In This Article

The Inflation Debate…

“…when a successful trade becomes consensus, the clock is more than likely ticking… Year-over-year growth should explode higher over the next few month due to the base effects of last year, though we could very well be a mere quarter away from reaching the top of a market decline that will make most investors feel like a novice skier being Heli-dropped at the top of a triple black diamond ski slope.” OSAM March 2020

We’re going to do a little something different this month; we kindly ask for a little grace.

As the inflation debate rages on, we thought it best to approach this note with more visual aids than words (hence the length, don’t let it discourage you from reading, it moves quickly). Our guess is that all readers have heard the expression, “a picture’s worth a thousand words”?! We’ve worked on limiting text, interjecting thoughts between poignant imagery with this thought in mind.

As you move through the note, please consider whether your personal experiences are in line with the presented data driving our current views. Taking it a step further, please contemplate how our discussion might affect different income demographics differently?! As always, should you think we’ve completely missed the mark, let’s have a conversation!

In March, when we wrote today’s opening words, forward looking data was suggesting we were close to seeing peak inflation hence our views on, “a mere quarter away”. And with 3Q2021 a mere few days away, some growth and inflation data have, in fact begun to decelerate.

So, are we still headed for that triple black diamond ski slope that we mentioned in March?! The answer to this question is probably, but more than likely not just yet? This piece will explain our ambiguity…

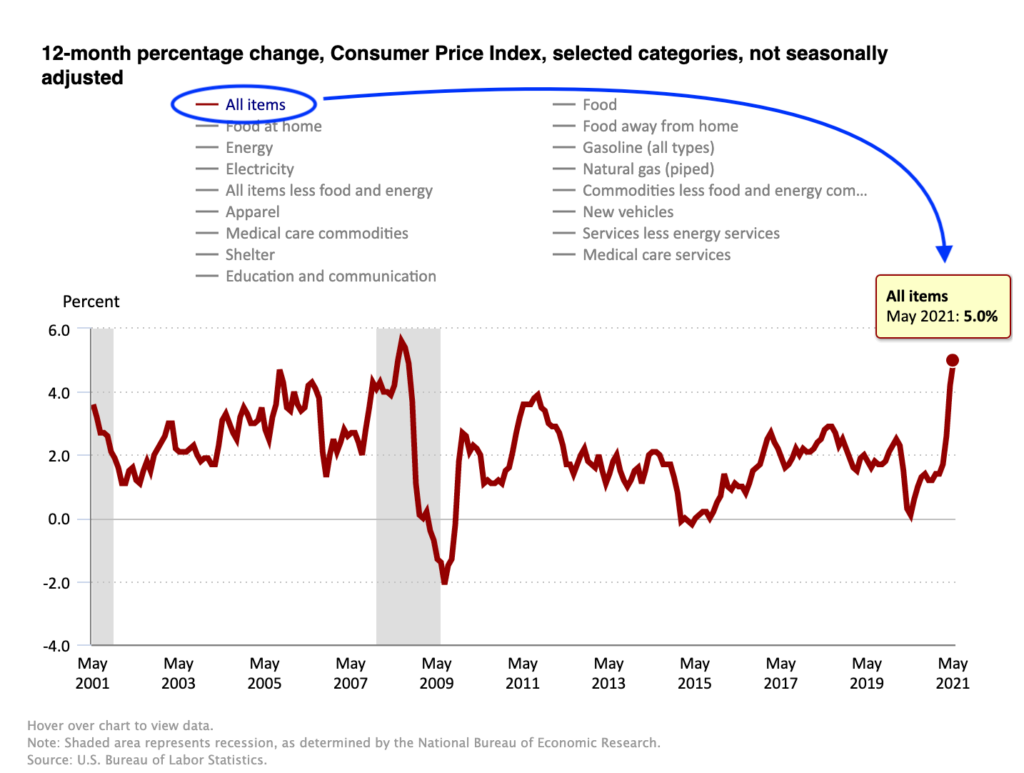

Earlier this month, the CPI (our government’s primary measure of Consumer Price Inflation) hit 5%. At a time when Federal Reserve officials have attempted to downplay, and at times, outright dismiss inflationary pressures.

While overall, growth and inflation data may be slowing as some components soften, arguably, the most heavily weighted of inputs have either just begun to move higher (Shelter) or conditions remain favorable for them to reach new cycle highs (Oil). This divergence in data may create and environment which fails to press overall growth and inflation to new cycle highs, however, it very well could be strong enough to maintain a persistently high level of inflation, well above that of what we’ve seen in recent history. A scenario which could bring us to an environment that looks more like a short-term bout of “stagflation” delaying the “deflation” the data was suggesting would currently be facing.

Stated differently, we’re moving from an environment where growth and inflation has accelerating faster than any previous time in history to one where both will be mildly decelerating, yet still persistently high. For a moment, think stepping on the gas of a Porsche, launching it from 0 to 100 mph to then lighten up on the gas pedal gently settling your speed at a comfortable 90 mph. Quite different than a deflationary event which would be akin to slamming on your breaks abruptly decelerating from 100 to 20 mph.

The importance of it all is this current scenario could provide us with a longer landing strip before we reach that triple black diamond mountain we referenced in March?!

Persistently high?!

A “deflationist” might point to a commodity like lumber as a data point suggesting that inflation has already rolled over. And while Lumber is admittedly down roughly 50% from recent highs, it’s still up over 100% YoY (Year over Year) and +15% over the last 3 months … so while this recent correction could be considered “deflationary”, the up 100% represents “persistently” high.

At last check, the most recent decline has yet to be passed along to builder lumber packages which have seen ZERO meaningful decrease in pricing, which equals persistently high housing prices. A deflationist might then suggest that housing starts & new permits have started to roll over … which is also true, and we’d counter with Inventory continues to be at near record lows as BlackRock has just re-entered the single-family home rental market with a $6 billion dollar investment further reducing inventory (persistent).

What’s most important to remember is lumber is not nearly as heavily weighted in CPI numbers as say, SHELTER or OIL which we’ll elaborate on shortly…

In similar fashion, many in the deflationary camp are now pointing to the current decline of the 10-year treasury to a 1.51% being a deflationary signal. Deflationists are POSITIVE the peak in yields occurred at the end of March when the 10-year hit 1.765%. Be mindful these are the same “experts” who have watched rates soar from an August 2020 low of 0.504% and not a single deflationist called this historic back up in yields as they’ve had their faces ripped off.

