In This Article

“Does the flap of a butterfly’s wings in Brazil set off a tornado in Texas?” Edward Lorenz; 139th meeting of the American association for the advancement of science, 1972

Deterministic chaos

Edward Lorenz was a brilliantly educated mathematician, receiving degrees in mathematics from both Dartmouth (1938) and Harvard (1940).

As a child he was fascinated with both numbers and the weather and while not many of us can say we truly have lived out our childhood dreams, Lorenz can, once writing in an autobiographical sketch:

“As a boy I was always interested in doing things with numbers, and was also fascinated by changes in the weather”

In 1942, while working with the U.S. Army air corps, Lorenz regained his passion for meteorology which is where he turned his focus earning his masters (1943) and doctoral degree (1948) in meteorology from MIT (Massachusetts Institute of Technology), respectively.

After receiving his doctorate, he remained on staff at MIT, eventually working his way up to department head from 1977 to 1981.

Lorenz was an active, mild-mannered gentleman; an avid hiker and cross-country skier up until roughly 2 weeks prior to his passing on April 16, 2008, at the age of 90. He was also extremely well respected amongst his peers, as longtime friend, and retired federal climate scientist Jerry Mahlman once said:

“Of all the geniuses of that era, he was the quietest and most humble and the most kind”

One might find it ironic, as is so often the case, that this soft-spoken, humble, kind, mathematician, and meteorologist became what the field of math and science knows as, the father of “Chaos theory” also known as “Deterministic chaos”.

One of the founding principles of Chaos theory comes from another well-known thought/discovery of Lorenz’s known as, “The Butterfly effect”.

As MIT tells the story, in 1961 Lorenz was re-running data through a 12-factor weather simulation program, though on this evening he rounded the data, simply rounding from .506127 to .506; a de minimis amount.

Upon his return from grabbing a cup of coffee, his program generated a dramatic difference in the results “of over 2-months of simulated weather”.

“The unexpected result led Lorenz to a powerful insight about the way nature works small changes can have large consequences. The idea came to be known as the “butterfly effect” after Lorenz suggested that the flap of a butterfly’s wings might ultimately cause a tornado.” (See: opening quote)

Oxford define Chaos theory as:

“the branch of mathematics that deals with complex systems whose behavior is highly sensitive to slight changes in conditions, so that small alterations can give rise to strikingly great consequences.”

Which begs the question: If the slightest of changes can have “strikingly great consequences” to “complex systems”, how severe can the consequences be when extreme shocks collide with complex systems?!

BIG WINGS ARE FLAPPING

In July we briefly noted data coming out of Europe in a section titled, “you keep saying global” (as in, “the very real risk of a GLOBAL economic slowdown/recession”)

Today, in almost every measure, data from the Eurozone is WORSE than that of the United States. Long time readers know that I am a staunch advocate for @Hedgeye; in my opinion, there is NO SINGLE BETTER COMPILER/AGGREGATOR OF DATA in the industry; no better group at NowCast-ing the information collected.

For the purpose of this section, we just assume credit Hedgeye for while we rooted out quite a bit of data ourselves, some of the Rate of Change information is theirs, so again, we want to make sure to give credit where it is due. Their generosity via what they share for free on Twitter is a true gift to all investors. We would recommend any serious investor attempting to navigate these treacherous waters alone pay for a Macro Pro Subscription, it’s the best education/value for dollar on Wall Street.

Moving on…

If you think inflation is bad here in the U.S, Europeans are being squeezed by inflation like a 20-foot boa constrictor wrapped around their chests restricting spending as a boa would crush their last breath.

Last week Eurozone CPI came in at 9.1% YoY, which registers yet another sequential acceleration to all-time highs; Germany’s CPI registered +7.9% YoY, while Spain’s has skyrocketing to +10.5%, Austria +9.3%, and the U.K. up +9.9% YoY, respectively; primarily driven by (but not limited to) the parabolic rise in energy prices.

And while energy prices in many EU countries have, in fact begun to roll over, the massive price acceleration has become crippling to EU countries. For context, even though energy prices had fallen in Germany by nearly 50% earlier this month, as @Hedgeye Daryl Jones noted … this is STILL roughly 10x higher than the long-term average. For context, my energy bill last MONTH was $374.26 and I can guarantee you if that was multiplied by 10 = ($3,742.60) I would without question, be altering some spending habits…

