In This Article

“Time For Jay to go hard! 100 BPS” @jimcramer 6.10.22

Send in the clowns

Merriam-Webster defines a clown as:

: a fool, jester, or comedian in an entertainment (such as a play); specifically: a grotesquely dressed comedy performer in a circus.

: a person who habitually jokes and plays the buffoon

While Merriam-Webster was formed in 1831, clowns, without question, predated them. As lore goes, the word clown was derived from the Icelandic word “klunni” which translates into “clumsy person”.

Clowns link back as early as the Fifth dynasty of Egypt (2400 BC). It’s been written that early clowns often doubled as priests, though clearly their roles have morphed over time and by region.

“Clowns of ancient Greece were bald and wore padded clothes to appear larger. Ancient Roman clowns wore pointed hats and were the butts of the jokes.” History of Circus

When the word “clown” comes to mind, most think “circus”, however, there are numerous “types” of clowns: Your traditional “Whiteface” paints his/her face white, typically emphasizing features such as the large red nose and mouth, dressed in oversized clothing and shoes; buffoon like (think Bozo the Clown). The Whiteface clown was designed by Joseph Grimaldi in 1801 … in the clown hierarchy, the Whiteface is on top.

There’s the Auguste clown, portraying a “stupid or clumsy” character; then Tramp clowns, Character clowns, Mimes, Rodeo clowns, Creepy clowns, Jesters … the list goes on! There are even subsets of clowns within the hierarchy (who knew)?!

Other than the Creepy Clown (they just freak me out); be it singing, slapstick, juggling, piano, physical humor … each clown character uses a different skill, tactic, or trait in an effort to achieve a similar overall result/outcome … entertainment … laughter … comic relief!

At the same time, some clowns have an extremely serious job!

For example, the Rodeo Clown (also known as a bullfighter) and Barrel Clown, literally place themselves in danger to save the lives of thrown Bull riders. The Barrel clown uses a large, padded metal barrel as protection for himself, luring the bull to attacking them (protected by the barrel) rather than the cowboys who has been thrown from the animal … while the Rodeo clowns’ sole job is to protect the thrown rider; literally placing himself directly between the bull and thrown/injured rider.

Breaks in action are often filled with humor or animal acts, though, make no mistake these clowns exist to save the lives of bull riding cowboys who are thrown from a 2000 plus pound animal and in many circumstances how they perform is literally the difference between the life and death of an individual.

In researching for this piece, I came across the below excerpt from author unknown, though the parallels accurately relate to both bull riding and RISK MANAGEMENT.

“Their (The bullfighter/Rodeo clown) role is particularly important when a rider has been injured, in which case the rodeo clown places himself between the bull and the rider or uses techniques such as running off at an angle, throwing a hat, or shouting, so that the injured rider can exit the ring. When a rider has been hung up, they face the extremely dangerous task of trying to free the rider, with one team member going to the bull’s head and the other attempting to release the rider.”

There are a lot of clowns in the financial industry, each serving different roles. The puppet advisors who parrot the approved narrative allowed to be discussed by their employer; the jesters who are made famous by their “calls”, lauded for their intelligence and genius, only to be proven the fool as their aggressive risk taking is eventually exposed by the economic cycle, which they are oblivious too.

Be it Cathy Wood of ARKK investments ($ARKK) or Ross Gerber of Gerber Kawasaki ($GK) who are paraded around financial networks as the coming of the next messiahs or to a lesser degree, hot shot hedge fund managers like the “Tiger Cubs” led by a former protégé in Gabe Plotkin, founder of Melvin Capital … who failed to recognize and properly risk manage in both the #reflation of 2021 as well as the most recent #disinflation/#deflation of 2022. These individuals may be “well recognized” or “famous”, but they clearly don’t understand macro-economic cycles as one is currently smacking them collectively across their faces … they’re not alone.

The Rodeo & Barrel Clown

There are those in this industry who, like it/know it or not, shoulder the imperative roles of the Rodeo and Barrel Clowns. When they fail, the consequences can be equally catastrophic to the investor as it could be to the thrown Bull rider (and no, I’m not joking, exaggerating, or laughing).

It’s important to note that there is a definite distinction between the Rodeo and Barrel clowns’ jobs, each very specific when they enter the ring. While it’s the Barrel Clown’s job to provide safety via distraction for both the Bull rider and Rodeo clown; jumping in and out of barrels in an effort to distract the bull, they also entertain the audience during breaks. The Rodeo clown (or BULLFIGHTER’s), however has a single job, which is to protect the Bull rider.

We’d liken extremely high-profile individuals within the financial arena, who are a. revered as “experts” in the industry b. possess a significant amount of influence, to be Barrel clowns.

While they should be protecting investors, providing them with factual information and data, they typically place their self-interests above all, entertaining more than anything.

“There’s no sign of a broader slowdown that I can see in the economy” Fed Chair Jay Powell 6/15/2022

Federal Reserve Chairman Jay Powell is an unelected official, yet the world’s economies are virtually tethered to his every breath. When Powell speaks, most all ears on Wall Street are listening. Fed Chair Powell is a Barrel Clown, while is job is to protect … he mostly entertains (and does both poorly).

