In This Article

Tombstone

“You’re a daisy if you do” ~ Doc Holliday

One of my favorite movies of all time is Tombstone. The story of Wyatt Earp and his brothers Marshall and Virgil as they attempt to settle down in Tombstone, AZ., leaving behind Wyatt’s “storied” history as the former Dodge City man of the law. However, after numerous encounters with a band of ruthless cowboys in their new lawless city, the Earps feel compelled to clean things up. They, along with longtime friend; a degenerate gambler/dentist and gunslinger, Doc Holliday make sure the cowboys know the people of Tombstone will no longer be kicked around or live in fear.

As movies go, the writers and producers did a very good job from a historical accuracy perspective; in fact, many of the scenes, including some of the more unbelievable ones, such as Bill Brosius missing an enraged Wyatt Earp three times from point-blank range before Earp guts him with a shotgun blast, or the film’s depiction of the shooting at the O.K. Corral are as historical documents suggest.

When I think of western movies two things immediately come to mind … these two thoughts also happen to be on the top of my mind as Q3 comes to a close … So, what are they?!

The first: Shoot-outs! Show me a western without a shoot-out and I’ll argue it’s not a real western film. Tombstone’s shootout at the O.K. Corral was one my all-time favorites, ending with Doc’s famous one liner, “You’re a daisy if you do”… instant classic.

The second: Sprinting towards a cliff! Maybe my kids have watched “Back to the Future 3” too many times, but how many times have we seen the “hero” pulling the “heroine” free from an out-of-control carriage just moments before it launches off a cliff; or a variation thereof?!

This month’s note we’ll briefly explain these thoughts and how they correlate with what we’re seeing in financial markets today.

“We caution those without a risk management strategy to not be in such a hurry to sprint towards a cliff” ~ OSAM August 2021

Sprinting towards a Cliff…

“Sprinting towards a cliff” simply encapsulates the ever-growing BTFD (Buy the F’ing Dip) mantra — the race to push all of your money into financial markets on any drawdown on the faith that markets always go up, and doing this obliviously as to what cliff lies in front of you, how far away it may be, and how deep down you are likely to fall?

As much as “fear” sells, it’s not our motivation with this section. While it’s been scientifically proven that fear is a bigger motivator than greed, and if my job was selling newsletters, incentives might sway one to push fear a little harder in an effort to generate more revenue selling said newsletters …

My business, however, is NOT newsletters; it’s managing risk. While there will come a day that buying a dip like last Monday’s will be the exact wrong thing to do, as it turned out, Monday was not such a day; rather, it was the most right thing to do as the rest of the week proved.

To understand why we’re writing about market cliffs now, I want to take a step back and very briefly discuss previous crashes and responses…

Anyone who understands addiction will sadly and unfortunately understand this thought – what leads to an addict’s ultimate demise is the constant need for MORE. The human body builds a tolerance to any given dose, almost nullifying its affect, which then requires a constant need for increased dosage to achieve the same level of “high”.

An overdose, by very definition, is taking more of a drug than one’s body can handle; in the addict’s mind, MORE is the only answer to overcoming the tolerance that has been built up over time… Sadly, the constant exceeding of thresholds becomes too much for the body, eventually killing many addicts.

This analogy carries over into financial markets and while this note won’t dive into market structure, understanding the gist of what I’m describing should give readers a precursor into current thoughts.

The global central banking system has a few “drugs” at their disposal. Most would refer to its first drug of choice as “interest rate policy”; the second would be “monetary policy”; followed closely by the newest kid on the block, “fiscal policy”.

