In This Article

‘Twas the night before Christmas …

And I’m slowly recovering from one of the worst fevers of my adult life; my head feels like it had been pounded on for days. As I write, my nostrils which had shrunk to the size of pin holes are just beginning to open again and my lungs are exhausted from hacking.

Less than a week ago I ran a 7:40 mile and immediately followed up with my ‘almost daily’ core routine (easy hecklers, I know it’s not great, but I’ll take it for 6’3, 255lbs and nearly 49 years old in less than 2 weeks); today, I’m feeling blessed to just make it up the stairs from the kitchen to the bedroom!

Given the violence and speed in which this illness entered our home, it reminded of certain things we’ve written in the past which were eerily prescient, coming a few short months to weeks before severe market downturns (that most never saw coming); which pale in comparison to the scope & size of today’s challenges, yet echo today’s current economic environment.

This month’s note is going to remain on the shorter side … as most are (and should be) entrenched in their respective holidays’ and more than likely don’t feel like reading a dissertation on the rate of change in economic data; coupled with limited strength, energy & creativity on my part given this cold, I’m going to keep this one brief.

The first thought that immediately came to mind is something we wrote in 4Q2017… “From Hero to heel in just under a week!” … back then, it was meant to be a take on the old industry adage, markets take the escalator up and elevator down … and is something that every investor should hold as a reminder as to how disturbingly quickly things can change in financial markets.

It was our very first note as a new firm, published on February 2nd, just a few days prior to a day that will forever be remembered in the derivatives markets as “Volmageddon” (which took place on February 5th, 2018).

At one point that day, the DJIA had lost 1,500 points, eventually closing down 1,175 points with the VIX or volatility index spiking by more than 117% from closing price to closing price (17.16 to 37.32 DoD (Day over Day) … how’s that for volatility?!

Given the current data, it should lead one to question whether the suppression of the current volatility regime will remain or are we about to see another volatility explosion?!

I don’t know the answer to this question … at the same time … if history has anything to say about it, there is a very high probability the majority of investors, who are as net long as they’ve ever been, are being set up for an exogenous shock.

D.I.S.C.O.N.N.E.C.T!

At their most recent FOMC (Federal Open Market Committee) meeting, Federal Reserve officials adjusted their remedial “dot-plot” projection LOWER by 75 basis points. For those unfamiliar, the FOMC dot plot is a formally updated chart published by the Federal Reserve (quarterly), which reflects each Federal Reserve official’s forward-looking projection as to where they foresee the central bank’s short-term interest rate (the Fed Funds Rate), literally with DOTS … it’s their “crystal ball”.

Here’s the thing: I can’t remember a time where the Fed’s forecasts were accurate, the “dots” are literally perpetually wrong! At the same time, in his most recent press conference, Fed Chairman Jay Powell not only would NOT commit to cuts but stated they would raise rates if inflation doesn’t reach their 2.0% target.

That being said, how have markets reacted to this information?! Well, they immediately priced in 7 rate CUTS for 2024 … SEVEN; with a 10% chance of an 8th and a 1% chance of a 9th?!

I want to repeat that for you again … the Fed is seeing the “possibility” of 3 rate cuts in the back half of the year (assuming inflation reaches their 2% target), yet markets are telling the Fed that they’re cutting rates 7 to 9 times (between 175 and 225 basis-points) with the first cut coming as early as MARCH!

How’s that for a disconnect?!

So, no one is hedged, 0dte call option buying is through the roof, the volatility complex is suppressed and yet, we’re seeing some of the worst recessionary data since the Great Financial Crisis; from the industrial complex and small business optimism surveys, as the collapse in just about every vertical of bank lending is bleeding through to the consumer as we’ve highlighted and viewed through multiple lenses for months … none more pertinent for the purposes of the economic cycle than credit card defaults, and the massive spike in net charge offs.

What could possibly go wrong?!

… the cycle’s gonna cycle …

That’s what will “probably” go wrong. It’s the very reason we’re able to pull quotes from past notes written under similar economic conditions; for simply stated … the economic cycle continues to cycle. Through all the QE, not QE, BTFD facilities, TGA spend downs, the economic cycle persists, and gravity most frequently wins … until an intervention of sorts occurs (assuming one does); then it’s rinse repeat, but not without the pain (as we discussed in our Ouroboros example from 1Q23)

In November of 2019 we were in a very similar place to where we are today; and as we wrote then:

While we have mapped these exact circumstances out for years, the embedded risks in the system have grown exponentially making us a bit more cautious and defensive, while many investors are throwing caution to the wind as either a. no one cares because markets are at all-time highs and that’s all people care about or b. people have an unrelenting belief those at the Federal Reserve will pull us out of all things “trouble” as they have in the past!