Those of you who have read our work understand our true distain for Federal Reserve officials; having predicted their countless blunders over the years, well in advance. Last month we detailed the idiocy of Powell’s “Beveridge curve” vs. reality, which is blowing up quickly in his face as we, simply relaying the data, said it would.

Our archives are public, if you haven’t done so already, feel free to explore, it warehouses what we’ve said over the years, and thoroughly details the “why”; we’ll take our track record and accuracy over that of the Fed and the majority of economists any day of the week and twice on Sunday.

We digress…

At this moment in time, not only is Powell miserably failing to do his job, but it’s also almost as if he’s deliberately attempting to kill a bewildered bull rider, leading the bull squarely in his direction. For example, when recently asked why the Fed changed shifted away from their “anticipated” 50 basis point hike, adjusting to 75 basis points, Powell responded by saying this:

“the preliminary Michigan reading, it’s a preliminary reading, it might be revised, nonetheless it was quite eye catching and we noticed that. We also noticed that the Index of Common Inflation Expectations at the Board has moved up after being pretty flat for a long time, so we’re watching that and we’re thinking this is something we need to take seriously. And that is one of the factors as I mentioned. One of the factors in our deciding to move ahead with 75 basis points today was what we saw in inflation expectations.”

So, the Michigan reading was “eye catching” and “inflation expectations” from those who’s “expectations” have been INCORRECT with near 100% accuracy is now dictating how the Fed’s “blunt tools” are being used. Full disclosure, for the life of me, I have no idea what he means by “eye catching”?!

At the same time, Powell stated in this very same meeting, the quote we shared above:

“There’s no sign of a broader slowdown that I can see in the economy” Fed Chair Jay Powell 6/15/2022

Jaw meet floor…

There isn’t a person alive who studies macroeconomics that didn’t gasp for air and say, did he seriously just say that with a straight face, he can’t be serious”?!

I would also challenge anyone to watch the Fed’s most recent press conference and tell us where Powell cited any DATA to back up any of his absurdly ridiculous assertions! (click here for the transcript)

We have detailed both the slowing consumer and inflation topping process for well in excess of 6 months, and while we’ll be slightly more understanding with readers conceptualizing how inflation is, in fact rolling over (as its more complicated given lead/lags as calculated by the CPI); there is absolutely NO WAY the head of the Federal Reserve can say such a thing and not be dumb, blind or flat out lying … so we reiterate what we said last month in speaking to Powell and JP Morgan CEO Jamie Dimon:

“These two are either incompetent, lying through their teeth or both … but let’s face it, they likely didn’t get as far as they have in life by being dumb?!” OSAM May 2022

The ATLANTA FED literally just dropped their GDP NowCast to 0 … ZERO … a GOOSE EGG! While the NY FEDERAL RESERVE’S model is currently projecting NEGATIVE GDP growth for 2022 & 2023…

How do you stand front and center, as Chairman of the Federal Reserve, head of the FOMC (Federal Open Market Committee) with the Atlanta Fed GDP estimate at 0, the New York Fed GDP estimate negative and state there is “NO SIGN of a broader economic slowdown”? My head wants to explode.

When discussing the absurdity of Mr. Dimon’s, “the economy is strong” comment in May, we stated:

“Apparently, his definition of strong is quite different than ours … which is why we will happily stick with the data while he panders to his ogling fans.”

In this instance, if Powell doesn’t consider the fastest economic contraction in history (in Rate of Change terms) unfolding in real time before our eyes to be a sign of a “slowdown”, then as was the case with Mr. Dimon, our definition is quite different than his … and still … as we also stated then:

“we will happily stick with the data while he panders to his ogling fans.”

The Data vs. Powell

Detailing the steady deterioration of the consumer has become a full-time job, especially when considering consumer spending comprises 70% of GDP with the retail and services industries being critical components of the U.S. economy. Last month we walked you through the disastrous results of $WMT and $TGT, dissecting the shifts and slowdown in consumer spending from general merchandise to necessities while also discussing how the impact higher oil and gas prices will continue to have on the consumer (slowing at a faster pace).

Apparently, that data is a nothing burger to Powell … if only there were more … (think Mitch, think!!!)

As Powell sits on his thumbs suggesting there are NO SIGNS of an economic slowdown, and as mentioned above, having detailed $TGT (Target’s) most recent earnings debacle and inventory build … no more than 3 weeks post their earnings announcement, $TGT decided to PRE-ANNOUNCE next quarters numbers, taking guidance DOWN, AGAIN on operating margin to 2% citing INVENTORY write downs.

Target did note that they expect food/beverage, essentials and beauty categories to show continued strength, while DISCRETIONARY items will CONTINUE to suffer as trends continue to shift AS WE DETAILED LAST MONTH:

“The company cited pressure on the … say it with me again folks … MARGIN; including, but not limited to, higher markdown rates on LOWER-THAN-EXPECTED SALES in the “discretionary category”, increased compensation (i.e., WAGE INFLATION) flowing through as a negative”

We continued:

“Sticky inflation has forced the American consumer to shift their spending AWAY from discretionary goods (i.e., general merchandise) TO necessities (i.e., FOOD) as companies overloaded inventories at extremely high prices and expanded at too rapid a pace. We also know from recent retail sales data that there has been a 37% shift in spending on fuel (gas) as the consumer is now putting the few extra pennies, they have left into their gas tanks”

Which takes on a whole new meaning with gas prices now up 50% YoY as of June 7th, 2022.

