In This Article

THAT TINGLING SENSATION…

Many of us have a tingling sensation on the back of our necks that something is not quite right with today’s markets and economy. Unemployment is high, bankruptcies are rising to record levels, debt and leverage are at WW2 levels, and the government’s fiscal deficit is too obscene to print here. Yet markets flirt with all-time highs. And we all have the feeling of certainty that Uncle Fed (the rich uncle who always helps us out) is always there if things get out of hand.

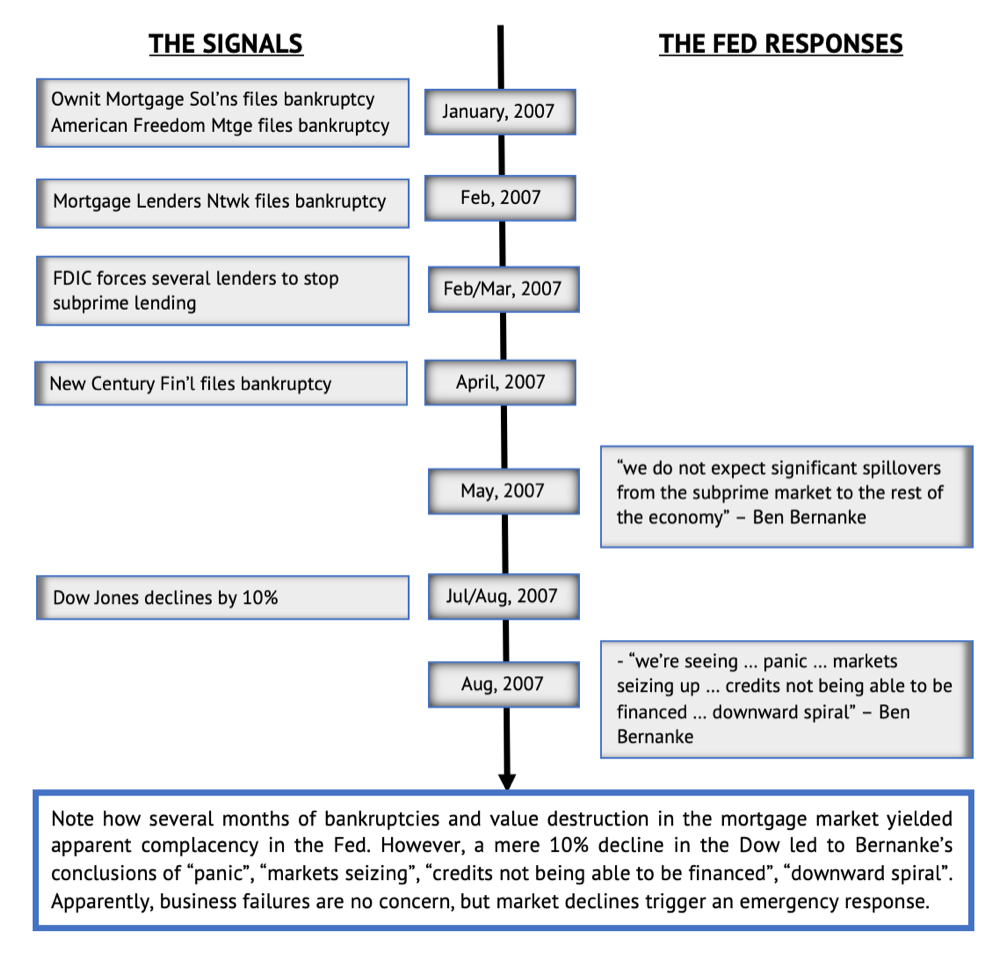

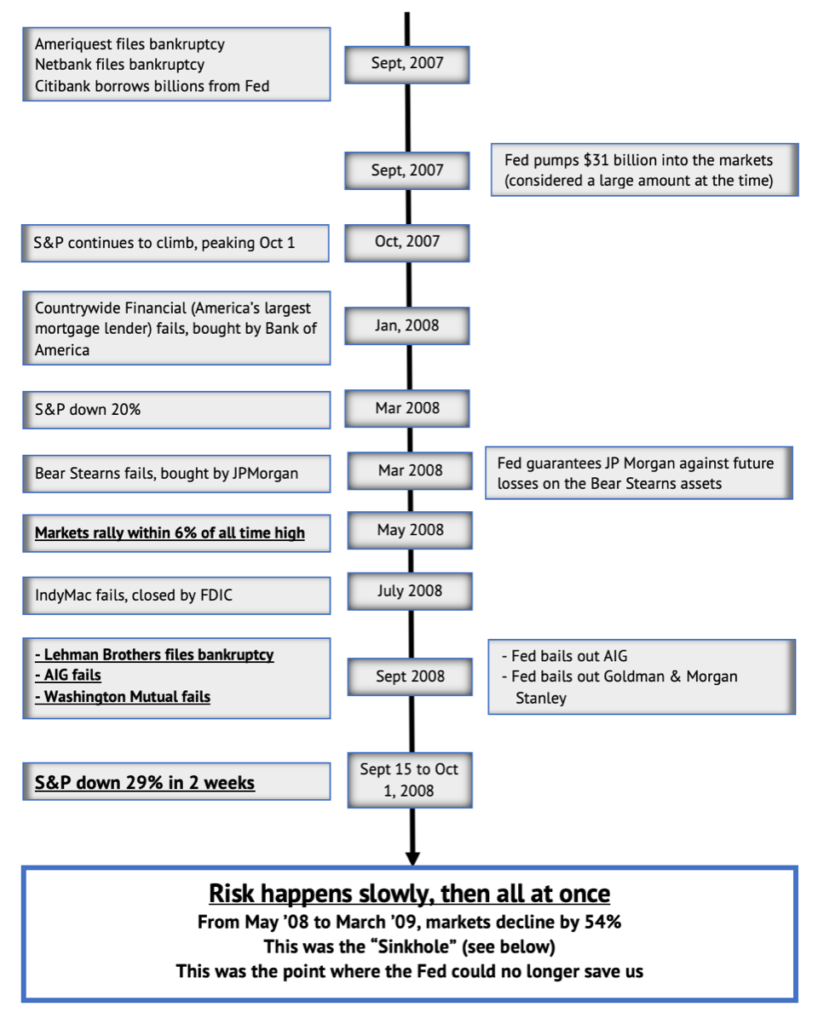

How do we square this circle, of economic catastrophe accompanied by rising equity prices? Is it all because of reliance on the Fed’s issuances? Is there a comparison in history that we can look to for some guidance? To answer this, let’s look at the sequence of events that built up to the global financial crisis in 2008, to see whether there are any lessons to be learned. Without going into too much gory detail, the following table gives a timeline, showing “The Signals” (that maybe something was wrong) and “The Fed’s Response” (telling that all is well, and they will save us).

SINKHOLE

Per the USGS (US Geological Survey) a sinkhole is, a depression in the ground where the water has nowhere to go but down. Beneath the subsurface, the groundwater drains through salt beds, gypsum, limestone or other soluble carbonate rock, and the underlying rock is dissolved over time, creating underground caverns and spaces.

So where am I going with this?!

