In This Article

The More things Change…

It’s been 23 years in the financial business and I often wonder what my life would be like if I was as blind and ignorant as to how equity markets functioned today, as I was in 2000/2001 when clients watched “diversified” Unit Investment Trusts (UITs) get decimated during the tech bubble? Or had I not executed 500k share “buy” orders of Freddie (FMCC) and Fannie (FNMA) from arrogant portfolio managers who dove headfirst into “moral obligations” of the US “government backed” GSEs as the independent research I was reading spoke to their impending bankruptcies. “Are you sure you want to do this?” was met with “execute the F*cking order or I’ll take the trade to SALI!” Good times… good times…

Lately, I feel like I’m on a treadmill running up hill, for as different as the catalyst which pops a bubble always is, it’s as much the same (a bubble)… and yet, we’ve learned nothing. The mindset and attitudes of investors tend to be very predictable. From the onset of early conversations, I can usually predict with fairly good accuracy as to how the business relationship will progress. Certain clients become very good barometers as to the overall mood of the mob; whether, nervous or euphoric.

I want to make this clear, we’re not calling for a crash today, calling for a crash is a bit of a fool’s errand. If you’ve taken a minute to read anything, we’ve written over the past 3 years you’d know we have mapped this market and the Fed’s actions out well in advance and about as accurate as anyone in finance. Yet with calls as accurate as they’ve been, the gap between our performance and indices has prompted some conversations and calls. We’ve even lost an account or two. (Predominantly from those who don’t read what we’ve written).

It’s important for investors to understand “the why”. Today, we’ll walk you through a growing body of evidence supported by copious amounts of data along with timely words from some regarded as “the smartest in the room”. It suggests the engine which supports current asset prices is and has been sputtering. The car is leaking oil and the Fed is doing everything it can to add more. Though they have yet to fix the leak (the problem). The car can run for a while longer, but anyone who knows anything about cars will tell you when the oil dries up the engine will seize…

As the Fed was increasing rates we wrote of the high probability of a melt-up as the Fed would be forced to decrease interest rates and restart QE, (which they have done). Having said that, the probabilities of a sharp, prolonged decline is without question rising… and sure as the day is long, we (investors) never learn. With the resumption of QE and the euphoria of S&P all-time highs, investors from large to small are chasing dreams piling into markets as if Bentley dealers are having a 90% off black Friday sale.

Those who should read this won’t and those who currently understand these concepts, will. The more things change, the more they stay the same.

In this note we share with you the mindset of some of “the smartest guys in the room”; exploring their message and how it correlates with the consistency of our work. Finally, we will show you what the engine (and leaks) look like under the hood of the car that everyone keeps bidding the price up on. I like the way this note flows, it’s quite a few pages, but there are numerous graphs which speak much louder than words, PLEASE read it. Cycles matter, we believe we understand where we are in the cycle though, you should too.

Smartest Guys in the Room

“It doesn’t matter whether it (the next downturn) comes in one year or four. If you don’t start preparing now, you will maybe do better while the economy continues to do okay, but whatever gain you get from that will be overwhelmed by problems with your investments in the downturn…

“Investors should systematically reduce risk. They have to be highly diversified, and that doesn’t just mean financial assets…”

“(Investors) need to position themselves for the next global downturn because it will lead to substantial changes in the markets…”

“Why do Investors need to prepare now?”

“It’s difficult to make those adjustments while the decline is underway because the liquidity won’t be there. This time the liquidity is going to be very challenging in the corporate bond market.”

The above quotes come from an October 30, 2019 interview with Jeffrey Gundlach and Swiss newspaper Finanz und Wirtschaft (translated: Finance and Economics). We encourage you to read the entire interview, you can do so by clicking here.

I’ve been writing since July of 2015. Writing can often be a double-edged sword. On one hand, everything you’ve written is forever logged and archived, while on the other hand, everything you’ve written is forever logged and archived (think about it). In this business, writing catalogues and timestamps our thoughts for all to judge. Writing in this business is akin to having our own baseball card allowing investors to judge performance based upon numerous factors. There will always be those who focus on a single years batting average, while more astute investors will focus on the collective (Batting average, accuracy, on-base percentage, slugging percentage, walks, errors, etc.) i.e. managing risk over a full investing cycle.

While we’ve said this before, we’ll repeat ourselves for first time readers. If you judge “risk management” off of a single year’s batting average, you’re missing the point. Go out and buy an ETF – the S&P, for if that’s your barometer of success, then that single item is what you should own. If your choice is to chase dreams rather than earnings growth and relative value, as we quote Gundlach above, “you will maybe do better while the economy continues to do okay, whatever gain you get from that will be overwhelmed by problems with your investments in the downturn”

In a similar vein, Bridgewater Capital founder Ray Dalio has recently stated:

“If you don’t own gold (say 10%)… there is no sensible reason other than you don’t know history and you don’t know the economics of it.”

Dalio has recently been scrutinized by the MSM (in the specific link, CNBC) for his comments on gold and the short term performance of his flagship Pure Alpha fund, which was down -4.9% through the first half of this year (June 30,2019). The comparison used by pundits was the S&P 500, which at the time was up roughly 18%.

While we should all welcome a healthy dose of scrutiny, making a short-term performance comparison with one of the smartest guys in the room with an “everything up” narrative, is the essence of what Dalio is speaking about; they don’t really know history and don’t understand the economics of it…

They’re judging and questioning one of the all-time greats, a Hall of Famer, by looking at his one year batting average without considering his history, other merits or more importantly, THE WHY? WHY has one of the greatest investors of all time positioned his Pure Alpha fund this way?! What is he seeing that has led him to make these decisions for the BILLIONS of dollars he manages for himself and others? The man doesn’t need to work; his personal net worth is estimated at $18.7 billion; he’s a philanthropist, a teacher, he’s pleading with people to learn…

The late Richard Russell began writing the well-known “Dow Theory Letters” in 1958. His most popular piece was titled “Rich Man, Poor Man (The Power of Compounding)”: The below excerpt should be put to memory. It’s timely:

In the investment world the wealthy investor has one major advantage over the little guy, the stock market amateur and the neophyte trader. The advantage that the wealthy investor enjoys is that HE DOESN’T NEED THE MARKETS. I can’t begin to tell you what a difference that makes, both in one’s mental attitude and in the way one actually handles one’s money.

The wealthy investor doesn’t need the markets, because he already has all the income he needs. He has money coming in via bonds, T-bills, money market funds, stocks and real estate. In other words, the wealthy investor never feels pressured to “make money” in the market.

The wealthy investor tends to be an expert on values. When bonds are cheap and bond yields are irresistibly high, he buys bonds. When stocks are on the bargain table and stock yields are attractive, he buys stocks. When real estate is a great value, he buys real estate. When great art or fine jewelry or gold is on the “give away” table, he buys art or diamonds or gold. In other words, the wealthy investor puts his money where the great values are.

