In This Article

Viva Las Vegas

Working alone leaves one quite a bit of time pondering self-beliefs. Whether we manage the bulk of our client’s financial net worth or a mere fraction of it, there is little room for bias, obtuse thinking or pride. In an effort to keep our mindset “in check” we make a concerted effort to study and approach markets from multiple angles. We read as many theses as possible, from arguably the most well-respected financial minds to have graced Wall Street with their presence, both living as well as pioneers no longer with us. Collectively, when combined with our personal work and experience, our “perspective” is then shaped and molded.

As well-read and researched as we aim to be, it is always nice to have an “extra set of eyes” keeping our thoughts in check, while also providing thoughtful insight on things we may be overlooking or flat out missing?! Ray Dalio recently shared a “Work Principle of the day”:

5.2” Find the most believable people possible who DISAGREE with you and try to understand their reasoning!”

We couldn’t agree more!

With the above thought in mind and the third quarter now closed, rhetoric surrounding China/US trade, the Brexit deadline of October 31, Fed policy changes and turmoil in an often overlooked and frequently mentioned interbank lending market (known as the repurchase or “repo” market”) among other things, created significant volatility in financial markets. It was timely for us to have had the privilege of spending last week In Las Vegas for the 16th annual Stansberry Research Conference. We did search high and low for as many opposing views as possible in an effort to reframe or dial in out thought process, below we share what we found.

Stansberry put together a brilliant lineup of thoughtful minds that took the stage and in no particular order, I’ll summarize a few of the most poignant themes to come out of the conference. If you are familiar with my work, you may find the overall theme eerily similar to our message over the last 18 months?!

Jim Grant is a Wall Street legend who deserves top billing. Grant is one of the few voices who wrote extensively about the dangers lurking in the sub-prime market years before their blow up in 2007/08. Jeffrey Gundlach has said of Grant’s work, (it’s) “The only research that I pay for.” Infallible, no; though his staunch support for sound money and free markets has been refreshing as we witness academics destabilize economies around the globe in real-time. His presentation drew uncomfortable laughter as his statements of facts were so outrageously mind-numbing, laughter was a better choice than tears.

The ire of this humor, a $3.5-billion euro dominated 2.125% coupon 100-year Austrian bond yielding less than 1%-YTM due in 98 years. Those who bought this bond 2 years ago are up nearly 75% on their principal (take the gain) This, at a time when both social and political risks around the globe are exploding.

While Grant has been called a “bear” in the past, his observation and analysis is sound. Who in their right mind would lend Austria money earning less than 1.00% for roughly 100 years and think it’s a good investment?! We speculate, only those looking for safety and protection against a larger event?! Possibly momentum speculators?

Though we ask that you consider Austria’s existence in the preceding 100 years…

Annexed by Germany on March 12, 1938 by a man named Adolf Hitler?! Austria then defaulted on their debt… Now, in a fiscal pact with 19 other countries (some attempting to escape the European Union as we write (Brexit) with others on the brink with the rise of populists). ALL countries within the EU maintain different political and philosophical beliefs trapped in a monetary pact. At 73 years young, Mr. Grant’s prediction was that in 98 years when this bond is to mature, he will look better than this bond… We, personally don’t want to envision either outcome, neither will be good.

Economist and NYU Stern School of Business professor, Nouriel Roubini also took the stage… Known as “Dr. doom” for his “gloomy”, yet accurate prediction in 2008/09, Roubini had me wanting to jump out a window; our conference room was on the promenade level one story above the pool, for an instant I considered jumping, though merely hurting myself from a 12’ leap wasn’t a realistic option (more would have been required after listening to Roubini’s global outlook). While I jest, for nearly 45 minutes, Roubini walked the audience through multiple global economic scenarios and outcomes from possible to most probable… Not a single one was favorable.

I anticipated a bearish but realistic lean from Roubini, though one of my absolute favorite speakers on all things the Federal reserve is former Fed Insider, Danielle DiMartio Booth. Author of Fed Up and founder of Quill Intelligence (@quillintel), she speaks openly and eloquently, most often upbeat with her trademark sarcastic humor. Though, on this day her tone was direct but soft; I would describe it as slightly somber (as in, don’t shoot the messenger as she was just reporting the facts). I have just re-read her presentation (or Quill as she calls it) and much of her presentation paralleled our feelings on BBB-rated corporate debt, her information updated from our writing of January 2018 and 2Q2017, while her presentation also elaborated on collateralized loan obligations (CLOs), only bolstering our thesis making it more poignant today than when we wrote it over a year and a half ago.

