In This Article

MAYDAY! MAYDAY! MAYDAY!

In the early 1920’s, a senior radio officer at London’s Croydon Airport, Frederick Stanley Mockford, was asked by his superiors to think of a word, easily understood by all pilots and those on the ground, which conveyed distress during an emergency.

With much of the air travel in and out of London’s Croydon at the time going to and coming from Le Bourget Airport in Paris, Mockford proposed the term “Mayday” – derived from the French word, “m’aider”; simply translated “help me”; a shortened version of the French phrase, “venez m’aider” meaning “come and help me”. The suggestion was made to say the word 3 times to be sure it was not mistaken with any other similar words or phrases. For over 100 years, “Mayday!” in the world of aviation and navigation, equals an emergency.

When the New York Stock Exchange was formed in 1792 it set minimum commissions. For over 180 years, brokers bought and sold equities never having a conversation about charging more or less than any competitor as ALL brokerage firms charged the same transaction price. In fact, if you were a broker who attempted to charge customers less than the dictated rate, you could be penalized and “you ran the risk of being expelled from the stock exchange,” as Jason Zweig of the WSJ wrote in April 30, 2015 about the often overlooked May Day.

Then it happened — “MAYDAY!” – the commission structure changed on May 1, 1975 when an SEC ruling allowed the previously FIXED commission schedule to become NEGOTIABLE.

Why do We Care?

This seemingly harmless decision so many years ago has sealed the fate of an entire financial system via the virulent power of unintended consequences. To believe this decision merely offered a cheaper way to transact is first level thinking.

May Day structurally changed the foundations of our financial system in all financial markets. The unintended consequences of that decision 45 years ago are so far removed from most people’s minds that most are unaware of its inevitable negative impact.

Very few ever question “the why”, but in this case, it’s imperative for you to truly understand the “why” in order to avoid the carnage. Our goal in arming you with this knowledge is to make you less interested in chasing the rising prices, and more focused on figuring out how to preserve your life’s savings – truly the ultimate Mayday!

Got Threshold?

Mark Granovetter published a study on group behavior in The American Journal of Sociology, Vol. 83, No. 6. (May, 1978), pp. 1420-1443 titled, Threshold Models of Collective Behavior.

“The threshold is simply that point where the perceived benefits to an individual of doing the thing in question … exceed the perceived costs.”

“…these models can be applied to processes not usually called “collective behavior,” such as voting, residential segregation, diffusion of innovations, educational attainment, strikes, migration, and markets as well as the more typical processes of crowd behavior and social movements.”

Note that his model describes all group behavior, applying equally well to financial markets as to riots.

“Different individuals require different levels of safety before entering a riot and also vary in the benefits they derive from rioting. The crucial concept for describing such variation among individuals is that of “threshold.” A person’s threshold for joining a riot is defined here as the proportion of the group he would have to see join before he would do so.

…. The threshold is simply that point where the perceived benefits to an individual of doing the thing in question (here, joining the riot) exceed the perceived costs.”

Again, while Granovetter uses the example of rioting in his paper, he specifically states, these models can be applied to processes not usually called “collective behavior, “such as … MARKETS”, with an obvious example of this being “FOMO” as investors join the crowd in fear of missing out on returns.

During the below discussion, we’ll help you understand how the perceived beneficial cost structure triggered by Mayday has interacted with the threshold model of collective behavior in the context of investing and the dynamics of financial markets. Structural changes decades ago sealed the fate of the industry; human behavior, self-preservation and thresholds are and will continue to accelerate the final outcome.

What changed?

“Deregulation provided the window for people to begin to innovate … It turned the whole industry upside down and led to this great mass flourishing of services and pricing and technology.” ~Charles Schwab

Charles Schwab became the first financial institution to offer discounted stock trades on the very first day allowed, MayDay. Schwab led the charge into the discounted commissions business and paved the way for numerous financial startup firms to “innovate”. One of these innovators, has become a titan in the industry, a member of “The Big Three” – The Vanguard Group. Founded on May 1, 1975 (MayDay!), this company is now the largest provider of mutual funds and second largest provider of passive ETFs in the world.

Note the evolution, from discounted commissions to passive ETFs. As we will see shortly, passive ETFs, though seemingly benign, may have an extremely ominous outcome. The act of merely allowing discounted commissions wasn’t what changed the face of the industry; yet it was THE NECESSARY KEY which opened a portal to an entirely new world of “services, pricing and technology”. The Industry was turned “upside down”, battle lines were drawn.

