In This Article

“The striking thing … the economic data have been surreally good!” (source revealed below)

Principles

I’m a fairly large individual … standing at roughly 6’3” 255lb; a 52” chest, 36/38” waist depending on the cut of pants with veins popping from my forearms, it’s safe to say I have an athletic build. Over the years, many have suggested that I can be intimidating at times. I humbly say …only when absolutely necessary!

Obviously, I haven’t always been this size. In grade school, I was thin … scrawny even … I couldn’t intimidate a cat let alone peer, but it’s never stopped me from sticking up for those who may not have been able to stand up for themselves.

Intentionally or not, kids can often be cruel. Whether it an attempt to look “cool” in front of their peers or be it a misguided angry child, bullying is something I have nor ever will accept, regardless of size.

In 5th grade, while leaving school I encountered 3 ‘friends’ picking on a ‘special needs’ child. Nearly 40 years ago, the slur was “retard” and these 3 kids who I had called my friends were calling a special needs child, “retard” while taking turns pushing and punching him.

As is typical with a fight or bullying scenario, a crowd had gathered, yet no one had done anything to protect the weaker, defenseless child. For whatever reason … be it peer pressure, the fear of not wanting to be judged by the other students or maybe it was the fear of possibly getting punched themselves … regardless, the crowd did nothing but watch.

Sadly, the same thing happens today, with the difference being most preferring to pull out a cell phone to record someone getting their face punched in vs. actually helping … though, I digress.

When the three boys saw me, they smirked, they even laughed with the expectation, for whatever reason, that I would join them … I did not!

Among a sea of screaming 5th graders, I intervened, first by telling them to stop … to leave him alone; but when they didn’t, it quickly escalated into a 3 on 1 fist fight as their anger shifting in my direction for ‘crossing them’; at least it was diverted from their initial target who couldn’t defend himself.

Similarly, to how they misjudged my initial reaction, they also failed to anticipate that not only was I not going to back down from them, but openly welcomed the confrontation.

My experience from a very early age has always been … when it comes to bully’s, MOST are cowards attempting to mask their own insecurities in an effort to make themselves feel better. They lack the courage to take on/face someone more able, with heart … for deep down they’re scared … which is the very reason they prey on weaker individuals who are much less likely to fight back from the onset.

I definitely took some punches that day, but the bullies folded relatively quicky after someone actually punched back. I never backed down and refused to quit … pressing forward with more tenacity, grit and resolve … which is how I choose to live my life to this day.

Allow me to be brutally clear … I am not advocating for people to aggressively seek out fist fights. Thirty-five/forty years ago on the school playground, they happened (and I’m sure they still do). However, bullies don’t just throw punches; regardless of what proverbial punch is thrown, I and this firm will always stand resolute in never backing down to bullies in an effort to protect others.

When backed into a corner and confronted by the “authority figures” (teachers and principle), these self-proclaimed tough guys spinelessly attempted to lie their way out of what they did … but it was too late for them; they couldn’t hide from the truth! Too many people had witnessed what had happened … still they had no shame.

Bullies, who are ultimately shameless cowards (in most cases) will do anything they can to pass blame, attempting to shirk any form of accountability or responsibility for their actions.

Ironically, after a lone individual had stood up to these bullies (me) … and they had lost … that countless others were now willing to stand up and speak out against them (funny how that happens)?!

From a very early age, I’ve had zero tolerance for bullies and/or liars … we stand firmly grounded in our principles and will never stop fighting for them regardless of how many punches I have to take or who the bully is.

Since opening our doors, we’ve called out those marketed as “experts” to the largest of wall street firms who are truly nothing more than bullies, as they perpetually lie to the American public while creating asset bubbles bound to burst as they’ve flooded the system with cheaply financed money (to be refinanced at some later date).

They attempt to gang up on and belittle anyone who stands up to them and calls them out, only to state, “no one could have seen this coming” while literally crying on the same financial media channels who perpetuated their lies in the name of advertising revenue, as they beg for bailouts when the crashed come … because they NEED the bailout!

They throw this leverage at overhyped companies going to zero in exchange for billions in investment banking fees … one of many examples of this would be $WE (WeWork), which we literally dismantled in September of 2019; we opened our piece writing this:

“We are a community company committed to maximum global impact. Our mission is to elevate the world’s consciousness. We have built a worldwide platform that supports growth, shared experiences and true success. We provide our members with flexible access to beautiful spaces, a culture of inclusivity and the energy of an inspired community, all connected by our extensive technology infrastructure. We believe our company has the power to elevate how people work, live and grow.” WeWork S-1, “Our Story” page 1

I’m legitimately asking a question here… Can someone tell me what the *$@# this means? Seriously… I’ve been in this business for 23 years and have never witnessed this level of B.S.

We continued:

“To Assess WeWork by conventional metrics is to miss the point. WeWork isn’t a real estate company. It’s a state of consciousness.”

Folks, you can’t make this stuff up… This pseudo multi-billion-dollar real estate leasing company is described by their CEO as “a state of consciences”?

WeWork, which was once valued by Wall Street charlatans (bankers) at nearly $50 BILLION dollars … just filed for BANKRUPTCY on November 7th, 2023. $50 billion dollars of capital was just eviscerated … it was only a matter of time before this specific shell game collapsed.

We’ve recently called out B.S. on … the BLS … Powell … Yellen … Goolsbee … C-level executives from Microsoft to JP Morgan to the Federal government (among countless others); for when the perceived ‘authority figures’ tasked to “protect” the masses are the root cause of the problem and are lying every step of the way, it becomes even more abhorrent!

There are very few in this industry standing up to the bullies for hard working Americans who just want to go to work and save for their future retirement, or that of their children or grandchildren?! We understand it shouldn’t be their job to understand systemic market pressures, though at the same time, the only way this madness stops, and the cycle is broken is by exposing these bullies for what they truly are … marketeers for massive profit at the expense of trusting and unsuspecting hard-working Americans.

