In This Article

Dasymutilla Occidentalis

One of the greatest accomplishments of my life is being a father. At times it feels as if it’s a constant, never-ending, thankless job. The amount of work that goes into raising children is a massive, total, unremitting commitment. But the rewards are simply priceless.

Every now and then, a free moment affords me the opportunity to reflect on the past. Certain memories are unforgettable. Some thoughts bring with them smiles, like the birth of a child; some can instantly invoke tears — nearly a year and a half later, it’s still difficult for me to even write, “like the death of a brother”.

While the very same experience can bring with them tears of both fear and joy, simultaneously; for I can assure you that even the strongest of individuals will find themselves shedding tears as your 18 month old child is wheeled into surgery, screaming for you to not let them take her, while the news of that surgery ending in success bring tears of joy and relief as you’re reunited with your child a mere few hours later.

The fluctuation of emotions that a parent endures is larger than the ups and downs of the greatest of the rollercoasters that we described last month. The most fascinating aspect about becoming a parent is that the expectation of what parenthood will be like is so different than the reality of parenthood. What you visibly observe, and experience is so much different than the emotional experience that you expected when you boarded the ride. Parenthood is NOT as advertised, and the child does not arrive with a User’s Guide!

Our girls (now 7 & 9) are active, curious, adventurous, fearless … I can’t think of a time when they haven’t raced outside to check out a new type of animal or insect in the yard; there was not a frog, toad, snake, or bug they wouldn’t try to pick up, until … Dasymutilla Occidentalis !!!

One day while exploring our driveway with her Mimi, my oldest daughter, Emi, came upon what appeared to be a very cool looking furry red ant. Mimi picked it up and placed it in a cup for the two to further explore. It didn’t take longer than a google search to find this:

Red Velvet Ant: Cow Killer (Dasymutilla Occidentalis)

“Velvety hairs in bright red and black are clear visual warnings on the Cow Killer that should give one pause before touching. The Eastern Velvet Ant – also known as the Cow Killer – is not an ant at all, though the female looks and walks like one. The Cow Killer is actually a type of wasp, and the wingless female has a ferocious sting that is rumored to be strong enough to kill cattle. For humans, the sting is extremely painful, and this insect should not be handled.” ~ insectidentification.org

26 years …

I’ve been in this industry for nearly 26 years and the deeper I get, the more Cow Killers I encounter …

Cow Killer could be a metaphor for so many parts of Wall Street that can be catastrophically destructive to your financial health/wealth. Which begs a few questions:

- Do you know what they look like?! How to identify them?

- Do you understand what to do when you encounter them? How to react?

- Have you learned from previous encounters, or do you blindly follow the crowd?

I’ve experienced a “real” Cow Killer two times in my lifetime and can promise you, while the innate emotional response in our second encounter was tested (knowing the ramifications of a bite) … both recognition and maintaining a cool, calm demeanor was paramount as we knew exactly how to handle the situation.

Metaphorically, I’ve met many Cow Killers face to face throughout my professional career: the tech bubble of 2000, the GFC of 2008, the taper tantrum of 2013, the Powell Pivot of 2018, the Covid crisis of 2020, and finally ……. ……. bringing us to today.

While each of these crises have all manifested differently, the primary characteristics have ALL been the same … BOTH GROWTH AND INFLATION DECELERATING SIMULTANIOUSLY. Frequently, there is also a policy mistake laying at the feet of Federal Reserve. Is this sounding at all familiar? Let’s review today’s circumstances and see how they compare to the Cow Killers of the past.

An Inconvenient Truth – Growth and Inflation is Decelerating

“It’s going to be the biggest step down in RoC (Rate of Change) terms of the modern era …ALL I CARE ABOUT IS ROC … you can like that, you can hate that, love it, whatever that’s all I care about” ~ @KeithMcCullough Hedgeye, Mid Quarter Update Call February 9, 2022

Why is this important? Because decades of back-testing have shown that market prices decline when growth and inflation are both decelerating. Please read that sentence again.