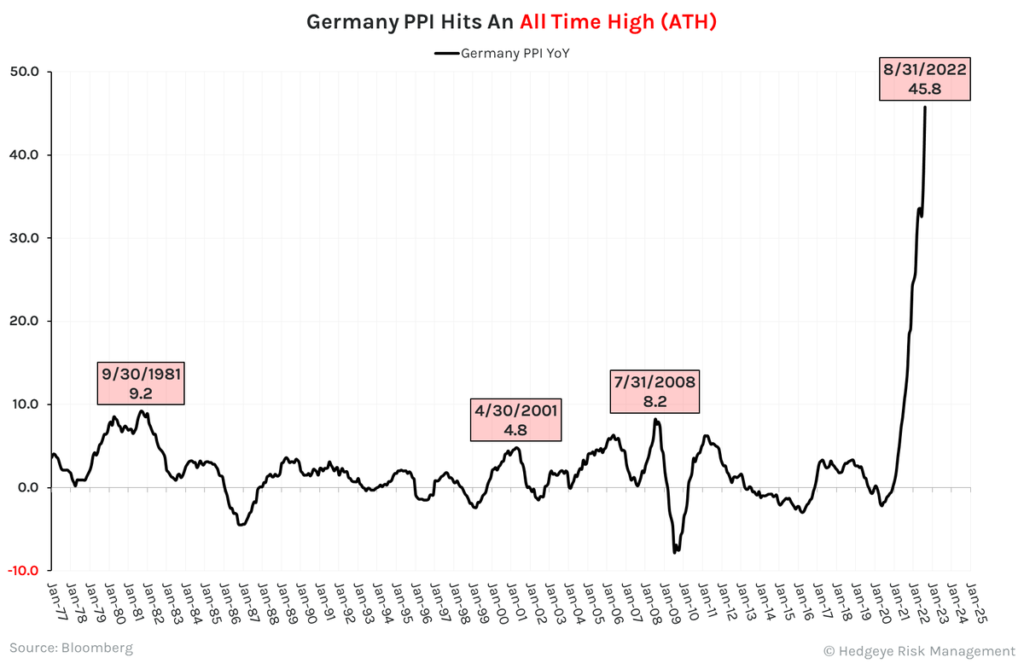

While this drop in energy prices may have hit the pressure relief valve on CPI, Eurozone PPI continues to accelerate to sequential all-time highs. And if investors thought July’s +4.0% MoM & 37.9% YoY PPI was staggering … August PPI just made European’s eyes water, registering up +45.8% YoY.

Note: consensus anticipated +37.1% (as we’ve questioned many times, how these experts can be so consistently wrong … and still be considered “experts” is beyond us).

As @HedgeyeFig generously shared courtesy of Hedgeye Macro team member Ryan Ricci, the increase was led by energy (139% vs. 105% in July), natural gas (209.4%) and electricity (174.9%).

This is extremely troubling, for PPI is typically a leading indicator for Eurozone CPI as “it measures the rate of change in prices of products sold as they leave the producer”, suggesting little reprieve from current levels (think constant squeeze as they gasp for breath (or breathing room))

Moreover, Eurozone PMI for August slowed to 49.8 (contractionary), from 51.2 in July. Both manufacturing and composite PMIs also decelerated from previous months; with manufacturing falling minimally from 49.80 to 49.60, as composite fell from 49.90 to 48.90 … ALL CONTRACTIONARY!

The meteoric rise in energy prices is crippling the European economies in real time, leading to layoffs, furloughs, partial factory reductions and outright factory closures. A recent article from the Economic Times titled: ‘Crippling’ energy bills force Europe’s factories to go dark, details the challenges facing Ark International glass.

At the moment, nearly half of Ark’s natural-gas powered furnaces have been shut down, leading to the furlough of 4,500 employees. The remaining 5 furnaces will be converted to diesel power creating an unexpectedly large expense for both the company and environment … so much for clean energy?!

“It’s the most dramatic situation we have ever encountered,” stated Ark CEO Nicholas Hodler, “For energy-intensive businesses like ours, it’s crippling.”

Though the damage stretches FAR BEYOND a glass manufacturer … more from the article:

Makers of metal, paper, fertilizer and other products that depend on gas and electricity to transform raw materials into products from car doors to cardboard boxes have announced belt-tightening. Half of Europe’s aluminum and zinc production has been taken offline, according to Eurometaux, Europe’s metals trade association.

Among them is Arcelor Mittal, Europe’s largest steelmaker, which is idling blast furnaces in Germany. Alcoa, a global aluminum products producer, is cutting one-third of production at its smelter in Norway. In the Netherlands, Nyrstar, the world’s biggest zinc producer, is pausing output until further notice.

Even toilet paper is not immune: In Germany, Hakle, one of the largest manufacturers, announced that it had tumbled into insolvency because of a “historic energy crisis.”

So, it should surprise no one that European sentiment readings are about as bleak as they’ve ever been. Last week the German Zew Economic Sentiment reading for September came in at -61.9 decelerating from an already abysmal -55.3%, registering its lowest level since October of 2008. For those with short memories, October of 2008 was some of the darkest days of the Great Financial Crisis (GFC).

