In This Article

My poems—I should suppose everybody’s poems—are allset to trip the reader head foremost into the boundless.Ever since infancy I have had the habit of leaving myblocks, carts, chairs, and such like ordinaries where peoplewould be pretty sure to fall forward over them in the dark.Forward, you understand, and in the dark. Robert Frost to Leonidas W. Payne, Jr.,November 1, 1927 (Robert Frost in Context pg. 59)

Two Roads

In 1915 Robert Frost sends what would be the first, in an exchange of multiple letters to his friend and powerful literary thinker at the time, Edward Thomas; a poem titled, Two Roads.

It’s clear from the words exchanged between the two, Thomas was a bit unclear of the meaning in Frost’s words… As irony typically works, it was Thomas and his indecisiveness on long walks with his friend, Frost, that inspired the eventual masterpiece … though, even after exchanging these notes discussing, clarifying, Frost still had friend “in the dark” and confused as to their true meaning.

So, it should be no surprise to readers that their interpretation of Frost’s words may not be as cut and dry as they seem (or were taught)?!

To this day, routine internet searches to notable poetic critics often refer to the piece based off of its more memorable conclusion, citing the work as, “The Road Less Traveled”:

“Two roads diverged in a wood, and I — I took the one less traveled by, And that has made all the difference.”

And yet, the title of the piece is neither “The Road less traveled”, nor Frost’s original, “Two Roads”.

One can understand such powerful imagery can surely bring us each to a point in time in which we were all faced with a decision that could change the trajectory of our lives. And while the aforementioned line is one of the most memorable Frost has written … The piece, when read in its entirety, should leave the inquisitive puzzled, with more questions than answers.

Why? Frost was deliberate in changing the poems title from “Two Roads” to “The Road NOT Taken”, it was a conscious decision after the letters he exchanged with Thomas. The reader’s attention is drawn to, “the one less traveled by”, but the title points to what’s not done, or which road is “NOT taken”, which is less frequently discussed.

Princeton academic, Pulitzer winner and Frost historian, Lawrance Thompson suggests it was “Thomas’s habit of “regretting” the paths he and Frost took during their long walks throughout the countryside” … or “crying over what might have been” that influenced the piece.

While Harvard Scholar and Frost biographer, Mark Richardson has noted:

Which road, after all, is the road “not taken”? Is it the one the speaker takes, which, according to his last description of it, is “less travelled” – that is to say, not taken by others? Or does the title refer to the supposedly better-travelled road that the speaker himself fails to take? Precisely who is not doing the taking?

Intentional or not, Frost juxtaposed two visions — two possible poems for the reader, from its onset. As poetry columnist for the NY Times, David Orr writes:

“The first is the poem that readers think of as “The Road Less Traveled,” in which the speaker is quietly congratulating himself for taking an uncommon path (that is, a path not taken by others). The second is the parodic poem that Frost himself claimed to have originally had in mind, in which the dominant tone is one of self-dramatizing regret (over the path not taken by the speaker). These two potential poems revolve around each other, separating and overlapping like clouds in a way that leaves neither reading perfectly visible. If this is what Frost meant to do, then it’s reasonable to wonder if, as Thomas suggested, he may have outsmarted himself in addition to casual readers.”

Frost deliberately leaves inquisitive readers and literary academics in the dark, exactly as he explained to Leonidas Payne in 1927 (see: opening quote).

Volumes of words have been written on this very poem, and it’s not our place to solve Frost’s riddle today. Though, what struck us as pertinent given current times is the simplicity of the surface read, should never overshadow the less obvious, often deeper questions.

While this poem might appear simple with an initial read, as you can see, deeper thoughts lay beneath the surface and the driver of today’s thoughts.

“Two roads diverged in a wood, and I — I took the one less traveled by, And that has made all the difference.”

Two roads are definitely diverging in markets … and while Frost may have purposely left readers falling forward, “in the dark”, our goal is to pierce that veil of darkness with light making the path of choice clear, one which, unlike Thomas, will leave us with few regrets.

Darkness

“My poems—I should suppose everybody’s poems—are all set to trip the reader head foremost into the boundless.” Robert Frost

A wordsmith can and will find multiple ways to say the same thing, “trip(ping) the reader head foremost into the boundless”, “to fall forward … Forward, you understand, and in the dark”. Some, myself included, might suggest that Frost’s goal was simply to get people to think!? To examine and approach a scenario from as many angles as possible.

As the poem goes:

And be one traveler, long I stood

And looked down one as far as I could

To where it bent in the undergrowth.

Then took the other, as just as fair,

And having perhaps the better claim,

Because it was grassy and wanted wear;

Not a day goes by in financial markets when we’re not faced with an important “choice”, and most frequently, as Frost’s traveler notes, multiple paths can appear equally as “fair”. I’d argue, without exaggeration, there has never been a time over the course of my 26 years in markets, proper risk management has ever been more important, given an economic/market outlook so dire.