While discount firms were setting new standards, the traditional Wall Street firms were scrambling their marketing departments, working overtime in order to figure out how to convince investors to pay much more to trade with them, when the exact same trade could be executed elsewhere for a fraction of the price. Investors started migrating to new providers and lower cost structures. This migration happened slowly and in stages.

Both Schwab and Vanguard were the corporate “radicals’’ (to use Granovetter’s phrasing) whose initial goals were to attract like-minded advisors/employees and investors in order to succeed.

Wall Street’s answer … Advice, Service & Fear…

The response of the traditional Wall Street brokers required “innovation” as well. Rather than fighting a battle on commission, many firms began to offer their clients “fee-based accounts”, wherein investors would pay their advisors for their “expert” tutelage with “all trading included” (Beat that discount guys!) To which discount firms casually said … “hold my beer”

I entered this industry as a traditional broker in 1996, yet even then, commissions were rarely questioned, nearly 21 years after Mayday… Multiple sales managers were hired in an effort to convert our “sales force” from commissioned brokers to fee-based advisors with little to no avail… How could that be 21 years after the Berlin Wall of the industry came crumbling down?! In a single word… Incentives!

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” ~ Upton Sinclair

Note above I used the phrase “sales force” – one colleague used to call himself a “peddler”. Wall Street is a marketing machine – have you noticed that “stockbrokers” have morphed into “Financial Advisors” or “Wealth Managers”.

These Advisers strategically flipped to selling up-front loaded, “best of breed” actively managed asset managers, typically in the form of mutual funds. Mutual funds once carried with them a 5.75% up-front fee with annual “trails” to pay annual compensation back to an Advisor. The incentive structure shifted from executing trades to gathering assets and letting the mutual fund managers make the investment decisions.

The prevailing sales pitch by these Advisers became, let’s allow the “professionals” who “kick the tires” of these companies every day to actively manage what stocks or bonds to buy within the Mutual Fund – we will allocate you to the right managers and “diversify” you at the same time. (Sound familiar?! I see you nodding your head in agreement from here).

And so, it went… a 45-year game of chess, for every move big Wall Street made, the “discount” world countered and the “innovation” hasn’t stop; “no-load” passive index funds forced “B”, “C” and eventually “I” shares; high commission trading succumbed to paying for advice in fee-based accounts, actively managed mutual funds battled it out with low fee index funds. By the early 2000’s, corporate pension plans had given way to the rise of 401k’s and no-load/discount firms had risen in popularity and notoriety. This evolutionary process has inevitably led to NO COMMISSION trading and Exchange Traded Funds with anemic fees.

The logical and inevitable conclusion has almost arrived – the financial markets are dominated by ETFs – massive funds that make trading decisions based entirely and solely off of an index, with near-zero fees.

It’s estimated that there are nearly twice the amount of passive ETF/index funds for every individual companies’ stock that currently trades on the exchange

This has led to a swelling investment by ETFs in the stocks that are on the major indices, creating the momentum that has pushed valuations to levels only remotely connected to economic fundamentals. Wall Street has spring loaded the largest momentum trade in history which is currently playing out before our eyes. The momentum is astonishing, and can be rewarding, but what most investors forget is that momentum works in BOTH directions…

So, why does this History Lesson Matter?

Unintended consequences — a perpetual, price agnostic bid for equities in markets has been created. Virtually every dollar being contributed to self-directed 401k, 403b and 529 plans, automatically moves into an ETF, and when the ETF turns to the market to fill the investors’ orders, they do NOT care about valuation or what price is paid – the algorithm is automatic. It’s the simplest of algorithms; dollar in = BUY, dollar out = SELL making passive investments PRICE AGNOSTIC. ETFs don’t care if Apple is obnoxiously “overvalued”, it cares about what percentage of the index Apple represents, which in turn defines how many shares of Apple are to be purchased based upon the size of the buy ticket.

In our 1Q2018 note, more specifically the section titled, “Death by Water” we stated:

As money continues to flood markets via ETF’s and index investing, caution has been thrown to the wind, as money is now primarily added to companies based upon “money flow” alone, rather than fundamentals. Given the exponential growth over the past few years, prices are quickly becoming disconnected from underlying valuations.

As long as you are making money, that might seem to be a problem which you can overlook, but as we shall explain shortly, the machine is becoming very susceptible to extreme volatility.

For those of you who have read our work over the years we’ve written about an impending market melt-up of epic proportions based upon money flows and market structure. Just as we described an imbalance of what natural buyers could buy from a much larger universe of forced sellers in the bond ETF space, which we witnessed in March as credit markets froze, requiring the largest Federal Reserve bailout in history. This dynamic works in both directions, and also exists in the passive equity ETF space.