As the 10-year makes a series of lower highs (yields) in conjunction with lower highs, what if the 10-year is doing nothing more than consolidating like Oil did as we described in March? What happens if the 10-year breaks out to higher highs as a myriad of inflationary data presents itself in the following months as we’ll discuss below?

THE FED SHOCKS MARKETS

“The process of reopening the economy is unprecedented, as was the shutdown at the onset of the pandemic. As the reopening continues, shifts in demand can be large and rapid, and bottlenecks, hiring difficulties, and other constraints could continue to limit how quickly supply can adjust, raising the possibility that inflation could turn out to be higher and more persistent than we expect” Fed Chairman, Jay Powell June 16, 2021 Press Conference

NO SH*T JAY…

For the last year the Federal Reserve has downplayed and muted any talk about inflation; from denying the price increases which has engulfed every American over the last year even existed (something we have vehemently rebuked) to, should we get inflation (which doesn’t exist now) we’ll let it run hot for a while (but if it does it will be transitory). To finally admitting what we’ve been telling you for over a year, that “inflation could be higher and more persistent than we expect” … No sh*t Jay!

This shift in Fed tone SHOCKED the market last week with fear becoming the prevailing emotion for what WAS the first anticipated rate hike built into the Fed’s perpetually wrong “DOT PLOT” has now been pulled forward from 2024 to 2023; Gasp, the horror that there now “could be” be the possibly of 2 whole 25 basis point hikes 2 years from now!

Alright, we get the panic (sarcasm) … Fed officials did open the taper conversation, reducing current QE (Quantitative Easing) sooner than anticipated. Last weeks knee-jerk reaction from investors came in the name of a “possibility” (a might, maybe, we’ll see) that the Fed Funds rate could be increased by ½ a percent, 2 YEARS from now, while over $2.4 Trillion more in bonds are committed to be purchased by the fed over via QE) over the next 2 years ($120 billion per month). Can someone tell me how fragile a financial system is when a 50-basis point move in rates over 2 years from now and $2.4 trillion in asset purchases isn’t enough and shocks markets?!

Reminder: we were ahead of this tapering discussion and echoed a possible solution floated by Credit Suisse’s Zoltan Pozsar in last month’s note during our discussion surrounding the RRP (Reverse Repo) Market (which eclipsed over $803 billion today with 75 counterparties) … good times, good times…

Sure, the system is stable!

THE EVER ELUSIVE 5%

So, what could the Fed possibly be looking at that FORCED them to make this abrupt about face in their language?! Long time readers know and understand that we believe the reported CPI to be a bullsh*t number. The calculation is old and antiquated; the Fed has changed the rules as to how it’s calculated numerous times. In no way is it a true representation of the real economy, as it consistently under reports real inflation, however, it’s what most of the Fed policy is based off. Unfortunately for the Fed’s narrative, June’s CPI report was one hell of a whopper:

As you can see, the last time the CPI registered over 5% in the last 20 years would be July of 2008. At this point it’s nearly impossible for Federal Reserve and government officials to hide behind the “there is no inflation” mantra; “transitory” is the best they’re going to be able to do as even muted inflation data smacks all Americans in the face.

While 5% CPI is a massive print, we believe it’s more important to peek under the hood of what got us here to determine whether “persistent” over the next few quarters is POSSIBLE and/or PROBABLE, ultimately prolonging a deflationary event or not; so, let’s take a look!

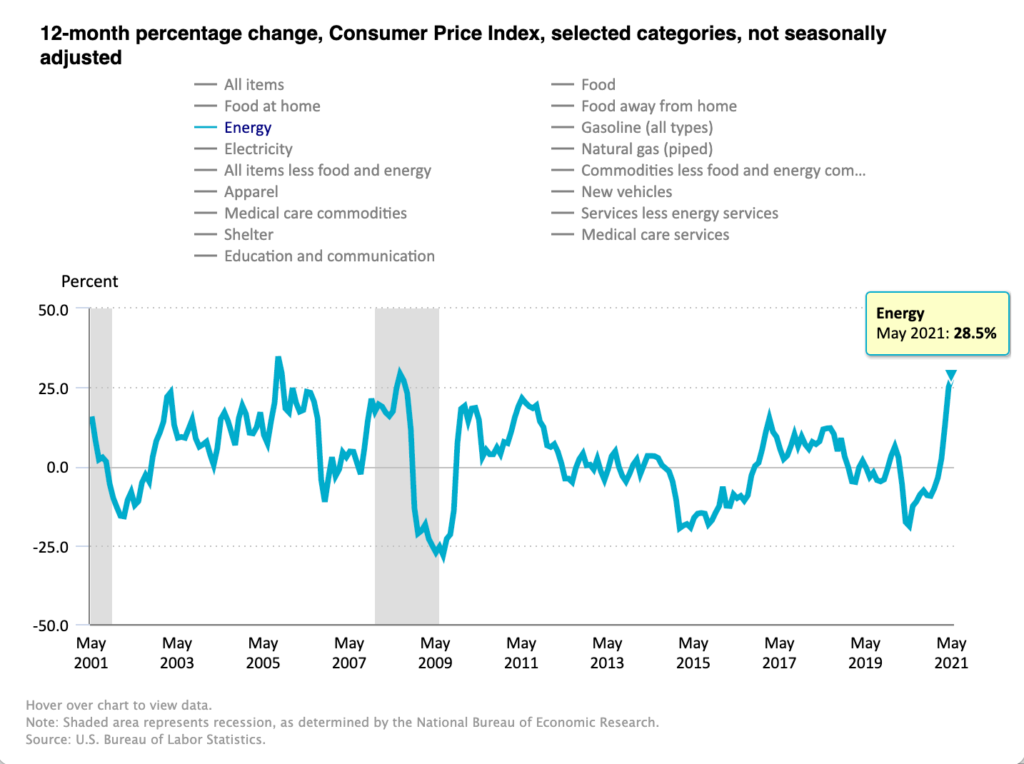

We discussed our positioning in Oil/Energy companies in our most recent quarterly. At the time these positions were a short term drag on our performance. As we stated at the time, it was our opinion that oil and energy companies were in a consolidation phase, which is what drove us to increase our position sizing … which, in retrospect it was a good decision.

Energy prices have exploded as Oil continues to push new cycle highs nearly daily. Economies around the globe continue to re-open, summer driving season is upon us, air travel is normalizing to pre-pandemic levels while refiners have yet to fully ramp production; all of which has oil pushing $75 p/barrel. June’s most recent CPI print does NOT reflect current per/barrel oil prices of $75.

