In This Article

The Day I Nearly Died

Watching waves crash can have a very peaceful, calming effect on most people… The rhythmic, circular motion of massive energy passing through enormous bodies of water manifesting as thunderous booms or tiny ripples at the sandy shoreline; for those who have never experienced them, I would recommend you give them a try. The wind, the sounds, the salt air, you’ll quickly understand what I am talking about.

This product of nature’s repetitious beauty and distinctive sounds draws people to them in droves, all while lulling them to sleep. Our society covets this resource; some of the most expensive land and homes in the world sit at the foot of the ocean; unobstructed views commanding significantly higher prices.

Its tranquility creates short memories as we often forget how its massive power can become tremendously destructive, reducing entire communities to mere ruble in the blink of an eye.

In spite of their soothing nature, I was terrified of the waves as a child, more specifically, the rip currents that lay hidden to the untrained eye; to this day causing me significant angst as I watch my 5 & 7-year-old splash in their shallows.

Those in the NY/NJ area may be familiar with Accident Park? The nickname given to the once popular, “Action Park” located in Vernon, NJ. Vernon Valley Great Gorge was the host of skiers in the winter while Action Park’s water slides, Tarzan swing and wave pool drew summer crowds in droves. It was the wave pool, which became the source of my fear of the ocean, which lingers to this day.

While stagnant, wave pools look like any other ordinary pool, their surface initially calm, almost glass like. However, once the wave making mechanism is turned on, the repetitive motion begins. Small ripples make way for larger waves; at first, the undertow is slight though with each passing wave, every aspect of the circular motion gets stronger; water is sucked in creating the undertow spitting out larger waves. The undertow increases in strength, even larger waves are produced; rinse, repeat.

For those who read these notes, you know I am a bit OCD for accuracy. I do recognize there is a material difference between “undertow” and a “rip current”, especially when being produced from a wave pool – for now, just think of both as an exceptionally strong current that can take you in a direction you don’t want to go (whether being pulled down under the water preventing you from coming up for air or out to sea away from the shore)…

I was roughly 5-6 years old and just had to be one of the first to enter the pool. At that age, my excitement got the best of me. My attention was focused on the ripples turning into larger waves (jump, jump, with each passing wave another larger jump). What I failed to recognize as a child was the undertow building in strength with each passing wave. Quickly, my excitement turned into straight up fear, as I was swiftly dragged under the surface unable to breathe.

At that age, I didn’t know what an undertow was, and I wasn’t a strong enough swimmer to fight it. Keeping my head above water was impossible regardless of how hard I tried; panic ensued. My last memory of that day was my mother screaming at a young lifeguard to help me; I reached out as far as I could, then I blacked out…

I consider myself lucky, lucky to have a parent who was watching so closely, lucky the lifeguard got to me in time, lucky to have come out of that scenario alive. From that day on, my mother forced competitive swimming upon myself and my siblings. We all became very good swimmers; I became a lifeguard and while this occurred when I was so young, I firmly believe that day so many years ago, left a lasting affect shaping me into who I am as a person today.

My wife jokes that I am a “helicopter parent” – I respectfully disagree, just hyper-aware of my surroundings; the full picture, the details (or as many of them as I can possibly identify).

And it’s why I tell you this story. My mind processes each and every situation from a risk reward perspective first; it doesn’t matter if I am driving, parenting or making an investment decision. To this day, my initial focus remains the rip current that lays hidden, the one that terrified me as child and continues to keep me on edge as my children learn to surf or merely jump the oceans waves.

As calming as the waves can be, my personality traits don’t allow me to forget their hidden dangers. It doesn’t mean we don’t go to the beach, we just spent a week in Corova, NC accessible only by a 4 wheel drive SUV with air released from their tires (think about my nerves knowing it will take 30-45 minutes just to get to a paved road let alone a hospital?!).

Understanding risk, as with most facets of life, begins with awareness; identifying and educating yourself on their characteristics. Again, we don’t stop our lives over risks, but we do respect them…

You don’t have to stretch all that much to draw parallels between the characteristics of waves and financial markets. Markets, like waves can lull you to sleep or destroy your financial future in a heartbeat if you’re not paying attention. We recognize that not all strong and powerful waves become destructive, and not all market corrections are as severe or damaging as others.

Over the last decade, financial markets have produced ripples to mediocre storm surges leaving behind more positive memories with forgettable pockets of negativity; nothing severe enough to facilitate material change.

