,800 truckers just declared bankruptcy. This hyperlink lists the largest trucking companies that have folded in 2019; dubbed the “Transportation Bloodbath.”

Energy companies like Chesapeake Energy (CHK) continue to drown in debt. Lord only knows how Chesapeake, with an estimated $700 million in debt service load expected for 2020, will service it’s debt?!

What about Boeing? How will the 737 Max groundings affect the supply chain?

Spirit AeroSystems (SPR), who manufactures the fuselage of the 737 max is now laying off 2800 workers starting January 22 as production of the 737 Max fuselages have been halted.

Does this speak to strength of the consumer or economy? How about large purchases? Like, say… Autos? Looking at the most recent data available from Manheim:

“Retail sales of new vehicles were down 7.1% in December, leading to a retail SAAR of 14.3 million, down from 15.0 million last December and down from November’s 14.8 million rate.”

“New vehicle inventories came in under 4 million units for the eighth consecutive month”

We’ve discussed weakness in auto dating back to 2016 (our archives should be updated with prior notes shortly), most recently in our 2Q2019 note, both the “Coming to America” and “Desperation” sections:

“Last week, as reported on by the Wall Street Journal, GM, Ford (F) and Fiat Chrysler (FCAU) reported their worst first half auto sales in years. GM’s drop to 1.57-million units was its worst since 2013 (a 15% year over year decline), while Ford’s roughly ~290k units was the company’s worst first-half year since 2012; a 27% year over year drop and half of what their first quarter sales were in 2016.”

“Though, you would have no idea Ford’s sales have slowed by 50% of what the were selling in the first half of 2016 by looking at the equity prices or debt level pricing levels as discussed above.”

All while interest rates are nominally higher than ZERO and auto dealer incentives have literally NEVER been higher. J.D. Powers November 2019 numbers released in December.

“Average incentive spending per unit is on pace to reach $4,538, an increase of more than 12% from last year and the first time ever above $4,500. The previous high for the industry was $4,378 set in December 2017.”

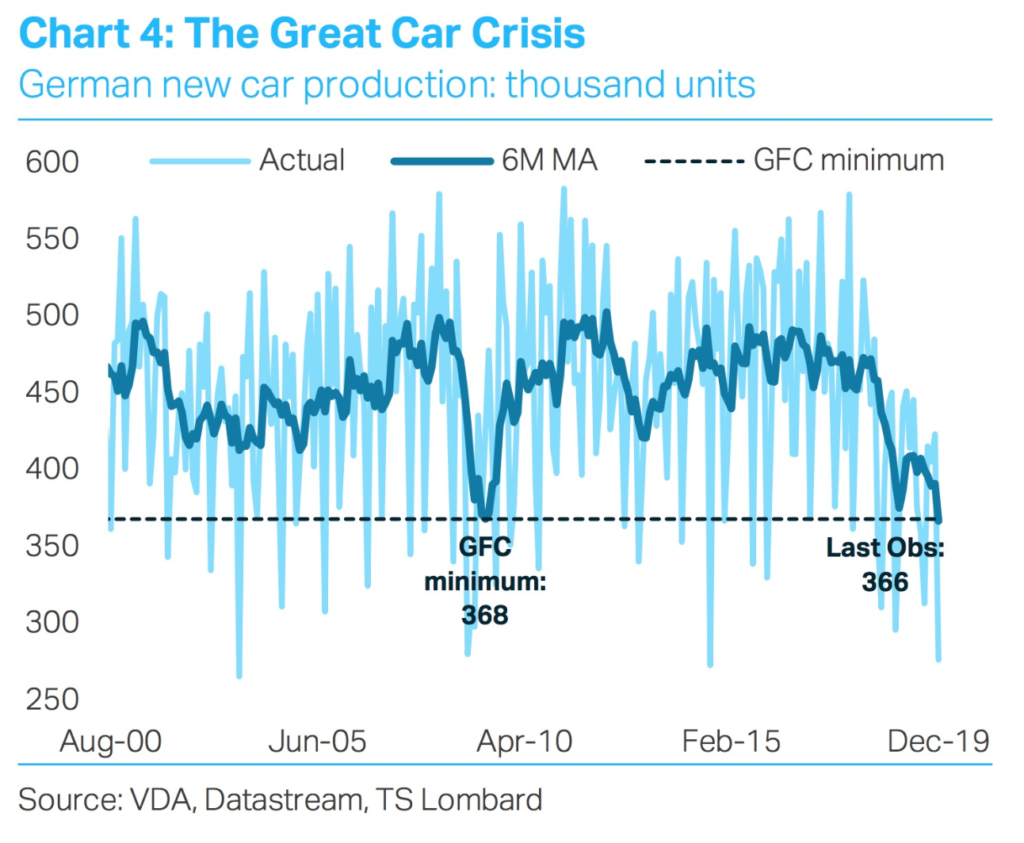

Global auto production is no better as Germany has hit multi-decade lows as the most recent car manufacturing data shows, lower than 2008 in during the Great Financial Crises.

