In This Article

A Star was born…

On March 30, 1970 at 12:10 am one of the greatest athletes in history was born. He was a stud, though as is typical with those who become special, it’s not often recognizable from the onset.

“I didn’t think much of him when we first got him”

“I thought he was just a big clown. He was real clumsy and a bit on the wild side, you know”

Like most fairytales, this too was one that only narrowly came to be. Sickness, heartache, infighting, irony, financial woes, highs, lows, fear, doubt and a coin flip ultimately brought us the GOAT (Greatest of All Time).

Christopher T. Cherney was born in 1886 in Richmond, VA and grew up in nearby Ashland. He was locally educated at both Randolph-Macon and Washington Lee University; graduating with an engineering degree, business endeavors moved him north. Pelham Manor, NY became his “home” for nearly half a century.

Cherney became a prominent engineer and businessman with accomplishments that included: forming both the Federal Water Service Corporation and the Federal Water and Gas Corporation; chairman of the board of Southern Natural Gas which was purchased by El Paso Corporation; formed a deep-water drilling subsidiary in the Gulf of Mexico; involved in multiple landmark court cases heard before the Supreme court solidifying the backbone of current US administrative law.

Yet none of these achievements were what he was most known for…

Cherney had an affinity for horses. As a child in Ashland, VA, he learned to ride at a farm known as “The Meadow”, and in 1936, Cherney made his most noteworthy business deal, acquiring this ancestral landmark. This deal made sense as Cherney was also one of the founders of the New York Racing Association, which today operates the three largest Thoroughbred horse racing tracks in NY State (Aqueduct, Belmont Park and Saratoga Springs).

Cherney founded Meadow Stud and Meadow Stables, which operated out of The Meadow in Caroline County Virginia. Meadow Stud bred thoroughbred horses, while the horses that ran for Meadow Stables wore the distinctive blue and white colors of Cherney’s college fraternity, Phi Delta Theta.

Collectively, Meadow Stables and Meadows Stud produced quite a few stakes-winning champions over the decades. Hill Prince was the 1950’s American Horse of the Year, and Cicada was the leading money winning mare for years. But, Somethingroyal was the dark horse who bore a legend.

Irony and a Coin Flip

A dispersal sale is one where an entire farming operation or group of livestock is sold “expeditiously”, typically triggered by a death, poor health, retirement or financial distress. Good luck fell upon Cherney’s heirs when he bought a mare named Imperatrice at a dispersal sale in 1947. Unfortunately, Cherney himself would not live to see the spectacle that almost never was.

In 1968 Cherney fell ill and was admitted into New Rochelle Hospital. Due to both his poor health and poor financial planning, Cherney’s farm was nearly sold off in what would have amounted to be … a dispersion sale… Cherney had 3 children, two daughters (Margaret Carmichael and Helen Bates “Penny” Tweedy) and a son, World Bank Economist Hollis Burnley Cherney.

Penny pushed back against her siblings wishes to sell the ailing farm, ultimately avoiding a fire sale and navigating the farm back into the green … what was unknowable at the time was, it came at a price – A BIG ONE!

Penny also had to deal with the toss of a coin. In 1965, prior to falling ill Chris Cherney had struck a deal … a foal-sharing agreement with an Ogden Phipps. Phipps was, of all things … wait for it – a stockbroker and thoroughbred owner/breeder. Phipps owned a sire by the name of Bold Ruler, who, by agreement, would be bred with two Meadow Farm broodmares. Prior to the foals’ birth, A COIN TOSS decided who got first choice of the newly birthed foals…

With her father ill and in the hospital, daughter Penny Tweedy was now in charge sending two mares to Bold Ruler to be bred – Hasty Matilda and Somethingroyal. In 1969 Penny LOST the coin flip and Phipps chose the foal of Hasty Matilda (which never came), leaving The Meadow stuck with Somethingroyal’s yet-to-be unborn foal…

Remember the name of the mare that Cherney picked up at the dispersal sale in 1947?? It was Imperatrice. It was Imperatrice who birthed Somethingroyal… and now, following a near dispersal sale of their own, AFTER LOSING A COIN TOSS, The Meadow was left with:

“Big Red”

“Big Red” as he was known, is THE GREATEST RACEHORSE OF ALL TIME. Voted #35 of ESPN’s Top North American Athletes of the Century and #1 name in horseracing. Of the 13 horses to have won the ever-elusive Triple Crown, none have won their races in such decisive fashion. He set records on tracks of different length and surface, he could pace himself, coming from behind when he needed to or as he showed in the Triple Crown winning Belmont Stakes, he nearly went wire to wire… For those who have never seen the race, it’s impressive, well worth the watch…

For as dominant as Secretariat was, fear and doubt still entered the picture immediately prior to his Triple Crown quest, for in his final preparation before the Kentucky Derby (the first leg of the Triple Crown) Secretariat finished an unexpected 3rd at the Wood Memorial.

The loss opened the door just enough for emotion to creep in. Was the Triple Crown as “sure a thing” as many had believed it to be? Given his “blocky build”, did Secretariat have the stamina to win the Derby? Was he unstable or unsound?

What people didn’t know until many years later was that, just prior to the race, an abscess was found on the roof of Secretariat’s mouth, making him sensitive to the bit he was biting down on. (A bit is an important component that contacts and controls a horse’s mouth). Nearly six years later, Eddie Sweat, Secretariat’s groomer at the time of the race, told The Thoroughbred Record that the abscess “bothered” Secretariat “a lot”. The abscess was tended to by trainers and had healed prior to the next race, which was the Kentucky Derby… We all know how this story ended…

Secretariat won the 1 ¼ mile Kentucky Derby with a record setting 1:59, a record which stands today with only one other horse in history breaking the 2-minute mark. Two weeks later he took the 2nd leg of the Triple Crown, winning the Preakness with a record setting time of 1:53, a record which also remains intact today, and shortly thereafter, Secretariat took the Belmont Stakes in historic fashion, winning by nearly 30 lengths with, you guessed it – another record: 2:24 (over 2 seconds faster than the previous record) …

Though what prompted this introduction and a microcosm takeaway within a much broader story as we head into the 2nd quarter of this year, was HOW Secretariat won many of his races … especially the 1 ½ mile Belmont Stakes.

We all know Big Red was fast, but in the Belmont, he ran EACH FURLONG FASTER THAN THE PREVIOUS ONE. It was remarkable, almost as if he got faster with every step… NET NET, Secretariat was THE HORSE you wanted to be on heading into and down the final stretch…

Just as Secretariat is the best racehorse in history into and down the back stretch, we believe we’re riding the best businesses to own heading down this back stretch of the investing cycle, headed to the finish line. Just like training a champion, we believe in the proven processes and disciplines of building a winning portfolio.

Cycles

Each of the three races which comprise the Triple Crown are different lengths; the Kentucky Derby is one and a quarter mile, the Preakness is one and three sixteenths, while the Belmont is one and a half miles. Full cycle investing is similar in nature … different economic cycles last different lengths of time and as we’ve discussed numerous times prior, these cycles don’t just start and stop at the beginning or end of a quarter.

