In This Article

Well, that didn’t take long

“What to expect?! Think “bail out”” ~OSAM June 2021

The United States is neither a straight Democracy or Republic, for nearly 250 years, we’ve operated as a Democratic Republic or Representative Democracy whereas citizens vote for their politician or representative (Senators and Congressmen alike) who then, in turn, make laws on behalf of those whom they represent.

Earlier this year Rochelle Walensky was a professor of medicine at Harvard Medical School, also Chief of Massachusetts General Hospital’s Division of Infections Disease; today she runs the CDC.

No one voted Rochelle Walensky into a political office, the CDC is a public health bureau, not a legislative body, and yet, on August 3rd, in the face of a known wall of legality issues, Rochelle Walensky, ultimately nationalized the private housing market by extending the CDC’s eviction moratorium which had expired on July 31st.

As her law reads, it is now a FEDERAL CRIME for owners of these properties to evict individuals under ANY circumstances, as making someone pay to live on your property is now a FEDERAL CRIME, all the while, landlords are required to pay all incurred expenses on these properties mortgage payments, taxes, etc.

We told you this would happen in June, albeit in a slightly sarcastic tone leading up to a very blunt statement:

“Knowing this, does it surprise you that the CDC has just extended the eviction moratorium “ONE FINAL TIME”. No, seriously, it’s the last time, believe us.

Per the AP, “A Biden administration official said the last month would be used for an “all hands on deck” multiagency campaign to prevent a wave of evictions”

What to expect?! Think “bail out””

We followed up again last month on this very same topic:

“As I was writing yesterday this headline hit, “U.S. HOUSE SPEAKER PELOSI AGREES WITH BIDEN CALL TO EXTEND EVICTION MORATORIUM ‘AND WE ARE EXPLORING ALL OPTIONS TO DO SO’ … DEMOCRATS SEEK EVICTION MORATORIUM EXTENSION THROUGH DEC … -PELOSI SPOKESWOMAN

Remember when they said it would be the last time?! Like, 4 whole weeks ago when they said it?! You just can’t make this shit up anymore folks – you just can’t.

We continued:

Regardless of where you sit politically or how you FEEL about Covid, just know: the “all options to do so” Pelosi spokespeople reference in an effort to once again extend the eviction moratorium will require breaking the law as the CDC’s eviction moratorium itself was recently deemed illegal by the U.S Appeals Court

Regardless of which way you lean politically this should NOT be a Right or Left issue, it’s a; do you believe in the laws of our Country or NOT issue. Do you believe rights and civil liberties should be protected issue?! Do you believe in the structure of our government issue, such as the checks and balances of the Executive, Legislative and Judicial branches? And more importantly, do you respect them?!!!

As we’ve stated – what Rochelle Walensky has done ISN’T REMOTELY CONSTITUTIONAL, and the Supreme Court agrees:

On June 29th, 2021, the Supreme court made their voices heard on this issue after an Emergency Application for a Vacatur of the Stay Pending Appeal, Alabama Association of Realtors v. U.S. Department of Health and Human Services, No. 20A169, was laid on their plate on June 2, 2021

Justices Thomas, Alito, Gorsuch, and Barrett were willing to end the eviction moratorium on the spot and voted as such. Justice Kavanaugh became the swing vote and while he agreed with the aforementioned justices, he did allow for the existing moratorium to remain in place UNTIL its previously scheduled end date of July 31st.

Constitutionally speaking, Justice Kavanaugh’s words could NOT BE CLEARER as he wrote in his opinion attached to the June 29th ruling, Kavanaugh states:

I agree with the District Court and the applicants that the Centers for Disease Control and Prevention exceeded its existing statutory authority by issuing a nationwide eviction moratorium.

In my view, clear and specific congressional authorization (via new legislation) would be necessary for the CDC to extend the moratorium past July 31.

Justice Kavanaugh ONLY allowed the eviction ban to remain in place for a SINGLE reason, in his own words:

BECAUSE the CDC plans to end the moratorium in only a few weeks, on July 31, and because those few weeks will allow for additional and more orderly distribution of the congressionally appropriated rental assistance funds, I vote at this time to deny the application to vacate the District Court’s stay of its order.