The surface area of the sinkhole is literally the last domino to fall. Water over a period of time washes away the underlying support system. As the erosion creates larger spaces and caverns beneath the surface, the underlying support system degrades until a critical point is reached where a very LARGE, SWIFT and DAMAGING collapse occurs. Nobody notices the problem until the surface collapses.

The metaphor is clear. In the GFC, numerous bankruptcies signaled that the support was eroding beneath the surface, but the surface (i.e. the stock prices) appeared safe and reliable, until September 2008 when the market suddenly caved in.

Gentle reader, with 20/20 hindsight, we can raise our eyebrows in astonishment at investors who maintained their euphoria and bought into markets from Jan ’07 through May ’08. After all, they had 14 months of increasingly alarming signals that something was wrong; that trouble was brewing underneath the surface … Hindsight is wonderful, isn’t it?

While it takes work and isn’t a perfect science, sinkholes can often be detected; as with most crises, warning signs often flash for some time before reality sets in. More important to remember, many linger for MUCH longer than most people care to acknowledge.

How does the above lesson reflect upon conditions in 2020? How good is your 20/20 hindsight? Have there been any leading signals this year? Is there a Sinkhole developing today underneath market prices?

Often, the signals are only recognized after the fact, when the market has made dramatic moves and we look back to say “Oh, yeah, I should have seen that coming”. At some time in the future, are we going to consider a myriad of datapoints which have been representative of signals?