Fed Chair Powell must have been having Bloomberg difficulties that day, for that’s screaming slowdown.

We’ve also been talking about the meteoric rise of mortgages (in March, April, and May) and their impact on housing prices as well as what we believe the impact to financial institutions will be given the anemic number of mortgages economically feasible to be refinanced (maybe 3-6%) … and the bleed through continues:

Finding themselves back at April 2020 levels, U.S. MBA Mortgage Purchase Applications came in down -7% WoW, -21% YoY and -31% lower since January (roughly ~6 months). Refi activity literally imploded DOWN -75% YoY (what was that we said about mortgages eligible to be refinanced again?!)

The meteoric rise is making it virtually impossible for non-cash buyers to move, for merely shifting into a like priced home has become unrealistic. In merely borrowing the same principal loan amount, payments have increased by nearly 50% for the average borrower with good credit with the 30-year fixed mortgage rate rising from 3% in December to the current 6.03% (albeit higher for most) …

Stated differently by Gordon Johnson, co-founder of GLJ research, who literally tweeted the below as I worked on this section:

“Using a simple mortgage calculator & considering the 52-week low for the 30yr fixed mortgage is 2.8%, the price of a $400k house at a 30yr fixed 2.8% rate would have to drop to $272.5k (-32%) at today’s 6.03% rate for the payment to stay flat.”

So, it should surprise no one, especially the Chairman of the Federal Reserve, that new home sales were down -16.6% MoM in April … remember data comes in on a lag and things are deteriorating at a much more rapid pace.

Home Builder Lennar ($LEN) released stellar earnings for the second quarter of this year earlier this week (again, rear view mirror driving) … what’s MUCH more important is what their Executive Chairman Stuart Millar just told the world:

“While our second quarter results demonstrate strength and excellent performance throughout the quarter, the weight of a rapid doubling of interest rates over six months, together with accelerated price appreciation, began to drive buyers in many markets to pause and reconsider. We began to see these effects after quarter end.”

“The Fed’s stated determination to curtail inflation through interest rate increases and quantitative tightening have begun to have the desired effect of slowing sales in some markets and stalling price increases across the country. While we believe that there remains a significant shortage of dwellings, and especially workforce housing, in the United States, the relationship between price and interest rates is going through a rebalance.”

First slowly … THEN ALL AT ONCE!

Couple this with the most recent Michigan Consumer Confidence expectations literally registering their lowest reading since 1980 … collapsing -8.2pts from May to a reading of 50.2, with Current Conditions falling -7.9pts from May to 55.4 = RECORD LOW and Expectations (as previously mentioned) down -8.4pts from May to 46.8.

Not to mention the NFIB Small Business Sentiment Forward Outlook hit an ALL-TIME LOW with its 6/14/2022 report, coming in at negative -54?

Please, consider this for just a moment … ALL-TIME LOW, RECORD LOW, LOWEST SINCE 1980; a time frame which encompasses the “Global pandemic”, the GFC (Great Financial Crisis), the Tech bubble bursting, the Long-Term Capital hedge fund failure rocking markets, the Stock Market crash of 1987 (Black Monday) … and your Federal Reserve Barrel Clown Chairman just stood in front of the world and said he sees “no sign of a broader slowdown that I can see in the economy”.

Nope, nothing … what-so-ever … except for the handful of below data points (among others) that ARE ALL DECELERATING AT A PRECIPITOUS PACE showing those who study macro-economics how WEAK both the U.S. consumer and economy are.

- Auto Sales

- Rail Traffic

- Headline Retail Sales

- Retail Sales Control Group

- MBA Mortgage Purchase Index

- NFIB Small Business Optimism

- ISM Manufacturing PMI

- ISM Non-Manufacturing PMI

- PCE Deflator

- Core PCE Deflator

But, eye-catching

Regular readers know we have believed Powell to be full of **it (or outright lying) when discussing any economic data regarding the consumer and/or the economy for some time … he was on the “transitory” inflation train when we told you it was going to be persistently high … ironically, we provided the DATA and were right, he cited “used cars” at the time and was again, abysmally incorrect.

Now he’s telling you that he saw some “eye-catching data” which is why they raised the Federal Funds Rate 75bps rather than 50bps while citing NO DATA. I’m still baffled as to how this unelected clown has so much power and control over the future of our economy?! Moreso, why is anyone continues to believe a word he says (or has their money being managed by anyone who does)?!

Point: but OSAM, you’ve been wrong about inflation … we’re not in a disinflationary/deflationary environment, the CPI is still high!!!

Counter point: we’ve stated numerous times that “topping is a process” … and without question, we are dis-inflating … by CPI standards, NOPE … just by nearly every other measure which includes the majority of data inputs which comprise the CPI.

The best metaphor we can think of is that of a “Sinkhole” which we used in 3Q2020:

Per the USGS (US Geological Survey) a sinkhole is, a depression in the ground where the water has nowhere to go but down. Beneath the subsurface, the groundwater drains through salt beds, gypsum, limestone or other soluble carbonate rock, and the underlying rock is dissolved over time, creating underground caverns and spaces.

So where am I going with this?!