A cavalier glance down each road to check on some “underbrush” nor choosing a path “because it was grassy and wanted wear” isn’t going to cut it when it comes to protecting generational wealth. Our current situation is a “leave no stone unturned” scenario … so let’s get started.

Today’s narrative, or darkness Wall Street spews in an effort to pull the wool over the eyes of the average investor, are few, simple, linear, and often contradictory.

For instance, the same “experts” that never saw our current Bear Market coming, are the very same people who are now suggesting it’s over. There answer as to why? because equity market prices have recently bounced. I want you to think long and hard about this popular belief … because markets “recovered” an arbitrary percentage off their June lows, the bear market is over?! (Palm meet forehead)

Here’s another one: because the data is … wait for it … deteriorating so badly, that the Fed will have no choice but to “pivot” and cut rates (the classic, the Fed will save us argument).

One more: because “peak inflation” (again, the “transitory” inflation that none of these people ever saw coming) is now rolling over (seriously folks, you just can’t make this stuff up) … because … because … because … these people do nothing but tell stories and prey on your emotions.

How’s this for emotion?! From investor.com: “A Dovish Powell Could Set Stage for Stocks to Erase All Losses by Year-End”. I challenge you to read the article, it’s painful; no facts, no data, nothing but conjecture and hope. And hope if not a risk management strategy.

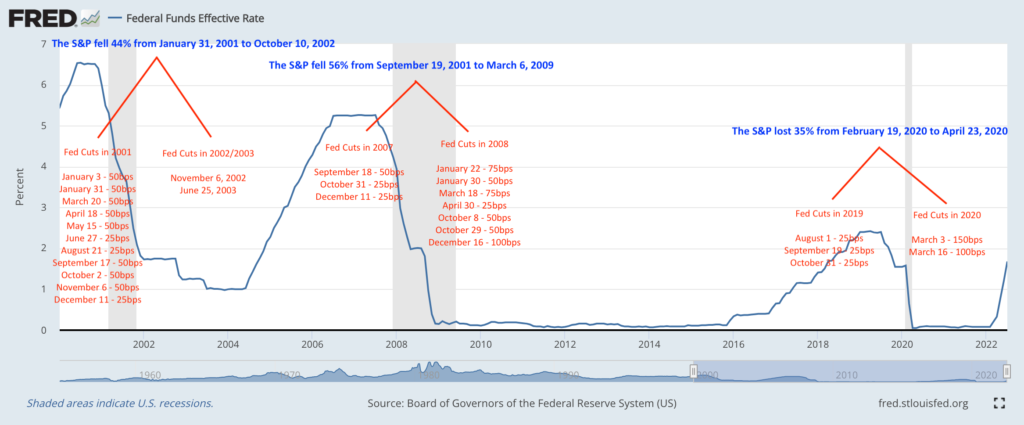

If investor.com were interested in sharing facts, you’d think they would have mentioned the largest of equity drawdowns (CRASHES) have occurred AFTER the Fed had begun cutting rates (i.e., gone “dovish”). Cutting rates is an acknowledgement that the economy, as measured by growth and inflation are simultaneously DECELERATING and the economy is either already in, or heading into recession (the severity of which, TBD)

While a dovish pivot “might” be perceived as bullish while algorithms chase charts, cutting rates alone is NOT BULLISH, it’s BEARISH! This held true in 2001/02, 2007/09 & 2020.

The WSJ just penning this recent doozey: “The Nasdaq Composite Is Back in a Bull Market: The tech-focused index has risen more than 20% since mid-June but is still down 18% this year”

What the Journal, and the countless other rodeo clowns conveniently omit is that 23% happens to be the historical average bear market rally, but again … FACTS?!

While we are always cautious of historical analogs, it’s still extremely important to both, be mindful of and understand them.

Ironically, this bit of information didn’t slip by famed investor, Michael Burry of Scion Capital, known for his epic investments made during the Great Financial Crisis as he noted 8/12/2022 on twitter:

“Nasdaq now up 23% off it’s low. Congratulations, we now have the average bear market rally. Across 26 bear market rallies from 1929-1932 and 2000-2002, the average is 23%. After 2000 there were two 40%+ bear market rallies and one 50%+ rally before the market bottomed.”

Mind you … as we publish the Nasdaq has again sold off back below -21.8% on the year.

Revisiting a simple question

Long time readers know that our overall market thesis and positioning are both driven by the data, for while Frost believed all poems should “trip the reader” or in his case keep readers “fall(ing) forward over them, in the dark”, we’d consider the data to be the light piercing the darkness, removing the wool from your eyes.

Given the overall tone of this note, upon completion, readers could very well put it down with the belief that we’re omitting or cherry-picking positive data points in an effort to make things appear “worse” than they actually are, that’s how lopsided the data is.