- HY credit markets freezing for 41 days October 2018 to December 2018

- Fed moving from “watching paint dry” to “Powell Pivot”

- Repo crises beginning September 2019

- “Fallen angels” (IG bonds downgraded to junk) are at a record high of $217 billion YTD, compared to $150 bln after the GFC and $142 bln after the tech crash in 2000

- Over 65 Million individuals have filed for Unemployment Benefits over 30 weeks

- 25 million continue to receive some form of assistance vs. a peak of 6.5 million during the GFC

- VIX, a measure of nervousness among professional investors, is at a persistently high plateau

- Speculative grade default rate in bonds is up to 9%, the highest since the peak of 15% during the GFC

- More bankruptcies to September than any 12-month period since 2010 (Hertz, JC Penney, Neiman Marcus, Chesapeake Energy, this list is enormous)

- Amount of bankruptcies by assets is already greater than during the GFC

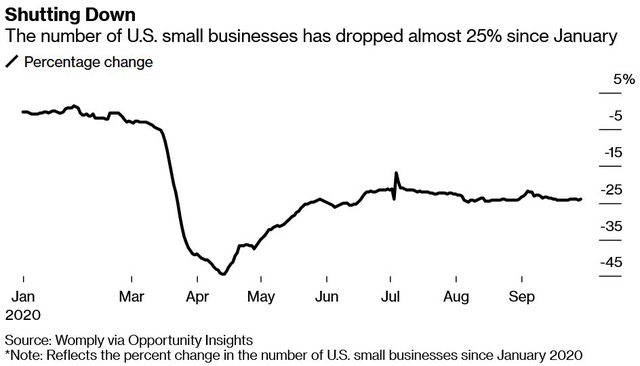

- Bankruptcies of SME (Small to Medium sized Enterprises) are at an unprecedented rate

- 25% of US small business have CLOSED

To walk you through the development of our current crisis would be to revisit the previous 4-5 years of my writing. We don’t have time for a history lesson today. Yet, it is important to not only recognize the parallels to similar time sets, but more importantly the differences (both subtle and glaring), for they matter.

In March we wrote:

We are now staring at papered over debt cycles, coinciding with the end of a business cycle, while our economy takes body blows from a global pandemic and structural deficiencies in the system, we’ve discussed for over 2 years, are being exposed (the construct of active v passive investing). Adding insult to injury, this is all colliding with a demographic shift in population (baby boomers retiring)

LOOKS CAN BE DECEIVING

The core of a healthy economy is its banking sector. For years I spent my life focused on banks; and again, while not all timeframes are comparable to others, there are many things we can learn from history … While there are countless lessons to be learned from the GFC of 2007-2009, the first thing is that assumptions are often clouded by personal bias:

Assumptions – Exhibit A, BANs (Bond Anticipation Notes): BANs were manufactured Wall Street products marketed and SOLD as liquid money market alternatives for those seeking a fractionally higher yield. This worked well for a while, until holders were frozen from redeeming their assets. The liquidity was an assumption based upon the stability of the commercial paper market – uh – bad idea when GE decided to use their AAA rating to borrow hundreds of billions to then buy credit card receivables of sub-prime credit card borrowers. BAD ASSUMPTION.

Assumptions – Exhibit B, Bank Balance Sheets: Another extremely poor assumption then was the valuation Wall Street placed on the assets of virtually every bank’s balance sheet; assets were grossly overstated based upon poor assumptions that housing prices couldn’t fall greater than an arbitrary number and could never collapse at the same time across the whole country.

What crises have proven time and time again, is that true risk is masked via constant central planning, artificially inflating asset prices on the balance sheet of these institutions; which is why they require a constant and LARGER bailout from the Fed with every passing crisis. In 2008/2009, we learned that home values were actually a mere fraction of what they were assumed to be. This resulted in a collapse of the banking sector, with bank prices dropping by 75% from September, ’08 to March, ’09.