Unfortunately, over the course of our nearly 3 decades in this industry, we’ve found that the behavior of the majority has remained relatively consistent. We’d liken the masses of investors to those initially cheering while watching the bullying or fight take place (in our above story); many being the very individuals pulling their cell phones out to record vs. those “few” who’s DNA tells them to stand up and fight!

Though, while it’s a very small minority, there will always be those who take the time to say, “hold up” … “not so fast” … “not on my watch”!

It’s only AFTER someone stands up to the bully or when those “bystanders” are directly impacted, does their tone change. When it comes to bubbles and investing, many will outright lose a significant portion of their life’s savings, adversely affecting retirement while those who caused/instigated the carnage are paraded back on stage in an effort to lie their way out of any form of accountability:

“no one could have seen this coming”, “there were no signs”, “the data was strong (as they literally cite zero data nor provide any numbers corroborating their B.S).

BRUTALLY CLEAR

So long as we are in business, not a single individual who reads are work will be able to say that we didn’t warn them to be leery of the wolves in sheep’s clothing, or of that there are massive recession warning signs FLASHING RED!

We’ve stated repeatedly over the years that, “cycles take time” … the tech bubble spanned 2001-2003, the GFC spanned 2007-2009, with ups, downs, bear market rallies and all … inevitably, market structure eventually give way as the dominos continue to fall … WeWork is just that, one more, of the many dominos that predicably topples into the next, then another and another which creates the cascade effect we’ve written about … until the system eventually gives way.

The data is screaming, “recession” and those focused on the data believe that there’s a very good chance we’re likely already one … there is very little that hurts more than a partially healed wound being ripped open again so no one should be surprised if 2022 lows are revisited again.

We began writing and warning readers about this current cycle since September of 2021, well before most all markets collapsed in January of 2022. We’ve also been clear about something else … price action is NOT economic reality … we know there is a structural passive bid pushing equities higher regardless of fundamentals, we’ve written about it many times.

For it’s the same structural bid that eventually works against the system as the latest of late cycle indicators rolls over; this being labor…

To date, from closing out our October note to current fingers on the keyboard, of all the economic data points that have been reported, we’ve seen THREE that have “beaten” expectations … THREE! (which we’ll discuss in detail below for even these “beats” can be disputed when dissecting the underlying data).

This month we again, lay the data out for you to decide … do you “believe” said “experts” who spew a narrative without providing a single piece of empirical data or do you understand how these economic cycles work overtime?! Or should you follow the data and learn how to spot them in an effort to protect your hard-earned capital from massive drawdowns as we did in 4Q2018, 1Q2020 & the majority of 2022?!

This credit-default cycle is by no means over … every passing data point supports the consumer squeeze is accelerating; financial institutions continue to tighten lending at an expedited pace, bankruptcies continue to rise as the internals of unemployment further deteriorates underneath the surface.

So, about that (recessionary) data

It’s about time we circle back to our very opening quote: “The striking thing … the economic data have been surreally good!”

It comes from none other than Nobel Laureate Paul Krugman! That’s right ladies and gentlemen, he’s back in the news, now being paraded from one mainstream financial network to the next spewing outright garbage and lies, which go completely uncontested by his interviewer. In a very recent interview on CNN, he literally had the audacity to open with the above quote, he continued:

“we can talk about surveys which in which people seem to be relatively happy with their own financial situation or we can just look at behavior people are out there with a lot of discretionary consumer spending, travel, hotels, restaurants … all of that is booming”

Words mean very little when they can’t be supported by facts, which is why we ask, what does the data suggest?!

October Retail sales, reported on November 15th … which was BEFORE this interview (meaning anyone with intellectual integrity would know) the data came in at +2.48% YoY vs. +4.05% YoY … which is a 157-basis point DECELERATION in rate of change terms MoM (Month over Month)

In October of 2022 this data point was +8.83%; a -72% collapse YoY … and while slightly more volatile, the most recent Redbook Weekly retail sales data decelerated WoW to +3.1% YoY, vs. +5.3% YoY … another significant deceleration.

Let’s again be clear, there is nothing “good”, let alone, “surreally good” about this data … NOTHING.

Moving on, the only “travel” data that’s remained stable has been leisure travel, with both business travel and hotels also in the midst of a significant deceleration in data.

Per Hedgeye Gaming, Lodging and Leisure Sector Head, Todd Jordan and their proprietary data which looks at forward hotel room rates in top 25 markets:

“January and February, on a year over year basis, room rates are tracking lower in early 2024 versus 2023 … so the overall trend is still worse … the underlying fundamentals in corporate travel looks like they’re getting worse and that’s confirmed also by our review of corporate airline travel … where bookings are … well below 2019 levels and still not getting any better so I think the outlook remains pretty negative looking ahead for business related hotels.” Hedgeye GLL Sector Head, Todd Jordan … The Call … 11/28/23 (abridged)

This, while restaurant traffic has been abysmal at best, as we noted last month:

“The QSR (Quick Service Restaurants), which is a “service”, has seen foot traffic DOWN for 3 sequential months … per Hedgeye’s Howard Penny, “the first half of October saw a 445-basis point sequential decline” … while Open Table has shown a massive deceleration in reservations over the last 6 months.”

To which we’ll add: Penny and Hedgeye have recently noted that YoY foot traffic in the restaurant space has decelerated from +14.4% in January 2023 to its current -8.0% YoY with 4 sequential negative month over month prints…

There is not a single word in Krugman’s interview that is backed by empirical data … still, he’s on parade right now; and you should really be asking yourselves why?!

Additionally, as we noted last month, please recall Treasury Secretary Yellen touting industrial production and manufacturing as strong along with consumer spending when she stated the below in a 9/24/23 interview on @CNBC:

“we still have a good healthy labor market, consumer spending remains quite robust, we’ve seen strong industrial production … I don’t see any signs that the economy is at risk of a downturn.”

As we noted at the time, this too, was a bunch of unsupported lies, which we called out then … however, digging deeper into this month’s data, we’re getting closer to ‘depressionary’ levels than ‘recessionary’.