And if no outstanding values are available, the wealthy investors wait. He can afford to wait. He has money coming in daily, weekly, monthly. The wealthy investor knows what he is looking for, and he doesn’t mind waiting months or even years for his next investment(they call that patience).

But what about the little guy? This fellow always feels pressured to “make money.” And in return he’s always pressuring the market to “do something” for him. But sadly, the market isn’t interested. When the little guy isn’t buying stocks offering 1% or 2% yields, he’s off to Las Vegas or Atlantic City trying to beat the house at roulette. Or he’s spending 20 bucks a week on lottery tickets, or he’s “investing” in some crackpot scheme that his neighbor told him about (in strictest confidence, of course).

And because the little guy is trying to force the market to do something for him, he’s a guaranteed loser. The little guy doesn’t understand values so he constantly overpays. He doesn’t comprehend the power of compounding, and he doesn’t understand money. He’s never heard the adage, “He who understands interest – earns it. He who doesn’t understand interest – pays it.” The little guy is the typical American, and he’s deeply in debt.

I

wonder why Warren Buffet is sitting on $128 billion?! Though, I

digress… This brings me back to the Gundlach interview: when asked,

Is

there any place where you can find value? His

response is very telling:

“Outright value? No. I don’t think there’s anything in the world of financial assets that one could call value, because the policies of the central banks have pushed valuations to levels that historically are associated with avoidance rather than allocation.”

While I don’t completely agree with Gundlach, I don’t completely disagree either… Patience pays!

Crescendo

cre·scen·do (/krəˈSHenˌdō/): Noun

- the loudest point reached in a gradually increasing sound. “the port engine’s sound rose to a crescendo”

- the highest point reached in a progressive increase of intensity. “the hysteria reached a crescendo around the spring festival”

Those with a musical background should be familiar with the term crescendo. Fun fact: The classical piece, Bolero, written by French composer Maurice Ravel is the single longest crescendo ever written. It begins with a whisper, then slowly, consistently and deliberately increases in volume and intensity for 15 minutes and 50 seconds to 17 minutes (depending on rendition, composer and pace) before finally ending with a thunderous finally!

Crescendo… The perfect word that came to mind as I sat down to write this note… It’s how we’ve delivered our message, which began with a whimper. When we wrote “Dark Clouds still loom in the distance… Debt” in 2017 as part of a larger note.

Debt, in and of itself, doesn’t create an end of the world scenario… However, when those who have borrowed can no longer pay back what they’ve borrowed, and the underlying asset held as collateral has little to no value… “Houston, we have a problem”

Just as every hurricane begins with a single gust of wind, with each passing note we’ve published mere gusts have strengthened to consistently strong and potentially damaging. Currently, tips of swaying palm trees are bending, touching the ground and what can be described as copious storm chasers are running straight for the storm.

Trusted sources from our President to Federal Reserve officials and large brokerage houses preach the “all-clear” while their actions SCREAM, we’re in some serious trouble.

This message becomes more alarming with every passing day. Gundlach and Dalio know it, they understand their history; and the value Russell speaks of in “Rich man, Poor man”. In managing hundreds of billions of dollars they want their clients prepared and aligned with the way they manag; they are not afraid of the impatient few.

On October 30, 2019, Fed Chair Powell literally said:

“Look at today’s economy. There’s nothing that’s really booming that would want to bust, in other words.” “It’s a pretty sustainable picture.”

You literally can’t make this sh*t up! Nothing that’s really booming? Pretty sustainable picture?

For years we’ve preached the overall themes from the Gundlach interview. We have shared Dalio’s affinity for gold and our thesis and conviction continues to strengthen with every passing move the Fed has recently made. We encourage you to visit our archives here, we back up what we say. (and are diligently working on adding pre-OSAM pieces as clients who made the move to OSAM make them available to us).

We were very bullish in 2016 and 2017 and our performance reflected our message. In 2018 we gradually became more cautious maintaining our thesis through today… We follow the data and capital preservation strategies, not emotion.

We have never been “perma-bears”, our focus is risk management. Our job is to defend your capital – not blindly chase returns ignoring the risk. Our job is also to understand cycles – not push chips “all in” at euphoric times which can’t be supported with data. That’s what people did in 2000 and 2007, how’d that work out for most?

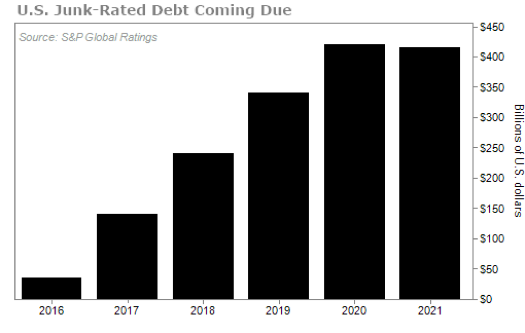

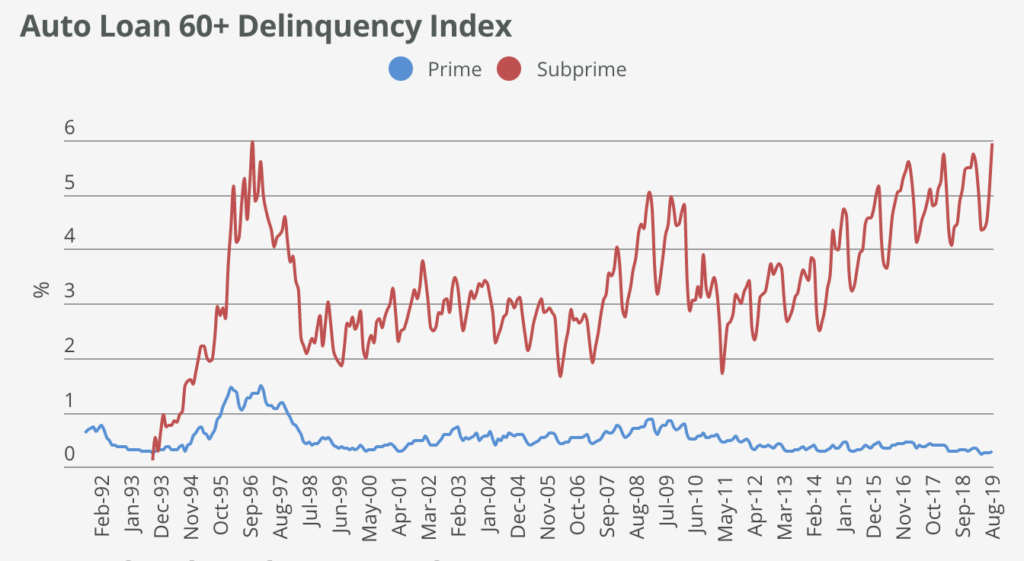

Excessive debt and leverage in our system (consumer, corporate and government), has been our constant message, specifically pointing to the erosion of credit quality in BBB and junk bonds, subprime auto lending and consumer credit lending. January 5, 2017, we provided clients with the below chart:

On the same day we also cited Morgan Stanley’s work on BBB and Junk bonds. Again, January of 2017 – we also said:

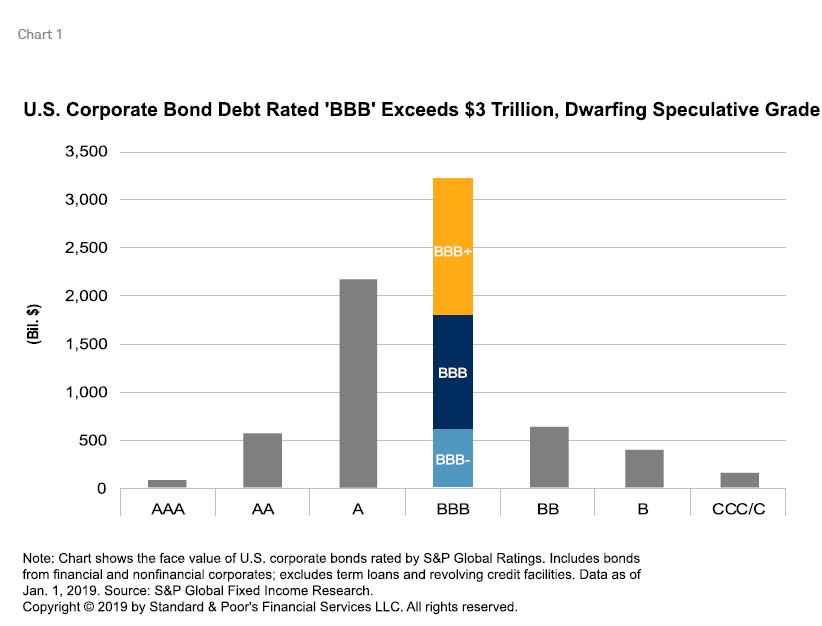

Corporate bond analysts at Morgan Stanley anticipate the default rate among junk companies to reach 25% within 5 years. The lowest “rung” of high-quality bonds or BBB Rated bonds used to comprise roughly 17% of the market now represents nearly 30% of all bond issuance. When adjusted for the amount of corporate debt issued, US equity markets are trading at record highs with outlandish valuations – though corporate earnings have fallen for five straight quarters.

What does this mean? It means BBB credits may not be investment grade credits anymore?! In a recent report from Bloomberg found here – both Moody’s and S&P have been“cutting companies slack on mergers and acquisitions, an analysis of credit-ratings by Bloomberg News found.”

“Over the past year and a half, both have bumped up their ratings by two, three or even six levels on a majority of the biggest deals, the analysis found.” (emphasis mine)

This theme has been expanded on in many of our notes over the years, too many to cite, but none more poignant then January 2018 – MOAB.

I’m going to circle back to the Gundlach interview with Finanz und Wirtschaft for a quick point:

When Gundlach was asked what the problem is with the corporate bond market? His reply is as follows:

“The corporate bond market in the United States is rated higher than it deserves to be. Kind of like securitized mortgages were rated way too high before the global financial crisis. Corporate credit is the thing that should be watched for big trouble in the next recession.”

When

asked how big the problem was his response was as follows:

“Morgan Stanley Research put out an analysis about a year ago. By only looking at leverage ratios, over 30% of the investment grade corporate bond market should be rated below investment grade. So with the corporate bond market being vastly bigger than it’s ever been, we’ll see a lot of that overrating exposed, and prices will probably decline a lot once the economy rolls over. Furthermore, central bank policies have forced investors into asset classes that they usually would be a little bit more hesitant to allocate to.”

Does any of this sound familiar? Gundlach, one of the largest, most well respected asset managers in the financial industry is citing updated research we’ve been talking about since January of 2017.

Could we both be wrong, absolutly… Though given the plethora of data, the probabilities are low. Laws of Economics don’t lie, people do… As such, our portfolio positioning has gradually become more defensive through 2018 & 2019 – it hasn’t just happened overnight. Positioning reflects the environment – and given September’s blow up in the repurchase markets, CAUTION is warranted regardless of the S&P’s performance (we’ll get into much greater detail shortly).

Another theme we have maintained is no one knows exactly WHEN the next credit default cycle will happen. In 3Q2017 after livestreaming the Grant’s Investors Fall Conference I wrote:

“I’ve been lucky enough to capture the thoughts of some of the most influential minds in the financial world over the last three weeks; it’s been mind-numbing. However, there is a tremendously important takeaway from all of this. Given all this firepower at these conferences, there have been 2 common themes that continue to resonate with me, I thought I’d share.

The first constant: The absolute best of the best, the smartest of the smart, those presenting or in the audience, regardless of conference I was at, constantly asked a singular thing. The question can be phrased countless ways, yet it usually boiled down to one simple word, “When”? When do you see markets crashing? When do you see inflation rising? When do you see interest rates moving higher? When will all the debt on the BOJ’s (Bank of Japan) balance sheet come to roost? What’s your timing on all of this going down?

When simplified, the question was always, When, WHen, WHEn, WHEN?!! The answer, is inevitably boiled down simply to, “I don’t know”?”

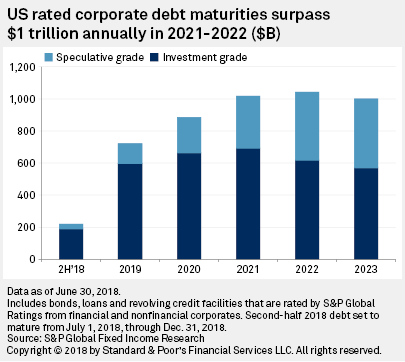

No one knows WHEN, though, when forced to speculate, we have consistently noted 2019, 2020, possibly 2021. Our thesis has been the sheer volume of debt, deteriorating quality and a need to be repriced over these years (as shown above); both Junk and BBB (investment grade paper) (see January 2018 – MOAB). These more recent graphs from S&P Global (below) show our current scenario as more elevated than before.

It doesn’t take a genius to figure out TRILLIONS of dollars in debt that needs to be repriced over the next handful of years is a big number! Anyone willing to look would have seen leverage ratios growing exponentially, credit quality was/is deteriorating, revenue and earnings had been/is contracting, all while the Federal Reserve was increasing interest rates, running billions off their balance sheet, the government delivered a tax cut (it couldn’t afford) while running trillion-dollar deficits (yearly)? And PhD, former Fed Chair Yellen thought pulling the largest buyer of treasuries out of the market at this time would be akin to “watching paint dry”? Academia folks!

We have stated our belief is that Morgan Stanley, S&P as well as PIMCO’s estimates regarding fallen angles (companies which are bank investment grade that are downgraded into the junk category) are likely light.

This Bloomberg study our January 5, 2017 note, and today we’ll add the Wall Street Journal’s updated October 20, 2019 supports our case. Again, our belief stems from structural issues within our system (see January 2018 – MOAB). Ratings agencies know they are being lenient; they don’t deny it, they cite “discretion” as their justification!