There is a flip side… while the strength of waves is primarily generated from wind and friction, more frequently than not, the most destructive storms originate from beneath the surface, often invisible to the naked eye. For example, The Japanese Tsunami of March 2011 destroyed cities and villages more than 3 miles inland. Created by a tectonic shift in the earth’s plates (a 9.0 magnitude earthquake beneath the ocean), no one saw this happen, but it was detected by measuring tools (a seismograph). Even still, there was little time to protect yourselves from the massive devastation that hit the coastline.

Instantly and with very little warning, both waves and markets can be more destructive than most can fathom; leaving carnage in their wake taking years, at times decades to recover. Unless you study rip currents, you won’t know what to look for.

The financial markets seismograph is on and registering warnings at an alarming rate – and while I’ll take a second to apologize for the length of some of my notes, and for what some may consider to be unsettling content, I won’t ignore them. Those who experience an earthquake don’t get to pretend it’s not happening because it’s inconvenient and they have things to do.

Just like the rip currents, identifying and educating yourself on these characteristics is tremendously important for our future success. Market seismographs are talking to us, the question is, are you listening. Furthermore, if the warning signs are making you nervous, maybe you’re not set up and allocated as best as you could be?! If we don’t talk about cracks in our financial system, you are likely to be blindsided.

Navigating Rip Currents

As discussed above, if you break down what we do here at Other Side Asset Management every day, in its most simplistic form, is weigh and manage risk vs. reward… We look for things most people aren’t paying attention to, we’ve described it as spotting cracks in the damn before the damn gives way. (or before the bottom falls out of financial markets).

While most believe they do this with their investments, history and studies prove time and time again that they don’t. Some of you have read this already but for those who have not:

“The industry preaches to stay fully invested with diversification as a means of loss mitigation. The issue is that there are few capital preservation investment strategies, such as QID’s Rotation Strategies, to protect investors from extreme downside risk. As expected, during major economic events such as the bursting of the technology bubble in 2001-2003 and the mortgage meltdown of 2008-2009 most asset classes participated in the stock market carnage. Therefore, the major benefits of diversification across asset classes failed investors when needed most.”DALBAR QAIB study page 8

25-years of these studies all come to very similar conclusions… The typically preached Wall Street model of risk mitigation through diversification is more a false sense of security than risk mitigation tool. Dalbar isn’t the only one with these findings and the conclusions aren’t new, they are infrequently spoken about because they aren’t convenient to what the industry wants you to hear.

As stated above, we are growing more concerned with embedded risks in markets, enough to suggest the risk of a catastrophic event is higher today than in any other point in history (though, higher risk does not necessarily equal imminent doom).

Throughout these pages, we will clearly lay out some of the signals we are seeing, you can decide for yourselves if you think it’s normal, but I’ll mention two items in the immediate in an effort to pique your interest and keep reading, these are very recent cracks that have formed and you have likely not heard or thought about them… but you should….

First, we’ve warned you that bond mutual funds and ETFs are not as advertised, for years we have discussed embedded risks in these products, if you have not taken our words seriously, consider starting. For as much as we’ve spoken about poor quality debt, the leveraged loan market and covenant light vehicles, we believe it’s fallen on deaf ears.