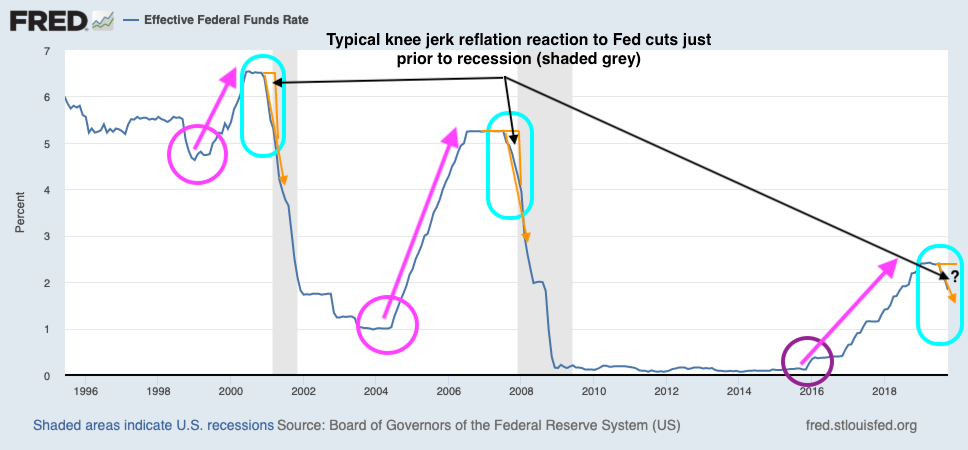

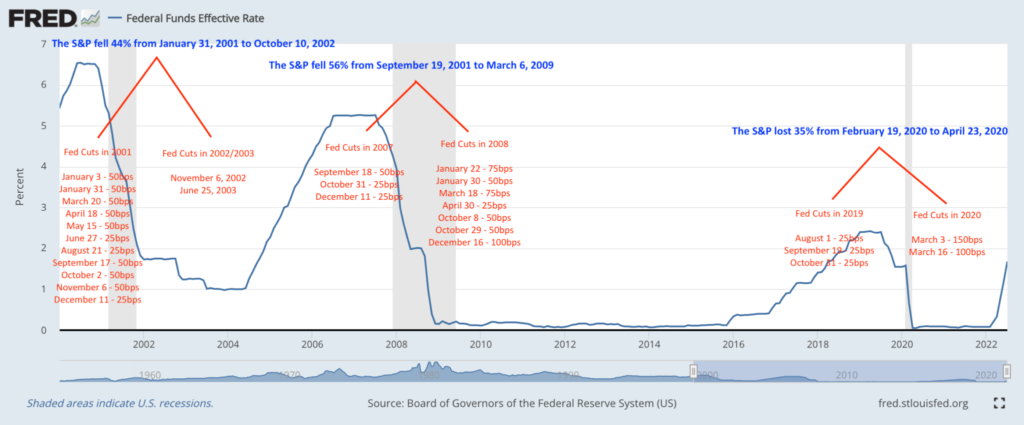

It was in that note where we showed a marked-up chart of the Federal Reserve’s raising and cutting (cycles) of their benchmark Federal Funds rate, and how they correlated with previous recessions (image below):

The recessions were ONLY recognized AFTER we were already in them as the data is reported on a lag and constantly revised, but again, this was written in November 2019, roughly 2 months before one of the most severe crashes in the history of markets … at the time we also wrote:

Not QE (QE) is expanding their balance sheet at a pace faster than QE1, QE2 and QE3; all the while, staring us all in the face stating their intervention is “NOT QE”. The reasoning behind it not being QE? The bonds being bought are short term?! Fun!

Fact: Balance sheet expansion is QE; its magnitude is troublesome and their abrupt about face while telling everyone things are “ok” should raise every American’s eyebrows.

We continued:

So, what’s the rationale behind telling everyone things are ok, while at the same time:

- Cutting rates 3 times in a 4-month time frame

- Launching a $75 billion-dollar repo facility

- Increasing a $75 billion-dollar repo facility to $120 billion dollars

- Introducing a $60 billion-dollar/month treasury bill buying program

- And increasing the size of their (The FED’s) balance sheet by nearly $300 BILLION dollars in the last 8 weeks as shown by chart above (source Federal Reserve).

For those still wondering what the answer to my earlier question was – it’s confidence, the rationale behind telling everyone that everything is ok while providing markets with the largest jolt of stimulus in history is confidence. They are telling you “The system” is ok (the data and their actions suggests it’s not).