Consumer Confidence in the Eurozone also saw another sequential deceleration from -25.0 in August to negative -28.8 in September … while Denmark saw its consumer confidence slow to an all-time low of -32.1, as did the Netherlands who watched their consumer confidence data hit -59 (a new all-time low), while Ireland consumer sentiment index just hit its lowest level since the Great Financial Crisis in 2008 after multiple sequential MoM declines … Good times … Gooooood times?!

Our above example of Arc International glass, nestled away in the small village of Arques, France is merely one example of a lone butterfly flapping its little wings fairly hard, and yet, just as Lorenz’s “butterfly theory” suggests, this small change is indirectly affecting an extremely large number of individuals around the globe.

“Arc indirectly generates another 15,000 or so jobs in the region, from cardboard factories that package its glass to transport companies ferrying its products. Arc’s other factories are in China; Dubai, United Arab Emirates; and New Jersey.”

It’s also important to note, a job loss RARELY just affects the individual who loses their job; from spouses to children the impact is compounding … and it’ just beginning.

Anomaly

As early as last September we began to discuss the timing of this current earnings recession:

By 2Q22, the deceleration in growth via GDP, earnings, etc. should be very noticeable. The second quarter is also when we should begin to see a real deceleration in inflationary pressures as well.

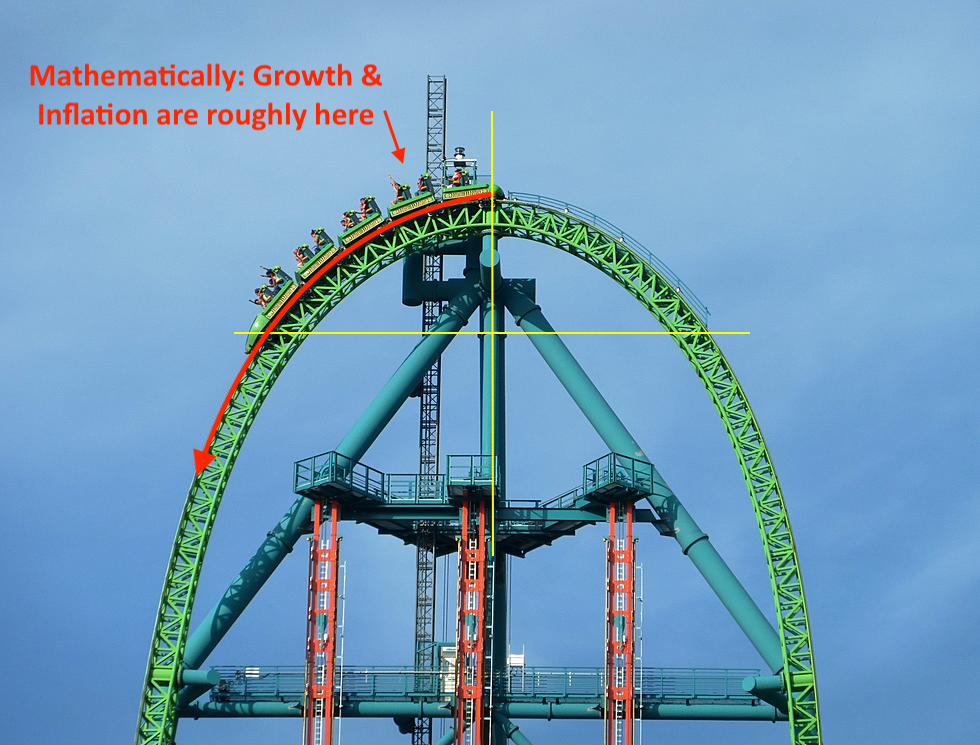

The visual imagery of where we were in the growth and inflation cycle couldn’t have been delivered more clearly in our 4Q2021 quarterly published in January:

“Let’s make this easy … Inflation & Growth are HERE…” (see graphic below)

In February, among other things, we discussed the un-comp-able comps that lie ahead for corporate earnings, while also providing a comprehensive list of all decelerating 1Q2022 data that had already begun to present itself in a crystal-clear manner.

In March we warned readers about the incoming housing slowdown as mortgage rates began to pop:

“As 30-year fixed mortgage rates just spiked to a 4.66% average making the average house roughly 13-15% LESS affordable than last year as most home buyers determine purchase price based off what monthly payment they can afford; begging the questions:

◦ Who’s going to be refinancing homes at these levels?!

◦ Who is left to refinance with rates being so low for so long?

◦ How will this move in rates affect borrowing via home equity lines?!

◦ And more importantly, how large of an impact will this have on housing prices?!

All of this leads to a slowdown in spending!”

