In This Article

Rigidity of BELIEFS…

In the 1950’s a West German pharmaceutical company by the name of Chemie Grünenthal GmbH developed what had appeared to be a miracle drug. Early animal studies suggested this drug to be so benign, researchers believed it was nearly impossible to administer a lethal dose (based on what is known as the LD50 test; also known as the Acute toxicity test)

“The LD50 (median lethal dose) test was introduced in 1927 by J. W. Trevan to estimate the dose of a test substance that produces 50% death in a given species of animals. It is usually the first test conducted for every chemical before further toxicity tests are carried out. It is used for estimating the potential hazards of chemicals on humans.” US National Library of Medicine, National Institutes of Health PMCID: PMC6117820

What was originally to be used as a sedative or tranquilizer, quickly expanded to include a plethora of ailments including the treatment of pneumonia, common colds, flu, headaches and nausea. It was believed to be so safe that it received over-the-counter licensure in July of 1956 in Germany.

When coupling its efficacy in treating nausea and its glaring safety profile, the drug became a natural fit for the treatment of morning sickness in pregnant women.

The name of this drug was Thalidomide!

It’s been documented that over 14 pharmaceutical companies were marketing thalidomide under 37 generic names (at minimum); UK based The Distillers Company, alone marketed Distaval, Tensival, Valgraine and Asmaval, stating at the time:

“Distaval can be given with complete safety to pregnant women and nursing mothers without adverse effect on mother or child.”

The US Food and Drug Administration did ultimately reject the sale of Thalidomide in the United States though, only after nearly 20,000 Americans were given the drug as part of two clinical trials operated by U.S pharmaceutical companies Richardson-Merrell and Smith, Kline & French

It took over 5 years before a connection was made between pregnant women taking thalidomide and the impact it was having on their children… As we know today, thalidomide was tremendously harmful to fetuses, especially when taken between 20 and 37 days after conception. In the end, it was estimated that over 10,000 babies were adversely affected globally by the drug, with nearly half dying within the first month of being born and many hundreds born with severe deformities.

The ultimate tragedy had occurred because the medical/pharmaceutical system believed that their testing protocols were rigorous and reliable. Rash decisions, poor assumptions and more importantly, strong belief systems have the ability to adversely impact societies beyond what most can comprehend.

Belief systems are embedded within our society … In 2Q2018 we briefly noted the story of Hungarian Doctor Ignaz Semmelweis. In 1847, Semmelweis solved the riddle as to why exponentially more women were dying postpartum in the hands of physicians and medical students in the older wing of the Vienna Hospital, he was assigned to than those giving birth in the newer obstetrics division staffed exclusively by midwives.

In the 1840’s, puerperal fever was the leading cause of maternal mortality in Europe. The BELIEF, at the time was that ‘miasma’ or stench spread disease. After the passing of friend and colleague Jakob Kolletschka, whose autopsy revealed his death came at the hand of puerperal fever following a scalpel wound he received while performing an autopsy on a woman who had died from puerperal fever, Semmelweis concluded:

“general sepsis arose from the inoculation of cadaver particles, then puerperal fever must originate from the same source. … The fact of the matter is that the transmitting source of those cadaver particles was to be found in the hands of students and attending physicians.”

At the time, doctors and medical students infrequently washed their hands. If disease spread via obnoxious odor (again, the BELIEF of the era), there was no need to do so when traveling between performing autopsies and delivering babies. However, if Semmelweis was correct and the “transmitting source of those cadaver particles was to be found in the hands of students and attending physicians” the belief system of that time was incorrect (as we know to be true today).

So where do the midwives fit in to the equation? Midwives didn’t perform autopsies, they solely delivered babies thus not transferring the “particles” in question.

Armed with the knowledge that a chloride solution removed ‘odors’, in May of 1847, Semmelweis implemented the protocol of handwashing for anyone who entered the older wing of Vienna Hospital. The result was an immediate precipitous drop of puerperal fever and postpartum deaths where the regimen had been executed.

Hand washing today is a “no brainer”, something everyone understands to be a necessity in an effort to prevent the spread of germs. However, in 1847 Semmelweis’s observations angered many of his colleagues … How could saving lives anger anyone?

Faux Foundations…

If Semmelweis’s work was accurate, those committed to helping people and bringing life into the world were in fact, inadvertently killing some. For challenging the “beliefs” of the majority, Semmelweis was shunned by colleagues, sending him into a depression; eventually dying from an infection acquired while institutionalized in an insane asylum.