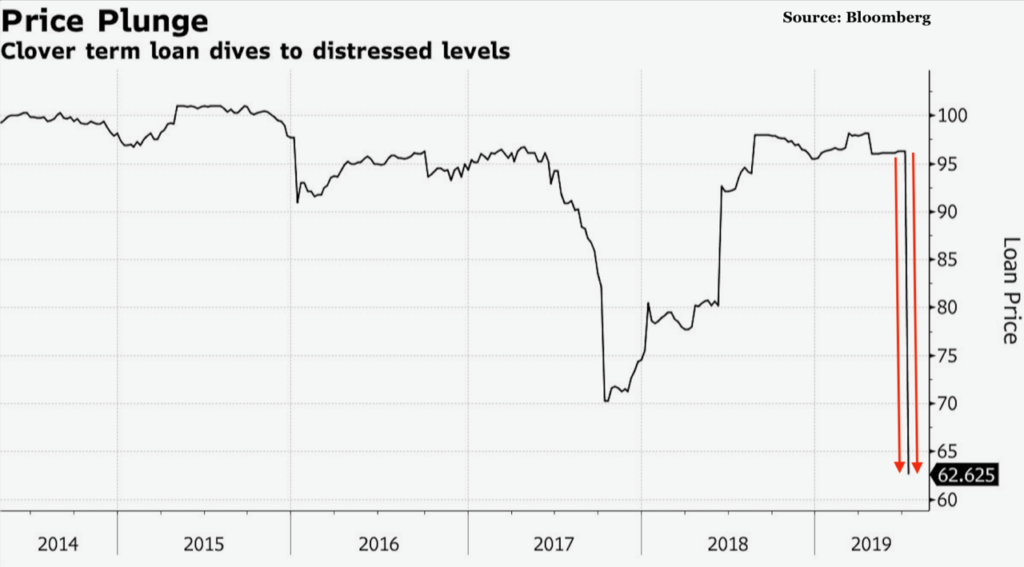

This week Clover Technologies leveraged loan of $693-million collapsed by over 30% in less than a day and a half. Many of you might say, but I don’t own clover technologies leveraged loan – I would question, are you sure? Because this is the sh*t your bond funds have been buying to stretch for yield. Per Bloomberg July 16, 2019:

“Those loans, as is typically done, were bought mostly by mutual funds and collateralized loan obligations, which bundle such leveraged debt into higher-rated securities that are pitched to more risk-averse investors”

“AS IS TYPICALLY DONE, WERE BOUGHT MOSTLY BY MUTUAL FUNDS… BUNDLE SUCH LEVERAGED DEBT INTO HIGHER-RATED SECURITIES THAT ARE PITCHED TO MORE RISK-AVERSE INVESTORS”

Sound familiar? Collateral Mortgage Obligations anyone? The ticking time bomb behind the mortgage meltdown of 2008/2009. Please let this sink in – this company loses 2 clients – paid themselves over $278-million in dividends over the last 9 years and a risk-averse investor will see their bond mutual fund drop in price.

Does price action that moves “straight down” in a day catch your attention? Normal?

Yes, one example, I get it – but 85% of these covenant light loans are literally priced to “perfection”; this is not sustainable in our current environment.

Our second example to keep you reading is more a question… Would you have ever thought that a BBB rated company one single notch away from being a Junk Bond; one with extreme leverage and sales fueled by subprime borrowers would ever be able to borrow money cheaper than our US government? Clearly, this should NEVER happen in a healthy, efficient market and you don’t have to be a finance guru to understand it. What’s worse, is almost no one knows it just occurred. We’ll explain in greater detail below.

Our objective here at Other Side Asset Management is NOT to maximize return at all times under all circumstances – it’s to recognize absurd discrepancies, preserve capital and create respectable returns in such a way you don’t risk losing everything when market forces trump Federal Reserve manipulation (at times we will (and have) exceeded benchmark indices, but WILL NOT ALWAYS). Currently, we are looking to participate in the euphoria while recognizing that this euphoria will not end well…

Having said this, let’s talk about our primary model:

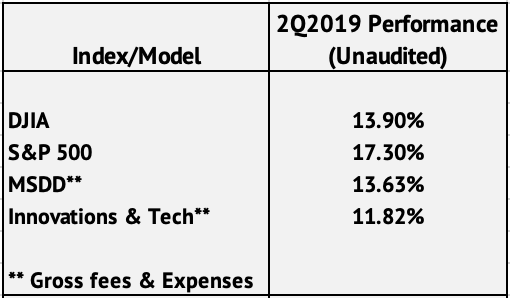

With half the year now behind us, we finished 2Q2019 up roughly 13.6%** on a gross basis – just about 13.1%** on a net basis. Please remember each client’s return reflects a bit differently as shares differ slightly based upon total dollars invested reflecting different percentages of the total account. As of the quarters end, we lagged the S&P by roughly 4.2% on a net basis.

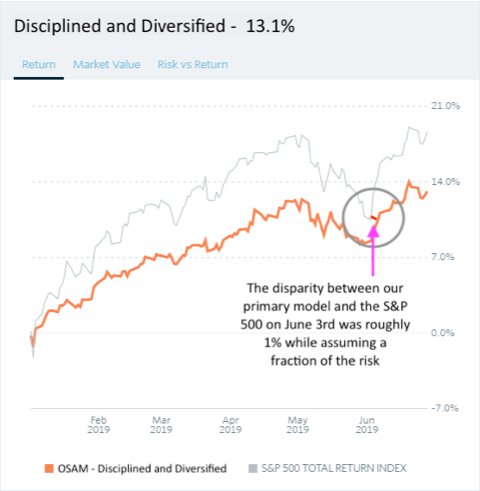

This feels an awful lot like déjà vous! Following May’s correction of 7.63%, as of June 3rd we were just about in-line with the S&P – within a percentage point or so with a very healthy, comfortable cash position.