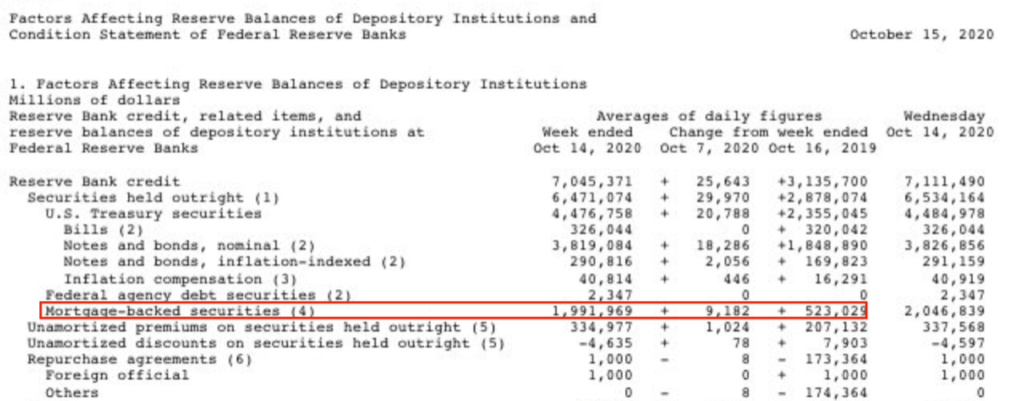

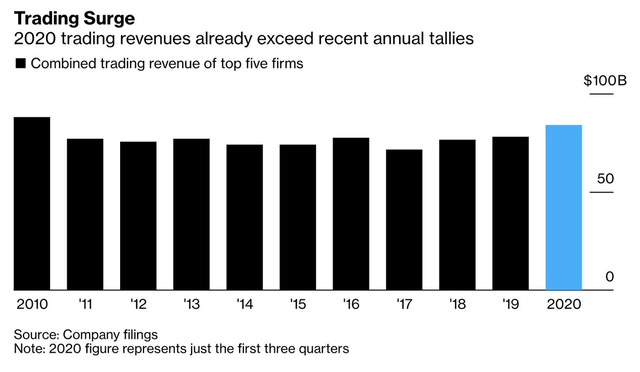

Today, banks are without question benefiting from the Fed’s QE. Financial institutions, specifically the larger GSIBs, are the facilitators of the recent MBS purchasing by the Fed, as shown in the following table: .

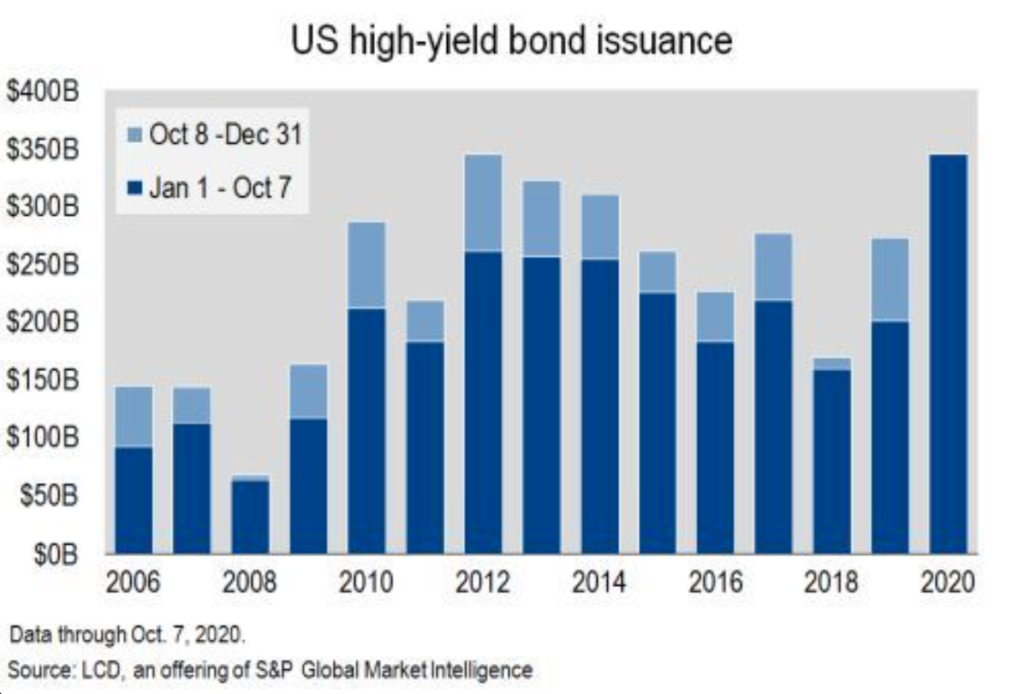

Also, the banks are the benefactors of record-breaking level of credit/debt origination. 2020 has seen a record amount of debt through to October 7 (below), along with capital raises via IPOs, as we’re seeing 4 to 5 new filings per day:

Still, financials continue to underperform!