October’s most recent ISM Manufacturing data contracted further from September’s reading of 49.0 to 46.7; a mere 70bps away from what would be a fresh cycle low for the indicator and its 12 sequential reading in contraction (below 50) … this is the longest stretch below 50 since … any guesses?! … wait for it from 2007-2009 … also known as the GFC (Great Financial Crisis).

This is a far cry from the 61.10 reading of September 2021 when we warned readers the cycle would be topping in the next few months (based on the data) … data peaked NOVEMBER 2021 (noteworthy).

The majority of other components were met with a similar fate of significant deceleration as well…

New Orders declined to an abysmal 45.5 in October from 49.2; a collapse of -3.70, while Business Employment cratered -4.40 as well, from 51.2 to 46.8.

And while “the majority” of other components, slowed … not all of them did so, as ISM prices paid accelerated from 43.8 to 45.1; +1.3; and Customer Inventories also rose from 47.1 to 48.6 … which tells us … inflationary pressures persist, amidst continued weakness in consumer demand large in part to higher prices and a tapped-out consumer.

Again, there is NOTHING positive about these recent data points, nor the data out of the recent Dallas, Philly and Richmond Fed’s regional surveys which echo this ISM manufacturing weakness, with the Dallas and Richmond Fed showing “Revenues” down -5.2 points and “New Orders” out of Philly nearing cycle lows…

To suggest there is anything “good”, let alone, “surreally good” in this economic data is unconscionable … and the only things that are “striking” about it, is how anyone who suggests as much can be considered an “expert” by anyone or in the case of Yellen suggesting the data is “strong”, can hold the position of treasury secretary?!

Employment

October NFP (Non-Farm Payroll) data (released in early November) saw a headline deceleration to 150k vs. the 336k MoM and “expectations” of 170k!

The unemployment rate inched up another +0.1 point from 3.8% to 3.9%, with average hourly wages decelerating from up 4.2% YoY last month to up 4.1% YoY, and overtime hours falling to +3.6% (decelerating wages as inflationary pressures tick higher). Temp. staffing was also down to -6.0% YoY.

As we’ve discussed in previous notes what may appear to be small/minor decreases in hourly wages adds up across an entire labor force, and temp. staffing is one of the first things cut when companies reduce head count!

These data points for the labor markets are NOT bullish, either!

Additionally, buried within the report, government jobs accounted for more than 1/3 of the total with the government hiring +51k vs. private payrolls coming in +99k, and if we sound like a broken record, as we discussed last month … government hiring has hockey sticked along with deficit spending to the tune of trillions, just as mandatory spending cuts go into effect with Congress once again kicking the spending can into early next year (part of the deal McCarthy made to become speaker).

Government jobs now accounting for roughly 14% of total jobs … we don’t see this ending well, either.

Additionally, following last month’s upward revisions to the payroll data (that we called complete B.S. on); this month, negative revisions came back for a curtain call, returning to the data to now make it 9 (NINE) consecutive months of negative revisions with August being revised lower by -62K from +227K to +165K, and September revised down -39K from +336K to +297K! You couldn’t make this stuff up in you tried, folks…

A few months ago, we reminded readers that the last time there were 7 revisions to this data was … at the depths of the GFC in 2008, after all the government B.S., following this month’s report, we’re now at NINE consecutive negative revisions … and the last I checked, 9 was greater than 7?!

Be mindful, “Manufacturing” declined this month by 35k jobs, with the data capturing the heart of the UAW strike. Thinking to next month’s data point, this will more than likely provide for a temporary “spring back” effect given the tentative resolution, which is the most recent initial claims data deceleration.

Outside of the CPI’s 10 basis point “deceleration” “beat” (which we’ll detail below) and this most recent initial claims report (courtesy of a strike resolution) these were literally the ONLY three “positive” data points released this month!

Though, as we note the “spring back” in labor is likely, the internals of labor markets continue to weaken, especially for thousands involved in the UAW strike as Ford recently announced layoffs in the 2,500 range, representing nearly half the employees from a Louisville plant that employs 3,483 and just over 700 employees from a plant that manufactures the electric F-150.

While we’re on the subject of Autos and layoffs …

“Recently, Auburn Hills auto supplier Unique Fabricating Inc. filed for chapter 7 bankruptcy earlier this month. Per the Detroit News, “The company “does not have sufficient capital to continue its operations,” so all of its employees will be terminated, according to the filing.” Additionally, (the company) “claims to have between 1,000 and 5,000 debtors and liabilities of $10 million to $50 million with the same value in assets, according to the filing.”

But I’m sure the 1,000 to 5,000 debtors won’t feel any ripple effects from this liquidation or the other bankruptcies which are piling up at their fastest pace since … immediately following the Great Recession.

There has been absolute CARNAGE in the trucking/logistics sector, and we’ve documented the bankruptcies of some, including the notable trucking company “Yellow” in our 2Q2023 note, though we’d need an entire note to document the entirety of what’s transpired in the area of logistics … thankfully we don’t have to as Craig Fuller of FREIGHTWAVES recently penned an article doing so, which you can read by clicking here.

While the Trucking industry, like many other commodity related industries are boom-bust, without these logistics/transport companies, it becomes harder for things to be placed on store shelves. Yet, more importantly, in our opinion … as noted by Fuller:

“the overcapacity spurred by the pandemic has caused freight-hauling rates to drop to 2019 levels — or worse. For the past 18-plus months, there have simply been too many trucks for too little freight.” (Emphasis ours)

Think about that … “too many trucks for too little freight!”

Question: does that sound like a booming economy to you?! Does it sound “surreally good”?! Do you really thing the layoffs will be isolated to this specific industry or will this weakness bleed into other areas?!

When the entire country has “too many trucks for too little freight” … it means less food to restaurants, clothing, shoes, purses, cosmetics, toys, etc., to retailers’, tires and auto parts for cars … it means less of most everything that’s purchased courtesy of an ever-weakening consumer given the compounding effect of the last 3 years of inflation coupled with an absurdly high cost of capital (among other things).