We’re approaching this note with a hypersensitivity to this thought. Sadly, there truly just isn’t much to any positive data to speak of); it’s anemic. At the same time, there is literally too much negative data to share in a single note without losing your attention, so we’re consciously disproportionately filtering the amount of decelerating data, trying not to exclude what’s extremely pertinent.

In 2Q2017 I asked 100 friends and colleagues a simple question

What is the primary fuel, which makes our economy function – the single, key item or “driving force” necessary for the U.S. economy to function?

Our answer to this question remains the same today as it did back then … as we wrote:

I’m speaking about the dynamic between CREDIT and DEBT! The Credit/Debt dynamic is without question, THE PRIMARY driving force behind our economy; without credit, the vast majority of American consumers wouldn’t be able to spend a fraction of what they do. The instant an item is purchased on credit, an immediate debt is created. We could argue the semantics as to whether or not we’re discussing two separate items, but it’s nothing more than a chicken or the egg scenario; without being approved to assume the debt, the credit isn’t extended, once an item is purchased with credit, the debt is immediately created. This dynamic is the lighter fluid on the U.S economy’s campfire.

Understanding the credit/debt dynamic has never been more pertinent given the current state of the U.S. economy.

When credit is flowing and money can be easily accessed, people spend igniting the economy ignites on fire. When lending institutions tighten and pull credit lines; when money is less accessible, the flames extinguish.

Late September, we told you the U.S. consumer would be hitting a spending wall in 2Q2022. We’ve been updating readers on the deteriorating data ever since, reminding them, cycles take time and topping is a process.

Habitual readers have definitely heard us echo the words of Hedgeye CEO Keith McCullough when he says, first things happen slowly, then all at once … and we now find ourselves at a pivotal juncture, for first consumers run out of discretionary cash, they then tap their savings accounts, followed by maxing out HELOCs and credit cards (which we’ve been writing about recently); finally, we get to the point where BANKS REIN IN CREDIT by tightening lending standards, while simultaneously pulling credit lines altogether.

Which is happening, now … abruptly!

How do we know?!

The Federal Reserve just told us in their most recent quarterly Senior Loan Officer Survey published at the end of July.

The Federal Reserve reaches out to Senior loan officers at financial institutions across the country asking 3 primary questions in regard to ALL types of lending: C&I (Commercial and Industrial), CRE (Commercial Real Estate), RRE (Residential Real Estate), Consumer lending, etc.

The question asked are: 1. Are you tightening lending standards? 2. Are you increasing spreads? 3. Are you seeing stronger demand?

Per the Report:

The July 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the second quarter of 2022

The results were stark, showing a massive change in tone in credit underwriting and financial conditions across ALL credit lines. More telling, the data was collected from early to late June, so it’s fresh. Here are some details from the C&I lending section:

Major net shares of banks that reported having tightened standards or terms cited a less favorable or more uncertain economic outlook, the worsening of industry-specific problems, and reduced tolerance for risk as important reasons for doing so. Significant net shares of banks also cited decreased liquidity in the secondary market for C&I loans, increased concerns about the effects of legislative changes, supervisory actions, or changes in accounting standards, and less aggressive competition from other banks or nonbank lenders as important reasons for tightening lending standards and terms.

Again, while the above quote is specific to C&I lending, the results were notably similar for lending across the board (feel free to fact check us).

What’s more troublesome, as noted by Hedgeye Financials sector Head/Macro team member Josh Steiner on “The Hedgeye Call” from August 2nd:

“When 2 of those 3 (the questions asked) have inflected to net tightening conditions, you’ve had a recession every time shortly thereafter. In all cases, we’re seeing this here … a massive increase in the net percentage of firms tightening standards”

Ironically, as financial institutions are tightening, loan demand remains strong … any guesses as to why?

We’d argue, with capital markets virtually closed, businesses are attempting to draw down whatever cash is available to them; just as consumers are:

major net shares of banks reported weaker demand for all RRE loans over the second quarter, except for HELOCs, for which a significant net share of banks reported stronger demand

For those unaware, HELOCs = (Home Equity Lines of Credit), meaning individuals are attempting to gain access to whatever capital they can, and quickly but access to these lines is being shut off at a precipitous pace.

A tightening of credit/lending standards exacerbates the challenges facing a U.S consumer already in shambles as the dynamic is a cascading one that flows into countless other facets of the economy.

The Consumer

With this in mind, the depressed psyche of the U.S. consumer should surprise NOBODY.

U.S. July Consumer Confidence saw another deceleration to 95.7 vs. 98.4 in June, this was the 3rd monthly decline in a row, registering a 17th month LOW, as the University of Michigan Consumer Confidence survey recently decelerated to an all-time low of 47.

U.S. July Retail Sales came in at +0.0% MoM, which is another deceleration from June at +0.2% MoM.