The surface area of the sinkhole is literally the last domino to fall. Water over a period of time washes away the underlying support system. As the erosion creates larger spaces and caverns beneath the surface, the underlying support system degrades until a critical point is reached where a very LARGE, SWIFT and DAMAGING collapse occurs. Nobody notices the problem until the surface collapses.

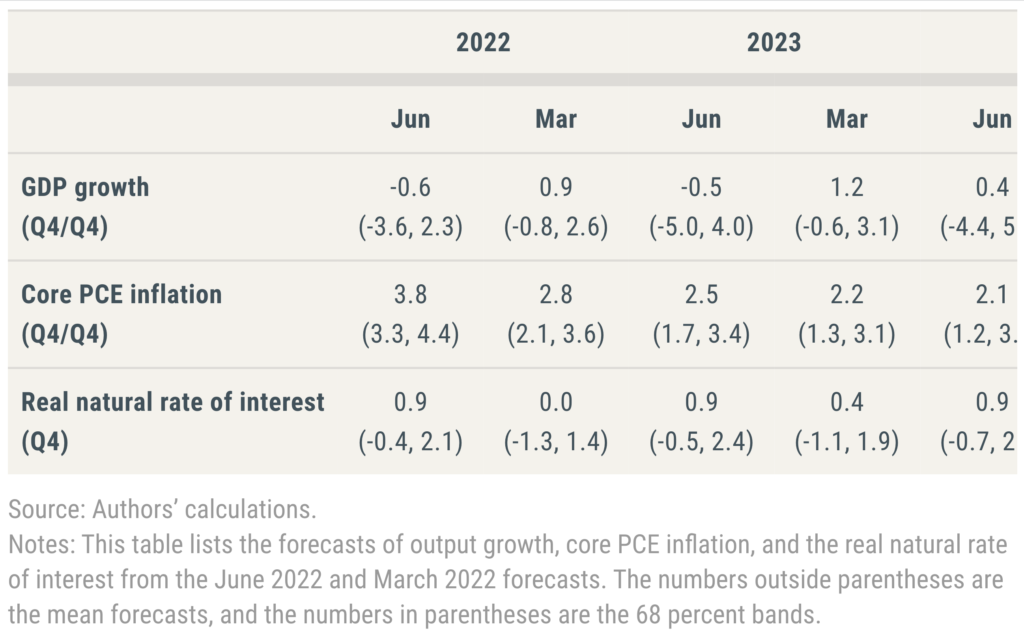

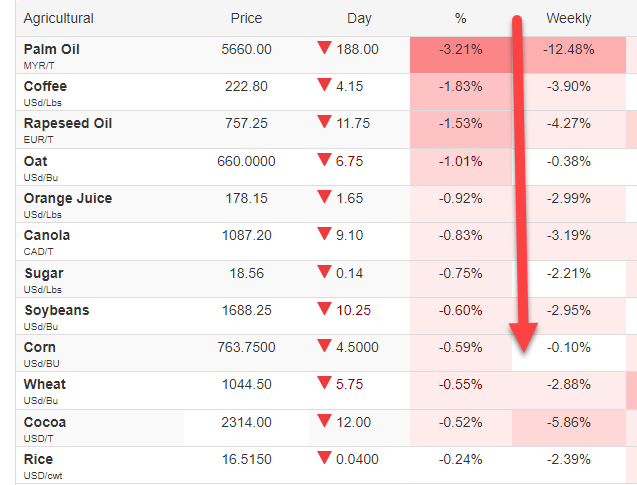

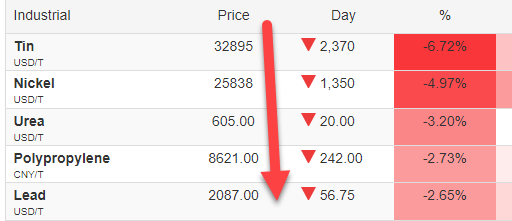

If we use this example in the context of inflation, virtually every raw material which ultimately flows into the CPI calculation at some point, is currently dis-inflating (WITH THE EXCEPTION OF OIL, which has just begun to crack, recently breaking Hedgeye Trade support) … the below images courtesy of Hedgeye CEO Keith McCollough are worth 1000 words … you can find his original tweets here and here…

Last June, when Fed Chair Powell and his fellow barrel clowns were still on the transitory bandwagon, we detailed why the CPI would remain “persistently high”, penning “The Elephant in the Room”, focusing on the SHELTER component for it comprises 33% of the entire index … which had yet to really show up in the data, but it would…

“One of the largest components to the CPI calculation, a subsector of “ALL items less food and energy” is SHELTER; broken down into two components … Rent of primary residence and Owners’ equivalent rent of residence.

Shelter comprises nearly 33% of the CPI …THIRTY THREE PERCENT … and as you can see from the below image, the cost of shelter has recently begun to move higher. For more than a year, the shelter component of the CPI has literally been “sheltered” from massive inflationary pressures for numerous reasons (think government intervention) like rent freezes and eviction moratoriums.”

In suggesting topping is a process, it requires one to not only understand the weighting of each component of the CPI, but also the timing/sequencing of how each lead/lag into the index and how they comp YoY (Year over Year) vs. their respective base affects. (See our February note: It’s not what you look at that matters… It’s what you see)

We’d like to think that we have a fairly solid understanding of the inner working of the CPI … and while I know we mentioned him in last month’s note, few understand the complexity of these dynamics better than Hedgeye partner Josh Steiner (@HedgeyeFIG), who heads up the Financials team and is a key player on the Macro team.