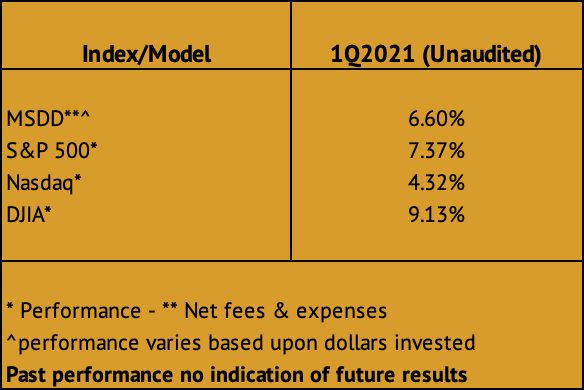

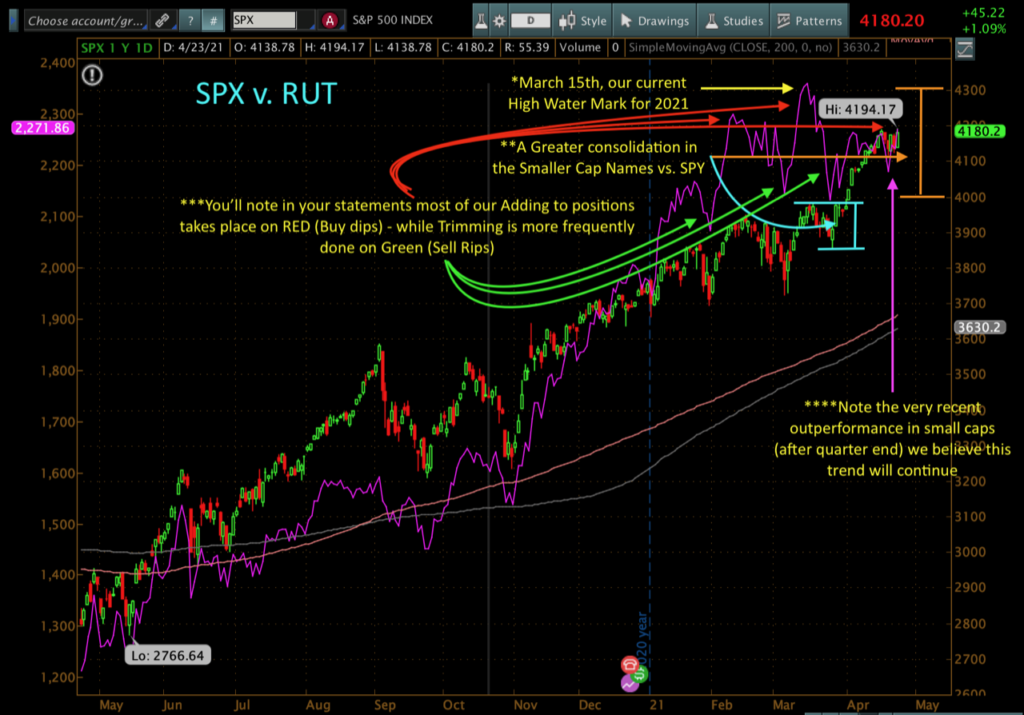

Our portfolio had a solid Q1, leading the majority of indices and beating most hedge fund managers handily into the last 2 weeks of the quarter. Although we’ve had a slight decline from the “current high” on March 15th, our performance to that date would prompt double back handsprings. Nevertheless, we subsequently corrected the last few weeks of the quarter along with “momentum” as a factor exposure, small caps and our energy positions being more volatile in the final 2 weeks of the quarter than broader indices. We’re still pleased with the results.

We did trade nicely around our positions heading into March 15, as our risk management process and tools had the vast majority of our names at the top ends of their risk ranges. Anticipating a correction? In layman’s terms, when you want to “buy low/sell high”, the only way to accomplish the buying on Red is if you sell SOME on Green, which we did. If a mistake was made, it is that we began re-deploying our cash a bit early into the selloff as the consolidation in price for some of our larger positions was mildly deeper, often typical when the preceding increase is more fervent.

However, within a handful of weeks, as we write, we’re back to within a stone’s throw of our March 15th high, poised to take advantage of the final stretch of this race. Our energy positions, small cap retail and cannabis names have been consolidating, and volatility has been showing bullish signs of collapsing — this is the sign of a price consolidation rather than a more prolonged correction.

Markets often wobble when Wall Street marks their books prior to quarter end, or Investment Banks get clobbered due to being overleveraged to Hedge Funds or “Family Offices” as we’ve witnessed multiple blow ups in March. But we don’t believe these wobbles to be a phase transition into a new economic cycle; thus, they are not the time to flip your exposure, they are often short-term hiccups. A phase transition into a new economic cycle, which we touched upon last month, is definitely something we should all be extremely mindful of, as I will touch upon below.

Last month we wrote:

“The Fed still denies that inflation surrounds us. But the question remains, IS THE CURRENT INFLATION STILL WITHIN A LONGER, MORE SECULAR PERIOD OF DEFLATION?! My belief is that it is, but with humility, I have to state that I DON’T KNOW. We’ll discuss this thought more in our next Letter, but at this moment in time, we simply don’t know”.