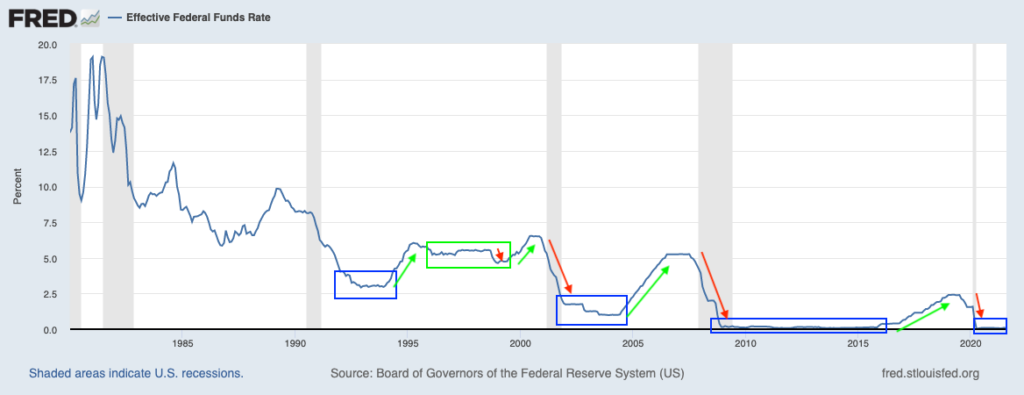

- Interest Rate Policy: an addiction to lower rates

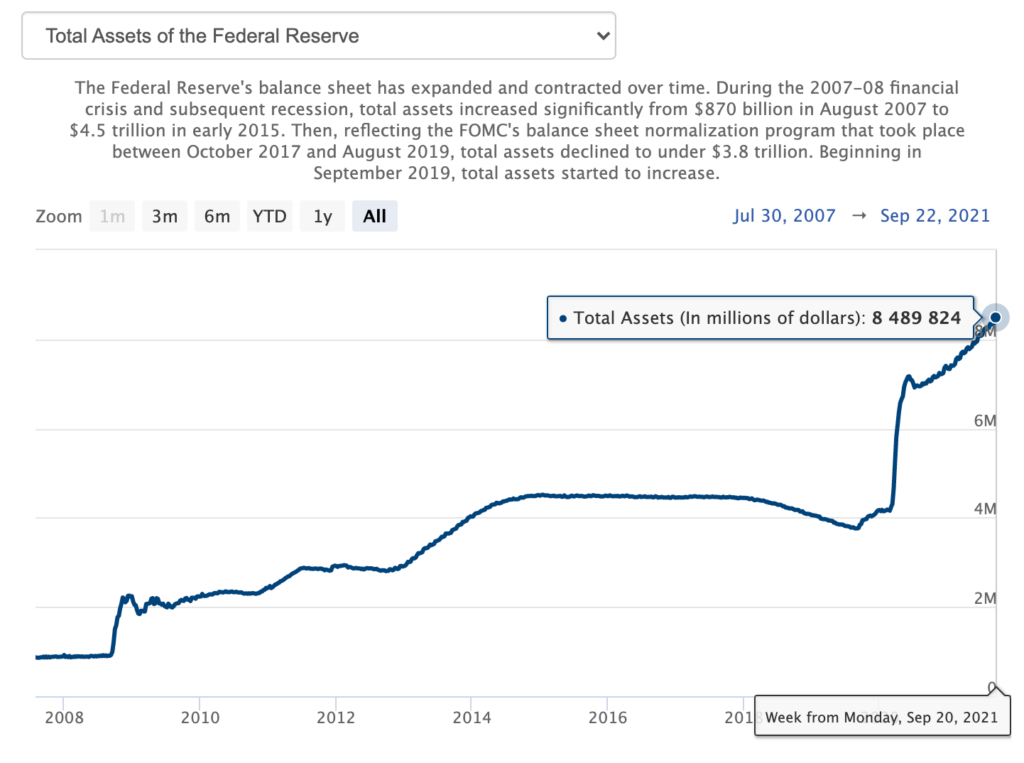

- QE – Monetary Policy + Expansive QE (balance sheet expansion)