In a similar vein, we noted in December:

“it is NOT the absolute levels of inflation or growth that markets care about most, it’s the directionality and RoC (Rate of Change) of them.” ~ OSAM Dec 2021

We’ve written many times on the importance of RoC (Rate of Change), directionality, and how over leveraged, illiquid markets have never mattered more, yet these simple truths are lost on both the Fed & Wall Street, for different reasons. In the Fed’s case, they’re a bunch of stubborn academics who are too focused on their academic models while having little practical investing experience. Wall Street investment bankers primarily care about investment banking revenues and self-preservation, rather than effective back-testing and risk management.

Though, ultimately these truths are the difference between what we “are seeing” vs. that which the Federal Reserve officials and most all of Wall Street “are not”?!

The short answer is, the DATA doesn’t lie, people do; while the longer answer is much more nuanced and the very crux of what we’ve been attempting to explain to readers over the past year. As we’ve noted before, the data is the data, however, it always comes down to HOW ARE YOU INTERPRETING THE DATA for it is fluid, never static. Allow us to explain.

Inflation

Nearly a year ago, as the Federal Reserve was trying to convince us that inflation was “transitory”, we detailed why inflation would be persistently high. We noted oil, shelter, and food inflation in our June 2020 Note. The Fed was making the mistake of telling us where the data was (by looking in the rear-view mirror at the historical data), while we were telling you where it was going (based upon future projections of the largest components of the inflation index).

Last month we noted:

“The harsh reality of the math is that the 7% [inflation] print, the highest since 1982, makes it quite likely that we’ll see lower CPI figures over the next few months, meaning a decelerating CPI.”

At the same time, we specifically noted THIS:

“As we move through the next few months, data points such as the price of oil will mask the overall deterioration and deceleration in both growth and inflation.”

With fuel prices and of all things, butter, the only commodities not experiencing lower highs, shelter’s flow through into CPI typically on a 3–6-month lag and used car prices only recently decelerating, albeit, at a precipitous pace, it would have been highly unlikely to see a decline in February’s CPI print; those components equated to nearly 400 bps or 4% of the previous month’s 7.04% CPI print.

Used Cars registered +40.5% YoY in this most recent CPI report, which was one of the more meaningful increases … but when you read the details of the Manheim Market Report to find out what the trends are now, rather than compared to last month’s rear view mirror, you find this:

“Manheim Market Report (MMR) values saw weekly price decreases in January that accelerated slightly in the final full week of the month. Over the full four weeks in the month, the Three-Year-Old Index declined a net 2.9%. Over the month of January, daily MMR Retention, which is the average difference in price relative to current MMR, averaged 97.9%, which meant that market prices were behind MMR values. The average daily sales conversion rate also declined in the month to 50%, which was below normal for the time of year … most vehicles showed price depreciation.”

These data have yet to flow into the CPI calculation … and this is a primary reason that we were specific last month in noting “over the next few months”, writing an entire section on “Topping is a Process”.

While the Federal Reserve “sees” a headline CPI number of 7.5%, what we see is that two of the top three contributing factors to the CPI are rolling over, with most of the ancillary commodities following in suit. OIL is the only commodity that is supporting the CRB Index … for now, all the other commodities are in decline.

This is what we meant by “the price of oil will mask the overall deterioration and deceleration in both growth and inflation”.

In anticipation of this, clients may have noted that we have lightened up on our bond proxies heading into the CPI print; we did this expecting a mild knee jerk response higher in yields, which we got. We have already begun to incrementally add back to our positions after headline chasers did what they always do, chase; this proved to be a very good decision into last week’s equity market decline.

A Slowing Consumer

There is a correction which we must make to a statement of ours above. While the elevated price of oil WILL mask the overall deceleration in INFLATION, the higher oil prices go, it will cause GROWTH to decelerate even FASTER, pushing the data down further than anticipated as we move into Q2. If you think about it intuitively, the more money that a consumer spends on gas, the less money they have for consuming … less consumption = lower GDP in all other sectors of the economy. Think of high oil prices as being a stealth tax.