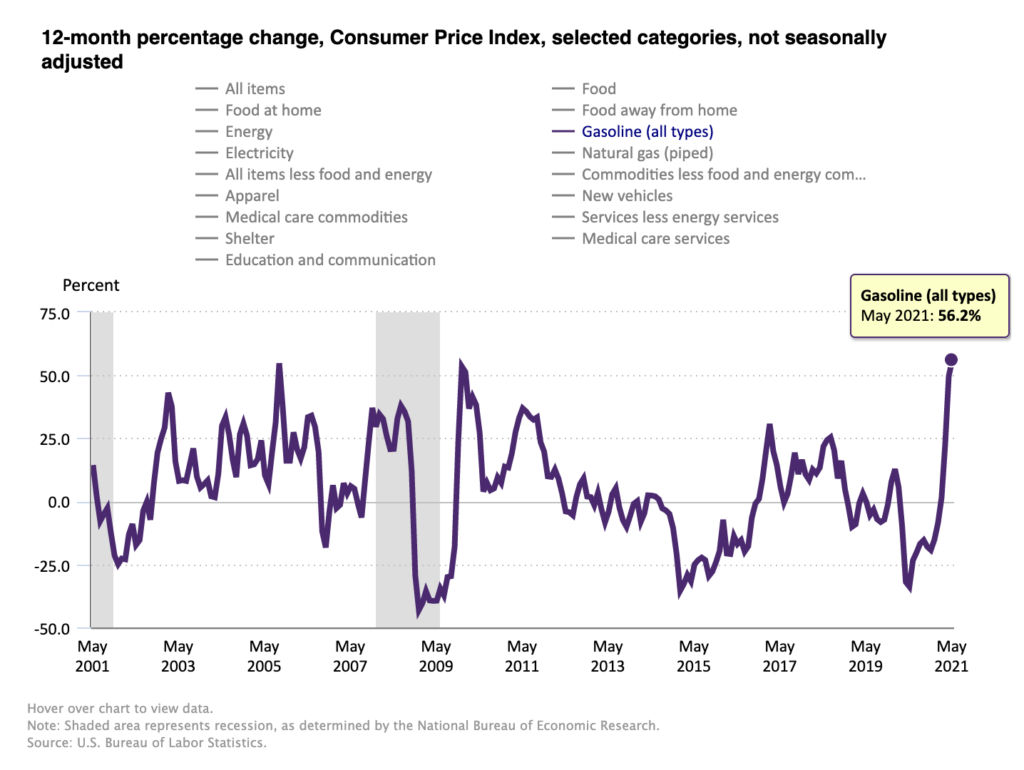

Given oil’s weighting in the CPI calculation, this data point alone could change the trajectory of inflation. But it likely won’t be alone … Many Americans, especially those who now fill up their gas tanks outside of cities (after the recent mass exodus) might have noticed the significant spike in gas prices. I ask you attempt to remove emotion when reading these next few sentences, though wouldn’t people have anticipated this outcome given the following political decisions:

- Shut the Keystone XL Pipeline down

- Revoked drilling permits in the Artic Refuge

- Continued push for “green energy” while threatening the oil and gas sector

While at the same time:

- Waiving Sanctions against the Nord Stream 2 gas pipeline

- Revoking on $100 million in weapons slated for Ukraine

If your thought was a loss of numerous US jobs, less oil/gas production, and muted capex (capital expenditure) you’d have been correct?! Couple that with an immediate increase in demand based on the aforementioned, oil and gas have begun to go vertical.

At the same time, we’ve literally handed Russia an underwater gas pipeline to feed Europe, which is an enormous economic gift/tailwind for Russia. The previously sanctioned Nord Stream 2 completely bypasses Ukraine (further weakening Ukraine’s economy). Adding insult to injury, cancelling the much needed and promised weapons to Ukraine further debilitates an already undermanned Ukrainian military as Russia publicly beefs up their troop presence along the Ukrainian border?! Wonder no more why we owned $RSX (exposure to Russia)?!

The next two images allow you to visually contextualize this as it correlates to future CPI; the first chart being the spike in “ALL types of gas” (think fuel) while the second image is slightly more subtle, though similarly to $75 per barrel oil not being in the May CPI number, Natural gas has just recently begun to hockey stick higher and is yet to significantly reflect in CPI, but it will!

Per the BLS press release, “the CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living”