We said we’d be as fair with the data as possible, so we’ll note some have attempted to argue the mild MoM deceleration in this retail sales data as an incremental positive, suggesting the consumer hasn’t outright crashed. We’d note:

1. That’s narrative, the data is the data and it decelerated … again. At the same time

2. Retail sales were up +10.3% YoY, BUT roughly 1/3 of that being spent on gasoline sales, which were up +39.9% YoY, food and e-commerce business attributing to the balance of the increase spend.

Our read through would be, the consumer is leveraged to the hilt (noting the hockey stick borrowing on credit cards) with any available discretionary money primarily being absorbed by the inflationary pressures of gas prices and food at home (among other things), with minimal discretionary spending, trying to take advantage of some deals via: Amazon’s uncharacteristic Prime day in July (of course Amazon is attempting to burn off some of that obnoxiously large, excess inventory the same as nearly everything at Costco clothing wise is $14.97 … retailers are stuffed with inventory). Leading us to:

3. “Yet”, the consumer hasn’t outright crashed … “YET”!

In late July AT&T ($T) told the world an alarming rate of consumers couldn’t pay their cell phone bills and we noted here. Currently, 20 MILLION people are behind on their ENERGY BILLS and facing shut offs (and the number is growing every single day).

The consumer is choking, those who can tap HELOCs are attempting to do so, others are max’ing out their credit cards … and we haven’t even discussed cars purchased during the pandemic now being repossessed at an exponential pace! Remind me how strong is the consumer, again?!

If you have an hour, we recommend you listen to Quill Intelligence and former Federal Reserve insider, Danielle DiMartino Booth interview car guru Lucky Lopez, it will blow your mind.

As the health of the consumer goes … so goes the economy and currently the consumer ill, very ill.

Housing

Plans of large purchases like cars, washing machines, refrigerators; more importantly … HOUSES, have been placed on hold by many.

Unfortunately, U.S. households tend to calculate “affordability” based off of monthly payments. With mortgage rates exponentially higher than where they were in December, the U.S. housing market continues to slow.

U.S. June New Home Sales fell to 590K, down roughly -8.1% from May registering their lowest reading since April 2020. June Pending Home Sales also decelerated, coming in at -8.6% MoM vs. +0.4% MoM in May.

With mortgage rates as elevated as they are, and recession looming, MBA Mortgage Applications fell again for the 4th sequential week, touching its lowest level since February 2020 and the U.S. August NAHB Housing Market Index also dropped to a contractionary level of 49 vs 55 in July.

The NAR’s (National Association of Realtors) most recently released data on existing home sales for July. It should be no shocker that it fell for its sixth consecutive month to a “seasonally adjusted annual rate of 4.81 million.” Down nearly 6% MoM and 20% YoY.

Adding insult to injury, recent data released from Redfin showed houses under contract cancellations balloon up to 16.1%, dare we say again, they highest level since April 2020, which as a bit of an anomaly of a year considering, well … they shutdown of the world due to covid?!

U.S. housing starts provided more data detailing the deceleration in housing markets slowing to -9.6% MoM and -8.1% YoY with single family starts decelerating at a more rapid pace of -10.1% MoM and -18.5% YoY … and while Phoenix isn’t “THE housing market”, it’s likely to be another “canary in the coal mine” with July registering the second lowest home loan closings EVER with Average prices falling -7.4% MoM (a great call out by @GRomePow)

AGAIN, THERE ARE SIGNS OF THE CONSUMER RUNNING OUT OF MONEY EVERYWHERE.

We’ve been trying to get investors to think of the adverse knock on effects of the housing market and slowing consumer for nearly 8/9 months, here were some questions we posed back in MARCH, at the same time, the conclusion is as accurate as it gets.

As 30-year fixed mortgage rates just spiked to a 4.66% average making the average house roughly 13-15% LESS affordable than last year as most home buyers determine purchase price based off what monthly payment they can afford; begging the questions:

◦ Who’s going to be refinancing homes at these levels?!

◦ Who is left to refinance with rates being so low for so long?

◦ How will this move in rates affect borrowing via home equity lines?!

◦ And more importantly, how large of an impact will this have on housing prices?!

All of this leads to a slowdown in spending!”

Which is exactly what we’re seeing; A slowdown in spending “cascades” into a slowdown in purchasing, resulting in a deceleration in manufacturing (this is what we mean by a cascading affect – the economy all flows together – it just takes time).

Most recent US manufacturing PMI data came in with a reading of 52.8 (again, another data point registering its lowest reading since 2020). New Orders came in at 49.2 (below 50 being contractionary), but U.S. New Orders going contractionary is consistent with the “Recession is Global” discussion we had last month.

New orders are also a leading indicator as it’s a clear-cut indicator that businesses are slowing down due to lack of demand.

July U.S. ISM Manufacturing PMI decelerated slightly coming in at 52.8 vs. June’s 53.0, AGAIN, another data point hitting its lowest level since June 2020. At the same time, this report also indicated that inventories came in at a multi-decade high with a reading of 57.