I DON’T WANT YOU TO TRUST ME, I URGE YOU TO CLICK THIS LINK WHICH TAKES YOU DIRECTLY TO SUPREME COURT JUSTICE KAVANAUGH’S OPINION, read it for yourselves…

A majority of Justices agreed the moratorium is CONSTITUTIONALLY ILLIGAL, Justice Kavanaugh merely said, hey, government, you now know this is illegal, but we’ll give you a month to get your sh*t together … then it’s up to Congress … to which the CDC, Congress and POTUS respond by spitting in the face of the highest court in the land.

The White House KNOWS they are breaking the law … How do we know? They said so on August 2nd:

“Unfortunately, the Supreme Court declared on June 29th that the CDC could not grant such an extension without clear and specific congressional authorization … To date, the CDC Director and her team have been unable to find legal authority, even for a more targeted eviction moratorium that would focus just on counties with higher rates of COVID spread.” Press Secretary Jen Psaki August 2, 2021 official White House briefing

Additionally, White House advisor Gene Sperling reiterated and confirmed the same thing here.

President Joe Biden himself stated:

“I’ve sought out constitutional scholars, to determine what is the best possibility that would come from executive action on the CDC’s judgement; what could they do that was most likely to pass muster constitutionally – the bulk of the constitutional scholars said that it’s not likely to pass Constitutional muster.” ~ President Joe Biden August 2nd Press Conference

Legal authority for the CDC’s re-authorization of the eviction moratorium wasn’t miraculously found on August 3rd, The President of the United States and Speaker of the House, Nancy Pelosi are WILLFULLY IGNORING THE SUPREME COURT’S OPINION.

The government will argue the court’s ruling was procedural and not a formal SCOTUS ruling on the merits, leaving uncertainty over the law, though Five supreme court justices stated VERY CLEARLY in this procedural ruling that the CDC has EXCEEDED ITS AUTHORITY and the executive branch has NO power; “clear and specific congressional authorization (via new legislation) would be necessary.”

Nancy Pelosi continues to spew garbage like this, “The CDC has the power to extend the eviction moratorium…” providing no legal explanation, ignoring the SCOTUS opinion, while refusing to call for a vote on the House floor.

Maxine Waters had this to say: “I don’t buy that the CDC can’t extend the eviction moratorium … Who is going to stop them? Who is going to penalize them?”

Ladies and gentlemen,

Those who willfully and knowingly break the law are ordinarily referred to as criminals. That term doesn’t change when it’s a select group of Washington elites … It doesn’t change if you voted for them or if you like them better than a previous administration … it also doesn’t change because emotionally you “feel badly” for those individuals slated for eviction. Do you feel badly for the landlord getting evicted because he can’t pay his own mortgage? REMINDER: Many landlords are small business owners NOT every landlord is BlackRock.

Government officials ignoring the rule of law, adopting a “Because I said so // who’s going to stop them” mentality is the way a totalitarian government runs itself. Constitutional rights and freedoms should NEVER be suspended, in the name of ANYTHING …

In our November 2020 note we wrote:

“WHEN PERSONAL BIAS SUPERSEDES THAT WHICH IS “PROCESS”, and “CONSTITUTIONAL LAW” DEMOCRACY LOSES ON EVERY LEVEL”

These words have NEVER been more true. We are losing our great democracy at an expeditious pace. When the executive and legislative branches are willfully ignoring the rule of the judiciary branch, AMERICA is in a very bad place if it goes unchecked. Literally, as we go to print the Supreme Court has FORMALLY ended the eviction moratorium – we’ll see what happens from here – content of the note still holds true.

While I’m aware that you don’t pay me for legal and political thoughts … the knock-on effects tied to the investing world are greater than time allotted for a monthly note, though we’ll tackle a few below…

“It’s like déjà vu all over again” ~ Yogi Berra

It’s been nearly a year since we began talking about inflation, in the face of every “scholarly economist” out there disagreeing with us, including those at the Federal Reserve.

We continued to beat the inflation drum through March and April, yet noted the data was suggesting the 3rd quarter would look more like a deflationary environment than anything. We also reminded readers that as the data changes, we’ll adapt with it.

It took nearly a year for Federal Reserve officials to admit that what we had been saying regarding inflation was true; inflation was more prevalent and robust than THEY had anticipated. And while the most probabilistic outcome for Q3 was deflationary, the odds change with every passing economic release, suggesting “persistently high” inflation would be with us for longer than most anticipated. In June, we explained it like this:

“Stated differently, we’re moving from an environment where growth and inflation has accelerating faster than any previous time in history to one where both will be mildly decelerating, yet still persistently high. For a moment, think stepping on the gas of a Porsche, launching it from 0 to 100 mph to then lighten up on the gas pedal gently settling your speed at a comfortable 90 mph. Quite different than a deflationary event which would be akin to slamming on your breaks abruptly decelerating from 100 to 20 mph.”