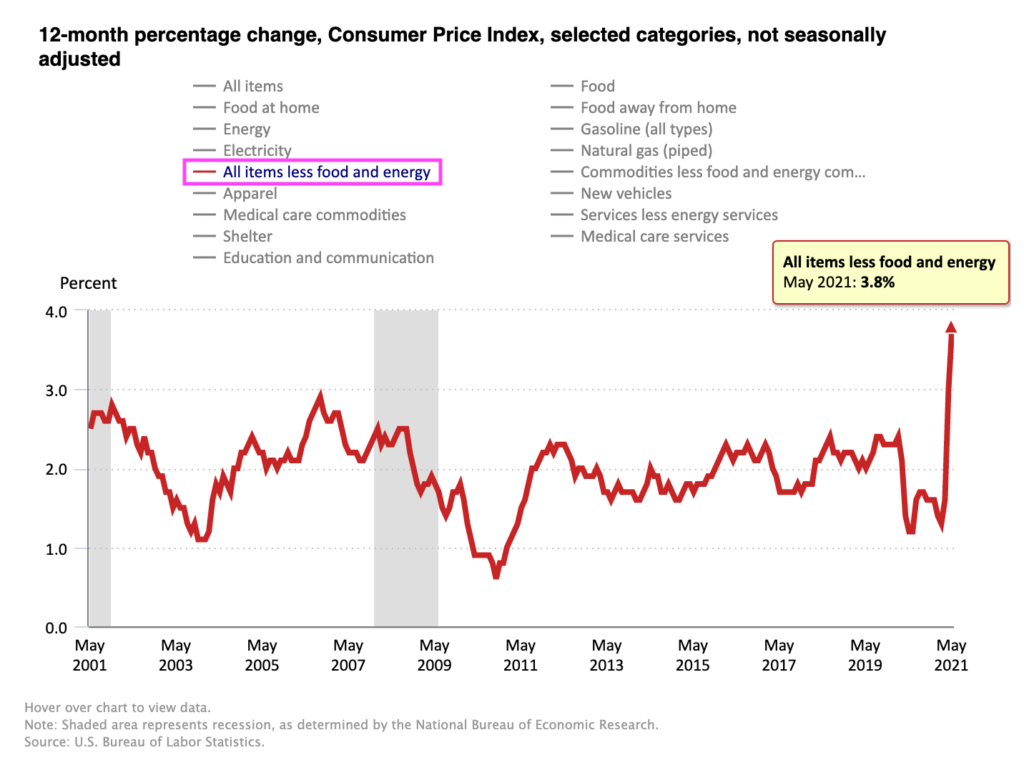

These items are broken into numerous subcategories, items in the “LESS FOOD AND ENERGY” category includes things like Apparel, New vehicles, Used cars and truck, Medical care commodities, Alcoholic beverages, Tobacco and smoking products, while “Services LESS ENERGY SERVICES” includes, Shelter (rent of primary residence and owners’ equivalent rent of residence), Medical care services (Physicians and Hospital services) and Transportation Services (which includes Motor vehicle maintenance & repair, insurance and airfare)

As we attempt to limit the length of the piece, we won’t go through every CPI subsector, though this is where things get interesting … As we can see, “Commodities LESS FOOD AND ENERGY” have skyrocketed …

In Fact, “ALL items LESS FOOD AND ENERGY” have increased substantially:

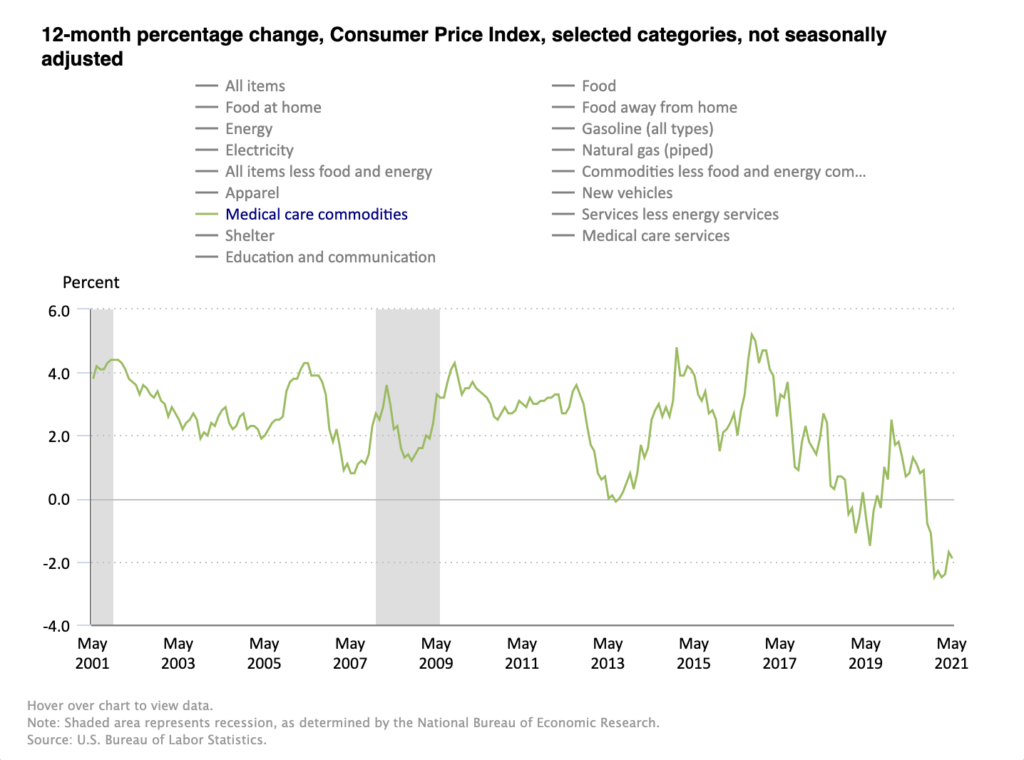

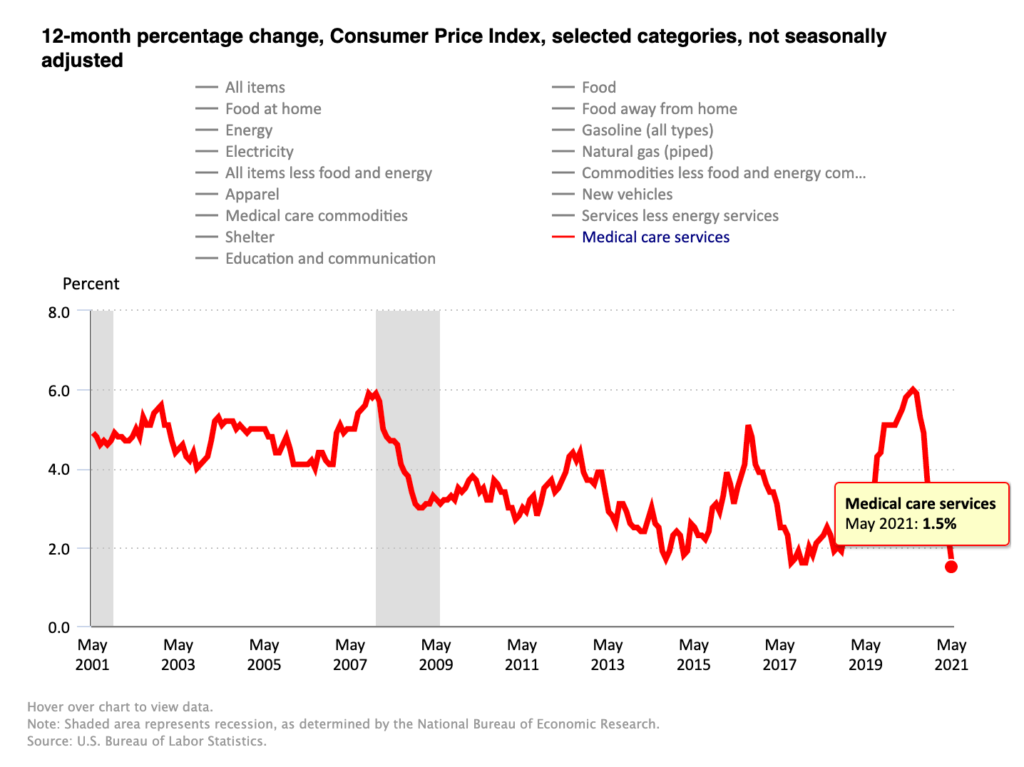

…with both Medical care commodities and services falling off the map, weighing the overall CPI down.

