In This Article

“Life can be so much broader once you discover one simple fact – and that is everything around you that you call “Life” was made up by people that were no smarter than you. Once you learn that – you’ll never be the same again” ~ Steve Jobs (The Lost Interview, NETFLIX)

It’s happening, again…

Federal Reserve officials along with Secretary of the Treasury Yellen have recently been out in full force pounding the inflation drum. As November came to a close, Federal Reserve Chairman Jerome Powell officially removed the word “transitory” from their language. Speaking before Congress, Powell stated:

“We tend to use [the word transitory] to mean that it won’t leave a permanent mark in the form of higher inflation … I think it’s probably a good time to retire that word and try to explain more clearly what we mean.” Jerome Powell; Nov 30, 2021

A few weeks prior, when asked if inflation would ease by next November, Yellen stated on CBS’s “Face the Nation”:

“The pandemic has been calling the shots for the economy and for inflation”

Just this week San Francisco Fed President Mary Daly proclaimed:

“Markets are not out of step with the Fed’s policy stance; the economy faces risks ahead, inflation will not last beyond the pandemic, but the pandemic will last for a while.”

This is where we remind you that none of the highly touted PhD academics, Wall Street economists, or Private Equity attorneys (in Powell’s case) would even acknowledge inflation as a concern 16 months ago when we started positioning for it; literally NONE!

Could you imagine if these “experts” who drive fiscal and monetary policy actually used real time data and math to determine the path of growth and inflation vs. narratives and emotion?!

Based on data and math, I’ve got a secret to tell you …

Inflation has already peaked – Shhhhh, don’t tell them!

Meanwhile, the financial media scurries like lunatics with their hair on fire screaming that the December CPI print was too “HOT”, being up 0.8% sequentially and +6.8% YoY. Is this a sign of chaos to come — “OMG it’s at the highest annual increase we’ve seen since 1982”. Similar to the message we attempted to convey in June 2021, they’re making the same mistake, AGAIN, failing to note the directionality of the two largest and most important components of the CPI: Energy and Shelter.

As we highlighted at the time, June was the month Fed Chair Powell finally acknowledged that “inflation could be higher and more persistent than we expect”; our cordial response being … No sh*t Jay!

Powell had no choice but to finally admit that inflation was real and would be with us longer, because at that point it was nearly impossible for inflation to not move higher, for some very specific reasons. First, was the spike (at the time) in energy prices, which had yet to flow through into the most recent CPI calculations. We wrote:

“Energy prices have exploded as Oil continues to push new cycle highs nearly daily … June’s most recent CPI print does NOT reflect current per/barrel oil prices of $75 … Given oil’s weighting in the CPI calculation, this data point alone could change the trajectory of inflation. But it likely won’t be alone …”

Why wouldn’t it be alone in driving CPI higher?! Because the next highest weighted input in the CPI calculation or as we dubbed, one of the other “Elephants in the Room”, had “sprouted green shoots”, we wrote:

“Shelter comprises nearly 33% of the CPI … THIRTY THREE PERCENT … and as you can see from the below image, the cost of shelter has recently begun to move higher. For more than a year, the shelter component of the CPI has literally been “sheltered” from massive inflationary pressures … when 1/3 of the survey spikes on a single data point, you better be seeing a precipitous fall in other metrics or things could get out of hand in a hurry … For the purpose of the CPI, “Shelter” trumps “lumber”.”

As things stand today, the exact opposite of what occurred in June is happening now, and rather quickly…

Given December’s most recent, “catastrophically high” CPI print, the report captured energy up +3.5% MoM with energy related commodities up +5.9%. However, what you most likely did NOT hear from financial media, Wall Street firms, or the Federal Reserve’s overpaid PhD academics is that in true government fashion, an extremely large chasm now exists between the government’s survey and what everyone else experiences in the real world.

Both Oil and Natural gas sold off extremely hard in the month of November with WTI (West Texas Intermediate Crude) down approximately 20% from the start of the month to beginning of December, while Natural gas was $5.51 in October, falling to $5.05 in November and currently resting at $3.65 USD per MMBtu (OUCH).

For those suggesting this might be attributed to the announced 50-million-barrel release from the US’s SPR (Strategic Petroleum Reserves) I’ve got a narrative bridge to sell you. Per the U.S Energy Information Administration, the US consumed 18.19 million barrels of oil per day while mostly shut down in 2020; using this as a baseline, the 50 million to be released equates to roughly 2.74 days of use.