Everyone knows the Fed Funds rate is and will be at 0.00% for quite a while, driving the 30-year mortgage to near century lows (currently it sits at roughly 2.80%). FHA lending is obnoxiously strong with recent data showing that Fannie Mae and Freddie Mac are not only WAIVING APPRAISALS through an automated appraisal waiver, with cash out refinancingrepresenting roughly 90% of refi’s; that’s tens of billions of dollars again being siphoned from homes (current est. of $50-60 billion annual run rate). Let’s repeat this for emphasis: cash-out refinancing of homes is 90% of refi’s, with limited appraisals — because it is safe to assume that house prices always go up, REMEMBER?! (See “Assumption B”, above.)

What we have been attempting to convey for some time, which is challenged by those searching for value in financials is that banks can have what appears to be the most pristine of balance sheets, however, if the banks’ business and CLIENTS are impaired, it is highly likely that the banks’ underlying assets are also mispriced, making the entire balance sheet riskier than assumed. As pointed out above, 25% of small businesses have closed over the past few months with an unprecedented number more in the que. Are we really wondering why C&I lending is down precipitously?!

Financials may look “cheap” from a valuation perspective at the moment, but their clients are quickly becoming absolute disasters as permanent layoffs accelerate. On October 17th, the MBA (Mortgage Bankers Association) provided details:

- Around 20% of mortgagors received permission from their lender to delay or reduce their monthly payment (by week).

- In aggregate, total MISSED mortgage payments were estimated to be as much as $19.4 billion for the third quarter.

- In aggregate, rental property owners lost as much as $9.2 billion in third-quarter revenue from missed rent payments.

- In aggregate, total missed student loan payments were estimated to be as much as $29.5 billion for the third quarter.

- The percentage of borrowers reporting missed payments (by month) was around 40% in the quarter.

The bounce of the financial sector off of March 23rd lows has been much weaker than many other sectors. We believe that the markets are discounting unsustainable revenue streams and that large loan losses loom in the near future.

Looking at government policy, the current Democratic stimulus package includes an additional year of rent, mortgage and eviction moratoriums. But, 50% of landlords are “small businesses” – could you run and maintain your small business without generating revenue for 2 years, while still having expenses like taxes to pay? Rents and mortgages will eventually need to be paid – bankruptcies will accelerate. Eventually, someone will have to pay the piper and while we believe we’re getting closer to this, the election will play a role.

Furthermore, NIM (Net Interest Margin) compression say … FOREVER is a very real thing as the Fed has said they aren’t even going to start to think about raising interest rates for ages. ZIRP to NIRP is very real and here to stay, it has decimated the European banking sector, for a refresher, you can revisit the Chasing Unicorns section of our September 2019 note. Or, look to the performance of the Japanese bank sector during their long experiment with ZIRP; their banks have NEVER reattained the stock valuations that they had 30 years ago. Mizuho (MFG) is down 85%; Mitsubishi (MUFG) is down 75%; these banks were once titans in the global financial system.

THE FED RESERVE HAS FAILED

Their policies can only hold the line for only so long, as we saw in 2007/2008.

Powell’s sharp tone when speaking to the National Association for Business Economics Virtual Annual Meeting on October 6, 2020 should shake every American, investor and saver to the core.

“there has been a decline in estimates of the potential for longer-run growth rate of the economy and in the general level of interest rates, presenting challenges for the ability of monetary policy to respond to a downturn.” (2nd to last paragraph)

Think about the parallels of current Fed actions to those described during the GFC. After mildly shrinking their balance sheet, the Fed is back to buying bonds, but this time they are buying debt issued by Microsoft and Apple! It’s financial engineering — Apple doesn’t need this money. The Fed purchase is supportive to asset prices, but not “stimulative” to economic growth. Instead, this allows Apple to take on absurdly cheap debt and Apple then turns around and continues buying back its own stock. Equity prices continue to rise on financial engineering rather than fundamentals. Apple and Microsoft represent nearly 40% of the XLK (tech ETF) and over 20% of the QQQ’s. The Fed buying these bonds supports the equity price of the most concentrated positions in major indices, in turn, supporting CONFIDENCE. Doesn’t this confidence game sound like a familiar page from the Fed’s paybook?

