In This Article

Cre·scen·do

/krəˈSHenˌdō/

noun

the loudest point reached in a gradually increasing sound. “the port engine’s sound rose to a crescendo“

MUSIC

verb

increase in loudness or intensity. “the reluctant cheers began to crescendo”

“Those with a musical background should be familiar with the term crescendo. Fun fact: The classical piece, Bolero, written by French composer Maurice Ravel is the single longest crescendo ever written. It begins with a whisper, then slowly, consistently and deliberately increases in volume and intensity for 15 minutes and 50 seconds to 17 minutes (depending on rendition, composer and pace) before finally ending with a thunderous finally!” ~ OSAM November 2019

In November of 2019 we used the term crescendo to describe where we were in the cycle as it pertained to DEBT. There are numerous thoughts in that note that we flat out nailed, though our focus was arguably incorrect; were we at minute 2 or 15 of Bolero or should we have focused on the crescendo of a different piece all together?!

To mix our metaphors, that note listed all the ingredients necessary to bake a perfect cake, though our measurements were slightly off. And while we added just the right amount of many, we did perhaps add a little too much flour and not enough chocolate and sugar for out liking; two years later, a similar set up lays before us. NOW, is the perfect time for us to make sure we’ve learned what we needed to as it’s time to bake the perfect cake. To complete our mixing of metaphors, we’ll prefect the recipe by dissecting past and present crescendos.

As we headed into the end of 2019, the repricing and rolling over of large amounts of high yield debt was an obvious problem, which proved prescient a mere few months later. However, debt wasn’t the catalyst that ignited the inferno that became the fastest drawdown in equity markets in decades; it was however, a powder keg of dynamite waiting to blow (and subsequently did), but it wasn’t the catalyst; meaning, it wasn’t the crescendo to have been focused on.

“You adapt, evolve, compete or die” ~ Paul Tudor Jones

As we adapt and evolve over time, we now more than ever allow the data to do our talking, focusing squarely on what specific economic investing regime we are currently in and which regime we are most probabilistically going. We’ve described these environments before as either “goldilocks”, “reflation”, “stagflation” or “deflation” (or Quads 1, 2, 3 and 4 respectively, in Hedgeye vernacular).

Again, stated as simply as possible, economic investing regimes are dictated by the simultaneous directionality (measured in rate of change terms) of both Real Growth (GDP) and Inflation; and whether they are accelerating or decelerating. (See: “Why it All Matters” from our July note for a refresher on the Quads)

We’re dissecting the content of our November 2019 monthly for numerous reasons. The first is pointing to an error in our focus of what we believed at the time was in a crescendo (debt) vs. the factor which more importantly had already peaked (we’ll discuss that factor below). The second reason, as noted above, is that while we had all of the ingredients on the table to bake a brilliant cake, it wasn’t as great as it could have been, and we always strive to learn and get better. The third reason is that given today’s current and forward-looking economic data, coupled with a handful of powder kegs and accelerants, we’re staring at a very similar set up to where we were in November of 2019, which again, most market observers are oblivious to.

In the spirit of adapting and evolving over time, while we protected against most of the downside during February – March 2020 exponentially better than most, we were still down. And though most managers in this business play the role of weatherman/woman very well, reporting to their clients that accounts are down during large drawdowns because “markets are down”, we don’t believe that’s the proper way to risk manage assets. Our stated goal of preserving capital means that we should, …. you know, … preserve our clients’ capital,

So, while we nailed the directionality of growth in November 2019, stating:

“While you continue to hear “better than expected” in reference to “earnings beats”, the rate of change has been negative for 3 quarters now.”

“Home supply behemoth Home Depot (HD) announced a revenue miss on 11/19/2019, lowering their future sales outlook. On the same day, Kohls (KSS) cut forward-looking estimates sending the stock down -22% in the last two days and -37% from its peak in April. Walmart (WMT) trades with a 27x PE, 23x FPE, has a 2.5% profit margin with $75 billion in debt… they, too missed revenue estimates and as I finish up writing, BJ’s wholesale warehouse (BJ) just announced a “meager earnings” beat, yet sales and revenues missed expectations, reducing forward guidance…”

We continued:

“It’s about too much leverage, too much debt. ECONOMIC CYCLES MATTER! DEBT CYCLES MATTER! Do you know what also matters? GDP growth, which is anemic at best… US GDP growth was recently slashed by the Atlanta Fed from 1% to 0.3% per their GDPNow:

As GDP deteriorates and the rate of change in corporate earnings and revenue decline at a faster pace, cost-cutting becomes management’s top priority.”