On June 4th, however, Federal Reserve Chairman Powell, once again stood at his pulpit, just as he did in late December and stated the Fed will use all of the tools in their tool box to defend their dual mandate creating yet another knee jerk move higher in markets based upon stimulus rather than fundamentals… Investors hear stimulus and they cheer, though, there is a very dark side to this stimulus, its destruction of savers, those on a fixed income (the elderly) and pension funds to name a few. Thought the primary dark side to stimulus is excessive leverage. Debt which we are literally drowning in, like quicksand.

We spelled out how much stimulus the Fed needed during the tech bubble of 2001-2003 and the mortgage meltdown of 2007-2009 in our 4Q2018 commentary. With 250-basis-points in their quiver, an already bloated balance sheet, and a consumer that can’t afford a new car at these levels (we’ll explain below) they’re going to have to get extremely creative to ward off the next credit default cycle.

We’re not sold on the market action, we believe the Fed is behind the curve, yet again. Our stance has been that the Fed would have to lower rates at some point; we’ve written about it and acted on it. It’s the primary reason we upped our Gold holdings in late October and December to roughly 7-8% of our portfolio. Odds are, we will look for another entry point to add to that position over the next few months.

As the Fed lowers interest rates and looks for creative ways to weaken the dollar, gold will be the primary beneficiary. Through Q2, we’ve stayed within ear shot of the benchmark indices while taking on much less risk.

Before we go into further depth on current markets, I think it’s important to share one of the most important lessons on investing that I have read in a long time. It comes from the godfather of investing, the teacher of most of today’s greatest investors, Benjamin Graham…

“Margin of Safety”

When people in the investing community read those three words, they typically think of investing legend Seth Klarman and his book “Margin of Safety”; while they should be thinking of his likely inspiration, Benjamin Graham’s timeless piece, The Intelligent Investor, Chapter 20: “Margin of Safety” as the Central Concept of Investment.

I’m embarrassed to say it’s taken me 23 years in the investment business to pick up The Intelligent Investor. While I’ve read numerous books from those considered to be the most successful investors in the world – Buffett, Zweig, Marks, Klarman’s Margin of Safety; the reality is many of their core principles and traits began with Graham so many decades ago…

I’ll hold much of my commentary on the book until I have read cover to cover, though from my current vantage point it amazes me as to how timeless most of Graham’s lessons are and how poignant they remain at this very moment in time.

My only current disagreement lies in his belief of stock/bond asset mix. Anyone who has read my work over the last few years knows I believe our bond market is a ticking time bomb where risk greatly outweighs the benefit. The above referenced Clover Technologies as well as numerous citations discussed in detail below are a continuous stream of warnings that the fuse has been lit. I have outlined my thesis in numerous notes, yet in no greater detail than part 2 of my January 2018 quarterly – which you can read by clicking here.

Now, before I’m engulfed with an endless stream of rotten tomatoes for what might appear to be criticism of the Godfather of risk management and value investing, I am not faulting Graham for his thought process. I do not believe anyone with a high intellect (especially that of Graham’s) could have foreseen how destructive the Federal Reserve’s monetary policy would be to the economy so many decades into the future. Today academics fail to see the destruction the FOMC’s policies have created. Even today, most PhD’s (including those who worked at the Fed in 2007 as well as today) refuse to recognize the Fed’s damage in real time?! I digress…

Graham is likely turning in his grave watching the FOMC and other global central banks dismantle free markets with now, nearly 25% of the global bond inventory offering negative yields.

It is in Graham’s summation of Chapter 20 I would like to draw your focus and attention to as he writes, “Investment is most intelligent when it is most businesslike” following with 4 principles…

It is his 4th principle that I would like for you to ponder…

“Have the courage of your knowledge and experience. “If you have formed a conclusion from the facts and if you know your judgement is sound, act on it – even though others may hesitate or differ.” (You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.) Similarly, in the world of securities, courage becomes the supreme virtue after adequate knowledge and a tested judgement are at hand.”

He continues:

“To achieve satisfactory investment results is easier than most people realize; to achieve superior results is harder than it looks.”

Before ever reading a page of Graham I shared this:

“I view the world much differently than most –from quite a different perspective. I’m also a loner – I don’t need approvals from a group to remain firm in my beliefs and convictions. I don’t take anyone’s “word for it” and don’t mind standing alone if it means doing what I believe is right over popular opinion. I’m open to conversation and healthy debate, but you better bring your supporting documents to back up your position…. So long as I believe my research to be extremely well documented and sound, I take comfort and pride in my work.”

In that monthly, I also pointed to sociologist, Mark Granovetter and his paper on “Thresholds”, discussing different personality types. I noted, “I happen to have a low “Threshold” (per Granovetter’s definition). Graham’s quote suggests he did as well, and having studied so many of his disciples; Buffet, Klarman, they all share this trait as well… I write this not to say, I am or ever will be as successful as Graham or his protégé’s as much as I’ll strive for excellence, though, it is tremendously important to recognize your own personal character traits and those of your advisors and how those traits correlate with investing.