Former hedge fund manager, now research newsletter editor Whitney Tilson provided a few long ideas, specifically the GSEs (FNMA/FMCC). Many of you reading have been with me long enough to know we owned these companies at our previous firm. Our thesis was similar to Whitney’s, yet our previous employer would not allow us to own the names in our discretionary models, in some instances, forcing us to sell while others opened segregated accounts to hold a single security with an asymmetrical risk reward set up. In the move to OSAM we consolidated and sold these positions as they were small, though we have subsequently re-opened them given recent favorable court decisions.

Moving on… I have written about Erez Kalir, founder of Stansberry Asset Management (SAM), in the past. Erez is a golden boy who’s managed roughly a billion dollars for one of the “godfathers” of the hedge fund world Julian Robertson. When Erez opened his new firm, Julian Robertson became one of Erez’s first clients. SAM was founded by Erez doing similar work to what we’ve done, utilizing high quality independent research like Stansberry, among others, to create world class portfolios wrapped with capital preservation strategies to protect investors downside and while I am extremely confident in the work we do, Erez has the ability to do some things outside of our scope of expertise.

Recently, he has been created investment ventures outside of financial markets. While I will not speak for Erez, I know he believes in undervalued real estate locations as people migrate from overpriced north eastern states to undervalued yet bustling southern locations. He’s also formed an investment vehicle concentrated on the business of factoring (a short-term lending businesses for small companies which don’t get paid from their vendors for 60-180 days out, primarily to those in oil/gas companies in the Permian basin). While his newest venture is in the area of “Opportunity Zones”, a capital gains tax haven.

While I am very confident in our abilities here at OSAM, if someone with a significant net worth asked for my opinion as what they should do with their money today, while our management style and capital preservation strategies would be on the list, it would only be one of many suggestions; life and money making opportunities exist outside of financial markets! Speaking with Erez would also be on that list, his mind works differently than most, he is one of those rare individuals that just sees things differently. He manages risk and spots value as one could imagine Mozart saw music (just one man’s opinion).

His real estate fund, “opportunity zone” opportunities and factoring ventures in the Permian basin are all items that to a degree, are not immediately correlated to equity markets.

It’s important to note most who provided long ideas at this conference focused on non-correlated asset classes to financial markets. FNMA is an event-based pick, gold is a storage of value and hedge, opportunity zones are a long-dated tax haven, etc… A theme that persisted though the conference.

Yes, there were those who feel as if these markets have a bit longer to run, Joel Litman & Enrique Abeyta to name a few (I’ll talk about Joel deeper into this note). While I didn’t get a chance to speak with Enrigue one on one, in my conversation with Joel he cited the lack of widening credit spreads as his primary reason for things not ending as quickly as the majority of other speakers. While I agreed credit spreads have not widened in certain areas (BBB or higher) it has in others (CCC), my volley back to him was egregious mispricing in markets due to central bank intervention and copious amounts of risk taking.

There was much more to our conversation some touched on below… though my point no more evident than in a WeWork bond trading north of 105 in July/August as the company was artificially valued at $47 billion, now they are desperately searching for capital to ward off bankruptcy having recently been dropped to CCC.

Admittedly, Joel got me thinking and he has graciously shared an institutional piece he writes with me, I have yet to fully process and digest it. Though I continued to search for another dissenting view…

Attendees then watched a bald headed, tattooed young man dressed comfortably in shorts and a tank top walk onto the stage (while carrying a beer). You could visibly see many (highly affluent, middle aged investors) in the audience scratched their heads wondering, who the hell is this guy? In what turned out to be arguably one of the more interesting individuals to listen to, financial blogger and pod cast host Christopher Irons (twitter handle @quoththeraven) shared with the crowd his experience and insight into the financial industry.

Mr. Irons definitely caught my attention as his story and message is one which should be heard far and wide.

Irons “unconventional” path into the industry led to his working at a firm named GeoInvesting. Over roughly 5 years, he and his colleagues exposed over 15 U.S listed China based frauds valued at over $10 billion dollars. Their research and boots on the ground legwork is what most investors believe investment banks, regulators and auditors actually do (spoiler alert it’s not). Among other things, his trips to China found overgrown railways and empty buildings where “sprawling cities” were reported to be. He and his colleagues questioned the system and looked with their own eyes rather than just accepting a “reputable sources” word for it.