The root flaw has the potential to be fatal to the unprepared investor.

Last month, we urged you to have a listen to Mike Green of Logica funds. I cannot stress enough the importance of this, active managers have a FIDUCIARY RESPONSIBILITY to their clients; in theory ALL FINANCIAL ADVISORS do as well…

ETFs do NOT.

It’s important to note that there are roughly 13,000 wealth management firms in the United States employing, approximately 440,000 wealth managers actively “managing” 43 million accounts with a collective net worth equal to 75% of that of the United States (source: Jim Bianco, Bianco Research)

“A stock is no longer bought because it’s “cheap” from a valuation to earnings, sales or revenue (perspective), it’s now bought because it’s part of a specific index and more money has been allocated to that particular index or ETF.” OSAM 1Q2018 page 10

At an active management firm, a value-oriented Portfolio Manager and team of analysts would traditionally dissect a company’s balance sheet to determine if they would be willing to part with their cash on any given day in exchange for an ownership interest of a specific company. In contrast, passive investments don’t buy a stock because it’s “cheap”. They don’t care what it’s price to earnings, sales or revenue is… for them, an order ticket equals BUY and the larger the market cap and nominal stock price of a company, the larger the percentage of funds will be allocated to that company’s stocks.

ETFs DO NOT NEED TO JUSTIFY THE PRICE THEY PAY.