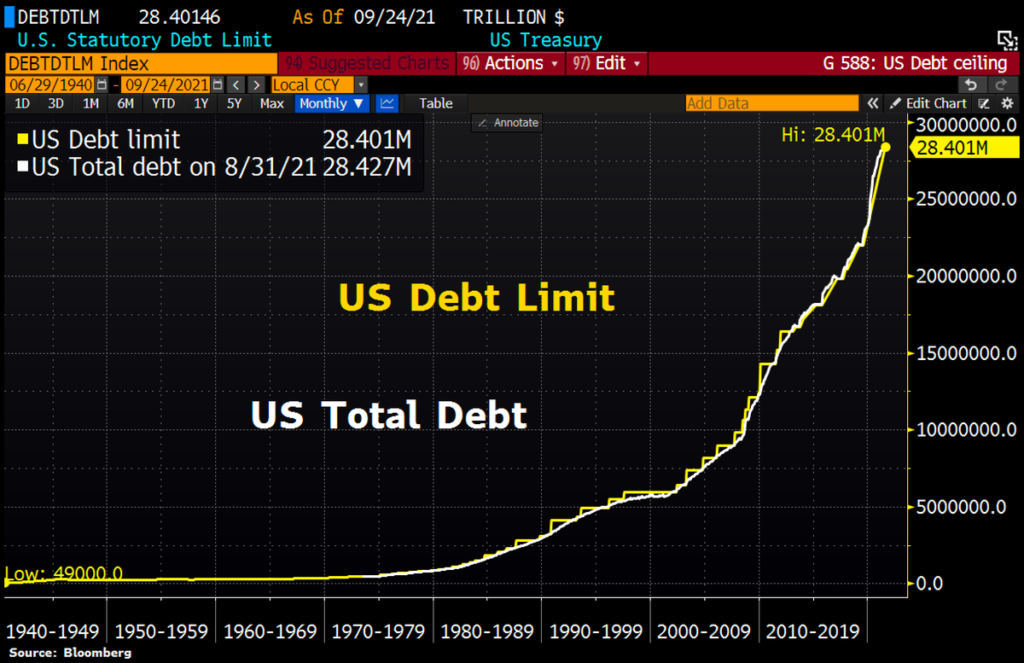

- The most recent Fiscal is difficult to show, but our addiction to spending/debt it not.

You see, the Federal Reserve’s responses to crises have evolved over time. For example, the Fed’s answer to the bursting of the tech bubble from 2000-2003 was of the first drug – cutting the federal funds rate (interest rate policy).

Fed Chair Alan Greenspan introduced this arrow into the Fed’s quiver in response to the stock market crash of October 1987, known as Black Monday. Ever since Greenspan’s intervention, the equity markets have immediately looked towards the Federal Reserve for a bailout. We broke down the recent history of the Federal Reserve’s response to asset market “turmoil” in a section of our 4Q2018 note; titled: The Fed: 650… 535(+400)…250(+?)…. In November 2000, the only arrow the Fed had was to cut interest rates from 6.5%, eventually stopping at 1.00% in June 2003.

QE (Quantitative Easing) didn’t exist until March of 2009, with an expanded response to the GFC (Great Financial Crisis) of 2007-2009. By that time, markets had become tolerant of cheap rates, cutting the Federal Funds Rate from 5.35% to zero simply wasn’t enough for markets to regain their “high”, to the point Fed staff recommended to Chair Bernanke that an additional “400 basis points” in stimulus would be required to save the financial system, representing the 5.35(+400) in the title of that piece.

As we noted back then:

As we wrote in our 2nd quarter note, from the mouth of former Fed Chair, Ben Bernanke June 2018 in an interview with Desmond Lachman of the AEI (American Enterprise Institute).

“We (the FOMC) didn’t know where the bottom was going to be and we were seriously concerned we were facing a new depression type situation – The staff was telling us that we needed 400 basis points more of stimulus, we had zero to give… because interest rates had been at zero since the previous November. So we needed to do something, and all members of the FOMC from the most dovish to the most hawkish were very strongly agreed with this (QE) was the best option we had.”

With the help of Congress, the Fed’s response to the GFC entered an entirely new stratosphere from the mere interest rate response that it used during the Tech bubble crash, by adding both a large-scale asset purchase plan and the creation of numerous credit purchase facilities such as TARP (Troubled Asset Relief Program), TALF (Term Asset-backed Securities Loan Facility), CPFF (Commercial Paper Funding Facilities), and the list goes on…

In the end, these MASSIVE Large-Scale Asset Purchases (QE) and liquidity facilities were enough to quell the financial system’s fears … the addict was again satisfied, but with a higher dose!

The final question on our mind in that piece, knowing the Fed had few arrows left in the quiver, was what hand could they play next; hence the 250(+?). What resources were at the Fed’s disposal to fight off the next market crash? We wrote:

“With the current Fed Funds rate now sitting at 2.5% (250-basis points), a far cry from the 6.5% Fed Funds rate of 2000 or the 5.25% the FOMC had to work with in 2008, the FOMC has far fewer tools at their disposal to counter a recession then at any point in the last 50-plus years.” ~ OSAM 2018

Each of these crashes are preceded by extreme ramps in equity markets due to a handful of factors, though none more correlated than access to excessive leverage due to relaxed lending standards under euphoric market conditions. We provided an easy-to-understand explanation of this dynamic in that very same 2018 note; in a section titled, “Understanding the Game”.

