In This Article

It’s Baaaaack!!!

“If carry makes the world go ‘round, and reserves make carry possible…the day we run out of reserves would be the day when the world would stop spinning... No, this is not an overstatement.” Zoltan Pozsar Credit Suisse Global Money Notes #26; December 9th, 2019

This month’s note will be lean, but tight. Our focus today will be an often forgotten, yet tremendously important segment of financial markets. We published Complexity, Fragility & Contagion on December 22, 2019, in an effort to provide a relatively detailed description of the overall “guts” of our banking/financial system:

“This concept is foreign to most of us and truthfully taken for granted, yet it is in these flows, which again, typically take place on an o/n (overnight) basis, that allow all financial markets to function properly. Relative Value funds can roll their books, dealers can settle with their clearing firms, banks can fund their everyday obligations making dollars available to all of us on demand. When the system works properly, it does so all because of this relatively obscure, complicated, misunderstood yet enormous marketplace.” OSAM 12/2019

What concept were we referring to? An obscure, yet imperative market known as Repo. The Repo or Repurchase Agreement market is an interbank lending market required to keep financial institutions and corporate treasuries functioning properly …

“Collateral, typically in the form of short-term T-bills (Treasuries), is provided in exchange for dollars. The vast majority of these transactions occur on an o/n (overnight) basis (rinse/repeat), while “short-term” can span up to 3 months. Consider these transactions “carry trades”; which can be likened to a “Bridge loan” (short-term loans that satisfy immediate obligations while permanent financing is arranged).” OSAM 12/2019

Long time readers may recall we signaled “yellow lights” or “caution” when discussing Repo markets in the fall of 2019, today we believe there to be reason to take note again … As we’ve previously detailed, Repo markets spiked mid-September 2019, requiring a substantial Federal Reserve intervention to restore order to the overnight lending markets.

The narrative at the time was that this intervention would be temporary, needed only for what is known as the “quarter turn”; the time when financial institutions ‘dress up’ their balance sheet preparing for the regulatory scrutiny which comes at quarter end.

As the Fed cited ‘nothing to see here’, we pushed back in our 3Q2019 note published in November 2019:

“So, what’s the rationale behind telling everyone things are ok, while at the same time:

- Cutting rates 3 times in a 4-month time frame

- Launching a $75 billion-dollar repo facility

- Increasing a $75 billion-dollar repo facility to $120 billion dollars

- Introducing a $60 billion-dollar/month treasury bill buying program

- And increasing the size of their (The FED’s) balance sheet by nearly $300 BILLION dollars in the last weeks as shown by chart above (source Federal Reserve).”

For those still wondering what the answer to my earlier question was – it’s confidence, the rationale behind telling everyone that everything is ok while providing markets with the largest jolt of stimulus in history is confidence. They are telling you “the system” is ok (the data and their actions suggests it’s not).” OSAM 11/2019