Our focus of what had reached a crescendo SHOULD have been INFLATION, NOT DEBT. Why? Because given the 2-factor model of both growth and inflation dictating which economic regime we are in, inflation at the time was the more important input. Inflation is what was beginning to roll over OFF ITS PEAK CRESCENDO to create the Quad 4 “deflationary” investing environment for 1Q2020, in which both GROWTH AND INFLATION were decelerating simultaneously. This is a deadly combination.

However, at the time this is what we wrote:

“As more supporting data comes in showing inflation is on the rise, corporate earnings continue to fall and labor markets are weakening, most will be caught off guard. So many more data points and signs of slowdown exist than you’re willing or care to read in a single note, we’ll spare you…”

Remember it’s the directionality of both growth and inflation that dictates the investing regime (or quad) NOT debt. In November of 2019 we inadvertently brushed over inflation from the perspective of what “had been” not what “was to come”. We had the right answer, but for the wrong reasons.

The 2019 note was written prior to our deliberate study and understanding of the Quads and investing regimes. It’s crucial to understand how all the ingredients are mixed and what measurements are most important. Yes, indeed, every chef must be humble enough to learn from his mistakes and improve on the next cake!

Last month we attempted to explain how some investors often improperly interpret data, even data which come consider stale as well as current data, for both are equally important just in different ways. We wrote:

“Markets are forward looking; they are a discounting mechanism for the future, constantly pulling in data; some of which is from the past, though without question, it has the potential to change future investing economic regimes. Most investors often dismiss old information as “STALE”, when in fact, these data could have a direct correlation to the future directionality of the Rate of Change off the previous quarters numbers. ‘

Markets are simultaneously looking backwards anxiously awaiting perceived “lagging” data points, while at the same time, discounting the probabilities as to whether forward-looking data will accelerate or decelerate off a final (yet to be determined) number (real growth in this case or inflation as outlined above).”

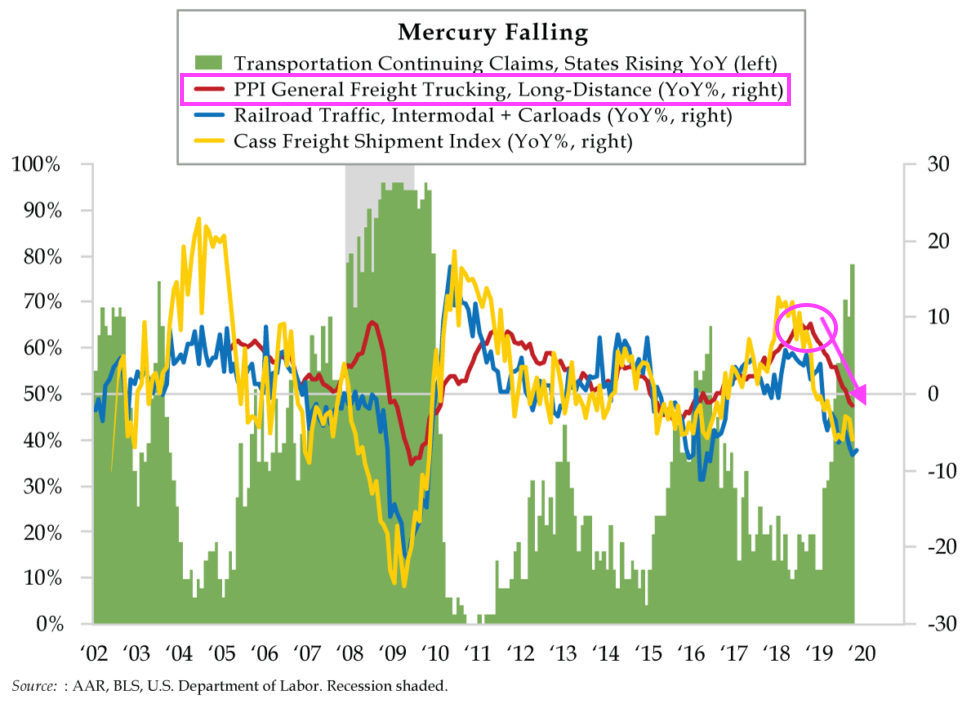

Ironically, in that November 2019 note, we had enough data right in front of us to piece the entire puzzle together for we included the below graphic. Note the highlight that we’ve placed today on the PPI figure:

Readers may also recall from last month:

“PPI (Producer Price Index) is a LEADING INDICATOR FOR CPI (Consumer Price Index) … Here is another example of correlation – PPI feeds through to CPI.”

We had a chart squarely in front of us showing PPI had rolled over, suggesting inflation wasn’t too far behind. There are very few perfect correlations, and PPI’s rollover in November 2019 didn’t mean CPI would necessarily follow, but it was, without question, a data point that suggested we should have scrutinized the overall “inflation” factor more closely.