Are you taking the advice of an advisor or CPA with a “roll the dice”, gambling mentality which overshadows your more conservative views? Is your own personality or that of your advisor damaging to your financial future and are you being realistic about it?

To be clear, the above doesn’t mean you should allow over confidence or pride to get in the way of intelligent investing. What I believe Graham to be tell us, is that it’s ok to not follow the herd. He’s telling you that the herd is typically wrong. Graham stood on an island and only a few are willing to join him… Those few are some of the greatest investors of the modern day and while people point to investors like Warren Buffet and Seth Klarman acknowledging them as some of the greatest, they proceed to invest in a manner completely opposite of how those greats invest.

We run models utilizing a strict discipline which cuts losers before they become problematic while allowing winners to run. That, in and of itself is completely different than what the masses in the investing world do. Stay true to what is more likely to protect you in times of distress, you don’t want to stay in a sinking ship because your buddies are too stubborn to acknowledge it’s sinking. Do your best to save them, but if they refuse, there comes a time when you need to protect yourself and your family. I don’t believe the ship is sinking, yet… but I sure as hell know where the lifeboats and life preservers are – and I’ve got a road map etched into my brain as to how we’ll get to them when the hull of the ship is eventually breached.

Coming to America!

Speaking of breached… Many academics believe central banking officials around the globe are making policy decisions on a whim. We continue to argue that they have become slaves to their years of blunders and mismanagement beginning with Greenspan’s reaction to the 1987 crash tying interest rate policy to asset prices.

In the minds of central bankers, lowering interest rates is better than the alternative outcome. Rather than allowing the financial system to work efficiently over the years, bankruptcy being a crucial cog in this system, central bankers will exhaust all options to maintain artificially inflated asset prices; as will politicians. You don’t get re-elected when people are out of work and pissed off.

Our brilliant PhDs continue to destroy our financial system, below is yet another effort to educate you on the growing disparities in what would typically be considered traditional/historical correlations, though at this point, the cracks in the dam (system) are so blatantly obvious they should be clear to most; it’s becoming unnerving.

To be clear, this statement is not one which is telling you to sell everything and run for the hills, yet… No one knows exactly WHEN the next credit default cycle will occur. No one knows exactly when that dead tree hanging over their house will eventually fall; you don’t know what storm will be its last, you just know it will fall and when it does, it will produce tremendous damage to your home if you don’t prune it, cable it or cut it down; if you don’t prepare in advance.

This will NOT end well for the majority; those with their foot firmly on the gas without a capital preservation strategy to speak of or mapped out plan. It will also become especially uncomfortable for those in more illiquid investments… including real estate and certain bonds and bond funds.

Allow us to explain…

The amount of global debt with negative yields has recently eclipsed $13-trillion dollars, doubling since December. Estimates suggest 25% of global bond issuance (corporate and government) is negative. Currently, roughly 85% of all German sovereign bunds are negative, while all but Switzerland’s 50-year bond is negative as well.

A world which consists of $13-trillion worth of negative yielding bonds is not one in which traditional economics applies. The idea of negative interest rates is idiotic at best. The best-case outcome is one where you lose money; savers, pension funds be damned! Those who are willing to accept a negative yield are literally willing to pay an institution for the privilege of holding your own money. Let that sink in for just a moment.

It’s only a matter of time before negative yields make their way to the United States…

We’ll explain with an example:

Whether you have a financial mind or not – humor me – this is a tremendously important and yet simple concept to understand. Let’s assume you have $100,000 burning a hole in your pocket, and you had to lend it to one of two entities for the same time frame (5-years), both bonds pay the EXACT SAME INTEREST RATE; the entities are listed below, who would you lend your money to?

- The United States Treasury – AAA (Moody’s) AA+ (S&P) AAA (Fitch)

- Ford Motor Credit (financing arm of Ford Motor Company) – Baa3 (Moody’s) BBB (S&P) BBB (Fitch)

No – I’m not joking… you have to pick one; either the US Treasury backed by taxing power and to a degree, the Federal Reserve or Ford Motor Credit backed by buyers (including subprime) of the Ford Focus, Mustang, Explorer, etc… you get the picture.

Trust me – I am NOT advocating for either, but this example exemplifies the absurdities that exist in today’s financial markets. I don’t imagine many of you would lend your money to Ford Motor Credit (FMC) over the Treasury?! Intuitively, you would choose the US government; But, if any of you thought about lending to FMC… ask yourself if you would lend to them if they were offering you a lower interest rate (lower yield) than a US government note over the same timeframe?