The country was literally forced to stay at home for well over a year. Hospitals, doctors, and elective medical procedures have been avoided like the plague. In fact, surveys suggest many people in dire need of medical care simply refused to seek treatment due to COVID restrictions, lockdowns, and outright fear.

However, with the world re-opening, do you believe these prices will remain depressed, or might they just turn around and begin to normalize? What once acted as a drag is now more likely to contribute as a tailwind to inflation as more people get out to seek the diagnostics and medical treatments they’ve been ignoring.

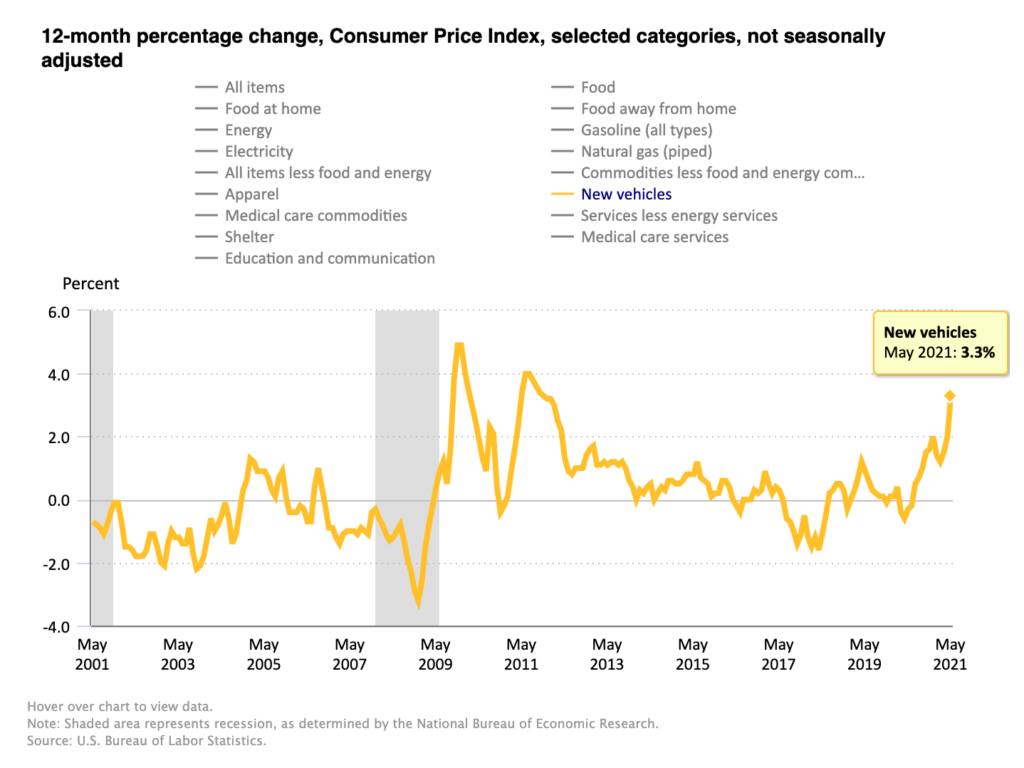

Yeah, yeah, but that will be offset by new and used car prices which have surged and can’t remain elevated forever … what goes up, must come down, right?

Maybe, maybe not? Though consider this … off the top of your head, do you know how many semiconductor chips are in a new car today?! As Car and Driver noted earlier this year, a new car can have over 100 semiconductor chips on board. Unlike older vehicles, semiconductor chips are now a necessity for everything from “touchscreens to transmissions”.

It’s recently been reported that the largest semiconductor manufacturer in the world, Taiwan Semiconductor will be increasing prices by up to 20% NEXT YEAR … and it’s not just TSMC:

“One Jiangsu diode manufacturer said its suppliers had raised prices five times since the second half of 2020. The hikes represented a total markup of between 30% and 40%, including a new 10% hike that came into effect last week. The same firm’s inventory was at “half their normal level””, Caixin reported

Now, think of all the commodities that go into the price of manufacturing an automobile and how much raw material costs have risen. Suppliers up and down the supply chain will be increasing prices; a 20% price increase on nearly 100 semiconductor chips is a single price input to manufacturing an automobile; even with the recent decline in certain commodities from obnoxiously high levels, input prices are still elevated. The price of hot rolled steel in North America just hit $1,800 per ton; a new all-time high, up 80% YTD and 255% since June 2021 (persistently high).

For a moment, think of all the consumer goods products semiconductor chips are in … refrigerators, dishwashers, washing machines, dryers, digital cameras, iPhones, smartphones, Alexa’s; if it’s electronic, its likely got a semiconductor chip in it. There are BILLIONS of products around the globe with semiconductors in them and those prices ain’t dropping anytime soon.

Does this sound immediately deflationary or could there possibly be a case for persistently high inflation?! Off cycle peak highs or not?!