The “Iron-y” here (PUN intended) is, while his approach in questioning the status quo is considered “unorthodox” to the masses, the questions he asked, which led to he and his colleague’s success seem so simple, evident and obvious. Critical thinking being integral in their success… A real time example:

No more than a few hours prior to Irons taking the stage – Fed Chairman Jerome Powell announces the Fed will begin to expand the balance sheet again, just “don’t call it QE” – it’s not QE 4 – they are merely liquidity measures to stabilize the “repo” markets! Seriously? If Fed apologists want to suggest injecting liquidity into “repo” markets is nothing more than modern day open market operations, fine… I’ll grudgingly acquiesce it’s a “closed system” but asset purchases are not a closed system, their nearly $400 billion commitment is liquidity that has proven to find its way to malinvestment.

My Goal… with these quarterlies is to frame investing differently than how you’ve been conditioned. MCK 2017

Horse meet water…

The tone of this conference was different than in years past. There were some great ideas pitched and a few speakers remain bullish for now, though, the overall skew was that of caution, follow your capital preservation strategies, RAISE CASH and own more hedges like gold or precious metals.

So much for traveling to Vegas in an effort to find those whom disagree with our thesis…

Again, I will note, as mentioned above, Joel Litman has a special talent and his thoughts differ from our own, while I jest that I didn’t find anyone in Las Vegas with a different point of view, In the spirit of Ray Dalio’s words, Joel’s perspective is worth further understanding, it deserves attention.

We don’t advocate for managing all of one’s wealth as we don’t believe any one firm has the ability to achieve the diversification all individuals should strive for. A REIT is not a tangible asset that you control or can physically walk into like a rentable townhouse; a gold ETF is not a physical coin you hold in your hand or can carry in your pocket… Most asset managers live in the world of intangibles, true diversification, proper diversification extends way beyond the borders of intangible assets.

Nothing Is Free

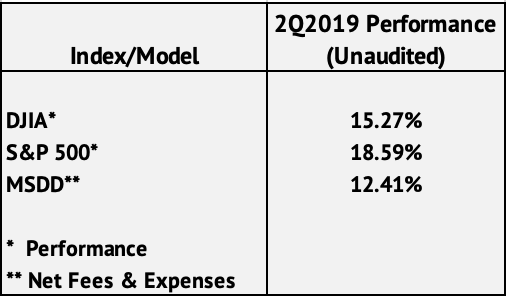

Having said that – let’s take a look at the numbers for quarter end with explanation and thoughts and insight?!

Depending on when you starting investing with us, you are either ecstatic, meh or somewhere in between; starting points matter?!

Most individuals measure performance solely on a comparison to a given index on 4 specified dates per year (quarter end). The quarterly numbers are what they are, and we’re not asking you to ignore them, though, we are urging you to understand the risk that currently exists in our system and how it relates to our performance. The chart below is of the S&P 500; start date of November 8, 2017… We believe this chart speaks volumes.

As you can see, the S&P 500 index moved up a quick 35% from the onset of president Trump’s victory until January 26, 2018, as did our models (we slightly exceeded the index over this period, though the auditors will tell us what start date we can use for fully audited numbers).

The following 21 months tell a different story. Equity market performance has been miserable, producing anemic returns with tremendous volatility. The S&P 500 has been virtually flat for nearly 2 years (and depending on when you joined us, your performance falls somewhere in-line). We freely admit, our performance over the past 18 months has slightly lagged the indices, albeit, for the very reason your invested with us; we have never hidden our primary focus is managing risk.

The bottom of equity markets fell out after peaking on January 26, 2018, the day after I resigned from my previous firm. Having zero control of client assets is not a good feeling as they remained with our previous employer, our hands remained tied for weeks.

In the years leading up to our departure and following that decline, many of you know that we had been cautiously optimistic as was evident in our writing as well as with our portfolio positioning. Our 1Q2018 note read:

“History is however; on the side of the bulls as bear markets are far less likely to begin when companies are showing continued strength in revenue and earnings, consistently beating Wall Street estimates. As we stare Q1 earnings right in the face, we’ll see if that trend continues?” 1Q2018

It wasn’t until December when our bias turned more towards the cautious half of “cautiously optimistic” and as we showed you in our last monthly, we outperformed the S&P by nearly 7% points in a matter of 19 trading days in the heart of the December 2018 selloff.