Our introduction has more of a point than just telling you stories about medical missteps. Belief systems often prevent even the brightest of individuals from accepting the most elementary of things for doing so forces one to question the very foundation of their knowledge. For example, most reading this fail to connect the trail of breadcrumbs I’ve been leaving back to their own current belief system…

While newer readers are less likely to have heard the name Ignaz Semmelweis, most surely recognize the name Louis Pasteur, no?! Pasteur has been lauded as the father of “Germ Theory”; which is the spread of microorganisms (germs) to explain infectious disease. But isn’t that exactly what Semmelweis proved? That disease could spread from a corpse to the living through a mechanism which couldn’t be seen (a microorganism)?

Virtually no one knows who Semmelweis is, yet Semmelweis’s work was done in the late 1840’s through the 1850’s while Pasteur’s was in the 1860’s. Semmelweis was shunned and institutionalized while Pasteur continues to be taught today in elementary schools around the country. Our belief system tells us Pasteur is the father of “germ theory” while Semmelweis’s work came years prior. In teaching PASTEUR, our institutions have and continue to build a Faux Foundationat the central core of our beliefs.

Even when blatantly obvious evidence smacks humans in the face, the ties from emotional beliefs prevent the majority from acknowledging or accepting it as truth for it shakes the very core of the foundation that formed the belief (If that’s not correct, what else do I believe to be true, that’s not?!).

Rigidity in beliefs has impacted the world for centuries, it has been the root cause of countless injuries and deaths; it has been the root divide of nations and religions; it can surely impact how you invest.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” ~Upton Sinclair

Almost a year ago, we concluded last May’s note with a section titled, “Embrace the Suck” which discussed our best ideas at the time. Given the macro environment, anticipated supply chain shocks, tens of millions of recently unemployed among countless other metrics, we had positioned ourselves in Gold, Treasuries the US dollar and a select group of US equities…

Our thesis was well researched and backed by volumes of historical data, though had we remained stubborn in our beliefs, our defensive set up would have gotten us slaughtered as Gold, Treasuries and the US dollar have been smoked over the last quarter or two.

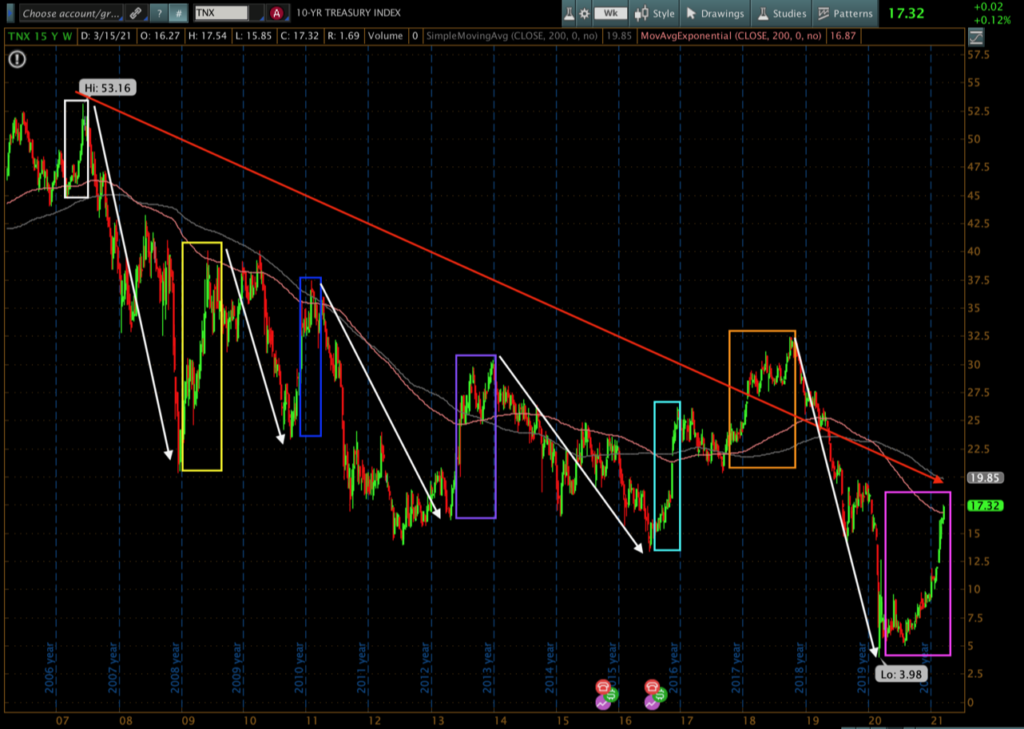

Very few things in life are ‘cut and dried’. There are typically multiple sides to a story able to produce varying outcomes; and while decades of loose Federal reserve policy promoted governments and corporations to gorge on obnoxious levels of debt, it had yet to produce growth let alone inflation; in fact, it has been deflationary by all academic measures. We talk about the fine print all the time; the devil always being in the details, with nuance having the ability to drastically change the outcomes.