Last month we continued to build our case for an environment that looks more like Stagflation:

“GROWTH is SLOWING as inflation ACCELERATES or, as we’ve beaten the drum, remains PESISTENTLY HIGH! Sound familiar? We know inflation has been accelerating for months, and continues to remain persistently high with nearly 1/3 of the entire input just beginning to ramp higher (SHELTER); anyone know off the top of their heads what happened with yesterday’s GDP print? It came in at 6.5% QoQ vs. an expectation of 8.5% (that’s growth SLOWING), signaling STAGFLATION”

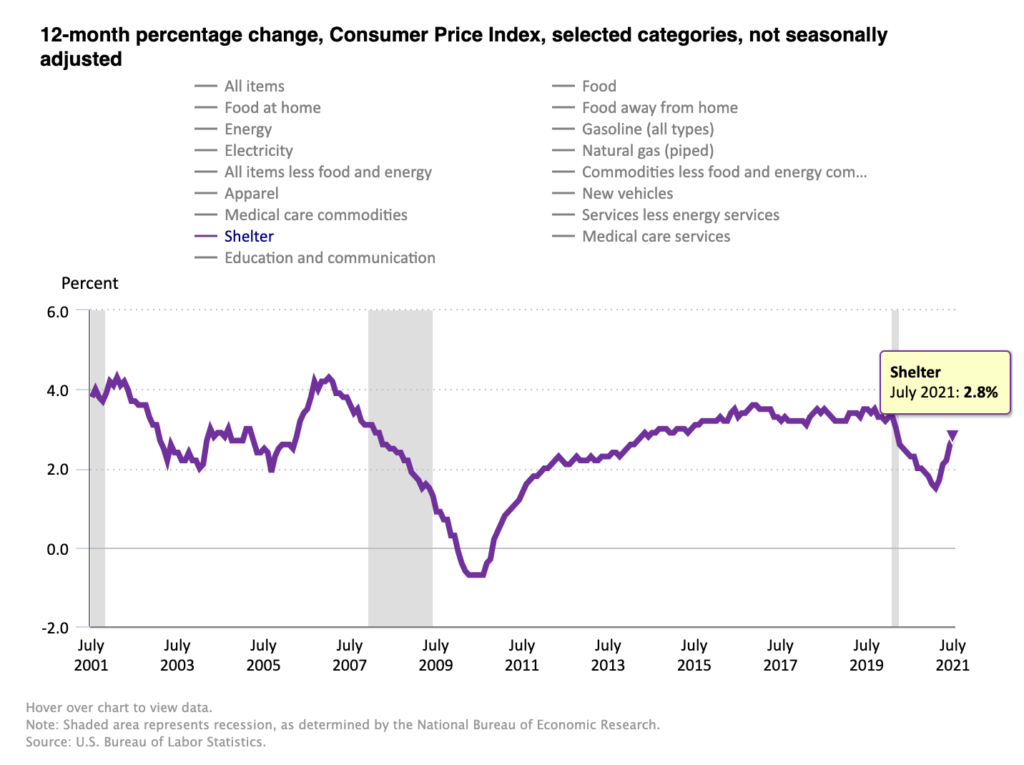

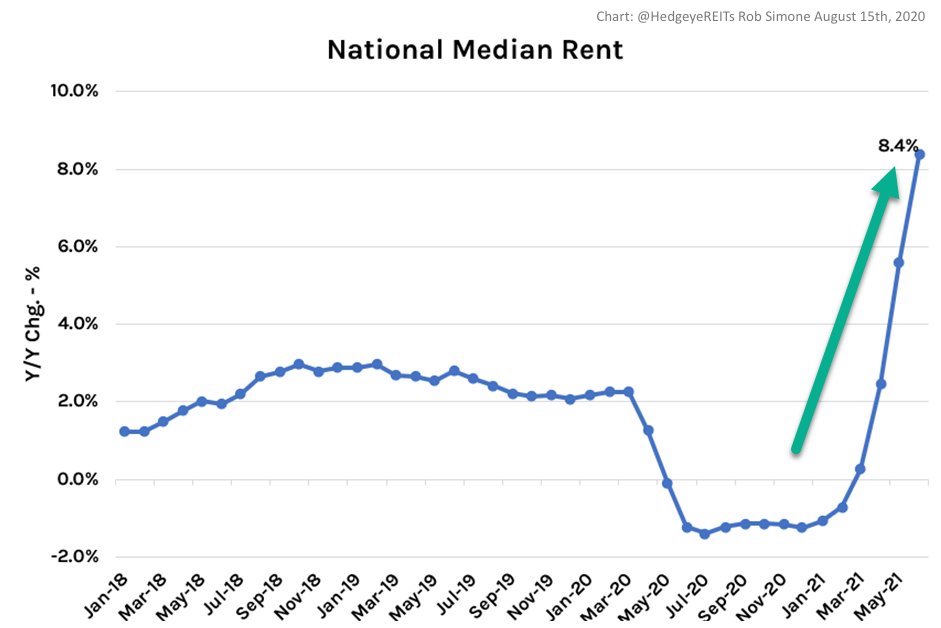

We have purposely reminded readers that “SHELTER” comprises roughly 33% of the CPI make up for some inputs are more heavily weighted in NowCast and Inflation models than others (making some worth more from an investing standpoint). Given the new eviction moratorium as of August 3rd, expiring on October 3rd or until the Supreme Court issues a “formal vs. procedural” ruling, the fallout from this is likely to be more of the same; persistently high for longer!

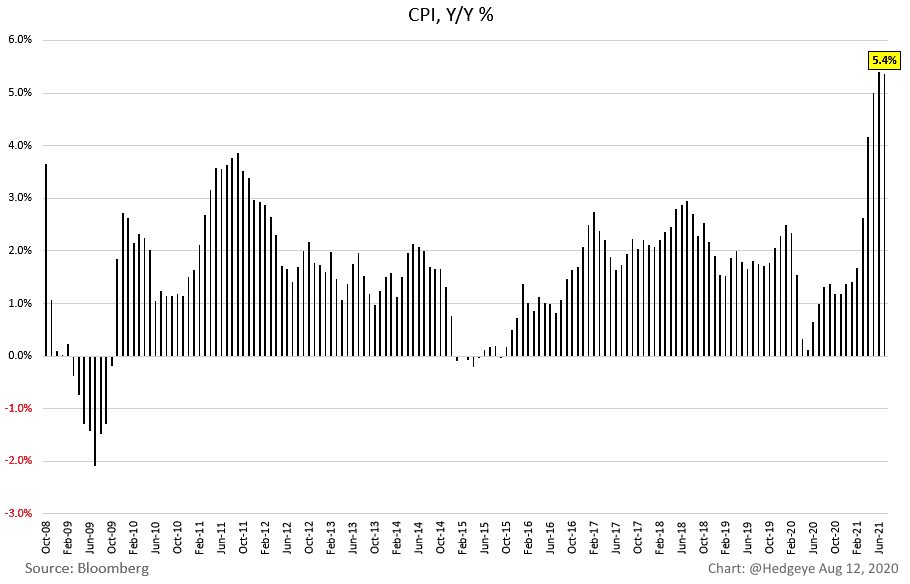

CPI data was released on August 11th, and it once again confirmed what we’ve been saying for some time now (ahead of both the Federal Reserve and consensus); yet another 5.4% CPI print. As we noted, the 5.4% reading least month was “the highest sequential acceleration since 1982”

While #Inflation might eventually prove to be transitory, as in its true definition “not permanent” … currently, anyone without blinders on can see this in every purchase they’ve recently made, though, the chart below makes it crystal clear that inflation is without question trending!

Moreover, as reported by the BLS (Bureau of Labor Statistics), the rent component of “SHLETER” is only up 1.9% YoY (Year over Year). Collectively, shelter (inclusive of rent and owners’ equivalent rent) is up 2.8%.

Does anyone actually believe this to be accurate?! Extremely doubtful… Hedgeye REIT analyst Rob Simone is seeing something completely different with new leases and existing tenant increases “blending” into the UP +8% range; STAGGERING.

Let’s consider Simone’s estimates to be high (I don’t think he is, but let’s assume so for the moment). Apartmentlist.com has compiled real-world examples of what homeowners are currently renting their homes for which suggests rents are up by roughly 5% annualized in the month of July.