We do know that the home stretch is where many races are won or lost, and currently the data does NOT suggest this inflationary cycle is over just yet. Rather, it is accelerating — allow us to explain…

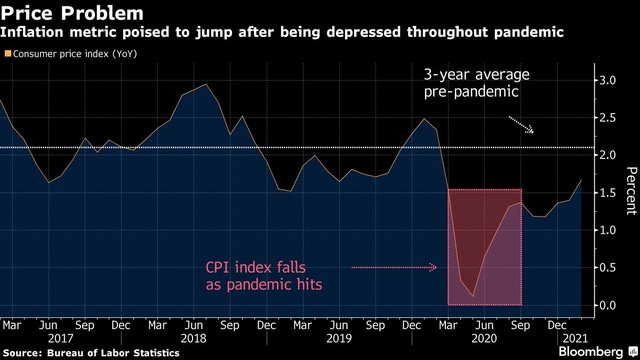

Last month we touched upon base effects (ie: the previous year’s figures that the current year is compared against):

“there is probabilistically more upside ahead as rate of change data over the next few months will be the strongest that we’ve ever seen due to the Covid-induced base effects”

“Year-over-year growth should explode higher over the next few month due to the base effects of last year …”

These are the easiest 1-year comps we have ever seen, as the economy in April 2020 was brutally hammered by COVID:

- Services/Consumption comps: -12.15%

- Labor Comps: -15.1%

- Manufacturing Comps: -15.8

- Durable good ex-defense & Aircraft: -19.6%

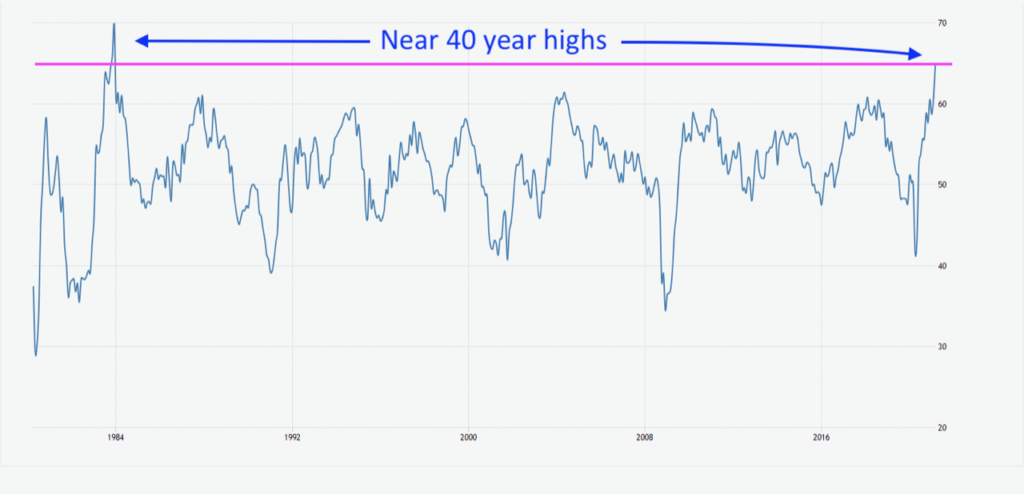

Meanwhile, one year later, March 2021 ISM numbers are through the roof:

- ISM Manufacturing at 63.7 (manufacturing being a leading indicator)

- ISM Prices Paid Index at 86.00 (both near 4 DECADE HIGHS)

- ISM Backlogs Index at 67.5 is through the roof

Expectations for future production, new orders, inventories, employment and deliveries are off the charts…

- The Supplier Deliveries Index rose 4.6% to 76.6% up from 72% in February

With:

- Consumer Inventories FALLING from 32.5 to 29.9 – which is waaay too low. Inventories NEED to be replenished

All of this means that consumers are buying at a pace which stores currently can’t keep pace with. Whether due to the pace of new orders, manufacturing backlogs, or to shipping/transport delays. Meanwhile, raw material costs are skyrocketing…

The Supplier Deliveries Index continued to reflect suppliers’ difficulties in maintaining delivery rates, due to factory labor-safety issues, transportation challenges, and increased demand. All 10 subindexes were positive for the period; a reading of ‘too low’ for Customers’ Inventories Index is considered a positive for future production.