Most of you are intelligent enough to know this scenario makes absolutely ZERO sense and should never happen in an efficient market. And yet… it just happened.

Investors recently lent Ford Motor Credit nearly $1-billion dollars at levels cheaper than the US government borrows at.

Ford Motor Credit Company, 1.514% 17feb2023, EUR (XS2013574202)

They just did it, raising the capital in Euros… and as I write, these bonds currently trading at 101.3 price which gives it a Yield to Maturity (YTM) of 1.14%.

The European Central Banks (ECBs) NIRP (Negative Interest Rate Policy), coupled with their QE stance (think asset purchasing) has pushed rates so low for so long that a US based icon, a single downgrade away from being a JUNK bond is now borrowing money at rates BELOW what the US government can borrow.

What’s to prevent countless other US companies to do so? If you were a US based company with UK subsidiaries and had the ability to borrow money at 3 or 4% vs. 1.514% what would you do?

Given the strength of the dollar, and disparity in yields due to the European Banks negative interest rate policy (NIRP), it’s now allowing JUNK RATED companies to borrow at negative interest rates.

As reported by the Wall Street Journal, their source Bank of America Merrill Lynch, there are currently 14 companies with junk ratings totaling roughly ($3.38-billion dollars – 3-billion-Euros) overseas trading at negative yields. Again, your best-case scenario is to lock in a loss – and now, the risk of losing all of your principle is exponentially elevated.

Desperation

Is what we are currently seeing out of the Fed and other global central banks and while lower interest rates will likely yield higher asset prices (in the short term) – odds are it won’t manifest in the traditional measures used by academic. Garbage in garbage out; when your input is crap your output won’t be much better; try making brownies with crap and let me know how it goes? This is exactly what we are seeing.

The mob is calling for lower interest rates, led by a barrage of presidential tweets. The FOMC (Federal Open Market Committee) has begun their traveling sales pitch as more Fed officials plead their case for the cut, with officials Bullard and Powell leading the charge leaving many economists and academics to scratch their heads.

Earlier this month President Trump’s twitter account lit the internet with even more reason to believe the Federal Reserve is headed towards lowering rates… Apparently, if Trump doesn’t get what he wants in the short term, he’ll find a way – even if that’s by nominating puppets (I mean economists) to the Fed who will. Via Twitter, Trump announced his plans to nominate economists Christopher Waller and Judy Shelton to the Federal Reserve board (as reported by the WSJ), both known doves, Shelton is oddly a bit of a gold bug?! An interesting new dynamic to add to the drama.

Additionally, to ensure the madness continues, the journal also reported earlier this month that the IMF’s Christine Lagarde has won the European Union’s support to replace Mario Draghi at the ECB. Lagarde, too, is a dove and is sure to continue Draghi’s NIRP (negative interest rate) and QE (Quantitative Easing) policy. This is a woman who has stated subzero interest rates were a “net positive”, leaving the reader to their imagination with this quote, “We are on alert, not alarm”.

While we don’t advise fighting the newly coordinated central bank efforts to flood the globe with an endless supply of money, we will again remind investors of a few things.

- The Fed has yet to actually do anything and has been “promising” to decrease rates since the day after Christmas (an unprecedented reversal of their yearlong stance).

- For those who study the Japanese model – they would know their economy is in the tank.

- The ECB (European Central Bank) has provided more stimulus to their region than the Fed and their economies and markets continue to struggle in the face of more stimulus.

We have noted anomalies and discrepancies in real time. Though, in my opinion, none are more prolific than UK “Star” fund manager Neil Woodford recently froze investors from redeeming cash from his $3.7-billion-pound UCIT (fund). Read about it here, here and here…

This calls the confidence of investors into question. If I am in the UK, invested with one of the most well-respected money managers around, and he freezes investors out – similar to a run on a bank, it can create a snowball effect with countless people saying, “give me my money”.

Do you remember August of 2007 when French Bank, BNP Paribas froze $2.2-billion in money market funds over subprime debacle before the crises really got underway? They couldn’t handle redemption requests. History arguably shows confidence as the most important cog in the financial markets gears in order to keep them running smoothly. The more unrest, the greater the chance of a sell-off being sparked.

The Fed is reinforcing confidence amongst the investing community, they’re saying, we’ve got your back! And while futures markets indicate investors have already placed a 100% chance on a 0.25%-basis point cut later this month, not every Fed official seems to be on board.