Our economy has been operating like it’s one big “cash out home refi” for years, constantly taking on more debt at a lower interest rate. Debt continues to balloon, while no incremental revenue or growth is generated. For example, rough numbers to date, $1.3 trillion of GDP has come at the expense of an additional $2 trillion of non-financial sector debt. That’s equivalent to approximately $0.36 cents of GDP growth per $1 of incremental debt: just abysmal and unsustainable.

“Inexplicable” ramps (by traditional Wall Street narrative) in 1999, 2007, 4Q2018 and 1Q2019 preceded each cliff and in all scenarios, it was ALWAYS easier for any advisor to gather assets for the fear of missing out (FOMO), also known as greed, was more powerful an emotion than the fear of falling off the cliff.

We began writing about “NOT QE” in September of 2019. As you may recall, the Fed refused to call it QE. Regardless of what it was called, it wasn’t working, as the Repo crisis was out of control by December.

By late February, with markets in a virtual free fall and Covid just starting to make headlines, the Federal reserve had cut interest rates back to zero, re-opened virtually every lending facility from the GFC, and created new ones no one would conceive they would ever do in buying Junk Bonds. Fed Chairman Jay Powell is on record stating what they did as, “CROSSING MANY RED LINES”.

The Federal Reserve took their interest rate and lending powers from the GFC, and inserted SPENDING powers, bringing this crack addicted market to an entirely new level. If that wasn’t enough, they begged the Federal Government for FISCAL STIMULUS of TRILLIONS as well; yet again, the crack addict needed more juice and this time they flat out broke the law for it…

When an exogenous event such as COVID suppresses supply and the government handouts literally give people more money than they’ve ever had while they were working full time, THEY WILL SPEND. AMERICANS CONSUME – THEY DON’T SAVE. Suppressed supply and increase demand ….. a textbook formula for increased prices.

However, the inflation won’t last forever (see below) and the Fed is likely to make a policy mistake (again, see below). When exogenous shock meets a deflationary economic regime, or “Quad 4” in Hedgeye vernacular (as we’ve described both here and here), investors should stop sprinting and open their eyes immediately, for there is an extremely high probability you’re a few steps from running off that cliff with no protection.

Furthermore, as we’ll explain below, the Fed’s quiver is about as barren as it’s ever been, all this while:

A Shoot Out’s a Brewing…

To review: Exogenous shock + Deflationary economic environment = “sprinting towards a cliff”. But when and why; and why are we warning you now?!

By 2Q22, the deceleration in growth via GDP, earnings, etc. should be very noticeable. The second quarter is also when we should begin to see a real deceleration in inflationary pressures as well. As previously discussed, a Rate of Change deceleration in both Growth and Inflation would place us squarely into a #Deflationary economic investing regime; the same environment that brought us the 4Q2018 decline and 1Q2020 crash (among other larger deflationary market crashes).

Throughout the piece, we’ve likened stock market crashes to sprinting off a cliff, and while it would be arrogant to suggest we could tell you exactly how deep this cliff will be, however really “big crashes” tend to occur when the #deflationary environment converges with a large exogenous shock. Our admitted concern re: exogenous shock surrounding the election occurred during a #reflationary economic regime; and economic regime trumped outside noise. The #deflationary scenario we’re describing already places us squarely into a crash like environment for markets, when coupled with exogenous shock things have the potential to get very, very ugly and that’s where the Ole’ western shoot-out comes into play…

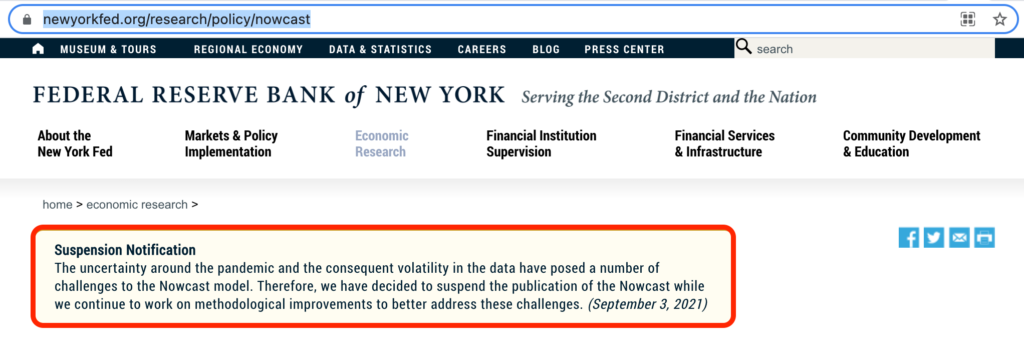

It’s important to remember the Federal Reserve is literally ALWAYS BEHIND the curve; their NowCast modeling is historically abysmal.

