In This Article

“…the lies/mistruths are simply embarrassing at this point. If it hasn’t been clear to you that your unelected officials could care less about the majority of Americans by now, you’re just not paying attention.” ~ OSAM 4/1/24

Flip-Flop

No, I’m not talking about the loose rubber sandals the vast majority of the world wears when the weather is warm, I’m talking about the 2nd listing in the Britannica dictionary:

2. chiefly US, informal: a sudden change of opinion

- a politician accused of doing flip-flops on important social issues

We used the opening quote a mere handful of weeks ago in opening our March monthly, published on April 1st. Little did we know that both elected and unelected officials at the highest levels would flip-flop on their ‘firmly rooted’, publicly stated stances so quickly?!

For the purposes of this note, I’ll refrain from discussing the geo-politics, but will touch on the politics of economics vs. the data.

It was in that very same note we quoted Federal Reserve Chair, Jay Powell as he said:

“We’ve got nine months of 2-1/2 percent inflation now, and we’ve had two months of kind of bumpy inflation. We were saying that well, it’s going to be a bumpy ride.” Federal Reserve Chairman Jay Powell 3/20/24

This statement coming as Powell and his comrades left 3 rate CUTS on the table into the back half of the year, which, the data has been refuting for months.

This ‘more recent’ policy stance has been a shift away from the Fed’s, ‘rate levels’ will be predicated upon their “data dependence” up through mid to late 2023. The game of verbal ping pong they’ve been playing was reinforcing their ‘Flip’ in December as they lowered their interest rate projections by 75-basis-point via their “perpetually wrong” dot plots; as we noted in a section of our December 2023 piece tiled D.I.S.C.O.N.N.E.C.T:

“I want to repeat that for you again … the Fed is seeing the “possibility” of 3 rate cuts in the back half of the year (assuming inflation reaches their 2% target), yet markets are telling the Fed that they’re cutting rates 7 to 9 times (between 175 and 225 basis-points) with the first cut coming as early as MARCH!

How’s that for a disconnect?!”

So, as the Fed’s been pandering to their handlers, doing the exact opposite of what the data has been suggesting, “Higher for longer” is something we’ve been hammering on for a while now … BECAUSE OF IT!

“When someone like Federal Reserve Chairman Jay Powell has the audacity to suggest in front of the world that the massive run up in Treasury yields isn’t large in part because of inflation expectations or credit risk based on the massive borrowing as he did last month … someone with more clout than us (say the financial media) who is allowed to ask him questions, should be calling BS.”

From our January note in the section titled, “They LIE”:

“So while much of Wall Street had been calling for those rate cuts, we’ve been pounding the table on higher inflation rates (thus, a higher Fed Funds rate) for longer. So, when this month’s sticky inflation report hit “hotter than expected”, with Headline CPI accelerating +0.3% MoM bouncing from +3.1% YoY in November to +3.4% YoY in December and Core CPI accelerating +0.3% MoM as well; with CPI services ex-Housing also ramping to +4.2 YoY” … our only surprise was they didn’t try to hide the ramp.

Or February:

“The odds of a March rate cut, as recently as the last week of December were as high as 97% … today that probability stands at 3% … the precipitous pace in which rate cut expectations collapsed following January’s CPI print is only remarkable to those who need the Fed to cut rates; for those with a decent handle on CPI construction or who follow @Hedgeye; whose inflation model has pretty much nailed each major turn … the only surprise is how others were so “wrong”?!

