In This Article

Q3 closes. What a difference a few weeks makes. It’s October already?! They’re doing WHAT? And the lesson to be learned is. Temporary vs Permanent loss. Do you remember that conversation we had last March? Fallen Angels

Please find below a snapshot of our Solutions Equity Model performance YTD though 3Q2017 vs. broader market indices; a quick synopsis of the model, then followed by broader market thoughts.

2017 performance through Q3 for the S&P

14.24% Total Return

12.53% Performance Return

2017 performance for Q3 for the DJIA

15.45% Total Return

13.37% Performance Return

2017 performance through Q3 for our Equity Solutions Model

14.33%** Total Return

12.93%** Performance Return

Q3 closes – What a difference a few weeks makes:

The last three weeks of Q3 were a bit “sluggish” for the portfolio. It’s no secret that two historically large hurricanes made landfall here in the continental US, plowing through parts of both Texas and Florida. These events put some downward pressure on much of the P&C sector; in sticking with our discipline, we sold two core holdings, WRB and AXS. While history suggests the proverbial “pendulum” tends to over swings to the downside further than it should in times like these, our model operates on a discipline to preserve capital; A core belief of ours is we would rather “live to fight another day”, then get caught with a “fallen angel” in our portfolio should current reality not follow history. There may be a time we revisit these names in the future, but for now, we’re more comfortable not owning these names as we determine whether or not this is more a “temporary” scenario vs. one that could become “permanent” (more on this later).

We’ve also witnessed a late quarter pullback in our gold and silver holdings; while they continue to maintain a positive trajectory, they too, weighed on our performance over the late weeks of the quarter. Adding insult to “minor” injury, we also witnessed a slight sell off in a few of our most recently acquired commodity related names and while the Facebook and Amazon’s of the world continue to make daily headlines, many of these commodity related companies have outperformed the highly touted and publicized FAANG names over the last 18-24 months. As institutional investors “begin” to take notice, there is a relatively high probability these names will become a much larger allocation in the professional communities portfolios fueling future growth after their recent pause. We believe the selloff in these names is healthy, however, it, too, has attributed to a bit of the portfolios “drag” as of late.

Reading the first few paragraphs, you might think we’ve done poorly this quarter and that’s simply not the case. Our China exposure continues to drive our overall portfolio forward and with Apple’s recent addition of Tencent’s “WePay” to their platform, we may have just witnessed the proverbial “passing of the torch” as Tencent continues to ascend to the top of the World’s largest companies list (currently sitting at number 8). Given its current growth and forward looking projections given China’s greater adoption and integration of everything mobile, we wouldn’t be surprised to see it surpass Apple in becoming the largest company in the world within the next few years – We own Tencent through our NPSNY holding at a significant discount to its intrinsic value.

We’ve also collected some nice income from our position in Two Harbor (TWO), while Annaly (NLY) has given us another solid dividend along with growth and stability.

With all of the minor bumps and bruises, we continue to outperform the S&P, with a slight underperformance to the DOW, but again, this performance comes with nearly 20-25% less risk and volatility than these major indices. The portfolio is roughly 82% invested with nearly 18% in cash; 5% of the invested portfolio is still hedged in gold and precious metal names. As mentioned above, we’ve recently added a handful of high quality names which have not yet had time to begin to contribute anything meaningful to the portfolio, having said that, we are still performing very nicely.

It’s important to note last quarter we mentioned stress in the credit markets beginning to trickle into the financial system. We will further expand on those thoughts below as it’s an important piece to our investment thesis. We continue to remain cautiously optimistic while wearing our seatbelts on each core holding.

It’s October already?

Q4 is underway with the markets “shrugging off” numerous headlines this year… Everything from a Hillary defeat, multiple failed GOP Healthcare “repeal and replace” attempts, White supremacy and Anti-Fa rioting showing arguably the ugliest side of humanity, back to back Hurricanes devastating Texas and Florida with relief efforts and community coming together showing what could arguably be the best efforts of humanity! All in the face of NFL Anthem protests, and, oh yeah… N. Korea claiming the US has declared war on them not to be overshadowed by the “Oh so important,” but is it really? – Federal Reserve “Taper” as it attempts to reduce the size of its ballooned balance sheet.

“Bull markets climb a wall of worry” – the saying has been around for decades and yet… Many pay the saying little mind. Something else that appears to be a constant from the beginning of investing is “investor behavior”. As Frank Brosens of Taconic recently stated, “Fear is a far greater component to the market place then euphoria.” This, in my opinion, is why most investors (retail and professional) have such a difficult time getting it right.

“SELL EVERYTHING AHEAD OF STOCK MARKET CRASH, SAY RBS ECONOMISTS” the above is an actual headline from the “Guardian”, read it here. The headline was in response to this 55 page report.