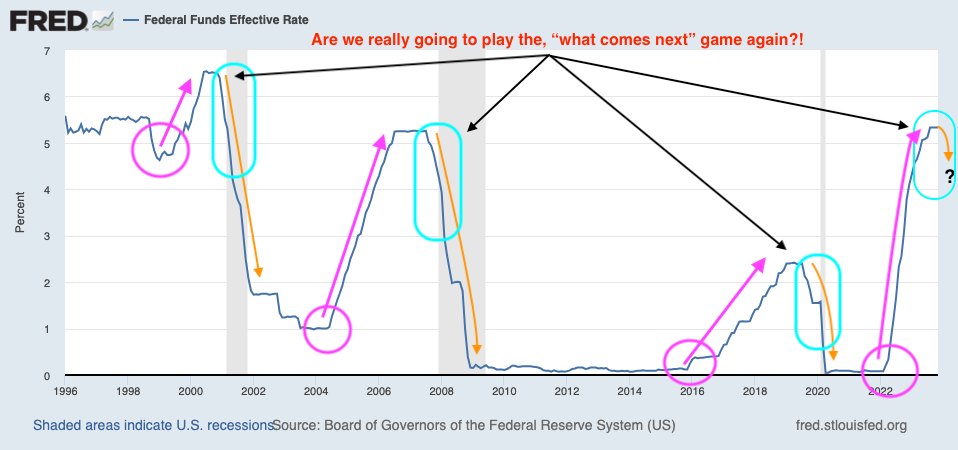

So, in the name of “history rhymes”, below please find an updated Federal Funds Rate chart, which clearly provides us with an answer to our “what do you think happens next,” question mark from our above 2019 image.

As mentioned above, the markets are clearly calling for rate cuts … but as we reminded readers in August of 2022 (chart below) rate cuts are historically NOT a positive catalyst for equity markets with negative -44%, -56% and -35% crashes occurring at the last three “turns” respectively; those being the popping of the tech bubble, the Great Financial Crisis unraveling and what others would label the Covid collapse.

It’s important to understand, November of 2019 came BEFORE Covid was ever mentioned in the news. You may recall, the first breaths of Covid came out of China in December of 2019. Did we have a crystal ball?! No, what we did was a. follow the data and b. understood that the Federal Reserve is ALWAYS late in policy response given they look at headline data vs. rate of change … which has them perpetually over-tightening at the worst of times; which is just as the economy heads into recession. Again, from our November 2019 piece:

As we discussed last month – while you continue to hear “better than expected” in reference to “earnings beats”, the rate of change has been negative for 3 quarters now. Beating reduced, reduced, reduced expectations is not growth and by no means warrants expanding multiples Wall Street analysts are calling for. Earnings have now been contracting for the last 3 quarters …

We continued:

Gravity exists in economics, there is no escaping it and understanding how to recognize it is part of the responsibility of any asset manager who calls themselves a fiduciary responsible for client’s financial futures. Economic cycles ebb and flow and for large investment firms, financial media, and advisors to ignore or brush these risks off as “long-shots” all while cheerleading “all-time highs” is borderline negligent.

It should now be apparent to everyone; the Fed does NOT have the ability to normalize interest rates …

Fed policy is also creating more Zombie companies (as describe in MayandSeptember) that at some point in time will not be able to roll their debt. What tips the scales? Absurdly high leverage ratios, shrinking sales, revenue and earnings, deteriorating credit quality, lack of natural buyers, you pick it… As revenue and earnings continue to deteriorate, rest assured costs will get cut, layoffs will ensue …

SOUND FAMILIAR?!

Zombie companies:

Valued at $8.9 billion dollars in 2019, SmileDirectClub filed for Chapter 11 Bankruptcy protection in September but just announced it will be shutting its doors completely. What?! An overvalued Zombie company liquidating … go on!

Just a few short days ago, online retailer, Zulily announced that they will be shuttering their doors due to a “challenging business environment”; much like SmileDirectClub, Zulily once carried a $9 billion dollar valuation!

And we literally just told you about what we believed to be the inevitable $WE (WeWork’s) bankruptcy filing in last month’s note, as we wrote:

WeWork, which was once valued by Wall Street charlatans (bankers) at nearly $50 BILLION dollars … just filed for BANKRUPTCY on November 7th, 2023. $50 billion dollars of capital was just eviscerated … it was only a matter of time before this specific shell game collapsed.

We first told investors this was very likely to happen in our September of 2019, note … the section was titled, “lighting money on fire”.

In November of 2019 we told people when this collapse would take place … it would occur when leverage ratios got “Absurdly high, when sales have been “shrinking” (which they have now, for well over a year), as have, “revenue and earnings” … and “credit quality” has been “deteriorating” since the beginning of 2022!!!

So, yeah … it’s happening again, under the exact conditions we said it would back in 2019 … and it’s not just in retail, it’s pretty much in all things “interest rate sensitive”.

The Commercial Real Estate market, for example, continues to get decimated with the AON Center in Downtown Los Angeles just selling for $147.8 million dollars … 45% BELOW the 2014 selling price of $268.5 million … the AON Center is the third tallest building in Los Angeles; while a 5 story LA building located near Century City and Beverly Hills just sold for $44.7 million dollars; a 52% DISCOUNT to its 2018 level of $92.5 million!