April’s note provided readers with a laundry list of carnage within the financial space as year over year revenue and earnings misses proved to be “un-comp-able” (as we said they would). Then in both May and June, the consumer slowdown we had been screaming about for nearly 9 months became visible to all as both $WMT (Walmart) and $TGT (Target) finally revealed what should now be obvious to anyone with a pulse … the U.S. consumer is a disaster.

This is NOT a victory lap moment; I can assure you … there is without question a point here much more poignant. In all of the aforementioned scenarios, what we had been detailing as extremely important progressions that occur within a business cycle, the vast majority of Wall Street firms, financial media pundits we’ve referred to as Rodeo Clowns, PhD economists and virtually all Federal Reserve officials have been brushing these events aside as “one-offs” or “anomalies”.

And yet, the blow ups continue … one after another. Last week alone there are too many to discuss, but one of the more notable disasters was:

Federal Express

Last week FedEx ($FDX) announced preliminary Q1 results of $3.44 vs. consensus estimates of $5.10 (yes, you’re reading that correctly) on revenues of $23.2 billion vs. $23.54 billion estimates; operating income came in at $1.3 billion vs. an estimate of $1.74 billion.

One of the most well-run companies in the world MISSED earnings by 34% or shall we re-phrase the statement. Wall Street estimates were 34% TOO HIGH given the #Quad4 disinflationary investing environment we are currently in (and have been describing to you for over 9 months now)

Worse?! FedEx cut current Q2 guidance to $2.75 (excluding costs related to business optimization initiatives and business realignment activities) while Wall Street consensus was roughly $5.48 per share; roughly a 50% miss to the DOWNSIDE.

Anyone remember when we said this in May?!

Ironically, last month we noted that certain bellwether companies are phenomenal barometers for taking the temperature of things to come.

Then proceeded to cite CarMax ($KMX), Walmart ($WMT) and Target ($TGT) among numerous others?

In regard to Target ($TGT) we said this:

The company has now guided the full year (2022) DOWN by 25%, while modestly trimming 2Q22 margins by a meager 50% … FIFTY F’IN PERCENT!!! THAT’S NOT A TRIM, IT’S A MASSACRE!

Or CarMax ($KMX):

Auto Sales were down -24.90% in March (CarMax: $KMX has been a BIG warning to investors)

Federal Express CEO Raj Subramaniam had this to say:

- Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S.

- First quarter results were adversely impacted by global volume softness that accelerated in the final weeks of the quarter

- We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first quarter results are below our expectations

Read these two lines from above again: macroeconomic trends significantly worsened later in the quarter … We are swiftly addressing these headwinds. We’ll briefly tackle “addressing these headwinds” first, circling back to “macroeconomic trends” later in the piece.

As we’ve noted too many times to count over the last year … cost cutting/cost reduction/trimming fat (whatever you choose to call it) ALL mean the same thing … LAYOFFS!

“They (the FOMC) are backwards looking – they don’t understand labor is as late cycle as it gets… As margins compress – profits fall – layoffs are around the corner – these (expletive deleted) will be tightening into one of the largest slowdowns in history” OSAM 4/1/22

Which is exactly what both the Fed and FedEx are doing … again, per Subramaniam:

“While this performance is disappointing, we are aggressively accelerating cost reduction efforts and evaluating additional measures to enhance productivity, reduce variable costs, and implement structural cost-reduction initiatives.”

FedEx will close 90 office locations, close five corporate office facilities, defer hiring efforts, reduce flights, consolidate operations, reduce Sunday operations & cancel projects: among other cost cutting efforts.

Along the same lines, Wall Street analysts were anticipating roughly $3 billion in EBIT (Earnings Before Interest & Taxes) from auto manufacturer, Ford ($F) … who just CUT 3Q2022 to be in the “range of $1.4 billion to $1.7 billion” … nothing to see here, just another “anomaly/one-off” the so called “experts” had wrong, to the HIGH SIDE, by roughly 50%

What do you think happens next?! I’ll give you one guess…

As a complete aside, did we mention Boeing ($BA) AND Goldman Sachs ($GS) … among numerous others … have announced fresh layoffs?! (Please remember, this comment is PURELY an aside, not meant to give you any hints as to “what happens next” at Ford (or just about every other company, large or small, out there).

It’s all connected

It’s not just a glass factory in Arques, France, or FedEx, Ford, Target, or Walmart. Nor are these small butterflies flapping their wings. What we’ve been pointing out to you over the past 6-8 months are NOT anomalies, they are enormous butterflies flapping their wings adversely affecting everything up and down an extremely complex supply chain; from raw materials/commodities to suppliers, manufacturers, to transports, warehouses, retailers, and down the line.

The globe is currently experiencing a default cycle of the highly complex business … in real time; and as we’ve described to readers for years … be it “time and patience” or “time and space”, cycles unfold over TIME.