This is nearly DOUBLE August’s most recent BLS CPI data and more in line with Moody’s Analytics Chief Economist Mark Zandi who believes current CPI data “lags the realty” as it’s based on a survey and NOT a homeowner’s “expectation” of what they would rent their home for vs. a real-world example.

Housing data continues to grind higher with July U.S New Home Sales ticking 708k vs. 676k for June, U.S Existing Home Sales accelerated to 5.99 million vs. 5.87 million with the median price of a newly built home reaching an ALL TIME HIGH of $390,500. How do you think that will affect first time home buyers?? (See: unintended adverse knock-on effects)

Toll brothers $TOL reported earnings last week, throwing more gas on the flames of the housing market fire, not only handedly beating earnings, but more eye-popping, the average home price Toll brothers is expecting to fetch for a single-family home in Q4 of this year is $840k bringing the average of the anticipated 10,100 units they expect to deliver to $830k for full year fiscal 2021.

While housing inventory may be building, being up 12% YoY, it was down over 50% from end of year norms – 12% is a blip relatively speaking.

Outside of the whole disregard for the Supreme Court’s opinion as to the Constitutionality of the CDC’s eviction moratorium, from an economic perspective, this new extension is likely to further prolong inflationary pressures … A primary driving force behind the pockets of turbulence we’ve recently witnessed and continue to see moving forward.

As Yogi Berra once said, “It’s like déjà vu all over again”. Similarly, to how we’ve repeatedly discussed the unintended consequences of the government’s awful policy decisions on the extended Pandemic Unemployment Assistance programs (PUA) gumming up labor markets keeping able bodied workers OUT of the workforce, this is yet another example of inept government thinkers failing to acknowledge significant adverse knock-on effects.

Sooner or later, the eviction ban will come to an end and landlords will increase rents. Houses won’t be built overnight; rentals won’t just flood the markets as these things take time. Someone will make up for the losses these landlords have been absorbing over the last 18 months and with limited supply, they have the pricing power. When this moratorium does lift, then you’re really going to see a hyper-inflation in rental markets. As the saying goes, “we ain’t seen nothin yet!”

Pockets of Turbulence

Stagflation has the characteristics of slower economic growth, rising or persistently high prices (inflation) and relatively high unemployment…

As markets currently trade, we’re witnessing a cacophony of data being released and markets are literally sorting things out in real time. As we’ve stated before, the prevailing regime, TODAY, is currently that of Stagflation, we also noted in our 2Q quarterly, “if only investing were that easy”

Last month we walked you through 4 distinct market regimes, in the essence of time, if you missed it, please review this specific section by clicking here…

While the prevailing market regime TODAY is stagflation, the dearth of data being reported is representative of multiple market regimes. For example, there’s been robust “Reflationary” earnings in many names, including that of many small cap companies we still hold such as $BKE and $FL. Labor market data reflects reflation as does Capital Spending. This data, however, has been met with both accelerating and decelerating data encompassing both real growth AND inflation.

Probabilities of market regimes are DYNAMIC; they change in the minute based upon the DIRECTIONAL Rate of Change of the information being reported throughout the quarter; all of which contributes to how market are discounted by rules-based ETFs, algorithms, Hedge funds, etc. which ultimately are the large swaths of money that dictate where money flows these days. We discussed market structure in our August 2020 note, it’s a very important read if you’ve missed it.

Markets will tell us what the current investing regime is if we’re paying close enough attention, and they discount them very quickly. Today it’s Stagflation (or Quad 3 in Hedgeye vernacular) based upon how most similar sets or historical correlations are performing; Large Cap Liquidity, Tech, Utilities, REITS have all been outperforming while small cap illiquidity (as a factor exposure) have been underperforming since late June early July (these are Quad 3 or Stagflationary characteristics); Gold having perked up is another example of a stagflationary core holding. Gold likes a flattening yield curve and declining real yields, more characteristics of a stagflationary environment.

The choppy turbulence we’ve been experiencing comes at the hands of mixed data, and while we can’t walk you through or expect you to understand it all, our point should come through clearly; allow us to explain…

Recent manufacturing data being reported is showing a mild slowdown. For example, August U.S. Flash Manufacturing PMI fell to 61.2, versus July’s reading of 63.4 which is a deceleration in data. This coincides with July’s ISM Manufacturing data also mildly slowing from June’s 60.6 to 59.5. New orders, too decelerated to 64.9 from 66.0, data supporting our above claim, manufacturing sectors are slowing. If these and the handful of other decelerating data points were all we had to look at, sure, it could lead one to believe that we are entering a deflationary environment, though, they are NOT.