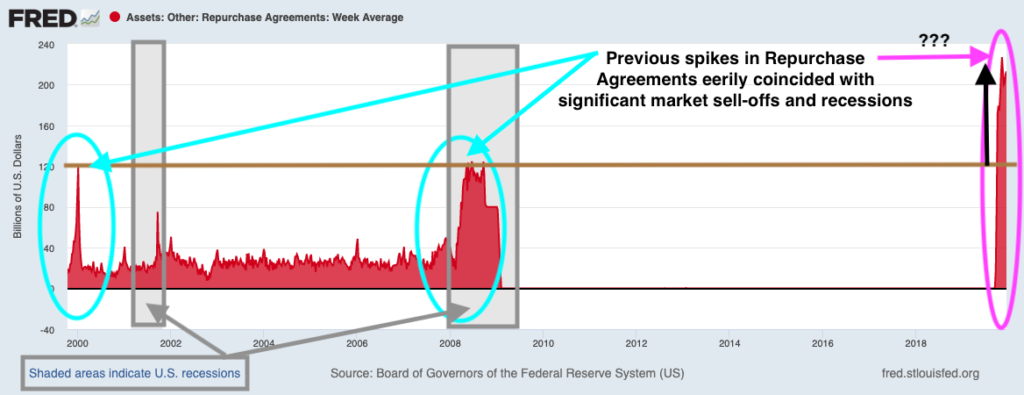

As for temporary, it surely was not, prompting our December 2019 note. As the Fed’s activity in Repo markets grew (exponentially), we thought it prudent to be vigilant. While there is never just one thing that signals caution and an increase in Repo activity doesn’t equate to an impending market sell off, nevertheless, Repo activity of such size has been cause for prudence in the past … That December we shared some history with readers:

Note that extreme repo spikes preceded both the Tech Bubble and GFC (Great Financial Crisis). Obnoxious Fed intervention continued in Repo markets through year end, well into February 2020. Our final “warning” came January 26, 2020 … and hindsight being what it is, we all know what happened 3 weeks later.

The “why” is arguable. Traditional narrative suggests “Covid happened”, and while we won’t debate the virus in this forum, if the Fed truly thought that the system was healthy, they wouldn’t have provided such support in Repo markets leading up to February 2020, nor would it need a ballpark $7 trillion dollar injection roughly 3 weeks following February 19th 2020’s peak euphoria. The common narrative is that Covid alone caused the $7 trillion; in fact, it was caused by Covid plus an unhealthy system.

Well before the closures and mass layoffs, BlackRock was handed a blank check to bail their own Junk ETFs out, making sure to include recent “Fallen Angels” like $F (Ford), backdated to ensure their inclusion in a “RED LINE CROSSING” junk bond buying program. We told you that Junk bond markets would collapse in early 2018… …we also told you the why and to a large extent, exactly how it would happen (down to citing $F (Ford) as one of the many fallen angel examples).

Flip side of the coin…

As discussed in September of 2019, there are always warning signs. The last few months we’ve focused on bringing you the data of accelerating inflation and of growth exploding off of base effects, suggesting there’s more in the market’s proverbial tank. Indeed, current inflationary data continues to leap off the charts:

- Home price appreciation up 12% YoY (Case Shiller)

- Median Home prices up 20% YoY (April existing home sales report)

- Fastest Rate of Home Price Appreciation EVER

- ISM, prices paid remain near nosebleed levels 89.6 (highest level since July 2008)

