In This Article

TAKE A BREATH

Seriously … take a deep breath!

One of the best ways to relax the body and mind is taking deep breaths. The simple process of inhaling slowly through the nose, filling both your lungs, holding that breath, then slowly exhaling out though your mouth has the ability to stimulate endorphins, increase circulation, and balance the body’s PH levels. It can lead to increased feelings of peace, calm and confidence.

It enhances your feelings, but feelings and emotions are NOT interchangeable. Emotions are fueled by chemicals released in the brain and are often “knee jerk” and frequently irrational reactions. Feelings, on the other hand, are sustained over a longer period.

But, this is a financial newsletter, so we’re not going all Yogi/meditation/psychological on you today. At the same time, having patience and a clear head, while removing your emotions and fading your feelings are immensely valuable traits to possess when investing. Over the course of my 26 years in this business, this has rarely been more important than today.

COW KILLERS

“Metaphorically, I’ve met many Cow Killers face to face throughout my professional career: the tech bubble of 2000, the GFC of 2008, the taper tantrum of 2013, the Powell Pivot of 2018, the Covid crisis of 2020, and finally ……. ……. bringing us to today.”

We introduced you to “Cow Killers” last month, though one not mentioned was 1Q2018; you see, I resigned from the firm I had worked at for 22 years on January 26th, 2018, the volatility index as measured by the $VIX closed at $11.08 that day. For those who don’t remember that day was the TOP of the market as measured by the S&P 500 at the time, closing at 2872.87.

What precipitously followed was the market event known as “Volmageddon” as the S&P fell roughly 12% in 2 weeks. The $XIV (Velocity Shares Daily Inverse VIX Short-Term exchange-traded note) dropped 14% through the February 5th trading session, followed by an 80% drop in after-hours trading. That ETN dropped 96% in under 24 hours and shuttered its doors the very next day. Nearly $2 billion dollars evaporated in what amounts to be a blink … RISK HAPPENS FAST … which begs the questions … Do you see it coming?

BUY ME 500,000 SHARES OF FNMA & FMCC

In early 2008 I was a member of an institutional team that worked primarily with Asset managers/funds and extremely wealthy individuals who trafficked in the small to mid-cap banking/thrift space; we also worked very closely with C-level bank executives around the country working corporate buybacks & cashless options exercises among many other things.

Readers may remember 2008 was a challenging time; mini bombs were blowing up around us what seemed to be daily; markets were in flux, the Federal Reserve was aggressively CUTTING RATES, buying bonds, and guaranteeing loans as well as taken countless other extra ordinary measures to prevent markets from collapsing.

Amongst the chaos, a client called in with an order to buy ½ million shares of both FNMA & Freddie Mac. At the time, shares of both government sponsored mortgage behemoths were off, but had not yet collapsed … it was at that moment I asked a simple question that changed the trajectory of my life; to me what I was asking was thoughtful and benign, apparently, he didn’t think so.

I asked him: “Are you sure you want to do that?!”

From his reaction, you’d have thought I killed his first born … “Who the F*&k are you questioning me?! Do you want this F*&king order or not?! I don’t pay you to think, I pay you to execute!” The tirade went on for a quite a while longer, though it ended with my simple response, “Buy 500k FMNA, FMCC in line; you would” and I hung up.

Traders understand my sentence merely confirmed his orders and instructions back to him; he wanted to buy the shares of FNMA & FMCC aggressively (“you would”) at these prices (“in line”) – this order was different from his typical order; VWAP (Volume Weighted Average Price) into the close, which meant he just wanted to buy or sell with volume over the course of the day.

What I felt after the tongue lashing?! nothing… My emotional reaction was nothing but a deep breath in and out. What I knew was that he was allowing feelings and emotion to influence his investment decisions.

“For most people, the most dangerous self-delusion is that even a falling market will not affect as their stocks, which they bought out of a canny understanding of value.” ~ Leon Levy; The Mind of Wall Street

THE FALLING KNIFE

It’s not as if there weren’t signs … The mortgage market was literally imploding, the Federal Reserve had CUT interest rates in JANUARY from 3.5% to 3%, in March they lent the Treasury $200 billion to bail out bond dealers stuck with MBS & CDOs. That same month the Fed backstopped JPMorgan’s purchase of Bear Stearns AND cut the Federal Fund rate again from 3.00% to 2.25%.