Often, the only way to adapt, evolve, progress, and move forward in life is by recognizing and learning from mistakes we’ve made in the past; this holds true in all facets of life, not just in business.

As we’ve committed to ourselves and to you, we will never close our mind to learning via constructive criticism.

While too much debt and leverage are undoubtedly a problem, the WHEN is more important than the WHY. The debt in 2020 became the powder keg that blew up only when it was set ablaze by a deflationary market regime. When the vast majority of investors attempted to deleverage at the same time into a market with limited liquidity it literally becomes the proverbial “FIRE!” in a crowded theater as everyone rushed for the exits at the same time.

When market circuit breakers blew day after day, it signaled that there weren’t enough buyers to take the other side of the trade for those investors who couldn’t liquidate quickly enough.

Some will toss the covid narrative around as the root cause of the event, but we couldn’t disagree more. While debt was the powder keg sitting in the corner waiting to explode, covid was a mere accelerant; a violent one, but an accelerant, nonetheless. So, what was it that sparked the fire? Simply put, Quad 4 or a DEFLATIONARY INVESTMENT EVIORNMENT.

Covid is what gave the Federal Reserve and government the “cover” to break as many rules and cross as many “red lines” as they did to bail out countless overly leveraged companies along with the likes of BlackRock and their fixed income ETFs with a blank check just screaming “confidence” and “liquidity”. For those who suggest otherwise, we’re open to hearing how a fixed income ETF with 10% illiquid securities (defined by prospectus as not being able to liquidate in under 7 days without adversely affecting price) can offer immediate liquidity… Exactly, you can’t, though I digress…

Which brings us to today…

Is there a similar scenario today which closely mirrors November 2019? Let’s look at the factors:

- Real Growth near peaking

- Inflation data peaking

- Debt at record levels NEVER seen in prior history

- Legislation which prevents the Fed from back stopping markets

- Political divide of epic proportions (See: The 4th Turning, written by Neil Howe)

- Mid-Term elections

That does not look like a healthy setup. Let’s start with the data:

Recently citing Daniel Kahneman’s recent book, “NOISE”, Hedgeye CEO Keith McCullough noted:

“these are ROC (rate of change) facts that should not be subject to your daily dose of click-bait and/or “unwanted variability in judgment that should be identical.””

What were ROC facts that Keith was thinking about? It was the data that he had just cited prior in his November 17th daily “Early Look” note, specifically:

A) US Retail Sales #accelerated to +16.3% year-over-year GROWTH in OCT vs. +13.9% in SEP

B) US Industrial Production GROWTH #accelerated to +5.1% year-over-year in OCT vs. 4.6% in SEP

Those are mathematical facts, one can choose narratives over data, but the thing about math is 2+2 will always equal 4; the data is the data. GDP growth matters; inflation growth matters.

But here’s the thing about baking cakes … some people can have identical ingredients laying on the table in front of them, but not all cakes are created equally, for it’s the measurements that the baker uses and the technique that he applies which will dictate the quality of the cake.

There are 30 core features in Hedgeye’s growth and inflation model and 28 key market signals that front-run them. Yes, determining which economic regime we are in (or moving into) is a 2 factor Growth and Inflation model, but there are over 30 weighted inputs which are reported monthly, giving us over 90 data points per quarter. That is the flow of data which determines the directionality of growth and inflation. That’s the math of it all. There is no “story”, no narrative, no waving of arms, no fancy theories – just hard numbers.

Anyone can look at all 30 features and try to bake the same cake, but if they don’t know how the features should be weighted, they ain’t gonna get the same quality cake (output); and @Hedgeye bakes the best damn Growth and Inflation cake I’ve seen in my 25 years in finance. Theirs is more accurate than the Fed, Goldman, JP Morgan, you name it.

While the upcoming Q1 is going to be a tight race re: Growth and Inflation peaking or slowing (which we’ll likely be addressing shortly), Q2 is most likely another story all together. Mathematically, including base effects, I have no idea how growth and inflation won’t be rolling over simultaneously into a Quad 4 DEFLATION. Goods inflation and energy are currently up 8.4% and 50% respectively, representing roughly 60% of the CPI print, so unless these inputs can compound similarly next year, CPI (inflation) will VERY likely stop accelerating, meaning that its ROC will become negative; coupled with a slowing consumer and tighter corporate margins it more than likely means we’ll be entering into a Quad 4 regime which has been extensively backtested to be extremely bearish for equities.

We continue to note 33% of the CPI input (SHELTER = Rent + OER) is still likely to move higher, but it’s unlikely to offset 60% (give or take) of the inputs that will likely be rolling over.

Could this change, YES! But how? I am having trouble foreseeing what could dramatically change this trajectory. The lack of government fiscal spending alone will be crushing to GDP and a watered-down infrastructure bill isn’t enough to fill the void of last year’s massive spend.