I take zero shame in admitting my growth in understanding these data series comes primarily from his work and the masterful job he’s done teaching those willing to listen.

For example, while housing data, as measured by the Case Shiller National Home Price Index peaked last July/August, history suggests a 12/15-month lead lag before that data shows up in the CPI report; meaning there is still a very high likelihood that the “SHELTER” component of the CPI (representing 33% of the overall index) will continue to provide upward pressure on the primary data point the Fed uses to base its interest rate policy off of. This dynamic could last for another two to four months, so even though housing data is rolling at a precipitous pace as we detailed above, our linear econ academics and Fed Chairman are staring at a high CPI headline number, but not seeing the working mechanics of an ever-changing data point. As we wrote in February, “it’s not what you look at that matters … it’s what you see” Henry David Thoreau

But there’s more! Per Steiner, a 2016 study done by the Kansas City Fed found for every 15% increase YoY in the Shanghai Containerized Freight Index, inflation rose 10bps on 1 year lag … meaning that while shipping has rolled over significantly (China shipping rates to the west coast has seen a RoC (Rate of Change) slowdown from 44% to 25% YoY; China shipping rates to east coast have slowed from 53% to 22% YoY as rates have also collapsed from China to the EU/Mediterranean); due to the lead/lag, we’re another few months from the “shipping” component of the CPI contributing to disinflation in the headline number. Important to note: these shipping rates have dis-inflated in spite of increased fuel costs.

The “Food at home” component is also on a lead/lag of roughly 7-months following the raw material price of the commodity. If you think about intuitively, the life cycle of certain commodities, from seedling to harvest, which is then converted to feed for cattle/hog/chicken or turned into say … cereal … price changes take time to flow through the supply chain.

Oil’s contribution to the CPI flows through much more quickly, it’s either concurrent or on a one-month lag, but given oil’s YoY comps being relatively easy … neither of the two largest contributors to the CPI will be providing much relief for the next few months, affording the Fed very little “cover” to be anything but HAWKISH at their next few meetings (unless they change the way they see the data and attempt to educate the world as we have, on what a topping process looks like?!) Which we doubt, for Powell would rather talk absurdities like “eye-popping” or “Beveridge curve” rather than be educational or truthful.

When we say topping is a process, whether you understand the cycle or not doesn’t change the fact that most all commodities have begun dis-inflating to deflating … with the jury on oil is still out!

So yes, earlier in the year we had believed CPI would have rolled over a little more quickly, to which we’d say: a. we didn’t forecast a war between Russia and Ukraine coupled with b. mind-numbingly absurd energy policy/sanctions from the current administration, yet more importantly … c. markets do change in the second and you must adjust with them. When sailing, should the wind shift, do you just idle or adjust your direction and tack to fill your sail again?!

At the end of the day, the surface beneath the sinkhole has all but collapsed, there are a few supports in place, but they are receding quickly. The surface (CPI) has yet to do so, but it eventually will … all the while, these Barrel clowns are staring at the surface yelling, “see, everything is fine … trust us”.

Sorry, I’m not sorry … I value my life and the financial well-being of my clients more than to trust a bunch of rodeo clowns over the data.

Tweedle Dee & Tweedle Dumb

Of all the high-profile Barrel Clowns out there, we’ve been especially hard on Jamie Dimon, recently quoting him as saying, “the economy is strong”, 10 days before reporting negative -42% YoY earnings miss back in early to mid-April.

Earlier this month he changed his tune (sort of) … (imagine that) … In the world of Jamie Dimon, the economy went from strong, to “a storm is coming”, NOW it’s a hurricane … but he doesn’t “know if it’s a minor one or Superstorm Sandy or Andrew or something like that so you better brace yourself” … all within a few months’ time, and still… he’s full of **it!

I wish I were joking, but I’m not! Recently, at Bernstein’s 38th Annual Strategic Decisions Conference in NY held on June 1st, Dimon spoke, and his words are just mind numbing to listen to. Though, given he’s someone held in such high regard, an entire industry hangs on his every word, as wildly inaccurate as they are (while, again, backed by zero data) … for example:

“huge growth in this country driven by fiscal and monetary stimulation that isn’t a normal recovery OK, and that that fiscal stimulus is still in the pocketbooks of consumers they’re spending it, they’re spending it very strong levels.”

No, it’s not and they’re not… the stimulus is gone, and consumer are literally crashing in real time … as we showed you last month, consumers took revolving credit to record levels and they have done so again in the most recent month’s data set. The only reason you place tens of billions of dollars on high-cost credit cards is because you’re out of cash and you NEED to, not because you want to.

So, much of what Dimon said in the embedded 5-minute clip is misleading, by someone with an obligation to protect investors (we won’t rip through “the why” line by line) … though, in the end, he now has provided himself with a little “CYA” to fall back on given he’s now told investors “to brace themselves”…

“you better brace yourself so, JP Morgan is bracing ourselves and we’re going to be very conservative in our balance sheet, with all this capital uncertainty we’re going to have to take actions and I kind of want to shed non-operating deposits again; which we can do in size … to protect ourselves so we can serve clients in bad times and so that’s the environment we’re dealing with and … I think it’s OK to hope that it will all end up OK, I hope it; that’s my Goldilocks … I hope, but who the hell knows?!” Jamie Dimon, 6/1/2022 Bernstein 38th Annual Strategic Decisions Conference.