Here’s the thing… Both the article and report were written in January of 2016.

Those who took the Guardian’s words of fear, driven by RBS’s report would have missed out on back to back double digit return years (by measure of broader indices as things stand as I write this)…

There’s a ton we could learn from history if we only allowed ourselves to; for instance, it’s October already! Seriously, where in the name of all that’s holy has this year gone? My parents would constantly tell my siblings and me, “don’t blink, appreciate these days, they go faster with every passing day”. “Yeah, yeah – sure Mom, sure Dad,” I would say while whispering under my breath how crazy I thought they were. It never ceases to amaze me as to how many things my parents “warned me about” that I paid little to no mind to (in the moment) – yet at one time or another in my life I have come to realize how correct they were, so many years ago. They literally road mapped the future for me had I only been more open to learning sooner.

History can teach us so many things, if only we walked through life with both eyes and ears open, allowing ourselves to learn from those who have already made the same mistakes. Rather, our behavior and emotions typically drives most of us to constantly repeat the same mistakes over and over again. Given this preface, please keep in mind it gives me no pleasure in beating a dead horse.

They’re doing WHAT?

I would like to stop talking about this, sincerely; I would. However, the calamities of the auto sector are simply endless. From subprime and deep subprime lending, investor malaise of accepting more and more packaged securitized loans from the financial industry, stuffed with this sub-prime debt, all while rated triple-A (by the same rating agencies that brought you the AAA securitized CMOs – I think most of us remember how these worked out?!) – There are endless topics to discuss.

From our Q1 thoughts:

The first being Auto loans, which we’ve discussed in the past, however, recent data shows delinquencies within this space to be deteriorating at a significant rate.

Per rating agency Fitch:

“Subprime asset performance remains considerably weak and continues to be affected by collateral originated and securitized from 2013 to 2015. The 2015 subprime transactions are the weakest from a credit and loan attribute perspective, even when compared to most recessionary transactions.”

Delinquencies of 60 days or more on relatively new loans are well above the 5% mark, and quickly closing in on 6%. These loans are going bad faster than they were back during the 2008 – 2009 crises. Adding insult to injury, car manufacturers are working on razor thin margins in what many would consider to be booming times for these companies.

Our Q2 note built on our Q1 thoughts showing our anticipated slowdown and inventory build:

“The market is definitely slowing … it’s something we are going to monitor month to month,” Chief Financial Officer Chuck Stevens told analysts on a conference call. “Pricing is more challenging.”

I continued…

As mentioned, these issues are not isolated solely to General Motors as Ford’s first quarter, while beating “industry experts” expectations, were 36% lower than 2016Q1 numbers. As Reuters reported here:

The company reported a first-quarter net profit of $1.6 billion, or 40 cents a share, down 36 percent from $2.5 billion, or 61 cents per share, a year earlier. (CFO Bob) Shanks said Ford’s own used-car values at its finance arm were down 7 percent compared to the same quarter in 2016, but said customers’ credit scores remained high and we “feel really good about where credit is. Clearly we’re moving to a different stage of the cycle, but we think based on what we know that we’ve got it covered,” he said.

Fast forward to late August; in the face of lack luster sales and increased auto loan defaults, have no fear, just as Bob Shanks stated, Ford HAS IT COVERED! Ford has taken matters into their own hands and announced on August 25th … Wait for it… Wait for it…

They will be changing its loan approval process TO LOOK BEYOND CREDIT SCORES in sales push!

As reported by the Wall Street Journal,

“Ford Motor Credit says it is looking at ways to increase loan and lease approvals for applicants with limited credit histories”

More from the journal:

Ford credit “has decided to change its approval process to look beyond credit scores in an effort to pump up sales”.

You read that correctly. The “different stage of the cycle” referred to above by Ford CFO Bob Shanks was a screeching halt in the purchases of new cars forcing both Ford and GM to close assembly lines for weeks at multiple plants as can be read about here and here extending the summer shutdowns by both GM and Ford which can be read about here. Leases are being turned in early at a record pace pushing down the prices of used autos and in the face of rapidly increasing subprime auto loan defaults the answer to their “we’ve got it covered” is, who cares about credit – just sell one to anyone with a pulse?! My guess is they’ve got their PR game faces on and any dealership you speak to will likely suggest they’ll keep things on the up and up… They’ll only go as low as 400 on the credit scores… SMH.

And the lesson to be learned is?!