Our focus is risk and we adjust our models accordingly by design. It’s because cycles matter and nothing is free. More frequently than not, there is a “catch” to FREE; an intended or unintended consequence. Happy meal toys aren’t free, McDonald’s is marketing to your children in an effort to gain a junk food client for life; this is clear to most given the example, but often overlooked when trillions of dollars are pumped into a financial system that appears to be functioning properly.

The devils are always in the details… When facts change, we re-evaluate; cycles matter, risk exists, and nothing is free.

There is NO such thing as a risk-free rate, 2008 should have taught everyone that there is inherent risk in markets; and there sure is hell no such thing as risk-free when speaking to negative yielding bonds. Guaranteeing a loss is not risk-free, guaranteeing a loss is a sign of desperation.

In 1Q2018 our bias was towards the optimistic side of “cautiously optimistic”, when earnings began to roll over and were no longer showing the continued revenue or earnings strength we wrote about in April, our tilt shifted to the cautious side of “cautiously optimistic”, thus, the slight underperformance as we drastically reduced our risk exposure.

As Wall Street companies “beat” their respective estimates, they are doing so in the name of greatly reduced expectations. Ask yourself how and why Wall Street analysts continue to increase price targets in the face of drastically reduced earnings estimates?! (we will below) History tells us this has not boded well for future stock prices.

We’ve been vocal about Wall Street analysts and their bias to maintain buy and hold ratings? Mark Bradshaw spoke of it in 2004, The Bias of Wall Street Analysts, Joel Litman wrote his own piece in 2004, Give My Regrets to Wall Street and I’ve said for years, in many cases a simple downgrade from a hold to a sell evaporates between 5-6 revenue streams to an investment bank though we’ll save it for a different time; buy and hold recommendations exude confidence.

Understanding a back story is pertinent as an investment thesis doesn’t always unfold overnight. These things take time and don’t always map an index, yet the road map we have written for nearly 4 years has literally played out with uncanny accuracy right in front of your eyes for anyone who has read our work.

We’ve extensively detailed the obnoxious size and abhorrent quality of our consumer, corporate and government debt. We’ve written about the collateralized loan markets and dangers lurking in the ETF markets, specifically credit risk liquidity issues which, in our opinion, will crush many unsuspecting individuals whose objective was safety. These risks are becoming more obvious by the day.

These are by no means fabrications of truth or minimal risks; RISK HAPPENS IN AN INSTANT…

“Global markets teetered. High-speed computer trading, driven by mathematical models, outran the pace of mere humans. Poorly understood derivatives set off depth charges everywhere, revealing hidden links that bound together the banks, insurers, giant investors, and big brokerage firms that populated Wall Street. Those connections stretched across all regulatory borders that rival government agencies defended so fiercely. At the edge of the cliff, some questionably legal steps saved a key firm from collapse, a failure that would have tipped a crisis into catastrophe.” A First-Class Catastrophe, page 1 Prologue, Diana Henriques

In reading this passage you would instantly think the author was referring to the 2008 financial crises, though you’d be wrong. Award winning author, Diane Henriques was also a speaker at the Stansberry conference. Her presentation thoroughly detailed October 19, 1987, known to most as “Black Monday”. Henriques details the events which led to the greatest one day fall in stock market history, 22.6%. I challenge you to read her book; there are some eerily similar correlations which lead up to that day, the 2008 Great Recession and today.

Perspective is something we frequently speak of in our notes; so, let’s put this into perspective. A 22.6% one day decline would slash 6,107.2 points from the DOW, 678 points from the S&P 500 and 1,842.35 points from the NASDAQ.

Again – RISK HAPPENS IN AN INSTANT – even current day…

On September 16, 2019, just two days before Fed Chair Powell cut rates for the second time in 3 months (in the strongest economy in decades), trouble began to brew in interbank lending markets. A repurchase agreement or “repo” is a form of short-term borrowing; per Investopedia, In the case of a “repo”, a dealer sells government securities to investors (think bank), usually on an overnight basis and buys them back the following day at a slightly higher price.

What is typically an extremely “safe and liquid” market saw overnight lending spike from under 2% to in some reported cases, over 10% (which went unfilled). These are financial institutions lending overnight to each other (repo markets can affect money market operations). The Federal Reserve Bank of NY immediately injected $53 billion worth of liquidity, another $75 billion the day Fed Chair Powell said nothing was wrong, yet have added hundreds of billions to these markets since – another $87.7 billion Tuesday, October 15th.