The consumer’s situation is also showing up in the Michigan Consumer Confidence Index, which plummeted to 61.7 in February vs. January’s 67.2, and down 19.7% YoY – registering as an 11-year low. Most notably, the report suggested this decline came from households with incomes greater than 100k+ (typically your larger spenders).

Another important consumer datapoint on the consumer, from Hedgeye’s Josh Steiner @HedgeyeFIG, shows Visa’s Spending Momentum Index dropping to 102.4 in January from 109.4 in December (a 7% monthly decline).

“The SMI readings continue to reflect that there is a clear indication of spending growth moderation in January,” said Wayne Best, Visa’s Chief Economist

Visa believes this spending should “rebound in the months ahead”, albeit, CITING NO SUPPORTING DATA … we’ll take the other side of this trade for the next handful of months and provide you copious amounts of data as to why.

I don’t believe there is a timelier and more blatant example that illustrates the differences in how those who refuse to adapt and evolve (i.e.: the Fed and Wall Street) sees data vs. what the market is seeing from a mathematical RoC (Rate of Change) perspective … From CNBC:

“Retail sales surge 3.8% in January, much more than expected amid inflation rise … much better than the 2.1% Dow Jones estimate” … more from the note:

… from PNC’s chief economist Gus Faucher:

“Consumers say they are worried about inflation, but they continue to spend. Even taking into account the December decline, retail sales in recent months have been increasing much faster than prices, so households are purchasing larger volumes of goods and services, not just paying higher prices. … On a year-over-year basis, retail sales overall rose 13%.”

While I don’t want to pick on CNBC or PNC’s chief economist, I’m going to, for again, Wall Street does NOT DO RATE OF CHANGE MATH! We’ll reiterate, Faucher states:

“On a year-over-year basis, retail sales overall rose 13%”

While this statement is true, it fails to acknowledge the rate-of-change deceleration in the data. Let me explain. The LAST TIME retail sales accelerated YoY was from October’s 16.24% to November’s 18.24% when retail sales data PEAKED; they have been DECELERATING at a faster rate ever since.

From November’s 18.24% print, they decelerated to 16.95% YOY in December, and have subsequently decelerated in January down to 12.96% YOY (this most recent report). While Wall Street cheers the 13% number, they fail to recognize what the markets are telling us; we’re already racing down the hill.

Imagine that you have just crested at high speed over the peak on a roller coaster and your heart jumps into your throat as the bottom drops out. THAT is rate-of-change thinking.

We caution you, BE CAREFUL of what the Wall Street talking heads are saying, it’s most frequently an uneducated narrative; “noise” if you will.

The empirical fact is the US consumer is slowing for an irresistible reason. Without the copious amounts of stimulus checks which everybody received at this time last year, the consumer has less to spend while the governments $1.3-TRILLION-dollars spending deficit we mentioned last month creates a virtual black hole; and this is before we even discuss comps, again, as we also noted last month:

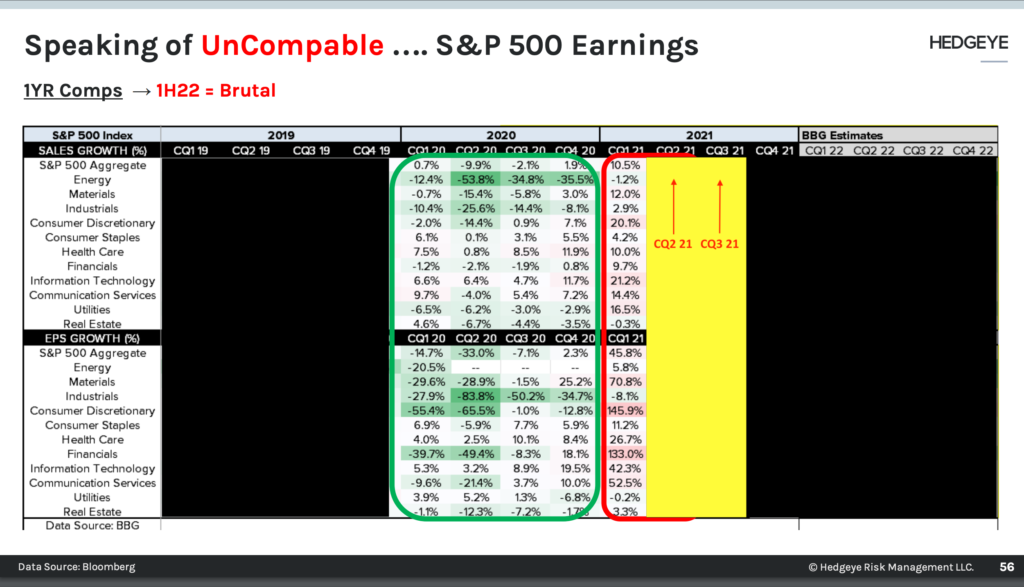

“Moreover, 2Q2022 YoY comps (comparable data) for most companies are virtually UN-compable; as in, they can’t be beaten.”

Hedgeye CEO Keith McCullough simplified the complicated, describing what “comps” are in a recent note:

“*Comps = Comparative Base Effect (or what happened last year that companies have to compare against)”.

Earlier this week he provided his twitter followers with a stunning visual of what an UN-COMPABLE base effects looks like in his “chart of the day” … As a paying subscriber, I know what’s behind the yellow and black redactions – and it ain’t pretty. I will never break a paywall, at the same time, I do know the unredacted version of this image has been shared and re-tweeted by Keith which you can find here; I URGE YOU TO LOOK AT IT, for what you will find, are comps we’ve NEVER seen before; it’s simply jaw dropping.

In summary, just as you should have expected a relatively hot February CPI print based on how the data is collected and calculated, you should be anticipating CPI to fall over the next 3-6 months as the slowing data begins to flow through.

Also, you should anticipate that GDP will get scalped from roughly 7% to 1-2% (as we explained last month). Wall Street has begun to cut their estimates; they’re still too high. The GDP impact becomes quite clear when we look at the early data: 9 out of the first 11 inputs used to measure and map growth (GDP) in Hedgeye’s 30-feature model, have decelerated into Q1:

- MBA Mortgage Purchase Index YoY: (Decelerating)

- Aggregate hours Worked: (Decelerating)

- Aggregate Labor Income: (Decelerating)

- Monthly Initial Jobless Claims: (Decelerating)

- Bloomberg Consumer Comfort Index: (Decelerating)

- ISM manufacturing PMI: (Decelerating)

- ISM Non-manufacturing PMI: (Decelerating)

- Rail Traffic YoY: (Decelerating)

- Retail Sales YoY: (Decelerating)

…. while only two have accelerated:

- Auto Sales YoY: (Accelerating)

- Total Employees on Non-Farm Payrolls: (Accelerating)

Game, Set, Match

Collectively, the above data points show that we are in a decelerating Growth and Inflation environment. This is important because such environments reliably back-test as being Cow Killers. While the data comes in pieces, when both sides of the growth and inflation equation are decelerating, the probability of an extremely significant and detrimental adverse impact on your wealth skyrockets (unless your wealth is risk managed!)

Suffice to say, the data points we’ve been seeing confirm what we’ve been writing about for some time and we expect these themes to develop further and more rapidly as we approach Q2. Remember, markets are leading indicators that will usually react in advance of these economic factors, which explains the market decline since November. The following are some of the markets’ leading responses to decelerating growth and inflation:

- The 10s/2s yield curve is COMPRESSING (flat yield curve)

- The 1yr forward OAS spread is now negative (last time August 2018 prior to the Deflation in Q4)

- High yield OAS spreads have blown out 65 basis points in weeks signaling stress in credit markets (a massive move)