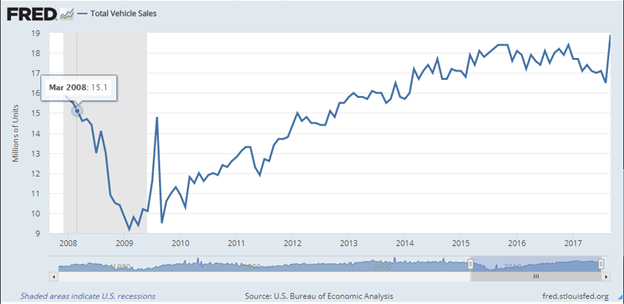

Immediately following the close of Q3 Auto manufacturer announced their BEST September since 2004. Per the U.S Bureau of Economic Analysis, total U.S. vehicles sales spiked to an annualized rate of 18.9 million.

Previous estimates suggested that Hurricane Harvey destroyed nearly 500,000 vehicles, while Hurricane IRMA side lined roughly 200,000. Asreported by Reuters, post hurricanes; it looks as if this is exactly what’s been replaced. From the Article:

While the hurricane recovery drove sales, “this will be a short-lived party,” said Michelle Krebs, executive analyst for online sales site Autotrader.com

More from Reuters:

New car sales in the Houston area, the fourth most populous in the United States, jumped 109% in the three weeks after Hurricane Harvey compared with the three weeks before the storm, according to car shopping website Edmunds

From my vantage point, it looks as if two tremendously destructive hurricanes, coupled with extremely motivated sellers offering attractive dealer incentives brought consumers back to the showroom. These buyers opened up their already strained checkbooks proceeding to add considerably more debt to an already unclimbable Everest. Yes, the insurance industry may have picked up some of the tab here, though, I’d bet dollars to donuts there is a significant GAP that’s been created (i.e. amount collected on junked car vs. what was paid out to buy something new). This is a “gift” to Wall Street, as it now opens the door for more deep subprime securitized loans to be produced and sold to rate starved investors, prolonging what seems to be the inevitable.

With people now focused on the headline “best September since 2004”, Ford has laid a new path for future growth to be generated on the backs of those who have the most difficulty carrying such a burden, since after all, now they can look BEYOND credit scores. My guess is this current rally is relatively short lived, as was the case during the times of hurricane Sandy; which provided little more than a cyclical bump; yet stranger things have happened.

Having said this, recent activity in Ford has the stock up nearly 25% in just over a month. While many are tired of hearing me speak to the woes of the US Auto sector, it’s extremely important that we pay close attention as it’s one of largest manufacturing segments of the U.S economy, as it goes, often; it’s how the economy goes.

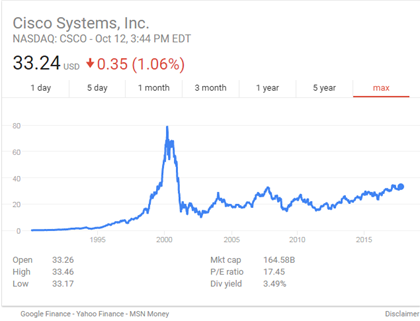

So what’s the lesson to be learned? There are a few in this section… 1. Never discount how far a company will stretch to survive. 2. I’ve outlined in great detail for years now, the disaster referred to as the US auto industry speaking to the hidden pitfalls, and I’m sure many have “traded” Ford stock over the last few years and may have profited; though, there is a difference between trading and managing portfolio risk. Some may say “I’ve been wrong” on this thesis? And this is a perfect example of my extensive writings on “being right while being wrong”. Over the last 5 years Ford (F) has lost nearly 45% of its value – with this short term rise of 25%, those who owned it at $18 are still “roughly” 75% away from breaking even (but clearly it’s temporary… or is it? more on this next).

For those who take the time to read these notes, a constant theme we carry about investing is; It’s not about being right on any one particular investment or thesis, but more so about preventing your “wrongs” from being detrimental drags on your portfolio. We believe investing is more about capital preservation and managing risk. It doesn’t matter how “sound” I believe my investment thesis to be, markets can remain irrational longer than most investors can remain solvent (this is not a cop out nor refusal to admit being wrong, being wrong is part of this business – more on this below). The “phenomena” of a particular investment not moving in the direction an asset manager believes the data suggests it should, is present every single day, in just about every portfolio.

We don’t own Ford, our current model isn’t permitted to short names, though “had we been” involved with Ford in any way, shape or form, our position would have most definitely been to the short side quite some time ago (as you could have guessed from our writing). While we could argue the semantics of where we would have shorted it (much higher) I can tell you exactly how we would have managed our risk had we been involved in the name. Ford has a volatility of roughly 17.5%; we would have covered our position nearly 8-9% ago based on our disciplines. Without a specific date and short price, we can’t say with “certainty” that we would have had a gain, however, what we can absolutely say and be sure of is, this recent action would have produced nothing more than a minor hiccup for the overall portfolio given our capital preservation strategies and VAPS (Volatility Adjusted Position Sizes).