Anecdotally, my wife sells consumer goods manufactured in China to big box retailers, these stores can’t get their hands on inventory quickly enough – no one has inventory. Many competing importers have fallen down on signed contracts and previous orders, everything from outdoor patio solar lighting to materials used to can food. And without stable relationships, you can’t buy your way onto a container ship. While we’re talking about shipping – what’s that data suggesting?! In international shipping news (haven’t you always wanted to say that?) Freight costs INCREASE over 100%.

Asia to both US East and West coasts are still experiencing very high volumes and port congestion, pushing factory-to-door delivery times to an average nine weeks compared to [a historical average of] four to five. Freightos Group May 31, 2021

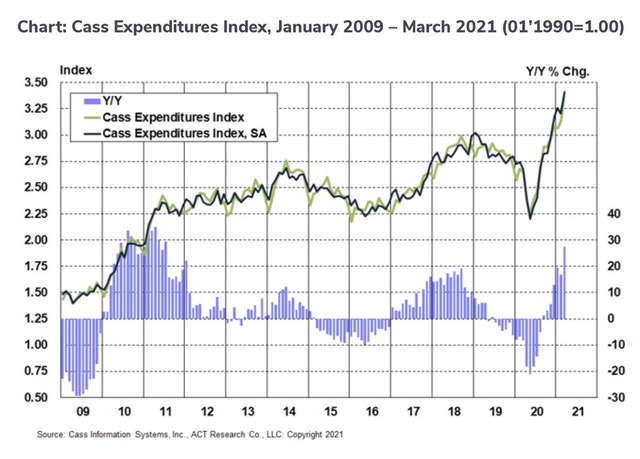

What about Freight you say?!

“Strong momentum continued in freight rate trends, with this month nearly off the chart, and we sense an axis adjustment on the way. This acceleration suggests Q2 y/y comparisons will be in the 40%-50% range, compared to the shutdown.” Cass Transportation Index March 2021

All of this leading to wage inflation:

“Trucking Companies Boost Pay in Hunt for Drivers as Demand Surges” WSJ April 14, 2021

With countless individuals still out of work, how could we be in the midst of a labor shortage?! Think Government policy pricing labor out of the market:

“The government is making it easy for people to stay home and get paid. You can’t really blame them much. But it means we have hours to fill and no one who wants to work.” — Tom Taylor, owner of Sammy Malone’s pub in Baldwinsville, N.Y., The Syracuse Post-Standard.

At the end of the day, there is only one way for this to flow and that’s through to the consumer in the form of higher inflation. The list of companies recently discussing increased cost, supply chain and gross margin pressure, wage inflation and increased prices is vast. Countless companies from all industries, Food & Beverage, Apparel, Chemicals, Fertilizer, Beauty, SEMICONDUCTORS bleeding into Auto, Energy affecting Travel & Airlines; everyone from Coca-Cola ($KO), Proctor & Gamble ($PG), ULTA Beauty ($UTLA) Scott’s Miracle Grow ($SMG) to ConAgra ($CAG), Lulu Lemon ($LULU) and Micron ($MU); are all talking price increases, the list is truly endless…

Inflation is now even showing up in the antiquated CPI data, which came in at 2.6% for the month of April.