Our current cost of capital hasn’t been seen in multiple decades, which is killing the consumer and small businesses affected by revolving lending, not insulated by cheaper long-term financing (low 30-year mortgages)

We’ve been reminding readers for over nearly 2 years that “cost savings” would equate to “LAYOFFS”?!

Well guess what consumer credit reporting agency, TransUnion just said?!

TransUnion said it will cut its workforce by 10%, or roughly 1,300 jobs, as part of a plan to reduce costs and fund growth,

The company expects to deliver $120 to $140 million of annualized operating expense savings and a $70 to $80 million capital expenditure reduction in 2026 relative to 2023 levels.

“While these changes involve difficult decisions, they strengthen TransUnion and create an opportunity to extract more value from our recent acquisitions,” TransUnion CEO Chris Cartwright said in a statement.

Citigroup just announced a massive overhaul to operations, per Reuters:

“The actions we’re taking to reorganize the firm involve some difficult, consequential decisions, but we believe they are the right steps to align our structure with our strategy,” the bank said in a separate statement.

As reported by CNBC, “Employees affected by the cuts will be informed starting Wednesday, with new dismissals announced daily through early next week”.

Wonder what they’re going to do with all the employees from the 64 bank branches U.S banks just filed to close in a single week?!

We could go on and on with the layoffs – as of this morning, per @MacroEdgeRes: Gilead, U.S. Steel and Broadcom are laying off roughly 1,000 employees each!

Amidst these layoffs and labor data per the BLS, there are six state measures of labor underutilization labeled U-1 through U-6 . For our purposes we’ll focus on the U-1, which defined by the BLS is, “persons unemployed 15 weeks or longer, as a percent of the civilian labor force”.

Among the many other recession indicators screaming, while “experts” continue to be paraded around the mainstream networks telling you that things are “surreally good”; historically, when the percentage of Americans out of work for 15 weeks or longer is up by 15% we’re already in a recession … today that number stands north of 28% and continues to trend higher as recently cited by Quill Intelligence CEO, Danielle DiMartino Booth.

DiMartino Booth went on to suggest that when all of the revisions to GDP are said and done years from now that she won’t be surprised if that data shows that we’re not already in recession … to which we agree.

Nothing says Merry Christmas, Happy Channukah and “surreally good” data like a pink slip to a massive number of Americans being FIRED right before the Holidays, isn’t that right Mr. Krugman?!

Free fall

The banking sector is in outright contraction as the industry as a whole was just downgraded by Moody’s ratings agency … as too, was U.S government sovereign debt! Per Morningstar:

“Moody’s said the downgrade of Bank of America (BAC), JPMorgan Chase (JPM) and Wells Fargo (WFC) aligns with its rating cut on Friday of U.S. sovereign debt to negative from stable.

Moody’s negative outlook on bank debt reflects “the potentially weaker capacity of the government of the United States of America (Aaa negative) to support the U.S.’s systemically important banks,” analyst Peter E. Nerby said in a research note published late Monday.”

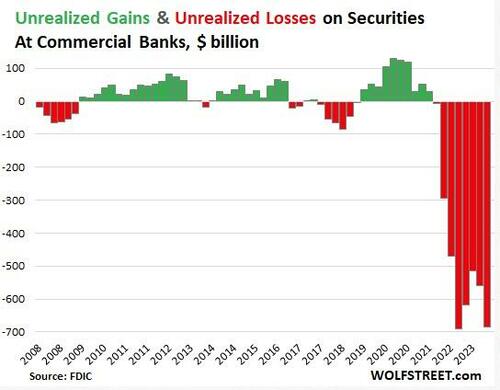

Deposits are continuing to flee banks, unrealized losses on HTM (Held to Maturity) portfolios and mortgage-backed securities at U.S. commercial banks ballooned by $126-billion in Q3 and now totals $684-billion according to quarterly FDIC data as reported by SchiffGold:

Now consider the balance sheets of many central banks!

The walls are crumbling around us with the data screaming massive contraction … which will continue to be perpetuated by the Ouroboros credit tightening cycle we’ve detailed ad nauseam for the last 6 months.

When it comes to the data, at this point it doesn’t matter if what we’re looking at the Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS), which, “addresses changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months” or the Federal Reserve’s H-8 data which updates the “Assets and Liabilities of Commercial Banks in the U.S”, weekly; every Friday at 4:15pm … the data is all saying the SAME THING … TIGHTER CREDIT CONDITIONS!

Most recent SLOOS data shows the net percentage of banks TIGHTENING in just about every vertical…

C&I (Commercial & Industrial) saw a 33% net tightening in lending standards overall – with to large & medium firms 30.4% net tighter and a 50% net tightening to small businesses – with a net negative -30.5% of banks reporting weaker loan demand QoQ (Quarter over Quarter).

CRE (Commercial Real Estate) saw a net tightening of roughly 65% on lending standards with drop in demand in the low to mid -50% (significant)

Consumers took another major hit with Residential mortgages (GSE/(FHA/VA)), credit cards and auto lending experiencing a continued acceleration in net tightening standards to the tune of net 10%/2%, 29%, and 15% respectively … Consumer loans (ex-auto & ex-card) experienced a net tightening of nearly 30%, with weaker demand across all categories.

Similarly, we’ve been discussing the deterioration in the Fed’s H-8 data for over a year now, most recently last month … which, also continues to spiral:

- Total lending (total loans outstanding) for September was up 4.5% YoY which slowed to 3.8% YoY in October, and most recently, in November to 3.2%!

- C&I lending is now outright negative having decelerated from +0.6% to +0.1% to now down -1.0% YoY over the same 3-month time frame.

- CRE lending decelerated from up +7.1 to up +6.3% to most recently up +5.8% YoY (also sequential decelerations).

- Similarly, to C&I lending, Auto loans are outright negative; down negative -2.2% to -3.8% to now negative -4.1 YoY for November … and last but not least …

- Credit Card lending has decelerated from +11.1 to +10.2% to 10.0% YoY.