Temporary vs. Permanent Loss…

In our above synopsis, we briefly outlined our thoughts on the P&C insurance sector; with history showing us there is a typical overreaction (to the downside) by financial markets in these names during times of “unknown loss”, often rebounding when the estimate of loss becomes more of a “known known”, and being less severe than originally believed to be. We also just spoke of Ford, its recent behavior in financial markets and the importance of our “core belief”, which is preservation of capital, and how to treat a position when it moves against you and remaining disciplined.

If someone asked you to provide an off the cuff description between permanent impairment and temporary loss, you might think it to be easy; any longtime owner of Lehman brothers, Lucent, Enron, Blockbuster (to name a few) might suggest with frustration that permanent impairment is losing everything, while “Temporary loss” is just that – temporary. Most every equity investor has experienced some form of temporary loss (whether they realize it or not), buy any stock and have it trade or close below your purchase price and viola, temporary loss…

Pretty cut and dry, right? Not so fast… Permanent impairment is losing everything (we can all agree on this) though, a “grey area” exists within the definition of “temporary loss”.

We talked about the Japanese markets in our Q2 note – Again (Nikkei) peaked back in 1989 just over 38,700. 28 years later, after dipping into the low 7,000 range, the Nikkei trades just over 20,600.

How would this be classified; permanent or temporary? How would you view it if you were 2 years away from retirement and a “buy and hold” index investor looking at this chart? Now consider you’re “attempting” to withdraw 4-5.5% as income supplements to fund your retirement! With the Nikkei at roughly 20,600 – you still need to just about double your money from current levels simply to break even. I won’t re-hash the DJIA taking nearly 26 years to surpass its 1929 peak following the crash leading us into the Great Depression… In the Nikkei’s case, the answer remains ambiguous, in the DJIA scenario, it was 26 years; lost decades.

Once considered “Angels” INTC and CSCO haven’t come close to “fully recovering” since their 2001 highs, which I guess could fall under the “grey area” of temporary?

For those who don’t remember Citigroup reversed split its stock and those investors who have held since 2007 are still down as much as 90%. Is this considered “temporary” if you are a buy and hold investor? Anyone who bought Citigroup near its high of $570 in December of 2006 and has simply held that position needs a rally of roughly 600-700% to simply break even on the position, but hey, it’s temporary, right?

Wall Street darling Goldman Sachs JUST recently broke even…

Mom and Pop investors don’t move markets; they are not the largest shareholders of these companies. Individuals and professionals alike tend to get blindsided by these downturns, which is why most mutual funds are adversely affected in bear markets.

If you were buying shares of Fannie Mae and Freddie Mac back in 2007/2008, you may have felt like you were on Disney’s Tower of Terror until it finally free fell to the basement floor. (But it’s backed by the government!) How many Puerto Rico bonds were bought by those believing PR is a “moral obligation’ of the U.S. government?!

Think about this for just a minute… At its peak, Valeant Pharmaceuticals was one of the most widely held stock in the marketplace; some suggested more professional money managers owned VRX than any other stock at a point in time, yet it fell from nearly $280 to $8.31 – the most brilliant minds on wall street buried themselves in these “safe havens” which eventually became “fallen angels” (more on this later).

How many professionals were buying Lehman Brothers as it was in near free fall thinking, “man, this is becoming such a good “value” – Lehman brothers won’t go out of business”? More than likely, they had the same thought about Citigroup as it was falling off the proverbial cliff during the great recession?

If so many were wrong on government backed Fannie Mae, how can you tell the difference? And if the answer, sincerely is, that you can’t… How do you mitigate your risk in an effort to protect yourself from getting caught up in something like this?

I point to this Warren Buffet quote frequently –

“Rule

number one: don’t lose money, rule number two: don’t forget rule

number one.”

– Warren Buffet

People love Warren Buffet quotes (myself included), reading this quote, being conscious of what he’s saying in the news and studying his actions does make me scratch my head though. No, I’m not poking the bear, I believe he’s a brilliant man, however; I also like to step back and ponder on things that may not make complete sense to me (its ok to question things regardless of who you’re speaking of). Warren Buffet has recently been public about investing in Index funds, and while I happen to think there is a time and a place for index funds, he’s also a man who has nearly 40% of his investible dollars currently in CASH. Index funds don’t have 40% of their assets in cash.