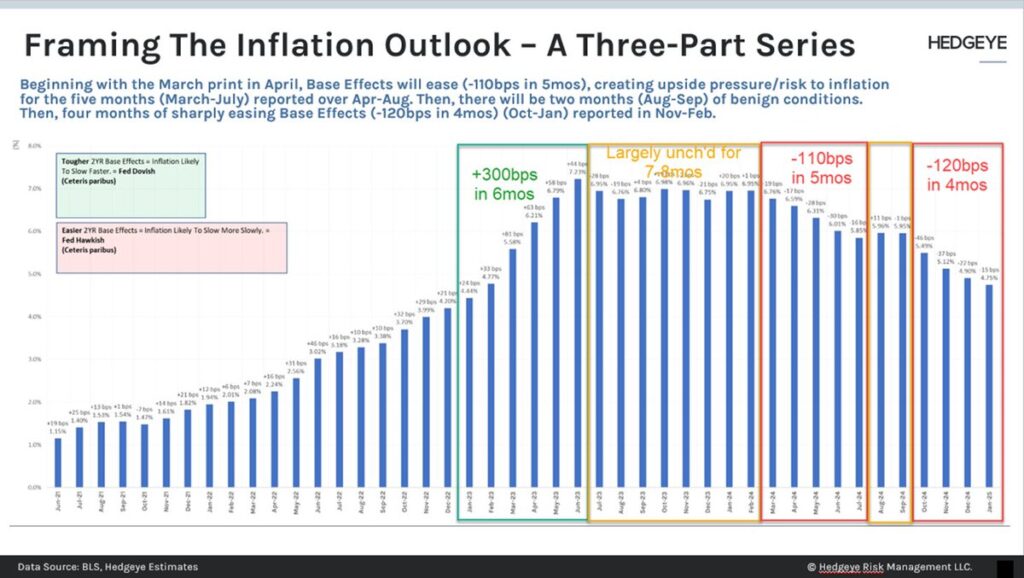

It was also in that February note where we called out the easing of the base effects in regard to the current inflation outlook … courtesy of Hedgeye’s Josh Steiner:

We reiterated out stance, which has been contrarian vs. that of the establishment: “we remain in the “higher for longer” rates camp … UNLESS … something “markets related” breaks bringing us much larger issues.”

We literally titled last month’s note, “Higher for Longer” … making this the sixth consecutive months we’ve been discussing the ramifications of poor Fed policy, coupled with their pandering, and obnoxious amounts of fiscal irresponsibility (courtesy of Washington politicians) and how it’s flowed through into the data, that it would most likely lead to higher inflation, which should accelerate further into the back half of the year given the base affects mapped out by Steiner in the above graphic.

That’s the quick and dirty on the Fed’s “flip” from a higher interest rate stance leading into October, to entertaining the rate cut discussion (in the face of disagreeing data) shortly thereafter. So, what about …

The FLOP?!

Well, that came just last week after March CPI data was released, which again came in “hotter” than expected … with Headline data coming in at +3.48% YoY vs. expectations of +3.4% YoY and +0.4% MoM which was unchanged vs. the previous month, though 10 basis-points ahead of consensus and up +30 basis-points MoM on a seasonally adjusted basis.

CORE came in at +3.8% YoY vs. wall street’s estimate of 3.7% YoY, which was also unchanged vs. February and +0.4% MoM which was again, hotter than wall street’s +0.3% estimates and unchanged vs. February on a month over month basis.

The big move came in the Fed’s coveted Core services number which accelerated +56 basis-points MoM, from +4.46% in February to +5.02% MoM in March. The irony is that this is the data point Fed officials love to focus on, and yet now that it doesn’t suit their narrative … the sound of crickets is all you’ll hear from the Eccles building!

Shelter came in unchanged at +5.7% YoY, with slight decelerations in OER (owners’ equivalent rent) and RENT both coming in at +5.91% YoY vs. +5.97% and +5.68% YoY vs. 5.77% YoY, respectively … lodging away from home decelerated as well. The acceleration came from Homeowners insurance which jumped nearly 50 basis-points from +4.06% YoY to +4.55% YoY.

And as we’ve been noting since the onset of this massive ramp in OIL/ENERGY related commodities (which was December); it would surely place significant upward pressure on the CPI due to its concurrent to 1-month lead/lag flow through into the data … and sure as the day is long, that’s exactly what the data showed … with Energy accelerating +2.1% YoY vs -1.9% YoY in February.