Whether it be the consumer at the retail level, large purchases, transports, energy – the data does not support the mainstream narrative of a strong consumer… Flat to negative earnings, store closures and bankruptcies, does however, give us a forward snapshot into the future employment outlook?

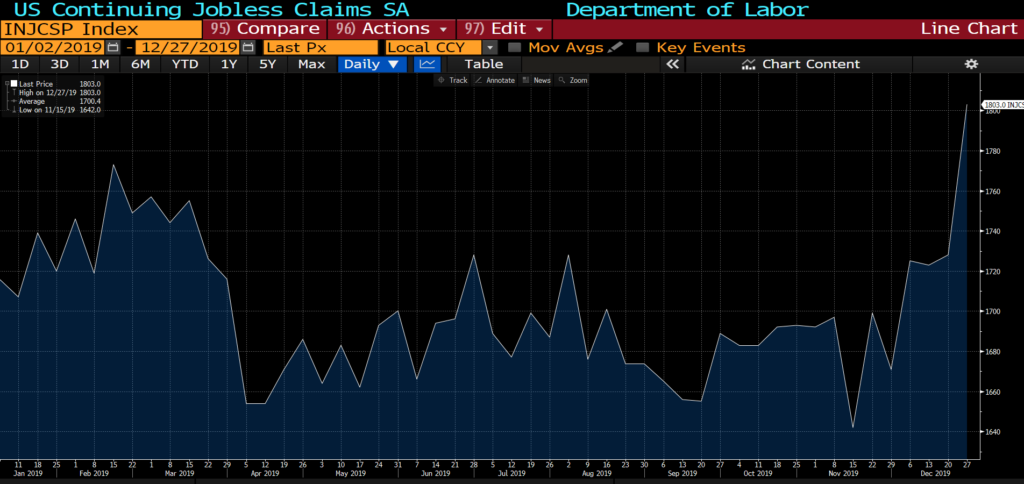

And as you can see below from the below image, US continuing jobless claims have spiked.

We’ve just scratched the surface of recent layoff announcements and as more companies are forced to shutter their doors and fail to manufacture earnings growth through financial engineering, we sincerely ask again (albeit, a bit differently). Will the momentum trade created by Central bank policy and the ETF machine be able to maintain equity valuations as the real economy continues to contract?!

What about equity VALUATIONS?

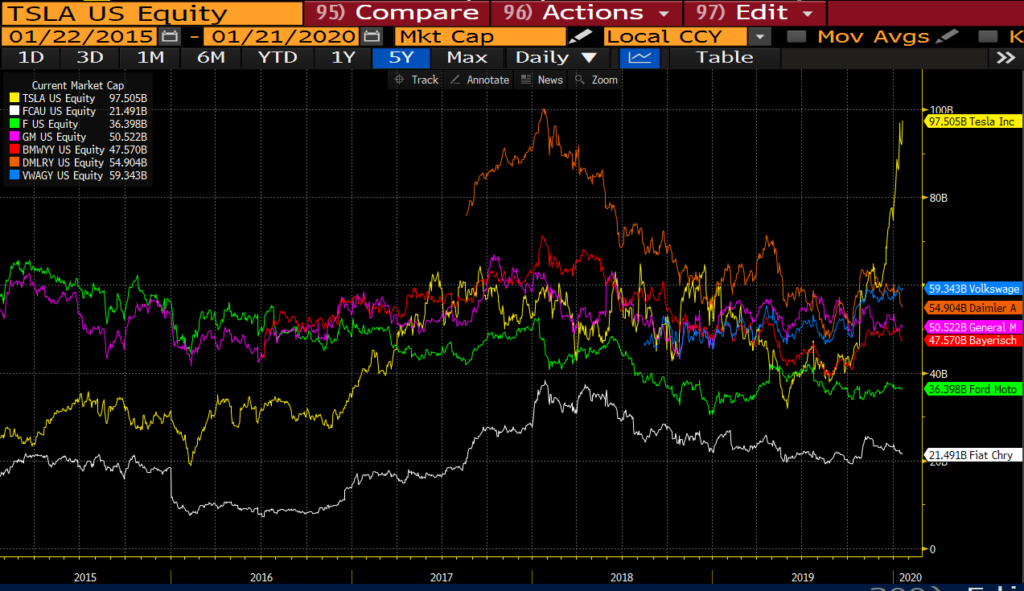

We’ve already discussed Buffett’s favorite indicator above, US equity market cap to GDP, which we know is exceeding “playing with fire” levels. So, let’s stick with the Auto theme… Tesla (TSLA) is literally the definition of “FROTH”. Our belief is Tesla (TSLA) will be a case study in economics classes for years to come. At the end of the day, we continue to believe Tesla’s equity value is a virtual zero. You can revisit our May 2019 Monthly if you care to delve further into our thoughts on the subject.