The Fed is doing its best to convince people that things are OK, but the collateral damage is the destruction of traditional market signals. The Fed is literally begging politicians for more fiscal stimulus, which would require the Treasury to issue more government bonds, giving Powell the ability to monetize more and more of that Treasury debt, thus providing a floor under credit markets.

The Fed now owns 22% of all marketable treasury securities, a new record and up from peak of 20% in 2014.

We’ve described this in the past as “MISPRICING RISK”. It also contributes to “ASSET PRICE INFLATION”.

As we noted last month, permanently unemployed numbers along with “white collar” job layoffs are already spiking – recent consumer confidence board data suggests “upper income” earners are leading the decline in data. Household income of those earning $75-100k was down -11.3 points MoM with those earning between $100-125k to be down -3.2 points. Bloomberg consumer confidence index household income above 100k was down 7 points MoM October – these are the “typical recessionary dynamics” Jay Powell spoke to in his October 6 speech we mentioned earlier:

“a prolonged slowing in the pace of improvement over time could trigger typical recessionary dynamics, as weakness feeds on weakness. A long period of unnecessarily slow progress could continue to exacerbate existing disparities in our economy. That would be tragic.”

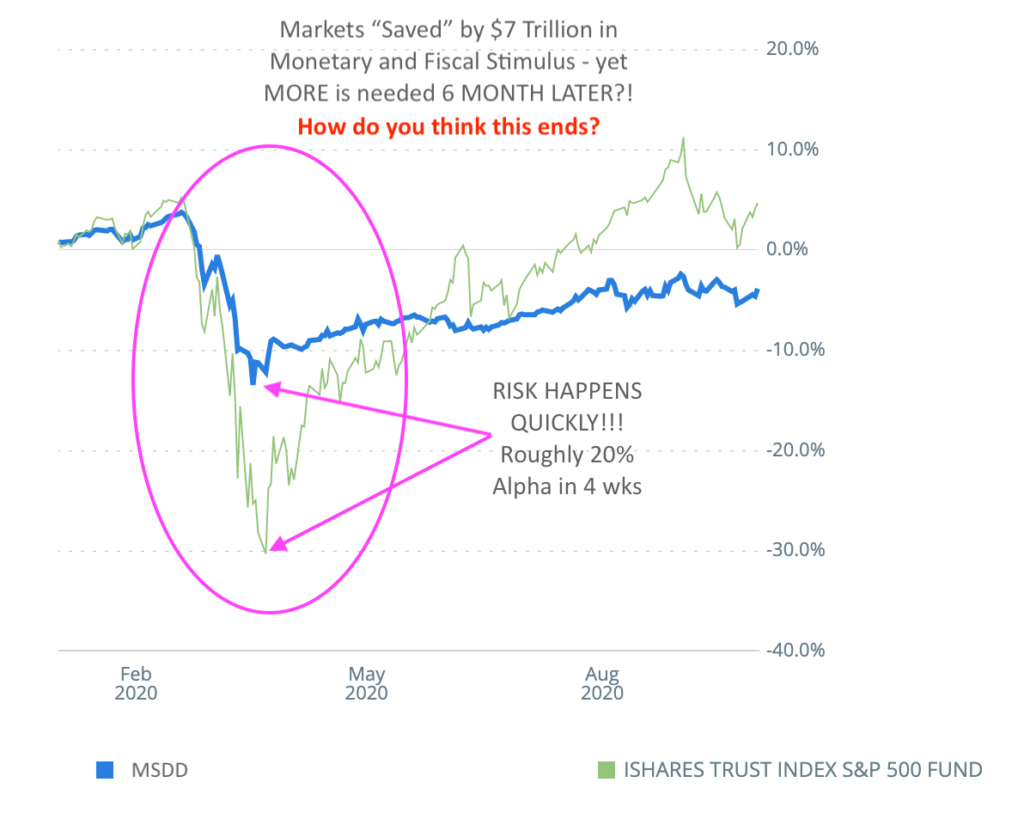

SO, WHERE DOES THAT LEAVE US?