We discuss CPI and the nuance of its construction quite frequently, because … accurate modeling matters. So, when the Chairman of the Federal Reserve, an attorney by trade states something so blatantly irresponsible such as:

… rates have moved up significantly. I think it’s always hard to say precisely, but most people do a common decomposition of the increase, and the view will be it’s not mostly about inflation expectations. It’s mostly about other things, you know, either term premium or real yields, and it’s hard to be precise about this. Of course, everyone’s got models that will give you a very precise answer, but they give you different answers. But essentially, they’re moving up. It’s not because of inflation.”

… it matters … which is why we called Powell out in September when he uttered the above B.S. … SEPTEMBER!!!

In that same September note we did NOT mince words, stating, “a lie is a lie” in regard to his below statement from August 25th

“At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks … Restoring price stability is essential to achieving both sides of our dual mandate.

We will keep at it until the job is done.”

And again, rightfully in February as well when we stated that:

(Powell had either been) “lying or maybe he should consider using models that have been consistently accurate, like Hedgeye’s, instead of listening to those who give him “different answers” (his words) that have consistently been wrong (i.e., pretty much all of Wall Street).”

Nothing the Fed has done or is doing is based on data dependency … they are ALWAYS late and wrong.

Now, when it comes to modeling CPI data, very few, if any do it better than Hedgeye’s Josh Steiner. Earlier this month (4/10/2024) he surgically dissected the nuance of the CPI data on the Hedgeye morning call from 4/10, noting that while shelter did come in “unchanged” … there was actually a 9 basis-point deceleration based upon how the series rounds to the nearest tenth … with the current reading coming in at +5.65% YoY (rounded up to +5.7%) vs. last month’s number which was +5.74% (rounded down to the nearest 1/10th … +5.70%) … again, models matter and we’re talking GRANULAR.

More recently, Steiner again noted the importance of base effects … as this month’s most recent CPI report saw a 33 basis-point acceleration against a 19 basis-point easing in the base effects. Per Steiner’s analysis, April is slated to see another easing of 17 basis-points creating a similar dynamic to that of March: with May easing by 28 basis-points, then subsequently June and July both easing by 30 basis-points and 16 basis-points, respectively! The base effects don’t (temporarily) reaccelerate until August and it’s by a meager 11 basis-points.

For those NOT aggregating, we would urge you to revisit the above chare and take a good, hard look at the easing of the base effects over the next 9 months where we will see a 110-basis point easing over the next 5 months, followed by another 120-basis point easing over the subsequent 4-month time frame which further supports the Higher for longer inflation environment, though, given the current set up, we could see inflation well into the 4% range into the back half of 2024, with further increases in 1Q2025?!

So, true to form, just as it was impossible to hide behind the multi-year ‘transitory’ narrative, there eventually comes a time where the Fed and their mainstream news minions, no longer have the ability to hide behind a facade as economic continues to flood the tape, which leads us from the Fed’s “flip” to recent “flop” … with statements from Fed Chairman Powell like:

“The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence,” Federal Reserve Chairman Jerome Powell, 4/16/2024

OR in a recent speech titled, “Economic Uncertainty and the Evolution of Monetary Policy Making”, Federal Reserve Vice Chairman Philip Jefferson stated:

“Of course, the outlook is still quite uncertain, and if incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer”

We’ve literally been laying a breadcrumb trail the size of boulders for months suggesting the stickiness of inflationary pressures were the most probabilistic outcome given the data, be it the ramp in oil and oil related commodities since they bottomed in December, to the price of Copper, Coffee, Cocoa, et. al. all the way down to the granularity of the base effect set up.

So, I’m sorry we’re not sorry for our extreme and unapologetic criticism of Powell and the more than 400 overpaid PhD economists at the Federal Reserve as their flip-flopping in regard to their interest rate policy stance is more aligned with how the wind blows than the actual RoC (Rate of Change) in economic data, which is what we will continue to present in the face of countless shifting narratives that attempt to bully the Fed due to poor positioning vs. economic reality.

It’s as if they’re legitimately attempting to navigate the Atlantic Ocean with an abacus while sailing a dinghy or as we’ve noted in the past, they’re just outright lying. Be it the wind or pandering to the narrative of Washington/Wall-Street elites, tap-dancing around what the next move in interest has sadly become political theater.