For example, just as we’ve described lead/lags re: CPI inputs … businesses have lead/lags, too.

Take the Radio industry … from the time an entity (business) decides they want to run an advertisement on the Radio, the billing cycle can take up to 6+ months. From the signing of the contract, until the day the first add runs can in some cases take 2-3 months alone (especially around Christmas time). Couple that with the actual advertising campaign (1 to 3 months) followed by a net-30 to net-60 billing process … quick math, suggest payments can lag by a good 6-to-7-months.

Now, apply what you now understand about the Radio advertising cycle; while keeping in mind the words of FedEx CEO, Raj Subramaniam and what he told the world:

“macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S”

If FedEx didn’t see the slowdown coming, Target, Walmart, CarMax, Ford, Alcoa, Dow chemical, Huntsman Chemical, Intel, Nvidia, Costco … (THE LIST IS LITERALLY ENDLESS) … do you really think the majority of small businesses who signed up for obnoxiously expensive advertising 6 months ago did?

Unless they were reading Hedgeye, our work, or that of a limited select handful, very few companies would have adjusted their marketing budgets or advertising spends preparing themselves for this collapse 3, 4 or 5 months ago based on what their bankers or Wall Street were pushing down people’s throats.

So, we’ll ask … what do you think is now happening amongst the top Radio companies?!

We’ve been educating readers for some time now on things like … AT&T ($) telling the world unpaid cell phone bills were exploding … or that 21 million Americans (and rising) are now delinquent on their energy bills … or that car repossessions have soared due to failure to pay … in the midst of credit card delinquencies ripping.

Many astute readers may conclude failing to pay bills is rapidly becoming an epidemic!

Which begets the question … how do you think this will flow through to a company like Google ($GOOGL), which is heavily dependent on ADVERTISING?!

FAANG

Let’s level up our thinking and connect some dots. The past few months we’ve talked about “Global Recession”, we’ve specifically focused on European throughout this piece for a reason … and as a reminder, “in almost every measure, data from the Eurozone is WORSE than that of the United States” (with U.S. data already as dark as it’s ever been).

We provided real time examples of Global inflation and skyrocketing energy prices directly affecting century old businesses, in turn, adversely affecting others around the globe, from China to NJ.

This piece has laid out countless examples of what Wall Street would like you to think as “anomalies”, which they are not … detailing FedEx, but naming no less than 10 other names (refraining from naming more solely based on time and truthfully, a reader’s attention span). Moving forward it’s important to remember:

- FedEx cited significantly worsening “macroeconomic trends later in the quarter”

- Ford cut EBIT by 50% as countless other companies pre-announce and blow up one by one … as:

- Wall Street analysts perpetuate absurd, ‘pie in the sky’ growth expectations

Also, that billing cycles for many industries can take anywhere from 5-7 months … and finally, an ever-growing number of people are simply passing on paying their bills in the face of (but not limited to):

- running out of money, with a lack of ability to access cheap money, leading them to…

- max out more expensive lines of credit, such as credit cards with record high fees, which, in turn is:

- crushing household balance sheets, along with inflationary pressures (among countless other factors)

Is it really that difficult to assume everyone is in the same boat?!

How do you think this set up bodes for the mega cap FAANG companies (Facebook, Apple, Amazon, Netflix, Google … hell, add Microsoft and Tesla, too) where investors are still attempting to “hide out” in. What’s the data telling you? Is it screaming “GROWTH” or is it more probable the future of these companies holds the same fate as Wall Street’s graveyard of “anomalies”?!

One can always hope … though we’d respectfully reiterate: hope is NOT a risk management process)

Earlier last week asked our twitter followers if: “Anyone care(d) to remind us what % of the FAANG revenue comes from Europe?!” At the time we believed the number to be roughly 40%, though recently updated data credited to @Hedgeye Ryan Ricci via @KeithMcCullough on the 9/16/2022 Macro Show suggests “51% of FAANG revenues to be international”.

Google’s ($GOOGL) international revenue alone is 53%; when isolated to European exposure, that number falls to … 30% of revenues. Apple’s ($AAPL) international exposure sits at 58% with 24% being isolated to Europe … these numbers are astonishing on many levels.

If the European data wasn’t bad enough, here’s some additional international data via Hedgeye:

- 29 of 35 (83%) Central banks Hedgeye tracks are currently raising rates … INTO:

- 26 of 46 (56%) countries globally have 3 sequential #Quad4 (disinflationary investing regimes) … WHILE:

- 39 of 46 (85%) countries globally have at least 2 #Quad4 (disinflationary investing regimes) in the next 3 quarters.