We don’t hide who we are … managing our downside risk is a core principal to our investing thesis. The above illustration shows the benefit our capital preservation strategies provided earlier this year. They were the difference between losing roughly $100k on every million vs. over $300k; this over a 4 WEEK time frame (Feb 19 to March 23).

While many are focused on the right side of the chart (the surface area represented by price) we pay attention to the data and full cycle investing (the underlying decaying rot beneath the Sinkhole). This doesn’t mean that we don’t manage for the upside; over the years we’ve without question caught our fair share. There will again come a time to be increasingly more aggressive, we just don’t believe it to be today with so much rot under the surface.

We do our absolute best to remove political bias, often lumping politics into the “noise” category, but today there are ominous political risks on the horizon. There is no question that a huge amount of money (which

our country doesn’t have) will be spent by either party. With no stimulus prior to the election, those most in need are likely to see no money until late January, early February 2021; this will cripple many.

But what happens if we continue to be a split House and Senate? Continued gridlock as many individuals face financial ruin? What happens if the Republican party loses the White House? Were you aware that the Treasury’s bond buying programs expire December 31 and need to be re-approved by the Treasury to continue into 2021? Will the Republicans “play politics”, refusing to cooperate with the incoming administration, forcing the new regime to figure things out on their own?! Were you aware that the government stares at another shut down during its post-election lame duck session with December 11th being the deadline for politicians to agree on budget details?

A myriad of outcomes now depends on a handful of blowhards in Washington who currently find that playing politics is more important than crippling the economy and many US citizens.

On one hand we can make a case for outrageously high equity prices moving forward merely in the shift from actively managed funds to passive investments. In the same breath, we believe a sell-off of epic proportions could occur given both market structure and outright global economic dysfunction.

Having said that, we remain cautious and nimble.

OUT OF BULLETS

These notes are not our primary focus — managing our client’s risk and money is. Having said that, with this note in final edits, former President of the NY Federal Reserve (2009-2018) William Dudley wrote and opinion piece for Bloomberg which you can read in its entirety by clicking here. This is the same William Dudley who provided the below insight to the FOMC while serving as manager of the systems open market account at the FOMC’s August 16, 2007 emergency meeting (mentioned earlier in the Timeline).

In 2007 Dudley stated:

The market turbulence and the rise in risk aversion have created several areas of vulnerability. First, there is the risk that money market mutual funds could suffer losses on certain asset-backed commercial paper programs that have weak backstops. This could conceivably cause some funds to “break the buck.” In the worst case, this could even result in a run from these funds by investors. Second, worries about the exposure of the financial guarantors to the mortgage market could cause problems to spread from this area to areas that have up to now been more sheltered from stress, such as the municipal securities market.

But let’s get to the crux of the matter Mr. Dudley …

The intense market turbulence has caused investors to become more worried about the downside risk to the economy.

In his most recent Bloomberg opinion, he had the following to say:

“No central bank wants to admit that it’s out of firepower. Unfortunately, the U.S. Federal Reserve is very near that point.This means America’s future prosperity depends more than ever on the government’s spending plans — something the president and Congress must recognize.”

“No doubt, Fed officials should still commit to using all their tools to the fullest. But they should also make it abundantly clear that monetary policy can provide only limited additional support to the economy. It’s up to legislators and the White House to give the economy what it needs — and right now, that means considerably greater fiscal stimulus.”

Again, excluding some minor edits, our note was written before Mr. Dudley’s OpEd … We don’t carry a PhD nor teach at Princeton, our goal has always been to provide you with the information we would want, should our roles be reversed. Isn’t it ironic that it becomes so much easier for (ex)central bankers to be open with the public when they are no longer beho

As we mentioned in the introduction – Time and Patience are our assets right now … we’re also doing our best to be Prudent at a time when the Federal Reserve is doing everything, they can to make it as difficult as possible.

We’ll continue focus on managing our risk, seeking out asymmetrical risk reward set ups, letting our winners run while cutting our losers before they become problematic. We remain firm in our process and discipline.

As always, we’re happy to discuss our market thoughts along with these strategies and more, never hesitate to reach out with any questions or concerns. Thank you for your continued trust and support!

Good Investing!

Mitchel C. Krause

Managing Principal & CCO

Please click here for all disclosures.