Rather than doing their job, which is help the American people, the Fed’s flip-flopping has prompted markets to make some fairly harsh decisions on their own, while doing very little for those hardworking Americans they claim to care so much about.

The 10-year treasury moving nearly 100 basis points higher over the last 4-months does little for those who need to borrow/refinance, while it puts a significant ‘risk free return’ in the pockets of the top 10%.

Every FOMC press conference for the last two and a half years has begun with Powell uttering the following:

Sure, they do…

As for the data

Again, it supports our ‘inflationary’ higher for longer thesis, while also seeing incremental improvements on the growth side of the equation.

Earlier this month the March ISM Manufacturing accelerated to 50.3 vs. February’s 47.8 … a reading of 50 or greater is expansionary … we’ve mapped out a literal manufacturing recession for nearly 2 years, and while we’re not out of the woods yet, this is the first expansionary data point since March 2022.

The ‘Prices Paid’ component accelerated from 52.5 to 55.8 MoM … you shouldn’t need me to tell you this is inflationary, when input prices increase, the overall price at the register, baring cost cuts elsewhere, increases! Those cost cuts typically show up in R&D and labor (below)

Speaking of ‘Prices Paid’, sifting through the NY Fed’s Empire State Manufacturing number, which accelerated from a -20.9 in March to a -14.3 in April, with the prices paid component also increasing +17.4% MoM to 33.7.

Shortly after the Empire State data was released, the Philly Fed regional survey echoed the sentiment on U.S. inflation, as they also reported another significant move higher in the ‘Prices paid’ component, as it accelerated +15.5 points MoM, from March’s +3.7 to +23.0 in April.

PCE also came in up +0.3% MoM (a February data point) and +2.5% YoY, with Core PCE also accelerating +0.3% MoM, but decelerating by 10ps YoY from +2.9% YoY to +2.8% YoY.

Admittedly, ‘Prices paid’ hasn’t accelerated in all areas of the reported data, as the component within the ISM services did decelerate meaningfully to 53.4, which is DOWN -5.2 points MoM … HOWEVER, it is extremely important to note that Manufacturing is much more sensitive to near term moves in commodity price fluctuations than the ‘services’ side of the economy.

Mixes signals, part deux

We’ve definitely got some mixed signals out there, but inflation isn’t one of them at the moment.

For example, U.S. Retail Sales for March came in hotter than expected, accelerating +0.7% MoM, vs. consensus at +0.4% MoM, with February being revised higher to +0.9% MoM from the reported +0.6%; additionally, headline data also accelerating to +4.0% YoY vs. February’s +2.1% with most subcategories showing strength.

While Housing has also shown strength in the face of the bond markets doing Powell’s job for him as the NAHB HMI ticked at 51, which is good for an eight-month high with prospective buyers moving incrementally higher to 35 in April.

That being said, MBA mortgage purchase apps have now declined for 3 sequential weeks, most recently, a deceleration of -1.7% WoW.

While we could walk you through the mixed signals for multiple pages, I want to briefly discuss what I mean when I say, “the bond markets doing Powell’s job for him” … bringing us to:

The ‘K’

We’ve been describing the current economic ‘recovery’ as a ‘K’ – with the minority of the population that we’ll label, ‘the haves’ riding the upward trajectory of the ‘K’, as the masses of the country grasp tightly to the downward slope.

This dynamic can be seen through multiple lenses, bank lending data, credit delinquency data, subprime auto data, but few more important than that of the NFIB. While we’ve written about it, I don’t think we’ve ever defined the acronym … The NFIB or National Federation of Independent Business, reads the pulse of small business throughout the country, who, as we’ve noted many times in the past, employ nearly 98/99% of Americans.

Unfortunately, this data continues to remain weak, with March’s most recent report declining by 0.9 points to 88.5. We say “continues” as it’s the 27th consecutive month below the 50-year average of 98; it’s also the lowest reading since December of 2012 … which is good for a 135-MONTH low.