We’ve been discussing this problem for months now … over bloated inventories + a consumer on life support = VERY BAD (technical term), this theme was again validated mid-August with retail sales and U.S. business inventories for June coming in on the same day which showed us:

U.S. July Retail Sales coming in at +0.0% MoM, a deceleration from June at +0.2% MoM, while June U.S. business inventories were up +1.4% MoM and +18.5% YoY. With the stars aligning providing further confirmation, retail behemoth Target ($TGT) reported earnings on the very same day showing their inventories up +36% YoY; consistent readers will note we warned about $TGT back in both May and June.

As if the above isn’t “telling” enough: August’s Empire State Manufacturing data literally just fell off a cliff registering a negative -31.3, falling an eyepopping, jaw dropping -42-point drop from the previous month’s report, placing it firmly amongst levels seen in previous recessions.

As Daryl Jones of Hedgeye recently observed:

“the survey was taken between August 2nd and August 9th, so very recent responses … both orders and shipments led the drop at -26 and -50 points, respectively; Prices paid dropped to 5.5, which is the lowest level in more than a year”

All of this is simply devastating to:

Small businesses

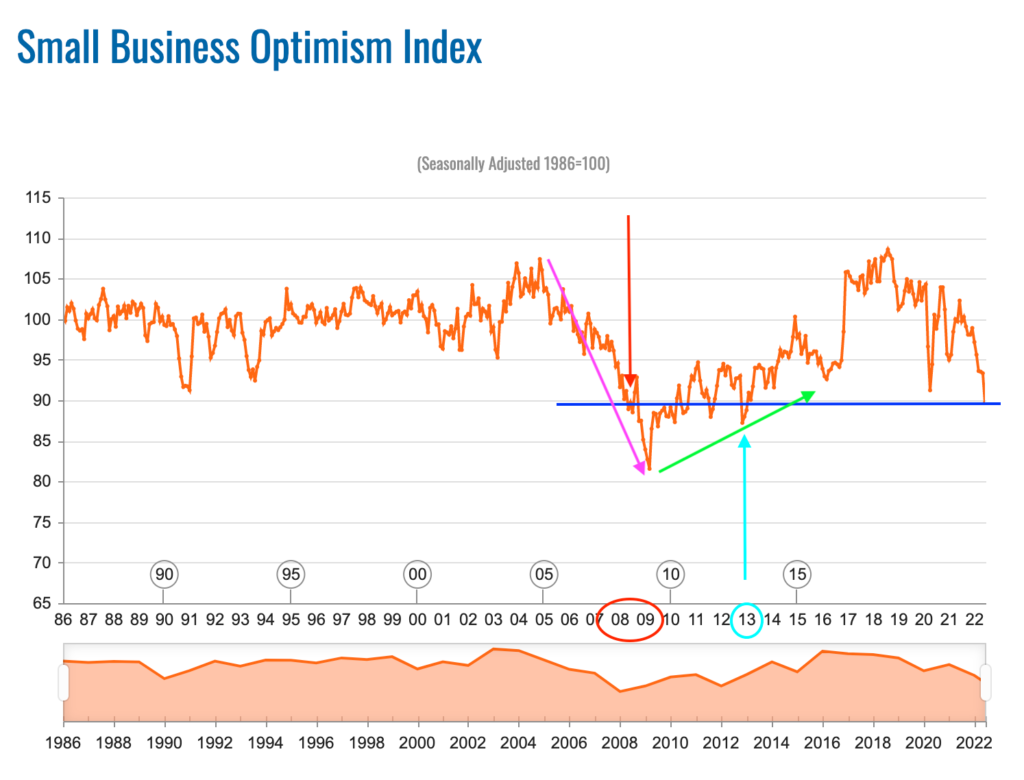

“Small businesses have been foreshadowing this pain. We’ve been detailing the deterioration in the NFIB small business confidence data series for some time as it continues to plummet …

The NFIB small business sentiment Forward Outlook is an even more telling indicator, as it measures the optimism (or lack thereof) of the small business owner looking forward by 6 months. This data series just hit ANOTHER NEW ALL-TIME LOW …

Small businesses have a difficult time navigating significant input cost changes. Large increases to raw materials, wage inflation, interest expense on debt, etc., all leads to margin compression and ultimately layoffs.”

So, with a consumer on life support and small businesses dying on the vine, it should again surprise no one that the small businesses optimism index just dropped to 89.68 from 93.33 MoM: forward expectations are BLEAK.

This reading represents a 9 1/2 year low; January 2013 being the last time expectations touched this level. Having said this, the last time expectations were decelerating to these levels was just PRIOR to the GFC (April/May/June of 2008).

Subsequently, it took nearly 5 years of further deterioration of the data and “recovery” just to get BACK to these levels. We’re still decelerating … more pain ahead is the statistically probable outcome.

Small business earnings are also down 25% with actual trailing 3-month earnings trends at levels only seen 3 times since the data series began in 1986; 1991/92, the implosion of the tech bubble from 2001/03, and the GFC 2007/09.