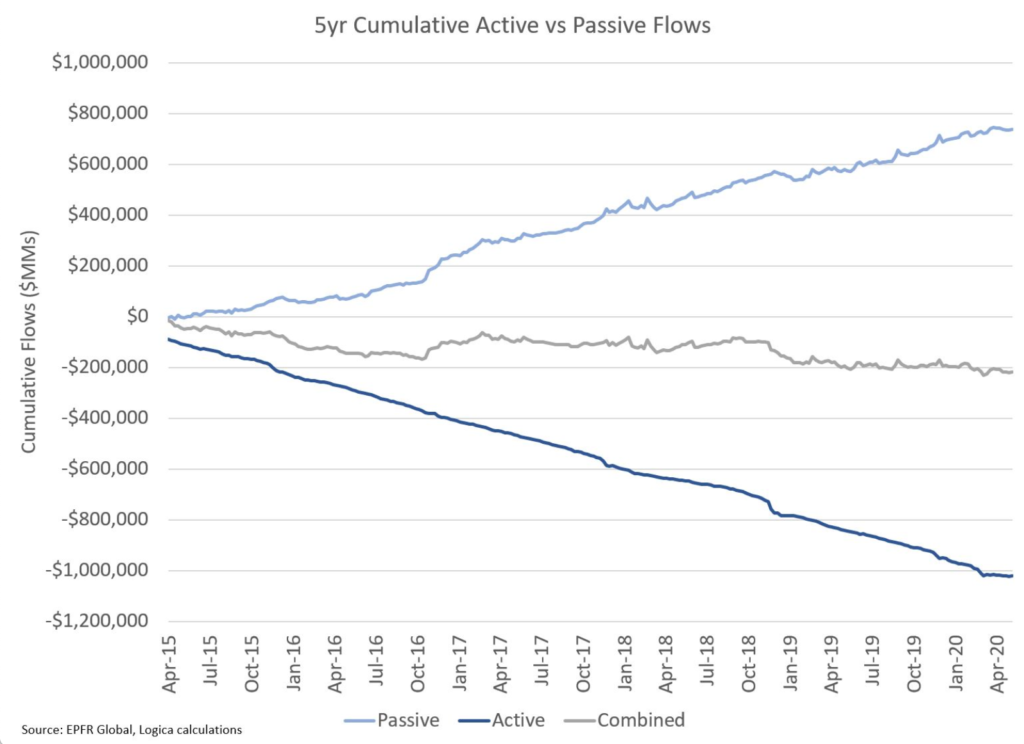

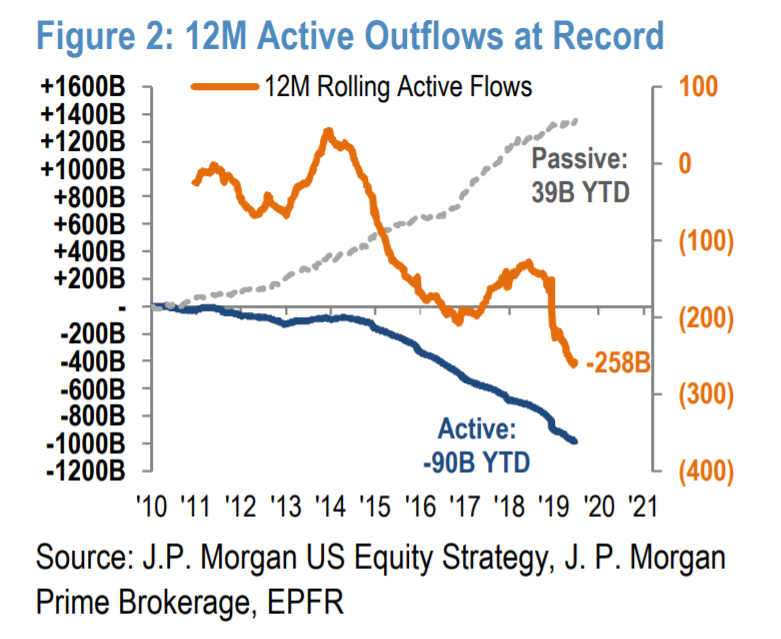

As active managers shy away from companies whose valuations are grossly dislocated from market price, money flow into passive investments conversely push these companies through the stratosphere – widening the chasm between Active and Passive performance. This is fueling an even faster migration from the nearly 440k advisors chasing the passive returns thinking ZERO about, RISK, market structure and the overall ramifications…

Today, we’re seeing an epic dislocation between “fundamentals” and “stock price” that seems to defy explanation, when in fact, there is a very rational, mathematic solution staring us in the face.