It’s so poor the NY Fed literally just suspended their NowCast model.

Currently, Fed Chair Powell has remained dovish and coy with his public message, though pressure to raise interest rates and taper asset purchases has been mounting as inflation remains persistent; we all know “tapering” is coming.

Tapering is just another way to say, the Federal Reserve will be systematically scaling back QE, their purchases of treasuries and MBS (Mortgage-Backed Securities). Currently, between the two, they’ve been buying $120 billion per month ($80 billion in Treasuries and $40 billion in MBS).

For those unaware, these decisions to “taper” or “adjust interest rate policy” are made by the FOMC (Federal Reserve Open Market Committee. The structure of the FOMC has never been more pertinent. The board consists of both permanent voting board members and regional Federal Reserve Presidents who rotate votes annually; this dynamic is imperative to understand given this upcoming “showdown”.

In January, the four regional voting members who will be replaced are; Chicago Fed President Evans, San Francisco President Daly, Richmond Fed President Barkin and Atlanta Fed President Bostic. These four together constitute a largely neutral block, neither hawkish nor dovish.

These will be replaced by Cleveland Fed President Mester, Kansas City Fed President George, St. Louis Fed President Bullard, who are ALL hawkish, as well as an “unknown” … For while the 4th should have been Boston Fed President Rosengren, he has resigned due to a little bit of insider trader controversy.

The FOMC, fresh with their newly appointed hawkish voters and relatively new permanent board member/voter in Christopher Waller, feeling behind the curve as core inflation rises (think housing as we’ve discussed), will most likely begin to RAISE INTEREST RATES as they are tapering, which will be considered a “double tightening” creating an exogenous shock heading into what??? A HIGHLY PROBABLISTIC DEFLATIONARY ECONOMIC REGIME… (the timing might shift, but whether it’s Q2 or Q3, it’s coming).

While this shoot out is occurring at the Marriner S. Eccels Federal Reserve Board Building, a MUCH LARGER gun slinging battle will be occurring on Capitol Hill.

By early next year, with slowing growth and inflation we’re likely staring at inflation adjusted GDP in the RED; yes, we’re talking negative real GDP … Top tiered Wall Street firms are predicting growth into the first half of 2022, but no one has a good answer on where they anticipate the growth to come from, outside of another expansive stimulus package (meanwhile, they are having trouble passing the infrastructure bill?!).

While Wall Street has begun to cut GDP forecasts, at the end of the day, they’re still way too high.

To reiterate, we’re likely staring at a pronounced deflationary regime in 2Q22, with some of the most difficult base effects ever seen as the Federal Reserve begins to “double tighten” into the slowdown with a borderline toxic political environment. Remember, “Deflation + Exogenous Shock = Cliff”.

As discussed earlier, the Fed’s rescue packages expanded from (1) simple interest rate policy to rescue markets during the Tech Bubble, to (2) interest rate policy coupled with QE (expanded monetary policy including off balance sheet facilities) during the GFC, to (3) interest rate policy, QE in the form of vastly expanded off balance sheet facilities (which arguably broke the law) AND fiscal policy from the Federal Government handing out checks to the American people in the form of PPP, PUEC, PUA, etc. to rescue markets through Covid…

So, what happens when a crack addict doesn’t have access to anymore crack?! Withdrawal…

Historically, Fed tool number #1 is interest rate policy, which, as measured by the Federal Funds Rate, is currently set at 0.00-0.25%. Now ask yourself a few questions: between now and 2Q22, how many times will the Fed be able to raise interest rates? How high could they possibly get them?