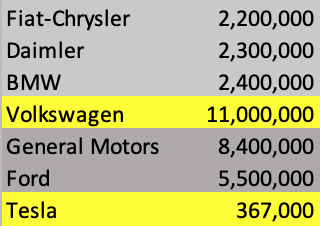

As of writing today, we continue to stay as far from Tesla as humanly possible (from either side of the trade) it’s simply too dangerous a name. Tesla, having lost money every year of their 16-year existence to the tune of billions, now has the 2nd largest market cap of any car company in the world at $102 billion. They recently surpassed Volkswagen and are second only to Toyota whose market cap is roughly $235.6 billion. The fluctuations vary so greatly by the day the below chart was generated as of 1/21/2020.

Tesla literally sells a fraction of what other global auto manufacturers sell and again, has never reported a yearly profit.

Whatever competitive advantage TSLA once enjoyed has shrunk based upon nearly 100 auto manufacturers globally will be offering EV vehicles within the next few years; the same time TSLA will be losing their government subsidies. Additionally, lemon lawsuits mount, the Solar City lawsuit looms, unexpected battery fires and recent accusations of Sudden Unexpected Acceleration causing numerous deaths pile high and yet, up, up, up with their stock price daily…

This is what froth looks like – this is a bubble; one which may very well get bigger, nevertheless it is a bubble.

[We acknowledge some may point to an Auto manufacturers EV ((Enterprise Value) which equals Equity plus Debt (both short and long term) as well as cash on the company’s balance sheet) as Ford, GM, and the others carry larger debt loads (primarily at their finance arms) which we’ve discussed in the past (2017-2019)].

However, in our opinion, NOTHING justifies this obnoxious equity valuation of Tesla. There is no data nor accelerating earnings growth fueling this run up in equity price; though there is quite a bit of emotion and free liquidity out there playing with an odd stock float.

We’ve written about zombie companies for years now, Tesla is one of them, but here’s a new data point. Did you know roughly 40% of listed companies have LOST money over the last 12 months as equities scream to new highs?! AGAIN – FROTH January 9, 2019, per the WSJ

What does the EV/EBITDA ratio suggest for valuation? (Enterprise Value of companies/Earnings Before Interest, Taxes, Depreciation and Amortization)?

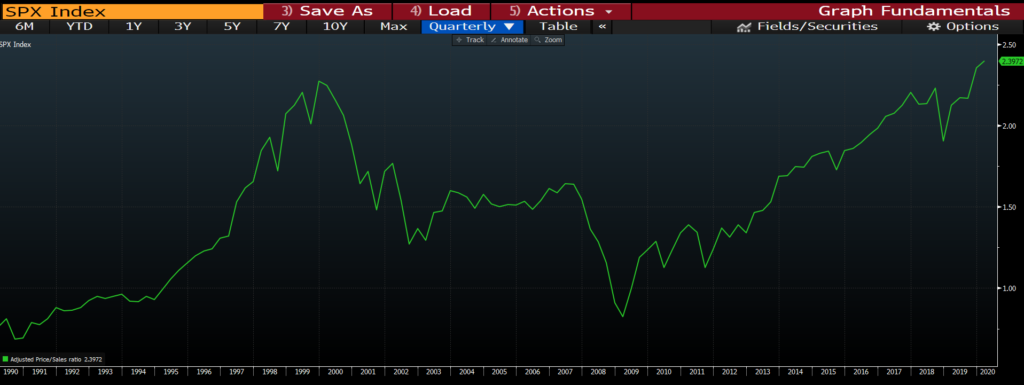

Price to Sales Ratios?

Are you seeing a theme? Are you looking at the X-axis and when the last time metrics surpassed levels like this? While former Fed officials say “nothing has broken, yet” or “we’ll never see a financial crises again in our time” – These metrics are all SCREAMING FROTH at the hands of the Fed attempting to save the banking system.