In April the Fed lowered the Fed Funds rate … AGAIN … and also added $100 billion to markets through their temporary Auction Facility; another $150 billion in May, $225 billion more in June before their temporary facility became a permanent fixture. The warning signs were literally EVERYWHERE … as both growth and inflation were decelerating at the same time.

Back to my client and his 500,000 shares of FNMA and FMCC, what this client was attempting to do was catch a falling knife in a deflationary investing environment while the Fed was being accommodative. A handful of months later, the United States Treasury Nationalized Fannie Mae and Freddie Mac, virtually wiping equity holders out.

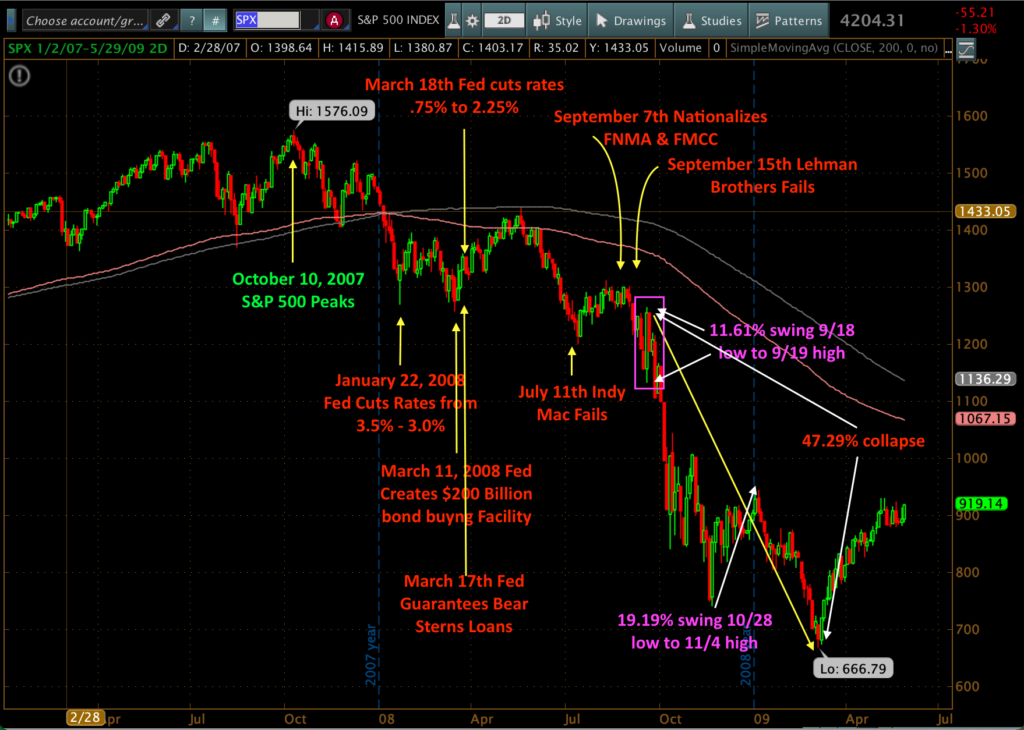

The image below shows a FRACTION of the grenades going off during the first half of 2008.

The S&P 500 was down nearly 23% from the October 2007 cycle high to September 15th, 2008, AS the Federal Reserve was providing copious amounts of “help”: subsequently falling an additional 47% after the September 15th Lehman bankruptcy.

One of the worst mistakes that investors make is riding their losers all the way down, making excuses due to their emotional attachment telling themselves “they’ll come back” or “I don’t want to take the losses” … at times like this, you need to remove emotion from the equation.

TODAY’S FALLING KNIFE?