At the same time, 32 million barrels is nothing more than an exchange over the next few months, per the White House briefing documents, “releasing oil that will eventually return to the Strategic Petroleum Reserve in the years ahead.” While the other 18 million is nothing more than, “an acceleration into the next several months of a sale of oil that Congress had previously authorized.”

Your 50-million-barrel announcement was a publicity stunt while the economic cycle is VERY REAL.

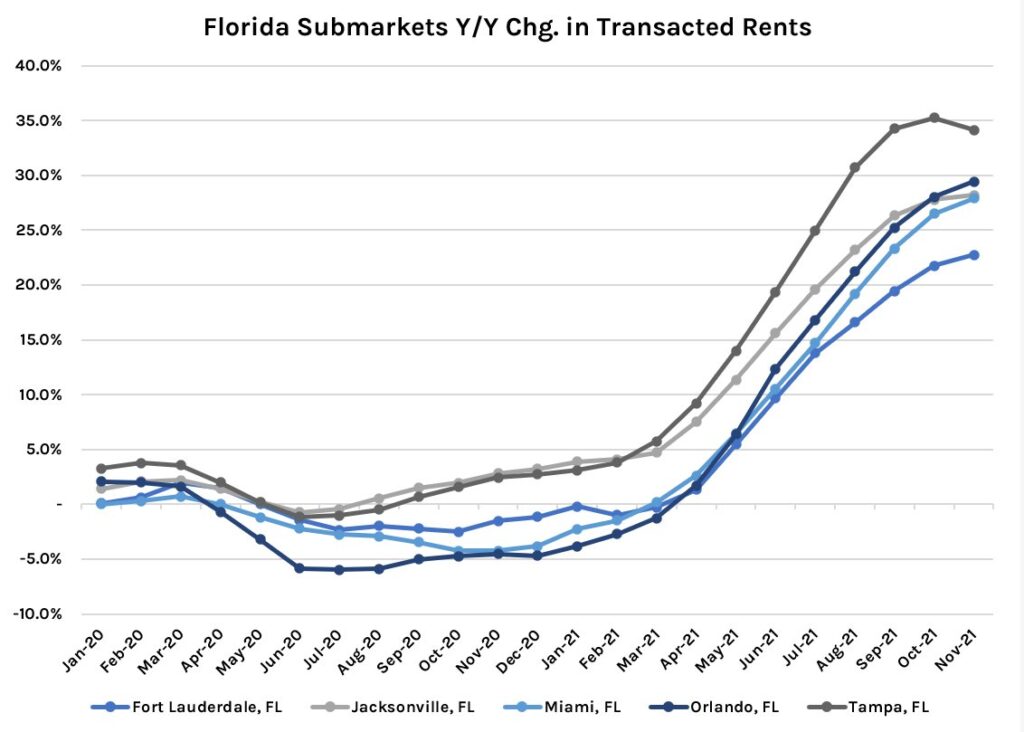

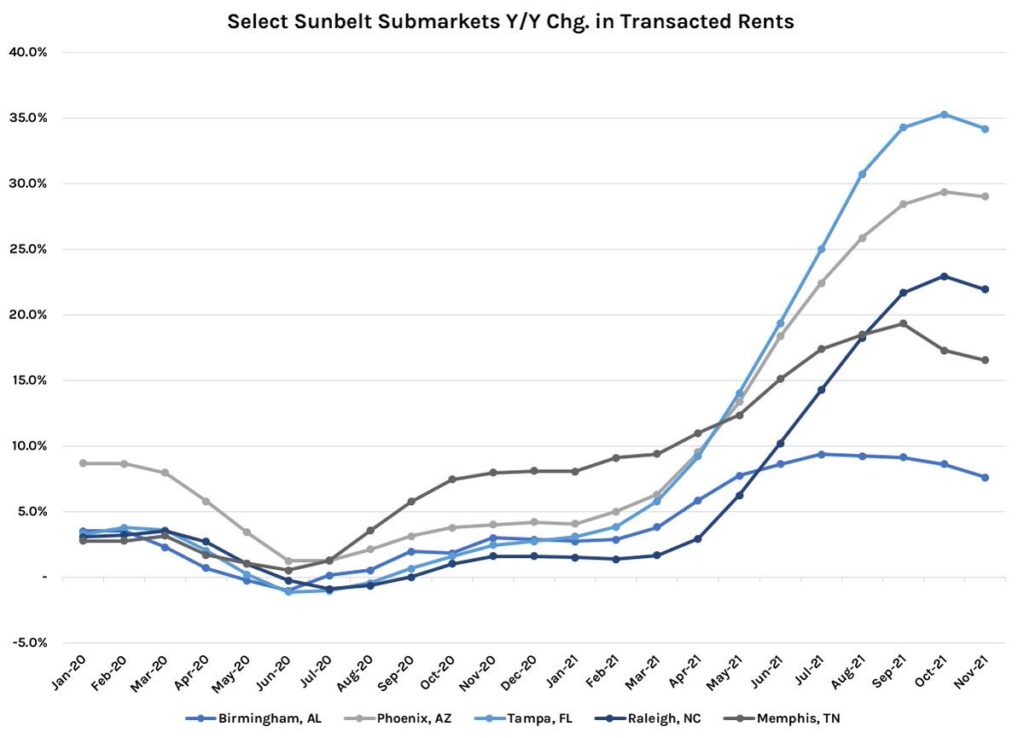

At the same time, rents appear to have peaked in many of the Sunbelt locations as they’ve begun to roll over on a RoC (Rate of Change) basis; Courtesy Hedgeye REIT analyst Rob Simone @HedgeyeREITs December 8th .

It should not need repeating, but I will … ENERGY AND SHELTER ARE THE LARGEST COMPONENTS OF THE CPI AND THEY HAVE PEAKED. As we’ve noted before, large moves in these metrics alone could be enough to tip the scales to disinflation, but they are NOT alone. If you look at any commodity, it’s likely either begun to roll over or is in crash mode.

Commodities that are typically grown vs. mined are known as “soft commodities” – such as coffee, cocoa, sugar, wheat, soybeans, cotton, oats, etc. They are all currently trending lower, as are most hard commodities such as nickel, copper, and aluminum. Truly, outside of corn and lumber, there isn’t much left out there with positive price momentum and lumber was down -9% just last week.

And while this wasn’t reflected in the most recent CPI data, it will be soon … As the masses frantically pull their hair out overreacting to inflation, just know unless we see a sustained rally in major commodities, we are poised for a deceleration into Q1 2022.

Things happen slowly … Then ALL AT ONCE.

“Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be” ~ Janet Yellen, London conference 2017

Clearly this quote didn’t age well for our now Treasury Secretary, the hubris to suggest economic cycles just disappear, coming from someone with her “pedigree “is truly mind numbing, but also very telling per our introduction. The cycle didn’t stop in 1Q2020, and given the math, it more than likely won’t be stopping in the not so distant future.