Inflation, Deflation … BOTH?

Last year, the Fed was no longer simply creating excess reserves within the banking system. The government was now literally handing people hard cash to spend on anything that they wanted to, while at the same time, suspending mandatory obligations such as rent and mortgage payments. As mentioned in previous notes, many of those unemployed were making more money on unemployment benefits than they were while working. The PPP program under the CARES Act became “forgivable windfalls” to the majority of those who took the loans. This transpired, as global supply chain disruptions due to COVID shutdowns were glaringly obvious. As we opined in our February 2020 note before any COVID related shutdown occurred:

“Supply chain disruptions have the ability to bring about inflation (and not the kind the Federal Reserve seeks).”

Still, our ‘best ideas’ positioning in that May piece was a deflationary set up, because that’s what made sense under those circumstances.

Discipline has always been at the core of our investing style as has the flexibility of an open mind, both had us cutting our dollar trade a mere few weeks after labeling it a top position; rigidity in a belief would have had us firmly planted in a money losing trade. June 2020 we began our final thoughts:

“Which brings us to a quick lesson on Risk Management. Last month we felt very strongly about the US Dollar, and long-term, we still believe in this thesis. The reality is, if stagflation sets in, the dollar is likely to be weak with commodities rising. As much as I believe in the strong dollar thesis, capital preservation and risk management aren’t always about being right. Our capital preservation strategy has triggered, so we’ll take a breather, placing the strong dollar thesis on the bench for a while just as a good coach would.”

And while some may be thinking a move of -13.4% to the downside isn’t that big of a deal, in the relatively stable world of currencies, it is a crash. When constructing a portfolio, position sizing is a very big deal. Currencies can often be sized larger as moves are typically much smaller on a percentage basis.