10 years ago, the Federal reserve’s balance sheet was nearly $850 billion with a volume of excess reserves at roughly $1.5 billion… Current day, post fix after fix after fix we have a system in which $1.3 trillion in reserves is now insufficient to maintain a functioning repo market as roughly 90% of excess reserves are held by the 5 largest financial institutions, many unwilling to part ways with their hoard (Partly because they need it and partly because of restrictions written in regulations).

For what was said to have been “contained” to a closed interbank lending system deal has now become “prolonged”; as the Fed has begun to expand its asset purchase programs (not a closed system) to calm repo markets.

THIS IS NOT NORMAL – a 2% to 10% spike in interest rates is NOT NORMAL whether you felt it in your portfolio or not. Just as quickly as the repo markets saw RISK happen, it can spill over into money markets, this can happen in both bond and equity markets.

Poor regulation (Dodd-Frank, Basel III) and artificially suppressed rates for an abnormally long-time has created an overleveraged system with copious amounts of malinvestment on top of a reserve shortage (concentrated) visible to anyone with a pulse (except for what seems to be academic PhDs and their buddies at the Fed who are selling you on a bullsh*t MMT theory).

Should we worry? I do enough worrying for us all so I’m not a great person to answer the question, but former Minneapolis Fed president Narayana Kocherlakota wrote a Bloomberg op-ed on why this is worrisome to him?!

While risk can happen in an instant, often there are some very visible signs which lead up to these event risks. For example, the slowdown in the Auto industry didn’t just begin this year, we’ve discussed the auto manufacturer’s inability to sell cars without low interest rates, their numbers being saved by hurricanes, and “looking beyond credit scores” in August of 2017. 2017 is PRE-TARIFFS folks… Are we really wondering why there are over 7,000,000 consumers over 90-days delinquent on their Auto loans?

The issues in our Auto and manufacturing sectors aren’t trade war issues, they’re a societal over-consumption and spending issue, an over leveraged borrower issue. Like a cancerous tumor whose cells continue to replicate until they infiltrate and consume an entire ecosystem (our bodies); the end result is not a positive one. Debt has grown for years. Increased interest rates were the sugar that’s fed this cancer. This is an end of cycle issue; more importantly, a man-made central bank artificially manipulating the most important pricing tool known to man issue, interest rates.

Just about every central bank under the sun has pledged endless stimulus to ward off recession, all dropping interest rates, many to zero (and in some cases below zero, our central bank has re-started its “asset purchase program”.

The President announced Friday, October 11, 2019 that we’ve now agreed to a trade deal with China (details are virtually non-existent, it’s not on paper, the Chinese want to talk more before their president signs it. The deal doesn’t include IP (intellectual property) and the Chinese have merely agreed to buy more soybeans/agriculture (as they had well over a year and a $28 billion-dollar federal farmer bailout ago)? But it’s great… this deal is a great deal… it’s the best deal, you just wait and see how great of a deal this is… (insert an eye roll here…)

And now Brexit is looking as if a deal can be reached.

On the back of all if this news, equity markets mustered a mere 1% gain last Friday?!

What happens when all perceived market overhangs (excuses), are off the table and earnings continue to roll over?

Our performance for the quarter comes with just over 24% in cash, an increased position in our gold holdings (8.5%) and a slight short hedge to the S&P. We will be implementing some new ideas while re-balancing our holdings, though our focus is not the day to day or the week to week price of the S&P 500, it’s managing the embedded risk in markets that have never been this extreme in history. Please, do NOT assume someone else is looking out for you because you’ve happened to walk halfway through a live minefield blindfolded and are still alive.

I shouldn’t have to preface as I write it often, markets can still move higher, and we will continue to participate, but right now you’re not paying me to be leveraged long beta, you’re paying me to navigate the back half of the minefield and get us all through alive and well…

An Honest Conversation

Let’s take a step back and have an intellectually honest conversation here… We’re not going to label people bullish or bearish – positive or negative – we’re just going to lay things out as they’ve been reported. We welcome feedback, tell us where you believe us to be wrong or what you believe we are missing?!

We’ve talked about the US consumer in previous notes. Fed Chair Powell has been discussing how strong and resilient the US consumer has been at each of the last 4 FOMC press conferences. In July he made it a point to mention that the US consumer accounts for nearly 70% of the US economy… Simple math, $21 Trillion-dollar GDP * .70 = $14.7 Trillion or so, fair?!