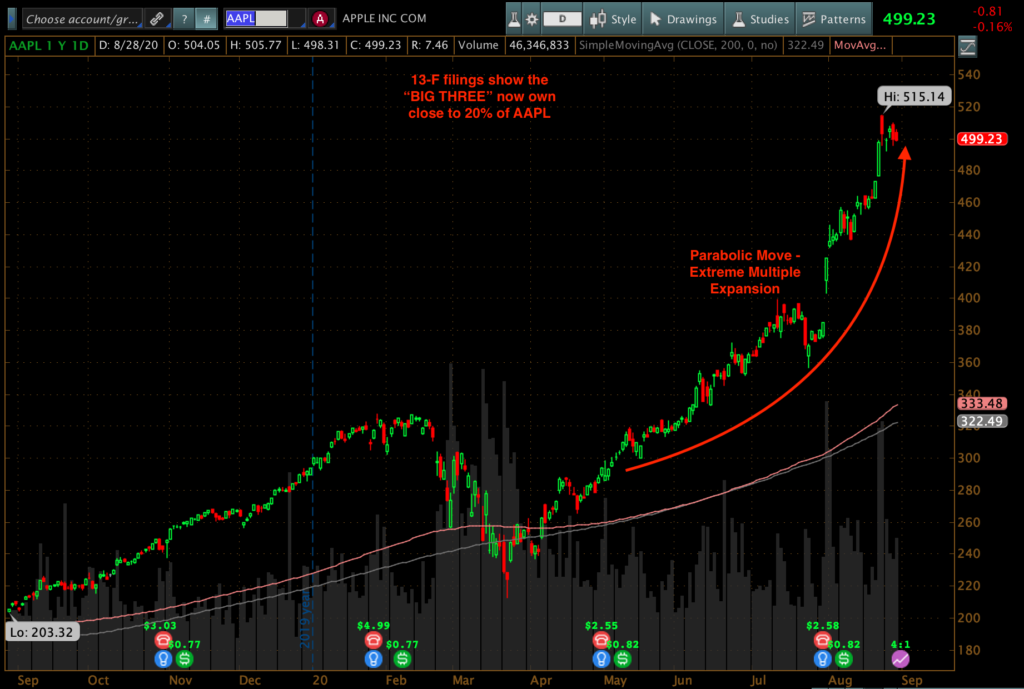

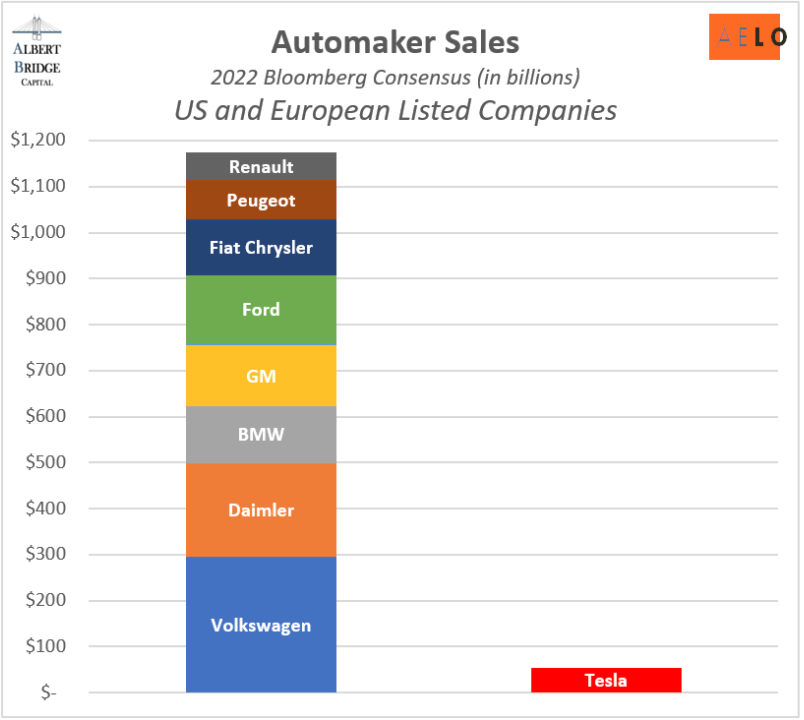

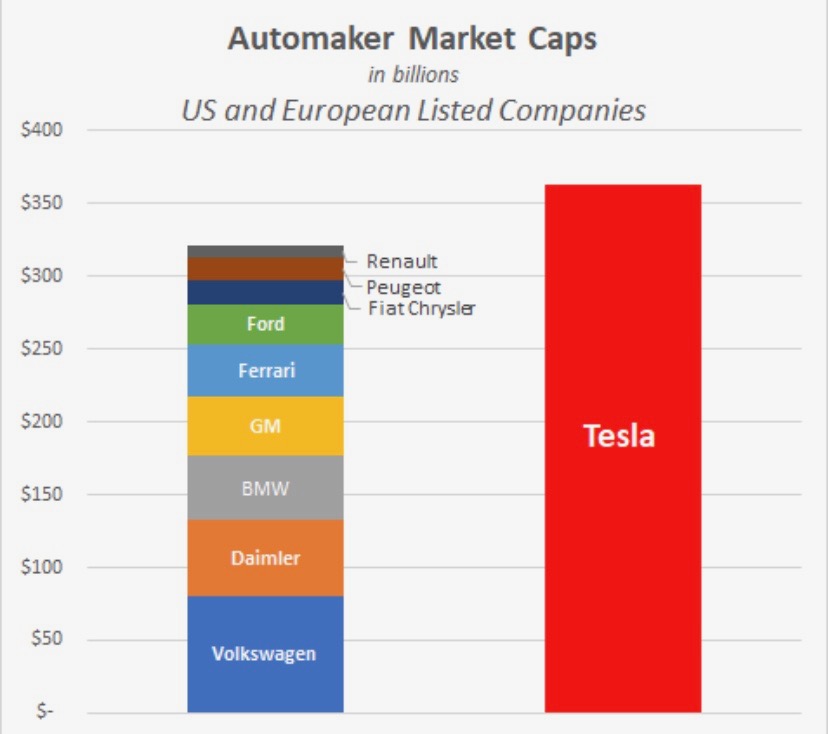

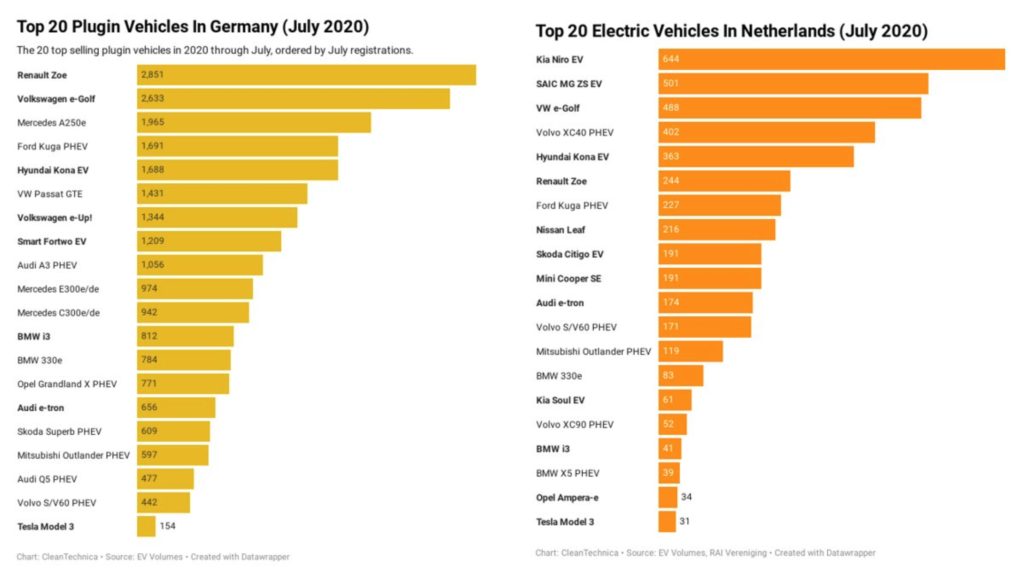

There is no FIDUCIARY in their right mind who can rationalize or justify either company’s multiple expansion/equity price move and still sleep at night … Over 70% of Apple’s Revenue comes from a single product, the iPhone and outside of a COVID quarter beat in earnings as the planet shifted to virtual learning, their revenues have been declining for 3 years. The graphs below say all you need to know about Tesla. They are not taking over the world when their Sales vs. competition looks like… and yet their Market Cap vs. ALL LISTED US & EUROPEAN AUTO MAKERS IS…

Source @AlbertBridgeCap

While their competitive MOAT has literally evaporated completely, and consumers are clearly choosing virtually every other EV alternative on the market over their product.

Source @AlbertBridgeCap

The parabolic moves of AAPL and TSLA adding hundreds of billions in market cap per DAY is not a rational value manager buying equity ownership of an economic firm … Rather, it’s a price agnostic passive buyer seeing inflows from the redemptions of an underperforming active manager as momentum buyers chase.

The loop continues to feed on itself at a more rapid pace, yet there is an even greater accelerant to this story, a powder keg in favor of the bulls. On average, actively managed mutual funds hold between 4-5% cash and equivalents where most ETFs hold roughly 10 basis points (0.10%). That may not sound like a big deal, however, in a vacuum, shifting assets from an actively managed world with 4-5% cash to one of 10 basis points would send the markets up roughly 50 times.

From Mike Green – The End Game