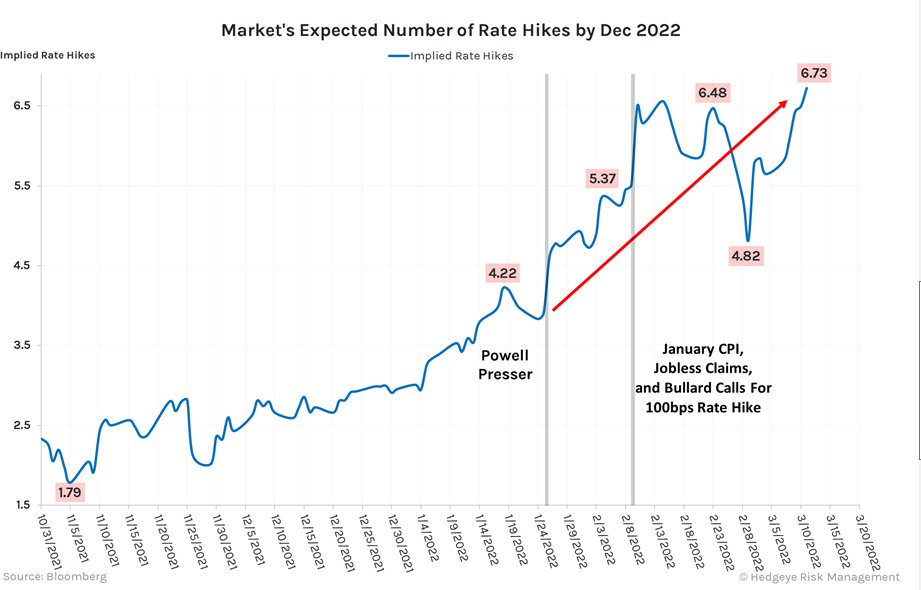

This past week the Federal Reserve RAISED the Fed Funds Rate 25 basis-points (1/4 of a percent), while promoting an additional 50 basis-points as early as May, “if necessary”?! Contrast this with the continuous flow of accommodating policies and measures that the Fed provided in 2008.

Historically, the Fed’s numbers are perpetually incorrect, yet today even they “SEE” Inflation of 4.3% at End of 2022 and 2.7% for 2023. Additionally, the Atlanta Fed NowCast sees Q2 GDP just north of 1%. So, the Fed is telling us that both Growth and Inflation is rapidly rolling over, and still they decided to TIGHTEN policy into this rapid #deceleration. They have become political pawns reacting emotionally to an uninformed public & political pressure.

The market cycle is driven by a RoC (Rate of Change) deceleration in both growth and inflation; and it’s the biggest we’ve seen in modern history. While “Russia” and “Covid” headlines are driving daily emotional FOMO; the recent prevailing Wall Street narrative suggested equities were rallying on “positive” Russian/Ukraine peace talk headlines two days before they also “rallied” as US National Security Advisor Sullivan stated the US was discussing the potential use of Nuclear Weapons with their allies and partners; try squaring that circle.

So again, let’s take a deep breath, not have a visceral reaction to the price of S&P futures or a multi-day bear market bounce. While everyone else becomes a virologist, political expert, geopolitical strategist, how are we looking to be positioned throughout this period and why; what’s the data say?!

STICK TO THE DATA

Like the PM (Portfolio Manager) I described above, most PMs operate under a belief system which the above Leon Levy quote nails so perfectly … these managers who run your money believe that they are so smart, “even a falling market will not affect as their stocks” because they understand value where everyone else doesn’t.

These are THE primary reasons we follow the data and our process over narratives. Think critically for just a second … assume Russia and Ukraine agree on a legitimate ceasefire, how will that change the directionality of our GDP going from 7% to near 0 sequentially? The answer is IT WON’T …

So, while most are emotionally knee jerk reacting to the fear of missing the market “rally”, chasing green after both positive and negative Russia/Ukraine headlines we’ve continued to add to and risk manage around our short and deflationary exposure based on our levels and process as we noted in our 4Q2021 note published mid-January:

With volatility now trending, the U.S economy staring at back-to-back deflationary environments in Q1 & Q2, we highly suggest you reconsider any “buy the dip” mentality to “sell and reposition into rips”. If you have not yet positioned yourself for a deflationary market outcome, we would urge you to use future strength as opportunities to do just that; raise cash and re-allocate. Deflationary relief rallies can be some of the strongest in markets history, however, the trend is still down, use them to your advantage.

The only way to confidently do this accurately is to understand we are no longer in the 6 consecutive quarters of “reflation” or Hedgeye Quad 2, but rather a deflationary regime, or Hedgeye Quad 4, which has vastly different characteristics.

DEFLATION

“While the elevated price of oil WILL mask the overall deceleration in INFLATION, the higher oil prices go, it will cause GROWTH to decelerate even FASTER, pushing the data down further than anticipated as we move into Q2.”

For headline chasers out there purely focused on the relatively recent run up in commodities such as oil, wheat, and nickel, many commodities across the board continue to trend lower such as coffee, oats, palm oil, rubber, tea and cotton with others, like copper testing trend breakdowns.