Berkshire Hathaway A shares fell from nearly $140,000 per share to roughly $78,800 from 2007 – 2008, that doesn’t sound like he followed rule number one or two. During that time he also made large, opportunistic purchases (he was greedy when others were fearful) Yes, Berkshire’s loss was temporary (4 years temporary until September 2012) and now Berkshire has moved higher over the last 5 years, but again, how did you know the difference between Berkshire’s “temporary” or government backed Fannie’s “temporary” (if that’s what we’re calling a virtual 10 year wash out)? The answer is most, usually don’t and can’t. (We’re not even touching upon questions like; did you need any money during that time? What if interest rates skyrocketed on your fixed income investments, etc.)

So I ask again, how do you mitigate your risk in an effort to protect yourself from getting caught up between permanent or temporary loss? What are your rules? Do you even have any?

Do you remember that conversation we had last March?

Discretionary accounts are not “typical” on this side of the business; many brokers may “act” with discretion when they don’t have the ability or authority to do so, but that’s a story for a different time. My typical days are comprised with hours of reading, research and writing. Truth be told, I often feel like a bit of a hermit… It’s kind of a catch 22 – I do more reading and research than I’ve ever done while in previous positions; it’s a necessity in order to be relatively good at what I do, yet, I don’t have a job unless I get out and find new investors or keep up with my clients…

I recently put down the reading and made a few calls to some friendly voices; I was a bit surprised to be met with the same phrase… “I was just thinking of you?” – The first time I heard it, I quickly took a mental inventory of current events… Performance has been solid, I can’t think of an adverse event in any of these accounts… “Good things, I hope,” I said.

“Do you remember that conversation we had last March?!” I knew immediately where this was going. They continued, “You had mentioned something at the time and it stuck with me, as it sounded so crazy”.

Toys R Us had just filed for bankruptcy protection. Many of you who read these notes have come to learn my primary fear in today’s current economic landscape is the tremendous volumes of debt that exists. Government, corporate, consumer, sub-prime, or bank investment grade debt (that shouldn’t be) has all risen to levels never seen before. The idea that debt had been properly cleaned out and restructured during the 2008/2009 housing crises, both domestically as well as globally, is just factually wrong with more debt existing today than ever before. While “too big to fail” financial institutions like Bank of America are now bigger post crisis given their acquisition of companies like Merrill Lynch who were bought out of necessity, not want, so are Debt to GDP levels.

I am by no means a high yield debt guru, though the guys over at Stansberry research, have done a tireless amount of work on raising awareness of the egregious amounts of debt that exist today, spoke to the importance of Toys R Us, and their debt restructuring last March. As much of their work often does, it caught my attention. As many of you know, I believe they are some of, if not the smartest, most honest guys in the financial research business, their work on Toys R Us proved to be spot on, yet again…

Toys R Us bonds had been trading around the 95 level until very recently when, bids fell off a cliff just days before the company filed for bankruptcy protection. “Yes, I remember the conversation – I remember it vividly,” I said.

The importance of my conversations, both a year and a half ago and my writing about it now is less being involved in a specific trade and more so in where we are in this corporate debt cycle. This particular debt was not bank investment grade credit, even still, owners of the bonds didn’t see the bankruptcy coming (as suggested by the strength in the bond prices merely days before the announcement). With rates as low as they are, will investors continue to allow subprime companies to restructure debts at these obscenely low yields. At what point will investors demand some form of return given the inherent risk in these products? Government bond buying programs around the globe have skewed markets into a false sense of security.

As a junk rated credit, Toys R Us is no “Angel”, but with bonds trading near par value ($950 per $1,000 bond), it was trading as if bankruptcy was nowhere in the minds of those who owned these bonds as they stretched for yield. Just how many “Angels” are out there trading at or near par value which may be “days” away from filing Chapter 11?

Fallen Angels

In his 1982 book, “The Art of Selling Intangibles”, Le Roy Gross suggests:

Many clients, however, will not sell anything at a loss. They don’t want to give up the hope of making money on a particular investment, or perhaps they want to get even before they get out. The “getevenitis” disease has probably wrought more destruction on investment portfolios than anything else. Rather than recovering to an original entry price, many investments plunge sickeningly to even deeper losses.

Hersch Shefrin and Meir Statman explore this thought as they study theory and evidence of the “Disposition effect”, suggesting investors sell winners too early while riding losers too long. You can find their work in the Journal of Finance, Volume 40, Issue 3 (published, July, 1985)

Whether scholars such as Gross, Shefrin or Statman, or even Warren Buffet go on record suggesting “Selling” is arguably the largest challenge investors’ face, these men undoubtedly have a much greater understanding of what amounts to be “Academics” in the world of investing, then I. If markets were only about “academics”, all those PhD’s would be retired from making so much money managing assets; and the Federal Reserve PhDs and Financial institution CEOs would never have been blindsided by the mortgage meltdown of 2008/2009, but that’s simply not the case.