“our mandate is to serve the U.S. economy and not a particular market.” ~Atlanta Federal Reserve President Raphael Bostic, July 11, 2019

Bostic is a self-described rate-cut skeptic, but if the Fed is looking at their “data”, things still look good; for instance, the jobs numbers reported on July 5th blew away expectations coming in at 224,000 vs. the anticipated 165,000. US Retail Sales recently exceeded expectations. Housing sentiment rose in July matching expectations… The FOMC has the WSJ writers scratching their heads as you can read in their piece titles, “Fed’s Rate Cut Plans Stop Making Sense”.

The Fed can no longer argue they are doing anything but supporting asset prices (which is not part of their dual mandate). We are witnessing a global slowdown of significance, which the Fed has single handedly created… Our troubles have little to do with a trade war and everything to do with over-leverage and an inability to afford debt at even slightly elevated levels (2.5% Fed Funds Rate).

On July 8th German chemical giant BASF reported a 47% decrease in EBIT YOY in the Q2, threatening to cut profits by 30% – citing general weakness in industrial production especially in Auto (big shock there, we’ve written about this trend for over 3 years).

Last week, as reported on by the Wall Street Journal, GM, Ford (F) and Fiat Chrysler (FCAU) reported their worst first-half auto sales in years. GM’s drop to 1.57-million units was its worst since 2013 (a 15% year over year decline), while Ford’s roughly ~290k units was the company’s worst first-half year since 2012) a 27% year over year drop and half of what their first quarter sales were in 2016.

I need you to digest two things right now.

- Fords first-half of the year’s sales were HALF of what they were in 2016 (They have lost half of their first-half sales in 3 years) and for those paying attention, nearly ¾ of Ford’s Q1 earnings came from their credit arm (Ford Motor Credit), NOT selling cars.

- In the aforementioned WSJ article, each car companies’ spokespeople as well as representatives from Edmonds cite “HIGHER INTEREST RATES” as the cause of the sales slowdown BUT expect better second-half sales with the anticipation of an interest rate cut. The only think that will bring back Auto sales is… “lower rates”

Though, you would have no idea Ford’s sales have slowed by 50% of what they were selling in the first half of 2016 by looking at the equity prices or debt pricing levels as discussed above.

Markets, like investors are greedy, and unless we see at minimum, a .50-basis point cut, markets are likely to be disappointed come the end of the month. Without an August meeting on the calendar, this leaves quite a bit of uncertainty until September’s FOMC meeting. Coupling a nominal rate cut of .25-basis points with poor corporate earnings will be a recipe for disaster; at some point markets will force the Fed’s hand to be more assertive and Fed officials know it, which is why as of a few days ago, Chicago Fed President Evans is now selling an “argument” for a 0.50-basis-point cut.

If the FOMC does cut by 0.50-basis points it should terrify investors.

“Historically, initial Fed rate cuts in response to a market downturn have been followed by very negative consequences (after the initial obligatory market pop), because they generally indicate that something has gone wrong. – John P. Hussman, Ph.D., November 28, 2018”his July 2019 note is a must read

Equity markets grind higher in anticipation of these cuts, though, we will point out a few more historical anomalies that continue to garner caution regardless of what the Fed says (if Ford Motor Credit borrowing at cheaper rates than our Federal Government wasn’t enough to wake you up!).

Historically, there are certain sectors of financial markets that traditionally lead markets higher; it should be intuitive as to why, as you hear them.

We’ll start with Transportation stocks: the more goods and services purchased, the more things need to move; from mines to refiners, manufacturers to wholesalers then retailers and finally the end user. In a growing economy, the movement of a more goods should be reflected in the equity prices of those doing the moving – and yet, today it’s not…

Jay Van Sciver head analyst, cyclicals, industrials & materials analysts at Hedgeye Risk Management recently provided you his outlook on Jim Grant’s Current Yield Podcast titled “The data couldn’t be clearer”. Speaking to his current outlook on Industrials:

“I think it’s clearly decelerating… we’re in a potential industrial contraction and contraction in durable goods orders”

“The data just couldn’t be clearer whether it’s airfreight, railcar loadings; whether it’s intermodal or total, even truck tonnage is basically flat in the most recent readings, so everything is telling us the same thing.”

Next up, Semiconductors: Semiconductor chips are found in just about everything these days; from cars to phones, “smart” garbage cans to refrigerators, the IOT (internet of things) movement has exploded. With more growth comes the need for more chips, which, too should translate into higher equity prices for the sector, though similar to what we’re seeing in transports, the sector is lagging:

Finally bringing us to Financial stocks: How is it all getting paid for?! Growth is typically fueled by capital (in one form or another). Historically, an increased amount of capital (debt) is required to fund larger acquisitions and growth (under normal circumstances, reflecting in the price of those companies that control it). A slowdown in growth requires less capital all around.