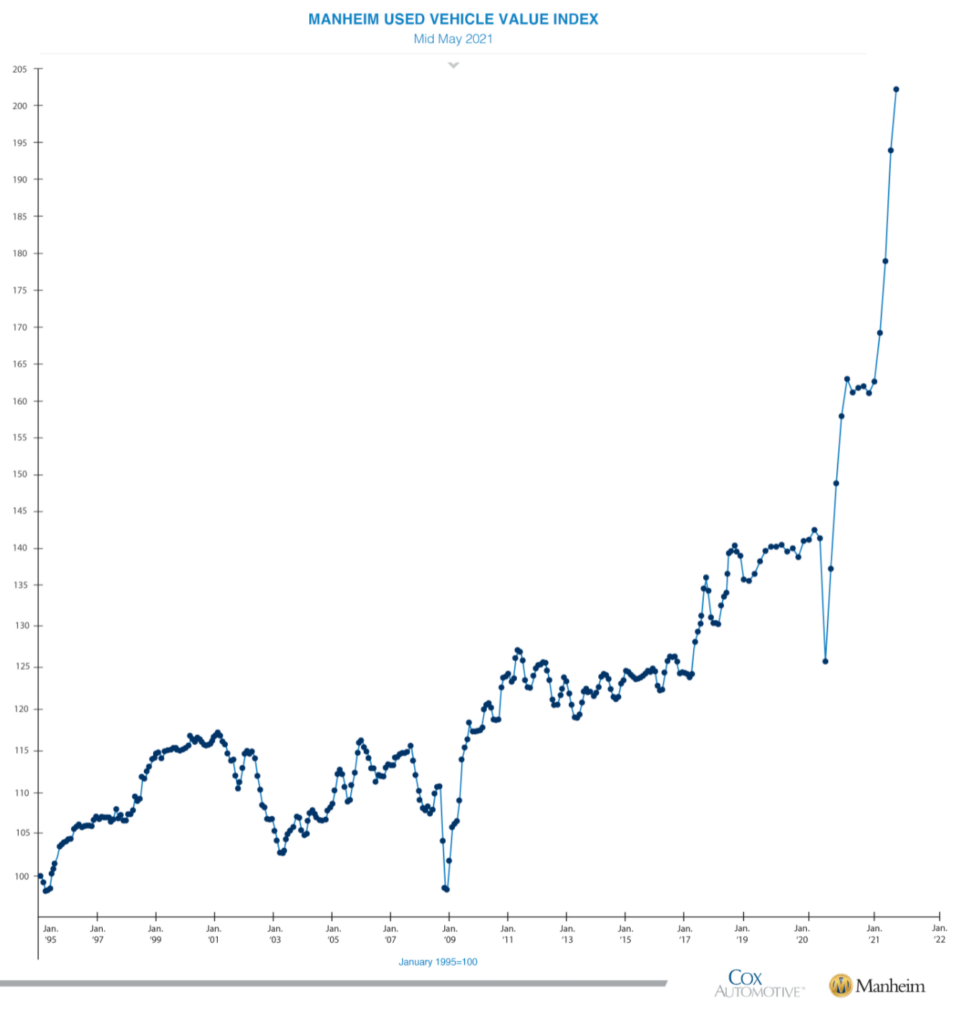

- Used Car prices are up nearly 50% YoY – we’ve NEVER seen anything like this – EVER – 50% in a year… for what was once a consistently depreciating asset … Let that sink in…

We don’t believe markets are ready to roll over just yet, and inflationary prices may remain elevated for some time, however, we have noted multiple times that Q3 projected data suggests a mild deceleration in both growth and inflation. The data is the data…

So, if we’re pleased with our current positioning with “all systems a go” on the inflationary front, why are we discussing Repo again today? When you couple Q3’s probabilistic deceleration in both growth and inflation with the flip side of the Repo coin… the prudent may begin to raise an eyebrow?!

If you visit the New York Fed’s website and search out their Repo operations, it will bring you to a page titled Repo and Reverse Repo Operations

“Temporary open market operations involve short-term repurchase and reverse repurchase agreements that are designed to temporarily add or drain reserves available to the banking system and influence day-to-day trading in the federal funds market.

Reading just a wee bit further brings you to this:

“A reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. For these transactions, eligible securities are U.S. Treasury instruments, federal agency debt and the mortgage-backed securities issued or fully guaranteed by federal agencies.”

In layman’s terms, when an “eligible counterparty” needs dollar liquidity, they will engage in a Repo agreement swapping securities they own for dollars (as discussed December of 2019) … a Reverse Repo is the opposite transaction, when a financial institution has TOO MUCH LIQUIDITY or a MONEY MARKET FUND NEEDS THE COLLATERAL, they will swap excess reserves (dollars) for eligible securities (as noted above, eligible securities consist typically of U.S. Treasury instruments, federal agency debt and the mortgage-backed securities issued or fully guarantees by federal agencies). It ain’t just banks folks, and it’s not only domestic institutions (some foreign financial companies participate as well.