There is no economist, investor or analyst in this world that can rationally explain to me how Tesla (TSLA) who delivered 76,230 cars in 2016 should have a markets cap of nearly $56 Billion dollars. The company has failed to meet virtually every manufacturing and sales target it has set for itself. The company has over $10 billion in debt; it’s chewed through more than $10 billion in cash since 2012. Given its current cash position and burn rate, it could be out of cash by 1Q/2Q2018 unless it raises more capital in the not so distant future? Ah yes – and it has never turned a profit, EVER. Adding insult to injury, once TSLA surpasses 200,000 vehicles sold, it will also lose its government subsidy at a time where competition in the electric car market is about to explode with tremendous supply coming from viable, currently profitable auto manufacturers from GM to BMW, Audi and Mercedes to name a mere few…

Nope, I’m not missing anything (other than making money in the stock’s historic rise) – I’m not missing the “green” aspect, clean energy, less fossil fuels, the solar roofs, the batteries, the home generators or that the top line class has so many bells and whistles it will make your head spin, all while being one of the fastest production vehicles on the road… I’m not missing any of it, in my world, at some point a company needs to make more money than they spend; the time comes when fundamentals trump “potential” (maybe the US government debt model is showing us something different?) There may come a time where markets will be free rather than money simply being free. We can only ponder how things may look if money were more expensive to borrow; maybe it wouldn’t be given away so freely?

For as much strength as TSLA has in today’s markets, I’m wondering if “electric cars” with government subsidies is simply more “sexy” then an iconic toy retailer?! Always remember, just because you believe your thesis to be rational, doesn’t mean the markets will feel the same way at the same time! My belief is Elon Musk, TSLA and their new bond holders will fall, hard; though many will continue to hold the name thinking, “but its Tesla, it’ll come back”.

A “fallen angel” is a one-time Wall Street darling, highly touted and loved by many, though, experiences a steep decline in price from a once previous high; a fall from grace, if you will, creating many unhappy investors as most continue to hold on to these securities “hoping” for it to regain its glory. Hope is not a strategy…

Is Tesla a future “fringe” fallen angel? While there is brand recognition in the high flying name, it does carry a junk rating on their debt “warning” people that it carries with it more risk than bank investment grade debt.

AT&T (T) however, is currently bank investment grade, rated triple-B-plus. Post-acquisition of Time Warner (whom (T) is buying for nearly $85 billion dollars), some analysts anticipate their leverage to be roughly 3.7 times with nearly $250 billion of debt (comprised of on-balance sheet as well as off balance sheet debt; off-balance obligations consist of items such as operating leases on cell towers which must be included as debt per FASB, unfunded pension obligations and healthcare expenses).

Highly respected research analyst, Craig Moffett of MoffettNathanson has been rated the #1 analyst in the U.S. Telecom sector by Bloomberg among numerous other accolades. You can hear him speak of the merger here, In May he upgraded T from a Sell to Neutral, which you can read about here, though I have pulled an excerpt below:

“Certainly, there are few positive signs to which to point,” Craig Moffett wrote in a note to investors. “Competitive intensity may have ebbed a little… but only a little; in fact, just last week, after talking about pulling back, both Sprint and T-Mobile launched yet another round of aggressive promotions. And things will likely only get worse when the next iPhone comes to market this fall. Meanwhile, Verizon and AT&T are both shrinking at their fastest pace ever; indeed, every one of AT&T’s major business segments is now contracting. Only international, which represents just 5% of revenues, is actually growing.” (Emphasis mine)

Many investors have believed AT&T to be a relatively “stable” name over the years. Investors who are looking for safe income streams may flock towards T’s 5.1% dividend yield? Let me ask, would you consider a company with nearly 3.7 times leverage, $250 plus billion in debt and a mere $7 billion in cash, with every business segment contracting, “SAFE”? Just look at this number ($250,000,000,000)

Did 2007-2009 teach us nothing about leverage? Inevitably, all of us at some point will likely own some names that may appear to be “ahead of themselves”; there will more than likely be some very familiar “Angels” that we all know and love which won’t survive the next credit default cycle. If this is the case, what rules do you use to protect your capital when you own stocks that may not necessarily trade rationally?

I leave you with a final lesson to be learned from the “who’s who” of the investment community…

Over the last few weeks I’ve had the privilege of sitting in on a few very prestigious investor conferences, learning from some of the most respected Wall Street minds. From the likes of Alan Greenspan, Jim Chanos, Frank Brosens, Porter Stansberry, Steve Sjuggerud, David Lashmet, Erez Kalir and Marty Fridson to name a few. These consummate professionals both presented and answered questions from audiences of equally intelligent professional investors at their respective conferences. Listening to the who’s who of the investing world was a tremendous opportunity to learn. To be clear, learning doesn’t mean “regurgitate”; what you learn may not come in exactly what is being said, but often, in what’s not being said or what can simply be observed?