Per NFIB Chief Economist Bill Dunkelberg:

“Inflation has once again been reported as the top business problem on Main Street and the labor market has only eased slightly.”

The report went on:

“The net percent of owners raising average selling prices rose seven points from February to a net 28% percent seasonally adjusted.”

Small businesses tend to rely upon revolving credit lines, which are typically highly interest rate sensitive, vs. the larger corporations, many of which have the ability to access credit/debt markets, locking in rates over a much longer duration.

Many larger corporations were able to refinance their debt at near zero borrowing rates throughout 2020, into 2021 as Covid became an excuse for both the Federal government and Federal reserve to light money on fire, however, access to cheap credit with a longer duration wasn’t available to the heartbeat of America (or working class) who have watched their revolving lines explode higher!

Remember, inflationary pressures (i.e., ‘Prices paid’ among other indicators) have been re-accelerating with the set-up into the back half of the year being even more difficult given the base effects as described above.

So, while there were some minor improvements buried in the nitty gritty of the NFIB series, the overall theme remains … those WITH assets are currently in a position to enjoy extremely low interest payments on fixed borrowing terms while their excess cash earns a very respectable 5% + on interest income given the current rate environment … while those WITHOUT are experiencing the exact opposite … obnoxiously high interest and living expenses given the explosion in borrowing rates (revolving credit lines), in the face of squeezing margins, reduced profitability, lower investment/spending, hiring, and shrinking incomes … among other things!

Even if the Fed does come in and cut rates 2 times into year end, which the data definitely does NOT support), the majority of businesses borrowed between 0% and 2.5% … with rates currently north of 5%, what’s 50-basis-points in cuts going to do?! The answer is nothing for the small business, yet it would surely send inflation even higher!

Speaking of incomes

In most sane worlds, you’d need some form of a job in order to have an income … and true to form, BLS data from last month, once again came in “hotter than expected” at +303k, which just happened to be above all Wall Street estimates; the highest being 290k, suggesting people are all good.

Par for the course, last month’s data was revised slightly lower from 275k to 270k; while at the same time, these multi-sigma ‘beats’ are now becoming the norm with March being a 4-sigma beat, February and January being 3-sigma and 5-sigma beats, respectively.

Though, again, as we’ve been noting for months now … the loss of Full-time jobs vs. increase in Part-time jobs continues; most recent data showing we lost -6,000 full-time jobs in March, while adding +691,000.

Additionally, the trend in where the jobs are located remained consistent as well, with more than half coming from the black hole called Government, followed by Education & Healthcare. (you just couldn’t make it up if you tried folks)

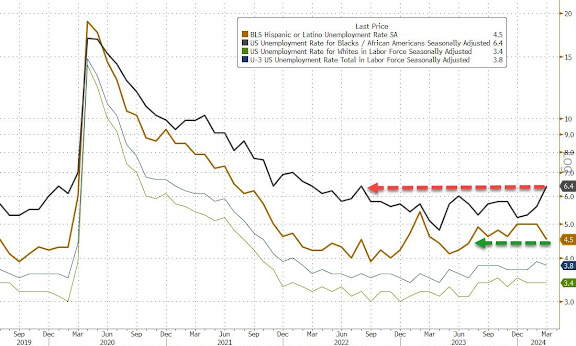

I frequently write, “they just can’t stop lying” … well, because they can’t! I want to make it clear, with each fabrication of the truth we call out, an empirical fact is presented as evidence; so, when 42-year-old, Yale, Yale Law & Cal Berkeley educated, Wally Adeyemo, stated on April 5th that, ‘Black unemployment has come down, but there’s still work to do’, it’s easy to say, he’s full of sh*t, as the unemployment for Blacks has been rising for months, most recently hitting 6.4% … its highest level in nearly two years and roughly 68% higher than the current unemployment rate of 3.8% (Image courtesy of Zerohedge)

For those unaware, Adeyemo is our current U.S. Deputy Secretary of the Treasury… who happens to be black?! You’d like to think that he’d be keenly aware that what he’s saying is completely disingenuous!