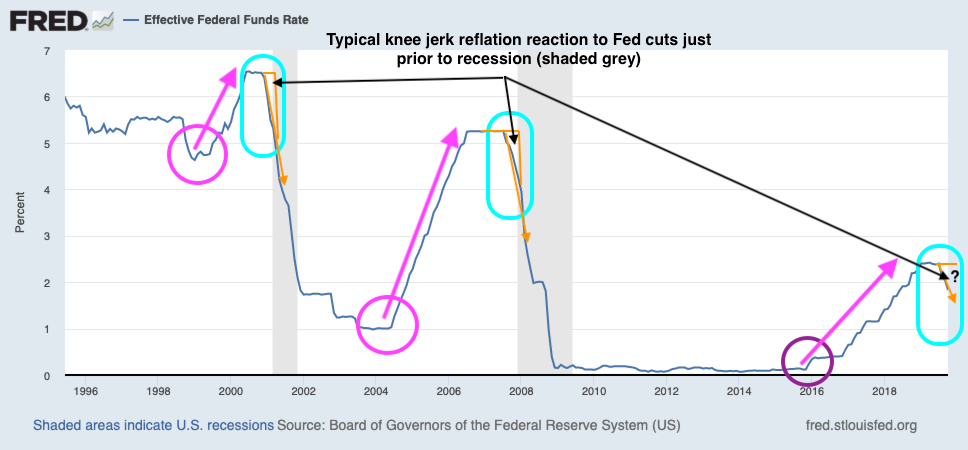

Our notes have described the Fed’s “most likely” path to a “T”, We were adamant the Fed would have to lower rates, stop QT and resume QE due to the aforementioned all while the Fed was raising rates. We discussed this throughout 2018; though dumbed it down in our 4Q2018 note “The Fed, 650… 525(+400)… 250(+?)…” (page 4)

Having said all this, we have pressed the “melt-up” in equities theme, stating markets have never had more embedded risk, however, the odds of a “Melt-Up” were that much more plausible, to be followed by a “Melt-down” of epic proportions. This remains true today. Again, from our 4Q2018 note: (page 16)

So how could we believe the odds of a Markets “Melt-Up” have increased?

As we’ve said in the past, we don’t believe Powell or any other Fed president has the stomach to see this through (interest rate hikes)?

“they are all just terrified of the likely outcome, should they be the one who tell the truth, which sets the house of matchsticks ablaze” OSAM – 2Q2018 note

We continued:

“We have beaten the proverbial dead horse on excessive debt and our inability to afford higher interest rates; the market voiced their opinion to the Fed in December. An ultimatum, either reverse course and use all tools at your disposal or forever be the face and name associated with what could very well be one of the most prolonged, troubling, painful recessions in history; which again, “is the blood nobody wants on their hands”.

Did you have to ask?

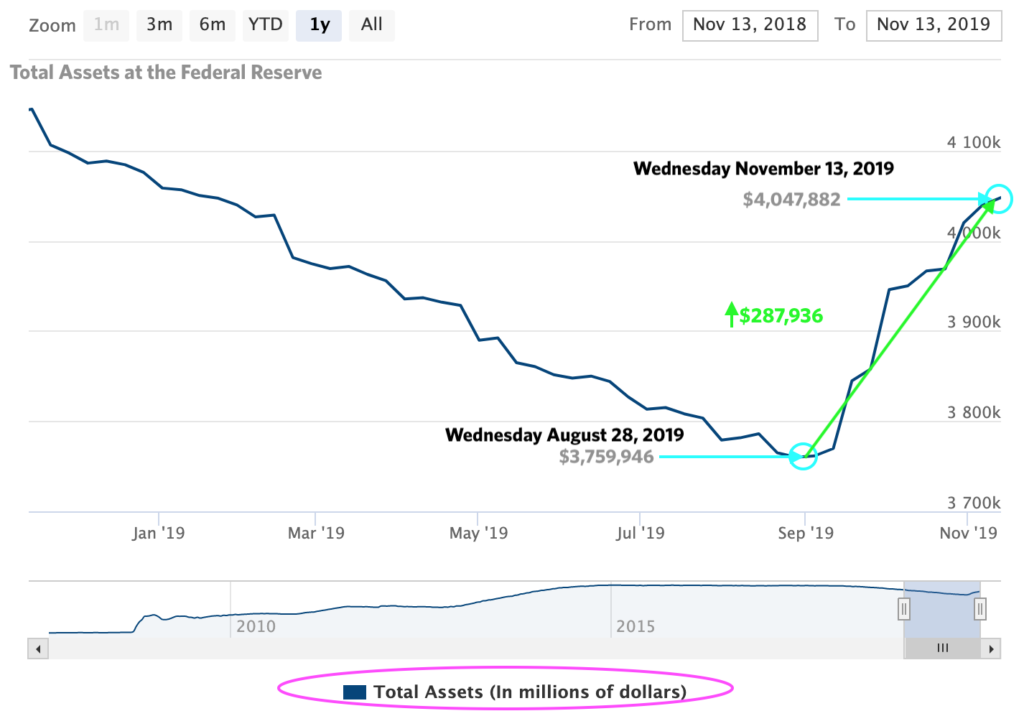

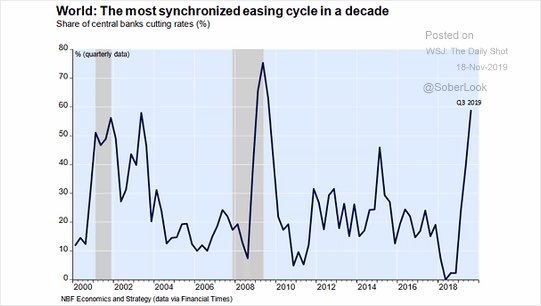

We have been consistent with our message; the Fed would have to cut interest rates and restart fiscal policy (QE). To date, they continue to play with words refusing to admit their liquidity measures are a new QE (Quantitative Easing) program. It took the Fed roughly 23 months to reduce the size of its balance sheet from $4.5 trillion dollars to $3.8 trillion! You call it what you will, but this is what NOT QE (QE) looks like…

Not QE (QE) is expanding their balance sheet at a pace faster than QE1, QE2 and QE3; all the while, staring us all in the face stating their intervention is “NOT QE”. The reasoning behind it not being QE? The bonds being bought are short term?! Fun

Fact: Balance sheet expansion is QE; its magnitude is troublesome and their abrupt about face while telling everyone things are “ok” should raise every American’s eyebrows.

In similar fashion, the Fed gradually eked their benchmark interest rate from 0.1% to 2.4% over a 3-year time frame; then in an immediate about face, with the economy being in “good shape” (their words) the Fed abruptly cut their benchmark interest rate 3 times by 0.25% in 4 ½ months, decreasing the Federal Funds Rate from 2.5% to 1.75%.