We understand it’s challenging to see such high gas and food prices and think disinflation/deflation at the same time; though comps are the mathematical reason financial markets are experiencing what they are … as we wrote last month:

“*Comps = Comparative Base Effect (or what happened last year that companies have to compare against)”. ~ Hedgeye CEO Keith McCullough

We also provided readers with a sector by sector visual of the base effects we’re up against shared by @KeithMcCullough on twitter which you can find again by clicking here … there is literally a wall of comps we’re sprinting into; they get progressively larger, and we’ve only just gotten to the starting line.

“March, April, May, is the DEATH MARCH into the Quads … and it’s STILL MARCH” ~KM 3/11/2022 TMS minute 6

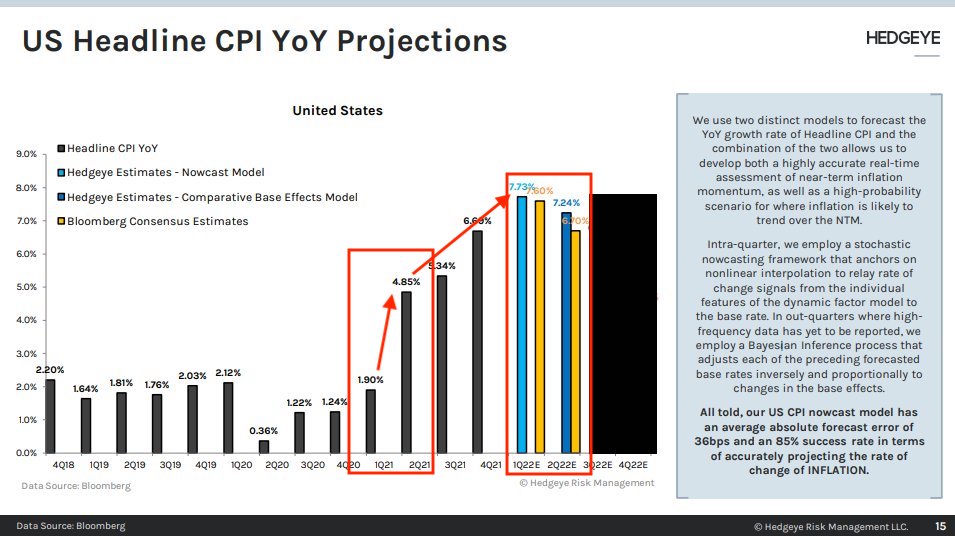

From a disinflationary perspective, a glimpse into the base effect we’re looking at in CPI terms also comes courtesy @Hedgeye Twitter Chart of the Day from 3/15/2022 … and while we’re NOT going to copy and paste the entirety of their commentary, for you can read that HERE, we have emphasized the year over year comparisons in red on the below graph.

As noted by Keith McCollough, “The one-year base effect jumps from 1.90% to 4.85% from 1Q to 2Q” … which is “the steepest quarterly ascent in inflation’s base effect” EVER … “The higher inflation readings go in February and March; the faster inflation slows at this time next year”.

Companies are reporting the slowdown throughout Q1 in real time.

A recent example is retailer $CTRN (Citi Trends), who just reported 4Q2021 earnings, beating “consensus” by $0.10. But the $0.10 “beat” came from a snapshot in time which began nearly 6 months ago when the investing regime was “reflationary”. Wall street consensus for CTRN’s 1Q2022 was at $1.82; the company guided to $0.25 with sales expected to be DOWN 25-30%. Yes, you just read that correctly; “consensus”, the “experts” most are listening to were at $1.82 …

Hedgeye retail analyst Brian McGough recently stated, “just to pause and reflect on that for a minute, most analysts DON’T KNOW HOW TO MODEL SOMETHING DOWN 25-30%; I even have to stretch in order to get there for a lot of these companies.”

DOMINOES

As was the case in 2008, it’s been a rare day that’s recently passed when a proverbial bomb like this hasn’t exploded in global macro markets, for example:

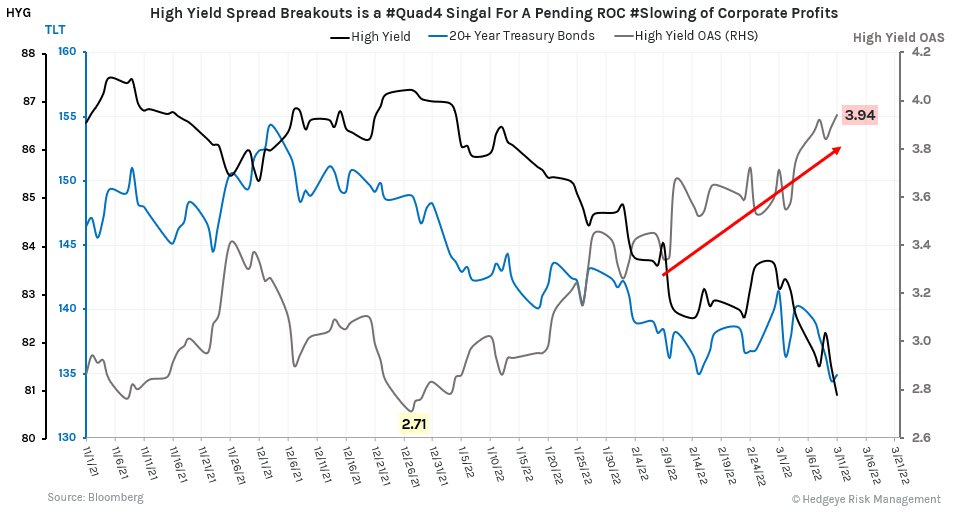

• Financial Reporting Service BBG reported the BNPL (Buy Now Pay Later) company $AFRM pulled a recent $500 million ABS (Asset Backed Security) deal as the buyer of their “High Quality” tranche backed away midway through the deal. As high yield credit spreads are rapidly widening around global markets. As of today, HY OAS is now 408 bps over treasuries

• $AFRM (Affirm Holdings) stock price has lost 85% of its market cap since November 8th, 2021 (the same day the Russell 2000 peaked) it lost 15% on Monday, March 14th alone… That’s a bomb; a wealth wrecker. More pertinent to the story, credit markets freezing is something financial markets can’t handle as we’ve discussed numerous times in the past (here, here)

• $TSLA (Tesla), with north of $10 billion of cash on their books, was recently forced to cancel a $1-billion-dollar asset backed bond offering (credit is tightening)

• Almost daily, multiple stocks are fluctuating 20-30% (primarily trending declines)

• There is not a single European country NOT bearish as defined by Hedgeye bearish trade and trend models

• The entire belly of the yield curve is currently INVERTED 3s/10s, 5s/10s, 7s/10s

• The 2s/10s yield curve continues to flatten touching 18 bps last week

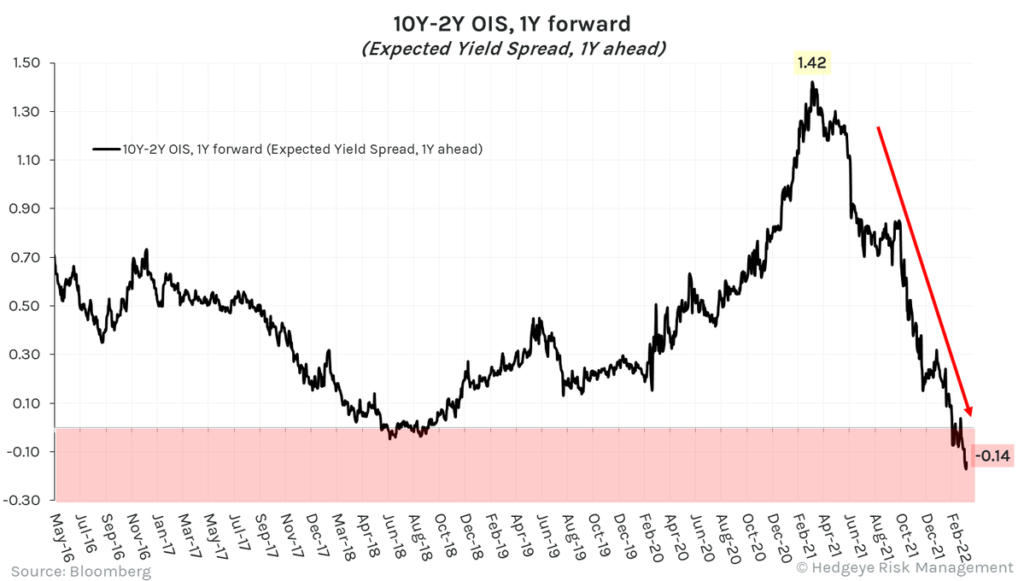

• The 10Y – 2Y OIS, 1 year forward (Expected Yield Spread, 1Y ahead) is inverted which is saying the market is expecting an inverted yield curve over the next year. @Hedgeye 3/21/2022

The last time this happened was August 2018 before Quad 4 in 4Q2018. Remember, that not every negative yield curve has been followed by a recession, BUT every recession has been preceded by a negative yield curve.