Following this report, PIMCO CEO Mohamed El-Erian stated, “It is a jobs report that confirms US economic exceptionalism.” (Palm meet forehead)

I honestly can’t remember when it was in my career that I came to realize that these, ‘experts’ everyone dotes over are literally little more than bought and paid for shills who have ridden the multi-decade wave of obnoxious government spending & irresponsible central planning policies?!

It doesn’t take a genius to figure out that part-time work pays significantly less, has fewer benefits, and is less stable than full-time employment. While I am open to correction, I know of no stable economy that has ever been built on the backs of part-time, unskilled labor along with a government workforce whose salaries are paid with trillions of deficit dollars as we rack up over $35 trillion in national debt?!

Final thoughts

Given my last few travel days have delayed this note into May, it’s given me a glimpse at the most recent ISM manufacturing data, which fell -1.1 points back into contractionary territory of 49.2 … with new orders falling -2.3 points to 49.1, Export orders falling -2.9 points to 48.7, Backlogs down -0.9 points to 45.4 and most notably for the purposes of this note … PRICED PAID UP +5.1 points to 60.9; a new 23-month HIGH!

While Manufacturing has shown incremental improvements, bottoming is a process … which may take some more time?! That being said, the breakout in prices is VERY clear … and given the MoM and trending price increases in many raw commodities, inflationary pressures are back.

These inflationary pressures are destroying the lowest economic cohort which can be seen in real time through the lens of Dollar General, which has watched its stock price collapse over the past year and a half with CEO, Jeff Owen stating in June of 2023:

“Unfortunately, our customers are saying they’re having to rely more on food banks”

$DG’s business model caters to those earning less than $40k per year and at this point, the bottom half of the ‘K’ is flat out broke, in many cases, unable to afford household staples.

95% of food banks are calling for an increase in food assistance, while nearly 60% of Americans can’t afford a $1,000 emergency … … as combined household debt (mortgage, auto, student and credit card) is currently north of $17 trillion + dollars (a new record high) … this is the bottom half of the ‘K’!

The delay has also given us the ability to hear Fed Chairman Powell speak after the most recent FOMC meeting, where he said that additional rate hikes were “unlikely” … while in the same breath he mentioned the Fed’s balance sheet run-off would be slowed. I wonder why?!

Keep in mind the number of times he used the work “transitory” before flip-flopping when they could no longer hide?! Then remember how he flopped again from bumpy to higher for longer (inflation) in less than a month … he hides until he no longer can. So, as inflation continues to trend higher given the set-up we’ve been describing for months now, he’ll eventually have to do something (or the markets will continue to force his hand as it currently is).

Powell came from Private equity and right now, private equity is getting decimated in the commercial real estate markets.

As noted by @MacroEdge here are just a few office towers that have recently sold for pennies on the dollar:

- AT&T Tower in St. Louis just sold for $3.55 million or $2.00/sqft, previous sale in 2006 was $205 MILLION

- 100 N. Charles skyscraper in Baltimore has just been listed for $1.5 million … a similar tower (One South Street) sold for $24 MILLION in 2023 … the building was previously sold for $66 MILLION.

- 1740 Broadway in NYC just sold for $200 million … $BX (Blackstone) had previously bought it for $605 MILLION in 2014.

Regional banks hold nearly 80% of CRE loans … and Private equity is knee deep as well with a significant amount of pension money involved. The longer rates stay high, something is very likely to break, be it commercial banks via a collapse in CRE that can no longer be hidden or the masses which comprise the lower portion of the ‘K’! Should rates come down, inflation will likely rip even higher, creating a larger societal divide between the so called ‘haves’ and ‘have nots.’

Markets have been choppy, and while data is improving, with favorable base effect for growth, there are still many mixed messaged. Thus, we will continue to follow our signals and risk management rules … be tight on the stops and let winners run that remain above their trade and trend levels.

As always, never hesitate to call with any questions or concerns!

Good investing!

Sincerely,

Mitchel C. Krause

Managing Principal & CCO

Please click here for all disclosures.