I’ve been lucky enough to capture the thoughts of some of the most influential minds in the financial world over the last three weeks; it’s been mind-numbing. However, there is a tremendously important takeaway from all of this. Given all this fire power at these conferences, there have been 2 common themes that continue to resonate with me, I thought I’d share.

The first constant: The absolute best of the best, the smartest of the smart, those presenting or in the audience, regardless of conference I was at, constantly asked a singular thing. The question can be phrased countless ways, yet it usually boiled down to one simple word, “When”? When do you see markets crashing? When do you see inflation rising? When do you see interest rates moving higher? When will all the debt on the BOJ’s (Bank of Japan) balance sheet come to roost? What’s your timing on all of this going down?

When simplified, the question was always, When, WHen, WHEn, WHEN?!! The answer, is inevitably boiled down simply to, “I don’t know”?

The second constant focuses around, what I found to be the highlight of multiple conferences for me, which was a debate between James Grant and Jeremy Grantham, two brilliant minds of the investing world. I won’t give away anything from the conference; merely point to a high level observation. The debate was titled “Resolved – It Actually Is Different This Time”. Two Scholars laying out there cases for the current market landscape and what the near and long term future holds for investors in financial markets? Both men have called major market events prior to “said events” coming to fruition – yet on stage, these walking financial encyclopedias had a completely two completely different outlooks (hence a debate – wouldn’t be much of a debate if they both agreed, right?)

Let me summarize these two observations! All the best, most intelligent investors wanted to know from their presenting peers was, “when they foresaw something happening” and even the smartest can’t agree.

Sound, unbiased research is necessary to be a successful investor, prudence is required, though regardless of how promising a balance sheet looks, or how deep a “value” any specific name may be, the reality is things don’t always work out as investor (professional or individual) believes they should. Book value is a moving target and a name can always get cheaper. Our belief is, there comes a point where “pride” needs to step back and prudence should then take a step forward. Our philosophy would rather err on the side of prudence before tiny ripples become thunderous crashing waves. Our goal is to allow winners to run, while cutting losers before becoming problematic. Will we always be right – ABSOLUTELY NOT, we are merely attempting to put the odds in our favor by sticking to our rules and discipline. As outlined above, numerous “we don’t know” scenarios exist (for us as well as the Grants and Grantham’s of the world), we feel it’s prudent to then, take a breather when “markets” decide it’s time to shake out the permanent losers from those which will become temporary. After the markets have made their decisions is when we’ll feel most comfortable stepping back into any particular name? We’re ok missing the absolute peaks and valleys; there is plenty of money to be made in-between the extremes.

Final Thought

There is a relatively new documentary on NETFLIX titled, “Steve Jobs, The Lost Interview”. In this particular interview, he said something which I thought was worth noting and passing along.

First, he noted something about life:

“Life can be so much broader once you discover one simple fact – and that is everything around you that you call “Life” was made up by people that were no smarter than you. Once you learn that – you’ll never be the same again”

He the then noted about business:

“Throughout the years in business, I found something, which was… I always ask why you do things. And the answers you invariably get are, “oh, that’s just the way it’s done”. Nobody knows why they do what they do. Nobody thinks very deeply in business, that’s what I found.”

He continued:

“So in business a lot of things I, I call it folklore. They’re done because they were done yesterday and the day before; and so what that means if you’re willing to sort of ask a lot of questions and think about things really hard, you can learn business really fast; it’s not the hardest thing in the world. It’s not rocket science.”

History has proven time and time again that even with all the titles, PhD, CFA, CFP, etc. very few actually “think about why they do what they do” especially in the context of Jobs’ quote. Academics often speak in absolutes, for example, CMO’s have never defaulted… until they do! People rely so heavily on labels and assume those referred to as experts have everything under control. 30 years doesn’t necessarily create an expert if that person has done the same thing and made the same mistakes for 30 years. Many of the most well respected money managers in the world couldn’t tell the difference between what was to inevitably become permanent loss vs temporary setback during the tech and housing bubbles – the best PhDs at the Federal Reserve couldn’t spot the housing crises coming – the best CEO’s and their companies managed risk so poorly they sent themselves into bankruptcy or forced merger. What it it’s less “spotting it coming” and more, stepping out of the way if it really looks like it might be?

My belief is there are fewer portfolio managers who actually “get it” in this business than those who don’t. Even fewer which can act based upon prospectus; Erez Kalir of SAM (Stansberry Asset Management) “Gets it”, Jim Grant or Grant’s Interest Rate Observer, “Gets it” but many just don’t. It would more than likely behoove most to stop listening to what every “expert” on CNBC or Bloomberg is saying and just think about things rationally for a moment?!