Stated differently, small business earnings are already registering recessionary conditions with expected sales over the next 3 months also at levels not seen since the GFC.

Small businesses literally account for nearly 99% of all businesses in the United States?! The economy is a living, breathing thing and when part of it is sick, it’s always contagious.

Leading us to what we believed would be the case on the growth (or lack thereof) side of the equation back in our 4Q2022 note published in January, reiterating in February:

“you should anticipate that GDP will get scalped from roughly 7% to 1-2% (as we explained last month)”

In both notes, and subsequently thereafter, we have attempted to painstakingly detail why. To date, we’ve been fairly accurate … Q2 U.S. GDP came in at NEGATIVE -0.9% QoQ, well below consensus of +0.8% and the second quarter of sequential deceleration. In most worlds, this would qualify as a “recession”, though apparently not in the world of our current administration who has recently attempted to change its definition. (I guess if you pretend it’s not, it’s not?!)

As the consumer struggles, credit tightens (fewer mortgages are originated/refinanced), the housing market significantly weakens, credit tightens further (home equity lines are pulled or reduced as there is less “equity” in homes), manufacturing softens, new orders shrink, small businesses struggle leading to the latest of cycle indicators:

Layoffs

We are not going to belabor this topic, anyone who has read our work over the last 8 months knows we’ve been very staunch in saying, “labor is late cycle”. We have been highly critical of the Federal Reserve’s cavalier and irresponsible stance in referring to JOLTS data and the Beveridge curve as signs of strength, which we’ve previously addressed here and more recently, here.

Today we’ll make a few brief, but salient points re: labor/layoffs.

The list of companies now firing employees continues to grow. Just last week, Shopify $SHOP announced intentions to layoff 10% of its global workforce. Microsoft $MSFT, Oracle $ORCL, Groupon $GRPN, Robinhood $HOOD, Peloton $PTON, Walmart $WMT … the list is becoming a very, very long one, but more importantly:

- Apple $AAPL recently announced they are laying off more than 100 of their contract-based recruiters. These are the individuals responsible for hiring new employees. This move speaks volumes to us, for recruiters fill a pipeline and similar to when an oil well is closed, it can’t just be turned back on like a light switch. It takes quite a bit of time, money, and resources to get it operating again. So not only is $AAPL cutting head count, but they’re also telling you they won’t begin to rehire for quite some time.

- Ford $F just announced they would be laying off 3,000 employees to “cut costs” and pay for “EV” transition. The reality is they’d have to cut them regardless due to the consumer slowdown, but meh… #FACTS vs. #Narrative

- A recent survey from Big Four accounting/audit/consulting firm PwC (Price, Waterhouse, Coopers) found that 52% of executives and board members polled said that they were “REDUCING HEADCOUNT OR PLANNED TO”

More than HALF the companies PwC polled are either FIRING or are PLANNING TO.

We’ve been telling you the layoffs were coming, there aren’t many times we wished we were wrong; this is one of those time. Unfortunately, we’re not.

Consumers, at an alarming rate can’t pay phone bills, energy bills, car loans and this is before they’re losing their jobs. What happens then?! How will they pay their mortgages?! Or BUY FOOD?!

We weren’t kidding in June when we said,

“when these Rodeo clowns in the financial industry fail to do their jobs, financial ruin is without question correlated with actual death”

Shades of Grey

If you NEED to search for silver linings or shades of grey, here they are:

The most recent Durables Goods Orders came in at +1.9% MoM, accelerating (albeit mildly) to +10.9% YoY.

The rub here is excluding defense and transports the data came in -2.1% MoM, decelerating 290 bps to +4.6% YoY. so, basically … aside from supplying a war that’s not ours, the rest of the economy looked like crap (again, technical term) … I guess war can be good for someone?!

Additionally, U.S. Redbook Weekly Retail Sales came in at +12.7% YoY, which is also an acceleration off the previous week’s +10.7%

ISM Services PMI and Markit Service PMI for July provided us with conflicting data, but still, the data is the data and the collective, as a whole, is what we follow.

- Point: while the ISM services report did accelerate to 56.7, bouncing slightly off of June’s 55.3 reading.

- Counterpoint: the Markit service PMI report saw a deceleration to 47.3 from 52.7 in June registering its lowest reading in two years

And finally, July U.S. Small Business Index ticked up slightly to 89.9, from 89.5 in June, an incremental positive, but as we noted above in the small business section, small business data is already recessionary.

This is it … this is all the data that we could find that has the potential to be construed as “positive”. Aside from ISM services being the anomaly, we argue the good isn’t … good.

If you haven’t noticed yet, nearly all data points within this note fall into the “lowest since the 2020 pandemic” or “all-time lows” category. Eventually, as is typical with markets, you’re likely to get some form of a bounce off of all-time or cycle lows. The question becomes, what then?!