If you think about the simple math of what happens when you move from a world that’s 100% discretionary and discretionary investors carry about 5% cash … to a world in which it’s dominated by passive investors who carry on average about 10 basis points of cash; the staggering math that you go through as you realize that moving from a 5% cash holding universe to a zero point 1% holding universe causes the market to go up 50X; that’s the only way it works, cause the cash is neither created or nor destroyed.

While it doesn’t take a genius to figure out that 50X is a BIG number, why not just plow chips ALL IN? Woohoo, Rolls Royce’s for all!!! Well, for numerous reasons; a. we don’t live in a vacuum b. demographics suggests sellers need living expenses they can no longer capture through fixed income investments, c. d. e… Though, we believe Mike Green, explained it brilliantly (and simplistically) on The End Game Podcast:

“now the problem with that is that simultaneously it also takes the volatility through the roof.”

“Markets are the solution for transactions. The price that you see is the intersection of supply and demand, not in some theoretical sense but it’s the point at which buyers and sellers were able to meet and balance that book. Well, if there are no discretionary buyers that are capable of meeting the 1% redemption because they only have 0.1% of the capital, there’s no price at which that market can clear. Except — ZERO.”

There are many simulations that I can run, … I’ve simulations in which the market goes to zero.… AND WE’RE NOT THAT FAR AWAY FROM WHERE MY SIMULATIONS START TO SAY, NO, YOU CAN ACTUALLY GO TO ZERO.”

Mike’s quick to note:

“The machine approaches limits far before it gets to that point. The volatility becomes so extreme, I would argue, this is what we saw in February, March. It’s not that the passive players sold, which is what I was always concerned about. It’s that they didn’t buy anything anymore.”

This is what happens when active sellers dwarf the systematic buyer pool and bids either don’t increase or dry up completely – liquidity disappears, and prices fall like stones off a skyscraper … Markets can’t clear.