Ask yourself a question, how can I capture the upside of the market while protecting my downside? That answer is relatively simple: own high-quality names and use capital preservation strategies (removing emotions) OR call us. Yes, that is the extremely simplified version which doesn’t cover or protect against a “Black Monday” scenario – there is a bit more to it than that but “It’s not rocket science folks.”

In the spirit of Steve Job’s quote, very few people talk about the “Other Side” of the investing story – that’s what we attempt to do here. We make painstaking efforts to educated investors about the Other Side, and then ask which side they’d prefer to be on?! Which side allows them to sleep more soundly at night?

As always, please feel free to reach out with any questions or concerns.

Good Investing,

Mitchel

I knew this was getting long, but here is an important Bonus paragraph for those interested in large geopolitical events… I would highly recommend you read it…

Don’t get caught off guard…

Back in June of 2015 I began documenting and sharing my thoughts with a small group of clients and prospects. Some reading this today have been doing so since the beginning, while others, we’ve picked up along the way. August of 2015, I wrote a few notes speaking to the IMF’s inclusion of the Chinese yuan as a new reserve currency, suggesting that finally, after all these years, China had jumped over enough of the hurdles the IMF committee had laid out for them and as the world’s second largest economy, it, was now their time. On November 30th, the IMF made the official announcement; we followed with another note December 1. (See attached)

From our December 1, 2015 note:

Without question, the U.S. Dollar is still the world dominant reserve currency, this is not up for debate, nor has it been in my previous notes. What is up for debate is now with the Chinese Renminbi (Yuan) considered an official reserve currency for the IMF’s SDR basket, market share of the dollar amongst “World Settlements of goods and services” will begin to diminish. As market share erodes, demand inevitably decreases. While this will take some time, the speed at which it happens is more than likely faster than most anticipate. The door has now been opened for the second largest economy in the world to compete on the currency stage where the dollar has had very little competition in recent history.

As you can see, we mentioned the changes would most likely be gradual at first, yet “the speed at which it happens” is even faster than we anticipated. In less than two years, this could become one of the most important announcements of the modern, global era, and in typical mainstream media fashion, this news, while mentioned, seems to be getting swept under the rug.

According to the Nikkei Asian Review, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”

Crude oil has primarily traded around the globe in US denominated dollars for decades creating an elevated demand for dollars; it’s mostly been priced in either Brent Crude or West Texas Intermediate (WTI). While the Chinese exchange is not fully operational the INE (Shanghai International Energy Exchange, a subsidiary of the Shanghai Futures Exchange), reported successful testing in production environment for the crude oil futures and their hope is to be operational by the end of this year.

Simply adding a futures contract denominated in something other than US dollars might not sound like that big of a deal to some, to others… it’s much more than that. First, it’s “convertibility to gold” pegs the price to a hard asset. Next, any trades in the Yuan is one less trade denominated in dollars, clearly increasing demand for the yuan and decreasing demand for the US Dollar. Additionally, there could be some much larger geo-political implications to this as it’s no secret there are some countries that don’t get along all that well with the US. Russia has worked with China for years now in an effort to minimize their use of the US dollar. As the Nikkei Asian Review points out, oil exporters like Russia and Iran (even North Korea for that matter), could possibly skirt by U.S/UN Sanctions by trading their oil in Yuan and then converting it to gold (taking little to no Yuan currency risk).

China is the largest oil importer in the world, importing from countries all over the world; like it or not this will have a significant global impact over time; the question which still remains is, when? Over how long a period of time will it take to become a major impact to the dollar? This is not something to sweep under the rug and definitely something to be aware of over the next few years.

Legal Information and Disclosures

This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. Other Side Asset Management, LLC. has no duty or obligation to update the information contained herein. Further, Other Side Asset Management, LLC. makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Other Side Asset Management, LLC.. (“OSAM”) believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Some headlines have been slightly modified, shortened, broken into multiple levels in order to fit our Web-based table of content – early PDFs are all in original form as they have no hyperlinked Table of Contents…

**To reiterate: Past performance is NO guarantee of future results. You can lose all of your money investing in the equity markets. Performance varies slightly based upon; differing fee schedules, total dollars invested, fractional shares are not purchased, “date of entry” the portfolios most recent “volatility adjustment of position size”, along with many other unforeseen variables, et al. If “date of entry” into the model is after January 1, 2017, your performance numbers are based upon date of money being in good form to invest. Call with specific questions or concerns. Additionally, these are my views, thoughts and opinions which may differ from that of the firm. These are the views I use to gauge how I run my discretionary Equity Solutions Model.