Flash manufacturing PMI declined, however, the price component within that data set accelerated to 75.9 from 74.6 in Julywith delivery times remaining near all-time highs, a sign of strong demand. Additionally, July U.S. Markit PMI Manufacturing accelerated slightly from June’s reading of 63.1 to 63.4, and while we don’t want to sound like a broken record month after month, supply chain issues are likely flowing through in these numbers, as they continue to restrict growth. What makes us think this to be the case?! Commentary from the July IHS Markit U.S Manufacturing PMI release:

“Capacity is being constrained by yet another unprecedented lengthening of supply chains, with delivery delays reported far more widely in the past two months than at any time prior in the survey’s history. Manufacturers and their customers are consequently striving to maintain adequate inventory levels, often reporting the building of safety stocks where supply permits, to help keep production lines running and satisfy surging sales. “The result is perhaps the strongest sellers’ market that we’ve seen since the survey began in 2007, with suppliers hiking prices for inputs into factories at the steepest rate yet recorded and manufacturers able to raise their selling prices to an unprecedented extent, as both suppliers and producers often encounter little price resistance from customers.”

This is inflationary … and it’s also conflicting data muddled by external forces.

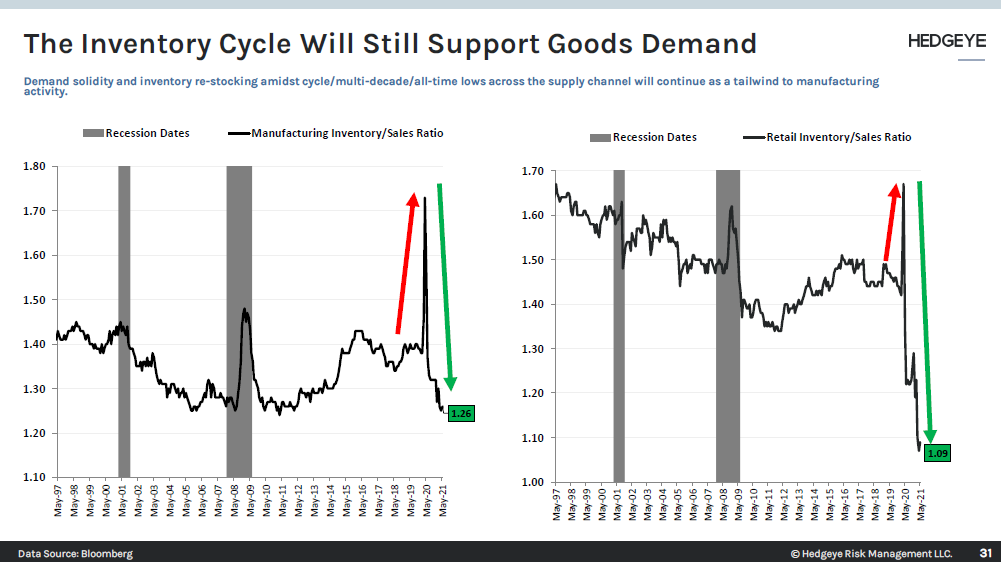

Speaking of conflicting data and “adequate inventory levels” as you can see below customer inventories hit yet another cycle LOW, declined to 25.0 (down -5.8) …

Chart courtesy of @KeithMcCullough via Twitter August 24th, 2020

In order to replenish Inventories, a LOT of business activity must transpire. Make no mistake, inventories NEED to be replenished adding to already elevated inflationary pressures. For a moment, ask yourself what’s necessary to rebuilt inventories? If you’re answer was raw materials, you’d be accurate; steel, copper, cotton, etc., most of which are trading just off or close to cycle highs.

Consider this, if manufacturers are manufacturing product with raw material costs at or near cycle highs, fuel costs extremely elevated and transportation expenses like shipping, freight, and rail through the roof, do you think you’ll be paying MORE or less for products in the future?!

Again, referring back to the earnings reports of retail names like $FL and $BKE, these companies are NOT discounting product. With inventories so low, companies like these are selling items at full price; a trend likely to continue for a longer time frame given the dynamic described above.