Outside of 5 bullet points, of which 2 are contradictory and one is barely an acceleration off recent cycle lows, the rest of these pages are filled with mathematically factual decelerating data.

These aren’t the signs of a new bull market. It should be fairly clear which ROAD SHOULD NOT BE TAKEN AND WHY!

A thought on CPI

Peak inflation is in, congratulations … welcome to the party Jim Cramer, glad everyone can finally see it. The market’s been discounting it for 6 months and as we told you 3 months ago:

At the same time, the deceleration in other material inputs on lags such asl, agricultural products like corn and wheat, industrial metals like copper and housing, coupled with more difficult YoY comps (base affects) will start to kick in making the disinflation to deflation more visible over the next quarter or two.

With this in mind, let’s review what the Fed’s 2 primary mandates are. #1 is headline CPI with #2 being employment.

First things first, headline CPI should REMAIN north of 8 for the next 2 to 3 months, high 7’s being your best case; definitely NOT “firmly on its way to 2%” as Powell has stated … Why?!

While the collapse in housing data (discussed above) continues to be a negative for growth (GDP), given its 12–15-month lead lag into CPI (discussed in previous notes), with U.S. May Case-Shiller home prices being up +1.5% MoM and +18.3% YoY, it is highly probable this data will offset what any recent price decline in Oil is likely to take away. SHELTER, which again comprises 33% of the total number, should keep headline CPI elevated for a few more months at a minimum.

Back to Labor, which again, is the latest of late cycle … while layoffs have begun, it hasn’t done so in a meaningful way.

So, let’s discuss the Fed’s “dovish pivot” narrative again … better yet, let’s share the recent opinion of former NY Fed President William Dudley (2009-2018). I caveat the below with a. I don’t trust Dudley as far as I could throw him b. I am sure there is political jockeying and animosity amongst other Fed officials, bringing me back to point a. c. I’m not sure how much of what Dudley said, that he himself believes? leading us to d. everything he’s saying echo’s what we’ve mapped out for some time. (I would encourage you to listen to this brief interview) we added a few comments below (in blue):

- I think the markets is misunderstanding what the Fed is up to

- I think the fed can be higher for longer than when market participants understand at this point

- I think basically people misread the last Powell press conference; they took the notion that we might not get 75 basis points in September as imply at the Federal Reserve is almost done, I don’t think the Federal Reserve is almost done

- so there’s a lot of work to do even if energy prices come off and bring down the headline rate of inflation the Fed’s got a lot more to do (which it won’t as offset by shelter)

- I think 4% plus(FF rate)is the minimum that I’m expecting

- I think the other thing that’s important to recognize here is the fed’s not going to ease off anytime soon because they need to be confident that they’re actually getting inflation back down in 2%

The mistake of the 1970s was not that chairman Burns didn’t tighten monetary policy, he did tighten monetary policy, he actually generated a couple recessions, but he didn’t stay tight enough for long enough and so inflation got embedded, inflation expectations rose and then that’s what required Paul Volcker to come in and really put

the economy through the ringer; and chair Powell doesn’t want to do that, so they want to be highly confident that they’ve solved the problem of inflation before they relent.

- that’s the key issue here is the tightness in the labor market, the labor market is much tighter than the Federal Reserve wanted it to be (they are always late to this party)

- so the labor market is much tighter than the Fed wants, the wage inflation rate is too high not consistent with 2% inflation that’s why the Federal Reserve has to navigate this, generate a slowdown that lasts long enough to push the unemployment rate up well above 4%. (It’ll get there, the Fed is already behind the curve, that ship has sailed)

We’d argue the Fed’s hawkish actions coupled with their recent dovish rhetoric is nothing more than their attempt at controlled demolition. We’d also remind readers what we mentioned earlier:

“While a dovish pivot “might” be perceived as bullish while algorithms chase charts, cutting rates alone is NOT BULLISH, it’s BEARISH! This held true in 2001/02, 2007/09 & 2020.”

The cutting of interest rates isn’t what’s “saved” equity markets from disasters, it’s the copious amounts of helicopter money and bond buying programs (that they don’t just have the authority to do anymore without Congressional approval (as explained here))

At this point it’s crystal clear to ALL with a pulse (excluding Fed officials & Wall Street firms), that the ROC (Rate of Change) of BOTH GROWTH AND INFLATION are SIMULTANIOUSLY DECELERATING. This is what Hedgeye describes as #Quad4 and it’s NOT GOOD for asset prices.

As noted above, last December we told readers growth, as measured by GDP would go from 7% to 1% -2%, and it has … next up is 0, and over the next 4 quarters we’re likely headed negative, in the direction of -2 to -3%. Hedgeye’s most recently updated NowCast models have us in 4-consecutive #Quad4’s.

The collective of data is decelerating, a mathematical fact; and with it, markets are more than likely to follow in suit.