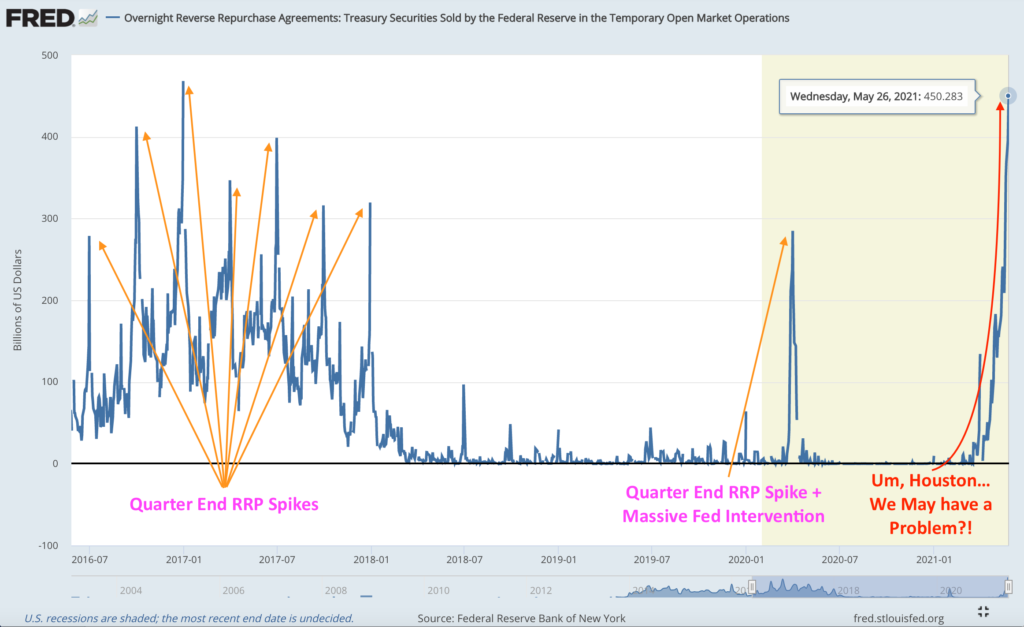

While Repo was the red flag in September of 2019, Reverse Repo is making eyes pop today. The NY Fed executed on over $369 billion in RRP on Friday, May 21, 2020. This number is staggering considering we’re nowhere close to a “quarter turn”, when banks frequently dress up their balance sheets preparing for the regulatory scrutiny which comes at quarter end.

If we thought $369 billion was staggering, while in final edits of this Letter, The NY Fed announced Monday’s RRP of $394 billion (54 counterparties), Tuesday’s explosion of $432 billion (48 counterparties) and Wednesday’s jump off the chart of RRP of $450 BILLION (46 counterparties) …

In the aforementioned December piece, we also introduced you to Zoltan Poszar; recent activity has got his ears perking up as well…

“The use of the facility has never been this high outside of quarter-end turns, and the fact that the use of the facility is this high on a sunny day mid-quarter means that banks don’t have the balance sheet to warehouse any more reserves at current spread levels.” Zoltan Pozsar, May 17, 2021, Global Money Dispatch

Banks are flush with dollar liquidity and in need of collateral, primarily due to the flood of money into the system as the Fed continues to buy over $120 billion of bonds per month while the Treasury has been reluctant to issue T-bills (albeit 4-week bills are yielding 0%, and occasionally trading in the open market at negative yields). The Fed’s QE has simply pulled too much collateral out of the system (a defacto monetization of government debt).

The nuance of it all is rather complicated, requiring quite a bit of detail and “inside baseball” language even when attempting to speak in plain English, however, “the why it’s important” is relatively simple. Unless the Treasury decides to issue a truck load of short-term T-bills, there won’t be enough collateral in the system for it to properly function.

If things remain as they currently are, Federal Reserve officials will be forced to talk “TAPER” and QE will most likely slow before anticipated; and most investors remember what happened during the last “Taper Tantrum”. With each explosion in RRP (Reverse Repo) usage we are likely that much closer to a more volatile version of a “Tantrum” with markets MUCH less able to handle exogenous shock due to the rapid expansion of passive investing and the diminishing number of price sensitive buyers (as we’ve discussed ad nauseum).

Should the Treasury acquiesce and issue said “truck load” of T-bills, this will more than likely flatten the belly (middle) of the currently steepening yield curve. Navigating this minefield of unintended consequences based on the Fed’s limited toolbox (regardless of what they tell you) is becoming increasingly fraught with risk.