Got it … Jamie Dimon is protecting JP Morgan’s balance sheet … THEY are going to be VERY conservative!

And recently, his firm has even taken a “neutral” stance on equities … Mmmm ok, so you’ve sold or trimmed equities and moved to a form of treasury bond proxy for your clients? (bond proxies are down 23% & 28% YTD respectively as measured by $TLT & $ZROZ) … Seriously, what does it mean for their investors and those who follow them?

As a FIRM they have recently stated this::

“with growth slowing and the Fed becoming more hawkish, consumption may soften, particularly if unemployment rises and savings are depleted, but oil prices remain high.”

OK, so a nearly 9 months after we told readers exactly what would happen, when and why, $JPM comes around to “consumption may soften, particularly if unemployment rises and savings are depleted, but oil prices remain high.”

Seriously, this is the best Wall Street has to offer?!

THE FED HAS BEEN HAWKISH, CONSUMPTION IS GETTING OBLITERATED (as we’ve outlined for months now, most recently via $TGT & $WMT + copious data points), UNEMPLOYMENT IS RISING AND OIL PRICES ARE HIGH (and is likely to be the last domino to fall).

They should be embarrassed … and still, what does that mean for their investors or those who hang on their every word?!

At the same time, virtually no one is calling any of these failed Barrel clowns out!

When Rodeo clowns fail

Remember, the barrel clown has two responsibilities: 1. To help protect the bull rider and rodeo clown as the bullfighter works to save the thrown bull rider… and 2. Entertain the crowd.

The rodeo clown has a SINGLE JOB, and that’s to PROTECT the bull rider at all costs, though all too often, they forget what their primary role is and attempt to entertain while FAILING to protect the bull rider.

In our opinion, there’s nothing lower or worse than a failed rodeo clown (bullfighter) and by now you may be wondering who these rodeo clowns are?!

“The press [is] the only tocsin of a nation. [When it] is completely silenced… all means of a general effort [are] taken away.” – Thomas Jefferson to Thomas Cooper, Nov 29, 1802. (*) ME 10:341

Our founders were staunch believers in a free and independent press!

So much so, that through the years, the media had been dubbed “the fourth branch” … as in, the 4th branch of the US government with the belief that their responsibility to inform the populace was essential to maintain a healthy functioning democracy; a profession with responsibility unlike others.

Those with a massive outreach who broadcast nearly 24/7 were once our countries “protectors” … When tasked with interviewing the proverbial “experts”, their duty is to report the factual data, and hold said “experts” to account when they say incredibly absurd things; especially when what’s been said has a high probability of harming the majority of those who don’t know any better.

Their job is NOT to become chummy with or pander to those society brands “the elite”.

There is a reason our founders believed the INDEPENDENCE of press to be imperative. Today, rather than protect hard working American citizens, facts and data are now clouded, blurred, or simply ignored as financial, political, or special interests take precedence … These are your failed Rodeo Clowns!

When Federal Reserve Chairman stepped up to the podium last week and stated, “There’s NO SIGN of a broader slowdown that I can see in the economy”, not a single reporter in the room challenged him. No follow up questions about current housing data or the significant slowdown in consumer spending … no contradictory data provided on the skyrocketing balances on revolving credit carrying with it absurdly high borrowing costs which will cripple average Americans. No one had the stones to flat out say, “Are you feeling ok sir, or have you LOST YOUR MIND?!”

Outside of our firm, Hedgeye and possibly a few others, who have you heard say “LABOR IS A LATE CYCLE INDICATOR”?! From our vantage point, we fall in the extreme minority in calling out of Chairman Powell on his Beveridge Curve idiocy last month and “no signs of a broader slowdown” among other things, this month.

We encourage you to read/listen to Fed Chair Powell’s most recent news conference. Should you, please seriously consider the questions asked by these so called “professional financial journalists” (I use the term professional loosely) … Reuters, the NY Times, CNBC, the WSJ … below are just two examples of the fluff thrown his way:

HOWARD SCHNEIDER, Reuters: Chair Powell, did you feel you boxed yourself in with the language you used at the last press conference on 50 basis point hikes in June and July

JEANNA SMIALEK, New York Times: I guess I wonder if you could describe for us a little bit how you’re deciding how aggressive you need to be. So obviously 75 today, what did 75 achieve that 50 wouldn’t have and why not just go for a full percentage point at some point?

- “boxed” in by your “language”?! … SERIOUSLY???

- what did 75 basis points achieve that 50 wouldn’t have?!

NOTHING … the answer is NOTHING! It wouldn’t have mattered if Powell raised rates by 200 basis points, virtually nothing he or the FOMC did at this meeting would affect next month’s CPI for the very reasons we described throughout this piece regarding lead/lag flowthrough in the primary data points and their methodology used to calculate “inflation” … with this in mind, it’s unlikely we see a dip into the mid 7’s until mid to late-Q3, which should keep the Fed hawkish through September at a minimum.