As we move into our final thoughts, I thought I’d mention something too ironic not to. I spent the bulk of my weekend composing this note. Monday morning at 5:59am I chuckled; for it was when my institutional note from Quill Intelligence crossed my inbox … its title:

“Recession Flags Too Numerous to Compile”.

Confirmation bias, maybe?! At the same time, Quill Intelligence CEO Danielle DiMartino Booth is a former Federal Reserve insider and highly regarded amongst those cemented in data.

While our view may fall on the road less traveled, we’re definitely not alone on our journey … we’re traveling with some extremely well-respected names here; be it Hedgeye, Danielle DiMartino Booth, economist Daniel Lacalle.

There’s a reason we preach and follow data, for while there will always be challenges and hurdles to overcome along the journey, in the end, it’s the data that typically prevails.

Again:

“I’d argue, without exaggeration, there has never been a time over the course of my 26 years in markets, proper risk management has ever been more important, given an economic/market outlook so dire.”

Final thoughts

We’ve been talking about this economic slowdown since September of last year. @Hedgeye armed anyone willing to listen with a treasure trove of data and information that we added to our arsenal.

It wasn’t until March when we heard a single CEO start discussing the oncoming economic downturn as we had been, ONE, and it was Gary Friedman of $RH Restoration Hardware.

Virtually every other C-level executive, CNBC talking head, Federal Reserve official and Wall Street firm continued to talk about a “robust” 2022 … they all parroted forward growth, “especially in the back half of the year”, and just as they failed to see inflation, they too, failed to see this economic slowdown.

Then, as they panicked over inflation, we educated readers on disinflation leading to deflation; detailing “the why”. We’ve walked readers through the difference between what the whole of the data was saying vs. what the antiquated headline numbers were producing.

Nearly all of Wall Street, the Fed, financial media have been wrong and late on EVERYTHING … not just inflation and the economic slowdown, but on all things “business cycle” related. With the masses of CEOs touting strong employment on their conference calls, we wrote:

“They (the FOMC) are backwards looking – they don’t understand labor is as late cycle as it gets… As margins compress – profits fall – layoffs are around the corner – these (expletive deleted) will be tightening into one of the largest slowdowns in history” OSAM 4/1/22

We could pull from a myriad of quotes, but it wasn’t just the FOMC, it was Microsoft’s CEO, Apple’s Tim Cook. It was Amazon, who after all their tough talk about maintaining employees, laid off nearly 100k workers last quarter and no one made a peep as it was mostly abroad (rest assured, it’s coming to the U.S).

It’s as if the “best and brightest” running our country’s top businesses either have zero forward vision or as we’ve stated before, they only know one road, refusing to comprehend a second road even exists.

Be it greed, incentives or quite possibly … they’re just not that intelligent, I honestly don’t know at this point. But what I do know is their life’s blood (stock options, retirement, salary, bonuses) are all predicated on markets only going up and they will do or say anything to perpetuate it.

Unfortunately for them, cycles happen. And to their defense, for decades now, every time a true credit default cycle has come along the Federal Reserve, in their infinite wisdom, has “saved” markets. What they’ve really done has merely prolonged and exacerbated an eventual, even larger disaster.

We’re currently saddled with a $12-TRILLION-dollar corporate bond market. Currently, capital markets which provide liquidity to these markets are barely functioning. As the Fed irresponsibly hikes rates and shrinks the size of their balance sheet via QT (Quantitative Tightening).

Let me make one thing clear, it’s not the act of hiking rates nor reduction of the balance sheet that’s irresponsible, it’s how they’ve approached it and their timing (a story for another time).

Ultimately, the Fed has created the largest asset bubble in the history of bubbles with more debt and the worst of credit quality, EVER.

Without question we stand before two roads, but it’s not a leisurely stroll we’re on where the repercussions of our decision carries with it no regrets.

This isn’t April of 2020, junk bonds haven’t been bought through SPIV’s (and now can’t be without Congressional approval), $7-trillion in stimulus has NOT been approved. As Quill Intelligence stated succinctly, the “Recession Flags (are) too numerous to compile”.

Yes, the markets have a perpetual bid given the dynamics of passive investing, in turn, yes, bear market rallies exist; typically occur on the lightest of volume days, and they can be violent. At the same time, the price of equities doesn’t change the underlying economic conditions.

The economic data continues to deteriorate … so do recessionary signals, be it: high yield spreads widening, the depth of the inverted yield curve, the tightening of credit across all lines, capital markets being virtually closed, the collapse in most commodities given the strength in the U.S. dollar; the list goes on…

The data doesn’t suggest our current bear market to almost be over, on the contrary, it’s telling you it’s just begun.

Following the current bullish road (narrative) requires very little thought and refers to little to no economic data. It does, however, invoke a whole lot of emotion … we urge you to fade your feelings, you’ve worked too hard for too long!

Markets aren’t about taking the road less traveled, they are, in the spirit of Frost, about which road NOT to take! If they happen to be less traveled, so be it … “and that has made all the difference!”

Good Investing!!

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.