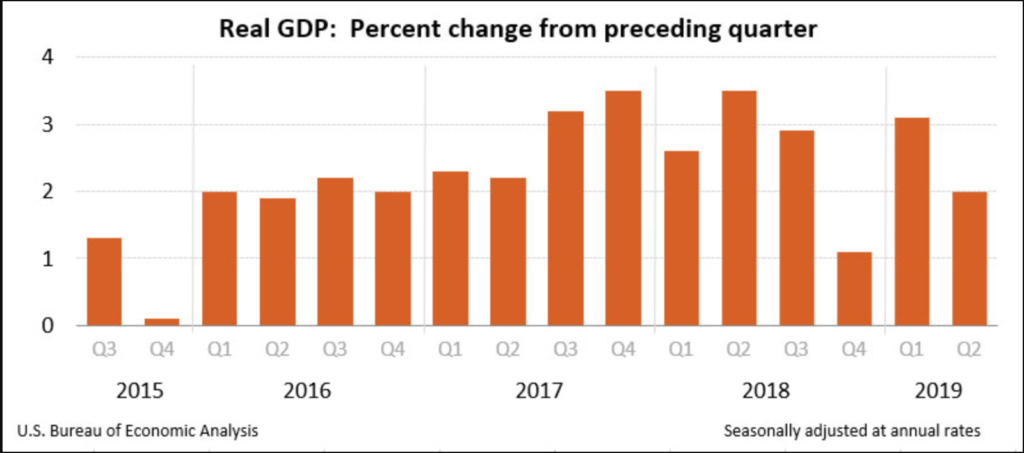

While US GDP has been growing, it’s by no means been setting the world on fire.

How do we define, not setting the world on fire? 1.9% average growth since the end of 2015 with GDP slightly above 3% for 4 out of the past 16 quarters? Again, feel free to disagree; don’t shoot the messenger.

The rest of the world has been slowing more dramatically…

China peaked 2Q2017 @ 6.9% and has fallen to 6.2% by the end of 2Q2019; 6% will be difficult to achieve this year without some miracle statistical work. The European Union peaked in 4Q2017 @ 2.7% and has dropped to an anemic 1.2% as of 2Q2019, as eurozone manufacturing PMI recently fell from 47 to 45.7 (the lowest level in 7 years).

At 30% of eurozone GDP, Germany is the largest contributor; their PMI recently fell to 41.7% (the lowest reading since the financial crises). These numbers come delivered to you, neatly wrapped with a bow in spite of nearly a decade of massive European Central Bank (ECB) stimulus and negative interest rates. For those of you who didn’t see last month’s note, we urge you to revisit what negative yielding interest rates have done for the eurozone’s top financial institutions over the last decade.

Slower growth equates to lower earnings, as has been evident with earnings rolling over the past 4-5 quarters. On July 2, 2019, Bloomberg reported over 80% of companies in the S&P 500 had slashed forward earnings estimates “reducing company projections at the fastest pace in 3 years”. The trend has continued into Q3.

Companies have beat earnings expectations, though in most cases the numbers being “beaten” are extremely watered-down versions of what was a much higher number that’s been reduced. As Wall Street firms have been reducing earnings estimates they’ve been increasing price targets, projecting earnings multiple expansion… As mentioned above, as the global economy shrinks?! In the spirit of Christopher Irons, ask yourself if this make any sense?

Put yourself in the seat of a CEO, how would you increase your company’s earnings in the midst of a global growth slow down?

It’s relatively simple, you tighten your budget and cut expenses.

When you hear budget cuts or cutting expenses, think job cuts. CEOs can buy cheaper toilet paper, take away company cars and stop allowing lavish steak dinners, or they can fire a non-revenue producing employee and off-loading his/her responsibilities to another employee who doesn’t want to get fired – sadly, this is the easiest and most efficient way to cut costs. Unless you produce or generate revenue, as an employee, unfortunately you are an expense to any company’s bottom line.

Think about fast food chains now automating ordering… an upfront expense to install new machines, much cheaper in the long run. This is how companies will combat $15 minimum wage and it’s just an example of how larger companies will deal with a slowing economy. Don’t think for a second this will only affect lower paid employees. The General Motors (GM) strike was a PR gift to C-level executives as dealers had 3 production year models of brand-new vehicles on their lots; it was either a strike or forced production cuts. The UAW (United Auto Workers) gave GM necessary production cuts without the PR nightmare.