A collapse in credit = a collapse in the consumer

Speaking of Credit Cards … this is the metric our disingenuous ‘experts’ attempt to focus your attention on as a sign that the consumer remains “strong”, while regular readers know this couldn’t be further from the truth.

For over a year we’ve been discussing the massive increase in borrowing, which has fueled the absurd, “consumer is strong” narrative. As cycles take time, and the consumer runs out of money; mortgages and student loans need to be repaid, government SNAP programs have expired, this has all contributed to this epic collapse in retail sales, which has been trending in the data for over a year.

And then you throw increased prices due to inflation on top of 24-28% borrowing rates, you should be able to understand that the life is being sucked out of the consumer and any purchasing power they once had.

The consumer is strong narrative can easily be put to rest by asking a simple question. If all-time highs in credit card debt of nearly $1.1-trillion dollars was a sign of strength … why are the largest credit card issuers in the country seeing their delinquencies and charge off rates balloon to levels not seen since the GFC (Great Financial Crisis), with employment as tight as the government/BLS claims it to be?!

In our 4Q2022 note we started raising the question as to how the unemployment rate could be so tight and yet sub-prime auto loans were hitting their highest delinquency rate on record?! We wrote:

“THE UNEMPLOYMENT RATE PRINTED A FRESH 50-YEAR LOW AT 3.5%” and yet, today still we’re experience, “THE HIGHEST DELINQENCY RATE ON RECORD”; now, square that circle!”

Again, never tell us the signs haven’t been visible, though, I digress, back to current delinquencies …

$COF (Capital One) card delinquencies were up 131 basis points YoY to 4.5% well above pre-pandemic levels of 3.8% in 2019. Net charge offs are up 2.15% to 5.08% YoY vs. 4.00% in 2019.

$DFS (Discover financial) is echoing the same trend in data with their delinquencies eclipsing what was last seen in November of 2007, further deteriorating from last month’s levels which we detailed here or in our Q2 note, here.

The last time delinquencies were accelerating to levels like these was the summer of 2008 … again, for those with short memories, that time frame lies squarely in the middle of what’s known as the GFC (Great Financial Crisis) we may have mentioned it a few times before?!

As credit card companies become increasingly alarmed by a deterioration in credit quality (let alone a massive one like the one we’re currently seeing), they WILL START PULLING BACK ON EXTENDING CREDIT (LENDING) AT A MUCH MORE AGGRESSIVE PACE! Which is exactly what the SLOOS, H-8 and real time credit card data should be telling you.

While we have mentioned this before, its importance cannot be understated … we literally wrote our 1Q2023 note expanding on this theme, spurred from a quote from Hedgeye Financial sector head Josh Steiner, who eloquently stated:

“Bank lending conditions are causal and reflexive, and they feed forward on themselves … so as they tighten conditions, economic activity slows … slowing economic activity drives non-performing rates (both consumer and commercial) higher … that causes banks to further tighten and contract activity and so on and so forth… UNTIL … you get the circuit breaker, which is the Central Bank, doing a full 180” Josh Steiner, The Call; 4/6/2023

Which is exactly what’s playing out in real time before our very eyes.

“…financial institutions will continue to tighten lending standards while simultaneously pulling back on credit availability … sucking the life out of an already crippled U.S consumer who desperately NEEDS the money.” ~OSAM, “Odds & Ends” 1Q2023

In the past we’ve also stated:

“lending to people who no longer have the money to make or keep up with their payments is most likely not be the best strategy as we head into recession … SEE: 2006/2007 heading into the GFC for reference should you have any questions as to how this ends?!”

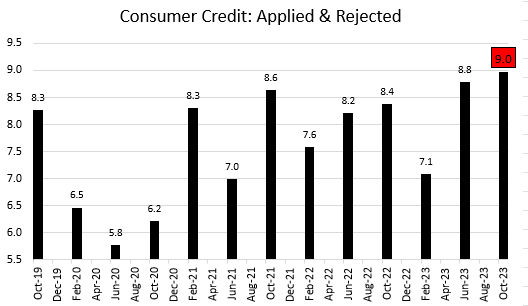

Which is also exactly what these companies have been doing, albeit, at a decelerating pace as shown above! The pull back on lending can be visually seen multiple ways, for instance … Consumer Credit: Applied & Rejected rate which has recently risen to cycle highs!

The insatiable need for access to money persists … which has most recently been partially filled by the BNPL (Buy Now Pay Later) industry … which as Quill Intelligence CEO, Danielle DiMartino Booth just noted:

“There are a record 27.85 MILLION unsecured installment loans as of Q3 2023 per @TransUnion data. The average balance per consumer is $11,692 sporting a MINIMUM monthly payment of $349 … ON TOP OF ALL OTHER MONTHLY OBLIGATIONS … because, why not?!”

Fear not … U.S. consumers ONLY added an additional $7.3 BILLION to these BNPL programs from November 1st to November 26th, up 14% (per Adobe) as reported by @Zerohedge. We’re not exactly sure how much data you need to see in order to contextualize how large our current problem is, but its BIG!

TRUE PAIN

There is a reason we present the data as we do, for when bullies like Krugman attempt to dismiss non-academics for their being less intelligent to their superiority as they lie through their teeth in order to perpetuate a falsehood, it’s truly demeaning to the majority of Americans. REAL PEOPLE are getting decimated, and it’s being dismissed as a “painless” recovery.