Which brings us to Federal Reserve Tool #2. “(4) Not more than the sum of $454,000,000,000 and any amounts available under paragraphs (1), (2), and (3) that are not used as provided under those paragraphs shall be available to make loans and loan guarantees to, and other investments in, programs or facilities established by the Board of Governors of the Federal Reserve System for the purpose of providing liquidity to the financial system that supports lending to eligible businesses, States, or municipalities by—” SEC. 4003. EMERGENCY RELIEF AND TAXPAYER PROTECTIONS

If you read the above quote, it comes from H.R. 748, also known as the ‘‘Coronavirus Aid, Relief, and Economic Security Act’’ or the ‘‘CARES Act’’which was passed on December 27th, 2020. On page 190 you will find Section. 4003. Emergency Relief and Taxpayer Protections…

Which, when stated in plain English says, that it’s illegal for the Federal Reserve to create many of the off-balance sheet bond buying facilities the Fed used to calm markets during the COVID melt down. It was inserted to prevent Fed Chair Powell and his ilk from breaking the law “crossing many red lines”; no municipal bond purchases, nor corporate bonds (which would include junk bonds) and no handing companies like BlackRock blank checks to bail out their own illiquid bond ETFs … WITHOUT THE APPROVAL OF THE LEGISLATIVE BRANCH.

Bringing us to the Fed’s newest of tools, which is begging the federal government for “Helicopter” money: Before we move on, I’d like you to think about current relations between our representatives in Washington; in both the House and the Senate … It’s TOXIC … and while there are certain things Democrats can do without Republican support, there are some things, like another astronomical bail out of the economy, which would require bilateral support.

Now ask yourself … With the Republicans focused on taking back both the House and Senate and on impeaching President Biden over, ah, you name it … Do you really think Republicans will provide the Federal Reserve with the same tools that were stripped as recently as December of 2020? From the onset of this “crisis” we’ve currently injected roughly 42.3% GDP into the system via fiscal stimulus alone, do you honestly think Republicans will provide anything that could be considered a “win” heading into mid-term elections?

Herein lies a shoot out of epic proportions. The most probabilistic economic investing regime of #Deflation coupled with a highly probable exogenous shock which could very easily make Feb-March 2020 look like kinder spiel (child’s play).

While markets can and usually do discount events early, what we’re staring at come Q2 of next year, again, INCLUSIVE of some form of left leaning infrastructure and fiscal spending package, likely places us ALL on that triple black diamond few have ever skied. While we might be slightly early in discussing this now,

if you read any of our archived pieces, you’ll note we began discussing probable looming market corrections early, however, we remained very deliberate in keeping our finger on the pulse of what laid before us in the moment. If you look up toward the horizon, you will see that cliff too.

In the very same 4Q2018 note we also wrote a section discussing why the probabilities of a melt-UP had just INCREASED at the time. Our final warning note where we did not leave room for interpretation was on January 26th, 2020, 3 weeks before one of the most swift corrections in market history.

We mention this for today markets are telling us that we’ve shifted economic regimes from stagflation to reflation. Last month we told you that this could happen very easily:

“Markets are smart, the data has been mixed, and while Stagflation is the current market regime, it won’t take much to shift the regime from stagflation back to reflation, which is something we are watching very closely. A better-than-expected print in one of the heavier weighted metrics like, Hours worked, Labor Income, Jobless Claims, and Non-Farm Payrolls and we could find ourselves back in a “reflation” regime relatively quickly, OR NOT at all; we’ll allow markets to provide the answer to this question, they will tell us.” ~ OSAM Aug 2021

And tell us they have! Over the last week, markets have so far confirmed this shift with bond yields breaking out, rate sensitive asset classes like Gold and Utility stocks breaking trend lines to the downside, and small cap names closing up above previous resistance levels.

What we’re saying and markets are confirming, is we have some time before markets discount 2Q22.

The deflationary event that we believed would have happened in Q3 of this year hasn’t been permanently prevented, merely pushed to the near future.

While there is quite a bit of time between now and Q2 of next year, it’s almost mathematically impossible to see an acceleration off this year’s base effects. The imminent deceleration, coupled with a hawkish FOMC and a toxic political environment will likely collide with a deflationary economic regime at a most inopportune time!

Investing happens in cycles, be mindful of the cliff you’re sprinting towards and the shoot-out that’s brewing.

For movie buffs, here is Tombstone’s depiction of the “Shootout at the O.K. Corral”

As always, we’re happy to discuss our market thoughts along with strategies and more, never hesitate to reach out with any questions or concerns.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.