As the vast majority of Central banks across the globe, including but not limited to … “the South Africa Reserve Bank +75 bps, the UAE +75 bps, Saudi Arabia +75bps, Hong Kong +75 bps, Philippines +50 bps, Indonesia +50 bps, Switzerland +75 bps, Norway +50 bps, and Taiwan +12.5 bps” (Credit @HedgeyeDJ for the compiled list) … are all hiking interest rates into global #Quad4 slowdowns.

With the largest of Bellwether names deriving such a large percentage of their revenue from many of these countries; again, how do you think this all ends?! Where will the revenues come from?!

While in final edits $AAPL just announced significant production cuts for iPhones … this should surprise NO ONE who’s been paying attention.

Given the massive weightings of these FAANG names in indices, ETFs, and closet benchmark Funds, as reality begins to set in for Wall Street portfolio managers (and investors alike) that the Central Banks are no longer the “SAVE” option for markets … the real fireworks begin. (and yes, we are aware of what the BOE announced this morning, good luck with that).

Talk about, first things happen slowly … then all at once!

Meanwhile, back at the ranch

We purposely took a break from our typical U.S. centric data to show you the magnitude of how severe things are globally. Given how interconnected this complex system that we call global finance is, there is an extremely high probability that things are likely to get very dark.

The bad U.S. data hasn’t gone away … nor has it materially improved from a macroeconomic perspective over the last 4 weeks. In fact, the 2/10’s U.S. treasury yield curve spread has re-widened touching a deep negative -56 bps before slightly tightening again.

With the Wall Street Rodeo Clowns touting the yield curve’s “re-flattening” move from negative -48 bps on August 10th to a mere negative -21 bps on September 13th, suggesting we were headed back to positive territory, we tweeted:

“Curve should invert back to a deep negative -45+ bps in short order, could surpass -50bps – we’ll see…”

It took less than 9 days for the curve to widen back to a negative –56 bps, which is the largest inversion since 1982.

While the likes of Fed Chair Powell, Treasury Secretary Yellen and the current Washington administration suggest this yield curve inversion “doesn’t matter”, it WITHOUT QUESTION DOES. They are lying to you; literally calling you stupid to your faces … there is NOTHING that these “experts” have said publicly over the past handful of years which should have earned your trust! I can’t think of a single thing off the top of my head that has been INTELLECTUALLY HONEST OR ACCURATE?!

Mind you, these are the same people who told you inflation didn’t exist, then, when it could no longer be ignored, flipped to saying it was transitory.

After recently reviewing the Fed minutes from one year ago, Daryl Jones, Director of Research @Hedgeye, recently reminded Hedgeye subscribers of the Fed’s inflation forecast from last year:

“a year ago, they said … by this time this year, inflation would go from being 4.3% (last year) to being 2.2% (this year) … just think about how bad that projection, which is only a year, like how awful that is … it’s just staggering that the people that make those projections, are actually in charge of setting monetary policy.” TMS, September 22, 2022; 5:00 minute mark

As we know, the most recent headline CPI for the U.S. came in at 8.3% YoY … just awful!

This week, the British pound touched HISTORICAL LOWS … and while CDS (Credit Default Swaps), at both the corporate and sovereign levels had been slowly expanding, last week things heated up at an alarming rate; CDS on the Philippines, Thailand, Indonesia, South Africa, South Korea, the UK, Israel, Mexico (the list goes on) are all blowing out, as are China’s XM bank, Barclays, Credit Suisse, and Softbank (among other corporates)!

The meteoric rise in mortgage rates continues, with the 30-year fixed rate mortgage rising with every edit. It was at its highest level since 2008 (6.29% up +27 bps WoW) on Monday; Tuesday they hit 6.87% and as I’m working through final edits, they’ve eclipsed 7%.

So, it should surprise no one that housing data here in the U.S. continues its free fall. A recent headline out of Redfin reads “luxury-home purchases plummet 28%, THE BIGGEST DROP ON RECORD” (emphasis ours). August U.S. existing home sales declined -0.4% MoM and existing home sales are down -26% YoY on a monthly seasonally adjusted annual rate (SAAR).

The NAHB (National Association of Home Builders) confidence index registered 46, dropping -3 points MoM (Month over Month), its lowest level since early 2014. And while there was a slight uptick in U.S housing starts for August +3.4% MoM, YoY they are still down -14.6%; though, bigger problems loom.

The most recent housing ‘Permits’ data decelerated AGAIN, down -3.5% MoM, hitting new cycle lows. For those who may not know, ‘Permits’ are a LEADING indicator for the housing industry as you can’t start building a new home without securing a permit … fewer permits = fewer homes = housing slowdown continues to accelerate.

And while this data is bad, it can without question, get much worse. The homebuilder confidence index hit an all-time high November of 2020; that number was 90. So, while the most recent data point of 46 is a rounding error away from a 50% decline, the January 1991 low was 20 and the Great Financial Crisis low was touched in January of 2009 … when the index hit 8.