How does that bode for the US consumer? Are they as strong as advertised?

- September 24th – Consumer Confidence survey fell from 134.2 to 125.1

- October 2nd – The ADP employment numbers were lower than expected at 135k (140k were the expectations) while the previous month was dramatically reduced from 195k to 157k.

- October 3rd – The Institute for Supply Management (ISM) released their PMI data falling from 49.1 to 47.8 the lowest reading since the Great Recession (below 50 is recessionary)

Then came the ISM’s Non-Manufacturing Index (NMI). The importance of this number is it measures outside the Manufacturing sector, including agriculture, retail, transports, mining and utilities to name a few. Many of the industries supported by the manufacturing sector.

- ISM’s Non-Manufacturing Index (NMI) fell from 56.4 to 52.6 (dangerously close to a recessionary reading of 50)

- Non-Farm payrolls were next and have been revised negatively for well over a year….

All of this affects consumer confidence and spending… First comes the slowdown followed by the job cuts.

The most recent retail sales number were weaker than expected.

Because cycles matter and risk happens quickly…

Stating The Obvious

After stating all of the above – I’m well aware of cliché’s abound – “Don’t fight the Fed”.

The Fed has been in existence since 1913, they have been present and some argue, responsible, for every market implosion since… The Fed has done an excellent job at creating asset bubbles, they don’t have a great track record when it comes to preventing catastrophe.

We formally began writing on the quarters since January of 2017 (intermittently since July 2015) and the script we’ve written has been as close to accurate as it gets. Not many were telling you the Fed was going to cut interest rates, in the face of the Fed raising them while unwinding their balance sheet. As Fed officials suggested unwinding their balance sheet would be like “watching paint dry”, Fed Chair Yellen June 14, 2017, we told you why that wouldn’t be possible. Our 2Q2017 note, 1Q2018, MOAB along with subsequent notes in our archives.

The presumption of ungodly power has been bestowed upon the Federal Reserve and other central banks by investors. The number of analysts I read reporting on negative news, reduced earnings estimates, etc. has exploded and yet, the majority end with… “But the Fed will step in” or “bolstering case for more rate cuts” or “making the case for additional Fed stimulus”.

David Levine is Founder of Odin River, among other things, he is the former CIO of Artivest while cutting his teeth in the financial industry under hedge fund icon John Paulson during the 2008 crises. David also operates the twitter handle @paranoidbull.

David has recently been interviewed by Stansberry Investment Hour as well as Real Vision TV, I think this quote from the Stansberry Investor Hour episode 122 to be extremely accurate as well as poignant:

“We live in a world where people think they can tell you what tomorrows stock price is going to be, which is just insane. We live in a very short-term focused world and we live in a world where people have been compensated for ignoring all risks and being levered long beta, all at the top of the biggest bubble in history, while political risk is exploding.”

This cycle is far worse than last cycle…

“This cycle is worse because every single person you talk to will talk to you about impeachment, they will talk to you about war with China, they will talk to you about some of the most extreme political risks that you could imagine and then they’ll completely ignore that we are at the top of the biggest bubble in history in the sovereign credit market – right, we’ve got $50-60 trillion dollars of government debt that’s been intentionally manipulated and mispriced for like a decade, still like $13-14 trillion of negative yielding government debt, right, it’s just totally insane in my opinion.”

Everyone, everything, every entity has their (its) limit or breaking point; there is no unbreakable object, and I won’t be so arrogant as to tell you when the Federal Reserve or equity markets have reached theirs… I also won’t be so callous with my client’s assets as to pretend we are not witnessing the greatest economic experiment of all time, as arguably the largest risks we’ve ever seen embedded in financial markets are staring us in the face…

The Fed’s solution: more of the same which has gotten us here; absurdly low interest rates, more asset purchases bloating an already stout Federal Reserve balance sheet encouraging malinvestment, perpetuating zombie companies, stifling productivity and real growth.

But hey, the S&P…

Bart The Mother

While recently listening to Jim Grant’s “Current Yield” podcast, Grant’s Deputy Editor Evan Lorenz provided the perfect analogy to our current dealings with the Federal Reserve’s constant need to find a fix for a fix for a workaround for a fix; I thought it worth sharing.