What it is doing is spiking the cost of capital for everyone from those who need a mortgage, to governments attempting to fund themselves, to corporations big and small … quality credits to junk borrowers! We’ll elaborate on this next month, but it’s something we’ve been discussing for years, describing this specific dynamic in simple terms in our 4Q2018 note which you can read here…

When the FOMC meets in July, CPI will be hot again, same with August … though, they’ll be in Jackson Hole. September we’ll get some slight cooling from shipping and possibly housing, but moderate at best. The Fed’s use of their “blunt tool” is blindly crushing demand that’s already being systematically dismantled and these Rodeo clowns are focused on being “boxed in by language” or why 75bps, rather than the cost of capital and flow through to layoffs & bankruptcies?!

Have you considered if mortgage payments have risen by north of 50%, what’s happened to corporate borrowing? Given the consumer slowdown and now earnings recession, how do you think this will affect margins? Doesn’t take long to get to massive layoffs.

The “journalists” questioning the Fed lobbed a few softballs re: employment/labor, but not a single chirp or push back on any of the clear BS answers Powell provided to the world, which is shameful … and an absolute failure to do their jobs in defending investors.

The same held true when Jamie Dimon said, “the economy is strong”, as well as during the recent interview we’ve cited. No … what does Neutral mean? Have you recommended clients sell equities? Have your analysts cut any securities to SELL ratings, if so, how many?! Or … If you’ve gone neutral on equities, where do you recommend your clients hide during this hurricane?! Have you recommended bonds (which, mind you, are down 22%-28% year to date)?! So much for a place to hide…

What about recommending a minimal amount of short exposure as a hedge? Possibly some exposure to the U.S. Dollar index or GOLD for outside of energy/oil, there are few other assets up this year. What about simply holding SOME cash as older investors who don’t have the time to “hope” things come back, where they can wait out this storm?! Remember, Mr. Dimon’s “Goldilocks” was “HOPE”

“… I think it’s OK to hope that it will all end up OK, I hope it; that’s my Goldilocks … I hope, but who the hell knows?!” Jamie Dimon, 6/1/2022 Bernstein 38th Annual Strategic Decisions Conference.

As we’ve written before, HOPE is NOT a RISK MANAGEMENT PROCESS… at the same time, this conversation from Dimon came on a day where the S&P was down nearly -18% YTD, with the Nasdaq and Russell 2000 down nearly -25%, respectively … and as we type they are now down -24%, -32% & -27% respectively … leading one to wonder, how can the largest U.S bank be so late with these comments?! Are they that poor at economic forecasting?!

Mind you, as we type, we are flattish to up on the year … That is ALPHA!

Ultimately what Jamie Dimon just said was: Dear clients, now that you’re down well in excess of 20%, you should consider risk management … after all, we’ve begun to position ourselves MUCH more conservatively than you, we won’t tell you how to risk manage or what stocks to sell, but good luck. (Forehead meet palm, repetitively)!

And again, no pushback from the Rodeo clowns, just cheerleading from Bloomberg, CNBC or legacy financial media and the likes of Jim Cramer (our primary example as to what a failed Rodeo clown looks like). Cramer is without question, a true clown of epic proportions … zero risk management, zero models, zero macro-awareness (which can be summarized in this single tweet here); just screaming into the TV as his top recommendations get decimated … we await his tears when things get so bad that he begins to cry; begging for the Fed to save markets (just as he’s done in the past).

An independent journalist’s job is to protect the investor, they’ve sadly chosen “ratings” taking on the role of “entertainer”.

Do you remember my opening quote? “Time For Jay to go hard! 100 BPS” @jimcramer 6.10.22. If he knew anything about macro-economics and understood the data, he’d know 50, 75 nor 100bps matter to anything but to asset prices, which will continue to get pummeled even harder and cost of capital, which will lead to layoffs and bankruptcies. All while he buys for his family trust and investing club followers, Uh, good luck!

Again:

“when a rider has been injured, in which case the rodeo clown places himself between the bull and the rider or uses techniques such as running off at an angle, throwing a hat, or shouting, so that the injured rider can exit the ring.”

The Rodeo clown literally jumps into harm’s way, positioning themselves between the thrown riders and a 2000lb angry animal looking to kill … they use many different techniques to PROTECT THE INJURED RIDER … that is what true journalists should be doing for you, THE RETAIL INVESTOR whose entire life’s savings is at risk.

Raoul Pal of Real Vision is another failed Rodeo Clown, turning Real Vision from a refreshing visionary platform into an all-out crypto pump stage.

When industry veterans say things like, “I am irresponsibly long $ETH [Ethereum]” or “These are near risk free returns” knowing investors would follow … it’s reprehensible! He knew full well and good that given his reach and audience he had a responsibility to be more prudent.

And when these Rodeo clowns in the financial industry do fail to do their jobs, financial ruin is without question correlated with actual death … given the recent carnage in crypto, meme stocks, SAAS, small cap Russell names combined with the HODL (Hold On for Dear Life) mantra, people have watched 60-100% of their assets wiped away … in some cases, overnight!