While we have mapped these exact circumstances out for years, the embedded risks in the system have grown exponentially making us a bit more cautious and defensive, while many investors are throwing caution to the wind as either a. no one cares because markets are at all-time highs and that’s all people care about or b. people have an unrelenting belief those at the Federal Reserve will pull us out of all things “trouble” as they have in the past!

Either way, we would urge you to brush up on your history surrounding the Great Depression and debt cycles (both long-term and short-term). You can (re-)read Ray Dalio’s “Paradigm Shifts” written July of 2019. We’ve provided you with this link before. History suggests neither scenario is likely to end well; not just that which dates back to the early 1900s.

So, what’s the rationale behind telling everyone things are ok, while at the same time:

- Cutting rates 3 times in a 4-month time frame

- Launching a $75 billion-dollar repo facility

- Increasing a $75 billion-dollar repo facility to $120 billion dollars

- Introducing a $60 billion-dollar/month treasury bill buying program

- And increasing the size of their (The FED’s) balance sheet by nearly $300 BILLION dollars in the last 8 weeks as shown by chart above (source Federal Reserve).

For those still wondering what the answer to my earlier question was – it’s confidence, the rationale behind telling everyone that everything is ok while providing markets with the largest jolt of stimulus in history is confidence. They are telling you “the system” is ok (the data and their actions suggests it’s not).

Without question, this is a confidence game and at the point in time people believe the central banks have lost their handle on all things monetary, it will be very painful for those who are not prepared, market liquidity will dry up instantly.

Before moving on, I believe there is a “c” to my above scenario. Which is my prevailing thought. People don’t want to think of the “what if” scenario should the Fed not be able to pull a rabbit out of its hat. Personally, I hate thinking about it, but I will not turn a blind eye to it.

Gravity exists in economics, there is no escaping it and understanding how to recognize it is part of the responsibility of any asset manager who calls themselves a fiduciary responsible for client’s financial futures. Economic cycles ebb and flow and for large investment firms, financial media and advisors to ignore or brush these risks off as “long-shots” all while cheerleading “all-time highs” is borderline negligent.

It should now be apparent to everyone; the Fed does NOT have the ability to normalize interest rates… They are sacrificing savers, pension funds and the entire financial system. Now that she is no longer Fed President, Janet Yellen apparently can say things she failed to acknowledge while in charge (amazing how that happens)?!

“Saver’s are getting penalized, it’s true”

No sh*t Janet, you were largely part of the problem!

Fed policy is also creating more Zombie companies (as describe in May and September) that at some point in time will not be able to roll their debt. What tips the scales? Absurdly high leverage ratios, shrinking sales, revenue and earnings, deteriorating credit quality, lack of natural buyers, you pick it… As revenue and earnings continue to deteriorate, rest assured costs will get cut, layoffs will ensue and they can only admit their policy has failed and cycles matter when they step down from the Fed!

As we discussed last month – while you continue to hear “better than expected” in reference to “earnings beats”, the rate of change has been negative for 3 quarters now. Beating reduced, reduced, reduced expectations is not growth and by no means warrants expanding multiples Wall Street analysts are calling for. Earnings have now been contracting for the last 3 quarters:

“The blended (year-over-year) earnings decline for Q3 2019 is -2.3%, which is below the 5-year average earnings growth rate of 6.9%. If -2.3% is the actual decline for the quarter, it will mark the first time the index has reported three straight quarters of year-over-year declines in earnings since Q4 2015 through Q2 2016. It will also mark the largest year-over-year decline in earnings reported by the index since Q2 2016 (-3.2%).” FactSet November 15, 2019 pg. 6 of 28

Home supply behemoth Home Depot (HD) announced a revenue miss on 11/19/2019, lowering their future sales outlook. On the same day, Kohls (KSS) cut forward-looking estimates sending the stock down -22% in the last two days and -37% from its peak in April. Walmart (WMT) trades with a 27x PE, 23x FPE, has a 2.5% profit margin with $75 billion in debt… they, too missed revenue estimates and as I finish up writing, BJ’s wholesale warehouse (BJ) just announced a “meager earnings” beat, yet sales and revenues missed expectations, reducing forward guidance…

Again, please remind me how solid and resilient the consumer is? After roughly 10 years of near zero interest rates with the Fed being forced to reduce rates after raising them to an anemic 2.5%!

This is NOT about trade wars and China folks, It’s not about a $20 billion-dollar per year soybean deal. It’s about too much leverage, too much debt. ECONOMIC CYCLES MATTER! DEBT CYCLES MATTER!

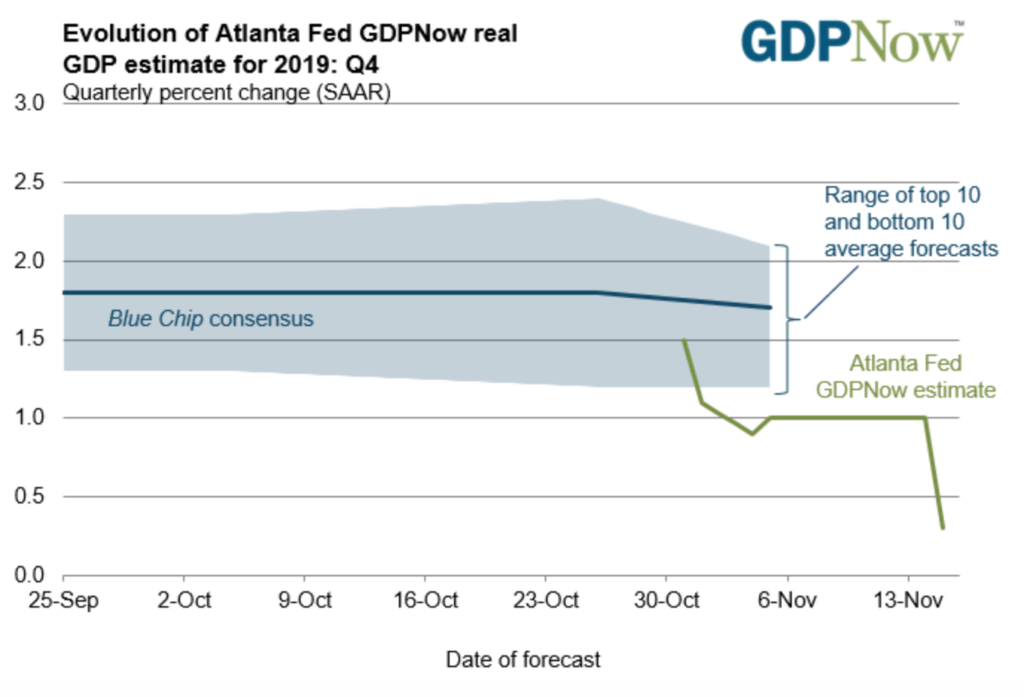

Do you know what also matters? GDP growth, which is anemic at best… US GDP growth was recently slashed by the Atlanta Fed from 1% to 0.3% per their GDPNow:

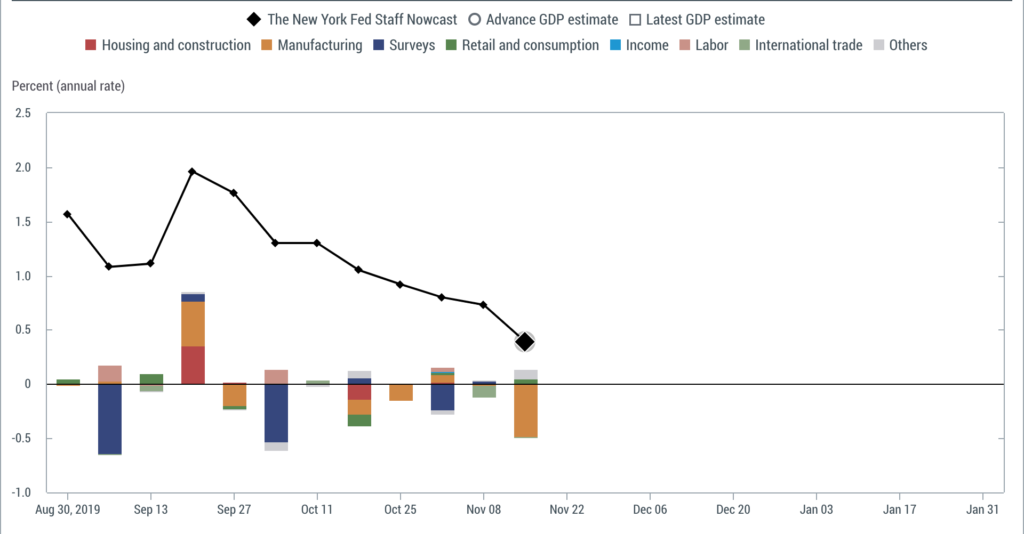

While the NY Fed NowCast recently slashed its forecast from 1% To 0.4% (there is a 0 and decimal point in front of that 4 folks) it’s 0.4:

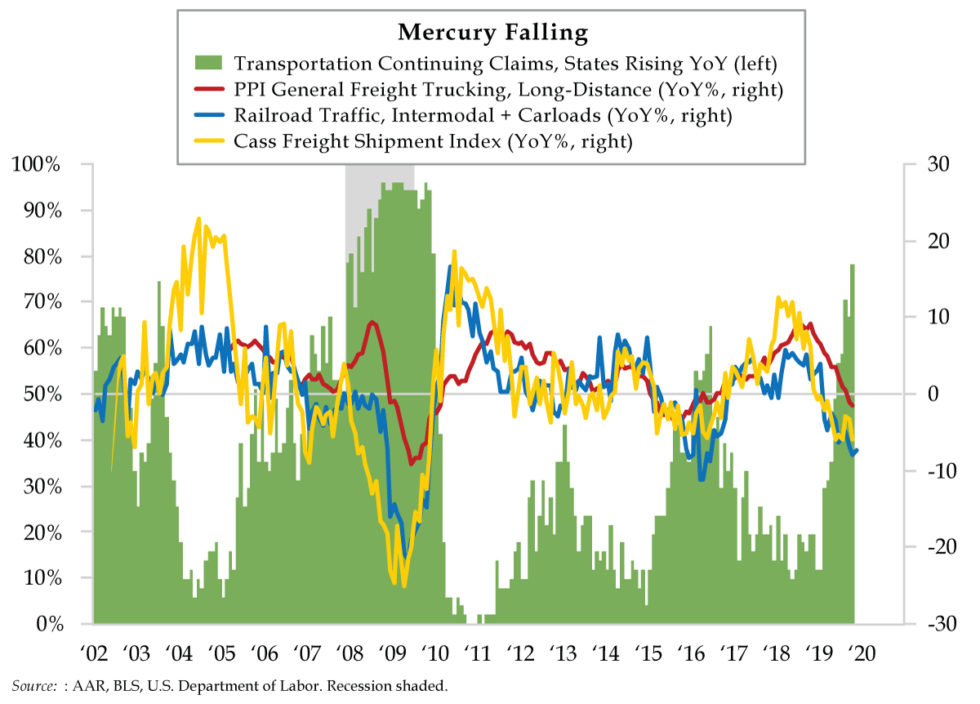

As GDP deteriorates and the rate of change in corporate earnings and revenue decline at a faster pace, cost-cutting becomes management’s top priority. This has been showing up in the leading indicators for some time now and no one – I mean, no one has done a better job at drilling down into the data then Danielle DiMartino Booth. We’ve touted her before as Former Fed insider, 9-year advisor to former Dallas Fed president Fisher and author of the book Fed Up. We now introduce her as founder and CEO of Quill Intelligence, a research group dedicated to fair and unbiased financial education. Among countless other things, she proves a picture is worth 1,000 words, we proudly share the next 3 graphs with her permission and that of Quill Intelligence.

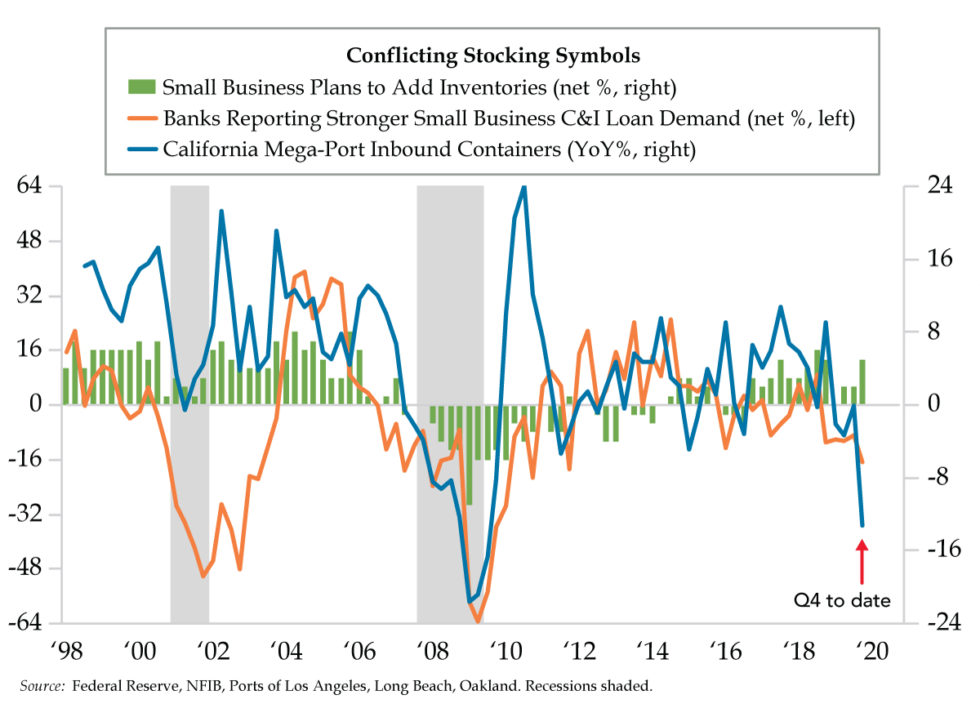

Simply stated, consumers can’t buy “stuff” (technical term) if it’s not being “transported” to stores; whether by boat, truck or train, as movement of consumer goods slow (yellow, red, blue lines below). More of those who move these items (truck drivers, delivery drivers, train engineers, ship captains, crew, etc.) file for unemployment (green bar graph below).