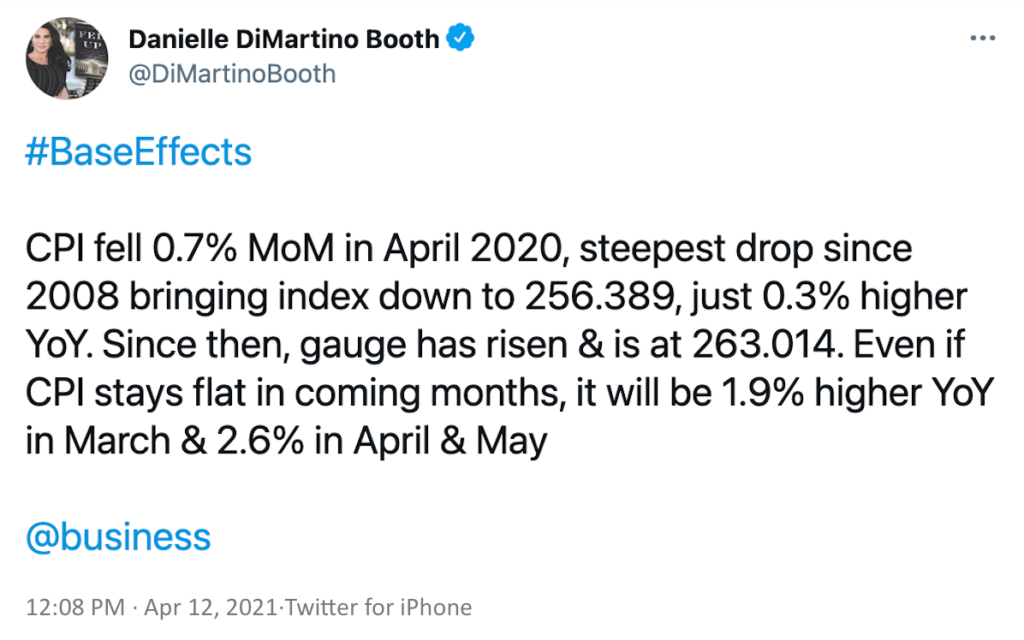

Danielle DiMartino Booth illustrates in a recent tweet what we had been referring to last month re: base effects of CPI data (I’ve taken the liberty of breaking out the embedded illustration in her tweet to make it easier to read).

We remind readers that the above trends have begun without the March stimulus checks in the data, and without the Biden Child Tax Credit payments (in July). Remember that $3 trillion infrastructure we discussed last month when we wrote “As I write, House Democrats are proposing a $3 Trillion dollar infrastructure spending bill.”?

Umm, yeah, about that…. it’s now an estimated $4 TRILLION dollars… As the Administration is also attempting to:

- Wipe out between $10-50k of student loans

- Implement a new first time home buyer tax credit of $15,000

- 21 Democrats want payments to individuals to become RECURRING & MONTLY

In this already obnoxiously overpriced housing market, with inventory at anemic levels and lumber prices having soared nearly 60% in the last few months … Typical inventory for the housing market is between 1.1 to 1.2 million units, today it sits at less than half that level (roughly 500k units). Do we wonder why lumber has been a moonshot?!

If you have 20 minutes – we would highly recommend you take the time to watch Hedgeye CEO Keith McCullough present this complimentary segment of their Macro Themes deck for 2Q2021. While the full 20 minutes is worth the watch, there are two extremely pivotal statements which he makes: one at the 3:08 mark, regarding inflation, and the second at the 8:00 mark, touching on business cycles. The latter point is very similar to what we’ve said for some time now regarding cyclicality within larger secular cycles:

“Directionally on inflation … It’s much more about the direction than it is about nailing the number to the decimal point. Now, to the decimal point we’re at 3.08 … again, It’s the path going there, it’s the entropy that occurs on the way there It’s exponential – it’s not linear”.

“We understand that structural risk remains – but what a lot of people don’t understand is that their theories on structural risk can be trumped in a very PAINFUL period of time in cyclical time… cycle time, market time”.

Limited spending throughout the lockdowns and increased government subsidies via multiple rounds of outright handouts have allowed financial markets to defy gravity with the US consumer clamoring to spend money. Per the BEA’s (Bureau of Economic Analysis) March 26th release highlighting February’s numbers, there’s roughly $1.9 Trillion dollars in the hands of the US consumer ready to spend BEFORE the most recent round of COVID checks. If you listen to the Hedgeye video attached, you might pick up on the tidbit Keith McCullough drops regarding the data point that $1.9Trillion in savings is greater than 40% of annual retail sales (w/March stimulus being roughly another 50%).