Additionally, lower to negative interest rates provides limited to no “spread” or NIM (Net Interest Margin) for financials to make money. Just this week JPM and Wells Fargo (WF) decreased future NIM expectations moving forward based on the anticipation of rates cuts (tighter spreads).

In the face of the Fed threatening rate cuts daily coupled with announcements from multiple central banks of their plan for more stimulus (whose economies continue to struggle after years of negative interest rates), these historical correlations continue to break down. Price action in these 3 sectors are commanding our attention in the very least; it’s telling us a story of slow to no growth, they are suggesting caution is warranted.

Markets, manipulated or not, can move higher without the participation of these sectors – but this price action speaks volumes. It’s screaming Asset Inflation rather than a stock moving higher on their future growth merits; markets are forward looking vehicles, to ignore these signs would be irresponsible…

We pointed to David Kotok of Cumberland Advisors in our last note. While we stated we disagree with what amounts to be semantics, we stated we agreed with much of what he had to say, the below specifically.

“The government is an input in markets all the time, and everywhere. What do you do today? I don’t know what others do; I know what we do. We have a cash reserve in the US stock market accounts. We take the bond accounts; we construct a barbell and the front end of the barbell is bigger than it’s been in a while. Barbell is short maturity, cash equivalents, one, two years – defense. I won’t take my money and lend it to the United States of America at 2% for 10 years and I won’t pay Austria money to hold money for me and charge me to do so for 100 years. How can I possible do that for a client? So, if I won’t do that with my money, I’m not going to do it for a client. (If a) client wants to fire me and go get somebody who will buy them a 2% 10-year treasury, good luck to you, but that’s the way we view the market.” Cumberland Advisors David Kotok, Yahoo Finance TV June 18, 2019

Those who know me, know I shoot it straight. I covet my family, friends and clients. I consider many friends and clients to be family. Our firm doesn’t exist without first, protecting our clients followed by taking on new ones and my family is my everything; protecting them is priority. I was recently asked if I secretly hoped for a downturn to be proven right?! This is lunacy – My thesis doesn’t need to be right for us to be successful in fact, I hope and pray that I am wrong for all too many reasons. I’d first state the obvious, I make more money as I grow my client’s assets, which is much easier to do in up-markets than down. I love this country; I take pride in its successes. I love my family and my little girls; I want a prosperous world for them to live in. Up markets or down, I need to find a way for clients to benefit and this starts by preserving capital.

I sincerely wish the market landscape looked differently; though, the economics of it are relatively simple.

We live in an overleveraged society with too much unsustainable debt on the books at unrealistically low interest rates; I don’t make these numbers up, numbers come directly from the Federal Reserve’s, the Congressional Budget Office. It should come as no surprise to anyone that everyone from individuals to corporations and governments who have over-extended themselves are having cash flow issues when interest rates are increased by 250% (or more) … You can only consolidate your bloated debt so many times at a zero percent teaser rate for so long until it catches up to you. While this analogy is more consumer oriented, it holds true for corporations and governments. Nothing is trickling-down in our economy, but debt continues to explode…

One thing I’ve learned after being in this industry for 23 years is that it’s very hard to change people’s minds. We can cite numerous red flags, sing, dance or try to illustrate how much the interest expense alone is on $23-trillion dollars, and nobody will really care, until…

Mindset is so important to investing. Being willing to give up a few percentage points for a brief period of time as insurance against catastrophe is something, I will buy any day. I say “be willing” because we don’t always give up percentage points. It takes cash on hand to buy when things are low, yet if you’re fully invested with a firm buy and hold mentality, you won’t have funds on hand to buy when things are low… At that point you turn into a pray things come back investor. Think about David Kotok’s words, he would rather be fired than knowingly do something he believes to be detrimental; a man of conviction, very respectable.

For the fraction of my audience that has made it this far, I thank you… We will remain vigilant and prudent. We will allow our winners to run and cut our losers before they become problematic. We will remain steadfast in our discipline as we continue to provide you with the information we would want to hear if our roles were reversed. If we are only managing a fraction of your portfolio, consider upping your allocation to us as we are likely one of the few firms that focuses on guarding against catastrophic loss…

For those reading this who continue to rely on the same traditional methods of protection marketed to you by the financial industry, which have failed the vast majority of investors over the years, it may be time for you to rethink your strategy, a conversation costs you nothing!