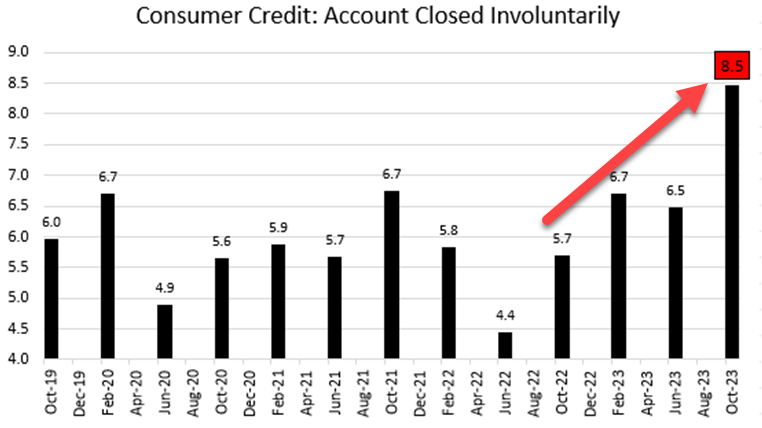

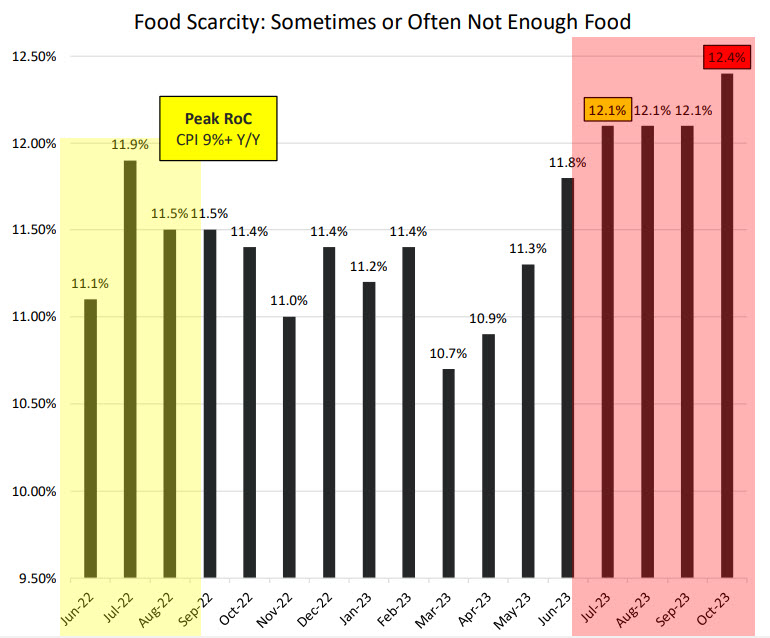

Sadly, the above data (numbers) don’t convey the full impact of reality! While we’ve previously noted that we won’t break the Hedgeye paywall, these next few images courtesy of Hedgeye CEO @KeithMcCullough as well as the @Hedgeye Twitter handle have already been made public. We feel it extremely important to visually contextualize the pain in the pockets of the consumer … as they say a picture is worth a thousand words.

How comfortable would you feel if your revolving credit line was just involuntary closed?! I don’t know about you, but we would place, “involuntarily closing credit accounts” as “pulling back on credit” … which is happening at an exponential pace!

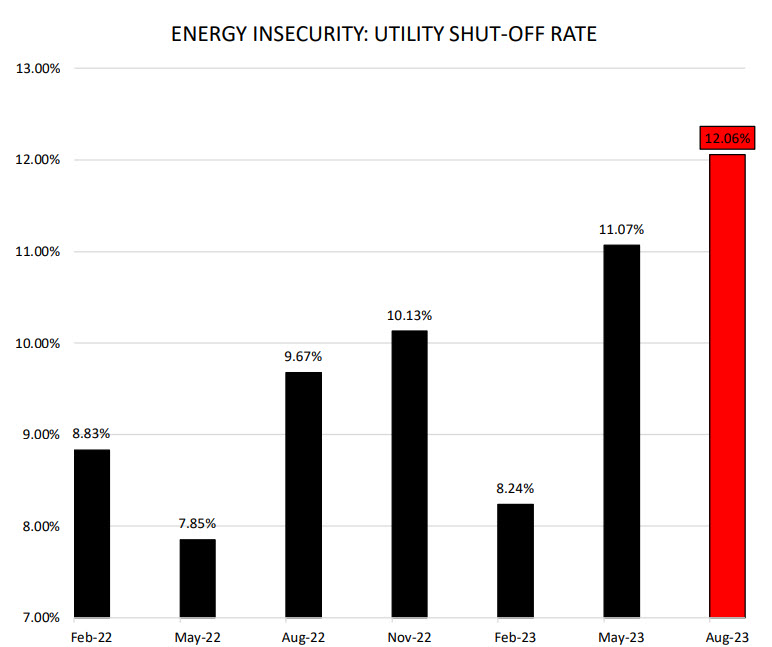

At the same time, an increasing number of Americans are being forced to choose between paying for their next meal or having their utilities shut off (as we head into winter)!

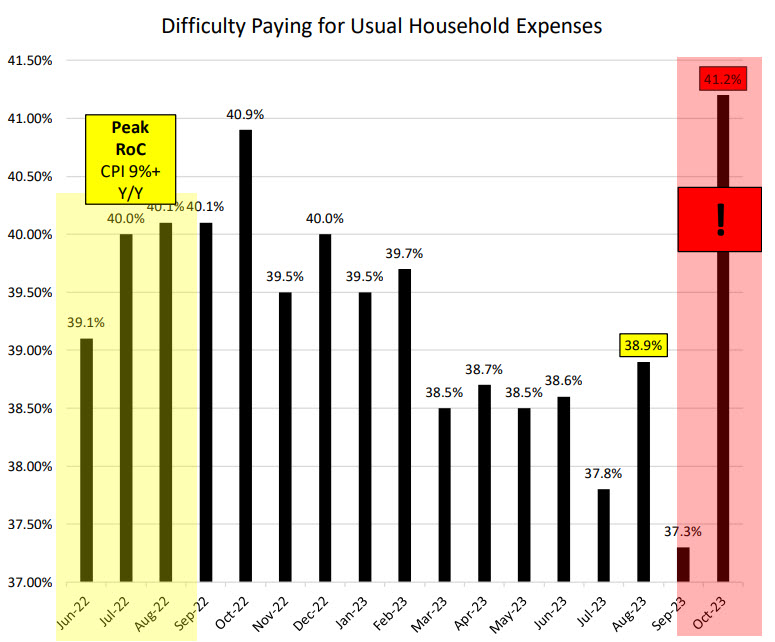

Something as routine as paying for typical household expense has recently become alarmingly difficult! If only we could put our finger on something that recently took place in October?! How about the resumption of student loan debt we’ve been warning about for 8+ months?!