We’d then ask how one can even stock shelves or transport items around when nothing is coming into port (Blue line below)? Or when banks are reporting weaker commercial and industrial loan demand (orange line below) as less business activity is transpiring.

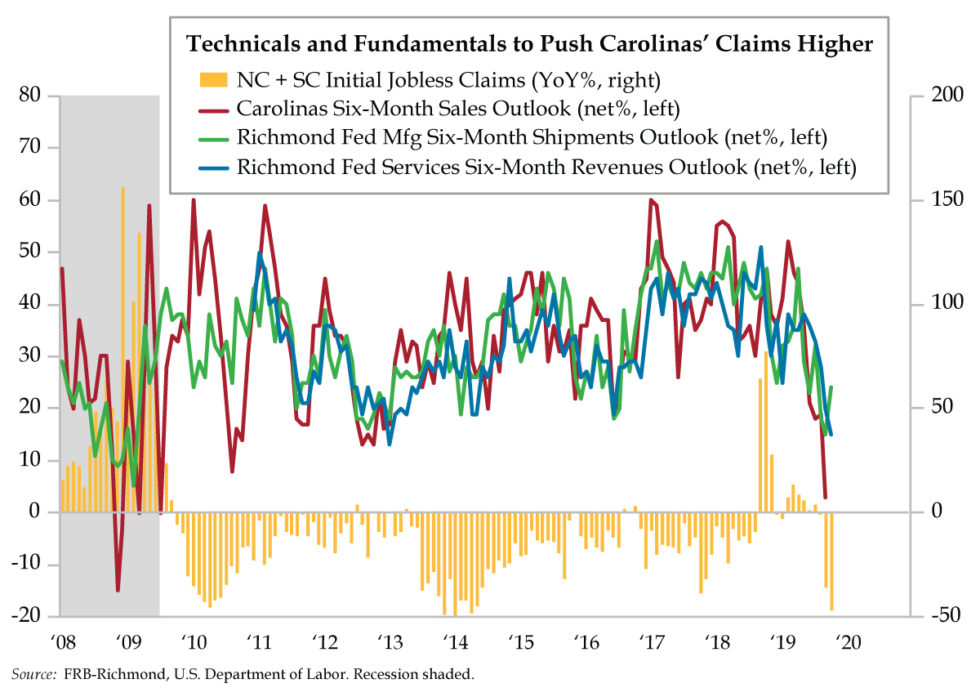

And for my North Carolina contingent, whom I’ve had numerous conversations with. Many believe we will be insulated by a downdraft (should one come)? Unfortunately, current data suggests otherwise. Below please find NC + SC initial Jobless claims coupled with six-month sales, shipment and revenues outlook. “WE” may just not be feeling it yet? Hopefully, the billions of Not QE (QE) trickles down to us! Hopefully, it starts to show up in the numbers! Hope is a strategy, right?

All while Sub Prime Auto loan delinquencies are skyrocketing! We’ve raised awareness to this since 2016 and it’s getting worse.

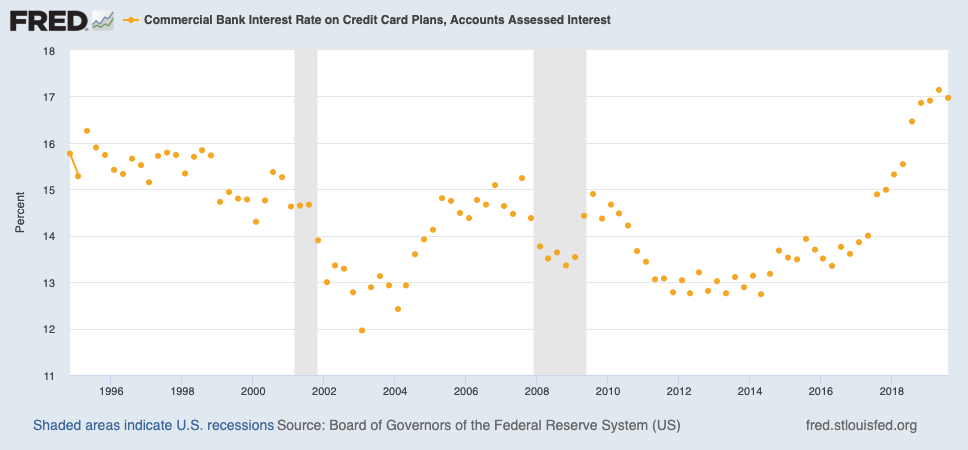

Meanwhile, the average APR on consumer credit cards is roughly 17.25% per creditcard.com (as of 11/13/2019). Just about all-time highs with benchmark interest rates near all-time lows. Does this make sense to you?

I thought loan sharks were illegal. How could this be? An insatiable appetite for credit. Are we still convinced the consumer is in good shape?

The very first “note” I wrote to clients was on June 17, 2015 (poorly written and remedial), yet my 3rd sentence read:

“Wall street lore says bond investors are often ahead of (and more intelligent than) those who trade equities, which is why many tend to look towards the High yield market as a leading indicator as to where stocks may be headed.” June 17, 2015 MCK

When Gundlach was recently asked how low the Fed go with interest rates, he responded by saying:

“The Fed will follow the bond market. It’s all they ever do.”

It’s why we follow distressed debt, Fed chair Powell comes from private equity, PE lives off debt and credit markets. He’s not decreasing rates and providing QE for equities he’s doing it for what’s looming in the bond markets (a liquidity freeze). How does one provide instant liquidity when underlying collateral is illiquid? it’s more ominous every day…

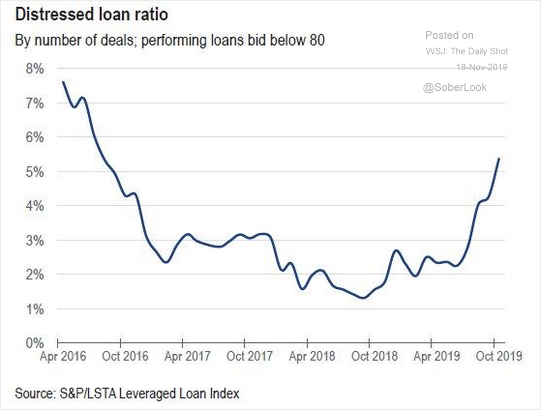

The number of leveraged loan issues trading sub $0.80 on the dollar continues to climb at an alarming rate:

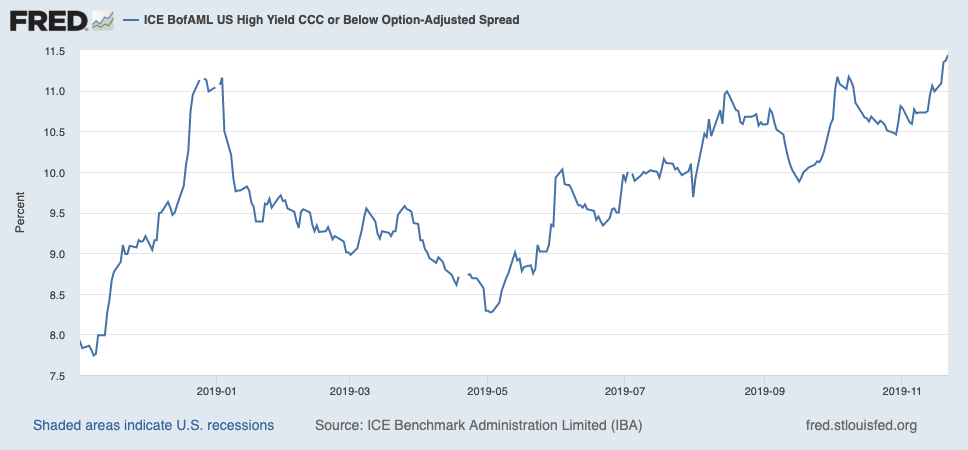

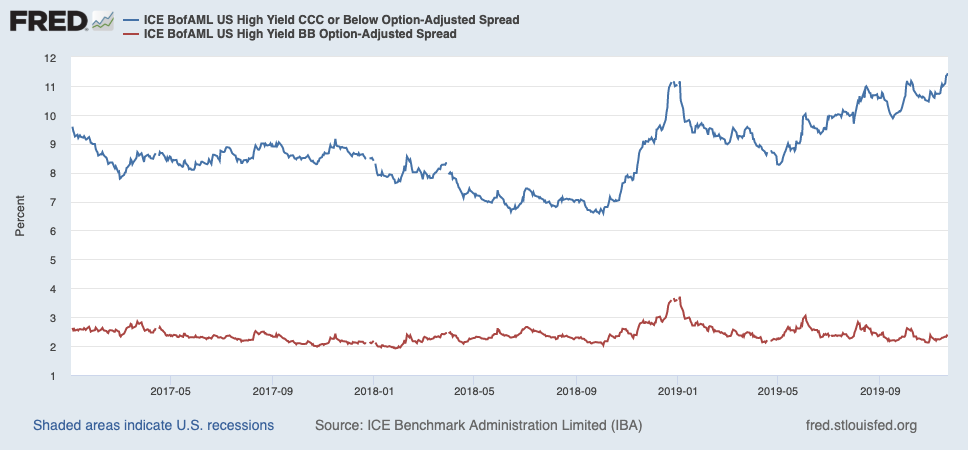

Additionally, the spread between CCC rated bonds (junk credit) vs. BBB has never been this wide! What is going on? Why the enormous disconnect and distortions within markets even with the Fed’s Repo purchase program and Not QE, QE?

The answer: as much liquidity as the Fed is injecting into the system, it’s simply not reaching the most distressed credit quality. Money is flowing out of the system as quickly as they are injecting it into the system (pouring oil in, but the leak is not fixed). This is such an IMPORTANT concept to understand.

Then couple it with what we, Morgan Stanley and Jim Grant (among others) have been saying for years; Gundlach, Danielle DiMartino Booth and the WSJ are now pounding on the drum. Much of the BBB credit, by leverage ratios and metrics are priced as BBB, BUT ARE NOT BBB QUALITY. They should have been downgraded to junk quite some time ago. There is a huge price distortion in credit markets with an enormous liquidity crises looming.

Currently, BBB paper is still supported by “natural buyers” (pensions, insurance companies, investment grade mandate bond funds). Bids and liquidity still exist for these companies, however, at the point in time the “investment grade/junk line” is crossed by some very large issuers, natural buyers will become sellers. Some “experts” suggest this won’t happen, though in the face of a crisis, they will… first sale is often the best sale.

They won’t want to face a lawsuit defending why they held on to a bond that went bankrupt when covenants and bylaws stated they should have sold on the downgrade. We have browbeaten this subject, but our January 2018 – MOAB piece should be revisited.

In a recent interview with Hedgeye Risk Management founder and CEO Keith McCullough, and former hedge fund manager, well respected Macro analyst and co-founder of RealVision TV Raoul Pal, Raoul mentioned 4 names (we’ve been talking about for years) which are very likely and incredibly large fallen angel candidates; AT&T (T), General Motors (GM), Ford (F) and General Electric (GE).

Pal added Dell ($52.6 billion in debt) – my understanding is Dell inc. is already junk, but Dell international Sr. debt has a Baa3 rating (per Moody’s), either way – whether fallen angel or simply needing to restructure, it’s no small deal. That’s would equal ~$500 billion of debt that is a single downgrade away from being junk –equal to ~42% of the entire junk market should those 5 fall. Buyers will NOT be there…

But rest assured folks, everything is ok – Global Central Banks are on the same page?! Good thing nothing is wrong with the economy and the consumer is in good shape!

There is an enormous disconnect between underlying economic fundamentals vs. equity asset prices being supported by Global Central Banks flooding the system with money and while the Fed’s liquidity pumping is proving to be short term bullish for the equity markets, It’s more than likely a knee jerk reaction reflation trade.

As more supporting data comes in showing inflation is on the rise, corporate earnings continue to fall and labor markets are weakening, most will be caught off guard. So many more data points and signs of slowdown exist than you’re willing or care to read in a single note, we’ll spare you…

Yet this all begs the question? Can the Fed push equity and asset prices to overly inflated levels in the face of a full-blown corporate earnings recession?! Said differently, could equity markets continue higher while the economy and consumer show signs of recessionary weakness?

It would be a first, but we will admit, anything is possible, not probable, but possible. It would create enormous political and social unrest. The wealth inequality gap would be exacerbated as is, the last time saw current levels was around the time of the Great Depression (1929/1930).

Meanwhile, citizens of Iran burned their central bank to the ground, as France and the Czech Republic and most notably Hong Kong face enormous protests of their own. Countries as Argentina, Chile and Lebanon are watching their economies fall to pieces. Social unrest around the globe is exploding.

The largest challenge is the “fixes” Central Banks continue to throw up against the wall in the name of prolonging our “current expansion” exacerbate the real issues as they are the root cause of them.

Making the probability that Economic Gravity will hurt that much even greater.

We are living in challenging times. There are ways to make money in these markets while reducing risk. With proper planning and a little patience, we will be prepared for the pivots and large inflection points.

Historically, the destruction of capital during times of economic crises has a much greater impact on overall long-term performance of portfolios than reaching for a few extra percentage points when markets make emotional moves higher while data continues to roll over. This is why we place so much emphasis on capital preservation strategies.

Whether you know it or not, times like NOW are the reason you have hired us or consider doing so…