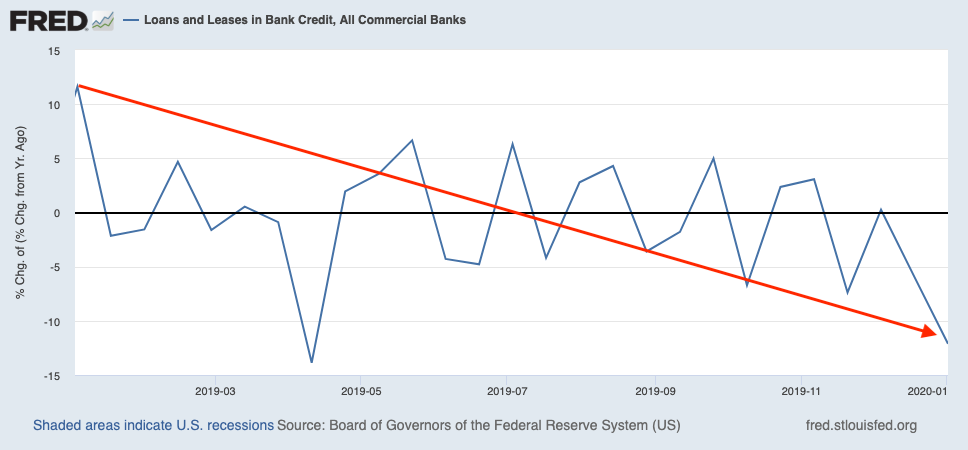

What about demand? Is there at least Commercial loan demand to support future growth? (insert frown face) Available FRED (Federal Reserve Economic Data) below suggests banks have pulled back on Commercial loans and leases…

We’ve discussed the importance of the extension of CREDIT and acceptance of DEBT and how it fuels growth, for a refresher, you can read about it in our 2Q2017 note, section titled, “So… what makes our economy function” and with less credit being passed along, growth becomes a challenge.

Services have slowed, manufacturing has slowed, and Inflation has been trending higher… Wage inflation is up, while hours worked are down… This is natural end of cycle economics. At the end of a cycle, employers will first cut hours before cutting an individual in an effort to manage expenses (they don’t want to lose the skilled labor). String together enough flat to down quarters and body count will eventually get cut.

There is a decisive body of evidence, backed by real DATA that shows the real economy is slowing. We are witnessing late stage business cycle activity. CYCLES MATTER (3Q2019) as does ECONOMIC GRAVITY (Nov 2019).

Tagging this information as negative makes investing emotional. The data doesn’t have emotion, it just is… We’re not calling for imminent crash, markets can remain irrational (emotional) longer than most can stay solvent? Coupled with the Fed’s help no one knows how far this trip will last?!

Many of you have read our work for some time. While Dr. Steve Sjuggerud coined the term “Melt-up”, unless you heard it from him, you likely heard it from us years ago when people were terrified. We’re believers in the Melt-up thesis, though we are keenly aware of history. The longer this market runs, the more bloated asset prices get without economic support, the more dangerous and damaging it will be when the Fed’s only ammunition (Rate cuts and liquidity injections) is being recklessly fired daily. There is a legal scope to the Fed’s mandate.

Again, keeping the words of Howard Marks in mind…

The best investments often are made in times of fear and desperation. That’s rarely possible when investors are willing to blithely dismiss the limitations of the past with the words “this time it’s different.” I would remind those investors of a quote usually attributed to Mark Twain: “History doesn’t repeat itself, but it does rhyme.” Of course it’s important that investors keep up with current developments and those that will shape the future. But it’s also essential that they not completely unlearn the lessons of the past.

We’ll leave you with this…

In making final edits to our note we came across this article on Seth Klarman (again, another giant we’ve written about and have done our best to learn from over the years). A few items to note:

- Per CNBC, Klarman recently wrote a letter to his investors stating, “the rocket fuel that has propelled markets in 2019 will run out,” according to a Bloomberg News report.

- Klarman noted that about 31% of the fund’s portfolio was in cash to end 2019.

You’ve heard both points from us many times. Klarman is likened to Warren Buffet by many; both known for a highly disciplined value approach. Hearing he/Baupost finished 2019 with nearly 31% of his portfolio in cash comes as no surprise to us. It’s important to remember, those with dry powder are the bids for the majorities panic selling in times of crises. The majorities panic turns into a wealth transfer of epic proportions. We believe this will occur in both equity and bond markets. When? Who knows – who cares? With proper asset allocation, hedges, asset allocation you shouldn’t.

Klarman is also known for market beating returns, however, per the Bloomberg account, Baupost managed only high-single-digit returns last year, citing a “few mistakes” he made along with “conservative positioning.”

Buffett and Klarman have a knack for sniffing out challenging times, both are known for patience and are currently sitting on a war chest of cash. I don’t know if they are right or wrong right now, but I can tell you this… After reading Hoover’s Memoirs, history sure as heck feels like it’s repeating more so than just rhyming… Exact quotes from bankers, politicians, economists, federal reserve officials. (that statement is emotional)

We’ll continue focus on risk, seek out asymmetrical risk reward set ups, letting our winners run while cutting our losers before they become problematic. We remain firm in our process and discipline. As always, never hesitate to reach out with any questions or concerns. Thank you for your continued trust and support!

Good Investing!

Mitchel C. Krause

Managing Principal & CCO

Please click here for all disclosures.