- Russell Index is down -17% from cycle high; -12% YTD

- Nasdaq Index is down -16% from cycle high; -14% YTD

- S&P Index is down -9.3% from its cycle high; -8.8% YTD

- All major large cap tech components except for $AAPL are in a Hedgeye Bearish Trend (our bet is it won’t be the anomaly, just the “last of the Mohicans” to fall) this will likely take the S&P with it

- Gold is moving higher on the flattening yield curve

- ALL commodities except for Oil and butter are deflating

The only thing that can make the above economic reality worse is a Federal Reserve policy mistake …. and, as we all know, the Federal Reserve continues to talk about rate hikes. Increasing interest rates into an economic slowdown will more than likely send equity markets into a full-blown crash … and if you don’t believe things can’t continue to crash from here, investors are waking up to companies like $MTTR, $RBLX, $NFLX, $ROKU, $CLOV to name a mere few, down 20-50% overnight; $AMPL was down 60% on Thursday.

“Crashes typically occur from oversold levels”.

If you need this to be over, good luck; we are of the opinion it’s just getting started but will be open minded to potential Federal Reserve bailouts. In this regard, we don’t think they have bipartisan political support as we wrote about last September.

Risk Management

Bringing it full circle, investing is akin to parenting in many ways. Each scenario is nuanced, where a single, canned reaction is often inappropriate. First, being opened to learning new things, followed by understanding how to recognize characteristics or behaviors and then adjusting to them in a split second is imperative. As a parent, I believe we should encourage and foster children to be inquisitive; not fearful! I want them to explore and question things growing into critical thinkers with the full understanding that what appears on the surface, is NOT always representative of what lies beneath the surface.

Similarly, some of the key characteristics to becoming a solid investor Include:

- Removing emotion from a situation

- Understanding how important it is to learn, evolve and adapt

- Recognizing certain traits and characteristics of things that can and will hurt you

For years our philosophy has been one of Shoshin – A word used in Zen Buddhism meaning “beginners mind”. It describes an attitude of openness, eagerness and lack of preconception when studying a subject, even when studying at an advanced level.

As we note on our website: We’ve experienced markets at an elevated level for decades, and yet, our approach is still one of Shoshin. We make a concerted effort to show investors that it’s not merely “ok” to think different about investing, but frequently it is necessary to do so.

Bear markets appear with less frequency than bull markets, but when they come, they’re ferocious and damaging. The adage about markets being an escalator up and an elevator down exists for a reason. What takes years to build can be evaporated in mere weeks; had you owned any of the above-mentioned companies, you could have lost 40-60% of your hard-earned savings, in what amounts to be a blink; overnight.

Markets today, by any metric, are “over-valued”, couple this with a deflationary investing regime + Federal Reserve Policy mistake, and it’s time to BE VERY CAREFUL. To quote legendary investor Jeremy Grantham: “Super-bubbles can really wipe you out, like 1929 did, and that’s where we are now”.

Learning to recognize the characteristics of a deflationary environment (i.e.: decelerating growth and inflation) isn’t just knowing when to buy the dip, or when to reallocate into different sectors, etc. The market is about to have a temper tantrum, and a different skill set is needed, learned from the past. There is a lot at stake here. Today is a point in the economic cycle when it is overwhelmingly important to focus on preserving your wealth – AVOID THE COW KILLER.

While most major indices have been collapsing, our clients will note the capital preservation and upticks in their accounts. We have balanced minimal short exposures with that of bond proxies. While we are pleased with how we’ve greatly outperformed over the past month and a half, preserving capital; should our thesis play out as anticipated and bond yields fall as the Fed either increases rates OR concludes rate hikes will decimate markets our bond proxies should move significantly higher, this is where the best risk reward set up lies. We are comfortable with our positioning with the understanding that bear market rallies will test your resolve.

It is our humble belief, whether you know it or not, times like NOW are the reason you have hired us or consider doing so… As always, we’re happy to discuss our market thoughts along with strategies and more, never hesitate to reach out with any questions or concerns.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.