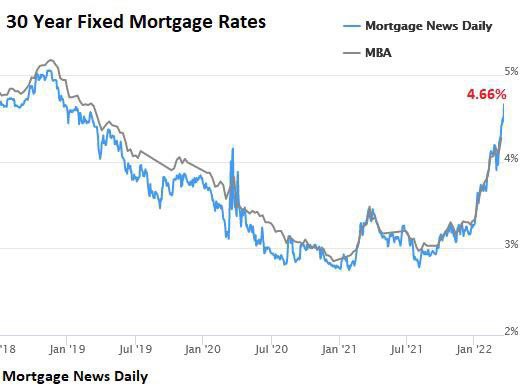

• As 30-year fixed mortgage rates just spiked to a 4.66% average making the average house roughly 13-15% LESS affordable than last year as most home buyers determine purchase price based off what monthly payment they can afford; begging the questions:

◦ Who’s going to be refinancing homes at these levels?!

◦ Who is left to refinance with rates being so low for so long?

◦ How will this move in rates affect borrowing via home equity lines?!

◦ And more importantly, how large of an impact will this have on housing prices?!

All of this leads to a slowdown in spending!

This is all flowing through into the most recent US Consumer confidence numbers as they just registered its lowest reading since 2011, slowing to 59.7 in March vs. 62.8 in February, OUCH! Can you blame them?!

• And still … the Fed is tightening (raising rates), with nearly 8 Rate hikes priced in for this year by the futures market.

FINAL THOUGHTS

Circling back to our story from 2008, I don’t care if it’s business or life, we should ALWAYS welcome dissenting thoughts and opinions, in a respectful cordial manner. As much as I believe what the probabilities of the data is signaling, no one knows what tomorrow will bring?! It’s the best answer I can give you; at the same time, in allowing our process, disciplines & rules to dictate our positioning, we know what we’re going to do and at what levels regardless of the direction … and over time, we feel confident that we’ll smooth out the proverbial roller coaster for our investors.

Over the past handful of months, we’ve talked about data at length and if we’ve been incorrect with anything, it’s without question been the price of oil and a few select food related commodities (which are currently rolling over); and clearly, we didn’t know with certainty that Russia would invade Ukraine?! Still, it hasn’t changed the path of economic gravity, it’s simply altered the timeline slightly and made it worse.

We’ve been writing about a deflationary investing regime since mid-last year, then September (A Shoot-Out’s a Brewing), November (Failing to Prepare is … Preparing to Fail), December (It’s about the TIME … Don’t get caught off Guard again), and January (Keep your hands and feet inside the ride until it comes to a full and Complete STOP!!! OR???)

We’re confident that we’ve given readers suitable warning and have positioned accounts for this disinflationary/deflationary environment in a timely manner. We’re doing just fine … at the same time, being wrong on the price of certain commodities doesn’t change our current positioning. There’s NO reflexive emotional reaction, the math and data increase our conviction as we noted last month when discussing the slowing consumer:

“While the elevated price of oil WILL mask the overall deceleration in INFLATION, the higher oil prices go, it will cause GROWTH to decelerate even FASTER, pushing the data down further than anticipated as we move into Q2.”

Stick with the data…

Last week markets “rallied”. For those who continue to find themselves emotionally affected by counter trend bounces let’s allow history to offer some perspective. We’d ask that you refer to the initial graphic above of the S&P 500; drawing your attention to two notable time frames (highlighted in purple and white): the first being 9/18/2008 – 9/19/2008 where the market rallied 11.61% from the intraday lows of the 18th to the intraday highs of the 19th; next is 10/28/2009 – 11/4/2008 when the market ripped 19.19% from the intraday lows of the 28th to the intraday highs of the 4th.

These brief “face ripping rallies” occurred WITHIN a 47% decline … Why?! because many investors get emotional … bear market rallies happen, and they’re violent; don’t get sucked in, don’t get whipped around … don’t get emotional! Remember, to take a deep breath and stick to the data and a process.

In our 4Q2020 note we referenced famed author Charles Dickens, today we’ll reference another Dicken’s classic … … the ghost of Christmas Future is literally road mapping what’s to come. You can either listen to him, protect your assets and enjoy your holidays with family, or act like that Portfolio Manager did so many years ago and wind up severely bruised or worse, in the financial grave – you have a choice!

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.