Which should play itself out in many “re-opening” names as revenues spike off negative comps; companies like Sally Beauty (SBH), Designer Brands (DBI), Cinemark (CNK) and National CineMedia (NCBI). Sally Beauty is a supplier to beauty salons while CineMedia has a tremendous market share of the advertising that you see on the screens before you watch whatever movie you’ve just gone to see. These companies were virtually shut down last year, comps and the RoC data off last year’s anemic numbers should blow Wall Street estimates away.

Furthermore, as Hedgeye notes, OVER 80% of Americans have said they have a vacation booked ALREADY which coincides with this comment that Delta CEO Ed Bastian recently stated on CNBC:

“We’re seeing a huge surge in bookings over just the last couple of months,” … “In March we had twice the number of bookings that we had in January just two months earlier.” … “I think the pent-up demand is unbelievable”

We think the best way to capitalize on this is through our current holdings in Spirit Airlines (SAVE), as domestic travel and leisure are primarily where the demand is with more lucrative business and international travel still remaining on the weaker side. Though as airport activity and international travel pick up, we also believe numbers will skyrocket for DUFRY AG (DUFRY) who has an enormous market share of the Duty-Free shops throughout airports worldwide…

Camping World Holdings, Inc. (CWH) is another way to capitalize on the American’s thrust to get out of the house. Camping World is America’s largest RV retailer. They reported fiscal 2020 Revenue of $5.4 billion which was a YoY (Year over Year) increase of 11.3%; with 4Q2020 revenue up $1.1billion, a 17.5% increase YoY. The RV Industry Association recently reported a record number of RV units shipped in 1Q2021, and a February survey shows 48,286 RVs shipped, representing a 30.1% YoY increase and making it the best February on record – November and December also saw record sales.

Americans are tired of being couped up and are getting out in droves…

But the thing about Cycles …

… is they always turn.

Circling back to that second thing Hedgeye CEO Keith McCullough said that stuck with me. It was the very essence of the core of our last monthly, just stated more eloquently; at the 8:00 minute mark he said:

“We understand that structural risk remains – but what a lot of people don’t understand is that their theories on structural risk can be trumped in a very PAINFUL period of time in cyclical time… cycle time, market time”

Structural risk exists, we’ve been telling you this dating back before COVID; we’ve written about the decimated workforce with millions simply no longer looking for work, the tax revenue shortfalls of major cities and states, the elevated risks of financial markets due to the rise of passive investing, the corporate sector just getting more leveraged and indebted over the last year… None of these structural risks have gone away…

We used the first sentence of the below quote earlier, but here is the full excerpt, as the back half is more fitting for this section…

“Year-over-year growth should explode higher over the next few month due to the base effects of last year, though we could very well be a mere quarter away from reaching the top of a market decline that will make most investors feel like a novice skier being Heli-dropped at the top of a triple black diamond ski slope.”

Backlogs will get filled – inventories will get rebuilt – higher lumber prices and limited housing supply coupled with increase mortgage rates will slow home sales – empty shelves will begin to backfill… Some signs of this are already occurring:

- The Suez Canal doubles traffic to clear backlog

- Shipping giant Maersk expects to add 260k TEU-sized containers by end of Q2

- Lumber prices, how high is too high?

- Even toilet paper companies are catching up with us hoarders…

The remedy for higher inflation is high inflation… For example, I told my wife over a month ago to BUY STEAKS ANY TIME they looked good and went on SALE. The price of meat has been relatively cheap as many cattle ranchers were no longer providing Prime meat to restaurants (the largest purveyor of meat). As restaurants opened, demand for meat would spike – less Prime for you and me at the grocery store. It was much easier to buy meat cheap, vacuum seal and freeze them as the price of meat would be rising…

So, what did we find at the grocery store this weekend? You couldn’t buy a strip, ribeye or filet less than $15.99 per pound while under normal circumstances, a weekly sale would have you anywhere from $7.99-$8.99 per pound. That’s a 77% increase in the price of meat we were buying no more than a month ago…

This WILL work itself out … given enough Time and Space…

You don’t completely re-position your portfolios into quarter end, to make your numbers look better on a specific day… We’re just not going to do that! However, there will come a point in time where we do reposition, as the “reflation/inflation” trade starts to roll over. But it won’t just happen in a single set of names, it will show itself in all markets… bond yields will head south, dollar north vs. other currencies, gold north, equities across the board will likely see a prolonged pressure…

When eye popping headline inflation numbers are dismissed and the markets are staring at that triple black diamond, that’s the time to reposition…

Until then … just know we’re on the horse we want to be riding down the final stretch…

Today’s Introduction …

… isn’t merely about a great racehorse – if you allow it, it can teach us all much more about life, financial preparation and, yes, about luck.