If this wasn’t enough to churn your stomach, and while we’ve noted it in the past, recent data out of Fidelity suggests the hardship withdrawal rate from retirement savings/401ks continues accelerate:

“In Q3, 2.3% of workers took hardship withdrawal, up from 1.8% in Q3 2022. The top two reasons behind this uptick were avoiding foreclosure/eviction and medical expenses.

Additionally:

Inflation and cost of living pressures have resulted in increased loan activity over the last 18 months. In Q3, 2.8% of participants took a loan from their 401(k), which is … up from 2.4% in Q3 2022. The percentage of workers with a loan outstanding has increased slightly to 17.6%, up from 17.2% last quarter and 16.8% in Q3 2022.”

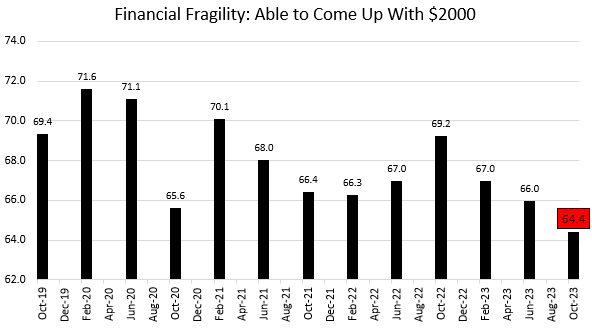

Hard-working Americans are experiencing VERY REAL PAIN, many are barely scraping to get by … as the number of American’s able to come up with $2,000 in the event of an emergency is at cycle lows…

Americans are desperate to get their hands on money by all means necessary! We’ve detailed labor data in the past with many individuals taking on multiple jobs in an effort to make ends meet … these are people actively and aggressively trying to put food on the table. This should turn the stomachs of any human with compassion, at the same time, it all flows through into what is, the economic cycle.

It reflects on corporate margins, manifests in layoffs, which further exacerbating the slowdown in spending … in turn, as noted above, further accelerates the pace in which banks tighten the lending spigots.

Unfortunately for those like Krugman and his ilk, these are empirical facts!

This note is long in the tooth as is, at the same time, we’ve missed quite a bit, but we’ll mention a few odds and ends as we close things up:

- The NFIB Small Business Index just collapsed again to near depressionary levels, this month to 90.7; nearly 2 years below the 50-year average.

- Existing Home sales fell to, ‘post Lehman brother’s collapse’ (2008/GFC) levels.

- New home sales came in down -5.6% MoM; +679K, below the +721k estimate and down from September’s +719K.

- The mortgage industry is so bad right now that Citizens Bank, the largest bank owned wholesale lender, is exiting the wholesale mortgage lending market! As are many others.

- Durable Goods are at levels last seen:

- at the heart of the GFC crash and:

- just before the 2020 crash.

- Earlier in the month, the Michigan Consumer Confidence data slowed from 63.8 in October to 60.4 in November, with forward inflation expectations increased from +4.2% in October to +4.4% YoY in November.

To be fair … after 3 sequential declines, consumer confidence data did accelerate to 102.0 vs. 99.1 (albeit, off a downwardly revised October print of 102.6 and 3 weeks of up equity markets) … however, “Expectations” remain below traditional recessionary levels of 80.

Virtually every thought/statement in this piece is tagged with a data point … an empirical factual number (most frequently stated in rate of change terms) to support the “claim” of what’s being said, and should one a data point be missing, it was attached to the claim when we originally discussed that specific point in a previous note (we’ve been detailing this deterioration in data for some time now).

In ALL data we trust

Let us again, revisit those 401k hardship withdrawals for a brief moment and recall the top two reasons for taking these withdrawals were to, “AVOID FORECLOSURE/EVICTION” and for “MEDICAL EXPENSES”!

And while not a perfect segue, now is as good a time as any to briefly discuss the THIRD of the now THREE positive economic data points reported this month (and I’m not even sure we could call it positive) … for while a growing number of workers are taking hardship withdrawals to keep a roof over their heads, pay for MEDICAL EXPENSES, put food on their table and keep their utilities on … the health insurance component of the CPI data calculation miraculously decelerated -34% YoY!

Could there be any more intellectual dishonesty in the government data?!

For the institutions reading, we absolutely understand there is nuance to the construction of this data point, it’s imperfect and poor at what it’s trying to measure; we also get that it’s a small weight to the overall data set … it’s simply unacceptable to have this poor a measure in such a pivotal data point.

Especially when this misguided figure contributed an -18-basis point deceleration within the headline CPI print; which came in slightly lighter than anticipated at +0.0% MoM, vs. expectations of +0.1%; +3.2% YoY (a 50-basis point deceleration annually) triggering a host of put covering sending markets higher on little to no volume.

This, as Core CPI accelerated +0.2%; 10-basis points lighter than +0.3% expectation and was still up +4.0% … and one of the Federal Reserve’s favorite inflation barometers in “Core Services”, also accelerated to +3.85% which was up +11-basis-points.

The “Shelter” component of the data was still a positive driver, up 6.7% YoY; something the most recent (albeit lagging) Case Shiller HPI housing data echoed as it, too was just reported as up +0.7% MoM and +3.9% YoY in September. … Energy did drag the number lower decelerating -2.5% MoM, -4.5% YoY; flowing through into the data more quickly than we anticipated in our last note, but still … be it this report or next, we knew it had turned to a negative contributor.

This push pull dynamic is what will keep inflation higher than the Fed’s target rate of 2% … which will keep Fed policy, “higher for longer” doing more structural damage to both the economy and consumer with each passing day as Wall Street is now pricing in a rate CUT for March 2024.