Suicide hotlines have shown up on Crypto Reddit boards with more and more headlines like this showing up in mainstream news outlets:

- Crypto investors contemplate SUICIDE with prices crashing as top finance experts issuing an urgent warning: ‘Don’t buy this dip – you’ll lose a lot more money’

- CRYPTO BROS ARE NOW ON THE FRONTLINES OF A FULL-BLOWN MENTAL HEALTH CRISIS

Don’t let the headlines fool you, it’s not just crypto that’s got people contemplating what should be unthinkable. Should you know anyone in this situation, please, don’t ever be afraid to reach out for help…

The National Suicide Prevention is available 24 hours a day, to both English and Spanish speakers! Their phone number is 800-273-8255

There was once a time when the proverbial financial Rodeo clowns took their jobs seriously. A time when they weren’t beholden to the marketing/advertising dollars of Wall Street. As a kid, I remember watching “Wall Street Week” hosted by Louis Rukeyser, where facts and data were reported and a prudent approach to investing was preached.

Unfortunately, after 20+ years of Federal Reserve bail outs, the Rodeo clowns have become confabulators … buying into their own BS and lies! It’s truly been a shame to watch unfold over the years.

Final Thoughts

“The liberty of the press is essential to the security of the state.” – John Adams

Liberty of the press isn’t just essential to the security of the state, it’s essential to much more from your own personal health, to in this case, you’re financial well-being.

The media has an obligation to protect the public and it’s about time we demand full transparency and accountability.

Investors have a right to know where conflicts of interest lie and what major corporation is funding the salaries of those in front of the camera … and until things change, our advice would be simple:

- Don’t trust your hard-earned capital with a bunch of failed clowns proven consistently wrong!

- Don’t place trust in your friend/neighbor “advisor” who regurgitates their narrative (NO, NOT EVERYONE IS GETTING SMOKED BECAUSE THE “MARKETS ARE”) … and finally

- TRUST THE DATA … at the same time, you better educate yourself on how to better understand it … you have a responsibility, too.

–When the President states: “there’s nothing inevitable about a recession” (because he was talking with Larry Summers … please, pay it no mind.

–When Powell declares: “There’s no sign of a broader slowdown that I can see in the economy”, it should raise eyebrows!

–When Treasury Secretary Yellen touts: that most economists do not believe the U.S. will enter a recession because they are considering “unique” post pandemic economic features, just remember this:

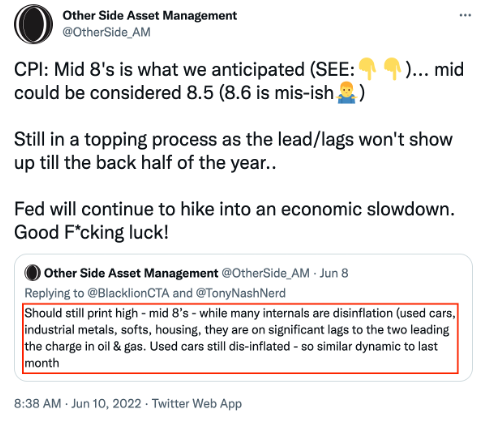

51 out of 51 economists predicted a headline CPI estimate for May that was BELOW the actual reported number! At the same time, we tweeted the below on June 10th, immediately follow the most recent CPI release:

“After 26 years, I still consider myself to be a knucklehead just trying to get better every day … and I was closer than the 51 economists…” OSAM 6/10/2022

How could we say such a thing?!

Because we told our twitter followers on June 8th our exact thoughts and why (note the similar tone to that tweet as found in this monthly).

We are by no means perfect, though following the data and utilizing the absolute best independent “bean counters” in the financial industry in that of Hedgeye, has without question kept us exponentially more accurate and ahead of the many highly touted “experts” our failed Rodeo clowns have you listening to.

As for the data, per Hedgeye, we are probabilistically to remain in a disinflationary/deflationary investing environment through 1Q23, and while things can always change, the Fed can reverse course, credit markets can outright break; we will follow market signals … as CHEAP can get CHEAPER and valuations can further deteriorate as Wall Street begins to slash earnings estimates … which we believe to be inevitable!

Just as $TGT (Target) preannounced next quarter’s earnings a mere 3 weeks after releasing their most recent quarter, countless others will have to follow in suit. Wall Street estimates will come down and inflation will also remain persistently high. Regardless of what the Fed does at their next few meetings, given how they “interpret data” (fly by the seat of their pants), they will most likely remain hawkish … until something breaks; credit, MBS, High Yield fixed income, ETF structure, counter party risk, I simply don’t know, but I’m fairly certain most are ill prepared for what’s to come.

Too many people have told me we’ve bottomed, and they are thinking about buying. While we’ll stick with the data, anecdotally, the time to buy … is typically when NO ONE WANTS TO BUY ANYTHING.

For years we’ve written about the blunders of the Fed and for the last 9 months we’ve been detailing the current grave mistake our Fed is now making; they are aggressively tightening into an economic slowdown; a GLOBAL economic slowdown.

In our opinion, this is not the time to be a hero, not the time to get cute … we are not being alarmist in saying, batten down the hatches as risk happens slowly … then all at once! We believe the current decline in markets to be tepid relative to what is likely yet to come.

Managing risk is NOT easy, it’s a serious business, we urge you to not leave your fate in the hands of a bunch of clowns!

Stay nimble – risk manage appropriately.

Good Investing!!

M

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.