Adding insult to injury, be mindful that housing data has a 12–15-month lag when it comes to headline CPI, so even in the face of this carnage, housing data will continue to produce inflationary headwinds for some time … As CPI remains elevated, the Fed will continue to in their “hawkish” stance.

Again, there is a very high probability thing are going to get worse … MUCH WORSE.

A BIG DEAL

Let’s go full circle for a second. Remember what the Butterfly theory suggests: small changes can have large consequences. Again, this is what eventually lead Lorenz to develop Chaos theory where “small alterations can give rise to strikingly great consequences when dealing with highly sensitive complex systems.”

There are many, including the committee that awarded Dr. Lorenz the 1991 Kyoto Prize for basic sciences consider Lorenz’s Chaos theory to be an inflection point in 20th century science for it impacted nearly every “branch”. As stated in his obituary by:

“the theory brought about “one of the most dramatic changes in mankind’s view of nature since Sir Isaac Newton”.

So, do we seriously not consider all of global macro financial markets to be a complex system?!

Which should then have had our initial question from early on in everyone’s head as they read this entire note … if the slightest of changes can have “strikingly great consequences” to “complex systems”, how severe can the consequences be when extreme shocks collide with complex systems?!

As we’ve echoed @Hedgeye founder and CEO, Keith McCullough numerous times in the past,

“it’s never just one thing, but the particular thing at particular moments in time.”

Take Real Estate … it was THE single largest contributor to GDP in 2021, providing more than $4-trillion dollars to the $22.99 trillion dollar pot; just north of 17.3%. Given the speed of our current unprecedented rise in mortgage rates to 7%, with the largest buyer of MBS securities stepping away from the market (The Federal Reserve) do we not think of this as a butterfly flapping its wings?

While these data points may not be the sole contributor to an impending house of cards collapse, we would consider this to be … A PARTICULAR THING AT A PARTICULAR MOMENT IN TIME!

Some additional ‘particulars’ to note:

- Inverted yield curves around the globe:

- Brazil, Canada, the Czech Republic, Mexico, Norway, Poland, and Sweden; with New Zealand, Singapore, Germany, and a handful of others on the cusp of inversion

- The widening of CDS (Credit Default Swaps) noted above

- The collapse in raw commodity prices

- When a majority of Central Banks around the Globe raising interest rates into a #Quad4 slowdown create and perpetuate a Global recession, which will adversely affect:

- The revenue streams of the largest weighted securities in all major indices, when:

- CEOs have proven they can’t forecast next week let alone multiple quarters ahead … like:

- Apple $AAPL production cuts just told us

From our vantage point, it appears as if a butterfly’s wings have flapped hard enough to generate a tornado of epic proportions throughout the complex system that encompasses all of global finance.

‘Particulars’ are screaming, very complex systems are breaking down; many on the verge of outright collapse.

While we’re discussing ‘particulars’, here’s one more Wall Street and markets have yet to “model”:

Given the massive amounts of debt that needs to be rolled over/repriced/re-financed at current rates (in some cases) 300-400% greater than what’s currently on corporate and sovereign balance sheets, debt service ratios across the entire system will explode exponentially. That’s when credit goes ‘bid less’, as in NO BID!

Then where do you think the ‘cost-saves’ will come from?!

And this is why ‘labor’ is the latest of economic cycle indicators. Because the cycle needs to work itself through a system in which C-level executives and Wall Streeters are INCENTIVISED to not see a future like the one we are currently in. They’re incentivized to see growth; they have no macro process.

The stark reality is that vast majority of CEOs truly have NO IDEA why consumers just stop showing up in their stores … none of them are proactively prepared … which is why so very few take down their guidance in advance; it’s also why FedEx, Ford, Costco, Target, etc. are “surprises” to both Wall Street and Investors, but it shouldn’t be to our readers.

What should also come as no surprise will be the future guidance companies provide on upcoming earnings calls. Miraculously, executives will see growth “firming as we head into the holiday season, with continued strength into 1Q23.” Don’t fall for it … remember 4 sequential #Quad4s … and we’ll adjust our sails as the data comes in.

Note: Sovereign debt needs to be rolled over just as corporate debt does, again, at current rates and most denominated in appreciated U.S. Dollars vs. local currencies which have all but collapsed … this is another “particular thing” to watch. Both developed and EM (Emerging Markets) alike will break (just as the British pound has).

Final thoughts

Having said all of this, it’s all come with a warning!

Maybe not from Rodeo Clowns, Wall Street or those whom they purport as “experts”, but by firms like ours; like Hedgeye, companies Wall Street laments daily.

With the help of @Hedgeye, their ENTIRE TEAM and the effort that we put in daily WE proactively prepared readers nearly 12 months ago.