Deflation is coming and most investors will not be prepared. They never are, primarily because they don’t know what to look for; they’re rooted in belief and narratives, not data or math. As markets trade this week, Quad 4 “Deflation” may already be upon us … we should know soon…

In a two-factor (growth and inflation) model, there are two economic environments where inflation decelerates: the first being “Goldilocks” (Hedgeye Quad 1), the second “Deflation” (Hedgeye Quad 4); in understanding that inflation is decelerating (as we explained above), the directionality of growth becomes the determining factor on which Quad we are entering. Why do we care about the two factors of Growth and Inflation? Because extensive back testing shows that these two factors most accurately predict the expected performance of different types of investments.

So, what about Growth?!

As we detailed over-reactions to the CPI print on the inflation side of the equation, we can similarly do the same for the most recent retail-sales “disaster” that “missed” Wall Street expectations. December’s retail sales print of +18.2% was, in fact, another MoM (Month over Month) ACCELERATION: 18.21% (November) > 16.26% (October) > 14.16% (September), Wall Street talking heads be damned.

We’ve also seen solid jobs data, and strong housing data with mortgage applications accelerating +0.08% WoW as both housing starts and permits accelerated for November as well.

As we’ve noted in the past, it’s never just one thing … for determining the directionality of Growth (GDP) it’s 30 economic data points per month, 90 over the quarter. So, whether it’s headline retail sales, retail sales control group, MBA mortgage purchase index, Aggregate Hours Worked, Aggregate Labor Income, the data pertinent to growth is the data, and it has continued to come in strong.

However, at the same time, it should also be noted, calculating GDP includes “Government Spending”: GDP = C + I + G + (X – M) or GDP = personal Consumption expenditures + gross private Investment + Government purchases + (exports – imports). We believe this is extremely pertinent to what’s happened throughout the month of December, as we’ll explain in detail below.

Despite continued acceleration in economic growth data which “should” be providing us with a brief “Goldilocks” environment, recent market behavior is currently signaling the probability that deflation is rising; in an ever-changing world, as information changes, so do probabilities.