Rebuilding inventories over the next few quarters may be reflationary/stagflationary for markets now, though doing so at peak cycle prices today does NOT bode well for Q2/Q3 of next year. And while from now until then may feel like an eternity … We caution those without a risk management strategy to not be in such a hurry to sprint towards a cliff …

Cue broken record: In similar fashion to supply chain constraints adversely affecting data, labor shortages can be seen in similar vein, for example, an important call out from the August Richmond Fed index report is less that the index fell, but more so that wages hit all-time high highs due to difficulties in finding able bodied workers.

We continue to see improvements in labor markets, as we suggested would happen with the cancelling of PUA by 25 republican states. Furthermore, Federal PUA programs end on September 6th for the 25 additional states that have yet to cancel it. With some suggesting the U.S. consumer is “slowing” each passing labor report suggests more abled bodied workers are getting back to work, which should be a continued tailwind for the consumer.

Finally, for now, U.S. Redbook weekly retail sales continued higher +16.6% Y/Y vs +15.0%; coupled with continued strength in Labor data, this should accelerate the U.S. services economy as it takes the reins from a mildly slowing manufacturing economy.

There are numerous data points that compile growth and inflation models, over 30 in Hedgeye’s proprietary NowCast Model; NowCast meaning what is the data saying NOW; TODAY, and what are the probabilities of market regime moving forward? Countless PhD economists attempt to NowCast data, including the Federal Reserve. Over the course of my 25-year career in this business, no one has a better NowCasts model than Hedgeye. Not Goldman, BofA, Citi – not Morgan Stanley or JPM, NO ONE!

Similarly to baking a cake, you can have all the ingredients you need to bake the best cake in the world laying in front of you from flour, eggs and sugar to baking powder and salt; but unless you know how many cups of flour and sugar or pinches of salt or number of eggs, the likelihood of your final product being anything close to world class is slim.

Markets are smart, the data has been mixed, and while Stagflation is the current market regime, it won’t take much to shift the regime from stagflation back to reflation, which is something we are watching very closely. A better-than-expected print in one of the heavier weighted metrics like, Hours worked, Labor Income, Jobless Claims, and Non-Farm Payrolls and we could find ourselves back in a “reflation” regime relatively quickly, OR NOT at all; we’ll allow markets to provide the answer to this question, they will tell us.

What are some factors and time frames that could drive regimes in either direction?

- Expiration of PUA on September 6th.

- As was the case with the eviction moratorium, I would normally expect some form of an extension, though in this case, I believe this will largely depend on #2

- A $3.5 TRILLION DOLLAR Infrastructure Bill.

- Should Democratic leaders unilaterally pass this this $3.5 Trillion dollar money grab, capital spending (or the anticipation of) could affect the data shift the data

- The House has returned from recess early (August 23rd) to focus on the infrastructure bill. The illegal eviction moratorium, nope, but a money grab, sure, why not!

- If the Federal Reserve walks back on recent hawkish “taper talk” at Jackson Hole this weekend

- Dallas Fed President Kaplan has recently walked back his hawkish tone on “tapering” stating he’s open to “shifting his view on taper if Delta Variant curbs recovery”, Bullard, not so much!

- Jobs, Jobs, Jobs, if September job reports continue to improve given the runway Republican Governors have provided in their states having cancelled PUA early

- Initial Jobless Claims (YoY), Non-Farm Payrolls (YoY), Aggregate Hours Worked (YoY) and Aggregate Labor Income (YoY) are much more heavily weighted in Hedgeye’s NowCast models. Stronger data in any of these reports could shift us back into a different investable regime.

Fed taper talk will also depend on labor market data, we know the Fed has been either willfully blind or ignorant on inflation over the past year, the question is how will they be on employment?! Our guess is they will milk the “full-employment” train as much as they possibly can as indicated by Fed Chair Jay Powell in his June 22nd remarks before a U.S. House of Representatives panel:

“We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances”

How to handle the ebbs and flows? We continue to be open minded and nimble. Currently we’re set up for Stagflation, though should we see a transition back to Reflation, we’ll position ourselves in the businesses and factor exposures that historically work in both environments. Additionally, we’ll maintain our macro exposures to certain European countries who have a more defined Reflationary outlook.

We won’t always get everything right, though over the course of time, our disciplined risk management process has gotten more right than wrong, while there are no guarantees in life, we are confident it will continue over full investing cycles. We continue to progress, making up some ground we lost in July as we divergence from indices due to our small cap exposure, bean by bean…

As always, we’re happy to discuss our market thoughts along with strategies and more, never hesitate to reach out with any questions or concerns.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.