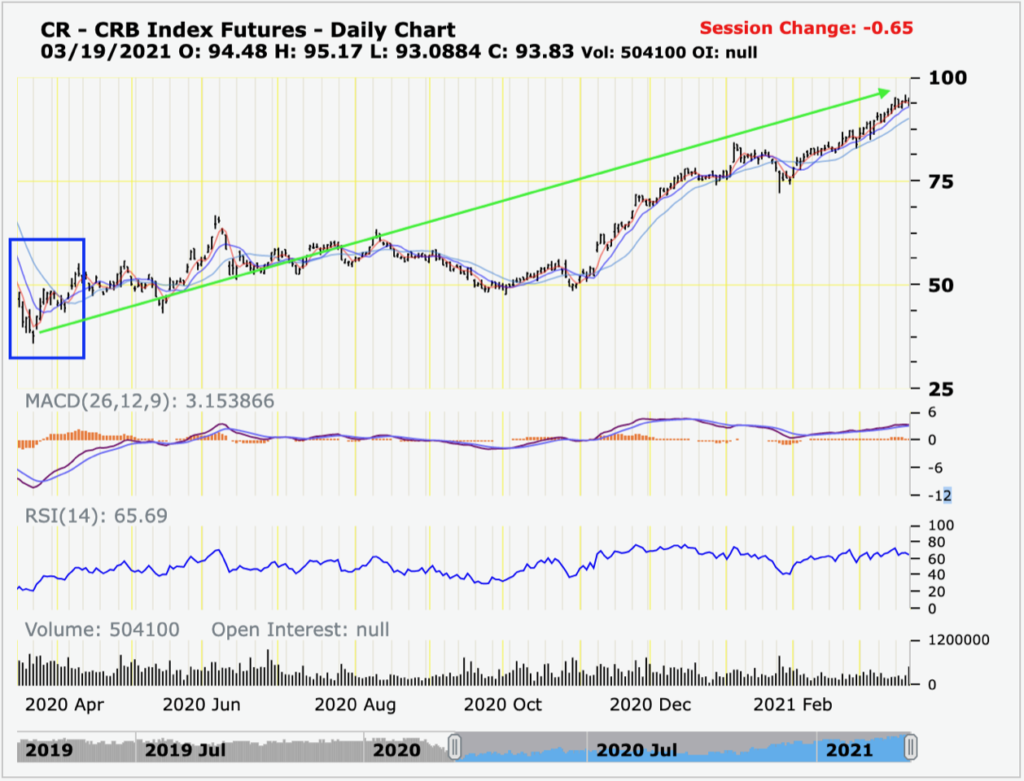

Not only did we sell the dollar, but we quickly bought inverse dollar trades, i.e., commodities, which equates to being LONG INFLATION. Why? Correlations… For if short term inflationary pressures were manifesting based on reasons discussed above, it would be reflected by a decline in the dollar (among other deflationary assets) as well as an increase in the prices of commodities. $DXY has fallen roughly -13.4% from its late March 2020 peak of $102.98 as shown in the above illustration, while the CRB Index is up over 150% from its March 23 low (below):

You may be wondering how one could nimbly move so quickly from being a “deflationist” to being an “inflationist”?! There are a few issues with this thinking:

- While 20/20 hindsight suggests we should have flipped our entire portfolio immediately, that is not how we do things … we remained true to our risk management disciplines in selling our dollar position, while incrementally adjusting the balance of our portfolio between inflationary assets (commodities and equities) and deflationary ones (Government bonds and Gold). For a period of time the portfolio acted like a seesaw, inflation up, deflation down and vice versa. As we discussed through November and December (and illustrated below); we felt extreme caution was necessary given the systemic risk that exists at the hands of the exogenous shock. So, we remained relatively market neutral.

- Our sell disciplines triggered on different assets at different levels and times (also illustrated further in the piece).

The primary answer to our deflationary to inflationary transition lies in understanding something which we’ve written about many times – an excerpt from our September 2020 note sums it up nicely:

“MORE stimulus is necessary, but its arrival seems uncertain. If and when we get it, it will likely pressure the dollar and be inflationary to commodities as well as equity asset prices, though, just as markets are screaming for MORE a mere 6 months into the largest V recovery bailout in history, it too would be transitory in nature.”

Virtually everything in the above paragraph has come true… We have received exponentially MORE “stimulus” (with more to come), the US dollar has been pressured, commodities have been outperformers and equity asset prices have increased substantially.

None of which is the most important line of that paragraph, which is: “it too would be transitory in nature”.

Webster defines transitory as “of brief duration”, while Oxford states, “not permanent”. Markets move in cycles which do not automatically begin on January 1st and/or end at the close of any specific quarter as traditional Wall Street brokerage firms train you to believe. As much as academia would like to pigeonhole people into being either an inflationist or deflationist, one can actually have a sound thesis for both: the difference being duration (time frame).

Duration forces you to have flexibility of mind to understand something like cyclical inflation can exist within a seculardeflationary environment. This allows us an opportunity to benefit from both sides of the trade. These inflationary pockets can last for some time as can be seen in the graphic below; a year or two is not uncommon for an inflationary cycle, as transitory issues like temporary stimulus checks and/or supply chain disruptions work themselves through the system.

When the government removed the obligation to make routine monthly payments (mortgages, car payments, credit card payments, student loans, rent) while handing Americans copious amounts of money to spend (above and beyond what families were used to making) in the face of these supply chain disruptions we’ve discussed, the rules of the game were altered, creating a pocket of inflation. The Fed still denies that inflation surrounds us. But the question remains, IS THE CURRENT INFLATION STILL WITHIN A LONGER, MORE SECULAR PERIOD OF DEFLATION?! My belief is that it is, but with humility, I have to state that I DON’T KNOW. We’ll discuss this thought more in next month’s quarterly, but at this moment in time, we simply don’t know because there are too many variables and too many unknowns.

As I write, House Democrats are proposing a $3 Trillion dollar infrastructure spending bill. Will that, when combined with the debt required to finance it, be inflationary or deflationary? What will happen within the time and space from proposal to either failure or passage, then to implementation? We know it’s borrowed money, which is ultimately deflationary, yet at the end of the day, price is the true arbiter.