As is the case with inflation, we’ve known that the growth cycle is also nearing the end of its rope. As we wrote in September:

“While there is quite a bit of time between now and Q2 of next year, it’s almost mathematically impossible to see an acceleration off this year’s base effects. The imminent deceleration, coupled with a hawkish FOMC and a toxic political environment will likely collide with a deflationary economic regime at a most inopportune time!”

Is this “the most inopportune time!”? The answer is, I don’t know yet…

We knew the fiscal/monetary spending hole that currently exists YoY was large, though, as of last week, the current administration’s $2+ trillion “Build Back Better” plan is now dead, creating a MUCH larger shortfall in YoY government spending; THIS information is NEW and carries with it significant ramifications to real growth/GDP as noted above. This also carries with it many cascading effects which will now hit the economy.

For instance, the roughly 90% of American families that have become accustomed to the monthly “Child Tax Credit” being in their mailboxes will now notice a very large void come January 15th, a highly probable hit to private Consumption. Additionally, without this Child Tax Credit, it’s now been estimated that nearly 1.5 million parents “could” drop out of the workforce to care for their children. While likely an inflated estimate, this is also NEW and will affect the math, NOT TODAY’S, but very likely the back half of 1Q2022 and most definitely Q2 & Q3 of 2022.

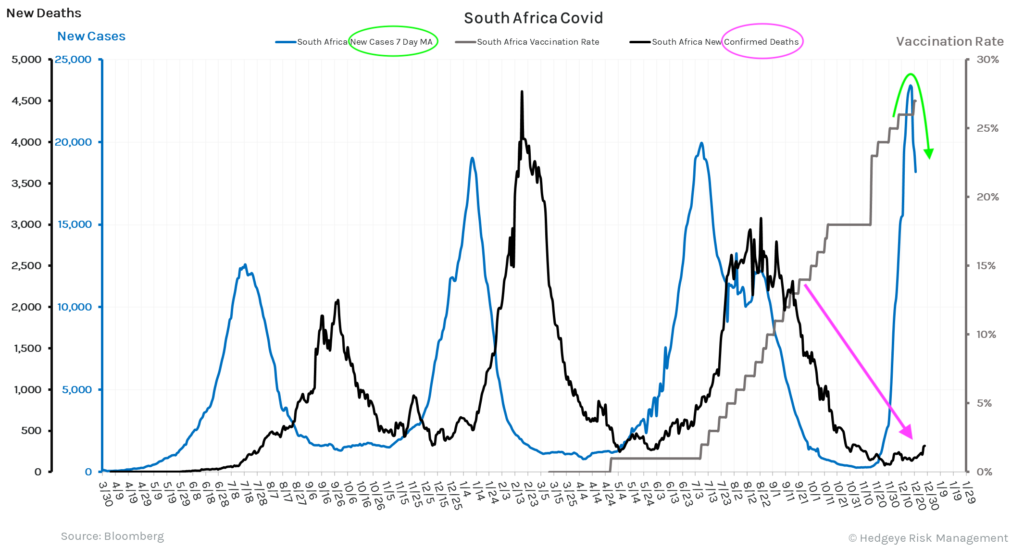

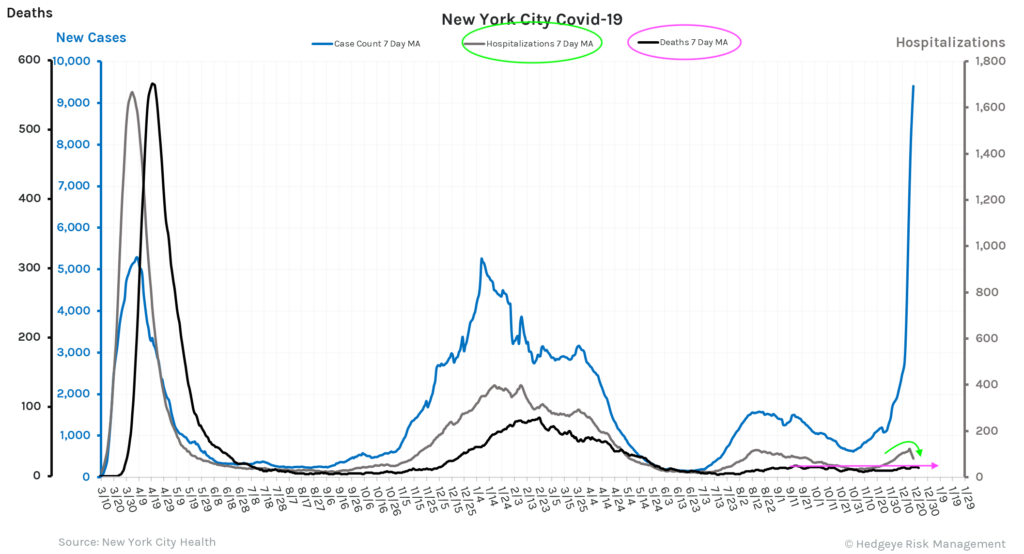

Adding insult to injury, we’re now watching another Covid variant freak-out unfold in the name of “Omicron”. We are not going to delve into Covid in detail because, frankly, the topic is overdone. What we will do is provide you with the data out of South Africa, where the new variant originated and NYC, where the greatest of panics tend to originate, (courtesy of Hedgeye Director of Research Daryl Jones @HedgeyeDJ), and let you draw your own conclusions:

Our discipline has always been to stick with the data and avoid the noise.

Could this be another buying opportunity as the emotion from Omicron catches up to the Omicron data?! Could more Quad 1 data points present themselves allowing for some additional upside in equity markets before the high probability of back-to-back Quad 4 deflationary environments slated for Q2 and Q3 of 2022 present themselves? Both yes, and yes?! Markets are currently attempting to figure out the best path forward, and as we write, these signals are mixed.

If you’re data dependent, the data has without question been that of “Goldilocks”. At the same time if not by Q1 of 2022, the US economy will be slowing in 2Q2022. Which is what makes our initial thoughts regarding the Federal Reserve and PhD academics so timely and pertinent.

There are fewer constants in this business than Federal Reserve officials being wrong at the most inopportune time. While the Federal Reserve “tapering” their balance sheet isn’t new news, Federal Reserve members continue to show a complete lack of understanding as to the economic cycle presented before them. As their own words show, they are tone deaf, speaking to emotionally driven events NOT math.