The Simpsons… Is the longest-running scripted primetime TV series in the United States, its lifespan has lasted over 3 decades (December 17, 1989 was the original episode); An animated sitcom with a cult following well ahead of its time. Primarily known for its mature, witty humor.

“Bart the Mother” is an episode in which Bart kills a bird with a bb gun then finds a conscience when he realizes he just killed a soon to be Mother bird as she was caring for eggs in her nest. Bart takes it upon himself to then “hatch” and care for the baby bird eggs only to be surprised when the little birds hatched? They didn’t look like birds… so Bart and his mother Marge, take these critters to the Springfield Birdwatching Society, headed by principle Skinner, for a closer look.

Immediately upon seeing the creatures, Principal Skinner attempts to kill what turns out to be “Bolivian Tree Lizards” – a highly invasive “oviraptor species” that eats bird eggs, then lays its own in the nest for the mother bird to care for… Until they hatch and the baby lizards then eat the mama bird. Springfield’s law states the lizards are to be killed upon sight.

Having raised the birds (lizards), Bart doesn’t want to see them killed so he runs and allows them to escape and true to form, the lizards proceed to wipe out the common pigeon. The outcome is unexpectedly met with town cheers as pigeons were seen as “the feathered rat” and “gutter bird”. Bart receives an award for his help in ridding the town of these “flocks of chattering disease bags”; bringing me to the point. The episode ends with a dialogue between Principal Skinner and Lisa with Skinner suggesting he was “wrong” to want to get rid of the lizards: (Minute 2:46)

Principal Skinner: I was wrong, the Lizards are a God send!

Lisa: But isn’t that a bit shortsighted? What happens when we’re overrun by lizards?

Principal Skinner: No problem, we simply unleash wave after wave of Chinese needle snakes, they’ll wipe out the lizards!

Lisa: But, ah… Aren’t the snakes even worse?

Principal Skinner: Yes, but we’re prepared for that, we’ve lined up a fabulous type of gorilla that thrives on snake meat!

Lisa: But then we’re stuck with Gorillas!

Principal Skinner: No, that’s the beautiful part. When wintertime rolls around the gorillas simply freeze to death!

What will our Bolivian Tree Lizard be for out low to negative global interest rates? What will be our Chinese needle snakes for our continued asset purchases and ballooned Federal Reserve balance sheet? What will be our Gorilla for our liquidity injections into a distressed, seizing repo market? More importantly, what will be our fix for the fixer when the fixer is perceived to be the root of the problem?

Larry Hite

We’re going to finish up with another investing legend.

Larry Hite is a Wall Street pioneer, though many of you have likely never heard of. Hite is known as one of the “forefathers” of system trading. Additionally, Hite co-founded Mint investments. By 1990, Mint had become the largest Commodity Trading Advisor in the World in terms of assets managed.

Hite isn’t a household name like Buffett but he is up there with some of the best traders Wall Street has seen. Hite recently gave an interview to Meb Faber of Cambria Investments and while I hope you all take the time to listen to the entire interview, there are some very timely, priceless lessons we should consider heeding.

“Cutting your loses and letting your winners run is MAGIC; and so, I amplified that, I used options, I used spreads, but all in the service of reducing my risk and making more money.” 12:28

His 4 foundational Principles discussed in his book The Rule: How I beat the Odds in the Markets and in Lie – and How You Can Too…

- Get in the game in the first place

- Don’t lose all your chips because then you can’t bet

- Know the odds

- Cut your losers and run with your winners

Starting at minute 14:03, while these are quotes, they are snippets from a larger conversation:

Hite:

“Do you know what the one advantage of the stock market is? The one real advantage? You don’t have to play… You have the ability to choose under what conditions you play, how you play and where you play. And you get that for free… it’s an enormous edge!”

“You want to be in the best position for you… You can come out with a configuration that puts the odds in your favor. You as an investor, by yourself can set the ground rules. That’s an enormous advantage!”

“No one says you have to play, but when you play you want to make sure that you are creating an asymmetrical bet.”

“I trade risk, I am looking for the lowest risk to get the highest return… So, it’s a situational thing.”

This interview took place on October 16, 2019. I’m pretty sure you’ve heard much of the above out of my mouth before, but thought I’d share an outside “expert” opinion?!

We’ll continue focus on risk, seek out asymmetrical risk reward set ups, letting our winners run while cutting our losers before they become problematic. We remain firm in our process and discipline.