The Elephants in the Room

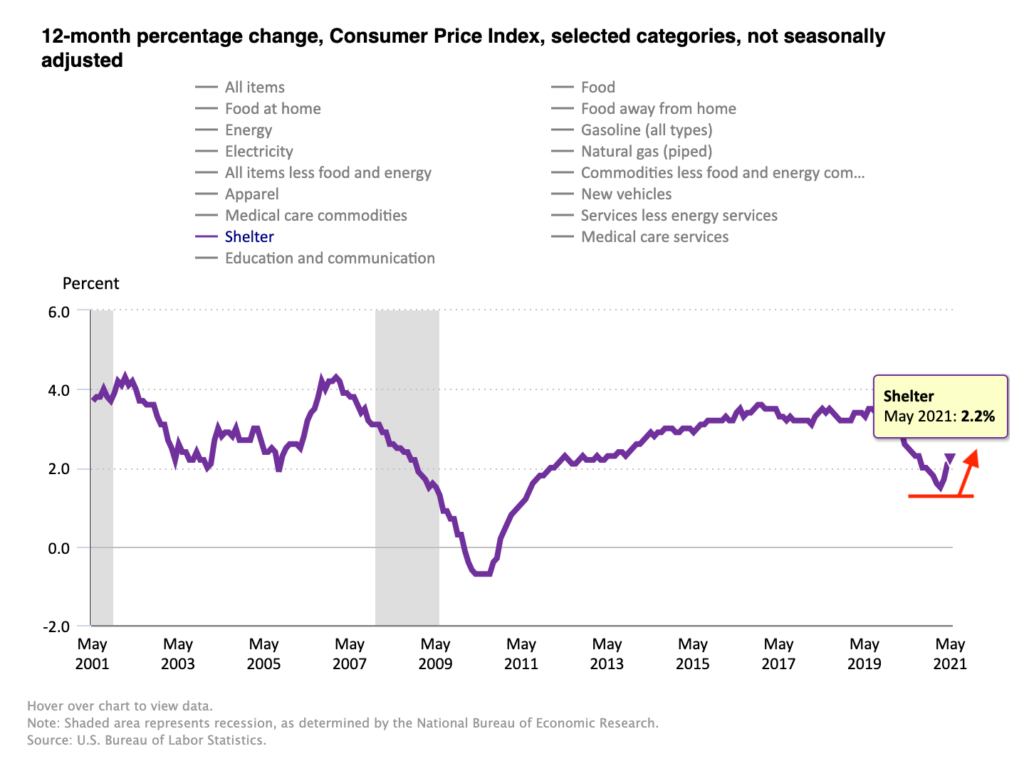

One of the largest components to the CPI calculation, a subsector of “ALL items less food and energy” is SHELTER; broken down into two components … Rent of primary residence and Owners’ equivalent rent of residence.

Shelter comprises nearly 33% of the CPI …THIRTY THREE PERCENT … and as you can see from the below image, the cost of shelter has recently begun to move higher. For more than a year, the shelter component of the CPI has literally been “sheltered” from massive inflationary pressures for numerous reasons (think government intervention) like rent freezes and eviction moratoriums.

Current governmental policies have created a ceiling for one of the largest components of how our Federal Reserve not only measures CPI but builds their entire economic policy around (artificially suppressing data).

Knowing this, does it surprise you that the CDC has just extended the eviction moratorium “ONE FINAL TIME”. No, seriously, it’s the last time, believe us.

Per the AP, “A Biden administration official said the last month would be used for an “all hands on deck” multiagency campaign to prevent a wave of evictions”

What to expect?! Think “bail out”; possibly an attempt to cap rent increases for once these moratoriums have been lifted, for you can bet your first-born that landlords will be increasing rent to offset the inflationary pressures they’re experiencing. This extra month extension may temper the next CPI survey pushing the “transitory” narrative, but when 1/3 of the survey spikes on a single data point, you better be seeing a precipitous fall in other metrics or things could get out of hand in a hurry as headline prints could spark fear fueling a self-fulfilling prophecy?! For the purpose of the CPI, “Shelter” trumps “lumber”.

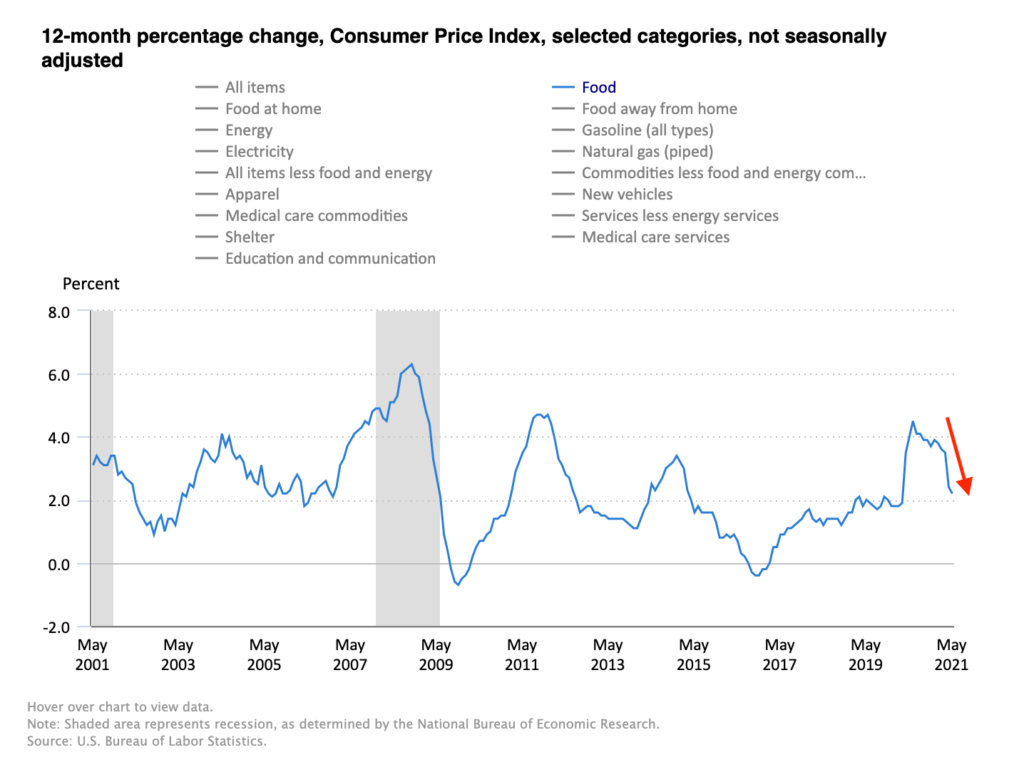

And while “shelter” has sprouted green shoots, for the purpose of this note, we’ll finish with some sad humor. For the government would like you to believe there has been NO inflation in FOOD. Currently, this is how the CPI has registered Food inflation (or lack thereof in their eyes).