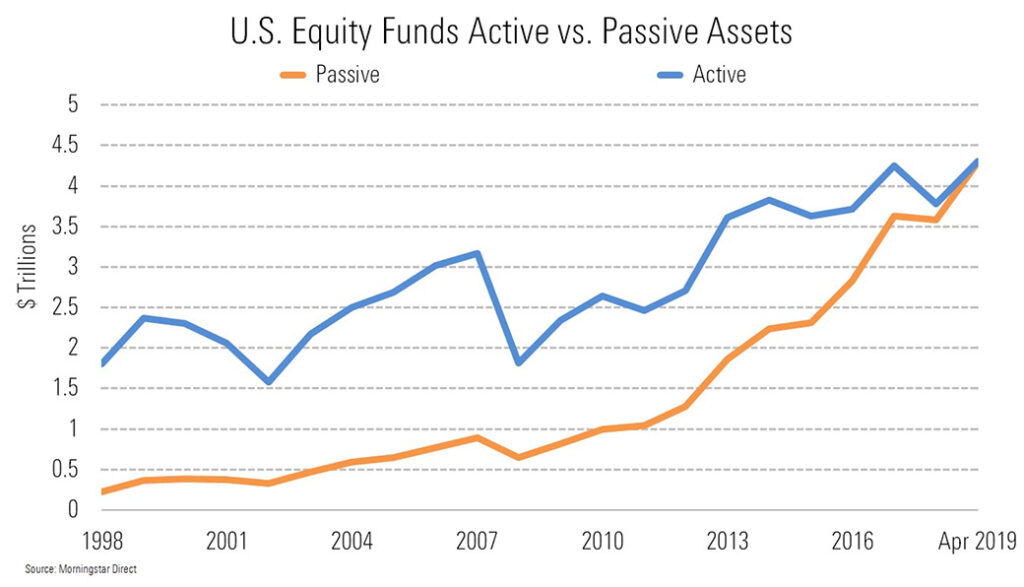

Since our writings in 2017/2018, things have shifted even further in favor of the passive ETF industry. As of August of 2019, passively managed U.S equity funds equaled $4.271 Trillion vs. $4.246 Trillion in actively managed funds. There is more money in passive index funds today than funds managed by active managers.

Visualized differently:

It’s not just Logica recognizing the shift…

Let’s review:

- Mayday changed Wall Street’s incentives, opening the door to innovators like Charles Schwab and Vanguard.

- This change turned Financial Advisors into asset gatherers, using mutual funds as the preferred investment choice.

- Passive investments, including ETFs steadily rose in popularity for those looking to reduce fees

- FAs are creating a larger chasm between Active and Passive performance by shifting from price sensitive buyers to price agnostic buyers.

- All of which is based upon human behavior driven by Granovetter’s Threshold Model of Collective Behavior – as each new “technology” gained acceptance, investors flocked into the herd.

- With the tipping of scales in favor of passive investments, spiking volatility and frozen markets (including equity markets) are to be expected unless something changes.

Ominous words…

Dr. Michael Burry (of The Big Short fame), currently with Scion Asset Management, is no stranger to controversy. For those of you who have watched The Big Short, Burry spotted the insanity, remained convicted in his work and, in the end, was right. Following that extremely trying experience, Burry removed himself from the public eye.

Late last year, Burry resurfaced in a lengthy email interview with Bloomberg, voicing his distaste for ETFs/index funds and likening them to the CDO market where he made his mark in 2008.

“This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue.”

Burry echoes much of what we’ve noted in the past re: purchases based on fund flows, price agnostic buyers, derivatives, etc… Below are highlights from the exchange.

“The dirty secret of passive index funds — whether open-end, closed-end, or ETF — is the distribution of daily dollar value traded among the securities within the indexes they mimic. “In the Russell 2000 Index, for instance, the vast majority of stocks are lower volume, lower value-traded stocks. Today I counted 1,049 stocks that traded less than $5 million in value during the day. That is over half, and almost half of those — 456 stocks — traded less than $1 million during the day. Yet through indexation and passive investing, hundreds of billions are linked to stocks like this. The S&P 500 is no different — the index contains the world’s largest stocks, but still, 266 stocks — over half — traded under $150 million today. That sounds like a lot, but trillions of dollars in assets globally are indexed to these stocks. The theater keeps getting more crowded, but the exit door is the same as it always was. All this gets worse as you get into even less liquid equity and bond markets globally.”

“Potentially making it worse will be the impossibility of unwinding the derivatives and naked buy/sell strategies used to help so many of these funds pseudo-match flows and prices each and every day. This fundamental concept is the same one that resulted in the market meltdowns in 2008. However, I just don’t know what the timeline will be. Like most bubbles, the longer it goes on, the worse the crash will be.”

Burry was wrong for a period of time in 2007 before he was right. In our current world, the COVID bailout hasn’t fixed anything. What the Fed/Treasury bailout has done is to add liquidity to the system via increased collateral, forcing up the most concentrated ETF stocks and pushing equities higher.