We are nearing the finality of a crescendo in both growth and inflation. One of them might roll over sooner, but by Q2 of 2022, they should both be decelerating together.

As for debt (remember, that’s the powder keg in the corner), usually the corporate balance sheets deleverage in recessionary times. However, this time, given the massive Federal Reserve bailouts, corporate debt has exploded even higher over the last 2 years creating an even larger powder keg waiting to blow. We’re much closer to minute 15 of Bolero then we were a couple of years ago.

In September we discussed the political factors listed above, numbers 4, 5 & 6. In the context of today’s note, the CARES Act signed into law December 27, 2020, included new legislation which prevents the Federal Reserve from using many of the tools it had on hand in 2020, which were deployed to resuscitate confidence in the markets that the Fed would back stop any defaulting debts. As we noted:

“Which brings us to Federal Reserve Tool #2. “(4) Not more than the sum of $454,000,000,000 and any amounts available under paragraphs (1), (2), and (3) that are not used as provided under those paragraphs shall be available to make loans and loan guarantees to, and other investments in, programs or facilities established by the Board of Governors of the Federal Reserve System for the purpose of providing liquidity to the financial system that supports lending to eligible businesses, States, or municipalities by—” SEC. 4003. EMERGENCY RELIEF AND TAXPAYER PROTECTIONS

If you read the above quote, it comes from H.R. 748, also known as the ‘‘Coronavirus Aid, Relief, and Economic Security Act’’ or the ‘‘CARES Act’’ which was passed on December 27th, 2020. On page 190 you will find Section. 4003. Emergency Relief and Taxpayer Protections…

Which, when stated in plain English says, that it’s illegal for the Federal Reserve to create many of the off-balance sheet bond buying facilities the Fed used to calm markets during the COVID melt down. It was inserted to prevent Fed Chair Powell and his ilk from breaking the law “crossing many red lines”; no municipal bond purchases, nor corporate bonds (which would include junk bonds) and no handing companies like BlackRock blank checks to bail out their own illiquid bond ETFs … WITHOUT THE APPROVAL OF THE LEGISLATIVE BRANCH.”

If both inflation and growth are decelerating in Q2 of 2022, it is shaping up to be an ugly challenge, yet the Fed will not have the tools that it had two years ago. The set-up exists for things to be an extremely dark time for those who are unprepared.

Should this occur, we KNOW the Fed is willing to break as many rules and laws (red-lines, as Chairman Powell likes to call them) as they can get away with to protect an outright collapse. The mystery lies in what will he (now that he’s just been renominated) be able to get away with in the face of increased political pressure, coupled with the new restrictions of the CARES Act and a set of politicians who are unwilling to work together and who are more interested in their political power struggles going into the mid-term elections.

We don’t say this as a scare tactic or narrative; if this occurs it will be data driven first and confirmed by market signals; the power kegs are ready to blow, and the accelerants are in place to spark an inferno. As we reminded readers most recently in September, markets are addicted to the Fed’s QE and always want MORE; which screams full blown MMT to us, but that needs a legislative body collectively working together (which we don’t have) … The Fed and Treasury will have to be overly creative in finding a new “innovation”, outside of MMT, but I can’t think of what that might be. What we do know is that they will do everything they can to pump liquidity into the markets yet again, which will more than likely lead to exponentially more inflation, and not the kind most can live with.

Let’s quickly revisit something stated above: “There are 30 core features in Hedgeye’s GIP (Growth, Inflation & Policy) model and 28 key market Signals that front-run them.”

As we progress through the next few months, we will be keenly aware to both the DATA and those signals which front run them.

25 years in the finance business and still, we continue to carry an open mind, which fosters daily learning and evolution. Zen Buddhist call it Shoshin or “beginners mind”, which has been our Philosophy displayed proudly on our website from the day we opened our doors; we believe it’s a crucial cornerstone necessary to compete at the highest level in this business. Proudly, our performance in down markets places us amongst many of the top investors, though, we continue to strive to get better managing risk/reward in up markets.

We’ll leave you with this recent webcast interview between Danielle DiMartino Booth and Hedgeye Founder Keith McCollough, recorded on November 2nd. Should you choose to stick with PRESSING, TIMELY and EXTREMELY RELEVANT finance talk, start listening at 20:40 seconds, though we suggest the entire video is worth your attention. Put it on in the car as you drive, I can promise you that it’s a more enlightening listen than watching an hour of news these days that consistently brain washes us into believing everyone’s angry and everything’s bad while reminding us where to get our CV shots (as if we don’t know already).

The bottom line — today is NOT a day to position for Deflation, but that day isn’t far off … 3 months will pass by in a blink and you better know where to go if and when the signals confirm deflation! We’ll keep watching the data for you.

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.