The below quotes come from Fed officials Waller and Daly on 12/17:

Waller:

- I do not believe that three rate increases in 2022 will cause the economy to enter a recession.

- Under my base case, liftoff is quite likely in March, however it could be pushed out to May

- Balance-sheet runoff by summer would also help remove accommodation, reducing the need for additional rate hikes.

Daly:

- In terms of Inflation, we are not behind the curve

- I’m bullish on the US economy

- The US economy is expected to grow well at least through the first half of 2022

A significant shortfall in the Federal Government’s spending is a mathematical input to GDP; both tapering and the raising of interest rates becomes a liquidity/collateral/leverage issue … Any combination of the above Fed tightening policy into a deceleration of both growth and Inflation becomes extremely disastrous at exactly the wrong time.

We can’t stress this enough, it is NOT the absolute levels of inflation or growth that markets care about most, it’s the directionality and RoC (Rate of Change) of them.

Remember, markets tend to front-run economic reality. So, we should not be surprised to see a correction begin in the weeks leading up to 2Q2022. But how many weeks in advance? We don’t know; nobody knows; all that we know is that “things happen slowly, then all at once”. So, we will continue to use strategies to preserve capital against a highly probable correction.

We concluded last month’s note by saying:

The bottom line — today is NOT a day to position for Deflation, but that day isn’t far off … 3 months will pass by in a blink and you better know where to go if and when the signals confirm deflation! We’ll keep watching the data for you.

As we’ve detailed in today’s note, the data HAS changed, inflation has rolled over, and the death of the BBB bill could very easily flip the growth side of the equation sooner than anticipated. There isn’t a whole lot of time between now and the second quarter of next year, so while we’re not positioning for outright deflation (yet), we have been raising our trailing stops, cutting holdings that have broken trends, trimming names into strength while rotating into names that should perform in both disinflationary and deflationary environments.

And we will watch the constantly changing data with intensity, providing you an update with finer focus in our next Letter.

It is our humble belief, whether you know it or not, times like NOW are the reason you have hired us or consider doing so… As always, we’re happy to discuss our market thoughts along with strategies and more, never hesitate to reach out with any questions or concerns.

A Final Thought

If you’re reading this today, it’s Christmas Eve … We believe regardless of religion, it’s a great opportunity to reflect on all things good in this world. A time to gather with family and friends; a time to GIVE, especially to those less fortunate.

If it’s not pocket change that you can spare, a big, wide smile will do … Smiles are FREE, but infectious.

To those celebrating, from our Family to yours, Merry Christmas, Happy Chanukah and a VERY Happy and Healthy New Year!!!

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.