Does ANY OF THIS COUND SURREALLY GOOD TO YOU?! Because it doesn’t to us…

Final thoughts

We’ve frequently acknowledged history doesn’t always repeat itself, though as the saying goes, it does often rhyme. I do remember the GFC vividly, I was on an institutional sales desk at the time, focused on the FINANCIAL/BANK stock sector. Some may want to put it out of their minds due to the pain and heartache it caused en masse, but it’s a historical reality and the pain was VERY REAL.

During times like these, the same cast of characters (mixed with the newest crop of pay to play puppets) are paraded around lauded as “EXPERTS” … they’re not … they’re bullies, using their fancy titles, popularity contest awards, and accolades given to them by the political administrations they shill for, who are literally lying to your faces in an effort to preserve “confidence” in the system they had a hand in breaking.

Find us anything of value Janet Yellen or Paul Krugman have brought to the table over the last 2/3 decades? Bernanke? Larry Summers? Goolsbee? Neel KashKari?! These are the failures who brought us the previous bubbles, each one of them self admittedly, NEVER saw these economic slowdowns and market crashes coming … but here’s the rub … not only did they NOT get fired, but they’ve all been promoted!

Adding insult to injury, many of them have enriched themselves to the tune of tens of millions, courtesy of speaking fees provided by the largest of WALL STREET FIRMS and INVESTMENT BANKS!

So, I started this note off on bullying for a reason. Until enough people stand up to the bullies, the same predictable behavior will continue. Price action will suck people into markets; experts will lie to the faces of trusting investors via constant marketing from financial media outlets (who capture the majority of their funding through paid advertising from the largest of Wall Street firms), which in turn will provide a form of confidence for investors … in the form of an unsupported narrative.

This buying provides the exit liquidity for the largest players who will position themselves accordingly until the Jenga tower topples.

It will then be the very same experts who “missed it” that will conveniently provide markets with the newest ‘solutions’, claiming ‘no one could have seen what happened coming’ … another bold-faced lie.

I am NOT the guy who will pull out his cellphone to record a fight in progress … rest assured, this is a fight, and I am standing on the very same foundational principles I acted on in 5th grade, only I’m stronger with MUCH more resolve. We will tirelessly fight to help those who may be more easily misled by these authority figures who are clearly lying in an effort to deflect your attention away from the data which represents economic reality. Paul Krugman may be a Nobel prize winner, at the same time:

- I don’t care who he is; nor do we care for his arrogance, ignorance, or deception (willful or not) … the data proves he’s either outright lying for the elites, or he’s incompetent (which I doubt to be the case)

- His words and narrative are empty, backed by ZERO data … which this piece should have more than shown. If he could back his statements up with data, he would have; it’s simply not there, which is why he cites NONE!

He/they can use adjectives like “surreally good”, but the data (that we’ve openly provided in detail) suggests nothing he or they have stated over time to be true.

I find the behavior of these ‘authority figures’ to be abhorrent, for who’s protecting others when those tasked to do so are the cause of the problems?!

It’s been our experience; be it in life or the nearly 3 decades we’ve spent in this industry that the “history” that’s eventually etched into the brains of the majority, is almost always unrecognizable to the masses while they’re living through it in real time. The old saying, misery loves company exists for times when a most need to believe, for their own sanity, that no one foresaw the negative event coming … otherwise they’d have to admit that they were wrong … which is something human beings have difficulty admitting.

If in the end we’re wrong and this time is different; if central bankers, the treasury with the help of Jamie Dimon and friends are able to ‘central plan’, spend TGA $$, manipulate options markets, deficit spend on hiring millions of government employees, beat the odds of every financial indicator out there, then we will raise our hands and say, “we were wrong”!

At the same time, while Wall Street begs for rate cuts, Jamie Dimon just said the Fed may have to RAISE rates again as did Atlanta Fed president Raphael Bostic.

As a fiduciary, we will always stand firm with the data and probabilities that lie within. If placing your hard-earned capital against virtually every recessionary indicator out there is what you choose to do, by all means … you do you.

We are well aware that the minority outcome can always turn up, but if we’re wrong, we’ll be wrong for the right reasons and not because we decided to roll the dice with the life’s savings of those whom we represent.

History suggests we’ve seen this movie before, and the same crowd who were crying in 2001, 2008, 2018, 2020 & 2022 … because they never see it coming … are once again focused on picking up pennies in front of the steamroller, because that’s what their bullied into thinking by the same ‘group think’ central bankers, economic academics, Wall Street ‘professionals’ and financial media who have failed to warn investors at virtually every downturn in modern history; the same individuals we have been warning you about for years.

Most didn’t like the final outcome in the past and while there are no guarantees, we don’t see a rosy outcome for how this current cycle ends. Given the tenor of investor sentiment and current behavior which can be viewed through their positioning, implied volatility discounts, and put/call ratios (among other things), we don’t believe it will end well for the bulk of investors.

We’ve opted for patience in safe, liquid roughly 5% treasuries over a slightly longer time frame with a good portion of our assets to sidestep the massive rollercoaster.

Our 1Q2023 Ouroboros thesis remains firmly in place which the data unequivocally supports.

though we would be remiss in failing to note that this time may in fact be different, in relation to if and how we do eventually get bailed out?!

One final anecdotal note, credit again to Hedgeye’s Josh Steiner who jogged our memory on a morning call from 11/15/23, as he revisited what happened to Countrywide mortgage back in 1Q2007 as their sub-prime booked delinquency rate was 10% which jumped to nearly 24% by 2Q2007 … which the market shrugged off through October … as Steiner states, which is something we’ve said in one form or another before, “the market doesn’t really care, until it cares and usually the market can’t see past its nose.”

Current data is extremely concerning and we’re calling it out, doing everything we can to get people to pay attention. Unfortunately, history also tells us, most people don’t care, until they’re forced to care, and by then it’s frequently too late!

Good Investing,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.