After being named horse of the year in 1972 as a 2-year-old, Secretariat was a force to be reckoned with. However, Christopher Cherney died on January 3rd, 1973 and left his estate (including Meadow Farms) saddled with an enormous tax bill… In order to keep the farm operational, his daughter, Penny Tweedy, was forced to “syndicate” Secretariat prior to his Triple Crown season for a record $6.08 million dollars (valuing 32 shares at $190,000 per share – another record broken by Secretariat). Penny retained 4 of the 32 shares and also kept all of Secretariat’s winnings for that race year.

The greatest horse of all time was taken off the track and retired to stud by December 1973 to settle a tax bill, due to the poor tax planning of an extremely affluent family. Not only did the family lose more money than one could imagine, but the world also lost the ability to watch a true gift of God.

So, in closing, let’s take another chapter from Secretariat’s book, on the need to get the details right. Make sure your tax planning attorney has crossed his T’s and dotted his I’s; we often work with friends because we trust them, though please make sure you work with those regarded as the best because they are the best at what they do. Check the titling on your wills, trusts, estate tax plans, etc. Should you like to discuss or review, we’d be happy to …

An example of attention to detail arose recently when we were asked to open a new account for a new client with the account titling ““tenants by the entirety”. This titling is often used by those who own quite a bit of real estate as the term “tenancy by the entirety” refers to a form of shared property ownership that is reserved only for married couples. A tenancy by the entirety essentially permits spouses to jointly own property as a single legal entity. This means that each spouse has an equal and undivided interest in the property.

This sounds harmless enough, BUT, an issue may arise when someone moves from a state that recognizes this titling to a state that doesn’t. States with tenancy by the entirety are Alaska, Arkansas, Delaware, Florida, Hawaii, Illinois, Indiana, Kentucky, Maryland, Massachusetts, Michigan, Mississippi, Missouri, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Vermont, Virginia, and Wyoming.

States like, say… New Mexico or California DO NOT. Just because a larger brokerage firm allows you to change your address, it doesn’t mean it’s ok. Change of address procedures are different than account opening procedures. Had we not caught this mistake, it had the potential to be EXTREMELY costly down the line. Paperwork may be a pain in the a$$, it may be cumbersome, we dislike it just as much as clients do. However – IT IS IMPERITIVE THAT YOU GET IT RIGHT….

I used the phrase “gift of God” for a reason. Regardless of religion or belief, Secretariat was flat out special. Writer George Plimpton described Secretariat as, “the only honest thing in the country at the time … Where the public so often looks for the metaphor of simple, uncomplicated excellence, the big red horse has come along and provided it.”

Upon reaching his great reward, it was found during autopsy that Secretariat was gifted with a heart nearly twice the size of the average thoroughbred … We all have the capacity to be a bit greater the more we open and expand our hearts and minds… It’s something every human would benefit from and it doesn’t cost anyone a dime. Given our current political and economic environment, I’d ask you, kind readers to consider making an effort – you’d be amazed at how far the ripple effect could take your kindness. Its positive effects are all encompassing.

We’ll continue focus on managing our risk, seeking out asymmetrical risk reward set ups, letting our winners run while cutting our losers before they become problematic. We remain firm in our risk management process and discipline; you can only buy dips if you have cash in hand from trimming the rips…

As always, we’re happy to discuss our market thoughts along with these strategies and more, never hesitate to reach out with any questions or concerns. Thank you for your continued trust and support!

Good Investing!

Mitchel C. Krause

Managing Principal & CCO

Please click here for all disclosures.