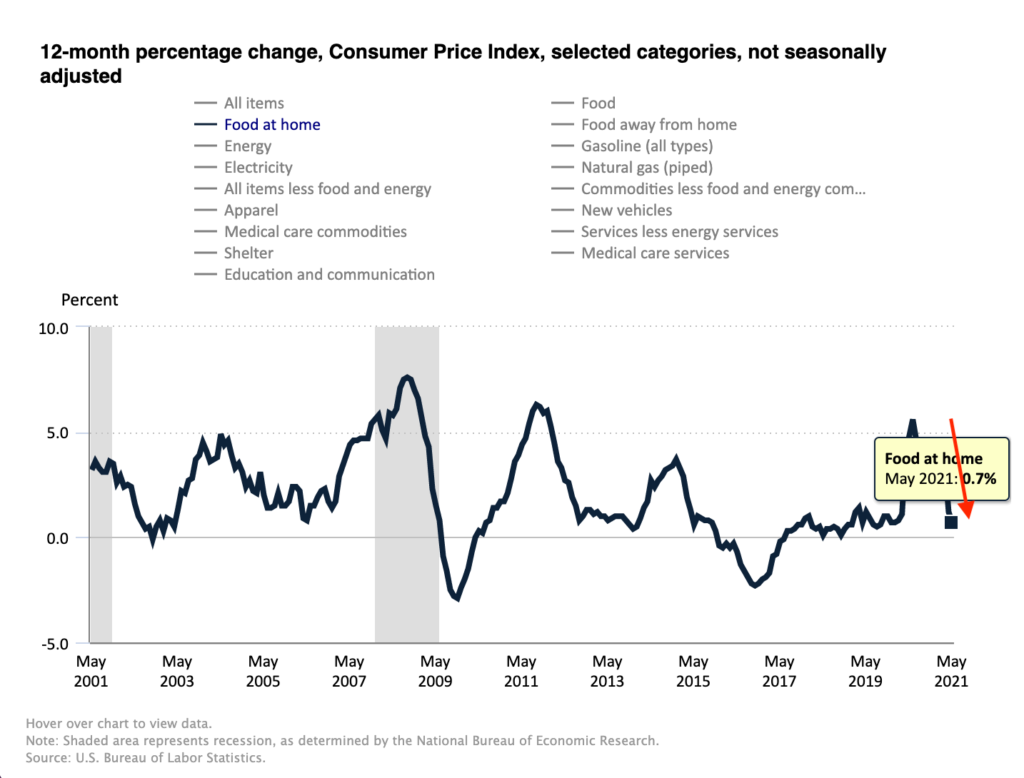

Food at Home:

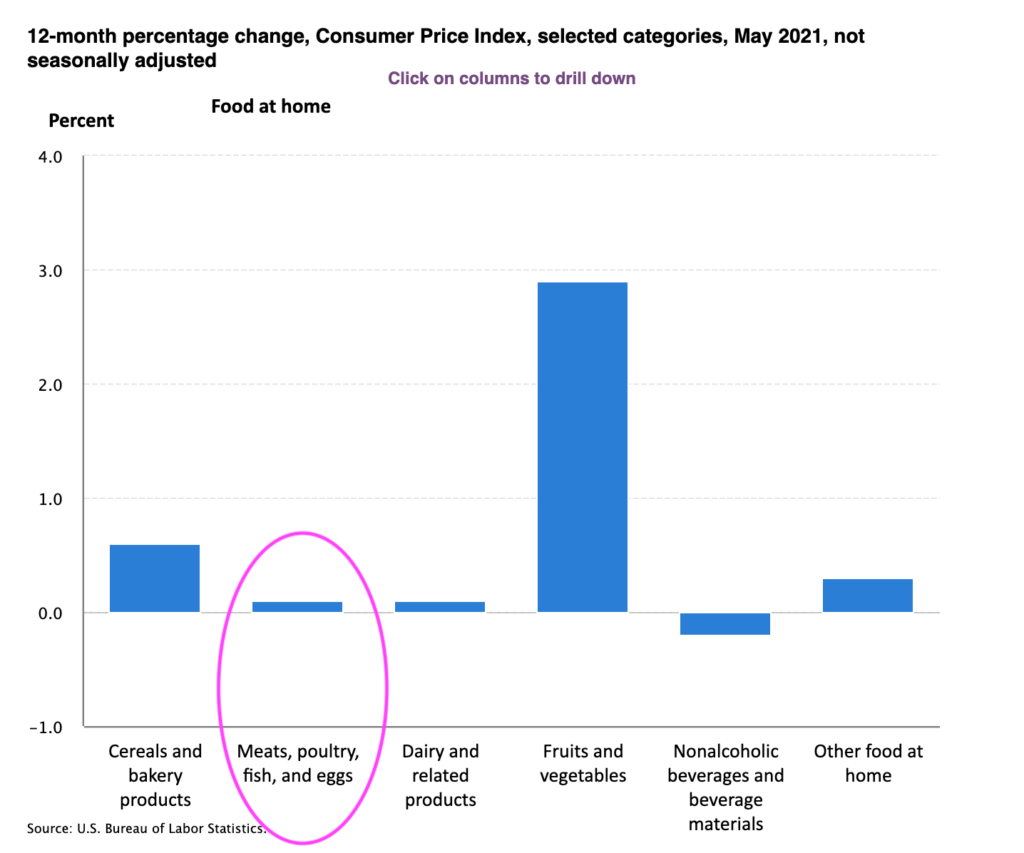

Forget about the “just off nosebleed” levels of soy, corn, wheat and coffee, the most recent CPI survey suggests the “Meat, Poultry, Fish and Egg” category has barely budged … see for yourselves.

Anyone want to take a stab at what Cattle and Hogs eat? Hint: see items in the “just off nosebleed levels” category. If it costs more to raise and finish a cow, and herds were thinned during covid given lighter demand and fewer buyers (think closed restaurants), do you think meat prices are more likely to increase or decrease in the near term?!

Don’t tell the BLS but while their report show a limited increase in Meats and Poultry, C-level food executives have cited 20-40% increases on certain cuts of meat?! and guess who’s been absorbing that cost? YOU!

Per the WSJ: “Keith Milligan, controller of Piggly Wiggly grocery stores in Alabama and Georgia, said the company was passing much of the increase on to customers, “There’s no way we could absorb some of the costs,” he said.

Again, supply chains will eventually right themselves; but when?