We know there are issues with the plumbing of our system – that is why the Fed is so active in this market, and it is why we study it and pass our thoughts on to you. The thing about Repo is… it’s less of a timing indicator than a barometer which tells you that stormy conditions are approaching, so keep your eyes and ears open. When the Fed intervened in the Repo markets in September of 2019, it was a warning, a precursor to Feb 2020. Yes, markets ripped from September to February and everybody felt the euphoria, but there was something lurking beneath. It was not merely a virus that caused the financial madness of last year.

As we wrap up final edits, Zoltan Pozsar issued his most recent Global Money Dispatch which offers some solutions to the above challenges, it’s short but concise.

There is the QE problem, the Wells Fargo problem, and the taper problem… The QE problem has to do with the Fed buying way too many mortgages, richening MBS relative to Treasuries. The Fed is buying $40 billion of MBS a month, and Bank of America is providing a tailwind by buying as many MBS as the Fed. What will fix this issue is either the Fed buying less MBS and more Treasuries, or Bank of America doing the same – the Fed for “market functioning” reasons and Bank of America for relative value reasons. Either way, fixing the QE problem will require one of these banks to buy more Treasuries before taper commences. If you are concerned about the MBS float, the last thing you need is the Fed suddenly lifting Wells Fargo’s asset growth ban. Wells Fargo has an unused balance sheet capacity of more than $500 billion, and after years of no growth and a shrinking loan book, it would be stepping into duration markets with force. If the QE problem is bad enough for MBS and leads to a bid for Treasuries, the QE problem plus freeing Wells Fargo now would mean MBS trading even richer and, by extension, an even stronger bid for Treasuries. Timing is everything… …and getting it right can turn a problem into an opportunity. While lifting Wells Fargo’s asset growth ban now would do more harm than good, it could come in handy when the Fed commences taper later this year or next. The market assumes that taper will lead to a sell-off in rates, like in the past – but that need not be the case. The Fed could announce its plans to taper, while at the same time announcing the end of Wells Fargo’s asset growth ban, so that fewer purchases by the Fed would be offset by more purchases by Wells. Less buying by the Fed and more buying by Wells Fargo… …and rates don’t have to sell off, provided there is coordination at the Fed. The monetary and regulatory arms of the Fed typically do not coordinate, but never say never. Using the Wells Fargo “option” could help the Fed make taper a smoother affair than the 2013 experience, which wasn’t smooth to begin with. It’s one thing to taper against a boring fiscal backdrop like during 2013, and another to taper against a backdrop painted with cumulonimbi of fiscal issuance – given the fiscal outlook, the Fed should be creative with the Wells Fargo option. Then there is the consensus problem, which is that everyone expects rates to go up from here, and “if everyone is thinking alike, then somebody isn’t thinking”: the macro reasons for higher rates make sense, but the potential for more Treasury purchases either by the Fed or banks before taper commences, and Wells Fargo deploying $500 billion of balance sheet after taper commences, could set off a rates rally from here. Consider these problems at least as risks…

“…provided there is coordination at the Fed. The monetary and regulatory arms of the Fed typically do not coordinate, but never say never.”

Pozsar, who is very highly regarded and well thought out, notes that coordination would be “required”, and then observes that the two parts of the Fed “typically do not coordinate”. While I do my best to stay away from absolutes like “always” and “never”, (1) we’re talking about the Fed (face, meet palm) … followed by (2) at the end of the day, the $500 billion in balance sheet that would free up from the Fed lifting Wells Fargo’s balance sheet expansion ban equates to roughly 4 months of Fed QE bond buying power. Yes, this could be spread out over some time if the Fed’s taper is gradual and Wells Fargo steps in incrementally … HOWEVER, at the same time, it still doesn’t solve the collateral problem.

This is definitely a “Yellow light” to be mindful of…

If ever you have a question or concern, you have an open invitation to reach out to us via phone (919-249-9650) or email Mitchel.krause@othersideam.com – You will always have our undivided attention.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.