Those in the “deflationary camp” arguing that what we are seeing in the price of gas, milk, beef, cocoa, coffee, lumber, homes or appliances today (among countless other items) isn’t inflationary are, respectfully, missing the cyclical duration. What we are seeing today is a textbook definition of inflation:

“Inflation: a general increase in prices and fall in the purchasing value of money” Oxford Dictionary

We are watching prices of goods and services skyrocket as the value of $DXY is falling: over the past 3 months, corn is up 14%, copper up 16%, broad commodity indices up 15%, soybeans 11%, lumber 8%, and oil 28%. Annualize that and then ask yourself whether cyclical inflation is with us. Deflationists can argue that this will end in a resumption of secular deflation, and they may be right, but until then you do not want to make investments based on that belief. Circling back to our opening paragraphs of this letter, invalid belief systems can destroy lifetime investments just as easily as they can destroy lives.

Now imagine the traditional “BELIEF” of a 60/40 stock, bond portfolio. Nearly half of your portfolio in treasuries/bonds are getting killed. Over the past 3 months, 20-year Treasuries are down 13%, and 30-years are down 17%. The most prevalent belief system that is promoted by most traditional Wall Street advisers would have lost you double-digits on half of your portfolio since mid-December. Don’t do that to yourself!

Is inflation really happening? I’ll give you a personal anecdote. I recently tried to buy a Bosch dishwasher. I was told that there was a 14-week back log! FOR A DISHWASHER! The link between scarce supply and increasing prices is well established. Luckily, I was able to purchase one from a close builder friend of mine who planned in advance. Now ask me about Italian tile?!

When this will right itself is difficult to say. The important thing is that we will continue to be both flexible in thought and disciplined with our risk management processes in order to capture upside while mitigating downside risks.

Our roots are currently shallow in both camps (Inflation/deflation). While there is probabilistically more upside ahead as rate of change data over the next few months will be the strongest that we’ve ever seen due to the Covid-induced base effects, selling in risk assets may come sooner than the math suggests as larger firms often attempt to discount and front run the data, in an effort to position themselves in calmer waters before the rough seas strike them. This can spark a large market selloff.

While it’s not easy to predict the future, we stand proud of what we’ve written and the work we’ve done over the years. Did our numbers kill it in 2020? Not by year end measures … but I surely would take a slightly muted year end number to have preserved as much capital as we did in February and March. Additionally, as flexible as we are in understanding that we can be wrong, we’ve often hit the nail on the head well in advance.

CLUELESS …

Is where Wall Street has been through all of this! As we were long select commodities in 2019, Goldman Sachs literally cut their commodities trading desk February of 2019. On January 26th of 2020, we literally walked investors through historic parallels pleading caution was warranted; titling the note “The Importance of History … and Boy, is it “Rhyming” today”. We wrote this note in the face of top economists at Goldman Sachs literally saying, the economy was nearly “recession-proof” when we began writing a few weeks earlier on December 31, 2019; sooo, that didn’t age all that well for them, did it?!

We’ve been long inflation over the last 9/10 months, more aggressively post White House transition, Wall Street is just now getting on board the inflation train. Bank of America recently cited, “2021 is a “turning point” for inflation” – Now, AFTER they’ve provided enormous alpha vs. the dollar, bonds and gold…

While some yellow lights have formed, few are currently red. However, when a successful trade becomes consensus, the clock is more than likely ticking… Year-over-year growth should explode higher over the next few month due to the base effects of last year, though we could very well be a mere quarter away from

reaching the top of a market decline that will make most investors feel like a novice skier being Heli-dropped at the top of a triple black diamond ski slope.

A quarter moves pretty quickly and can be accelerated if major investors attempt to front run the data. Risk manage your assets accordingly and be mindful of the pivot. When it comes, we’ll likely find ourselves back in many of the names we sold last year, as both growth and inflation decelerate at the same time…

We believe this to be a pertinent time to remind you of a quote we used in our 1Q2018 note. It couldn’t be more poignant given the topic of rigidity of beliefs… We leave you with the great Bruce Lee:

“I said empty your mind, be formless, shapeless, like water. Now you put water into a cup, it becomes the cup; you put water into a bottle, it becomes the bottle; you put it in a teapot, it becomes the teapot. Now water can flow or it can crash. Be water my friend.” ~Bruce Lee

Market structure suggests there will more than likely come a time when rigidity in a belief system such as: the market always comes back, don’t fight the Fed, a 60/40 portfolio will protect you (among others) will be a serious detriment to your retirement goals. We prefer our risk management process and disciplines.

As always, we’re happy to discuss our market thoughts along with strategies and more, never hesitate to reach out with any questions or concerns.

Thank you for your continued trust and support!

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.