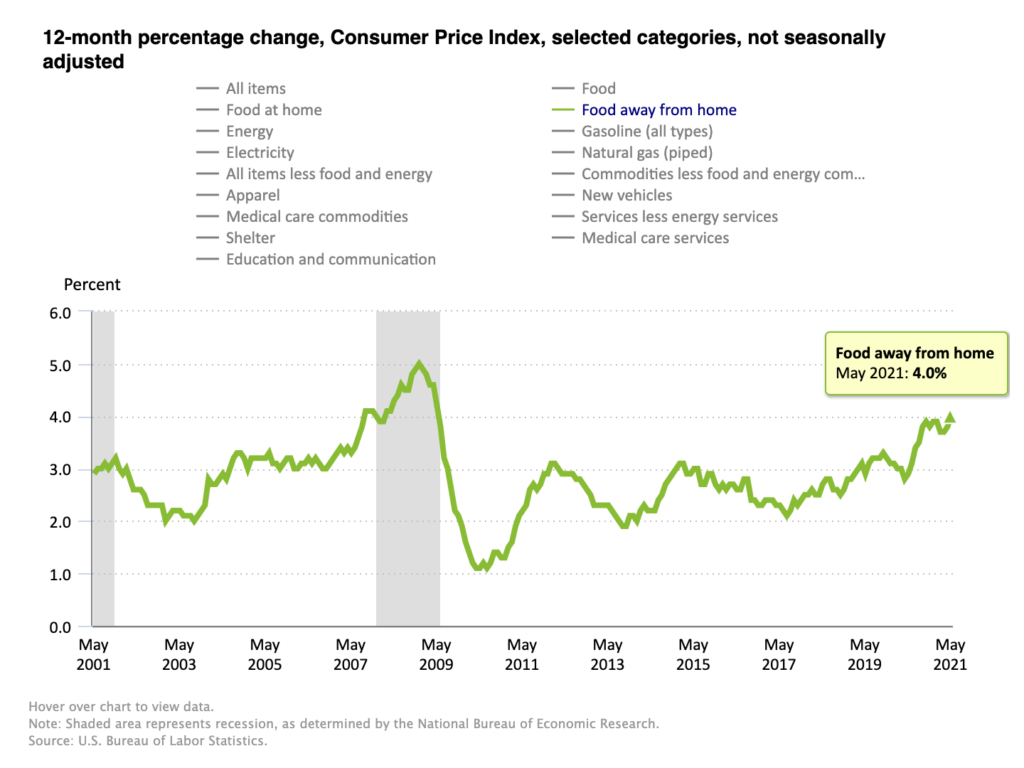

Currently, the only “inflation” the Fed sees in “FOOD” is “Food away from home”, i.e., eating out …

… though eating out introduces yet another form of inflation into the equation that “food at home” does not, SEE WAGE INFLATION which we have discussed in previous monthlies. Here’s more from the WSJ article:

“Labor shortages are hampering operations at stores from Starbucks Corp. cafes to supermarkets, prompting many employers to raise wages.”

But who could have foreseen this?! Clearly not the Fed (face … meet palm)

Again, the data used to calculate the CPI presented by the BLS as shown above suggests there is currently NO food inflation while executives at all major food companies (AT HOME FOOD COSTS) have all admitted to raising prices significantly and haven’t ruled out additional hikes.

Everyone from General Mills, Inc, $GIS Campbell Soup Co. $CPB J.M Smucker Co $SJM Unilever $UL, the list is nearly endless, and they have all raised prices out of necessity.

Unilever Chief Executive Officer Alan Jope told investors Monday, “We’re in a period of unprecedented commodity inflation”

Maybe those surveyed haven’t figured out that food companies are now selling smaller packages of some foods AT THE SAME PRICE as the larger size, which is how Unilever’s Jope believes they will recover some costs?! We’ll remind the BLS that PAYING THE SAME FOR LESS IS STILL INFLATION, even if the public doesn’t know they are being fleeced.

Wrapping it up

Deflationists suggest the prices of (insert product here) will normalize as supply chains right themselves, and they most likely will?! As we reminded readers in March and will continue to do so:

“Webster defines transitory as “of brief duration”, while Oxford states, “not permanent” … though we also pointed out:

These inflationary pockets can last for some time … a year or two is not uncommon for an inflationary cycle … As much as academia would like to pigeonhole people into being either an inflationist or deflationist, one can actually have a sound thesis for both: the difference being duration (time frame).

Duration forces you to have flexibility of mind to understand something like cyclical inflation can exist within a secular deflationary environment. This allows us an opportunity to benefit from both sides of the trade.”

If this note sounds eerily familiar to previous writings, it should. We’ve been way ahead of consensus on virtually everything discussed; down to suggesting readers stock their freezers up with beef. When the Federal Reserve admitted inflation may last longer than anticipated, they only did so because they had to.

In similar vein, this week China of all places, announced that they intended to sell strategic copper reserves to quell inflated prices. While both the Fed and China’s announcements within the same week placed a damper on some of our holdings these are enormous acknowledgements by both parties. They are telling you what we have been for nearly a year now, INFLATION IS HERE, and they are attempting to control it via rhetoric as financial systems are too fragile to remove the life support of QE and ZIRP.

Regardless of what they say in an attempt to downplay reality, knee jerk reactions by markets are to be taken advantage of.

As many reserves as China states they will sell as they attempt to quell the price of copper, China still needs more COPPER; EV’s need more COPPER, the world needs more COPPER, and you can’t just pop up a copper mine in a week, day, or year.

Let’s briefly circle back to something we mentioned earlier which is at the heart of the piece.

“At last check, the most recent decline (prince decline in lumber) has yet to be passed along to builder lumber packages which have seen ZERO meaningful decreases in pricing”

If you’re any supply house who owns lumber 100% higher from here, how anxious would you be to unload your inventory at a 50% haircut?! If an auto manufacturer’s input costs are at cycle peaks with semiconductor chips, steel, leather, etc. increasing the base cost of their goods, in how much of a hurry do you believe they will be to drop prices and cut profit margins? As margins are already being squeezed due to increased LABOR COSTS (ala WAGE INFLATION)?!

We may have already seen peak inflation data … if only investing (or life for that matter) were that simple. This is such an important conversation to have for if “persistent” inflation is probable (which if you couldn’t already tell by now, is our opinion), we’re likely closer to a version of stagflation as opposed to disinflation or deflation; and this will largely determine our market positioning for the next few quarters.

Deflation is in the cards, and we’ll be vigilantly looking for it but it has yet to present itself in the data. If we have seen peak inflation, next year’s base affects could become an insurmountable Everest given what we’ve already seen, though understanding the trajectory of near-term data points is very important.

Our job is to preserve and grow wealth for our clients. “Transitory” can last a long time, bringing with it a LOT of pain if you’re on the wrong side of this trade, especially over a multi-year time frame. This is why it’s so important to not get pigeonholed as either “inflationist” or “deflationist”, but agile and nimble enough to recognize and understand shorter term cycles within longer term trends while not getting shaken out of a counter trend move…

In the end, the Fed is likely to be proven right, as trillions in economic and fiscal stimulus works itself through the system inflationary pressures could very well prove to be “transitory”, though to constantly use such an ambiguous buzz word like “transitory” is about as disingenuous as it gets. OK, inflation is transitory … so when will the pain end for so many Americans? Our clients will know when we believe it has, for it will reflect in our positioning.

As always, we’re happy to discuss our market thoughts along with strategies and more, never hesitate to reach out with any questions or concerns.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.