Again, financing challenges brought about by exceedingly high interest rates! We wrote about this in detail in January of 2018 and literally mapped this out in our 4Q2018 note titled: The Fed: 650… 525(+400)… 250(+?)… which represented the number of cuts and amount of stimulus needed in the Fed’s recent cutting cycles.

So, Zombie companies are disappearing (= jobs lost), capital is being eviscerated, commercial real estate is in the tank and the consumer is desperate as the most recent banking data shows a continued tightening in lending as the deterioration in credit quality hockey sticks higher at the country’s largest credit card issuers (Capital One, Discover, et. al.) persists.

In September we wrote a note titled, “TRAPPED … There is no easy way out!”, for that’s exactly what the Federal Reserve is. If the Fed does wind up cutting rates before the 2% inflation target is reached, they’ll be doing so because the economy is likely already in recession; worse than we’ve been describing over the course of the year and the 175 to 225 basis-points markets currently have “priced in” will look like child’s play – as the Fed continues their Quantitative tightening cycle, shrinking the size of their balance sheet (a far cry from the 2019 easing) …

And If they don’t cut rates, we’ll watch the bankruptcy cycle accelerate at an even faster pace (which is already at a pace not seen since the Great Financial Crisis) which will continue to add to an even faster deterioration in labor markets. (Think of our Avalanche example from November 2022)

And when it comes to Jobs and the labor markets … 2023 has already handed roughly 62,000 employees in the financial sector a pink slip … no gold watch or cushy retirement for these poor unfortunate souls; per Lee Thacker, owner of financial services headhunting firm Silvermine Partners, as reported by the FT:

“There is no stability, no investment, no growth in most banks – and there are likely to be more job cuts!”

Regular readers know we’ve been discussing this dynamic for nearly a year, highlighting the job cuts along the way. During the GFC, there were roughly 140,000 jobs lost in the financial sector … and it is our humble opinion that the cuts have just begun to meaningfully accelerate … especially as the noose continues to tighten around the extension of credit’s proverbial neck, the economy will come to a screaming halt.

Treasury Secretary Yellen will likely continue to use the Treasury’s TGA account as has her own personal piggy bank propping up equity markets through the issuance of collateral in the form of short-term T-bills while the government attempts to hide the internal carnage taking place in labor market. They can play with birth/death rates and attempt to *print* government jobs all they want, still … the cycle will cycle … until something eventually breaks.

Final Thoughts

What might break?! While the list is quite long, I’ll give you something to consider as we come to a close…

While Wall Street cheered the recent minor acceleration in retail sales around the black Friday holiday season … last month we noted this would hit the margins of retailers given the steep discounting, but additionally that the bill was largely footed by those using BNPL programs (Buy Now Pay Later), we wrote:

The insatiable need for access to money persists … which has most recently been partially filled by the BNPL (Buy Now Pay Later) industry … which as Quill Intelligence CEO, Danielle DiMartino Booth just noted:

“There are a record 27.85 MILLION unsecured installment loans as of Q3 2023 per @TransUnion data. The average balance per consumer is $11,692 sporting a MINIMUM monthly payment of $349 … ON TOP OF ALL OTHER MONTHLY OBLIGATIONS … because, why not?!”

Fear not … U.S. consumers ONLY added an additional $7.3 BILLION to these BNPL programs from November 1st to November 26th, up 14% (per Adobe) as reported by @Zerohedge. We’re not exactly sure how much data you need to see in order to contextualize how large our current problem is, but its BIG!

This came at the same time nearly 40% of the roughly 22 million student loan borrowers MISSED their very first student loan payment which was due in October after the pandemic-relief pause ended (per the Department of Education). That’s right ladies and gentlemen, nearly 9 MILLION borrowers have MISSED THEIR VERY FIRST PAYMENT DUE and had NOT been paid through mid-November.

So, rather than repaying their first student loan payment, which hadn’t been paid in nearly 3 years, a host of Americans decided to load up on BNPL debt to buy heavily discounted inventory for the holidays…

Again, we ask … what could possibly go wrong?!

Please understand, equity markets are not the economy, though eventually the weakness in the economy is reflected in markets as structure breaks, bonds can’t be refinanced, bankruptcies spike, layoffs rise and 401k payments are paused, all things we’ve described over the past year and a half.

At times, I wish I could unsee what I foresee … but once you understand cycles, you just can’t. As always, we’ll do our best to risk manage accordingly.

We sincerely wish everyone good health and a Happy New Year! Hopefully we’ll be over the hump of this illness in the near future and will return to pure, uninterrupted data for our January piece.

Good Investing,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.