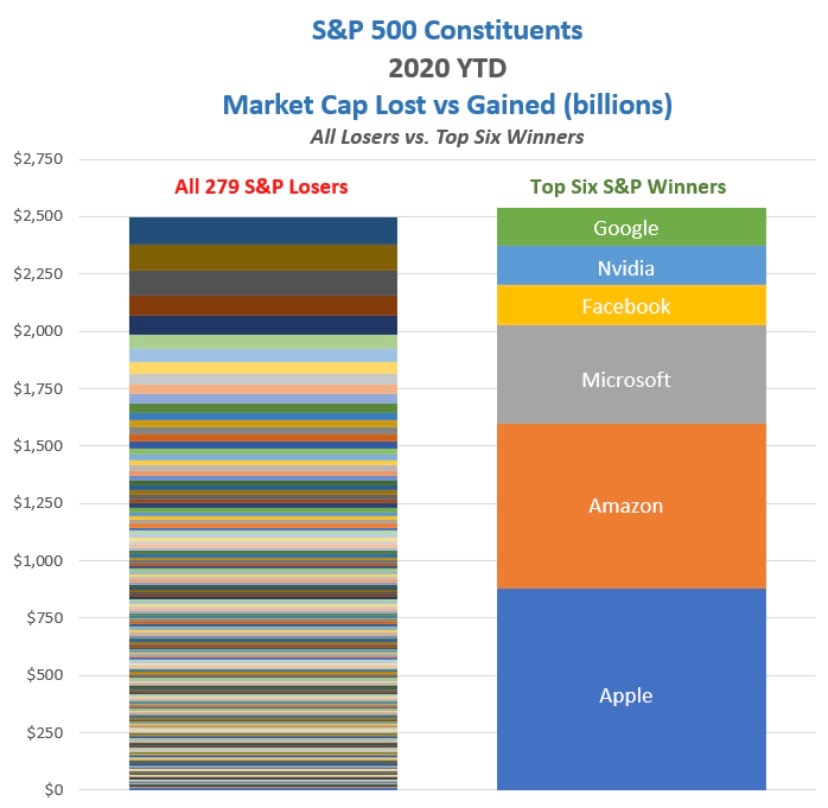

As I write, while the S&P is higher YTD, roughly 60% of the index remains negative on the year (299/500 stocks) while the top 6 largest by market cap are up over 55%. The below image is from August 21, representing the difference in my above quoted negative S&P components and that quoted in the graphic, none the less it makes the point.

Source @AlbertBridgeCap

Apple’s (AAPL) 13-F filing released 6/30/20 revealed “The Big Three” (Blackrock, Vanguard and State Street) own a combined 18.28% of its outstanding shares … the 3 largest Passive Investment firms own nearly 20% of the entire company, they are the largest, second largest and fourth largest holders of Apple. We could go through this exercise with the top names by market cap…

It is also extremely important to note that many Actively managed mutual funds have restrictions by prospectus which prevents them from owning more than a 5% position of any one specific name to avoid concentration risk – many ETFs do NOT. AGAIN – the issue is STRUCTURAL. The deck is stacked and not in a good way…

The “market” as we once knew is dead, we caution on benchmarking to a unicorn.

Jack Bogle, the father of the index fund, prior to his death penned a note November of 2018 in the Wall Street Journal warning of concentration risk, that too many shares of stock were controlled by too few hands suggesting it’s probably only a matter of time before they own half of all U.S. stocks;

“I do not believe that such concentration would serve the national interest”

Though as Burry says – the unwind of derivatives is going to be devastating – and while most people continue to buy the dip – there will come a time when, referring to Mike Green’s work, volatility will become extreme and an investor who lacks capital preservation strategies won’t survive. We continue to urge caution…

In June we mentioned American economist Hyman Minsky; it’s fitting we include his voice again this month as what we’re discussing today is a systemic instability that has been bred from what is perceived prolonged stability and prosperity

“… over periods of prolonged prosperity, the economy transits from financial relations that make for a stable system to financial relations that make for an unstable system.” Financial Instability Hypothesis, Minsky May 1992

It is worth reflecting that we are currently in the longest bull market in history. Market dislocations are likely to get MUCH worse, with increasing volatility, until something snaps.

We leave you with this…

Investors are placing a one way bet with their retirement money on THE FED’s infallibility, not considering the increased volatility and catastrophic outcomes that lie ahead based upon MARKET STRUCTURE. This is irreversible. I’m not saying money can’t be made, rather I’m suggesting that people who place their life savings on the roulette table and go all in on RED without the consideration that BLACK may hit are investing without capital preservation as part of their strategy. They will be devastated when BLACK inevitably turns up. When markets don’t immediately return to nosebleed levels as the law of diminishing returns takes hold and BTFD (Buy the F’ing Dip) turns into financial ruin. This is the key message of this note – find a balance between return on capital and preservation of capital.

Admittedly, the craziness can last for an absurdly long time – the melt up we described in 2018 may be here and it may continue – even in the face of the economic devastation we’ve witnessed over the past few months. We’re dialing in our balance; still, extreme volatility is mathematically inevitable … Defend your downside; this is something we are not willing to compromise on.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.