As early as September 2021, we pinpointed a deflationary economic investing regime for 2Q2022, stating:

“To review: Exogenous shock + Deflationary economic environment = “sprinting towards a cliff”. But when and why; and why are we warning you now?!

By 2Q22, the deceleration in growth via GDP, earnings, etc. should be very noticeable. The second quarter is also when we should begin to see a real deceleration in inflationary pressures as well.”

In November of 2021 we continued our efforts:

“The bottom line — today is NOT a day to position for Deflation, but that day isn’t far off … 3 months will pass by in a blink and you better know where to go if and when the signals confirm deflation! We’ll keep watching the data for you.”

Again, continuing in December 2021 with this warning:

“Remember, markets tend to front-run economic reality. So, we should not be surprised to see a correction begin in the weeks leading up to 2Q2022. But how many weeks in advance? We don’t know; nobody knows; all that we know is that “things happen slowly, then all at once”. So, we will continue to use strategies to preserve capital against a highly probable correction.”

As the winds shifted early in January 2022, as we suggested they might, we too, adjusted our sails:

“The closer we get to 2Q2022, the faster the ride will get … which is why we’ve been proactively preparing.

Our accounts have held in very strong over the past few weeks, with markets at their lows of the day, the NASDAQ down nearly 5.00% we were down roughly 0.55%; given the late day rally, we both finished the day in the green. We will continue to aggressively defend our capital.”

So where does that leave us today?!

Per Hedgeye NowCast models … it leaves us with 4 sequential #Quad4 deflationary investing regimes. A forward #Quad set up not seen since just prior to the Tech bubble in 2000/2001. At the same time, the overall macro-environment is arguably worse given we’re starting from the largest asset bubble in history, from crypto to real estate, tech stocks to private equity.

As Hedgeye communication analyst eloquently summed things up on a recent morning ‘call’:

“The fundamental problem here is that you have entire business models and capital structures that have been built up over the past decade that were just based off of zero percent or very low levels of interest rates and now with rates and spreads where they are, and continue to go, the math just doesn’t work.” Andrew Friedman @Hedgeyecomm “The call” 9/27/2022

If permitted, given the current environment, many companies will go bankrupt, with latest of cycle indicators, that being “labor/unemployment” skyrocketing. The consumer will fail to pay bills … car repossessions will continue to accelerate … personal bankruptcies are likely to reach unprecedented levels as asset prices are fixing to collapse … I could go on, but I think you get the picture.

Until when? I honestly don’t know; it depends on many factors. My initial thought would be when the rate of change in the data eventually troughs and finally begins to incrementally improve (most likely 4 quarters out, with markets discounting this move some time in advance). At the same time, we’ll see what, if any, outside factors present themselves beforehand (i.e. what multi-trillion dollar bailout is set in motion and when). As always, we’ll adjust with the data.

In the meantime, we lean short bias with limited items to buy long. The U.S. dollar is our largest position and is likely to remain so throughout the remaining #Quad4s. Even with decent clarity, this has been the most challenging investing environment we’ve encountered over our 26-year career. Virtually all asset classes are negative on the year, including bonds (which traditionally work in a #Quad4 environment).

We are by no means perfect but will strive to diligently risk manage these markets to the best of our ability.

We’ll leave you with this:

Most people are getting killed in markets, we are not. We are poised to enter the 4th quarter slightly down and a stone’s throw from flat vs. major indices, which are all down greater than 24%, the Nasdaq and Russell 2000 down roughly 33%.

We kindly ask that you keep us in mind when speaking with your friends who are without question getting smoked. We spend much more time risk managing our collective assets than marketing, thus any and all help is appreciated.

Finally, just as Lorenz’s Chaos theory “brought about one of the most dramatic changes in mankind’s view of nature since Sir Isaac Newton”, we’d boldly suggest Hedgeye’s development of the “Quad” framework, coupled with their “quanta-mental” approach to investing (quantitative combined with fundamental) to be one of the most dramatic changes in mankind’s view of investing.

We understand they stand on the shoulders of giants like the great Benoit Mandelbrot … at the same time, no one has developed and taught a system which allows individual investors to proactively protect and grow their capital in the constantly evolving, complex world of global macro finance as they have.

Given the structural changes that have occurred in markets over the past few decades (for reference read our August 2020 note: MayDay) capital preservation is more important today than ever before, and with the help of Hedgeye, we’re executing on our goals and objectives at an extremely high level, especially given the treacherous terrain.

As always, we will strive to get better every day in an effort to protect and grow your hard-earned capital over time!

Good Investing,

Mitchel C. Krause

Managing Principal & CCO

4141 Banks Stone Dr.

Raleigh, NC. 27603

phone: 919-249-9650

toll free: 844-300-7344

mitchel.krause@othersideam.com

Please click here for all disclosures.